JD

-

Content Count

60 -

Joined

-

Last visited

-

Days Won

7

Posts posted by JD

-

-

@WilliamH I can setup the new thread when we iron out the details. I've been to French's Rockaway Grill on Clearwater beach before and it had a nice view of the ocean.

I put together a google doc to get an idea of when everyone is available and where they would like to meet.

https://docs.google.com/spreadsheets/d/1YVlR5VEH6Fn3SJp4JQYyjkC0mBgaIwX_34vWSDqNLhw/edit#gid=0

-

On 8/21/2019 at 3:03 PM, Glenn Budde said:I am in Cape Coral..... Would definitely attend....

Was trying to get something going in South Florida Club....

even though it would be a further drive Orlando area would be more centralized....

Or we could just go all the way down to Key West (my hometown).....

I think that Orlando would be a little closer if we get people driving up from South Florida and from St. Augustine so that's a good idea

-

48 minutes ago, WilliamH said:Definitely we are going to insight Andrew to Florida!!!! That is 100% the plan 🙂 @Andrew Aziz

xcellent! Would you be okay leading this and creating a new Forum Post in the next couple weeks ?

I can help along the way if you need any input or ideas.

Yes, definitely. There are currently three different threads for Florida meetups so hopefully we can combine them to get everyone together. We've been tagging you in the South Florida club but I don't know if you can see that, I'll add you in that club😂

-

-

That sounds like a great plan, looking forward to the results!

-

1

1

-

-

On 7/18/2019 at 11:47 AM, Mark D. said:Other comments for tomorrow: I've noticed that i have a cycle in my trading psychology which goes: 1.) bad trades -> 2.) red P&L -> 3.) focus on getting good entries and stopping out appropriately -> 4.) good trades -> 5.)green P&L -> 6.) focus on being green for the week instead of good trades -> 7.) chasing entries/ stubborn losses -> 1.) bad trades... repeat cycle. i'm currently at step 6 going on 7.

has anyone else noticed this? any advice for keeping in the 3 through 5 steps? i know on paper what i need to do is don't worry about P&L and just worry about my trades but i still fall in to this cycle. any advice would be appreciated. i think Robert H made a video about this in one of his rants. I need to go review those again.

Hey Mark,

I can relate but don't really have an answer for it. I did basically ask this question for the podcast with Dr. Steenbarger next Friday. One interesting thing that I saw during the interview that William did with Jerremy on Youtube was to have a pain or consequence for breaking your rules. Jerremy would take away something that he enjoyed as a consequence to breaking his rules. They mentioned to start small and progress to greater consequences for rule breaking so I was thinking that it's worth a try. For example, Jerremy used to take away milkshakes for 2 weeks when he broke a rule since he loved milkshakes.

I actually tried something similar which was to cut myself off from live trading for the rest of the day when I broke my rules and it was working out well because the next day I knew I wouldn't be able to take any more trades if I broke my rules. The frustration from having to watch a good setup go by when your montage is locked because you already broke your rules that day is quite painful.

William mentioned something in that Youtube video which was to work on discipline outside of trading to influence trading by starting out small. Setting a task that you have to complete everyday and build it up as you accomplish completing that task. Here's a link to the video if you haven't already watch it.

-

Thanks for the monthly link @mrsemilla

I checked and you can setup the Stream Deck to work with TradingSim. All you need to do is edit the Hotkeys tab in TradingSim to match your hotkey key stroke in the Steam Deck setup and it will work like it does in Das or you can create new hotkeys in the Steam Deck to match the ones they have programmed in TradingSim.

-

1

1

-

-

Please refer to the official forum thread for the Clearwater Beach, Florida Meetup on Saturday, November 16, 2019.

Attendance Sheet: https://docs.google.com/spreadsheets/d/1YVlR5VEH6Fn3SJp4JQYyjkC0mBgaIwX_34vWSDqNLhw/edit#gid=0

-

That screenshot of FB looks like a lot of chop or the price is just stuck trading in a range. I saw this reverse ABCD pattern on INTC today that I saved to my playbook. There was a nice drop followed by small white candles that pulled back to the 9 EMA then another nice drop on heavy volume when the stock made a new 5 minute low. Here's a good video explanation by Robert.

-

On 6/15/2019 at 10:48 AM, Aiman Almansoori said:Thanks for this! I really love those points, I'd actually emphasize on recording the first 30 mins of Andrew trading live, I do hear Andrew and listen to his thoughts while trading but I don;t pay any attention to him sharing his screen as I'm busy with my own charts, watching how he traded after we're done with trading will be much useful. The recap is really helpful and summarize it, but on recaps we only see candles, we don't see the price action itself, the exact entry, was it while the candle was going up? or on a red candle at the pullback, I'd love to watch his trading recorded somewhere in the education center

Mentorships will also be amazing! Would love to see another one coming

Thanks

I really like this idea, maybe if Andrew can replay some of his live trades and provide commentary on what he is looking at in the price action, level 2 and T&S while looking for the setup.

-

1

1

-

-

On 5/18/2019 at 11:29 PM, Jramosent said:When this calculation gives you the amount of shares to take, how can you adjust accordingly depending on Equity? Say a stock price is $84 and per risk you can take 200 shares, this means you are currently using $16,800. If you have an account with less than this amount and no margin, then share size would be invalid? What would be your suggestions here?

Thank you

I took Onosendi's table and added in formulas to base the share size on account size and dollar risk per trade. You just have to update the yellow and orange fields once you download the file to excel and it will give you how many shares to take. It's based on a table so it doesn't have every single stop loss amount. I recommend using Kyle K's hotkey for entering positions based on your dollar risk.

https://drive.google.com/file/d/1Fn8E2fX-2NXLpZZaeK8M_qxEepPqzdGf/view?usp=sharing

-

Hi All,

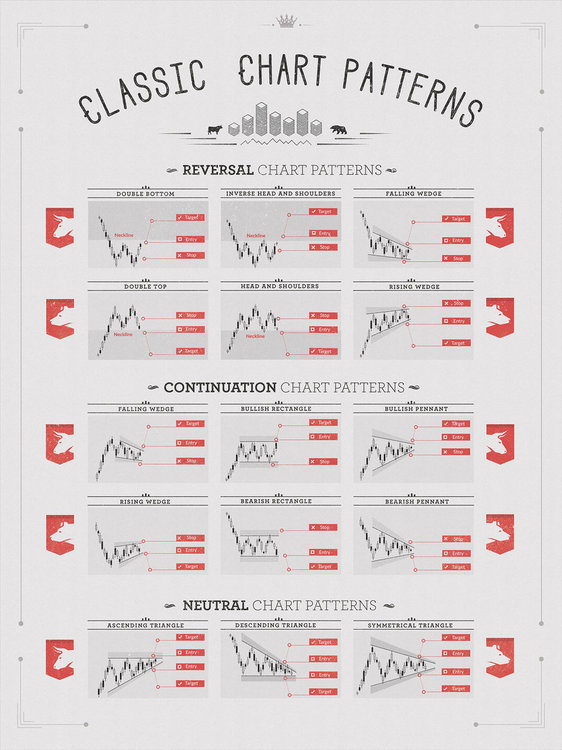

I found a classic chart patterns graphic after seeing that Michelle and Carlos have this up on their wall and really liked the idea of having it as a reference. It also coincides with Robert's video on wedges and triangle patterns.

Here's a link to high quality sections of the chart examples: https://www.behance.net/gallery/27641581/Classic-Chart-Patterns-Print

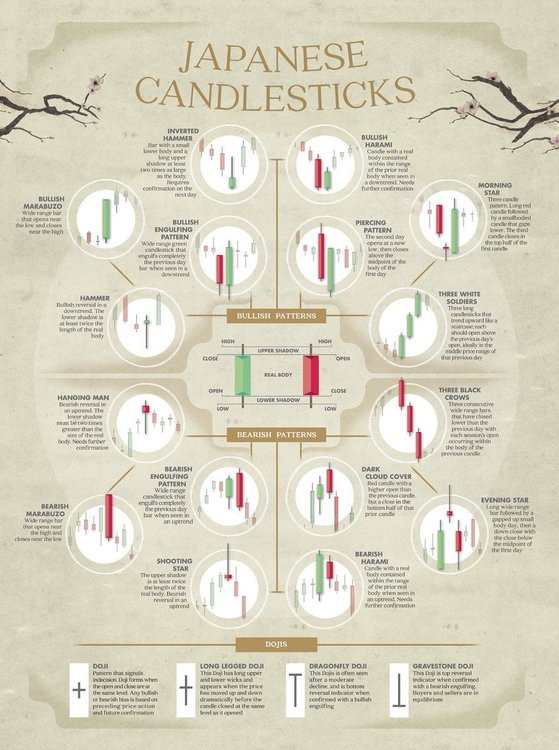

Added the Japanese Candlesticks chart which is really useful too.

-

5

5

-

2

2

-

-

Here's a way to add new rows quickly.

-

I've been part of the BBT community since the end of 2017. I did the trial membership at first because I was skeptical of day trading but after watching Andrew's classes and Youtube videos I saw how transparent and honest he is about day trading and the risks involved. I signed up for the yearly membership and then the lifetime membership when it became available. The chatroom and resources available in the education center have been really valuable, there's so much that I learn everyday from all the great resources that the community has available.

-

4

4

-

-

I was looking for the daily score card that Brett Steenbarger suggests but couldn't find anything to incorporate in my journal so I came up with my own custom journal. I borrowed a lot of what Robert has in his journal template and made an excel file that is formula driven when the trade log is exported and pasted into it. I copy the day tab that is currently labeled "04.25" and pull in my trade log from Das in there, then update the Summary sheet tab using the existing Hlookup formulas.

Here's a copy of the file if anyone is interested.

https://drive.google.com/open?id=1WcUmRE2lMy3jyf8UICQXdRXU1m7LUFgk

-

6

6

-

-

I had the exact same thing happen to me a few weeks ago, it was really strange and annoying. I was testing out a trigger order in my sim account and double checked that I had the sim account selected and shown on the montage but somehow it went through in my live account. I'll try switching my other montages to the sim account the next time I test out using a trigger order.

-

Hey Rob C,

I've noticed that when you switch your global templates between live and sim accounts, if you already traded live for that day and click on a ticker in the closed positions window it will revert back to the live account that you traded with and you can see it change in the montage. Not sure if it's your issue but I have to click on the market viewer symbols to make sure I accidentally don't trade live when I switch to my sim account.

-

Thanks Robert, your Youtube recaps have been really helpful. So far this strategy has been working out really well, I just have to keep working on my execution.

-

1

1

-

-

@Robert H I've been trying the 15 minute reversals for the last few days, it worked well in $AAPL today. For the $JD and $MU reversals, it came within a few cents of my target and bounced. I also took $ETSY yesterday but ended up getting out early. Looking back at them, maybe I should have taken profit a few cents above my target since the stock already dropped around 50 cents from the HOD. Do you find that since some of the move has happened by traders using lower time frames that by the time there's a fifteen minute low, some of the move has already happened?

Tampa, FL Meetup

in Members Introductions & Meetups

Posted

@Glenn Budde it auto saves so you are good.

@Steph those look like some awesome options