-

Content Count

477 -

Joined

-

Last visited

-

Days Won

36

Posts posted by Justin

-

-

Hey @miked and @James00trades it might help if you attach some screenshots, but here is what is supposed to happen:

This is an example of when you are trying to go long

On QCOM I want my stop to be 164.13. So I double click on the chart at that price and hit the first hotkey:

StopPrice=PriceYou will not see anything on the chart at this point.

The price is currently at 164.25 and I want my entry to be from 164.29. So I double click on the chart at that price and hit the second hotkey:

DefShare=BP*0.97;Price=Price-StopPrice;SShare=30/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare; SShare=Share;Share=Price*100; Price=StopPrice; DefShare=Price*100; Price=Share/100; Price=Price+StopPrice; StopPrice=Price; Share=SShare; TogSShare; Price=Price+.05;TIF=DAY+;Route=Stop;StopType=Limit; Buy=Send; Share=DefShare;Price=Share/100; StopPrice=Price; DefShare=400;TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice-0 ACT:SELL STOPPRICE:StopPrice QTY:Pos TIF:DAY+;This will show on the chart (below) as a range order, as the hotkey is set to do a 5 cent range (Price=Price+.05) - you can change this to whatever you're comfortable with. You will not see the stop loss on your chart until the price comes up and this range order is triggered.

As you can now see (below), the price has come up and entered me at 164.30 (as that price was in the 5 cent range of 164.29 - 164.34). You will also see that the stop loss has triggered upon entering the position at the original price I clicked on the chart - 164.13.

Does this explanation help a bit? I think it might be seeing the range order that is confusing.

-

2

2

-

-

On 12/27/2020 at 9:27 AM, Casey Gates said:Looking for a calculator for Risk, shares, and profit targets. I saw William using this one on a range order hotkey video. I can't seem to find him anywhere and I didn't see that he shared it anywhere.

If you know how to reach him on twitter or if you have anything similar to this and are willing to share please let me know... thanks!

I just plugged in the URL and you can request access to the sheet with a message. Try that?

https://docs.google.com/spreadsheets/d/19i3rRFIJnkoGiYT3l9MJN782nZn_yXL6/edit

-

-

12 hours ago, JasonH said:@Justin Thanks for sharing the chat log.

To be clear about what Justin is saying about commissions for partials adding up... that's only relevant for small share sizes that run into the minimum commission, and we already know Fixed pricing may be a problem in that case (trades less than about 150 shares as shown in the chart).

Most traders with IBKR Pro accounts funded >$25,000 are going to have trades >>500 shares.

My IBKR Pro account was setup this weekend. Going to request Fixed pricing. I'll share the results. Probably a "Misc" fee of $0.50 per second you hold the trade open or something like that.

200 shares seems to be the threshold 200*$0.005= $1.00

Definitely will be interesting to see your results. You don't need to request fixed pricing though - it's default on new accounts. Also you can change it at will in your account settings.

-

-

-

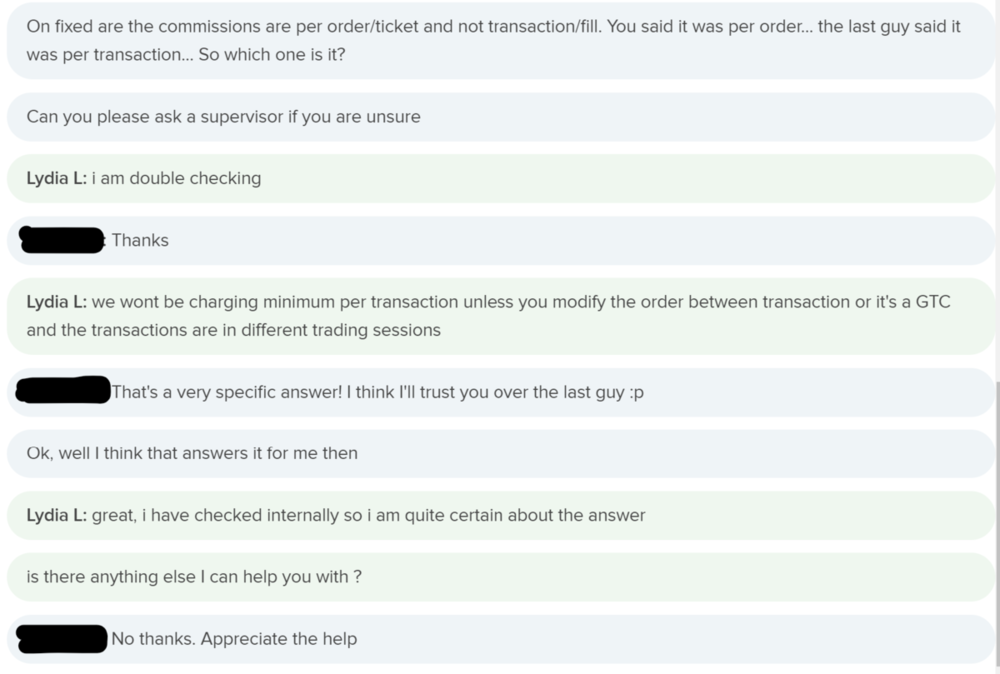

1 hour ago, JasonH said:@Justin, do you have actual account data to support commissions being applied to each transaction/fill at IB?

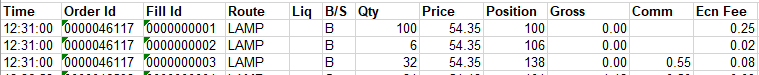

I only know what they do at CMEG, where the commissions are per order/ticket, not transaction/fill. Here's an example from my account report. One order/ticket = one commission (but three fills).

No, I got that information by asking IB Support's chat system.... But because of what you said about CMEG, I reached out to IB a second time to confirm.... And support said the complete opposite this time around

IB support is the worst.

I'm currently back in chat. I'll let ya know.

-

1

1

-

-

Make your range order a triggers order. The stop will only be placed after you enter a trade.

-

I think you're missing the fact that when you buy 100 shares you wont get it all in one lump. You will get 40 in one transaction, 50 in another, and the final 10 in a third. You will pay $1 on each of those transactions...

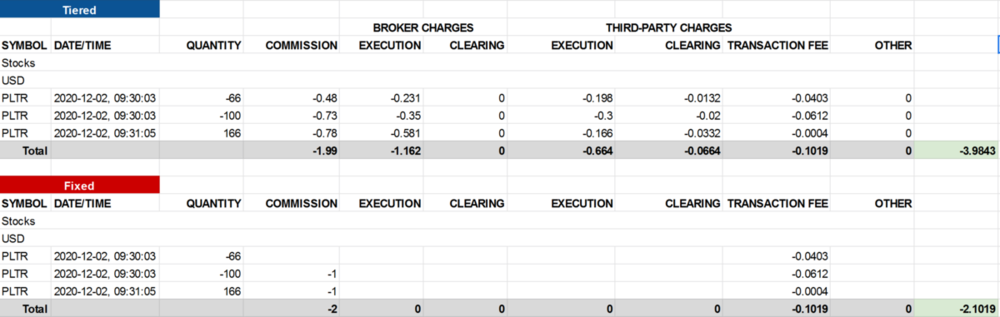

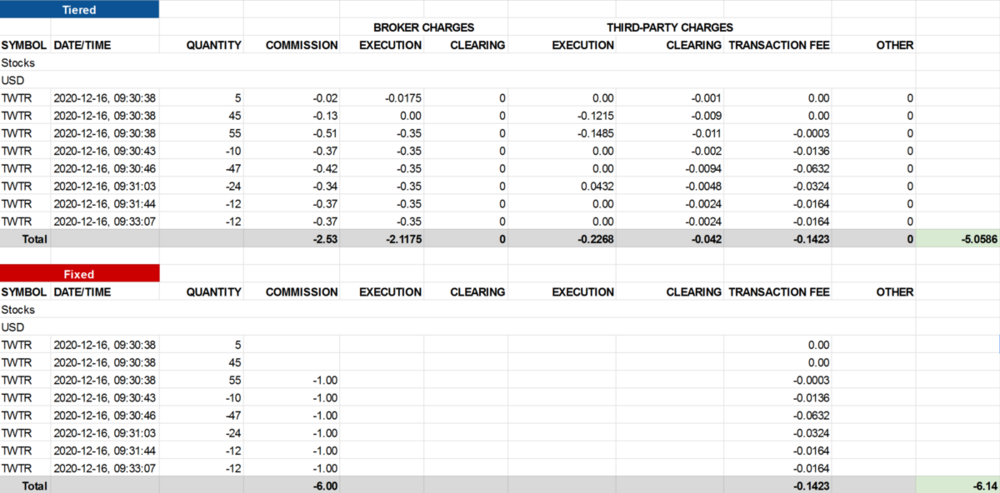

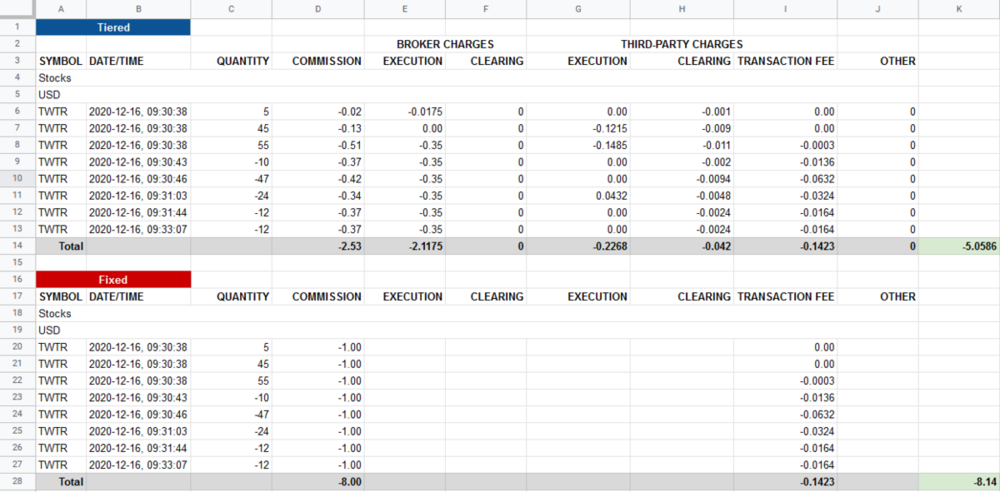

Here is a small trade I took on TWTR last week in tiered. And what the actual pricing would be in fixed. As you can see Tiered is $5.06 and Fixed is $8.14.

-

1

1

-

-

On 10/28/2020 at 3:28 PM, Terrence McIntyre said:@KyleK29 Hey Guys, I'm trying to set a hotkey with a set $ risk vs a % risk. What I have so far is a trigger order hotkey that determines the amount of shares that I can purchase with $250 and that sets a stop loss for a percentage of that amount. What I'm looking for is a trigger order that calculates how much shares I can get with a set amount of money then set a stop loss for a set amount of money vs a percentage if that makes sense.

ROUTE=NSDQL; Price=Ask;ACCOUNT=TMCME9043; Share=250/PRICE;TIF=DAY+; BUY=Send;TriggerOrder=RT:STOP STOPTYPE:MARKET STOPPRICE:AvgCost2*.90 ACT:SELL QTY:POS TIF:DAY+

That's exactly what this thread is about. On the first page you can go download Kyle's hotkey spreadsheet; it's all in there. And there are training videos at the bottom of the post.

-

14 minutes ago, Miklos Ekman said:Hi Kyle, is there any video guide how to set this up? Im keep having errors coming up:(

On the first post there are 5 videos explaining how to set this up.

-

I haven't tested this, but potentially StopPrice=AvgCost*.95

-

I'm sure a lot of you know already, but DAS released a new version today (version 5.5.2.0). It comes with a ton of changes that you can see here (https://dastrader.com/notice.html ).

Some changes I think people will appreciate:

- Added vertical dragging for chart.

- Added OCO script to support secondary order of OCO pair.

- Bug fix - there is problem when clicking on price axis label area when placing orders and alerts

- Added support for multi-script trigger orders (up to 5).

- Fixed RVOL column sorting in Market Viewer.

- Added support for stop orders in quote replay mode.

- Added more default settings for chart alert.

Download link here: https://dastrader.com/docs/das-download-links/

-

2

2

-

1

1

-

1 hour ago, Thomas said:How is this working for you? Ready for Live? Any of issues or changes?

Well with any hotkey you'll want to test in in sim yourself. But I have been using it live to great success!

-

1 hour ago, Ryan Wilson said:Thanks again! Made 12R on MRNA this morning (personal best trade in my 4-months trading) using the hotkeys for easy ADD and REDUCE strategy at HODs.

Well done Ryan! Super happy for your success

-

21 minutes ago, Paul aka Aurbano said:Due to last updates in the chatroom, the dark conpact theme with icon tabs that I designed stop working .... obviously, no ones fault

hehehe

hehehe

I did manage to fix most of the work ... watch pictures attached and download the new CSS style file ... go to the top of the thread in this page to watch how to install this chatroom feature

Enjoy ! any updates and fixed will be posted in the thread in the future.

Awesome @Paul aka Aurbano!

Two things I noticed... which seem to be completely related to my selfish self!

The right hand side of the screen code doesn't seem to work anymore:

/* move chat to the right */ #chatAlertsDiv { position:absolute; right:0px; top:0px; width:18%; } #presentationHolderDiv.l-cell { position:absolute; left:0px; width:82%; }And as a moderator, we also have an Admin tab between Trades and Swing.... Any chance to make a special script just for that

I can get whatever HTML/CSS you need, if you can't see it on your end!

I can get whatever HTML/CSS you need, if you can't see it on your end!

-

Please use this thread to post your questions before and after the Success Webinar!

Developing your Edge/Playbook through Journaling

Every trader has a different personality and style when it comes to trading. What will work for one trader may not work for another; therefore, to find what works best for you, begin to develop your edge through journaling and play booking your best trades. In this webinar, Mike will explain how he track the statistics for each of his trading strategies to validate if it presents an edge in the market.

By: Mike

Date : Wed, July 22, 2020

Time : 8:00 PM ET

Location : Webinar Room (Lifetime Members only) -

On 6/23/2020 at 10:44 AM, Thomas Clarke said:Is there a way to change our display name in the forum?

The default was my first and last name and I can't seem to be able to change the name displayed in the edit profile option.

Sorry for the delay on this @Thomas Clarke

If you go to your Profile on the main BBT website, you can change your display name there:

https://bearbulltraders.com/profile/ -

2 hours ago, Thomas Clarke said:@KyleK29Where is the most recent version of the hot key script generator kept. Is this it from page 1:

https://drive.google.com/open?id=1TJy7jRHhdMYGyyfKbbYd3M7j6bqxgeoy

Just want to make sure I am using the most recent release. This is fantastic stuff, so thank you!!

Yes! That's it @Thomas Clarke!

-

If your desktop has USB-C, I don't see why not.

-

Please use this thread to post your questions before and after the Success Webinar!

Different Days, Different Ways – Identify and Maximize Trend Days

Have you ever looked backed at a day and said:

“Why didn’t I just ride the trend? I’d be so much better off!”

Guess what? We all have! As Day Traders, our job is to find these high probability trends and use them to our advantage, as they offer some of the best directional advantage for a position. In this Webinar, I’ll go over ways to identify likely ‘Trend Days’ in the market and how to begin building different setups to utilize and maximize the price action. We’ll cover some Market Profile, Market Internals, Trade Logic and Timing, Indicators, and enough examples to make anyone salivate at all the possibilities!By: Jarad

Date : Wed, July 15, 2020

Time : 8:00 PM ET

Location : Webinar Room (Lifetime Members only)-

1

1

-

-

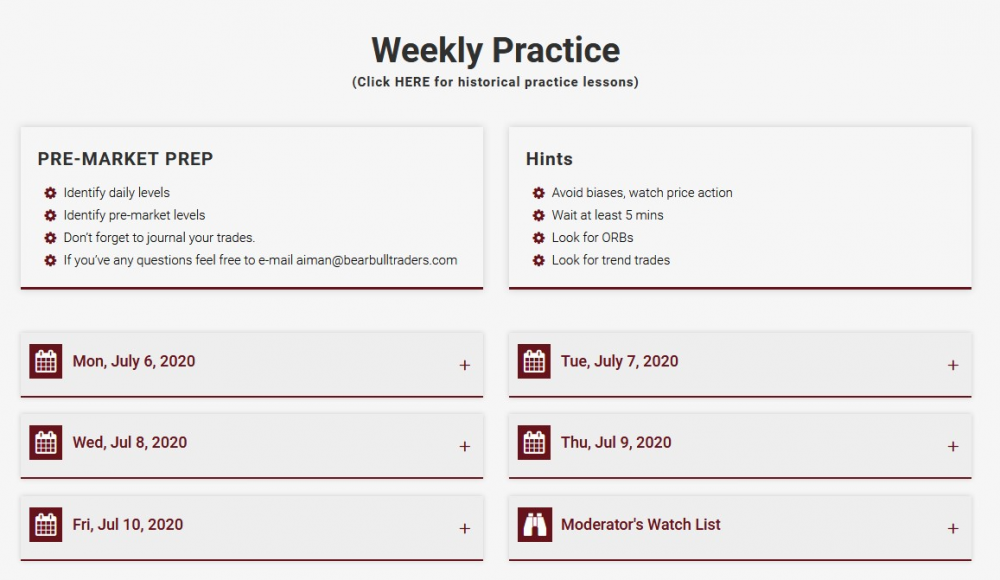

Hi Everyone,

For those who don't know, every Friday @Aiman Almansoori posts weekly Simulator training ideas! They are based on trending stocks of the day and stocks that our moderators focused on. He chooses two per day, each have multiple strategies to look for, the time to focus on them, a written analysis, and what the catalyst was for the day.

It also includes a watch list for all of our moderators from the past week!

-

2

2

-

-

1 hour ago, Andrew from Jersey said:Can I get a quick explanation of the various "ROUTE"s that are used in the hotkeys, and the importance of making sure the right "ROUTE" is selected for certain functions? I have mine set to "LIMIT", but there must be a reason you included the other routes as well.

Thanks for your time.

Different brokers sometimes have specific routes you need to use. And some brokers use the generic routes.

For example, Interactive Brokers uses the SMRTL and SMRTM routes.

CMEG uses the standard LIMIT and MARKET routes.

Simulator uses LIMIT and MARKET

In DAS, for stop orders, irrelevant of your broker, you still use LIMIT or MARKET. Those are the only options to select in the montage, so they need to be routed that way.

What you need to remember is what your broker uses, and then adapt the hotkey to your setup..

-

1

1

-

-

By D3000 I think you mean D3100 (The D3000 model is old junk

)

)

I used to have the the D6000, and it is definitely a better solution than the D3100 if you have USB-C in your computer.

That being said, while they both will work (I don't think you'll notice a latency problem) - they won't be using your graphics card's native GPU. They use DisplayLink technology that passes the video feed over USB, and you'll be capped at 60 Hz. If you're not going to be using the connected monitors, through the dock, for gaming, this probably won't matter to you. For me it did, so in the end I grabbed the WD19TB, which taps into the native GPU, and allowed me to use the 144hz of my monitors.

DAS - Stop Limit Order for Future Entry with Dynamic Share Calculation - Using $Risk with a Stop Loss

in DAS Trader Pro Tips and Tricks

Posted

Yeah you got it @miked!