-

Content Count

477 -

Joined

-

Last visited

-

Days Won

36

Posts posted by Justin

-

-

@fab has actually created a useful and extremely simple AutoHotKey script to automate exporting the Market Viewer window! You could easily change the script to adapt to the windows you want exported instead

You sound pretty savvy already, but let me know if you need help with it!

-

1

1

-

-

4 minutes ago, Throne said:FYI Justin this is the script I was trying to use out of the spreadsheet, Im with CMEG.

Scale- In POS % 50% Long:

DefShare=BP*0.97;Share=Pos;SShare=Share *0.5;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=LIMIT;Price= Ask+0.05;TIF=DAY; BUY=Send;DefShare=400;

Scale-Out POS % 50% SHort:

Route=LIMIT;Share=Pos*0.5;Price=Ask+0.05;TIF=DAY;BUY=Send Ah yes, I do believe you remove the + on DAY for CMEG.

But if you are using that script for Long, you need to use the other script I gave you to Scale out and sell 50% of your position:

Route=LIMIT;Share=Pos*0.5;Price=Bid-0.05;TIF=DAY;SELL=Send;

Also note, if you are trying to use the hotkey right now, it doesn't work well (or at all) during the market close or in the Replay function

-

1 minute ago, Throne said:THanks Justin I try these and see if I can get them working.

Great. Note that you can change the Route to Market and Price to Bid, for whatever your preference is on getting out of a position.

-

19 minutes ago, Throne said:Thanks for responding Justin, do you know know the scaling hotkeys should work with the stops? Im tracking on what you said with the flipped positions, thanks. I just would like to scale in and out if without taking the stop out if i can.

So you're asking If you are long and want to scale out 50% without touching your Stop Loss?

That could be something like this:

Route=LIMIT;Share=Pos*0.5;Price=Bid-0.05;TIF=DAY+;SELL=Send;

Short would be:

Route=LIMIT;Share=Pos*0.5;Price=Ask+0.05;TIF=DAY+;BUY=Send

-

17 minutes ago, bonniecawley said:Hi,

This is the first time I want to withdraw some money from my IB broker account back to my bank account?

I don't know how to do, please help ? please tell me how?

These are IB's instructions on withdrawing funds:

https://www.interactivebrokers.com/en/software/am/am/funding/withdrawingfunds.htm

-

7 minutes ago, Guillaume said:Anyone knows the script of the PANIC button ?

I know I can close all positions with (Shift+Escape) but I would like to create a PANIC BUTTON, not hotkey.

Is that possible ?

Right click in the button section of the montage and select Add Button.

Name it "Panic" or whatever else you want to call it

Give it the colors you want

In the script area simply type:

PANIC-

2

2

-

-

55 minutes ago, Throne said:Guys the hotkeys are working flawless for me, but I got a silly question when Im using the scaling in and out hotkeys do I need to cancel the the stop lost in order for them to take? I cant get the scale out hotkey specifically to work properly.

You technically don't need to cancel and reset the stop loss, but if you don't and the price goes against you, you'll suddenly be in a flipped position. This scenario will happen:

You are 100 shares long at $15You have a stop loss sell order set for 100 shares at $14.90You partial 50 shares at $15.50It goes back to your stop loss, and you're suddenly 50 shares short.This will cancel your stop loss and reset it to breakeven with the correct remaining shares:CXL ALLSYMB;Route=Stop;Price=AvgCost;StopType=MARKET;STOPPRICE=AvgCost;StopPrice=Round2;Share=Pos;TIF=DAY+;Send=Reverse;-

1

1

-

-

4 hours ago, peterB said:it would not be very wise to do it mathematically as you might miss the targets by a cent if the level you are reaching at is at 1.99R of your target

it would be better if you set your profit target later on once you are in the trade by clicking to the chart to the desired area of target and insert the order accordingly. you have plenty of time to do so anyway

Exactly what Peter said. Also we currently don't have a way to have more than two orders for taking a partial and then recalculate the stop loss without losing all remaining partial orders.

For example if you you're 100 shares long at $15, you two partials for 50 shares at $15.50 and 50 shares at $16.00. If you hit your first partial target at 50 shares and then it goes back to your stop loss, you'll suddenly be 50 shares short.

Best you can do is a single range order.

-

4 hours ago, peterB said:you already have ssd in your laptop

No, unfortunately it's a HDD.

Well... fortunately actually - because it's an amazing upgrade for any older laptop.

-

1 hour ago, hailchaser2 said:should I do the SSD change while I have it open?

100%! Correct me if I'm wrong but it doesn't look like that comes with an SSD... It's not always about space, an SSD over an old format HDD will make your computer scream!

-

19 hours ago, q3Maverick said:Hello,

Sorry for being a bit lazy and might have missed it as I am sure this is somewhere on the forum.

Can you please let me know the script of quickly flipping your position from long to short (short to long)? Of course, I am going to use the same size as the one I've started with.Thanks in advance!

Hey Maverick, I think this has been discussed before, and the consensus was two things:

1. There isn't a way to do this programmatically. But if you enter with a hotkey 100 shares long, you can simply have another hotkey for 100 shares short.

2. This isn't recommended. Quickly flipping your position is an indication that you don't have a strategy or plan going into a trade. You are best served to get stopped out and then find another trade that fits your plan.

-

5 minutes ago, Abiel said:Just tested on sim, working fine on my side!

Yeah, this was just this morning for about 10 min.

-

Hey, it was just a simulator bug, annoying I know, but not related to anyone who was live:

See my post here:

-

1

1

-

-

Hey Lenny!

First, that's great that you saw and analyzed that ZM was looking strong in the pre-market and overall today.

The first thing I notice is that your first entry is a bit chasing. We're already several strong moves away from the vwap. If you think there is still going to be some strength, I would try and wait to see if there is any pullback before entering.

The second thing I notice is that the pre-market high at around $124.50 (the bottom dotted red line on your 1min chart) was acting as pretty strong support. So better entries for your first, second and third trades would be getting in closer to that support line and thus would have your stop loss below the pre-market high.

Good job on your 4th trade though. Definitely looks like you had a wider stop loss!

For the 5th and 6th I'd definitely be hesitant to go long after that engulfing red candle (the one right after you got out of your 4th trade).

I think the main takeaway for me would be focusing on patience and waiting for pullbacks.

-

1

1

-

-

Hey,

I definitely understand the frustration and apprehension, but I really wouldn't worry too much about this. First, it was only in SIM (It's happened before), and I've NEVER seen it happen live on IB or CMEG.

Second, what they said is also true, if you ever go live you can either:

- Call your broker and have them exit your positions. They often have a priority number for this.

- Depending on your broker you probably have the ability to exit your positions by just going to their website

- Depending on your broker they probably have a secondary platform (like DAS) you could install if it is indeed a DAS problem.

-

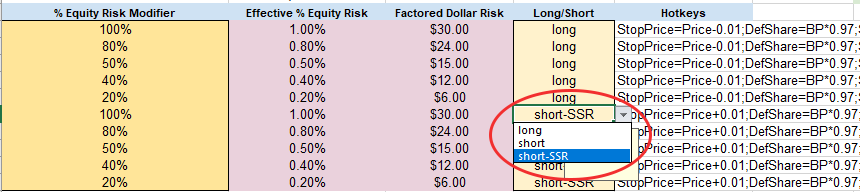

1 hour ago, peterB said:FYI there is no difference in the script selecting short and short-SSR in Kyles hotkeys sheet

Yes, I already addressed that here and how to fix it:

I talked to Kyle in a PM chat about it yesterday - so he knows.

-

Yeah, simply put, whole numbers are good resistance and support levels.

Obviously it's a bit harder with ROKU where it's going up full dollars within minutes.

That being said I think the best indicator was the second from the top red dotted line - the previous day close line (maybe color it a different color than high of day line). Previous day close is a very strong indicator. It was 63.84 and it bounced. I would have waited for a 1 min candle to close above that line.

-

7 minutes ago, hagereseb said:thanks Justin. this is why BBT is the best trading community - everyone helping one another.

100%

I still completely advise getting the hotkey from the spreadsheet yourself though (I just pasted them for reference). Simply make the change that I've highlighted.

-

31 minutes ago, hagereseb said:Kyle, when i choose the short-ssr drop down menu on the excel spread sheet, i don't see the price changing to Ask. did i download an older version?

@KyleK29 It does look like there is a bug in the spreadsheet. Changing the short to Short-SSR doesn't change anything for dollar risk. It does work as intended for Equity Percentage.

Dollar Risk - Short:

StopPrice=Price+0.01;DefShare=BP*0.97;Price=Price-Bid+0.01;SShare=150/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=LIMIT;Price=Bid-0.05;TIF=DAY+;SELL=Send;DefShare=400;TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice+0 ACT:BUY STOPPRICE:StopPrice QTY:Pos TIF:DAY+;

Dollar Risk - Short SSR (The highlighted red part is not happening on the spreadsheet)

StopPrice=Price+0.01;DefShare=BP*0.97;Price=Price-Bid+0.01;SShare=150/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=LIMIT;Price=Bid+0.01;TIF=DAY+;SELL=Send;DefShare=400;TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice+0 ACT:BUY STOPPRICE:StopPrice QTY:Pos TIF:DAY+;

Equity Percentage Risk - Short:

StopPrice=Price+0.01;DefShare=BP*0.97;Share=DefShare*0.167*Price*0.01;Price=Price-Bid+0.01;SShare=Share/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=LIMIT;Price=bid-0.05;TIF=DAY+;SELL=Send;DefShare=400;TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice+0 ACT:BUY STOPPRICE:StopPrice QTY:Pos TIF:DAY+; Equity Percentage Risk - Short-SSR (The highlighted blue part is working in the spreadsheet)

StopPrice=Price+0.01;DefShare=BP*0.97;Share=DefShare*0.167*Price*0.01;Price=Price-Bid+0.01;SShare=Share/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=LIMIT;Price=Bid+0.01;TIF=DAY+;SELL=Send;DefShare=400;TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice+0 ACT:BUY STOPPRICE:StopPrice QTY:Pos TIF:DAY+; -

1

1

-

-

2 minutes ago, hagereseb said:thanks justin. i have an excel spreadsheet i downloaded when william a dog talked about it - few months ago. when i look at it now, and i choose the short-ssr from the drop down menu, it doesn't seem to change anything. am i doing something wrong?

I'm actually just answering your question in the other thread. One second

-

1 hour ago, hagereseb said:this is the link to the video, no?

There are two links there. One to the original post that has his spreadsheet link and one that goes to the webinar.

It's just one is in link format and one shoes the dynamic post details.

-

50 minutes ago, Mike B said:Traders here are two hotkeys for SSR in CMEG.

Kyle hotkey with stop order placed.

DefShare=BP*0.97;Price=Price-Ask;SShare=50/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=SMRTL;Price=Ask;TIF=DAY;SELL=Send;DefShare=200;

2. Plain SSR Short

ROUTE=SMRTL;Share=100;Price=ASK;TIF=DAY;SELL=Send

No offense @Mike B, but like Kyle said in his webinar people should be getting the script directly from his spreadsheet.

He mentioned two things:

- The syntax can be broken by re-pasting the script

- Most people wont even know how it works and that just creates more problems. How many shares is it? Is it dollar risk? Is it percentage equity risk? How do I change it?

I've had 2 Skype calls and a long PM helping people with the hotkey because of this.

How do you set SSR with CMEG?

You go into the spreadsheet and click the drop down and change it to "short-SSR"

-

1

1

-

15 minutes ago, Andrew Aziz said:Is it a crazy idea? (I know Justin, I know what you want to say!)

I didn't say anything

-

Right click on a chart > Chart Area > Config Area > Enable order entry and order line movement

-

2

2

-

Uber short (March 27)

in Day Trading Examples and Review

Posted · Edited by Justin

For your firs trade it wasn't exactly a bad idea to go long there. It did break and the close above the VWAP on the 5 and 6 min. That being said, I'm always hesitant to go long or short the opposite way of the pre-market. Also, what was your stop loss? Seems very far away. Probably should have been just below VWAP.

For your second... Seems like a good entry to me. It's a bit extended, but you waited for a pull back which is good.