-

Content Count

717 -

Joined

-

Last visited

-

Days Won

97

Posts posted by Robert H

-

-

I'm only aware of one method to unlink a window from the Montage: select the window and type another ticker, then press ENTER.

-

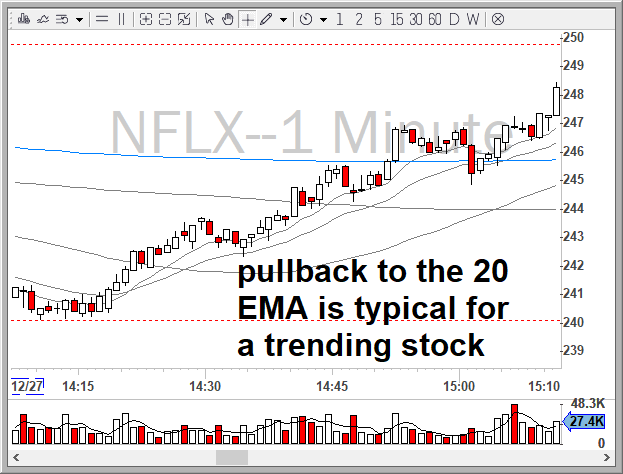

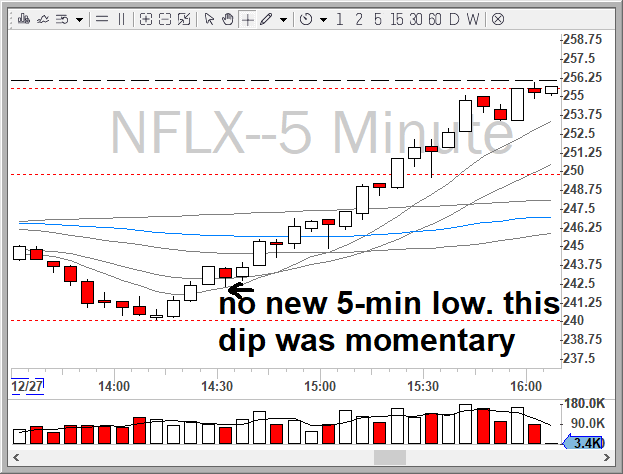

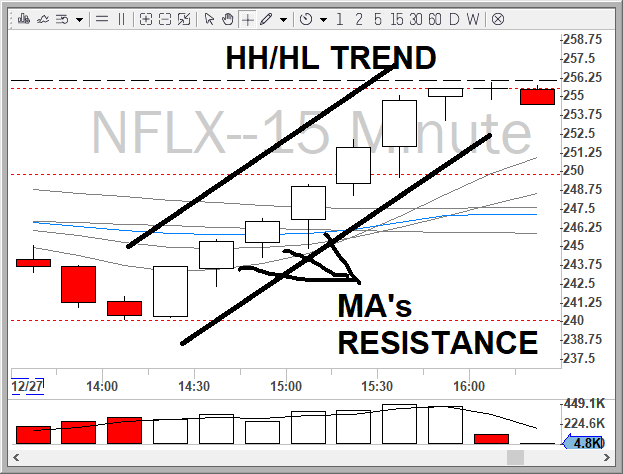

@mmohr63 It really depends. Sometimes I will bail on a new 5-minute low. Other times I will wait for a new 15-minute low. I will most definitely take partials if it fails to make a new 5-min high. When the price stalls like that it is either consolidation (good) or signs that the trend is weakening (bad). When the trend collapses, it becomes a reverse ABCD.

Keep in mind that the Reversal Strategy is no different than other strategies in terms of having potential targets and resistance in your path. Look for MA's to take partial with the final target at VWAP.

It also depends on your trading style. Do you keep a small number of shares until your break-even? If so, you could have rode this 15-min chart trend until $256 (higher highs and higher lows). If I recall correctly, this was a market-wide reversal and extremely strong in terms of momentum and speed. Under these circumstances, there should be no rush to exit the trade completely.

-

3 hours ago, Norman said:Thanks for the review Ross, very helpful.

One question: let's say I was observing a one minute chart in real time playback mode. Would a single one minute candle rise and fall (ie. show the struggle between buyers and sellers) as if you were viewing the same chart in DAS while trading live? And would the growth of a volume bar also match what you'd see in DAS? What I'm looking for is a realistic simulation of price (and volume) action. In your opinion, how does it compare to DAS in that respect?

I'll probably check this out myself with the free trial but the thought I'd start by asking you and get the information out there for interested members.Yes, the price action is live and is based on historical time and sales. The candles will pulsate and the volume bars increase just like in DAS. I recommend you sign up for the free trial and take it for a test drive.

-

21 hours ago, sandstorm said:I'm confused by this as well.

Here's the excerpt from Andrew's book (great read BTW):"If the current price of the stock is higher than the previous day close (for Stocks in Play that gapped up), the market is moving from a Green day to a Red day (meaning that the percentage that the price has changed will now be negative, which will be shown as red in most of the Exchanges and platforms). This is a Green-to-Red move."

The reason this doesn't make sense is the price in this excerpt is currently above the previous day's close,. Given we've gapped up we must be above yesterday's open, and ergo the price is up. Why would the percentage that the price has changed be negative? Nothing is mentioned about the open of the day when the gap occurs. We are above yesterday's close - shouldn't that be positive? And when we are up - are we not green?

If this said the price is below yesterday's close, and yesterday was green, and we're below the open, so the day candle is red this makes sense.

The wording for this strategy definitely needs some clarification. @Dima summed it up nicely:

Price is currently green and moving towards previous day close => G2R

Price is currently red and moving towards previous day close => R2G

Perhaps a better explanation would be:

"If the current price of the stock is higher than the previous day close and is moving towards that line, the market is moving from a Green day to a Red day (meaning that the percentage that the price has changed will now be negative, which will be shown as red in most of the Exchanges and platforms). This is a Green-to-Red move."

-

Hi Geo,

You do not need a broker for the DAS Simulator.

You can sign up monthly with DAS directly, or 3-months through us here.

-

1

1

-

-

6 minutes ago, nmarnson said:Can someone clarify what the best pricing structure is for a $30,000 account with IB? I'm lazy, and my head hurts.

For reference, this would be about 6,000 shares of AMD per trade, with multiple scale outs on winning trades.Tiered. Everybody uses this structure as it appears to be the cheapest in 95% of scenarios.

-

I don't think this is possible. It's called the "Market Clock" as it represents NYC time zone.

-

3 hours ago, KyleK29 said:I don't recall seeing this in previous versions.

Hi Kyle, this has always been an issue based on how VWAP is calculated. Here's an old post from @Dima regarding the subject:

Hope that answers your question.

-

Thanks, Kyle.

I found that even using the dollar risk version, the diminishing available BP was still an issue. I'm assuming this is because it still contains the DefShare=BP*X variable.

I've since switched to a more simple version based on @fjmocke original hotkey:

Price=Ask-Price + 0.02;Share=100 / Price;ROUTE=SMRTL;Price=Ask+0.05;TIF=DAY+;BUY=Send

As we know, the downside is being rejected based on insufficient BP. I manage this by copy/pasting my Withhold BP from DAS to Excel.

For some reason I couldn't get the STOP orders to work at all. Maybe I'm doing something wrong.

On behalf of the BBT Team: thanks again for all the work!

-

When first starting out or learning a new strategy, I would suggest respecting your original stop loss. This way you can get a feel for the signals that appear when the trade falls apart. As Mark Douglas recommends during the 20 trade exercise: make it mechanical and limit decision making.

As you gain experience, you will start observing the above indicators that reduce the probability of your trade working out. This is where intuition allows you to get out of a trade early. Remember that you can always re-enter as commissions are cheap. The danger when doing this as a beginner is that it leads to getting chopped up and/or revenge trading.

-

2

2

-

-

5 minutes ago, Brian B said:I can't seem to get this to work, not sure if Im putting the hotkey script in right. Any help would be appreciated.

This is the hotkey command:

https://finviz.com/quote.ashx?t=%SYMB%

You have to select the montage for pressing the hotkey.

-

1

1

-

-

Having a daily profit goal early in your trading career can have negative consequences. You may feel the need to press, chase, trade the whole day, etc.

Your goals should be based on execution, psychology, rule adherence, making improvements etc. Similar to what @rom30 mentioned above. Treat your daily goal and max loss as stopping points for the day.

That being said, a goal of 0.5% to 1% a day is usually recommended for early in your career. 5% is unrealistic. It also makes sense that your daily max loss is no more than your daily goal--a losing day should not wipe out a winning day.

Here are the numbers I used when first going live:

Account: $2500

Daily goal : 1-2% (25-50$)

Daily Max loss : 2% (50$)

Risk per trade : 1% to 2% (25-50$)If you risk 1% on a 2:1 setup that hits, then your day is over (one and done). Sometimes you end up with a few small winners and losers that put you black, small green or small red. It's a good habit to evaluate yourself throughout the day and know when to throw in the towel. Sometimes the market isn't tradeable, while sometimes the issue is with ourselves. For beginners this distinction is very difficult to make. So best to bench yourself.

Cheers.

-

2

2

-

1

1

-

-

The old GTA post kind of died off. I've closed it in hopes that this one gets more traction. Here it is for reference:

-

2 hours ago, Ofaruk1740 said:is there any best website (paid/free) where I can save my trade journal?

Check out www.tradervue.com. Lots of people in our community use it. There's paid and free versions.

Great stats and analysis on your trading.

-

@KyleK29 Thanks for adding the STOP order feature! I will test in simulator and report back. Awesome work on the Stop Order Modifiers, too.

I ran into an issue today while having multiple positions opened. Note I am using the % Equity Risk version of the hotkeys. I believe using the Dollar Risk version may avoid this.

So I opened position 1, risking 1% of my account. My buying power is now reduced by what is used by position 1. All is well.

I open position 2 using the same hotkey as above. However, I am now risking much less than 1% since the calculation is based off available buying power (of course). This leads to a much smaller position than what was intended. It gets worst if you open a third or fourth position. Note that my buying power is never fully consumed. Each subsequent position is just calculated based off the decreasing available BP.

I'm going to manually calculate 1% of my equity and use the Dollar Risk version. Will report back on results.

-

IB Canada gives 3.33:1 leverage (30% margin requirement) for eligible stocks. Most mid floats we trade fall into this category. Click the underlying stocks link here for further info.

Volatile stocks--such as $CGC--are not eligible for margin.

-

DAS doesn't have an equivalent feature that I am aware of.

-

2

2

-

-

On 11/11/2018 at 9:18 PM, stephenlee said:Quick question!

What does SMRTL mean?

SMRTL is Interactive Brokers' proprietary route for limit orders. SMRTM is for market orders.

-

2

2

-

-

11 hours ago, ebretrader said:Nice examples Roberts, but i still have problems, the last two days i had problems with the reversals on ROKU...i will be working on that next monday.

Post charts so we can review what the issues were.

-

21 hours ago, ftadeubr said:Thank you for the help, Robert.

In video-lesson 1, Andrew mentions we can set up the simulator to stop resetting the amounts. Could anyone help me find where I can choose that option? I would like to simulate the situation I will have when I go live, i.e., keeping my balance as days go by, instead of starting with a new balance every morning.

Thanks!

Take a look at this post for the workaround.

-

5 hours ago, Sukh said:My understanding is that this is completely DAS related, therefore can be done independent of which broker you use.

I don't believe so. The platform under CMEG is called Traders Elite Pro and has its own stipulations (i.e, Risk Control Page greyed out).

It wouldn't hurt to ask CMEG though.

-

-

On 10/28/2018 at 8:11 AM, Jmos said:Thanks Robert! What hotkey script do you use to automatically input the stock symbol when opening finviz? I attempted to put %SYMB% in the url of the hotkey, but does not open the correct page.

That script is located here:

-

13 hours ago, tardi44 said:Hi Robert,

Don't you pay everyday loan fees tarding in USD using CAD? 🤔

I understood that when tarding in a non base currency, IB open a loan in the equity currency and close it with the closing trade.

There is no loan or interest paid for intraday positions. However, if you end the day with negative USD and don't exchange funds to zero this balance owing, then there is interest. This is why I ensure I always have some USD per step (3) above.

-

1

1

-

Venting plus big loss

in Risk, Account & Money Management

Posted

@Fernando Samora We've all been there! You are definitely not alone.

I would suggest forgetting about that loss. The moment you start thinking about "making it back" is when emotions enter the equation again.

Focus on trading small and trading well. Your recovery plan sounds like a good start. Also look into Risk Controls to prevent these types of days from occurring. Best of luck.