-

Content Count

53 -

Joined

-

Last visited

-

Days Won

5

Posts posted by Matt

-

-

Hi @Kevin D, I highly recommend checking out @peterB blog. You'll find plenty of useful information about hotkeys in DAS.

DASTrader Hotkeys | Peter’s Substack | Peter Benci | Substackbest!

-

1

1

-

-

Please provide a screenshot with your post so we can help you.

QuoteHow reliant are most traders to this strategy?

Personally, I use it as a strategy to take position as one element among many others because, by using only the 5-minute ORB, I find that it lacks the big picture. Often, I prefer to do a premarket range breakout using a daily bias derived from an analysis of the higher time frames.

-

Hello, I would like to get your opinion on this quote from Thor: "Is there volume, price will move to size. If there is no volume, price will move to least resistance."

It comes from this webinar https://bearbulltraders.com/course/webinars-mentorship/lesson/strategy-2/topic/the-art-of-taking-trades-strategies-for-effective-trade-implementation-thor/ on the Bear Bull Traders website.

Based on RVOL as a measure of volume, where would you draw the line between "volume" and "no volume"? I find this topic very important, and I would appreciate your opinion.

It would really help me. If you have any personal observations, I'd love to hear them!

Thank you!

-

Cette offre tiens toujours. Nous sommes maintenant sur Discord depuis quelques mois.

-

-

-

I use the "BBT 3 month SIM" subscribtion. I try some of the hotkeys on your blog and this is not working. I will have to stay with the old syntax.

-

Ok! Thz @peterB It help a lot.

I did not find on the DAS website any documentation on the new syntax. Do you have anything?

I will use your blog for reference for now.

-

Hello,

I saw in one of @peterB's posts on is Blog that it's possible to add lines with hotkeys in DAS. I would like to add target lines for my 1R and 2R target dynamically when I take a position.

I tried adding code to Kyle's Hotkey without success.

Can someone tell me what's wrong with this code?

If you have any suggestions for improvement, that would be great.

Thank you!

StopPrice=Price-0.01; $STOP=Price-0.01; DefShare=BP*0.97; Price=Ask-Price+0.01; SShare=600/Price; Share=DefShare-SShare; DefShare=DefShare+SShare; SShare=Share; Sshare=DefShare-SShare; Share=0.5*SShare; TogSShare; ROUTE=LIMIT; Price= Ask+0.05; $PRICE = Ask; TIF=DAY; BUY=Send;DefShare=400; TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice-0.3 ACT:SELL STOPPRICE:StopPrice QTY:Share TIF:DAY; $TARGETR=$PRICE-$STOP; $RISKONE=$PRICE+$TARGETR; $RISKTWO=$PRICE+($TARGETR*2); FocusWidow TRADEFIVEMINUTES; DrawHorzLineWithPrice($RISKONE); DrawHorzLineWithPrice($RISKTWO);

-

Hey Dav003,

In Canada we don't have the PDT rule. Check for INBK it's a good broker. They have office in Montréal. As canadian or Québecois, I feel safe with them.

For paper trading, if you use DAS Trader Demo subscription, it already have a paper account integrated.

Good luck!

-

I don't have your talent and your knowledge in Das hotkey, but I'll get started on it. Thanks for all the tips in your blogs by the way. They are very usefull.

-

From my end, I frequently employ the Moving Average Bands (MAB) ATR indicator on TradingView. (it's free after all!)

(mab) ATR Band — Indicator by happymab — TradingViewThe ATR Band calculator on TradingView derives its calculations from the opening, which may not reflect the true ATR. Nonetheless, it proves highly beneficial, especially when trading gap stocks.

I did try your solution, PeterB, but activating the advanced features caused some of my other hotkeys to stop working.

-

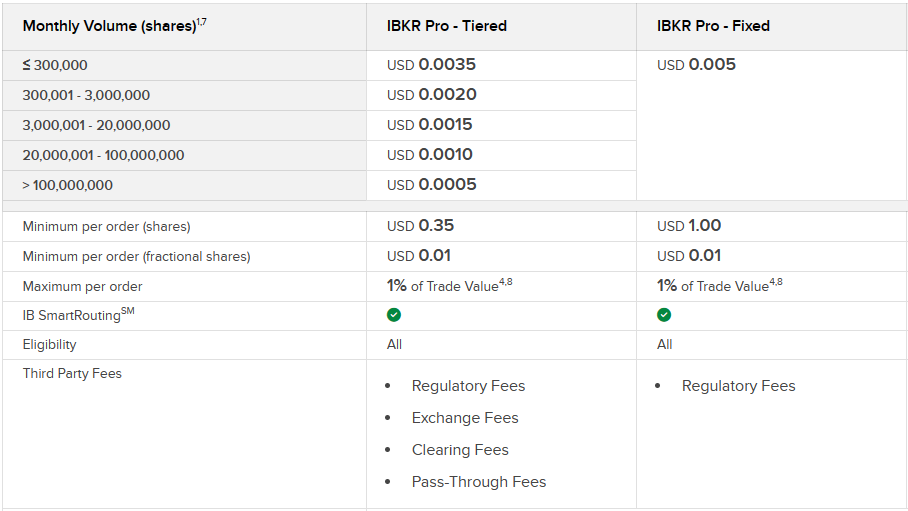

Hello, if like me you are using a simulator and you want to get a realistic idea of broker costs associated with trading, here is a Python script that will allow you to estimate fees per ticker. When I trade a ticker more then once, I divide the total transaction price in my journal.

To use it, you need to copy the "trade" spreadsheet from Das Trader into the Python prompt. The calculations are based on IBKR's fixed costs.

Here's a video demonstrating how to use it:

I can't attach python files so here the code:

# Function to get the table from the user def get_table_from_prompt(): print("Please copy and paste the table (press Enter twice to finish):") table = [] while True: line = input() if not line: break table.append(line.split()) return table # Function to calculate transaction fees def calculate_transaction_fee(num_shares, share_price): commission = round(num_shares * 0.005, 2) + num_shares * share_price * 0.000008 + min(0.000145 * num_shares, 7.27) # Apply a minimum of $1 per transaction commission = max(commission, 1.00) # Apply a max of 1% per transaction total_cost_one_percent = round(num_shares * share_price * 0.01, 2) commission = min(commission, total_cost_one_percent) # Apply maximum commission of 1% return round(commission, 2) # Get the table from the user table = get_table_from_prompt() # Dictionary to store cumulative fees per action cumulative_fees = {} # Calculate fees for each transaction and accumulate fees per action for transaction in table: time, action, transaction_type, num_shares, share_price, _ = transaction fee = calculate_transaction_fee(int(num_shares), float(share_price)) if action not in cumulative_fees: cumulative_fees[action] = 0.0 cumulative_fees[action] += fee # Display cumulative fees per action, rounded to two decimals for action, total_fee in cumulative_fees.items(): total_fee_rounded = round(total_fee, 2) print(f"For action {action}, cumulative fees are {total_fee_rounded} USD.") # Calculate and display cumulative fees for the day daily_cumulative_fees = sum(cumulative_fees.values()) daily_cumulative_fees_rounded = round(daily_cumulative_fees, 2) print(f"\nThe cumulative fees for the day are {daily_cumulative_fees_rounded} USD.")

good luck!

-

On 3/25/2022 at 6:25 AM, paqueuc said:Sorry to deter this old subject, but one more question before choosing between "DAS Trader pro with IB" or "DAS Simulator", please

With DAS Simulator, you don't need a IB account. Just the sim and you can try to trade.

-

Hi Petromil1985,

The DAS trader sim comes with a subscription to live market data feed. So you have real-time data as if you were trading with a real margin account. The only difference is that you don't have broker transaction fees. If you wish, BBT members benefit from a discount offer for a three-month subscription. This subscription is available with replay. Thus, you can download data from any trading day's tickers and practice outside market hours.

If you don't take the discount. The replay is available as extra. Last time I check it was 10$US by month.

Hope it help!

-

Bonjour Traderglobetrotter! Je viens de voir ton message. Je vais t'envoyer un message en privé.

-

Hi hurdleda!

The link are there in step 2.

best!

-

-

je t'écris aujourd'hui Sponge!

-

-

Hi, I trade using the ATR. To see it on a chart, I use TradingView (free version) and I've added the "(mab) ATR Band" indicator to my chart. It's very helpful for seeing the boundaries of the ATR. The indicator is dynamic and changes throughout the day with prices. This prevents me, for example, from taking a short position when the price is already close to the lower limit.

For the calculation check this article : Average True Range (ATR) Formula, What It Means, and How to Use It (investopedia.com)

-

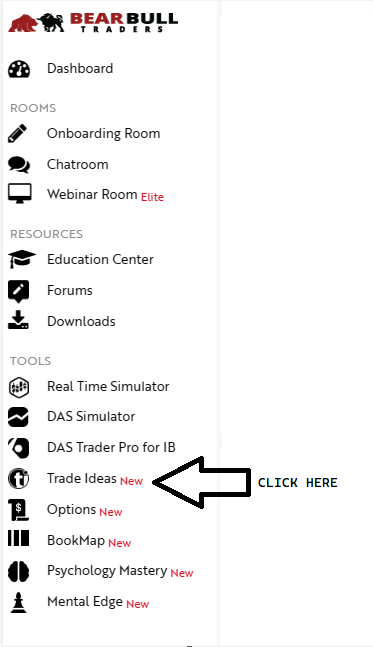

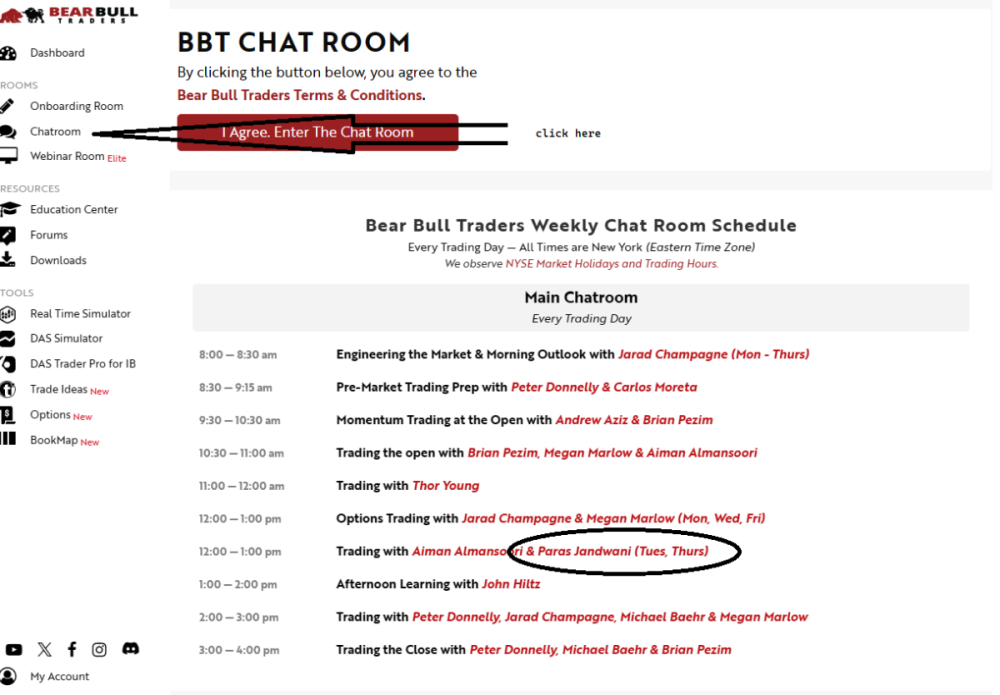

Hi NirajR, It's live in the Chatroom every week day.

-

-

Hello BBT,

My name is Mathieu. In English, I prefer to be called Matt. I live in Quebec. I've been a member of BBT for two months and I've been trading in SIM. My approach is serious.

Every morning, we are two BBT French-speaking traders on Messenger. We share our ideas, our successes and our mistakes, as well as our challenges and our hopes. If you speak French and would like to join us, please let me know through this forum.

Happy trading! Keep it green!

tchat francophone

in Topics

Posted

Le groupe Discord existe encore. Nous sommes 4/5 membres actifs. Il reste de la place si vous voulez vous joindre à nous.