-

Content Count

310 -

Joined

-

Last visited

-

Days Won

34

Brendon last won the day on September 16 2024

Brendon had the most liked content!

Community Reputation

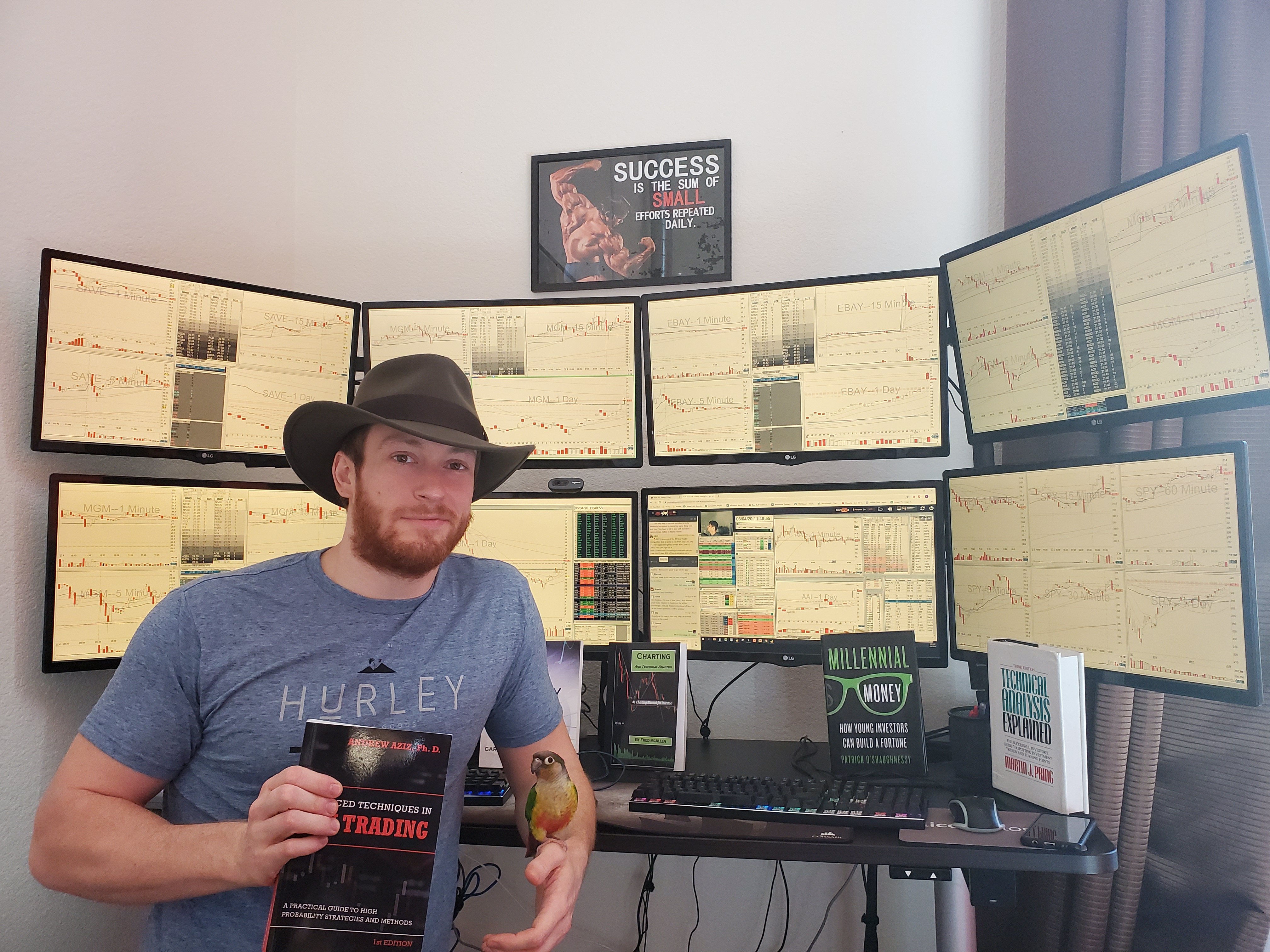

146 ExcellentAbout Brendon

-

Rank

Brendon D

Recent Profile Visitors

11,311 profile views

-

Hi Roberto, I can help with your DAS hotkey script issues. Send me an email [email protected] to further discuss. Thanks!

-

📉+$354 AMZN Stopped Out False VWAP Breakdown, flipped VWAP Breakout Success!🚀 After an initial strong selloff on AMZN there was a buyback and a falling wedge pattern forming. I thought we would break LOD and test Pre-Market Low. We squeezed to VWAP and I stopped out. We held VWAP and I flipped LONG for HOD Break and added heavily anticipating the break. We tested VWAP again but snapped back up, added more with confidence. Targets were Previous Day Close, Previous Day High, and large ASK at $178. The trade took longer than I would have liked. Paint was drying I that day. Patience Richard Parker! 1 on 1 Mentorship Available for DAS Trader Pro, see link below https://lnkd.in/gGVfdYcB #AMZN #AMAZON #STOPPEDOUT #VWAPBreakdown #HODBreak

-

📉+$238 NVDA Bounce from Previous Day High/VWAP🚀 Trade Date: 8/15/2024 NVDA had a nice move in Pre-market, sold off at the open but got bought up strongly, bullish candles! We bounced from previous day high and VWAP with a wicked DOJI and went long after a few minutes of holding consolidation. Target was high of pre-market and and R4. Then a final partial at $121. Simple, clean trade, nothing fancy. 1 on 1 Mentorship Available for DAS Trader Pro, see link below: https://lnkd.in/gGVfdYcB #NVDA #NVIDIA #VWAPBreakout #DOJI #PDHBounce

-

📉+$407 AMD Previous Day High Hold and VWAP Buyup/Breakout!🚀 Trade Date: 8/13/2024 AMD was holding above R3, holding previous day high, and was above VWAP. I went long and partialed with targets of pre-market high and R4 but was stopped out B/E for the remainder. We were holding again and went long again for a VWAP breakout, continued to hold, added more, and partialed at the same targets. My last trade I saw a nice buyup to VWAP but missed the prime entry and decided to go for a HOD/R4 breakout heavy size for a momentum scalp. Price action became choppy, I was over goal for the day and closed my position. AMD had a nice continuation trend to R5 however. 1 on 1 Mentorship Available for DAS Trader Pro https://lnkd.in/gGVfdYcB #AMD #VWAPBreakout #VWAPBuyUp #PreviousDayHigh #HODBreak

-

📉+$308 NVDA failed PDC bounce, stopped out but flipped success, AMZN HOD Break VWAP Breakout🚀 Trade Date: 8/9/2024 AMZN had a nice buyup from PDC and closed above VWAP. I went for a break of HOD towards R1, took a few partials, but lost momentum and thought we would pullback to Previous Day High again. Should have re-entered long again from the strong buyups for a break towards R2 but I saw better opportunities with NVDA. NVDA had a nice hold and buyup PDC. I went long for break of Previous Day High towards VWAP for an intended VWAP Breakout. Partialed at HOD but we pulled back to my B/E stopped out. Next we were holding S2 and went long for a breakout of PDC higher towards VWAP but rejected HARD! I felt a loss of S2 coming and large BIDs building at $104/Pre-market low towards S3 so flipped position went short and covered at these cam pivot levels/liquidity pools. 1 on 1 Mentorship Available for DAS Trader Pro https://lnkd.in/gGVfdYcB #NVDA #NVIDIA #AMD #StoppedOut #FlipPosition #VWAPBreakout

-

Brendon started following DAS Hotkeys for today's BBT 3 month SIM

-

Hey Roberto, I host BBT's DAS Trader Pro Onboarding class Mondays @ 12PM EST, we do go over the BBT Hotkey setup. Feel free to join and we can troubleshoot! https://bearbulltraders.com/onboarding/

-

📉+$596 AAPL Engulfing VWAP Breakout to Camarilla Pivots🚀 Trade Date: 8/7/2024 AAPL began to engulf the pre-market 5 min candle and once it bounced from PDC and broke VWAP I went long. My plan was to ride momentum to various levels and liquidity pools on the Level 2, Pre-market high, Yesterday High, and to partial heavily with a final target of R4. I should of left some on for a test of R4 but I was already up 3R! Clean fun trade once R3 was broken and ride to R4! #AAPL #AAPLE #VWAPBreakout #Engulfing 1 on 1 Mentorship Available for DAS Trader Pro https://calendly.com/brendon-bearbulltraders

-

📉+$472 AMD Reversal with Triple ADD to Pre-market low!🚀 Trade Date: 8/6/2024 AMD sold off hard from the open and I saw a reversal opportunity. After an exhaustive high volume red bar on the 1-min and large green bar closed above the 9-EMA, I went long for a VWAP Breakout. I decided to add again at VWAP after another huge bullish green bar. I again added at VWAP with a PDC target and partialed at S3 but the QQQ was losing momentum and exited more at Pre-Market Low and the rest at B/E. #AMD #Reversal #LostMomentum 1 on 1 Mentorship Available for DAS Trader Pro https://calendly.com/brendon-bearbulltraders

-

bjbuchannon started following Brendon

-

📉+$236 NVDA Failed VWAP Breakout but success on S4 reversal, GOOGL Failed VWAP Breakout but success 2nd attempt!🚀 Trade Date: 7/24/2024 I was looking for a quick VWAP Breakout on NVDA towards S1 but stopped out before we got there. Caught an S4 Reversal with decent volume on the Doji candle, went long at the break of the 1-Min 9EMA with a target of VWAP/Pre-market low, partialed at PM low and just short of S3. Partialed in more for another VWAP breakout and added again when we broke above VWAP for a 2nd time, partialed at S3 but decided to exit the rest at B/E after witnessing a hard selloff and loss of VWAP. Google had earnings and went for a VWAP breakout but got stopped out. Got bought back up and went long at VWAP, partialed at the moving averages and S3 and the rest towards S2. I should of got back in on the Doji buyups from the trend hold. NOT AN EASY DAY! #GOOGLE #GOOGL #NVDA #NVIDIA #VWAPBreakout #STOPPEDOUT

-

📉+$414 NVDA Classic HOD/VWAP Breakout!🚀 Trade Date: 7/23/2024 NVDA had a strong bullish previous day (7/22) and I was looking for continuation and close the gapdown from a few days prior. Higher lows formed (quasi ascending triangle) and once we had a close above VWAP I went long at HOD break, heavy size. I partialed at PDC, R1, PDH, and just shy of R2. I managed about 3R on the trade and did not want to hold until R3, which failed anyway. #NVDA #NVDA #VWAPBreakout #HODBreakout #CamarillaPivots

-

Back from vacation in Olympia National Forest, Washington! 📉+$315 NVDA Stopped Out 2/3 times VWAP Breakout! AMD VWAP BuyUp for HOD Breakout!🚀 Trade Date: 7/22/24 Semis and NVDA gapped up on Biden's presidential exit and possible easing Taiwan chip buzz. Was looking for a HOD breakout after the buyup from below VWAP and close above. I was concerned this would be a failed breakout and kept a tight stop. Got stopped out twice but saw a button forming (no new lows) and went long at the break of VWAP again for a break of R4 towards Previous Day High. Partialed a little early and should of held some towards R5. AMD had a beautiful buyup candle from VWAP and I was looking for a HOD break, High of PM break from R4 towards Previous Day High. Partialed on the way up but should of left some on for a test of R5. Instead I re-entered once we held trend and partialed towards R5. I like my AMD trade management best but my partials were a little early. #NVDA #NVIDIA #AMD #HODBreakout #VWAPBreakout #StoppedOut

-

📉+$489 AMD Failed ORB but Reversal Catch after Chop City! NVDA VWAP Breakout!🚀 Trade Date: 7/10/24 AMD was setting up for an ORB to R5/PM High but we rejected and after a few partials stopped out on slippage. Tried a reversal as we looked to hold YYH but stopped out at R3 multiple times. My concern was AMD's extension on the daily and if we broke LOD, we would tumble hard/fast. Should have waited to see if we would hold R3 before entering. Then at 9:40 the price action slowed and the bids dried up, bottom was in, saw this as the last chance to long for a reversal from R3 and partialed at Yesterday High. NVDA bounced off R1 nicely and held R2, I went for a classic VWAP breakout to R3/Yesterday High/ and high of Pre-market. This was a clean trade I am proud of after getting chopped up in AMD. #AMD #NVDA #NVIDIA #VWAPBreakout #ORBFail #Reversal

-

@tntp45 Thanks! Usually between $100-$200.

-

📉+$1205 TSLA Low of Day Break, AMD VWAP Breakout🚀 Trade Date: 7/8/24 TLSA was overbought on the daily and had an initial rejection of S2. A downtrend started below the 1-min MAs. Waited for LOD break and went short towards large orders on the L2 and S4 as a final goal. The candles were being bought up aggressively and after a final liquidity grab at $245 I exited fully as a pullback was likely and would take me out at B/E. AMD was breaking out on the daily and after an initial run sold off to LOD. After 3 candles of holding the 50 moving averages above R3 and pre-market consolidation I went long for a break of VWAP (QQQ was moving up) and a retest of R4. Partialed on the way up just shy of R4 as we lost momentum. I longed again at VWAP for a possible trend higher but it ended up being a scalp as the order book ladder cleared on the ASKs. #TESLA #TSLA #LODBreak #AMD #VWAPBreakout