-

Content Count

310 -

Joined

-

Last visited

-

Days Won

34

Content Type

Profiles

Forums

Calendar

Member Map

Everything posted by Brendon

-

If you're starting out, decrease that 1% risk per trade to 0.5% risk or 0.25%, 1% is usually what experienced traders work with because they have a large enough account, well over 25k and have the buying power to keep trading after red days. But since you mentioned your acct is around 5k and most new traders start with a small account. That 1% rule may not be the best option for your account size due to buying power risk (not being able to make trades with more expensive stocks).

-

Fair warning regarding CMEG lack of customer service

Brendon replied to dmiles's topic in Day Trading Brokers

I can also recommend having mobile DAS on your phone as backup to close any positions. It works well enough. -

How to Add/Remove Trade Icons on the Chart

Brendon replied to Robert H's topic in DAS Trader Pro Tips and Tricks

The new version is in beta, you can run the auto update feature in DAS under Tools to upgrade. -

Fair warning regarding CMEG lack of customer service

Brendon replied to dmiles's topic in Day Trading Brokers

Welp the most important thing in trading is keeping a cool head. Don't get flustered, act as a machine doing commands and IF/THEN statements. Problem solve what's holding you back, if CMEG causes a distraction and throws off your trading use a different broker. And thank you for making us aware of your situation! -

Fair warning regarding CMEG lack of customer service

Brendon replied to dmiles's topic in Day Trading Brokers

Hi dmiles, I know exactly what you are going through. To be fully transparent I used CMEG for about 1 year exactly and before that SureTrader and various other full service brokers. My experience was mixed, CMEG did have some of their broker rule changes and auto account wind up liquidation changes without informing their clients by email beforehand. Basically, they were changing their rules on the fly without giving notice and that 'messed' up some of my trades. I was holding some positions overnight during that time. I have had issues where trades got rejected for no reason and tried calling. CMEG is exactly what you said, when it works, it works fine, but when there are issues, getting a response can been difficult. When they first started back around Feb 2018 I dealt with their clients services directly and they were EXTREMELY helpful in answering all my questions. I did have success with wiring money in and out of CMEG within their time-frame but requesting statements was received with some dislike on their end. They only had a few dozen accounts at the time and I have no idea how much they have grown now but it could be an under-staffing issue. I have an IB account also now as a domestic broker is more reliable and their customer service is superb. Frankly, if you are just starting out, the PDT rule is probably for the best, and having unlimited day trades with a very small account offshore can be risky to account blowup. It was for me and I have learned to be better for it. And yes I agree, a confirmation email on all requests NEEDS to be sent to clients, that is unacceptable service on their end. -

Trade Date : 10/30/19 * 1 trade on $GE, wicked 1 min bull-flag, ugly 5 min

-

These hotkeys are in HOT demand. Just remember to NOT cancel your stops lol. It can be tempting but just say no and let the trade work itself out. However you can stop out early if you see the trade breaking down.

-

Can someone explain to me how IBKR uses margin?

Brendon replied to Sapperstien's topic in Day Trading Brokers

You bet, the rules of trading are a 'click' type learning curve, you either get it 100% or are completely lost, but we all get there. -

Can someone explain to me how IBKR uses margin?

Brendon replied to Sapperstien's topic in Day Trading Brokers

Margin allows you to have a larger position size, say for expensive stocks like +$200 with setups that the stop is only a couple cents away from your entry, you will have to take a large position and you will need the leverage, but your risk (stop) will still be 1% regardless. Your only risk is your stop, not the cash you use to enter the trade. -

Can someone explain to me how IBKR uses margin?

Brendon replied to Sapperstien's topic in Day Trading Brokers

That 1% is how far away your stop is from your entry in a trade (stop is where the trade no longer makes technical sense). So if that's 10 cents away from your entry, you better make sure your share size times 10 cents equals 1% of your acct. Hopefully that helps, I know it can be confusing with these terms at first. -

Can someone explain to me how IBKR uses margin?

Brendon replied to Sapperstien's topic in Day Trading Brokers

Yo, not entirely sure what you mean by your question, but you can just call IB and ask, they have great, very fast customer service. Leverage just increases your potential BP (and risk). -

Hmm I think I heard of them, I still would trade on your own with BBT. I wouldn't join a trading firm, period, and they pay next to nothing. Honestly trading is more discipline and a firm can't teach you that. As for the technicals and setups, you can learn that here or on your own. The last thing you want is your career under the gun of trading, while you're learning at least.

-

Rob C's Trading Journal - starting Feb 1 2019

Brendon replied to Rob C's topic in Day Trading Journals

Trading is not natural, this is mentioned in many many books. If I were to draw a primal analogy it would be like hunting buffalo, most of the time you fail, but you don't keep chasing the buffalo when you lost the initiative. I would assume a lot of young hunters did and either got killed like in the movie 'Alpha' or let other potential catches get away. Point is, plan your attack and even the best planned hunts fail most of the time. But the important thing is you survive to hunt another day and learn from your mistakes. When you make a catch it more than makes up for you failures. Food for weeks. Commissions are cheap as Andrew says. Sometimes you need to break a bone aka blow up your acct to learn this lesson. -

Hi BBT, I moved to San Jose, CA a few months ago and wanted to see if anyone is in the area to grab a beer or a gin/tonic (older gents) and talk some trading strat. i.e 'how you blew up your first acct, etc' stories. DM me or just reply if anyone is around

-

Eh most prop firms require you to use your own capital, i think min is like 10k or 5k, i called and got contacted by a few shops in NYC (T3 was one) when I was living there. They provide you with their platform and tools and 'show you some ropes'. mostly a gimmick if they are posting jobs out there or sending random emails to you. stick with learning on your own and use other resources like BBT. Once you go bear bull, you never go back, unless you're a Vancouver trader 😉

-

Brendon D 'The Big B' is BACK!

Brendon replied to Brendon's topic in Members Introductions & Meetups

First week back! annnnd the result is GREEEEN on all 3 day trades....PDT rule. Will do some sim trading for the rest of the week. IB commission structure makes taking partials a breeze without regret or FOF (fear of fees). Just want to shout out to Kyle, AdventureDog(great video), and Aiman for helping me with the auto risk management hot keys. Been trying to get everything to work in live. First trade I had no trade arrows lol, that was interesting, thanks DAS auto update... Took 3 live trades this week, some small winners, some large, some green that could have gone red (saved by my stop at b/e after partial), and now I can trade $300 stocks ($BA) with proper risk management. Can't ask for anything else, it just looks like it may be many months under the PDT rule until I grow my account. BTW - not sure exactly when Andrew started rockin' the beard but I am a fan, Beard Bull Traders. -

Hi Kyle, quick question if you don't mind, where would I put my acct#, live or sim, in the scripts? I rather have 2 sets of hotkeys loaded separate for sim and live trading. Thanks! BiG B

- 589 replies

-

- scripts

- risk management

-

(and 3 more)

Tagged with:

-

Brendon D 'The Big B' is BACK!

Brendon replied to Brendon's topic in Members Introductions & Meetups

What's up BB Traders, so I decided to go with IB and pull out of CMEG for a number of obvious reasons. Convenience of an onshore broker just can't be match. That being said I needed a larger account balance as IB provides less margin, especially on the short side. Almost there saving up, another week or two! I will follow along Aiman's path as I will restricted by the PDT rule for quite some time. See you all soon. No mistakes. -

Hey BB Team, Looking forward to the next meetup, my last one was the first ever meetup in NYC (sans Andrew 😞 ). I am wondering if we can move the time to 6PM, so I can get there after work, I get off at 5PM, if not no big deal, I'll just arrive a little late. Thanks, Big B

- 1 comment

-

- bayarea

- bearbulltrader

-

(and 2 more)

Tagged with:

-

Hello fellow BearBull Boss Traders!!! In short, I AM BACK! In long, I will tell you my journey and rather than have you read multiple paragraphs. I will use bullet points, short and sweet as a trader's time is too valuable. *2014-2015 - My co-workers were talking about penny stocks, I tried the all too tempting penny pumps by email alerts and stock twits using web clients i.e. TD and Scottrade. In the end I lost most of my capital (had no real education, no mentor. Left trading for a few years but saw the potential). *Feb - June 2017 - Tried again with web clients and eventually found Andrew's book among other technical reads on Amazon (reason I chose his book and community was that Andrew trades mostly non-low floaters aka no penny junk, also most other big chat rooms trade too many pumps). The BearBull community is not ridiculously advertised with false hope. I felt 'it was the real professional deal', and have not been disappointed. *Oct 2017 - Jan 2018 - Became a member and joined the chat room after the 1 week trial, started watching Andrew trade in the morning, joined his classes at night. Practiced in sim for a few months on my laptop, did not really have much risk control but was able to learn DAS and identifying setups to actually trade with some logic. Decided to then go live (too impatient). *Jan 2018 - Apr 2018 - After initial failure of almost losing my 5k starting capital due to high fees and poor risk control '''looking at you SureTrader auto liquidating my positions''', down to $1200, I was so 'good' at setups I eventually turned that into over $17,000!!! My average position size was between 50K and 100K worth of stock, risk management was non existent for my account size. Then I rolled 'ONE BAD TRADE' in good old WalMart (went short at the open, ran against me all day). Over the next several months I never recovered and slowly lost it all but a few hundred dollars. I was so focused on saying 'that can't happen to me, I can quickly get that back'. Lesson here is to manage risk and never revenge trade to make it back. It is not sustainable. *May-Nov 2018 - Began to revert to sim for many months and then move living locations from CT to CA. I decided to day trade before work, living in the PST zone. The pressures of trading are greatly reduced when you have cash flow, and can separate your career work and trading at different times of the day. I traded the first hour before leaving for work. I also developed and finally accepted risk control, share size, and hard stops at technical levels where the trade no longer makes sense, STICK TO YOUR PLAN. This was attempted with a small account but later switched to sim. *Dec 2018 - August 2019 - After plan was established and my risk control was priority over gains, my capital was too small to be profitable with fees. Left trading to focus on my career and to raise funds for trading. *August 2019 - Returning to trading for supplemental income and trade for the love of trading. I want to be the best I can be at it. Perfect setups and trades are more satisfying than seeing gains. It is all about how you get there. If you are going to be a trader part time or full time, make the decision to not give up. Problem solve your weaknesses. The goal continues to trade before work PST time, wake up at 6AM - do PM analysis until open - trade until 7:15AM head to work at 7:45AM. Do recaps at night and repeat! Just thought I would share my story briefly in case some of you are at similar stages in the journey to being a trader full time or part time. There is no better feeling than executing a perfect trade that you planned out and stuck to that plan. When that works out it's like getting a mental high. Feel free to message me with anything, see you all in the chat!

-

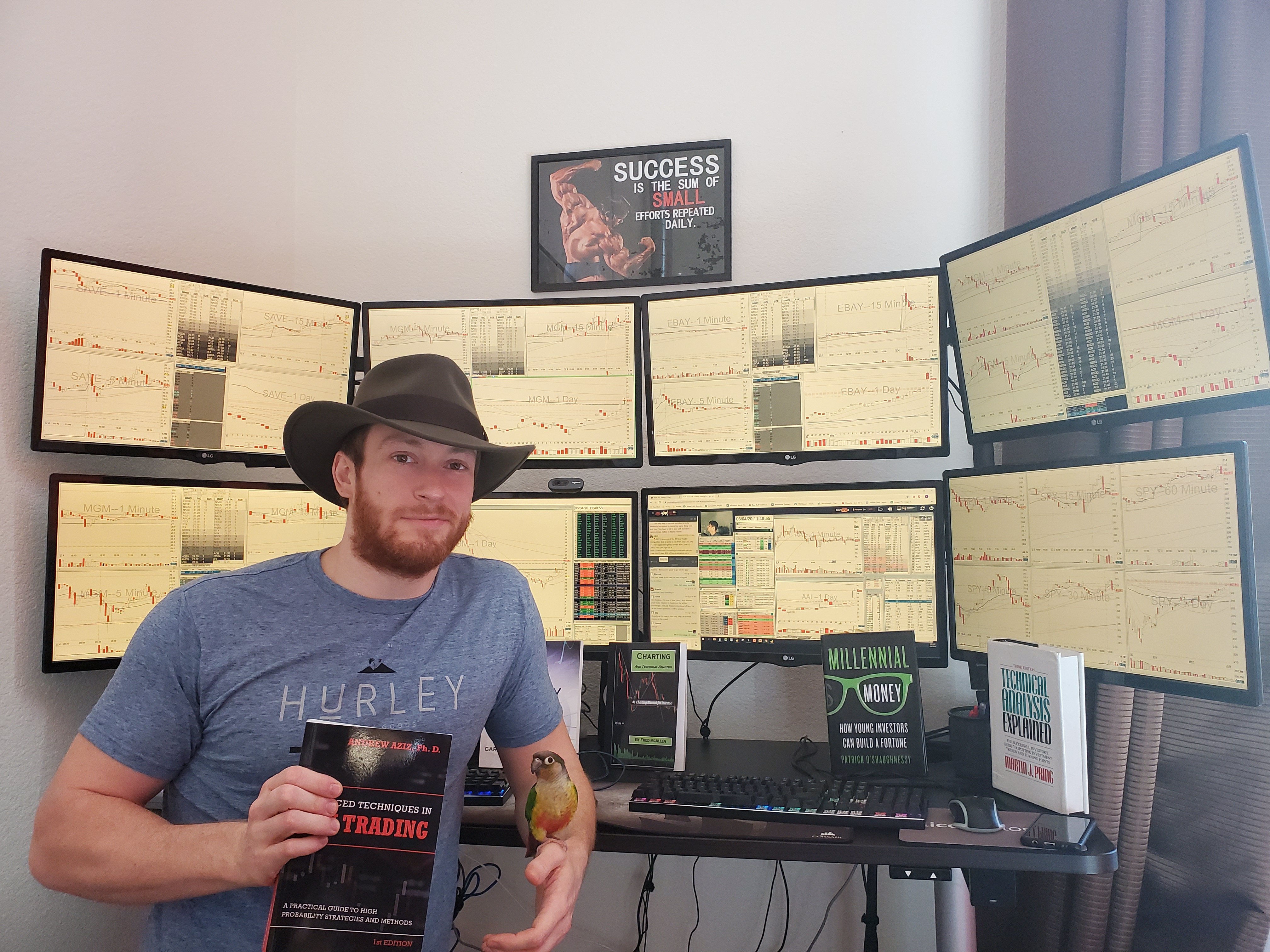

Show us your set-up!

Brendon replied to Jason H.'s topic in Day Trading Hardware, Software and Tools

Martin I got you covered https://www.amazon.com/gp/product/B075FP5RBL/ref=oh_aui_search_detailpage?ie=UTF8&psc=1 I miss the simplicity, then work your way up to 6-8 screens as you can filter the data. -

I bought a 49 inch curved Samsung Monitor

Brendon replied to vic's topic in Day Trading Hardware, Software and Tools

Yes please tell us which you prefer, I prefer having the actually screen separation, like 2x24 or 2x27 side by side, and have quad chats on each. An ultra-wide wouldn't benefit my style, but show us your chart layout!! -

New Deck keys.txt Hey Kevin, please see the attached, sorry it's a little late, hopefully you can still reference the file! *I would of attached my icons but apparently the Windows Disk cleanup program cleared my download folder (i bet some windows update had that auto selected) 😞 so I have to remake them all at some point.

-

Hey Kevin, yup that looks good for hard stops on the long side, you can add, ACCOUNT=(enter your sim account), into the script to test these keys before live just because there are so many you may of fat figured one. What I want to add next is a [Short SSR] folder for scripts that short on the ASK and not the BID side, it would look exactly the same as my SHORT folder just with different scripts. Let me know how it is going, I'm still working on a more polished tutorial but it seems you have the gist, great! Yeah the Deck is really a life saver, it makes the process mechanical and removes 90% of the emotion out of trading so we are trading the technicals and not our 'hopes it will turn around'. Not all of us have the boss's discipline nailed down. "Changing your stops on the fly is the most dangerous decision a new trader can make."