-

Content Count

254 -

Joined

-

Last visited

-

Days Won

48

Everything posted by Carlos M.

-

Good morning BBT family!

Enjoy the weekend and do something great with family and friends! Check out my new Bear Bull Traders Instagram account! https://www.instagram.com/carlosm_bbt

Have a great weekend and looking forward to our Pre-Market show Monday!

-

Good morning! Happy Sunday! Time to review Week #1 of 2019!

Let's review our journal, what we did well and what needs improvement this coming week. Highlight your top 3 improvement areas and let's focus on them this week. Do not worry about your P&L we have a whole year ahead of us to work on that. Let's start with getting a firm process, habits and foundation to support future growth.

Check out Reflection and Review podcast for Trading Journal ideas. See you all in the Pre-market show tomorrow 8:30 Wall Street time!

-

“You’ll never change your life until you change something you do daily. The secret of your success is found in your daily routine.”

Day Trading requires a lot of discipline at your trading desk and off it. Make sure you are puttting in hard work on your daily routine to motivate discipline in your personal life as well. Exercise, Read, Meditate.

Happy Friday from the local gym! Looking forward to a great Friday and morning Pre-market show!

-

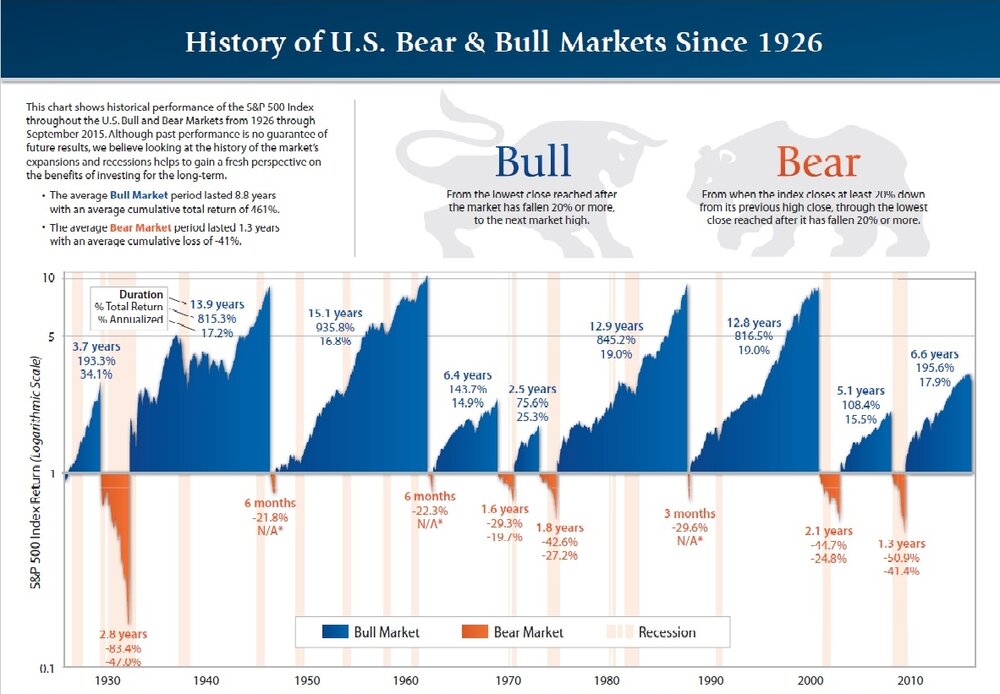

Here is the chart we shared this morning in the Pre-Market show as we discussed the Markets. Very interesting. There is a good read article about bull and bear markets here (https://www.brightscope.com/financial-planning/advice/article/27993/Bull-And-Bear-Markets-A-History/) were I found this chart.

-

Getting prepared for another week of trading. Sundays I like to take some time to review last week's journal and focus on what could be done better for the coming week. Every day we trade we take something with us. No matter if is a green or red day something was learned. What we did well we want to repeat and what we did poorly we want to improve. My job is to highlight those things and bring them front and center, with special focus what I need to improve on. Whatever your routine is to prepare for the trading week make sure you do it so you are ready to have a successful week.

Let's Rock This Week BBT! 🤘 😎 🤘

-

Ran into this picture online today... This is so true about any type of success in any career or goal. People only see what others have achieved and want the shortcut to the top. In my personal opinion, in Day Trading there are no shortcuts, the work must be put in, by education, practice, practice and even more practice. After comes the physiological and emotional part that is trigger when we put skin (real money) in the game. This is were we need to transform from a regular Day Trader's mindset to a Successful Day Trader's mindset. This is by far the hardest part of Day Trading and requires hard work, persistence, and dedication just to name a few.... #wegotthis

-

-

I agree! If you don't invest in what you want there is no return.. Day trading is like any other profession, it requires commitment, dedication, and hard work. People want to be successful and have success, but they don't want to put in the time or work. Unfortunately for them, it's not like that.

-

- Show next comments 9 more

-