-

Content Count

717 -

Joined

-

Last visited

-

Days Won

97

Posts posted by Robert H

-

-

7 hours ago, tjunayed said:Does anyone know if it shows the trades from previous days? I want to go back to previous days to review my trades. Thanks

No. DAS does a maintenance outage and resets everyday at midnight EST.

You must take screenshots before to save any history.

-

1

1

-

-

You mean a little box of them on webcam? OBS can do that with multiple video sources!

Check out this post for some basic info on OBS:

-

1

1

-

-

IB offers really good exchange rates!

Watch this video. Make sure to test it out in the paper trading account first.

-

-

Take a look at this post for how to create a hotkey for stop loss.

Try changing StopPrice=AvgCost*0.75 (long) and StopPrice=AvgCost+1.333 (short)

-

I'm pretty sure SEC regulations disallow shorting in a registered account (IRA, 401K, TFSA, RRSP, etc). Check with individual brokers for other restrictions.

-

This may be possible through the use of Symbol Lists.

1. Create a Symbol List (Tools > Symbol Lists > Create New List)

2. Select all stocks in your watchlist and Right Click > Send To > Symbol Lists

3. For each Scanner, Configure the Symbol Lists filter to only include your list (Add Existing List)

I'm not sure if stocks from your watch will meet the criteria for each scanner. Worth a shot though. Cheers.

-

Here's a clumsy workaround for keeping a running P&L in simulator.

-

16 hours ago, DennisO said:I am using the paid simulator

Could you record a video of what you see and post it on YouTube or email to the team? Thanks.

-

42 minutes ago, JD said:I've been trying the 15 minute reversals for the last few days, it worked well in $AAPL today. For the $JD and $MU reversals, it came within a few cents of my target and bounced. I also took $ETSY yesterday but ended up getting out early. Looking back at them, maybe I should have taken profit a few cents above my target since the stock already dropped around 50 cents from the HOD. Do you find that since some of the move has happened by traders using lower time frames that by the time there's a fifteen minute low, some of the move has already happened?

Yes, waiting for the new 15-min low means a later entry. However, I've found that the 15-min low confirmation increases the probability that the reversal occurs. If you go in too early on a new 5-min low, often it can squeeze you (ETSY did this yesterday and almost hit HOD before dropping). With experience, you will get better at gauging when it is ok to jump the gun.

Your MU trade was great. It bounced off the MA and then hit the VWAP at noon. Really strong stocks will often find support off the MA's during their descent.

JD basically bounced off the VWAP. As with any chart, MA's and levels are areas +/-0.05-0.10 and not exact points. I use limit orders a few cents away from targets to increase the likelihood of getting filled.

AAPL made a nasty pullback and new 15-min high before losing VWAP. This kind of move is typical; it's like a giant, slow-moving reverse ABCD.

For the reversal strategy, you need to use loose enough stops and give the play time to work out. This may not suit a lot of trader's styles or personalities. It took me awhile to improve my patience and learn to trust the charts. Cheers.

-

1

1

-

-

@Mohamed Omar Congrats on the green month!

Unfortunately, I'm unable to provide individual journal review at this time. I suggest you start a post in the Journals subforum and have other members/mods provide feedback. I can take a look as well.

Cheers and best of luck.

-

On 2/4/2019 at 6:07 PM, DennisO said:I am using DAS Sim Version 5.2.0.31 But I cannot reset the equity. I am right clicking the Account as you recommended below.

Hi Dennis,

Are you using the paid simulator or the 14-day free trial demo?

-

2 hours ago, DennisO said:I am using DAS Sim Version 5.2.0.31 But I cannot reset the equity. I am right clicking the Account as you recommended below.

Which window are you clicking? It has t o be the Account window per the screenshot above.

-

You can't add the Daily MA's directly, only through the use of Global Horizontal Lines which are sync'd across all charts timeframes for one ticker.

Take a look here:

-

Very useful for when you place in the wrong spot. Much better than right-click > remove > re-add.

-

1

1

-

-

Early on, ignore any profit based goals. Get a feel for the markets, try new strategies, pattern identification, time of day, etc. You can only learn by doing.

When you've decided what type of trader you are (i.e what you're good at), gradually treat it like real. So in your final month, stop at goal to instill the habit of stopping for the day.

One of the biggest challenges new traders face is overtrading. Either being hell-bent on a green day or feeling invincible after a few big wins.

Learning when to stop (both green and red) was a milestone in my journey.

-

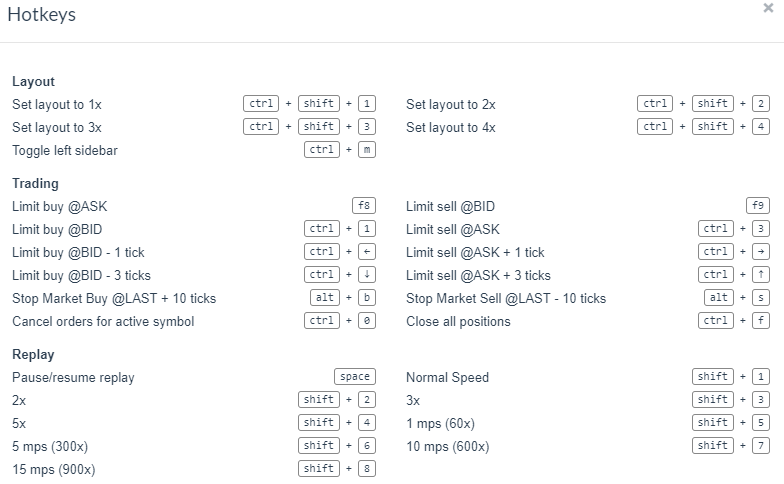

Sorry, I meant that you can't create new hotkeys/commands such as "sell 1/3". I only see the option to reassign the bindings for a preset list of existing commands.

@Ross K perhaps I'm mistaken? Thanks!

-

I just enabled editing.

It will happen if we can get enough members together!

-

On 1/21/2019 at 1:22 PM, Benjamin said:Thank you for the review. Can you elaborate more on shortcomings of the hotkey? What is the problem with hotkey functionality of Tradingsim?

Thanks

There is no customization. Your only option to assign hotkeys to the following commands:

I don't use the hotkeys--I use the BUY/SELL buttons on the right.

-

3

3

-

-

You get simulator as a paying DAS subscriber with IB, CenterPoint, SpeedTrader and CMEG.

IB offers free paper trading with their TWS platform (does not include live data feeds).

-

Please mark off your availability in this spreadsheet:

https://drive.google.com/open?id=1OaSvkl2G8GTBpaKSrFPukaA8R7C2ZkKi91safLqMLYw

UPDATE: Let's meetup Saturday July 6th. Andrew will be in town. Please sign up using attendance sheet above. Open to location suggestions. Last year we did Tap and Barrel in Olympic Village and it was a great atmosphere.

-

Yes. You need to work with DAS Support to link the additional IB accounts.

In terms of execution, you can select the account manually from the Montage dropdown, or specify in a hotkey. The command is:

ACCOUNT=UXXXXXX

-

1

1

-

-

Hi David,

Go to Tools > Status Bar

The tabs should be visible with that option checked.

-

Is Friday Trading Really Harder?

in Day Trading Strategies

Posted

I believe there is some truth to the Friday Effect.

First, volume begins to drop off sooner as traders start preparing for the weekend. That in turn results in other traders being more passive through a self fulfilling prophecy.

Second, there is the fear of going into the weekend red. That in itself has a psychological effect. Who here has desperately over traded into Friday afternoon to avoid dwelling over your losses?

Third, I've heard swing traders prefer not to hold over the weekend. Too much can happen over 60+ hours of market closure.

There is no hard evidence to support these theories--just anecdotal tales.