-

Content Count

717 -

Joined

-

Last visited

-

Days Won

98

Everything posted by Robert H

-

'Compare yourself to who you were yesterday, not to who someone else is today.'

-

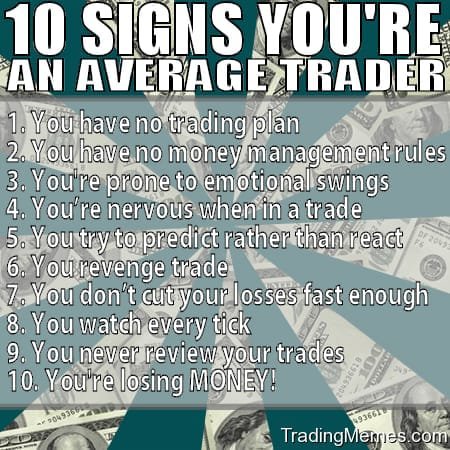

Most beginner traders--including myself--can be described by the criteria above.

The key to being consistently profitable is to cross out each item from the checklist.

The only feasible way to achieve this is to make each bad habit a goal that you will focus on breaking.

One. Trade. At. A. Time.