-

Content Count

254 -

Joined

-

Last visited

-

Days Won

48

Everything posted by Carlos M.

-

Good morning BBT! Happy Sunday morning! I love waking up early on Sundays and getting ready for the trading week.

Make sure to take out time today and review your journal for last week. As you know from my podcast on YouTube "Reflection & Review" https://youtu.be/yUzCnMbR3yI , it is critical to have a system that you can go back and review what you need to improve on for the following week. Tracking your main issues and highlighting them for improvement the next week is very very important.

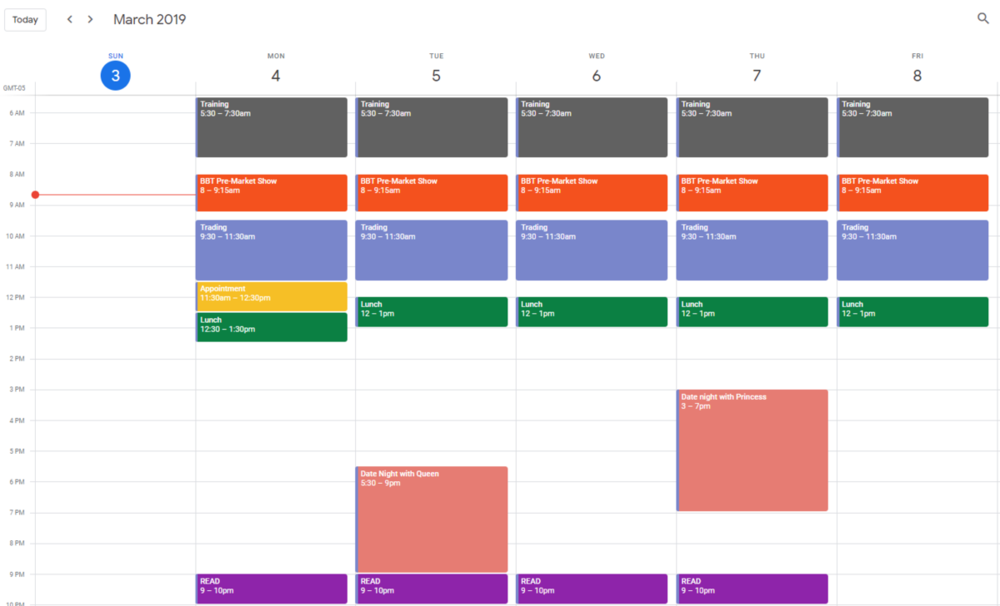

TIME MANAGEMENT

This week let's focus on time management. On Sundays, I also plan my schedule for the week, I literately put in everything. Below is what my week looks like almost every week. Now on all this empty white space I will fill in with things that I want to work on this week and get done. That could be time for your projects, maybe something you want to learn, studying and reviewing recaps. I will even block out 2-3 hours under "Me Time," this is were I will complete do what I want that is fun or chilled.

This can really help us manage our time and give us visibility how much time we have available. DO NOT WASTE IT.

Enjoy the rest of the weekend guys! Time to make this calendar look like a "Christmas Tree!"

-

-

Good morning BBT Family, Happy Sunday! Let's get up early and put in some work. All the work to become a better day trader is not put in during the market hours. Let's take advantage during the off hours to get closer to our goal. Few things we can attack today and tomorrow.

1. Review last weeks trading and highlight improvements areas for the coming week.

2. Check out members recap on YouTube and learn from them.

3. Read a book. (Andrew's 2nd book if you have not done so already.)

4. Review classes again and again.Let's put in the work during this off time! Let me know what you are doing on your end.

-

I guess binge watching the Lethal Weapon movies doesn't cut it 😉

Nah, I'm actually going to go back and look at the stocks I traded and find the mistakes I made, and potential signals that I should have heeded before/after I entered the trades. I'll also go back and take a look at my winners and see how I could have played them better (if at all possible)

Carlos, when you've got some free time, shoot me a message. I want to chat with you about the premarket show.

Have a good rest of the weekend/enjoy the Holiday!

-

.thumb.jpg.adc04f9c08fd75afd86d88691b67351f.jpg)

-