-

Content Count

477 -

Joined

-

Last visited

-

Days Won

37

Posts posted by Justin

-

-

A couple more spots to change will make that work - Which I've highlighted below:

CXL ALLSYMB;DefShare=BP*0.97;Share=Pos;SShare=Share *0.5;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=SMRTL;Price=Bid-0.02;TIF=DAY+; SELL=Send;DefShare=400;TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice+0 ACT:BUY STOPPRICE:AvgCost QTY:Pos TIF:DAY+;

-

One other thing to note is that when you do hit the second hotkey, your order will look like a range order (see picture below). This is actually visually showing your "fill up to" range (Thanks for explaining this Kyle!)

This is a little embarrassing, but I think I had this hotkey working quite awhile ago, I just didn't understand what I was seeing! 🤪 I thought it was some kind of weird range order, that the script wasn't working, and so I always cancelled it before triggering and went back to the drawing board!

And just going to tag some people who I know were interested in this in another thread:

-

4

4

-

-

What does this do:

This 2 part script will allow you to set a stop loss, set a future price on your chart where you want to enter, and dynamically calculate the shares you can afford based on a fixed dollar amount.

What do you mean by “2 part”?:

With the current limitations of DAS, it's required to use two scripts (hotkeys) for this to work.

1. The first hotkey will set where you want your Stop Loss to be

2. The second hotkey will set where you want your Entry to be

Example:

- The High of Day is $49.99

- The current price is $49.50 and trending back up towards HOD

- The L2 has lots of strong ASKS at various price levels above $50.00

-

You want to enter if it breaks $50.00

-

Double click on the chart where you want to set your Stop Loss - $49.90

- You hit Hotkey 1

-

Double click on the chart where you want to set your Entry - $50.01

-

You hit Hotkey 2

-

You hit Hotkey 2

- If and when the price hits $50.01 it will automatically enter you into the trade with your fixed $Risk and place your Stop Loss.

------------------------------------------

I used this on NVDA today at 9:51 ($415.63) for a HOD break. Luckily my preset stop was also set right below $415 at $414.97, so I didn't get wicked out 🙂 I actually set it up around 9:40 and wasn’t even looking at the chart when it entered for me! By the time I noticed I was in the trade I was already in the money!

Scripts:

Long $20 Risk:

Part 1:

StopPrice=PricePart 2:

DefShare=BP*0.97;Price=Price-StopPrice;SShare=20/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare; SShare=Share;Share=Price*100; Price=StopPrice; DefShare=Price*100; Price=Share/100; Price=Price+StopPrice; StopPrice=Price; Share=SShare; TogSShare; Price=Price+.05;TIF=DAY+;Route=Stop;StopType=Limit; Buy=Send; Share=DefShare;Price=Share/100; StopPrice=Price; DefShare=400;TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice-0 ACT:SELL STOPPRICE:StopPrice QTY:Pos TIF:DAY+;Short $20 Risk:

Part 1:

StopPrice=PricePart 2:

DefShare=BP*0.97;Price=StopPrice-Price;SShare=20/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare; SShare=Share;Share=Price*100; Price=StopPrice; DefShare=Price*100; Price=Share/100; Price=StopPrice-Price; StopPrice=Price; Share=SShare; TogSShare; Price=Price-.05;TIF=DAY+;Route=Stop;StopType=Limit; Sell=Send; Share=DefShare;Price=Share/100; StopPrice=Price; DefShare=400;TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice-0 ACT:BUY STOPPRICE:StopPrice QTY:Pos TIF:DAY+;Known Issues:

- I have seen the script fail and only enter me with a small number of shares. Uncertain what caused this, but I’ll be looking for it again.

Final Thoughts:

I’ve been testing this in SIM for a week and wouldn’t advise using it live without doing the same.

I know a lot of people have been asking for something like this - I would love to hear what other scenarios people would use this for!

-

4

4

-

1

1

-

Yes, that's also in the spreadsheet (although I added the stop order portion from the $ script).

This will add 50% to an existing position. So if you're long 100 shares, this will add another 50 shares and reset your stop to break even.

CXL ALLSYMB;DefShare=BP*0.97;Share=Pos;SShare=Share *0.5;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=SMRTL;Price= Ask+0.02;TIF=DAY+; BUY=Send;DefShare=400;TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice-0 ACT:SELL STOPPRICE:AvgCost QTY:Pos TIF:DAY+;

-

1

1

-

-

50 minutes ago, Andrew from Jersey said:Good afternoon all,

Is there a way to scale into a trade, long or short, and have the stop set to break-even?

Thanks,

Andrew

Hey Andrew, If you open Kyle's spreadsheet you'll see he has options to scale in additional risk:

$20

CXL ALLSYMB;DefShare=BP*0.97;Price=Ask+0.02-StopPrice;SShare=20/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=SMRTL;Price= Ask+0.02;TIF=DAY+; BUY=Send;DefShare=400;TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice-0 ACT:SELL STOPPRICE:StopPrice QTY:Pos TIF:DAY+;Hard to test right now (because the market is closed), but I think if you simply change StopPrice to AvgCost, that will reset your stop to break even at the same time.

-

1 hour ago, Paulius Kurpis said:Hi Fab,

what a great tool you have created! 👏🙏

One question or request?

Is it possible to export as .csv file?

Hey @Paulius Kurpis! First, welcome to the forum!

I don't think it's possible to export as a CSV, but you can export the SQLITE file and then convert that into a CSV.

In TradeReview

File > Export

Check only Export Trades

Choose an Export Directory

Download SQLiteStudio

In SQLiteStudio

Database > Add a database

Under Database type select SQLite 3

Under File select your exported .sqlite file from TradeReview

Under Name leave it as Trades

Press OK

Tools > Export

Select A single table

Press Next

Under Database select Trades

Under Table select Orders

Under Options check Export table data

Press Next

Under Export Format select CSV

Under Output choose a save location

Press FinishThe export gives two initial columns that are a combination of the date and time, but you can just delete them, as column D has the correct format

-

@Ryan Wilson @WindssKat @JenniferL @Travis Weirich

Might have an unexpected surprise related to this one... Stay tuned!

-

1

1

-

-

27 minutes ago, Benjamin Tang said:Hi Justin,

No open orders at all (hope you can see it on one of the screenshot from my original post)Hey, yeah I saw - I was just wondering if you even saw it flash and disappear right away?

Also did you see Kyle's comment?

16 hours ago, KyleK29 said:Few things, can you confirm you have 6:1 leverage (margin) on this account? Default is 4:1. The hotkeys you pasted are setup for 6:1 and a mismatch in leverage to the account can cause anomalies. Second, can you add a Trigger Order window and try again, see if a trigger order is being created? It's under Main Menu -> Trade -> Trigger Order .... this window works like the Open Orders window and will populate the status of active (not triggered) TO's.

-

1

1

-

-

Glad it worked! I’ll send an email to their lead developer about it too.

-

3 hours ago, Seydou Dia said:Hello friends, anyone using CMEG with the BBT promo code AND Kyle's hotkey; would you be kind enough to copy me your hotkey config. I am kinda confused with which ROUTE to use. I have read somewhere that LAMP route is not use anymore; but I am not sure. Thank you for any answer!

I asked Mike, if using the LAMP route is simply using LIMIT in the hotkeys:

QuoteYes as long as they have sent an email to CMEG and received confirmation from them all their orders during market hours will be on the lamp route.

-

On 7/5/2020 at 5:50 AM, Benjamin Tang said:I use this short command (please ignore the entry, its on purpose). i was expecting the stop loss will be triggered but that is not the case. can some body explain what is going on?

Do you ever see any open order in the Orders window to the left?

-

2 hours ago, Terrence McIntyre said:That hotkey from Das Trader creates a stop loss on a preexisting order correct?

Do you mean the hotkey from Kyle? It is not for a preexisting order. It sets a stop price and an enters you into a trade all in one hotkey.

2 hours ago, Terrence McIntyre said:Can the script be modified to use sim the reason I ask is because I changed the script and added ACCOUNT=TRxxx and it entered a live trade.

Can you share the script you tried? That should prevent you from trading on your live account.

-

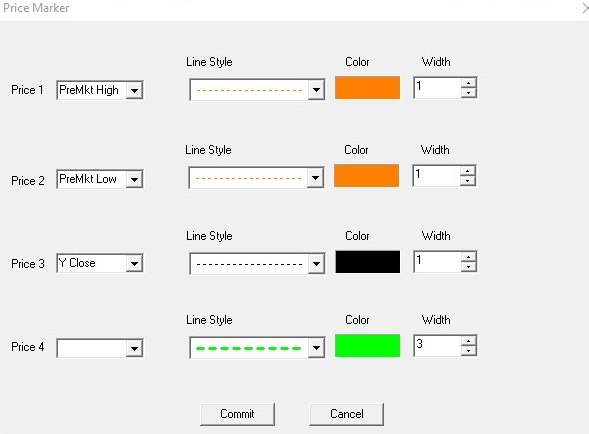

3 hours ago, gtichauer said:Hello,

Do you know if u can you show pre market low / high with Price Markers WHILE NOT HAVING pre market data checked? Or only when pre-market data is on the chart? Tks

Hey @gtichauer,

Yes, simply turn on a Study Config for them:

Right click on a chart and select Study Config

In the left column select PriceMarker and click Select-->

Now click on PriceMarker in the right column and click Config

Now simply add the top two settings I'm showing in the screenshot below:

-

3 hours ago, hsobers said:Hello, was there any further word from DAS on this feature? Thanks.

It has not been implemented unfortunately. Best bet is to just send in another request, and in the mean time just place them manually.

-

So my friend simply said you need to open the hotkey window in your main monitor, then you can move it over to another monitor.

-

1

1

-

-

I have seen that issue in the past, but not so bad. I believe it was a windows resolution/scaling issue... You can actually see the scroll bar off to the left...

I can't quite remember how it was fixed for the person who was having trouble. But I'll ask them and get back to you!

-

3 hours ago, Julio Hernandez said:Hi All - My name is Julio Hernandez. I'm from the Washington DC area and am working remotely for a small consulting firm. I've been trading for about 6 months now, mostly options and have found that I struggle with knowing how to lose. I let me losing trades longer out of pride/hope and lost some hard earned money. I found Andrews book on How to day trade for a living because I really wanted to learn how to trade the right way - so far I have alot to learn but I'm happy with the process. I'm grateful to be part of the community and can't wait for the journey to come. Thanks!

Welcome @Julio Hernandez! You're not alone, knowing how to lose is a common struggle among traders. If you haven't already definitely check out @Mike B's Psychology module on discipline in trading!

https://bearbulltraders.com/lessons/module-3-importance-of-discipline-in-trading/

-

1

1

-

-

On 6/14/2020 at 8:11 AM, Alam said:Hi Justin and other,

Thanks for great answers on hotkeys. Trying to set up following hotkeys but they are not working or have question

- Placing a limit order, where the price is picked up from mouse click and share size from the Montage

ROUTE=SMRTL;Price=price ;Share=Share;TIF=DAY+;SELL=Send

This is not working, it is picking up both price and share size from montage

- Close position (does not matter irrespective of long or short)

ROUTE=SMRTM;Share=Pos;TIF=DAY+;Send=Reverse

This is working, but would not it suppose to flip (reverse ) the position? Though it is working properly and closing the position without flipping the position.

Alam, I'm sorry I didn't respond to this. I'm not sure how I missed it.

1. You need to make sure that "Double-click to trade" is on. Right click your chart, Configure, and check "Double-click to trade".

2. It would not flip your position because the "reverse" simply stands for the opposite of BUY or SELL. So if you're long (buy) 100 shares, then the reverse in that script is (SELL). And as you are only telling it to SELL your Pos (position), it will only SELL 100 shares netting you at 0. I haven't tried this, but my assumption is if you did ROUTE=SMRTM;Share=Pos*2;TIF=DAY+;Send=Reverse, that would flip your position.

-

Glad it's working @Dieter These are the hotkeys for covering short positions. And yes, the BE hotkey remains the same!

Cover 50%:

CXL ALLSYMB;Route=LIMIT;Share=Pos*0.5;Price=Ask+0.05;TIF=DAY+;BUY=Send;ROUTE=STOP;StopType=Market;StopPrice=AvgCost;Share=Pos+share;TIF=DAY+;BUY=SENDCover All:

CXL ALLSYMB;Route=LIMIT;Share=Pos;Price=Ask+0.05;TIF=DAY+;BUY=Send-

1

1

-

-

4 hours ago, Dieter said:thanks, here a more detailed example what happens. After I press the Stop loss at BE button

Route=Stop;Price=AvgCost;StopType=MARKET;STOPPRICE=AvgCost;StopPrice=Round2;Share=Pos;TIF=DAY+;Send=Reverse;

it creates the SL order you see below. When I then press "Sell 50%", there is this error "invalid shares" you see below.

here the formula for the "Sell 50%" button.

CXL ALLSYMB;ROUTE=SMRTL;Price=Bid-0.10 ;Share=Pos*0.5;TIF=DAY+;SELL=Send

Maybe that helps you to see the error in one of the buttons. The same thing happens with the Sell 100 button. Only the Close all positions Hotkey closes the position.Hey, just use these instead:

Set Stop to BE:

CXL ALLSYMB;Route=Stop;Price=AvgCost;StopType=MARKET;STOPPRICE=AvgCost;StopPrice=Round2;Share=Pos;TIF=DAY+;Send=Reverse;Scale out 50% and update stop to correct shares at BE:

CXL ALLSYMB;Route=LIMIT;Share=Pos*0.5;Price=Bid-0.05;TIF=DAY+;SELL=Send;ROUTE=STOP;StopType=Market;StopPrice=AvgCost;Share=Pos-share;TIF=DAY+;SELL=SENDSell remaining position and cancel Stop Loss:

CXL ALLSYMB;Route=LIMIT;Share=Pos*1;Price=Bid-0.05;TIF=DAY+;SELL=SendOne other thing I noticed, although I'm not sure what timezone you're in. Stop Orders don't work in the pre-market.

-

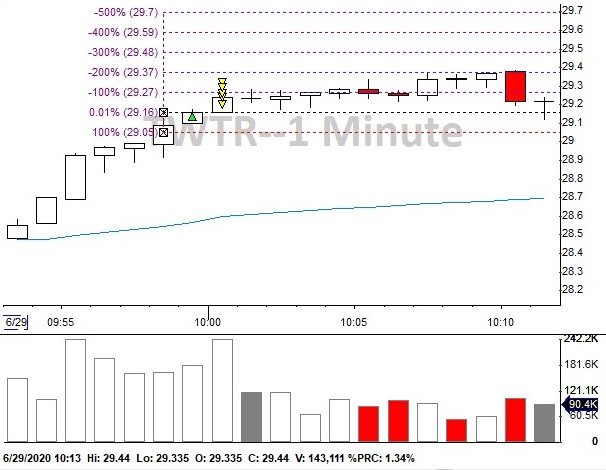

Unfortunately we can't script prices into horizontal lines.... Wouldn't that be nice 😛

There is a workaround with the Fibonacci Line tool.

To set it up:

- Set a hotkey to place a Fib line (script = FibonacciLine)

- Press the hotkey and draw a line anywhere on your chart.

- Right click on the vertical line and select Config.

- Chang the line settings to match this:

- Now, when you enter a position and have a stop loss. You simply hit the Fib hotkey, and click and drag down from your entry to your stop.

- You will then have nice price targets on your chart that will look like this:

As you can see, I'm embarrassingly partialed in my trade too soon! 🤣

-

3

3

-

1

1

-

-

Hey @Dieter

Try putting a CXL order in front of that script first. If you already had a stop loss placed you would near to clear the original one first.

CXL ALLSYMB;Route=Stop;Price=AvgCost;StopType=MARKET;STOPPRICE=AvgCost;StopPrice=Round2;Share=Pos;TIF=DAY+;Send=Reverse;

-

26 minutes ago, edequev said:Great Justin, thanks for your support! So, so, when a stock has a SSR... can we get that our orders get filled with BID +0.01 and price is going up, right?

have a nice Sunday Justin

Yes, your order will be filled if your hotkey is set for BID+0.01 and the price ticks up into it.

And thanks! You too 🙂

-

Hi Shannon,

Welcome to the forum! If you haven't already, your first stop should definitely be going through Classes 1-5 in our Education Center. If you've already done that, feel free to ask any specific questions you may have!

DAS Pro simulator does not provide News ?

in Day Trading Hardware, Software and Tools

Posted

Not sure about the Simulator... My assumption is it isn't available. You can always message DAS Support!

It does work for live; but in my personal opinion, it's not the best news aggregator out there. Listening to Benzinga in the chat room is a far more effective.