-

Content Count

293 -

Joined

-

Last visited

-

Days Won

21

Posts posted by Bailey Nevener

-

-

How are you tracking your stats to know if they are statistically profitable?

-

19 hours ago, Rob C said:All is reasonably well. Late April I took a week long seminar with advanced trading concepts. So I stopped trading live to practice them. They did not work for me and I am still not profitable in SIM/replay mode yet so I haven't traded live since. Also, last year May through August I was not profitable in Futures and stayed in SIM mode for the whole summer. So it may be the same circumstance this year as well. That is why I was thinking not to stress myself out trying to trade seriously this summer and learn algo while I wait for September.

Oh wow I've never been in an advanced trading seminar. That sounds legit. Well hopefully your efforts toward algo trading will bear some consistency for your trading. What are your main strategies for trading right now?

-

Hope all is well with your trading academy Rob!

-

1

1

-

-

10 hours ago, Rob C said:I was going to try it as well. I have some experience in computer modeling. I plane to start learning in July but with the Ninjatrader algo systems since I trade more with the Futures. May I ask which platform you use? IBKR API?

Yes that is correct. I have literally just started though, so I’m not useful yet.

-

49 minutes ago, Rob C said:Cool you are getting a Comp Sci degree. Do you think you would use it and try your hand at Algo trading?

Yes actually that's what I've been working on!

-

Sometimes my window would move off screen entirely or not be selectable from that Windows menu and none of my windows have title bars, so that explains my dilemma lol.

-

Bullshit talk is for people who've never been somebody.

Case and point today and yesterday.

I already made up all of the "losses" from last week.

There's a saying in the Navy, namely the Special Operator community.

"Get it right the first time."

-

57 minutes ago, peterB said:from the videos it looks like you are failing and full of bullshit talk. now if you say you made it ok, good for you.

LOL the week before this one is in a simulator account during the week of finals!!

You know the finals I am taking because I was honorably discharged from the Navy, so I’m using my GI Bill to get a degree in Computer Science.

If you looked for more than 10 seconds at my videos the stats are literally there showing that I make money significantly more, like mathematically indisputably more, than I lose money. I am profitable. You are not.

You are too lazy to literally watch more than 1 video that doesn’t confirm your bias.

What you are looking at is June, which once again, was leading up to finals so I barely traded.

Every single day I was up a large amount before hitting max loss. Which I noted was because I was getting cocky from how much consistency I was showing.

Something tells me that’s what you are struggling with confirmation bias in trading as well.

Too bad you can’t TLDR trading consistency.

-

Just now, peterB said:no i really meant it and i felt sorry for you but now i am not 🙂 Hopefully for Trader Joe it is useful information what you just wrote.

Why would you feel sorry for me if I am profitable? You take any power play you can get to make yourself feel better. You are such a rude person. And unprofitable. Big thing to remember is that you are unprofitable.

Yes so, once again, since I am profitable, and you are not, the person I originally replied to with useful information and a follow on source will be able to contact me to resolve their problem.

What’s ironic is, they are making money 😂 and you are not!

I don’t feel sorry for you. Your bad attitude deserves the lack of competency that you display.

Once again, you act like an ill tempered child.When I finished my second deployment in South China Sea I’m sure you were writing that next angry blog post. So looks like I’m getting better an better, and you are still rotten. Go figure.

-

14 minutes ago, peterB said:no offense Bailey but from what i have seen on your videos you need much more help than he does

Brother lol. I turned my 3k account into 37k. And I just turned my girlfriends account of 8k into 12k in the last 3 months. I am consistently profitable. Sorry to disappoint you. This individual that I am talking to on this forum can learn from me because they said they are struggling with consistency. I am not. You are.

I know you are butthurt because I found out that you’ve literally been on an increasing losing streak for the past couple of months. I literally traded myself out of debt.

I don’t know how old you are, but I feel like I’m back in high school. You know before I became a special operator in the US Navy as an aerial gunner and Helicopter Rescue Swimmer.

I don’t know what you were doing when you were my age, but hate to say it, you are behind me (in profitability) just like you were probably behind me in achievement when I turned 21. And 25. You fired the shots, but you can’t back it up. Stay in your lane.

You literally went from losing money “less and less” every month to losing “more and more”. I am already consistent with increasing consistency! Thank God because hateful people like you wish I was just as pathetic as you so you could be “right” about another thing.

Fortunately for me, your desire to be right doesn’t make you any more profitable.

Honestly you saying “no offense” just to insult me, and to be blatantly wrong (about yet another thing) is so indicative of your developing complex of insanity.

Great job distancing yourself from profitable traders though, I can see it’s working out great so far!

-

Juard,

This is an excellent question haha!

I hated it so much when this happened. I had to close the window, open another window, load configuration etc…. it was a nightmare just to avoid getting annihilated on a trade.

I actually figured out this answer by accident, and I was so happy when I did!

If you press Alt + Space a context menu will appear that will allow you to Restore the window to its regular size.

Good luck trading,

Bailey Nevener

-

1

1

-

-

On 6/15/2021 at 4:23 PM, Trader Joe said:Of my last 50 trades, only 7 have made the 2r profit target.

Joe,

This statement is extremely revealing. I also had this same issue for quite some time until I fixed how I placed stops. If you join me at the open when I’m trading for one of these mornings at https://m.youtube.com/channel/UCkK2SWIsYGuWm1gtlbD2C4w or on Twitch I can show you how I got over this. Mainly it involves sacrificing accuracy for a better risk to reward. If you would like an exact answer it would be much easier to show you in real time.

Good luck trading,Bailey Nevener

-

Yes there is through increasing the font size, when I get to my computer I’ll edit this reply and answer your question.

-

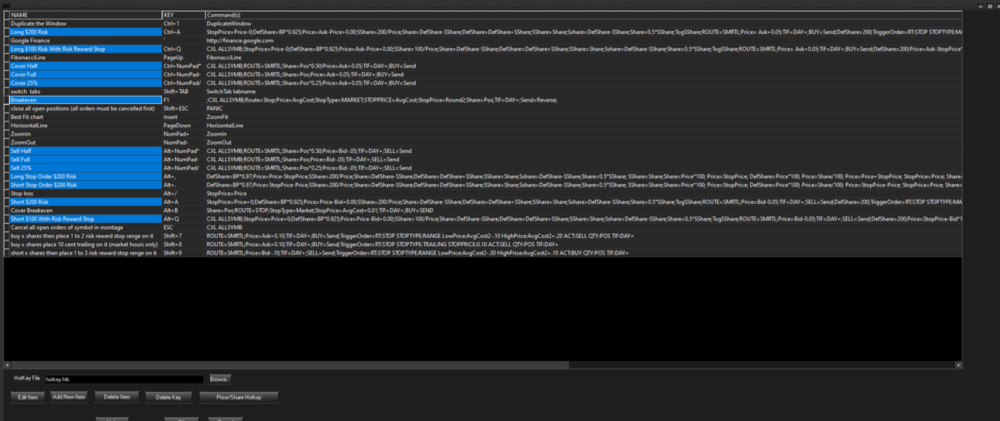

Post your Entry hot keys as well when you have a chance.

On 5/8/2021 at 9:02 AM, koreanwon97 said: -

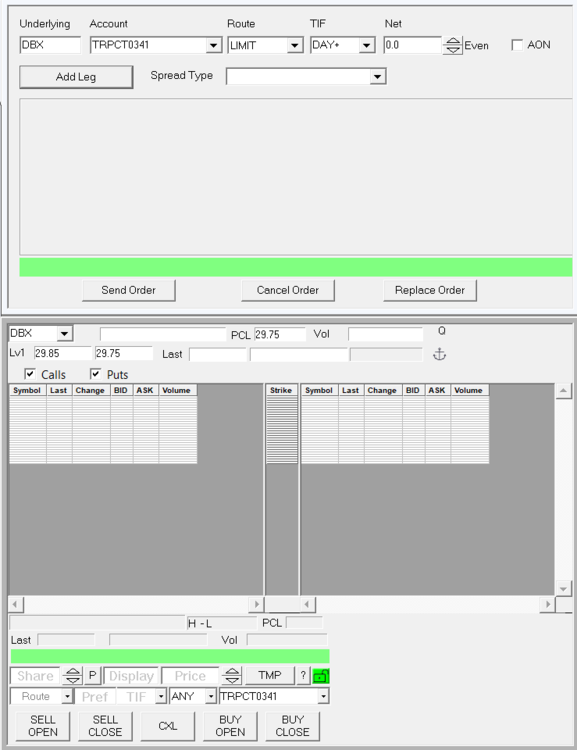

Hello Choppy,

This was my configuration when traded option in DAS before.

I anchored a chart window to the option's montage and traded from there as well. (Bottom Window)

If I wanted to trade any spreads I would use the Complex Options Window. (Top Window)

I'm sure that there are hotbuttons that can be configured to make them work even better,

but I didn't need them because I was mainly trading covered calls at the time.

(So I just needed to short the amount of call contracts equivalent to my share position).

It's not worth sending my whole layout for this because these windows are available from

Trade > Complex Options Order and Quotes > Option Chain.

If you stumble upon a hotkey layout that can manage risk for these windows please post it below.

I'm sure if I spent enough time I could make Kyle's hotkeys work for this with slight modifications to the order type.

If I end up needing to do that I will definitely post the scripts.

-

On 2/2/2021 at 9:21 AM, Kav_83 said:Wanted to understand if anyone's trading improved after implementing max daily loss risk controls? I generally do about 0.5% to 1% of account size daily around 70% of the month. But out of the remainder i have 1 or 2 days where I go hulk which eats up a lot of my profits. Wondering if anyone's performance improved after putting in max loss limits?

@Kav_83Yes it was instrumental to my success.

I am not a profitable trader without them.

I make money almost every day with them.

It's a psychological boost knowing you can't give up months of profits in one day.

Also @Abiel I found that Risk Control page I mentioned on DAS's website.

My risk controls look like the default HTML document that everyone sees or what can be seen in the Bear Bull Trader's video on Risk Controls YouTube video.

-

Hello Connor,

If you are already short a stock with SSR, there is no change in the way you will exit because you are buying shares to exit. (e.g. Route=Market; Share = Pos; Buy=Send)

If you are long a stock on SSR, there is no change in the way you will exit because you are holding shares and selling them, not selling short. (e.g. Route=Market; Share = Pos; Sell=Send)

The only restriction you should experience is the inability to short on the bid while entering.

Good luck trading,

Bailey Nevener

-

TPrice, or Trigger Price, is the price that will activate a stop order when hit.

Price is the farthest price from that trigger price that your order will be executed.

Here's an example.

Position:

500 shares LONG

Average Cost $10.25

Symbol XYZ

Limit stop order to be placed:

SELL 500 shares

Trigger Price $10.10

Price $10.00.

Symbol XYZ

If the bid of XYZ comes down to 10.10 (the trigger price), the 500 shares will begin to be sold.

If the spread is very wide on XYZ, and the bid drops past 10.00 before all of your 500 shares can be sold, the order will stop executing.

Therefore you may find yourself in a situation where the price is below 10.00 (the "price"), and you are still holding a portion of the 500 shares, say 125.

Why would a trader place an order that only sells their shares in a specified range?

In the off chance that there is a random spike down in the price of a stock in the blink of an eye, you wouldn't want to be the one selling at the lowest price.

You will often see stock charts with ridiculous spikes in the price action that correct themselves within a split second.

Imagine you placed a a market stop order (exits at any price below the trigger price) on the 500 shares you have instead of the limit stop order. (there is no "price" component of a market stop order)

It is possible during one of these random spikes, your shares would be sold near the worst possible price.

This could be several cents or dollars from where you were actually willing to sell, right before the price corrects right back to where it was just trading.

By using a limit stop order, you are preventing one of those spikes from costing you significantly more than you were actually willing to risk.

There still however is the chance that the bid and ask are so far apart that the price gaps past your limit stop order, in which case you will still experience the same problem.

My advice is, trade highly liquid stocks and have your limit stop order's distance between the trigger price and the price be wide enough to where the stock couldn't possible gap over it all of a sudden.

For most stocks this will be 10 cents or higher.

Many traders still use market stop orders because they are always trading very liquid stocks with no issues.

I personally use limit stop orders, but I use them for a different reason than the risk management aspect.

Good luck trading,

Bailey Nevener

-

-

I too did the steps described in the video. Even after updating I do not see this option.

-

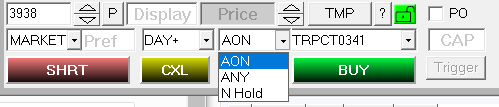

I don't know if this has been resolved, but to avoid it entirely you can set your order to an "All or Nothing" order.

This will not execute your trade until all the shares you request are executable.

Thus you will not experience the splitting of shares.

Good luck trading,

Bailey Nevener

-

Fun fact,

Bear Bull Trader' s forums crashed when I posted this list.

-

Hey Joerg,

Fancy seeing you around here.

I retrieved this list just for you.

Copy this as is and open a Market Viewer in the Quotes tab in DAS.

Click on the most upper row in the Market Viewer and press Ctrl + V.

If it doesn't work, add a couple New Rows and then try again.

Mine worked right off the bat, but I noticed that if I deleted any rows or anything in the viewer it took some fenagling.

-

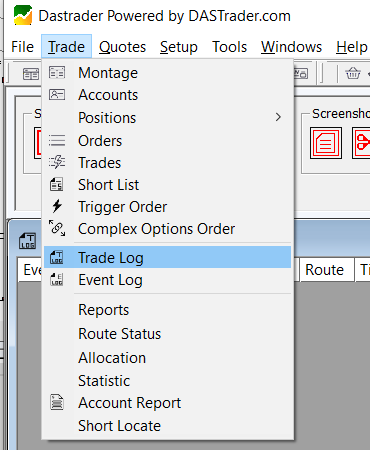

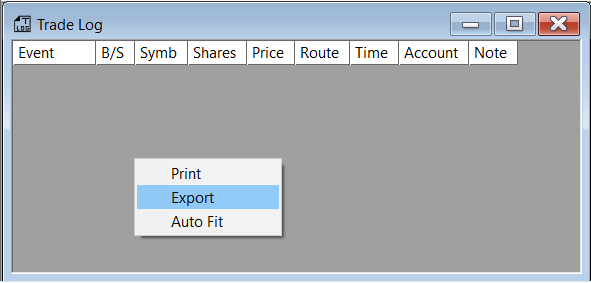

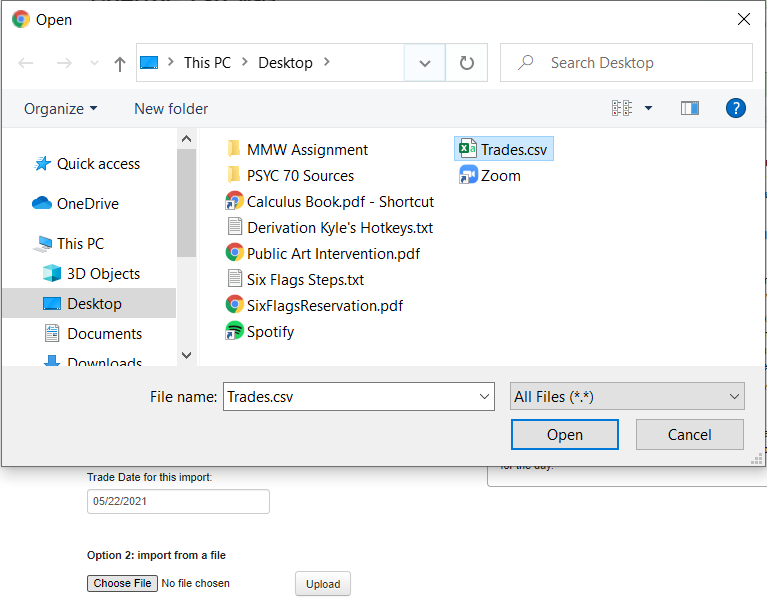

I currently import my trades with this method without using excel.

Step 1:

In DAS go to

Trade > Trade Log

Step 2:

Right click inside the "Trade Log" window and click "Export".

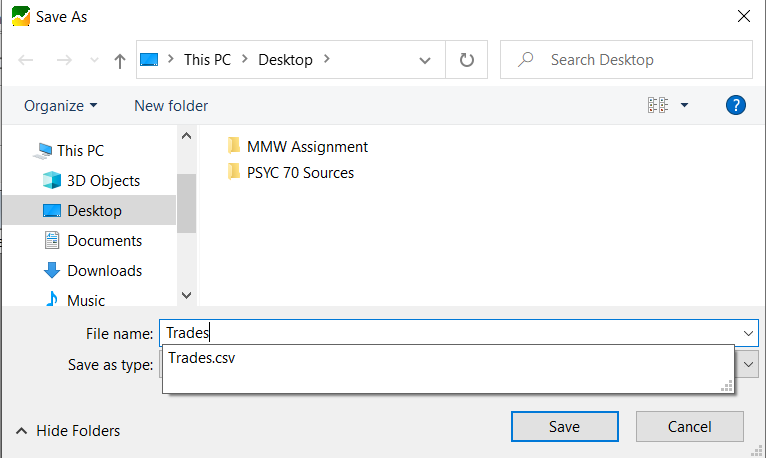

Step 3:

Save the .csv file as a recognizable name like "Trades" in a familiar location like "Desktop".

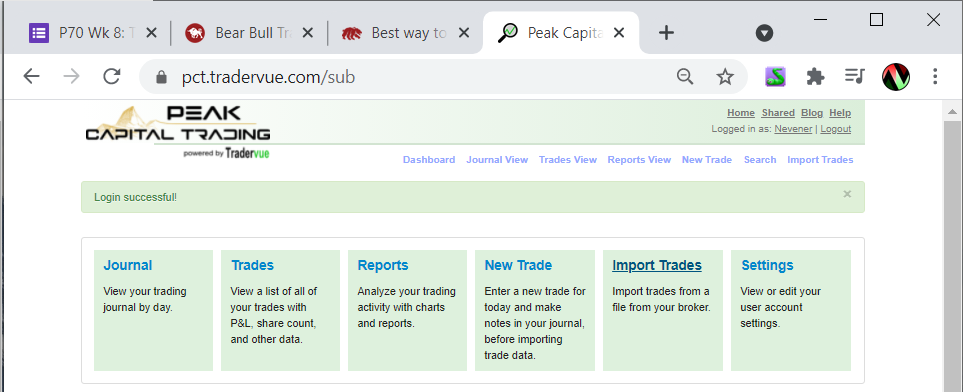

Step 4:

Go to TraderVue's website and on the "Dashboard", click "Import Trades".

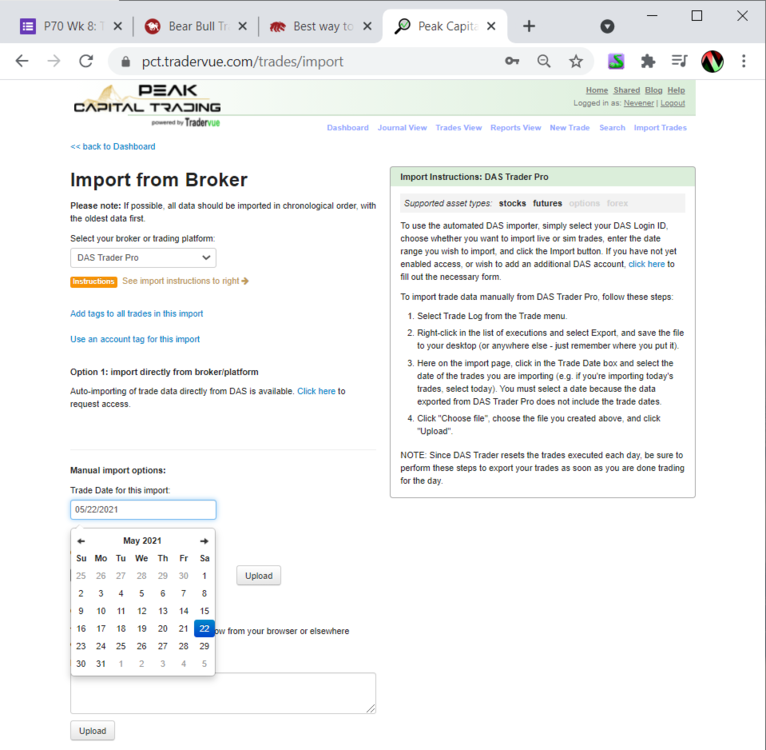

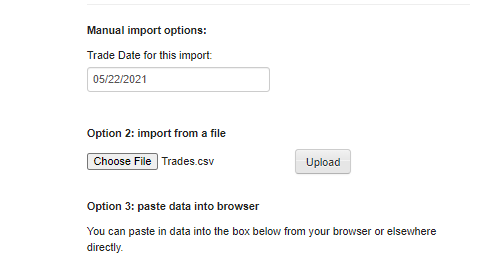

Step 5:

Go down to "Manual import options:" and click on the empty box directly below "Trade Date for this import:".

Click on the date the trades you are importing were performed.

Step 5:

Under "Option 2: import from a file:" click on "Choose File", and select the previously saved .csv file.

Step 6:

Click "Upload".

Hopefully I've answered your question fully.

Good luck trading,

Bailey Nevener

Rob C's Trading Journal - starting Feb 1 2019

in Day Trading Journals

Posted

Wow that's awesome! I'll have to give chartlog another try.