-

Content Count

310 -

Joined

-

Last visited

-

Days Won

34

Content Type

Profiles

Forums

Calendar

Member Map

Everything posted by Brendon

-

About 4 days max I think, sometimes really fast 1-2 days I had it happen. No issues and I did maybe 3-4 wire transfers. All online.

-

Hey nostalgiaguru, I am not sure if closing out SSR positions has improved, word on the street is that it is still an issue. So I just dont trade SSR with CMEG too often. I haven't had an issue in many months with closing out positions since. I guess I found my own solution 🙂 Hi, Jramosent, I use Chase as well for wire transfers to CMEG, just did a transfer last week with no issues, if you want to post a s/s of your recipient information here I can see if it matches mine. I set it up online not at a branch.

-

Hey All, Check out my really rough video on how I currently use the Stream Deck and a simple grid print-out to manage risk and share size. Polished version coming soon! Let me know if this is any help. https://drive.google.com/open?id=1Jzd8pXp0afvFEFZhG8d7mcCiwIF38li8

-

Bart's trading journal - free download now available

Brendon replied to bartpuszko's topic in Day Trading Journals

Hi Bart, I haven't used your journal yet but am very excited to do so. Question, so we should use that same link http://daytradearcade.com/trading-journal2/ to get the latest version every 3 months? Also if it expires with our data in it, is there a way to migrate that data over to the new journal or do we need to start a new one? Thanks!- 17 replies

-

- bart

- total trader

-

(and 1 more)

Tagged with:

-

Hi All, I am not sure if I can make it over there tonight, I thought it was Friday 😞 Between getting up at 5:45 and hustling to the cube all day it may just be too much during the week. Just got back from the East Coast yesterday actually so a little beat up. If I don't make it I hope you all have a great time and post pics.

-

Hey Nick, I will drive into what Rob H. said in chat. When the market has serious momentum in one direction or is volatile it tends to push other stocks around, now this is not always the case. But when that does happen the stock is no longer in play and trading independently. You have to use extreme caution if you decide to trade stocks that follow the overall market. They are susceptible to erratic swings due to any type of press releases throughout the day (i.e Trump burps). So keep MSNBC on in the bg. A strat to use, really the only one I can think of is paying close attention to historic and intra-day price levels on the SPY or whichever indices the stock is following...and scalping. You can definitely trade them but don't overstay your welcome. Some of the time a stock will run towards it's own significant level that syncs with the market, say a 50sma daily with the stock, and a 20ema with the SPY, that can happen. Keep those charts up and glances your eyes back and worth. More or less double the work and riskier by nature. -B.

-

Hi Gordon, I have not read the book yet, but have heard good things about it. My thoughts on reading the tape are this: The tape shows what actual orders have gotten filled vs looking at the L2 which are the limit orders that are there waiting to be filled. So the L2 is a before picture and 'the tape' is the after picture. Let's say you are looking at the L2 and orders are stacking on either side, say 10,000 shares are at the top of the ASK side, you would see the number '100' sitting there. If it decreased to now 50...just by looking at the L2 you do not know if aggressive buyers were buying on the ASK or those placing those 100 sell limits orders jumped to sell on the BID side before the priced broke down. Thus the term Andrew uses in his classes 'Aggressive Buyers' buying on the ASK or 'Aggressive Sellers' selling on the BID side (not sure if he uses the later term). Now you can have sellers on the ASK that believe the higher price will come to them and are in the middle of the L2 and not aggressive buyers who believe the price will come to them on the BID side bringing the price down. I keep my tape color coded to show Buy and Sell orders filled AT, ABOVE, and BELOW to show if those are aggressive buyers or sellers. In short it helps show who is in control. Also shows that were is order flow with the ticks of every order. You do not want to trade a stock with no order flow, so look for a tick of an order filled every second or so (shows good order flow and liquidity). Hope this helps! -B.

-

Hi All, Looking forward to this meet up! I am a couple hours away in Sacramento, do you think we can push this out by an hour, say starting at 7:00 PM. I am still on the 9-5 grind out here and can't really squeak off work too early. If not no big deal I will try my best to make it. Thanks, Brendon D.

-

True, 500ms is a little high for bounces, im in Sacramento and usually don't spike over 100ms too often (Xfinity). But then again I am not constantly checking my ping... DAS does freeze for a second or two from time to time, freaks Andrew out lol, and that could be what you're experiencing as well, we all get that (just DAS hangs) or that could be something different. Sorry not much help here. I don't know if bootcamp helps any either.

-

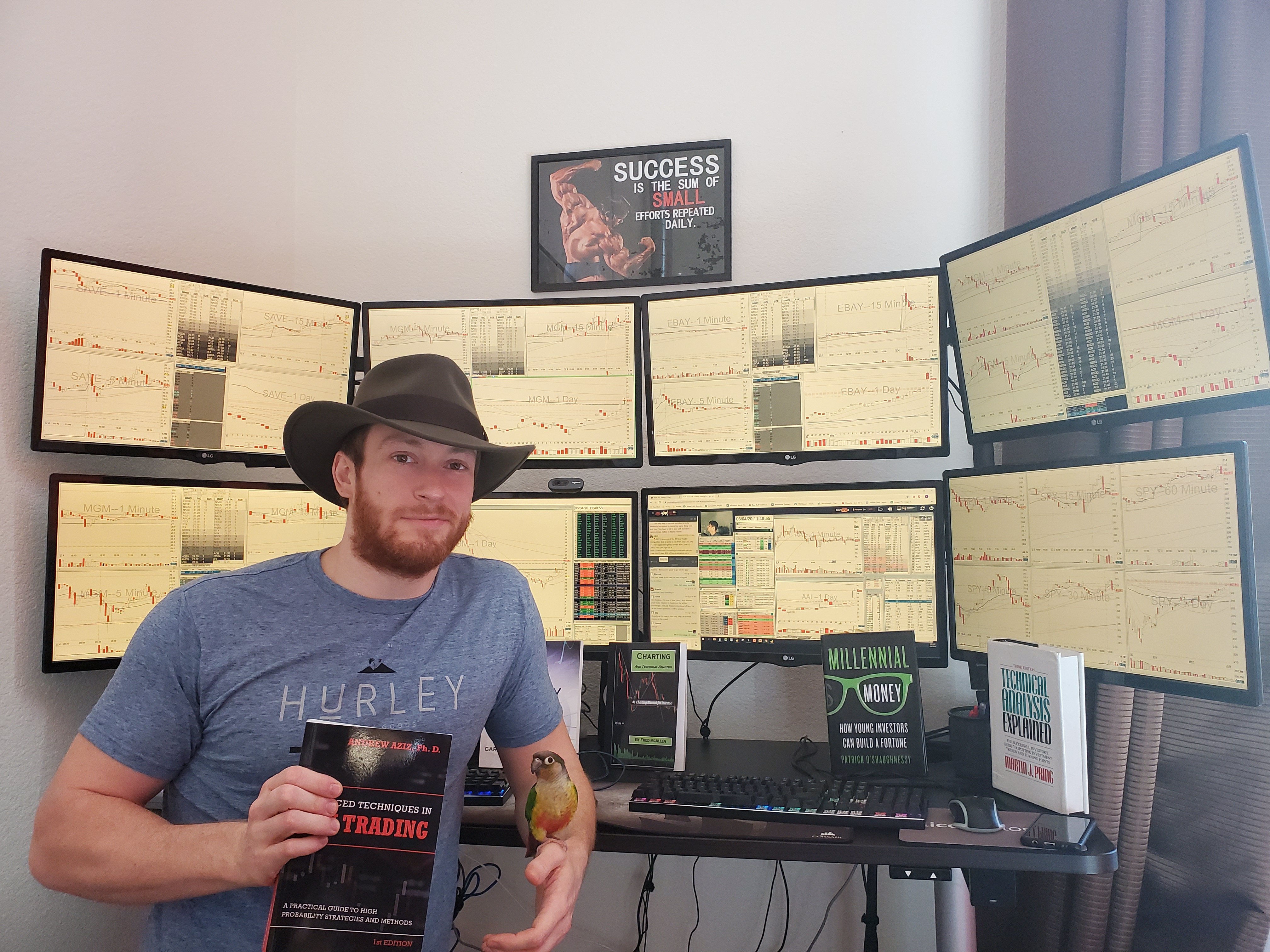

Show us your set-up!

Brendon replied to Jason H.'s topic in Day Trading Hardware, Software and Tools

Hey guys, I will try to make a tutorial video on my hotkeys for the streamdeck asap. I have updated the software and had no hiccups. I plan of making a combined video showing how I manage risk, share size, hard stops, all with hotkeys on 'deck'. The only time my strategy starts are become difficult is when the stock is moving too quickly to place appropriate stops (takes about a 1 or 2 second delay) at the technical levels so I am selective in what I trade. -

Hey George, I was in your shoes not too long ago...actually worse shoes because I often let the trade run against me until it came back so I could get out. Worked 95% until it doesn't and your loss cripples your account. Anyway you should at least look for 1:1 R/R 2:1 is optimal. I don't so much have a fixed $$ or cent risk per trade but a max loss of 1% of my acct per trade. Say $50 risk out of a 5k acct. That 1% potential loss determines my share size I can take. Carlos is right about working on entries, you can so easily be stopped out on a great setup but your entry is just off, especially in an ABCD pattern, be patient and try to get a solid entry on a pullback so you wont stop out as often. If you miss the pullback, let the trade go. Catch the next one. Pass up other setups that just don't have the reward. Take 2-3 trades but fish for the best setup you can. If it helps post your trades in the chat and some of us can give feedback. Try that and see how you do after a week.

-

Wow Made Dane, you put a ton of effort into all this. You know we need to convince Elagato company to release a larger StreamDeck to allow for more custom hard stop keys...maybe 5 across, 5 down. I use hard stops of 5c but run out of room with 1 device and have to make folders for additional keys. I agree stick with the 1% perhaps 2% account risk per trade and if you want to make more money, you will need to grow your balance not risk more...always remember that. Remember to log the days you break your rules and review them so you do not relapse. The way I am doing that now is living the cube life 'outlook and excel' all day long at work. Never again am I going to blow past my stops. I'll make a post about that sometime for anyone here not respecting proper risk management. Your trading is so dependent on your external life factors, so make sure nothing will interfere with your performance, i.e. sleep, stress, money, bills, kids, wife, hubby, etc...all of that WILL affect your performance to some degree. Very unlike other jobs and things we do during the day. Thanks for the detailed post bruh.

-

Hey Rob, Carlos, Have you guys made any updates to the s/s you use for journaling? I find video re-capping trades is excellent for the thought process but you also need the hard stats from an s/s to find out what actually works in the long-term? Would love to have a BearBull custom template so we can compare our perf. Maybe something like a trader of the month award.

-

Hi All, I am wondering why we can't have a meetup on the weekend? I think we all can make plans around that no?...even with family, bring them!! I would love to help set up a gathering on the weekend but during the week I am currently working (aka outlook and excel bs) so unless the meetup was in the evening, say around ~7PM...I don't think I could attend for this one...or be an hour late. If we can confirm a slightly later time in the evening or the weekend I'm down...I'll bring the beer and pretzels 😉

-

The platform is pretty much identical. The only difference I know of is the 'Risk Control' feature when you right click your account in the acct window. CMEG doesn't seem to have that so you better watch your max loss per day. Since I use them I just keep my max risk per trade so low I usually run out of trade setups before max loss anyway...if I was red on each trade. I emailed them about it a while back. Also I don't think the global trend line update that Lee W. was working made it to the release of DAS that CMEG uses. Perhaps in the next update once it's finalized with DAS.

-

I absolutely wholeheartedly approve of the 3 or at lest 2 separate tabs in the chat. Although chat volume may decrease after the morning session...during peak trading hours we need separation for questions on tech analysis and just random information. Thanks for bringing this back to how the old chatroom was. All that is left is to fix the video lag of Andrew, I want those lips sync! *side note - we have some of the other mods come on and talk to us...I vote for a webshow not just audio, looking at your Rob for that entrainment. I plan to do this full time and want to be entertained while I'm losing my shirt.

-

Hi Andrew, I confirmed today that SureTrader $4.95 flat free does include ECN fees. That screenshot is from CMEG's simulator so that may be why the rate is different...their Trade Fees used are based on the routes off their website and a simulator cannot know the route executed. Thank you for pointing that out if that is the case! I know Brandon C. was trading live today so he may be a better resource to help confirm the ECN cost. I have to revised my conclusions on CMEG and ECN charges. For the purposes of using CMEG as a 'gateway' broker they fill that niche very well and are competitively priced better than the competition and SureTrader. I will revise my above post. Thanks Andrew for checking into this!!!

-

I deleted my previous post, in short my calculations were incorrect due to testing the ECN rate in their sim. Thanks Andrew for helping!! --- For all traders that don't go over a $25,000 position size, take ~4 trades a day + scaling out ~3 times (a normal scenario for a new trader). I would like to point out if you are trading let's say 5K shares a day (~average share price you are trading of $20) with an ECN rate of $0.004 per share you would pay $20 in ECN fees. Let's also say you take 4 trades and scale out 3 times. 4x3 = 12 tickets x $2.95 = $35.40 in commission plus ECN of $20. A total of $55.40 of fees for trading that day. Now if you use SureTrader at $4.95 per ticket (including ECN fees) that's 12 tickets x $4.95 = $59.40 A total of $59.40 of fees for trading that day. Overall winner = CMEG, +1 for CMEG also because they do not restrict margin on most stocks like SureTrader does. *if your average share price is ~$15 is may be slightly cheaper for SureTrader, but only by a few dollars... If my above calculations make more sense this time use CMEG! If you are trading lower priced stocks (under $10 primarily, either trade less shares (under 5K) or consider another broker like IB. Fernando may have more insight on that. Thanks Andrew for helping me rethink their free structure and providing us with a good junior broker for new traders to use. Hopefully my above scenario can help new traders decide on their broker!

-

Throwing a quick example of today's double 1 minute bottom that Brian pointed out to us in chat. The 5-minute doesn't show much sign of a reversal at all, however looking into the 1 minute candles tells us the a clearer story....another lesson to use multiple time-frames when trading reversals. Once upon a time there was STX....the first time I went long I got stopped out, but my stop was at .46 area...so not sure why I had a bad fill in the .20s area...could be really fast price action slippage...I don't remember. It was a 1:1 risk, 2nd time was about a 1:5 R/R and nailed it. The lesson I want to point out is you can't take a reversal based on the 5 minute alone, sometimes you need to get an entry on the 1-minute that doesn't stop you out...just look at that huge 5 min candle at 9:55...you can't see the double bottom on the 5-min chart but you can on the 1-minute. Once you see the 2nd bottom form and bounce you can go long, I love those booster candles @ 10:01, they show a lot of conviction. One trade that worked out, one that didn't (50%) but bc of R/R, I was able to make a decent profit.

-

Breakeven Stop on our avgcost at StopMarket or Stop Limit

Brendon replied to HUDDIN's topic in DAS Trader Pro Tips and Tricks

Hey, I use ROUTE=STOP;StopType=Market;StopPrice=AvgCos for stops at B/E. Personal preference. -

Pending Order Question - What does 'SM' mean under Type?

Brendon replied to Brendon's topic in DAS Trader Pro Tips and Tricks

Interesting and perfect, thanks Rob. Man of wisdom. Also do you know how I can close my open positions and open orders at the same time with pushing a hotkey just once? If I use something like: CXL ALL;ROUTE=SMRTL;Share=Pos;Price=Bid-0.05;TIF=DAY+;SELL=Send It cancels my open order, but I get the Stop Order window to pop up wanted me to hit Okay to close out I rather not have to hit it twice as I could be tempted to not close out after 1 push. -

Hi All, Quick question, I was using the script ROUTE=LIMIT;Price=Ask+0.05;Share=5000/Price ;TIF=DAY+;BUY=Send;ROUTE=STOP;StopType=Market;StopPrice=last*.99;Share=5000/Price;TIF=DAY+;SELL=SEND I am not sure if this script works, im in after hours and only the buy is being executed even if the price moves above/below. Could be a sim issue or after hours issue... I think this pending order is that once the last price hits $50.16 the order executes and sells my position? Type SM: 50.16 not sure what that means? Any clue? The chart shows the sell order arrow at 50.74...so I am thinking that is the original order then the script amends it to sell at market once the last price hits 50.16? Any feedback would be helpful, sorry if what im asking is unclear.

-

How am I going to master the stock market...

Brendon replied to Robert H's topic in Day Trading Hardware, Software and Tools

"For some reason" might want to 'invest' in https://www.walmart.com/ip/Homax-Nail-Hole-Patch-Sapckle-White-5-3-oz/17300366?wmlspartner=wlpa&selectedSellerId=0&wl13=2598&adid=22222222227016744417&wl0=&wl1=g&wl2=c&wl3=80432605969&wl4=pla-177672085249&wl5=9032543&wl6=&wl7=&wl8=&wl9=pla&wl10=8175035&wl11=local&wl12=17300366&wl13=2598&veh=sem -

Hi Ben, I have not yet, but did inquire all the steps needed and options. It seems you can wire money out or they can mail you a physical check within a few days. Once I do withdraw money I will share that feedback as well.

-

CMEG 3 month Review I wanted to wait a few months before giving my opinion on CMEG. I have been using them since late February 2018 and am one of their initial client accounts. Let me preface this review by saying no broker is perfect but if you are using SureTrader...CMEG is far better overall and a solid choice for small accounts learning to trade with no PDT rule. Their client service is more than happy to talk/email you on any concerns. Who is to say other brokers do not experience the same issues from time to time? I will begin with some issues over the months I have experienced: 1. Orders getting executed (I have experienced times where I could not close out of a position and had to call/email them to manually do it). This lasted for a few hours, sometimes until the next day but usually was fixed overnight. ~2-3 times since February. I was not given a reason why this occurred. Also they do not reimburse any losses incurred for being unable to close out. 2. Changes to their margin policy (without email notification or a phone call on updates to their trading rules). For example, some of my hotkey scrips use % of Buying Power. On a few mornings CMEG had updated their margin allowed and the requirements behind usage. As a result my orders were not getting filled and I had no idea why! Rule parameters could vary from how much margin is allowed with long/short positions/per stock price/maintenance requirement per share...etc. I had to troubleshoot scripts with a real/demo account to understand what exactly was going on...alongside email/phone calls to the broker. A good habit was to test orders in pre-market with the provided demo account. Just because you were able to swing with 4:1 margin without liquidation or use full margin short at the open on XYZ stock priced at X dollars does not mean you can the next day. It's best to check their policy regularly or even better just call to see if there was an update. There was no mass email to clients for rule changes. However, I believe they now inform clients by email for most updates. Excellent! 4. This broker is overseas so be prepared to face international calling charges. However CMEG did help and credit my account for me unknowingly incurring international phone charges. They are not toll-free. They also credited back some of their platform fees that I incurred for the inconvenience of any changes that affected my trading which was very nice. A sign of goodwill and respect to clients. SureTrader refused to credit me back their withdrawal fee $40 after having me wait 3 weeks due to an error on their end to receive my money...I will never go back. 3. Platform software updates - they should inform clients of all manual changes, i.e the Mobile DAS App Order Route had to be manually changed to be able to login on your phone. This had to be changed to route 5016 from 5010 when they released an updated desktop client. Probably just an oversight but I had to take hours out of my day to figure this out, work with DAS tech support, and groupthink with BB members. Also it is best to talk to DAS tech support for any issues related to all licensed DAS platforms, both mobile and desktop. I did not expect CMEG to know everything about DAS as they are a broker and license the platform. 4. Email responses can vary, sometimes less than an hour, sometimes more than a day depending on the situation. Sometimes their phone number doesn't connect through, and I need to call a few times, and I think some of the email signatures use an outdated phone number? Something I'm not sure about that Lee W brought to my attention. I think IB can set up or the direct platform license from DAS has a risk feature you can right click on your account and set up risk parameters, i.e Max Loss, Max Loss Per trade. Not sure on this but CMEG does not offer that feature with their DAS license. Would be a nice feature for new traders to use though. I listed these concerns so CMEG can eliminate them. I am not criticizing their services and am 99% of the time pleased and comfortable using them as my broker. I often email them with suggestions on improvements and compliments. If I am able to work with these issues as a new trader you can as well and should use CMEG. Overall The $2.95 per trade promo that Andrew got us is probably the best you can get out there, unless you scale out 10 times, then IB may be the better choice if you have the account balance, or perhaps Speedtrader. This makes new traders less worried about commissions and breaking even and more focused on trading the setup. SureTrader charges $5 per trade in the U.S. and this makes it very stressful to manage, trust me. Performance has been getting steadily better (orders have been getting filled without issues for well over a month now). Closing positions has not been an issue for over a month as well. Excellent so far. FREE SIMULATOR, when you open an account! SureTrader does NOT offer that. The executions are very fast. Short inventory is excellent (they route through IB and seem to have even more available sometimes) I have not had any crashes of the platform. Windows 10 Pro. They do not restrict margin with many stocks, only in very very rare cases is margin restricted. I think in 3 months I've only seen 1 stock restricted and that was LFIN lol R.I.P. This is a huge advantage to build up small accounts over other brokers like SureTrader and IB. You need at least 5K buying power to make profits over these $2.95 commission fees on most stocks we trade. With 4:1 margin for <2.5K balance and 6:1 for >2.5K that's not hard to maintain and slowly grow on 1-2 trades daily A+ setups. The growing pains of their risk/margin policy changes has settled down. I think they compromised what they can manage and what traders feel comfortable using. It has been over a month I think, since the last big change, and I like what their rules offer! Makes new traders at ease. Rules are available on their website to view. I can pretty much use margin on almost all stocks I trade without issue. I don't trade stocks less than $10 too much and their rules tend to be for very low priced penny stocks. So if you trade from Fernando's watch list you may not be able to use too much margin. Also be aware that in the past you may have been able to swing positions using full margin, that has since been reduced to 2:1 margin, you get an email warning around ~3:48PM and ~3:53PM their system automatically brings you within that limit. When I asked, forced liquidation was not a part of their procedures but came into effect without me being made aware...so it's best to double check their rules weekly or you can learn the hard way. Remember they sometimes update their rules without emailing clients. If you were able to swing with margin in the past, give them a call to make sure you stay within guidelines come market close...if you're caught in a bad trade but like the daily swing. This really doesn't matter because you shouldn't be swinging with much margin anyway right? All in all, I would continue to use this broker and recommend them to new traders wanting to build up their accounts, learn to trade, practice in a sim for free, and use an excellent and tested platform. They are constantly improving and love to receive constructive feedback. It can only get better from here as they develop. Oh yeah wait times on the phone are usually pretty low, couple minutes at most, unlike some other brokers and their service team remembers you! Thanks Andrew for working with CMEG to help us small account holders be able to day trade along side the big boys.