-

Content Count

62 -

Joined

-

Last visited

Posts posted by Andrew from Jersey

-

-

-

July 2nd, 2020

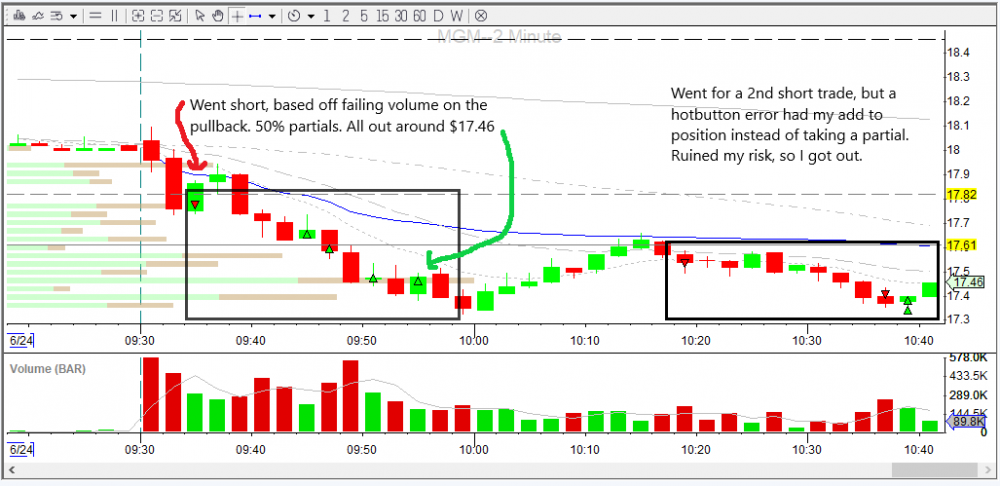

LIVE Trade with MGM

So I went against a rule I had, which was to stay in SIM for the month, but whatever, I had a good feeling and it was supported by some analytics. I used falling volume to make the overall decision to go short, and I used failing volume on all the pullups to make my adds. I always tried to keep my new adds above my partials, so my average cost and risk would stay in a good range.

-

1

1

-

-

-

@Christopher Patterson Can you explain what a "descending triangle" is? I took this trade based on "feeling". I knew the overnight and pre-market long positions were going to take their profit at the open, and it would drop at the open. But I'd much rather back up my "gut" feelings about a market with more sound technical analysis. Thanks for the support!

-

June 29th 2020

SIM trading

This was not a good morning. I continue to struggle with having patience. Tomorrow, I am staying off the 1-min and 2-min charts (except to verify entry/stop/target), and am resolved to try and trade off of the 5-min chart and allow things to open up before I enter/exit. Here's a trade a took on Gilead this morning.

-

1

1

-

-

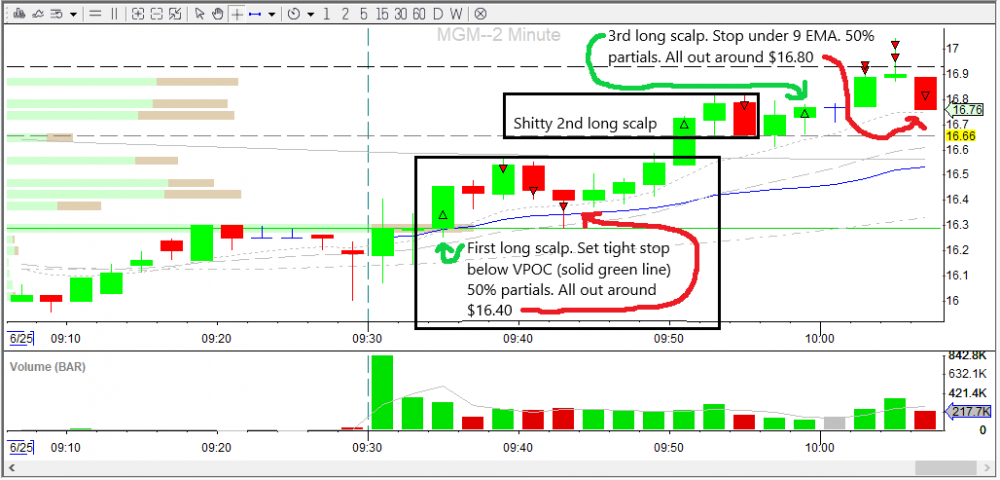

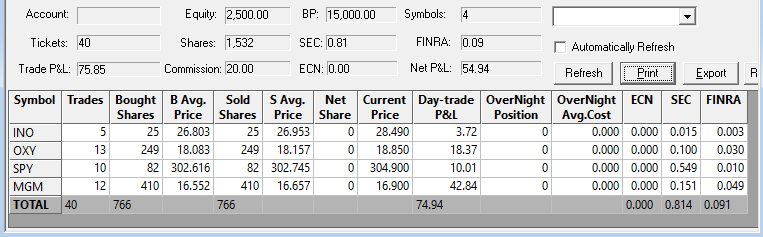

June 25th 2020

SIM Trading

Decided to try some scalping again, since I enjoy quick moves in and out. Broke my daily net goal of $50, so that's cool. I could have used a little more patience with OXY, because it ran for a while based on a news catalyst. Still favoring the casino/gambling sector. Is there an ETF for this?

-

-

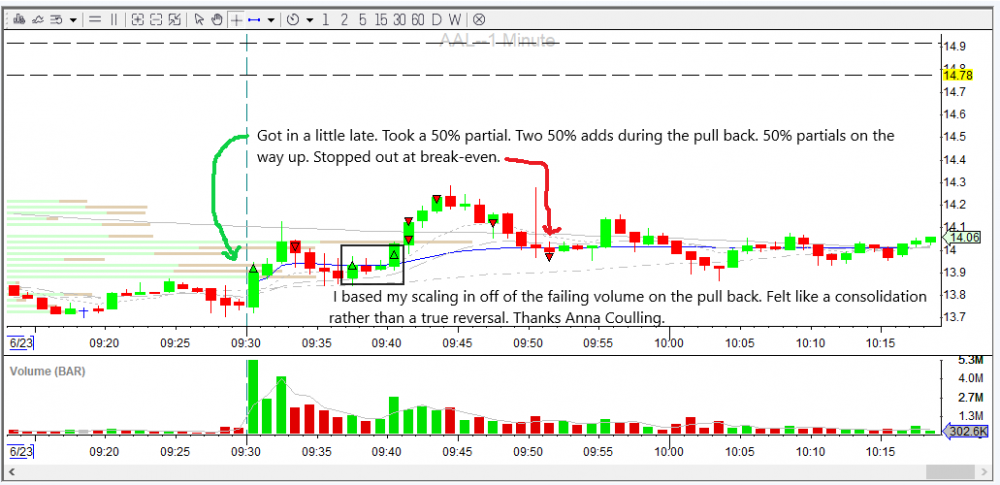

June 23rd 2020

SIM Trading with DKNG, AAL, and ACB.

Minimized my watchlist for the morning, and it served me well. Noted to myself yesterday that I am taking too many positions off the open to try and catch a breakout. Decided to be more patient today, and it paid off. First true green day in SIM, even with all the CMEG commissions and fees. Feels good.

-

-

Friday, June 19th 2020

Traded SIM and some live.

Experimented with low float stocks, and scalping (see the pair of 5 min candles around 9:50). I continue to want to use very tight stops on this "scalping" method. I'm finding out that I need to let the opening breathe a little more before making a verdict on which direction I think a market will go. I'm gravitating to these scalping strategies, opening range breaks. I'm trying to set some levels, namely previous day high/low, pre-market high/low, and previous day close.

-

1

1

-

-

-

Thursday June 18th

SIM trade with RCL

Again, most messing around with the software, and ironing out whatever I needed to with the hotkeys/buttons. I'm liking the buttons more, for some reason, not like it matters. Tried to catch some small waves up and down. Unfortunately, I didn't realize that I switched out of the SIM account, and into my live account, anytime I switched tickers. So, some of those early ins and outs are real, and I'm super pissed at myself for not paying attention. Obviously lost money. Whatever. Issue was resolved, and I'm damn sure I won't make that mistake again.

-

-

In the name of transparency and integrity, I have decided to share my journey into day trading from what is essentially the beginning. I have read the books, and dabbled in some simulated trading on my phone's thinkorswim app, but recently took the next step and opened up and account with CMEG, and finally received my platform activation link for DAS on Tuesday, June 16th.

It is my hope that this journal will help me to develop into a top tier trader, and will also be used by anybody else in their own education and journey into day trading. I apologize to all of the seasoned vets in this community if I make a fool of myself by making stupid or uninformed trades.

Here's a run down of where I'm at after downloading DAS on Tuesday...

Tuesday - dowloaded DAS, and went about watching the "DAS Resource" videos on the BBT site. Got myself somewhat familiar with the software. I'm not a "computer guy" by any means, but I am capable enough of understanding the basic fundamentas of the software. I also spent the evening establishing most of the potential hotkeys I'd like to use.

Wednesday - traded on SIM in the morning on NCLH, and tested out the hotkeys, and began addressing any issues I had with them.

Thursday, today - traded on SIM, with multiple tickers to try and expose myself even further to the markets. Didn't realize that the software switched me out of my SIM account, and into my live account, any time I switched tickers. Took stupid trades on my live account while continuing to work through hotkeys without realizing. Lost like 200 bucks. Super bummed. But asked about the issue in the chat, and got a response right away. Issue resolved, and I'lll check twice before taking on trade in the future. Can't afford those stupid mistakes.

I'll make two more posts after this with some screen shots of some practice trades....

-

On 6/12/2020 at 12:27 PM, Justin said:Hey Justin,

Yeah, it's an issue with DAS and having a Stop order open at the same time. You need to cancel the stop order and replace it. Luckily we can do that all in one hotkey:

CXL ALLSYMB;Route=LIMIT;Share=Pos*0.25;Price=Bid-0.03;TIF=DAY+;SELL=Send;ROUTE=STOP;StopType=Market;StopPrice=StopPrice;Share=Pos-share;TIF=DAY+;SELL=SEND

That will cancel the stop order, sell 25% of your shares, and replace the stop order in the same position with the new share count.

If you want to move your stop to breakeven you would use:

CXL ALLSYMB;Route=LIMIT;Share=Pos*0.25;Price=Bid-0.05;TIF=DAY+;SELL=Send;ROUTE=STOP;StopType=Market;StopPrice=AvgCost;Share=Pos-share;TIF=DAY+;SELL=SEND

@Justin What would the same concept hotkey be for the short side?

-

Does anyone know why my "50% partial" hotkey/button wouldn't be working for NCLH today? The stock had an SSF tag on it today, not sure what that all means but maybe that had something to do with it?

Anyways, the function was coming back as rejected because it was reading it as me trying to short? Not quite sure what's going on. I'd appreciate any clarity.

-

I have no intentions of trading options at this time. You're saying I can ask CMEG/DAS that I would like to swap in the ARCAbook data access for something I'm already paying for?

-

Thanks for the explanation @KyleK29. I really appreciate it. Once CMEG switches my platform from Sterling to DAS, I'm pretty sure I'll be asking for Level 1, Level 2, NASDAQ Totalview, and ARCAbook, as my market data accesses to receive.

-

Thanks @Justin I appreciate the clarity. While I have your attention, can I get some more clarity on the function of these hotkeys, but in some layman's terms?

Lets say a stock is 20 dollars currently, and I am eyeing a good stop .20 cents away at a moving average, with a planned target of 20.60.

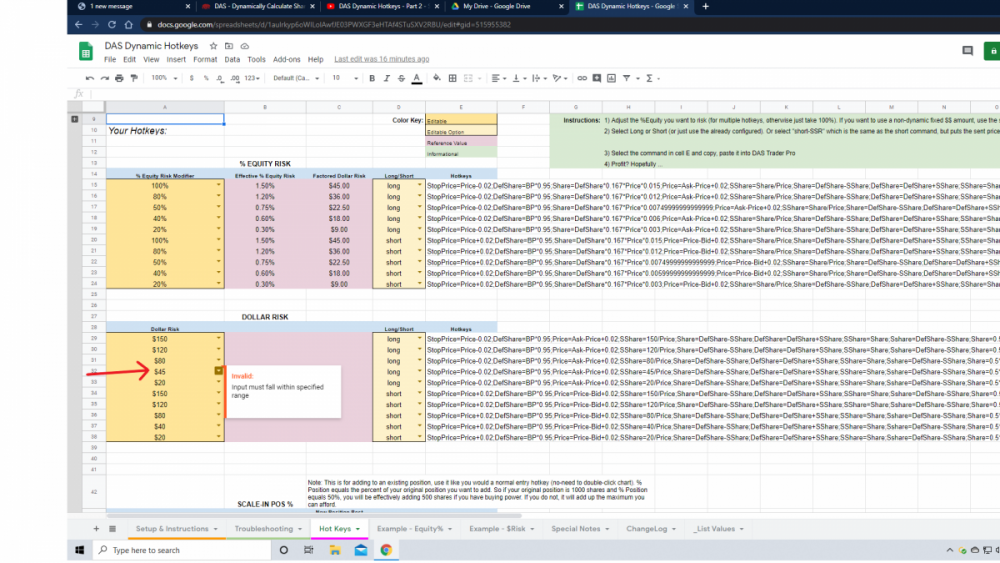

So, if my max risk on any trade is $45, and I am using the "dollar risk" hotkey (as shown), then am I correct in stating that I will be double clicking on the price I want to set my stop (19.80), and then the hotkey function is going to be calculating how many shares I can afford at the current price (20) based on my risk per share (.20 cents), with a total max risk in the trade of $45 worth?

So it seems in this example, I would be purchasing 225 shares at $20. Is that how this all works? I watched some of Kyle's example videos, and that seems to be what is happening, I'd just really appreciate some clarity on the function of it all. Thanks in advance for the help, it is VERY appreciated.

-

1

1

-

-

Here is the script: StopPrice=Price-0.02;DefShare=BP*0.95;Price=Ask-Price+0.02;SShare=45/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=LIMIT;Price= Ask+0.04;TIF=DAY+;BUY=Load;DefShare=100;TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice-0.3 ACT:SELL STOPPRICE:StopPrice QTY:Pos TIF:DAY+;

Here is a screenshot of what I was seeing.

-

@KyleK29 This is amazing work you've done. Quick question/issue... When I am trying to edit the "Dollar Risk" hotkey in Google Sheets, and I switch the dollar amount from "$40" to "$45", I am seeing a little red tab on that cell, and when hovered over will show a small bubble pop up with the words "Invalid: Input must fall within specified range". However, despite the red flag, I do see the new dollar risk value being inputted into the hotkey script. Will this "red flag" corrupt the hotkey at all, or can I just ignore that red flag? Thanks for your time and expertise.Thanks,Andrew -

Thanks @Brendon

At first, I thought I wanted NASDAQ Totalview, as it advertises providing ALL Level 2 quotes. But now I'm being asked by CMEG if I want NASDAQ Open+Totalview for $17 per month, or Level 1 and Level 2 for $20 a month. I'm a bit confused. I asked in the chat, and "Chris Mc" said I want Level 1, Level 2, and ARCA. So now I'm really confused.

Can I get a little more clarity on this?

Thanks,

Andrew

-

What is NASDAQ Total View? Does this data package include Time/Sales, aka "the Tape"?

What other market data access services or packages should a day trader be using?

I hope this post helps others understand market data access.

-

Good evening all,

I have completed my application with CMEG, and from my understanding, the platform comes with NASDAQ Total View (from what I've read here). My first question is, can anyone confirm that NASDAQ Total View is automatically set up with CMEG and whatever platform you choose (either Sterling or DAS)? And secondly, and more to my point, can anyone shed some light on what would be ideal "market data" to have access to while day trading equities? Obviously I'll want Level 2, which from my understand is included in NASDAQ Total View. But what about Time and Sales ("the Tape")?

Thank you for any response or advice, in advance.

Regards,

Andrew from Jersey

Andrew from Jersey - Day Trading Journey

in Day Trading Journals

Posted

July 7th 2020

Went for some scalps this morning. Green day. Should have stayed patient on that UAL trade based off of that falling volume on the consolidation.