-

Content Count

292 -

Joined

-

Last visited

-

Days Won

21

Posts posted by Bailey Nevener

-

-

Fun fact,

Bear Bull Trader' s forums crashed when I posted this list.

-

Hey Joerg,

Fancy seeing you around here.

I retrieved this list just for you.

Copy this as is and open a Market Viewer in the Quotes tab in DAS.

Click on the most upper row in the Market Viewer and press Ctrl + V.

If it doesn't work, add a couple New Rows and then try again.

Mine worked right off the bat, but I noticed that if I deleted any rows or anything in the viewer it took some fenagling.

-

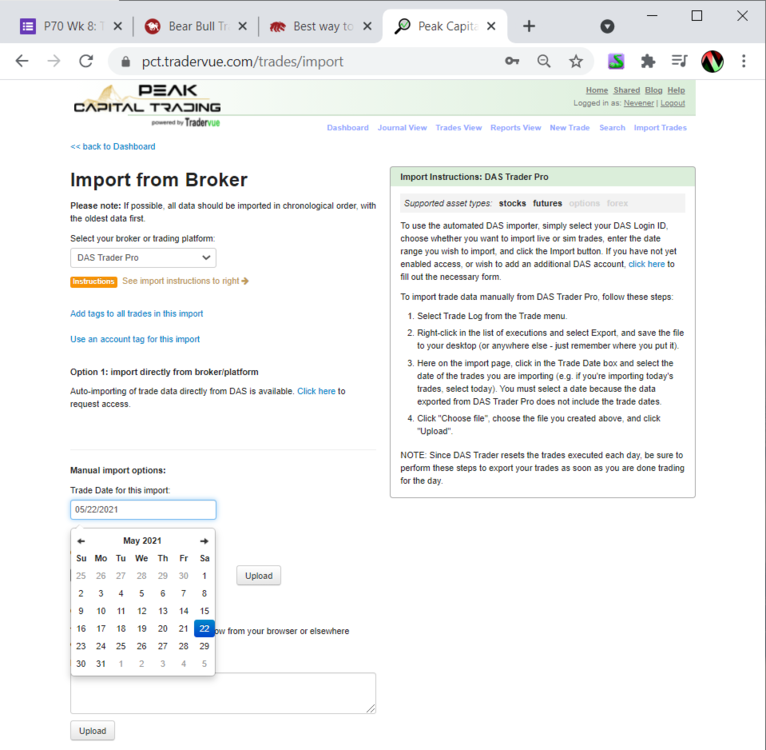

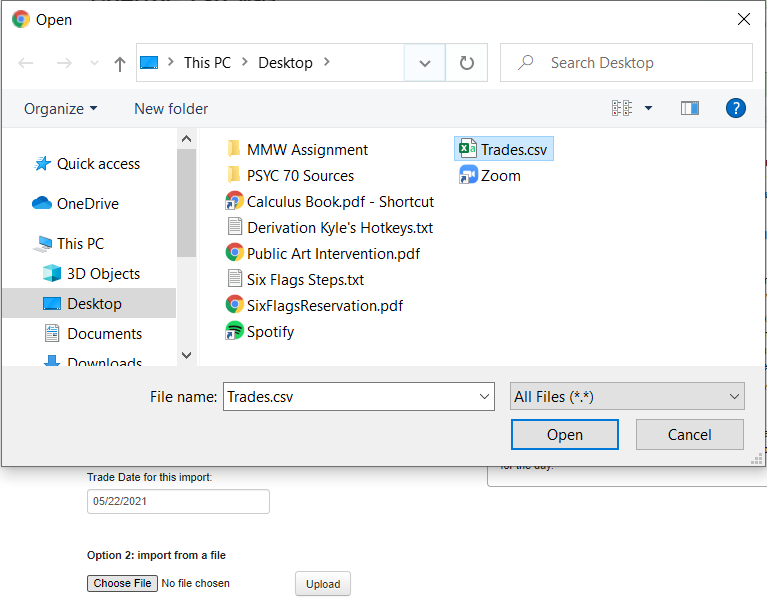

I currently import my trades with this method without using excel.

Step 1:

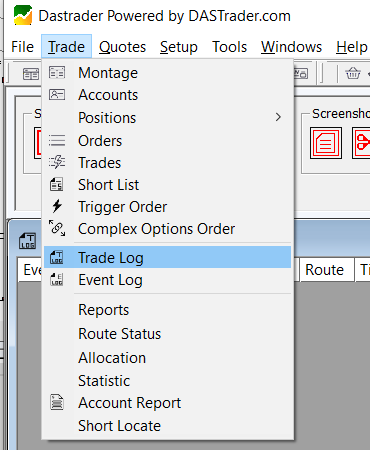

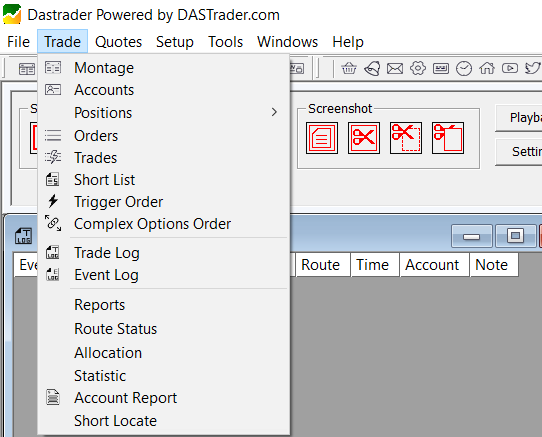

In DAS go to

Trade > Trade Log

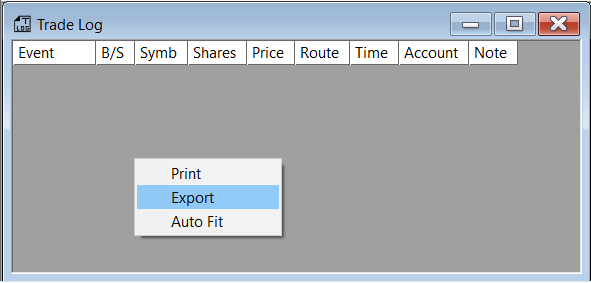

Step 2:

Right click inside the "Trade Log" window and click "Export".

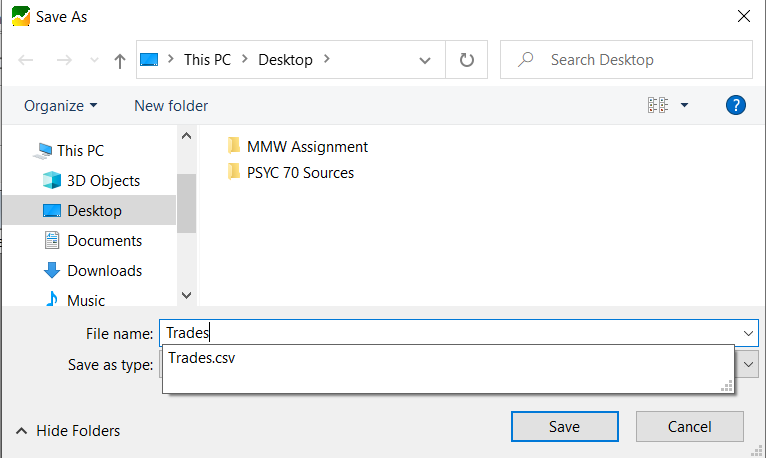

Step 3:

Save the .csv file as a recognizable name like "Trades" in a familiar location like "Desktop".

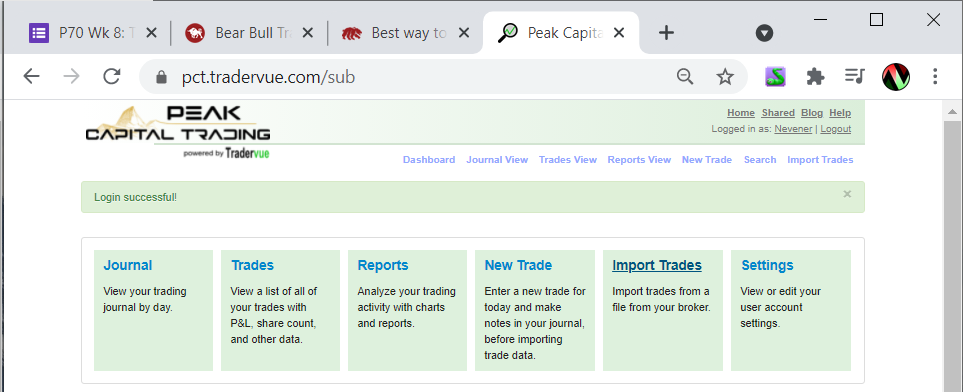

Step 4:

Go to TraderVue's website and on the "Dashboard", click "Import Trades".

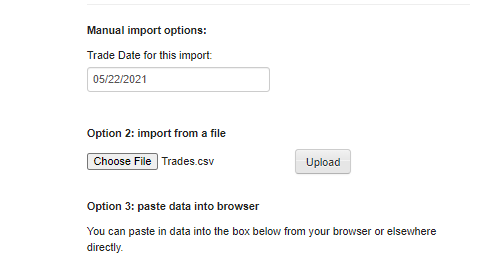

Step 5:

Go down to "Manual import options:" and click on the empty box directly below "Trade Date for this import:".

Click on the date the trades you are importing were performed.

Step 5:

Under "Option 2: import from a file:" click on "Choose File", and select the previously saved .csv file.

Step 6:

Click "Upload".

Hopefully I've answered your question fully.

Good luck trading,

Bailey Nevener

-

Good morning Kav,

If there is no S then it means it is not shortable.

If you are able to short somehow then this is an error from the platform or broker.

There's a way to short using the Short Locate feature if there isn't an S, but it is associated with fees I am not familiar with.

Good luck on your trading!

Bailey Nevener

-

7 hours ago, MIGS said:Thanks Bailey, I thought I had 1-4 margin (75% right?)... but is actually only 25% for most tickers...

Trust me when I say this is by far the most frustrating thing about using a broker. Their variable margin is too much for me.

-

1 hour ago, MIGS said:DAS shows a “withhold bp” way off in excess of the required $$ for the position, meaning if I buy 100 shares at 10 each instead of showing “withheld BP” of $1000 (100*10) it shows a lot more ( $$ much higher like 1300 )...anyone with the same issue???. Still using my training IBKR account but with full DAS version ( updating to current Rev didn’t fix it).

Good evening MIGS,

I have had similar issues in the past. My memory isn't crystal clear, but I believe that when I looked into this the math ended up working out. Basically there are variable margin requirements for each ticker, so if you are only allowed 25% margin, then IBKR will restrict a significantly higher amount of buying power than the position is actually worth.

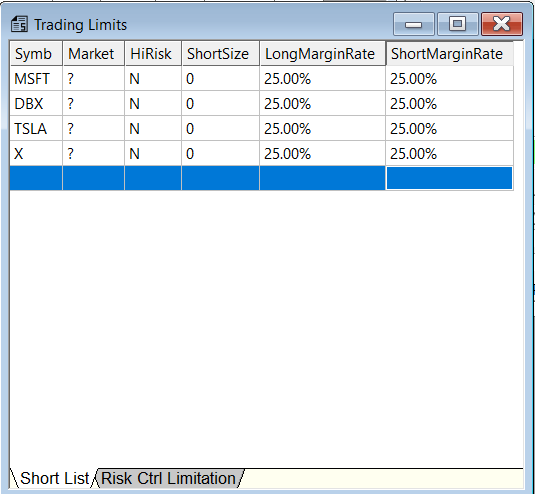

Anytime you have this issue, check the Short List provided by DAS. You can view if the symbol that is selected has any margin limitations.

TRADE > SHORT LIST

SHORT LIST

It is currently after hours, so this isn't updated correctly. However, this could be your next step in troubleshooting. Good luck!

Bailey Nevener

-

10 hours ago, peterB said:your tables say the same as mine so at least we have the math in-line

5R over 100 trades is the 0.05R reward to risk ratio per trade and you call it an edge which is correct mathematically.

Practically, you need to risk 100 dollars to make 5 dollars. And after taking 100 trades risking 10000 dollars you make 500 dollars. If you risk 100 per trade you need to take 1000 trades to make 5000 dollars. 50 trades daily.

Now start counting the commisions on how much you need to risk to make a living out of this edge. And count the time how much it takes you to take 50 trades daily.

It does not seem worth it to me.

I'll give you that. You would definitely need to already have a big account for the edge to be worth it with commissions.

-

2 hours ago, peterB said:i said

to me it does not look to be a worth it. you might missed the point where his P/L is 1:2 and not 2:1 as you wrote

which is just wrong. lets see

sorry, there is not a 10R edge here

You don't need a math degree to differentiate 1:2 and 2:1 but as market will teach you too, everybody can be wrong sometimes.

So instead of throwing fireballs lets keep the discussion moderate.

You got me, I said it in a way that tripped me up.

Here's the quote:

"2 gains required to = 1 loss in his strategy"

What I meant is, if he had 100 iterations with 70 percent of the time making a gain,

then they would have 70 units of gain, and 60 units of loss.

That's 10 units of gain.

Which would be 5R in this case.

Here's what I said, which framed it incorrectly:

Iteration Gain (+0.5) Loss (-1) 1 0.5 2 0.5 3 0.5 4 0.5 5 0.5 6 0.5 7 0.5 8 0.5 9 0.5 10 0.5 11 0.5 12 0.5 13 0.5 14 0.5 15 0.5 16 0.5 17 0.5 18 0.5 19 0.5 20 0.5 21 0.5 22 0.5 23 0.5 24 0.5 25 0.5 26 0.5 27 0.5 28 0.5 29 0.5 30 0.5 31 0.5 32 0.5 33 0.5 34 0.5 35 0.5 36 0.5 37 0.5 38 0.5 39 0.5 40 0.5 41 0.5 42 0.5 43 0.5 44 0.5 45 0.5 46 0.5 47 0.5 48 0.5 49 0.5 50 0.5 51 0.5 52 0.5 53 0.5 54 0.5 55 0.5 56 0.5 57 0.5 58 0.5 59 0.5 60 0.5 61 0.5 62 0.5 63 0.5 64 0.5 65 0.5 66 0.5 67 0.5 68 0.5 69 0.5 70 0.5 71 -1 72 -1 73 -1 74 -1 75 -1 76 -1 77 -1 78 -1 79 -1 80 -1 81 -1 82 -1 83 -1 84 -1 85 -1 86 -1 87 -1 88 -1 89 -1 90 -1 91 -1 92 -1 93 -1 94 -1 95 -1 96 -1 97 -1 98 -1 99 -1 100 -1 Total 35 -30 He has a 5R edge.

What I meant to say:

(Which by the way, was this: "2 gains required to = 1 loss in his strategy")

Iteration Gain (+1) Loss (-2) 1 1 2 1 3 1 4 1 5 1 6 1 7 1 8 1 9 1 10 1 11 1 12 1 13 1 14 1 15 1 16 1 17 1 18 1 19 1 20 1 21 1 22 1 23 1 24 1 25 1 26 1 27 1 28 1 29 1 30 1 31 1 32 1 33 1 34 1 35 1 36 1 37 1 38 1 39 1 40 1 41 1 42 1 43 1 44 1 45 1 46 1 47 1 48 1 49 1 50 1 51 1 52 1 53 1 54 1 55 1 56 1 57 1 58 1 59 1 60 1 61 1 62 1 63 1 64 1 65 1 66 1 67 1 68 1 69 1 70 1 71 -2 72 -2 73 -2 74 -2 75 -2 76 -2 77 -2 78 -2 79 -2 80 -2 81 -2 82 -2 83 -2 84 -2 85 -2 86 -2 87 -2 88 -2 89 -2 90 -2 91 -2 92 -2 93 -2 94 -2 95 -2 96 -2 97 -2 98 -2 99 -2 100 -2 Total 70 -60 He has a 10 unit gain.

Which is 5R because the units I'm talking about are worth 0.5 Risk.

(Which doesn't matter because you can just increase size)

"to me it does not look to be a worth it."

An edge is worth it if it works.

"So instead of throwing fireballs lets keep the discussion moderate."

I do not need to go post to post to point out how sideways you get on people, my last post about it has 4 people reacting in agreement. Which really says something because most people don't even log in.

-

On 1/2/2021 at 8:25 AM, peterB said:well its irrational to risk 1 dollar to get only half a dollar. especially when you know that you will succeed only 70% of times and need 240 attempts to get 20 dollars.

That’s an edge.

You literally just described an edge.

2 gains required to = 1 loss in his strategy

If he has a 70% win rate:

70 wins per 30 losses

Ratio 2:1 P/L adjusted =

70 R won for every 60 R lostA 10R edge.

That is an irrefutable edge by your own metrics.

Blind leading the blind.

This kind of advice I see you regularly and unabashedly give.

Maybe it’s the rhetoric in the way that you write that makes you sound extremely authoritative, but in any case, it is clear that you are not an authority on the matter.

If one has a math degree and they say 2 +2 = 5, that doesn’t mean that is actually the case.

Similarly, if someone were a BBT member for 4 years with a thousand posts, that doesn’t mean what they say about trading is correct, or well thought out.

I’m writing this here as a warning to others. If this wasn’t ADVICE being given by I wouldn’t say anything. But since it’s ADVICE you are consistently giving I am saying something.

-

On 1/2/2021 at 9:26 AM, JS said:I did not invent anything. All my trades are based on existing strategies from BBT. As a beginner I do not believe you can create your own strategy. But because of the bad trade management, I feel that I am scalping all the time. Not saying that I am scalping on purpose.

What I do want to know is that does Scalping really work? I hear and read that people do it and it is a specific type of trading style.

To be frank,

The person criticizing you is currently the most active close-minded person on this site.

He isn’t crunching the numbers. You are. He is being far to assertive about what he is saying to you while only leaning on half-baked intro-to-statistics level reasoning.

The most appropriate thing he could have said to you is, continue to increase your sample size. Your equity curve is up, so continue to increase sample size to be certain you won’t revert to the mean 0.

Once again, him calling what are you doing irrational is unfounded.

However, there is truth that trying to manage such a small R profit per trade exposes you to more aggressive drawdowns if you “mess up”.

Your equity curve is up. Continue to refine your parameters for entry and tracking. Increase sample size. I’m not sure if HE is profitable because he is basically trying to call the TOP on your equity UPTREND when it has shown NO WEAKNESS.

NOW THATS A LOSING STRATEGY!Cheers.

-

On 4/20/2021 at 8:12 PM, Khaled83 said:Hi Bailey,

Thanks for your reply. I noticed most traders don't talk about using options for risk management, is there a reason for that? What if I'm buying less than a 100 shares in a stock, how does that work?

I was hit hard yesterday with HAE gap down by 35% reducing my capital value by 10%. Worse my stop loss limit order did not execute due to not fulfilling the specified limit. I have a full time job. and I set automated orders, but that didn't protect me and I needed to be at the platform.

I don't understand something, if all the advice says we have to sell and accept any loss rather than hold and wait, why not set the stop loss for market price instead of a specified limit? The advice also says use stop loss limit.

Thank you,

Khaled

Good morning Khaled,

I am pretty sure that the premium of LONG options ends up deterring most from hedging their positions with them.

If you hold less than 100 shares of stock and you are LONG a PUT against it:

-

At expiration date your PUT option will either expire worthless or be exercised.

- Expire worthless - You lose the entire premium you paid for the option contract

- Exercised - You will be obligated to sell shares of the stock, but if you hold less than 100 shares you will end up actually being short stock. (Someone correct me if I'm wrong)

-

IMO I would buy a LONG PUT against my LONG STOCK position only for the short term.

- I wouldn't let my LONG PUT expire worthless because that's a lot of money lost to the wind for no reason.

- If you detect a double top or something like that in your stock pattern but you don't want to sell shares, this may be an 'option' for you.

I'm not an expert by any means on options, but I know that they are a powerful tool.

SHORTING options has a lot of support because of the statistical advantage option sellers have over option buyers.

The purpose of having a limit order is so that during the filling process of your order, you won't have a random fill super far away from the last sale price.

Almost always after a huge spike like that occurs the price comes right back to what it was trading at beforehand.

In other words, you are just risking getting slapped in the face prior to getting filled with your full order.

If you aren't trading with large size it really shouldn't be a problem.

Although this could be more of a problem during lower volume parts of the day etc...

Good luck out there,

Bailey Nevener

-

At expiration date your PUT option will either expire worthless or be exercised.

-

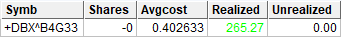

This is a short guide on how to read option symbols in DAS

Follow my Journal on BBT where I record my trading results:

When you initiate an option position in DAS,

it can be confusing knowing how to interpret the Symbol Column referencing the Option Contract.

For example:

A DAS Position Window with a closed option position.

Symbol Reference Guide

+ SYMBOL ^ YEAR MONTH DAY STRIKE

- "+" - denotes an option position

- SYMBOL - the underlying symbol

- "^" or " * " - denotes whether the option is a Call ( ^ ) or Put ( * )

-

YEAR - the year the option expires, represented by:

- 2020 - A

- 2021 - B

- 2022 - C

- etc...

-

MONTH - the month the option expires, represented by:

- 1 - January

- 2 - February

- 3 - March

- 4 -April

- 5 - May

- 6 - June

- 7 - July

- 8 - August

- 9 - September

- A - October

- B - November

- C - December

-

DAY - the day the option expires, represented by:

- 1 - 1

- 2 - 2

- 3 - 3

- 4 - 4

- 5 - 5

- 6 - 6

- 7 - 7

- 8 - 8

- 9 - 9

- A - 10

- B - 11

- C - 12

- D - 13

- E - 14

- F - 15

- G - 16

- H - 17

- I - 18

- J - 19

- K - 20

- L - 21

- M - 22

- N - 23

- O - 24

- P - 25

- Q - 26

- R - 27

- S - 28

- T - 29

- U - 30

- V - 31

- STRIKE - the strike price of the option (the decimal, if there is one, will also be displayed)

** While holding an Option Position in DAS it is important to know,

** the Shares column will actually show the # of Option Contracts you are holding instead of shares.

** (1 Option Contract is actually 100 Shares, but it would be displayed as 1 in the Shares column)

Let me know if there are any clarifications I can make.

I got all of this information from DAS's website at https://dastrader.com/documents/OptionSymbols.pdf

Good luck trading maties!

-

17 hours ago, Vasily Gydov said:DAS Sim has the same features as Das Pro Deluxe or Deluxe features is different from Sim?

They are indistinguishably similar

!

!

-

Is that Brian Pezim the father of Tequila above me?!

Yes there is a way it is by hedging with options.

If you are afraid of slippage from gap ups / downs you can hedge by buying a call or put against your position.

Example:

Long 1500 shares XYZ @ $20.

You set a stop loss at $19 GTC.

You also buy a PUT of 15 contracts at a $19 strike expiring a two weeks away.

If you woke up the next day and the stock gapped down to $16, your GTC stop loss may not have activated.

However, you would have the right to exercise your Put, selling your 1500 shares at $18!

Hedging is legit.

OR if you are lucky enough and your stop loss did activate on your shares for that loss, then you can trade that PUT option outright and make profit on that premium increase!

There you go!

Now your job is to determine what premium you want to pay an option seller for that protection.

It can easily eat into profits if you aren’t careful.

However you could offset that premium by selling a call against your shares (covered call), but that’s more for investments rather than swing trades.

Good luck!

STONKS!!

Join me in my Trade Journal livestream (Just type in my name in YouTube) in the morning if you have similar questions!

-

1

1

-

-

12 hours ago, Roberto said:Thanks for the reply. What I was referring to was the data feed, IBKR has a lot of options. But actually, since the original post, I've been seriously reevaluating if I need DAS at all. One minute ORB and scalping as a primary exit strategy won't be my game for a while, maybe ever. I may just use IBKR top of book feeds...

Oh my misunderstanding!

I use the deluxe $150 with the LVL 2 quotes.

I completely understand swearing off of the ORB strategies.

They were a heartache and a half when I started trading.

Bailey Nevener

-

On 2/23/2021 at 2:30 PM, Roberto said:Nobody uses IBRK and DAS Trader Pro?

For whatever reason I didn't see this on the recent activity feed matey.

I'm almost certain that Andrew uses the Tiered commission structure.

Let me see if I can find the video...

Take a look friend!

I use IBKR and honestly I have no idea what structure I use because my total shares used are so low.

If I had to guess I'm using fixed with no issues.

Enjoy!

-

On 12/11/2020 at 11:55 AM, Mitch The Duck said:Right now just trying to focus on remembering that calls and puts are a potential tradebook option when I get pretty committed to the idea that a move is coming or a trend is going to continue throughout the day . . . normally I get to the journaling stage of the day and look at the plays i made and go "d'oh, i could have just bought some calls lol

Same thing happened with me when GME put in its backside.

I forgot it was at one time a large cap stock that should have a option chain, but buying puts would have been amazing.

EDIT:

A Long Put and Short Call at the same strike, as well as an optional Call Credit Spread to short the IV would have been the proper method.

-

This guy definitely got me up to speed as well.

Good recommendation.

-

On 2/18/2021 at 10:33 AM, Rob C said:Hi Bailey,

Thanks for your post. Nope I still have a day job. When I started learning/practicing day trading, almost 3 years ago, I did create a business plan. The time line I gave myself was 5 years to learn the trade and work my way up to an income that I can sustain my present cost of living. I didn't see any profit for the first year and a half. I am definitely not made for day trading. My heart would pound against my ribs on every trade for the first year. So I had to make a lot of modifications to my personality. I think this was probably the reason why I stuck with it. I saw improvements in my discipline and patience in all parts of my life. Trading was essentially the vehicle for self improvement. Also I was well disciplined with my risk. So I wasn't losing much money during the 1.5 years.

Once profitable I ran into my next challenge which was sustainability. My systems in my tradebook seem to be profitable 4 to 6 months at a time. So I would prove them in SIM then spend a month with small risk. Then I would slowly increase my risk. Just about the time I would start making decent money my system would start to fail and I would go back in SIM to figure out what changes I need to make. I don't know if I have faulty systems or I am poor with continuously tweaking my tradebook, so they will fail sooner or later. I just hit a big snag like that recently. End of November I suddenly lost profitability so I went back to SIM. It took 6 weeks before I saw profitability return and now I am slowly increasing my risk.

I know it sounds like an insult when it takes longer than others to reach CPT level. But it really isn't. All of us perform self programming to fit our life endeavors. If these self modifications happen not to be ideal for the traits we need for trading, it takes longer to become a CPT. I personally have a really bad FOBW. Likely from being an engineer. I don't design processes to fail 40% of the time. So its a big task to change my mindset.

My biggest tip? Is turning off the chat when you are trading and only turn it back on when you are done for the day and just watching to learn. Just hearing the chat sways me a lot. When I turned off the chat, just before the open is when I made my first step into profitability.

Good luck with your trading.

Rob

Rob,

Thank you so much for replying sir!

I am also not made for day trading either. Perhaps before I joined the military I was easy-going enough to shake off the stress of trading, but nowadays it is something I have to directly plan to counteract.

It has stressed my relationships more than I could have ever anticipated and my life in general. It actually has been one of the hardest things I have done.

I have hit consistency enough times that, with proper systems in place, I can keep the profits from my last streak, go into the sim, and come back out making money again.

Respect that you are hitting it like such a madman.

In order for me to hit consistency it easily took over 2 1/2 years, but if I didn't have a job that whole time I am almost certain it would have taken below 9 months. However, I could never really know.

Also I 100% agree that the hype of the chatroom keeps me excited about trading, but goodness no matter who is trading, Thor, Andrew, or Brian, if they take a trade and for whatever reason I jump into it, I lose money every time. Therefore I also started muting them before I experienced any consistency. It seems a lot of us on here have that going!

Good luck with your trading as well!

Bailey Nevener

-

1

1

-

-

Hello Mark D.

I know it has been a while since you posted on the forum, but I was wondering if you had achieved the ability to make a living from day trading yet.

You have one of the most clean and consistent journals of anyone on the site, so I just wanted to see if I could get a temperature check of the general success on here for my sanity.I currently am not able to make a living from day trading by any means, and most of the money I have made in the stock market has been through my own intuition and trade strategies. Although Aiman really does give out amazing value.

Appreciate your thoughts.

Bailey Nevener

-

1

1

-

-

Hello Rob!

I see you are one of the most active members on Bear Bull Traders forums. I was wondering if you have had success in making a ‘living’ from trading yet, or what you feel is the distance between yourself and that.

I personally have not hit this level by any means. I would also like to add most of my consistent success with day trading has arisen from my own strategies and I have found very little consistency from any moderator’s thought process other than Aiman.

Appreciate your thoughts.

Bailey Nevener

-

That is what is referred to as a “Round Trip”.

That would take away 1 of your day trades available.While I was using TD Ameritrade they would also consider partials a round trip, so whenever I took 20%, 50%, and then 100%, I unhappily saw that all of my day trades were taken up.

-

Skye,

If your account balance drops below 25k at any point you will be locked out from placing any more trades.

I have personal experience of this through the DAS platform.

Intra-day, if your balance drops under 25k, you will receive an error message that basically says,

"Dear trader, because your account balance falls under the PDT minimum you cannot place anymore trades".

You will have to bring your account balance over 25k to even place another trade.

Your account will not be closed however.

Bailey Nevener

==============================

My YouTube Trading Journal

-

1

1

-

-

One thing that I would definitely consider is posting the higher timeframes, specifically the 15 minute and 60 minute chart for each stock. The trends and levels shown on the 60 are invaluable.

Both charts show higher highs and higher lows for the immediate 5 minute candles. That is great for considering a possible ABCD entry on the lower timeframes.

It looks like you got in for the premarket high break on both UBER and CCL. Both had good volume on the day, so I wouldn’t expect a sideways reaction. That is, it would either reject, or move higher. It moved higher.

The question about whether it was luck really comes down to where your stop loss was placed and what your profit target was.

If you took extremely heavy partials initially in your trade, then your long term results are going to be significantly more statistic intense because your margins will be thinner in exchange for a higher win rate.

However if you let the trade go in your favor 2R or more before getting all out intentionally, then it is likely that this will be sustainable over time.

The only way to ensure this is by sticking to your stops and having a reason to exit with full size either for a loss or gain.

The community would need the higher timeframes as well as your plan to truly and fairly analyze this trade.

STOP RANGE ORDER

in Day Trading

Posted

I don't know if this has been resolved, but to avoid it entirely you can set your order to an "All or Nothing" order.

This will not execute your trade until all the shares you request are executable.

Thus you will not experience the splitting of shares.

Good luck trading,

Bailey Nevener