-

Content Count

310 -

Joined

-

Last visited

-

Days Won

34

Content Type

Profiles

Forums

Calendar

Member Map

Everything posted by Brendon

-

Hmm well if you shorted 85 shares, with a stop of 7 cents away, that's $5.95 risk, not $20. You may have the script set to $20 but as Peter pointed out you may be limited to your buying power...And to risk $20 with a 7 cent stop you would have needed to short ~285 shares of AMD (at that share price). Hopefully this helps!

- 589 replies

-

- 1

-

-

- scripts

- risk management

-

(and 3 more)

Tagged with:

-

Hi Jra - post a screenshot of your order log because that sounds impossible. There could be some slippage between orders sent and filled, but be aware the script, by nature, is not 100% accurate with the risk calc.

- 589 replies

-

- scripts

- risk management

-

(and 3 more)

Tagged with:

-

Hey J, Welcome! Try to make it to the Seattle BBT meetup in a couple of weeks. I'm down in San Jose, CA so it's a little bit far for me to make the trip. Hey as long as you're not drinking coffee all those 8 hours of I think going live will be great for you now. Start small and protect that account while you get better at reading the charts.

-

Unfortunately the only solution that worked for me was to move time-zones to have a 'sure thing' on my trading performance while I work my career. Last thing you want to do is practice in a replay simulator, save up all your money, then leave your job for day trading and find out you can't hack it yet. Too risky...but if you want to get a general feeling for day trading absolutely try a replay sim, that is the first step.

-

Simulator BP question from a new member.

Brendon replied to Sheryl Rawlings's topic in DAS Trader Pro Tips and Tricks

Hi Sheryl, in short, no you cannot adjust any of these features in the sim. You can adjust your commission calculator to match your broker when you go live however. -

Hi Traders, This time I actually have a question and not just running my mouth. Does anyone know hot to set this up: Say you are long 300 shares @ $10 and want to scale out 100 shares at $10.30, 100 shares at $10.60, and the last 100 shares at $11.00 but want your stop to be at say be at b/e $10. And the stock hit your first two targets $10.30 and $10.60 but then failed and went back down to hit your STOP at $10. My question is it possible to have the pending STOP order calc your current position size, which is now 100 shares, not the original 300 shares? Can this be done with a script or in the montage? I know we can use a 'bracket order' to have one stop out price and in the money exit price, but is there one we can set up for multiple exits and then recalc your new position position to exit the correct size if stop is hit, without taking on a short (if the stop did not recalc). Also I am not looking for a trailing stop order. Let me know if I worded this confusingly and I will edit. Thanks traders (looking at Kyle 'the script wonder dog')

-

Huge VWAP Differences on different Timeframes

Brendon replied to AcKeBoNNiE's topic in DAS Trader Pro Tips and Tricks

But remember to not place your stop EXACTLY at VWAP, as it will never be the same on different platforms/market data providers. Leave a little wiggle room, like 50 cents on a 300 stock 🙂 but ya that wiggle room should be from the VWAP on the montage. -

I have not used TradingSim in years, and I personally did not like it. You don't want to cheap out on learning the ropes, if you are concerned with costs of your tools you are probably not psychology ready for the coming losses in learning to trade live. My opinion is to work with the real thing, the live market, and on the platform you will be using, like DAS. I would not buy a yearly package, that is probably way to long to spend on that platform for market replays. Then again I used this tool years ago and am not sure how good it is now. I heed to Carlos's advice!

-

Huge VWAP Differences on different Timeframes

Brendon replied to AcKeBoNNiE's topic in DAS Trader Pro Tips and Tricks

Yup I asked this question myself, look at your montage and see what the VWAP figure is, that is the correct value. It is usually correct on the 1 minute but it shouldn't be THAT much different between 1 and 5. 50 cents on a <300 stock is not that much. -

@glennthephoneman2020 I prefer to use Camtasia, it has more features and easier to record and edit in my opinion. Andrew and most mods use it as well. Not a fan of OBS. A lot of members record their trading days for journaling, it's definitely helpful! And to do video recaps helps a lot on going through your thought process. I am more a video guy than hard logs, I run off the 'big picture' for a month's worth of trades. I am not trying to micro manage my trades down to a point but I am sure I am losing out on some by not doing so.

-

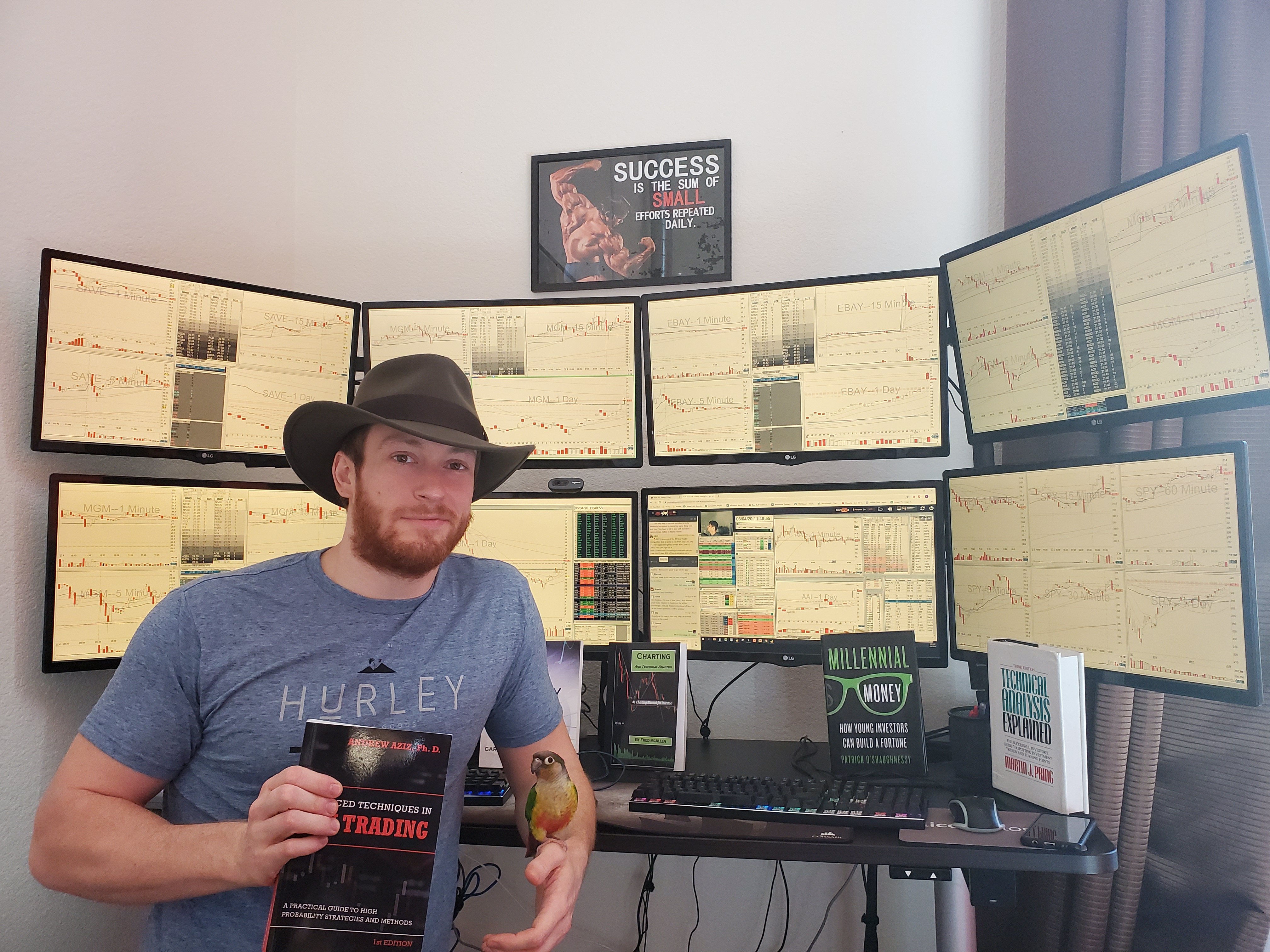

Dang, and you just got your dope new setup too! I run 8 monitors 1080 landscape, never had any issues at all. What gfx cards are you running? You can trouble shoot by maybe trying a different gfx card. I also have an HDMI switch that moves between my trading rig and my wife's work comp. Even with that I have no issues. Make sure your res is the same for all monitors, like don't run 1080 on some and then a different res on another, I can see that messing with DAS big time maybe.

-

https://www.bearbulltraders.com/downloads/ Go to downloads from the top right of your screen while at the website, not the forum page, and go to the drop down next to your name. The DAS layout file is in there.

-

Curious, how would this help save on fees? Odd lots cost more? I haven't noticed with IB.

- 589 replies

-

- scripts

- risk management

-

(and 3 more)

Tagged with:

-

Subscription Question

Brendon replied to Konstantinos Spanos's topic in Welcome: Bear Bull Traders Forums

Or you can do the American way and pay with 'credit' 😄 -

Welcome Glen, I went to Purdue in IN, go Boilermakers! I agree with having control over your investments, personally I manage my own investment account with ETF and indices vs a 401(k). I rather have the control to withdraw and not wait until I am in a wheelchair to use my money lol. Trading is a great way to supplement your income and I get a trade or two in with the boys before work. Beats anything else to have a side hustle.

-

Hi Traders, BiG B here. I am new to IB and apparently they restrict margin on a select number of stocks everyday depending on a variety of parameters, but I guess it's really due to volatility over a time period. Example ROKU has been bonkers the past 6 months and my order was rejected today. SureTrader pumps out a margin ticker list I think, CMEG may as well, in their platforms (DAS) but TWS with IB does not. Pretty ridiculous if you ask me. So if you are using Kyle's auto share size hotkey be aware your order could be rejected if your position is too large compared to you buying power. If you're trading with a smaller account like me taking large sizes even with minimal risk of $50-$100 per trade. Another reason to have a large enough account where you do not need margin...better save up small account traders!!! I am and probably will lower my risk per trade to $50, been using $100, to avoid order rejections.

-

Dang, this reminds of a football playbook or Moneyball...but better, amazing job with this!

-

I wonder how much sales Elgato generated from our community alone, everyone I talked to has a deck, or 2 in my case. Just amazing the power of how word or mouth contributes. I think 'Josh' started us on that migration.

-

I think this can be helpful for those who may need to leave their station and can't monitor the trade if it is a longer hold. But as traders we really need to be interactive to progress. Stopping out can be tough but scaling out at the proper r/r levels should be easier and something we all need to master and be interactive on. Kyle's stop out script prevents us from blowing up accounts and he has accomplished that. Too much auto pilot can be a handicap. But I definitely am in favor of trying this out and having the option for different types of trades or taking multiple trades at once!!

- 589 replies

-

- scripts

- risk management

-

(and 3 more)

Tagged with:

-

San Francisco Meetup with Andrew

Brendon replied to Abiel's topic in Members Introductions & Meetups

The wife and I had an absolute BLAST meeting everyone! Blew my expectations out of the water. Life is too short, double down for part deux all! -

Great Allen! Welcome! I went to Purdue, IN is pretty cool, real down the earth people. That's great u can do the 2nd shift, I had to moved coasts to be able to trade and work ha.

-

San Francisco Meetup with Andrew

Brendon replied to Abiel's topic in Members Introductions & Meetups

No it's some random man lol, and sure i'll dm you my routine when I get a chance -

San Francisco Meetup with Andrew

Brendon replied to Abiel's topic in Members Introductions & Meetups

I have a BBT shirt, it's a little too small to wear comfortably lol, but I will bring it. -

San Francisco Meetup with Andrew

Brendon replied to Abiel's topic in Members Introductions & Meetups

6:30PM works for me, 7PM would be better lol, at City Beer Store. I'll hit the road right after work, im in San Jose too so I should make it between 6:30 and 7PM! I will also bring my better half if that's alright.