Yardley

-

Content Count

23 -

Joined

-

Last visited

Posts posted by Yardley

-

-

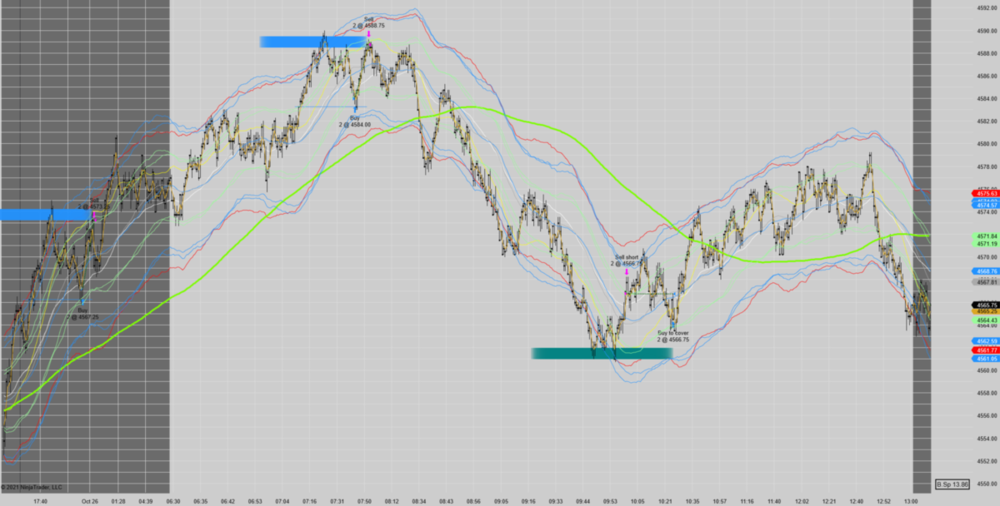

5 hours ago, Rob C said:Futures (MES) algo trading journal Tuesday 10/26/21.

I turned on the algo in SIM for the overnight session (Asian markets - dark shade background) because historical data shows this setup does quite well over night even with low volume. And last night the algo caught a really nice strength and pullback for a nice win.

The strength from the Asian markets continued into the open and we got a really nice pullback and the algo went long and immediately the price moved to my profit target. Soon after weakness struck and we actually got a setup for a trade in the opposite direction with good downward momentum and a strong pullback. Almost too strong of a pullback as the price almost stopped me out. Then the price moved in my favor but did not reach the profit target. Then a strong pullback and the algo stopped out at break even.

See you tomorrow.

Rob C

@Rob C which trading strategy are you using? Did you get an off-shelf trading strategy/system? I know ninjatrader has tons of trading strategies. Are there any free strategies or is it mostly commercial?

-

On 10/13/2021 at 5:05 PM, Rob C said:Hi Yardley, thanks for the note. The stop loss is now dynamic and calculated by a multiple of the 200 SMA ATR. The multiple will change based on the current market conditions (I run that data on the weekends). For yesterday it was about 5 to 6 points stop. I find the ATR very useful for Futures, ETFs and large cap stocks that do not have news.

@Rob Cvery interesting. I like how the algo removes emotion from trading and that helps tremendously in the long run. Do you mind pointing me to some good resources that will help me get started with Algo? I'm using Interactive Broker.

Which programming language are you using?

-

-

Hi Rob,

Can you give me some pointers on how you got started with futures? With my 9-5 job, it's becoming harder for me to trade stocks. So I thinking of switching over to futures or forex. What's your opinion about forex? Have you researched that before settling for futures?

Any advice will be very helpful.

thanks

yardley

-

-

oh, I missed his webinar.

Where's the link to his spreadsheet?

-

-

@Mike B do you use Kyle's keys (https://youtu.be/kDgiWrNVE3Q) to submit your max stop loss per trade?

-

59 minutes ago, MarkCB said:Almost forgot to journal again. I forgot too yesterday. It was a roller coaster yesterday. I was down, then up, then down, then up and then down at the end. I knew were I screwed up. Especially at the end. I thought I was looking at a 2 min chart but in fact, I was looking at a 5 min chart. Ah well.

Today was much better. Took 2 trades UAA, MU

UAA

Rising devil trade. Did get a little nervous as it wasn't going down as fast as I was hoping but made 1%.

MU

Saw MU perform a engulfing pattern on the 1 min chart and it went over the VWAP. The previous candle was also a hammer doji. The 2 min chart showed a hammer doji above the VWAP and the candle that was forming was also a hammer doji above the VWAP. So I went long. Got stopped out at my moving stop loss.

Made 2% total today. Pretty happy. I could have made more with FB as I saw all the signs but was afraid of over trading. But it was such a perfect set up that I should have just taken it. Whatever, no FOMO allowed.

I am at a point where I am debating on going live. However, my job is asking me to do 8am - 4pm shifts for 2 months. I am probably going to stay in sim and do live trading when I get back. We''ll see. See you all Friday morning as I'm back on 2 day shifts starting tomorrow!

Thanks!

@MarkCB what profession are you in?

-

How do they deduct the monthly fee for DAS Pro Software? Does it come out directly from your account or from some other source, like Credit Card?

-

Hi Glenn,

Can you share the scripts that you are using for the following buttons in your montage?

- Buy: $15/R, $30/R

- Sell: $15/R, $30R

Thanks

-

6 hours ago, Rob C said:Rob,

How are you getting these stocks? Is it from Brian's list?

-

On 8/28/2019 at 8:13 AM, Aiman Almansoori said:Hi Patrick! I don't know how TWS works, but on DAS I've configurable hotkeys(Kyle's hotkeys) Automatically calculates my share size depending on where I want to put my stop at+automatic stoploss

I also have hotkeys which I use to partial after which my stoploss automatically goes to b/e, if you don't want it to be at b/e you can just set it so that it doesn't stop you out at b/e. I think DAS is really configurable and you can play around with it to suit your trading style!

I never had any issues with DAS and it satisfied me even more thatn I expected so I really recommend it

@Aiman Almansoori do you mind sharing your DAS hotkeys? I'm specifically interested in the automatic b/e setup.

Thanks a lot.-

1

1

-

-

Folks,

Can y'all share your dastrader pro layout file?

Thanks

-

Thanks Robert!

-

Andrew mentioned something about a post regarding CPE in this video https://youtu.be/NuezkuTJJ54?t=10m44s

Can someone please point me to that post?

Thanks

-

Carlos,

Does their platform provide backtesting capability? Also, what was the minimum amount required to open the account?

kochu

-

Folks,

When do y'all plan of practicing using DAS simulator account? I hold a full time job (8-5) working from home one day a week. B/c of that I don't see myself finding the time to fully dedicate to practicing trading except for the one day I work from home.

Wanted to see where y'all stand.

.thumb.png.9a0d294501f9053c1f0cffa8fd140bdc.png)

.thumb.png.17d916e26543b5e36517438f3872f0fb.png)

Rob C's Trading Journal - starting Feb 1 2019

in Day Trading Journals

Posted

Thanks @Rob C for that information. I'm currently with IB and I was thinking of using their API to do algo trading. But their day/initial margin for future is pretty high. So I'm thinking of moving to Ninjatrader and may be use their strategy builder app. Do you pay any extra to do algo trading with Ninjatrader? Or is it just normal commission and market data fees? Also, do you the minimum amount/balance required to use their application to trade futures?