-

Content Count

717 -

Joined

-

Last visited

-

Days Won

97

Posts posted by Robert H

-

-

-

-

Monk, it happens when you press SHIFT repeatedly or hold it for too long. It happens to me as well every now and then.

-

Right click a horizontal line and Config. The changes are applied to new lines and not existing ones. So it's best to Remove All Lines first, add a line, then change config.

-

-

Yikes! Thanks for reporting back, Martin.

They should really let that be known before you open an account from abroad. Will you be looking for another broker then?

-

Sorry to hear that, Martin. Is you account with Interactive Brokers US or some sort of European subsidiary?

Andrew and myself are with IB Canada and the PDT rule does not apply. I can confirm this since my account is under $25k USD.

-

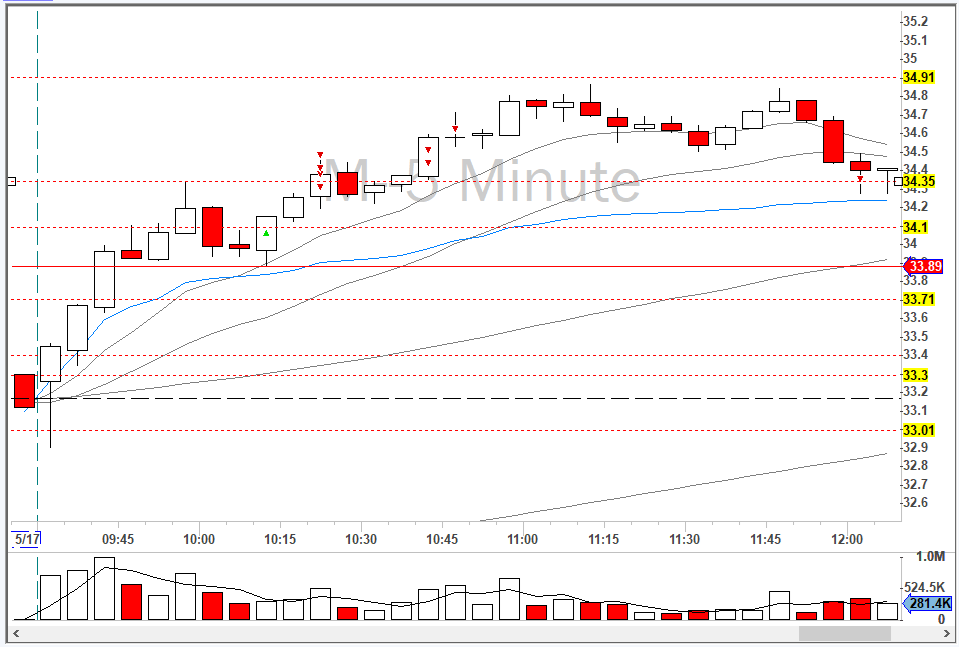

M ABCD/Moving Average Trend – May 17, 2018

Macy's was in play yesterday as it popped to new 52-week highs. Today saw the bullishness continue with a huge ORB to the upside. I didn't take the trade, but rather waited for a pullback. Around 10 AM, I saw an ABCD forming and waited for a new 5-min high. My stop loss would be 33.95 and my initial target at 34.35. With an entry at 34.10, my reward-to-risk was around 2.0.

After the stock popped, I scaled out aggressively at 34.35. I kept some shares for 34.50 and above. With my last bit of shares, I hoped to get to a level at 34.91 so I let it ride the 9 EMA. When it tested the 9EMA at 11:30 AM, I should have gotten out but it surged back to test the HOD again. I made the mistake of walking away and came back to see it lose the 9 and 20 EMA's. I quickly sold all and closed the trade.

The ABCD was a nice clean setup and I feel that I executed the trade well. The Moving Average Trend trade was a big fail on my part as I had many signals to exit: test 9 EMA, double top, loss of 20 EMA. Lesson learned: don't leave a trend trade unattended.

-

Nice trades, Carlos! Congrats and thanks for sharing.

-

I suggest you guys start a spreadsheet so everyone can mark their availability in a central location. Easier to schedule around.

Take a look at the NYC signup sheet as an example.

-

Is the Share size equal to your long position? Press the [P] to set it and the button should switch to SELL.

-

-

WTW ABCD - May 11, 2018

WTW gapped up and then rocketed at the open. I considered taking an ORB but it was too far from VWAP for a favourable risk-to-reward. Andrew ended up going long at 74.80 at 9:38 AM and managed to get some profit before the drop to VWAP. Shortly after, I watched an ABCD pattern consolidate with a strong support at VWAP and the 9 EMA. My stop would be VWAP at 73.80 with a target of 75.89. With an entry at 74.50, the risk to reward-to-risk was 2.0.

I accidentally took double the size and quickly sold half just above break-even. Despite my conviction that it was a long, I wasn't able to manage my risk properly with that larger size. The stock continued to make higher-highs and higher-lows and I scaled out accordingly. When it made a new 5-min low, I was all out. Unfortunately for me, that was just a quick pullback and the stock ended up hitting my target a few minutes later. Oh well--great trade nonetheless.

-

1

1

-

-

JD Opening Range Breakdown - May 4, 2018

I watched JD slowly trend down after bumping it's head on the 50MA at the open. It continued to make lower-highs and lower-lows until it finally lost VWAP. I waited for some sort of a pullback as the 3rd 5-mionute candle was just way too large and quick to trade. At 9:45 AM, I saw that it was a great 15-min ORB down. My profit target would be a level at 37.03 with a stop above VWAP at 37.85. With an entry at 37.65, my reward-to-risk was 3.0.

On the dip I quickly coverred some and continued to take profit on the lower-lows. When the stock reversed, it shot up so quick that I was barely able to cover my last bit of shares at break-even. Looking back on this trade, I should have covered more aggressively near the bottom since it was very extended from VWAP. Live and learn.

-

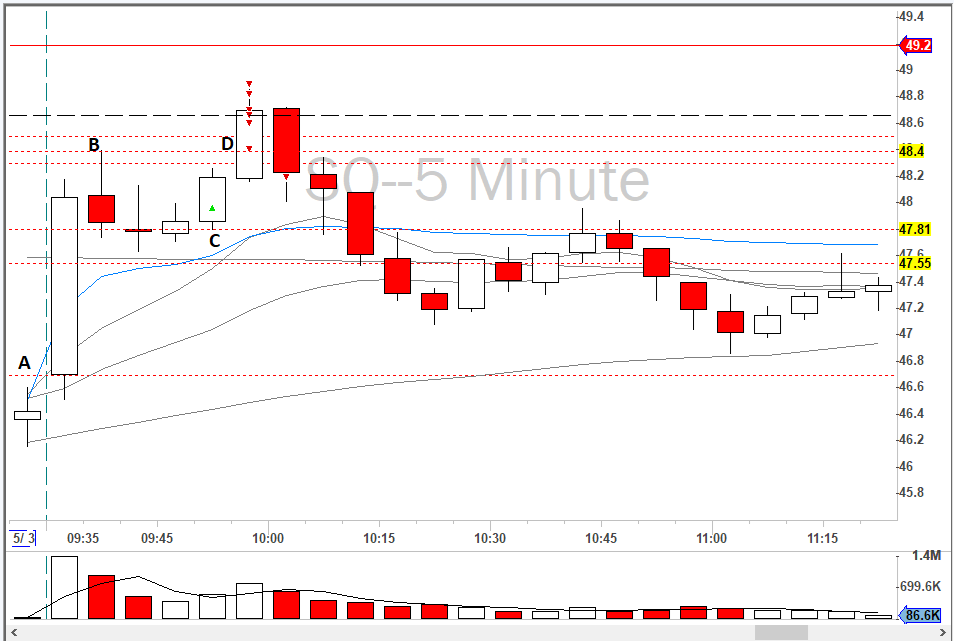

SQ ABCD - May 3, 2018

SQ opened up really strong on some sort of a Bull Flag. I watched it for an ORB but it quickly retraced and consolidated around the 47.80 level. After watching it hold the level, I waited for a new 5-minute high to go long an ABCD pattern. With an entry around 48, my stop would be 47.75 and my target the PCL at 48.65. The reward-to-risk was 2.7.

After it made a new 5-min high, Bulls jumped in and pushed the stock higher towards Y/YY levels. I took some profit there and continued to scale out at the HOD and PCL. My last bit of shares were sold on a new 5-min low right before it dumped to VWAP and below.

This was a classic ABCD trade on a bullish stock that was strong above all the moving averages and VWAP. In the first 30 minutes, the success rate of these types of trades seems quite high.

-

James, there's a link to the Google Sheet in the first post. Please put your name T-shirt size down. Thanks!

-

Got it, Bal. You didn't include a T-Shirt size?

-

Also, what was the minimum amount required to open the account?Account minimum is $30k. Please see this post for more details.

-

We are booked for Saturday, May 19! Here are the details:

Time: 3:00 PM

Location: Tap and Barrel (Olympic Village)

1 Athletes Way, Vancouver, BC V5Y 0C2

Reservation is under: Robert H

Depending on the weather, they may open up the patio and give us the option of sitting outside. Knowing Vancouver, my hopes aren't too high lol.

Any questions, please e-mail me directly.

-

Can I use my Das Demo default.dsk file with Das trader Pro?Yes. However, there might be a few anomalies. I remember a few of my windows (Positions, Account, etc.) reverted to black backgrounds. The rest of the layout stayed intact.

-

If your goal is for DAS to automatically send a marketable limit order--in the same way that Andrew would press his hotkey when the price reaches a certain level--create a hotkey or hot button with this script:

Share=Pos;ROUTE=STOP;StopType=Limit;StopPrice=AvgCost-0.10;StopPrice=Round2; Price=Bid-.05;TIF=DAY+;SELL=Send

That is equivalent to you pressing the 'SELL ALL AT BID - 0.05' hotkey when the market price goes 0.10 below your average.

I know I'm starting to sound like a broken record, but you may or may not get filled at a favourable price depending on the price action. This is true for both the stop limit order (above) and a manual press of the hotkey.

-

Thanks, Jimmy.

The only guaranteed way to not get shaken out by sudden spikes/drops is to not use a hard stop; this is why Andrew and others use a mental stop loss. For highly liquid stocks, it is very rare that the price drops suddenly for no reason. And if they do, there should be enough volume for your limit price to be filled on the way down.

The second best way is to use the Stop Limit Order I described above. It ensures that you are only stopped out if you are filled at a certain price below the stop price (i.,e a penny or nickel). It is a threshold you are defining by saying "if the price hits A, get me out only if the price is B or better. Don't just sell at the market price."

For example, you buy a stock at $10. You send a Stop Limit Order with Trigger Price at $9.90 and Price of $9.85. If the price momentarily drops $1 on some sort of fat-finger order, you will only stop out if you were able to get filled at $9.85. It could be the case that other traders got filled with Stop Market orders, and your $9.85 threshold wasn't met on the sudden decline. If the price suddenly comes back to $10 (again, it has to happen so quick/violently that your $9.85 is skipped), you are still in the position. If the drop was real and price continues declining, unfortunately you are still in the position.

Now this is a double edged sword because depending on the time/sales, order flow, L2, other market participants, etc. you may actually end up getting filled at 9.85 on the $1 drop. If the price recovers to $10, you're no longer in the position. However, if the price continues to decline, you have averted disaster.

There is just no way to determine whether the momentary spike is a real drop, or some sort of shake out. It also highly depends on what other limit orders are out there and the sequence of fills in the time/sales. Therefore, there is no order type that can predict the future.

I know that mitigate doesn't your scenario entirely, but this is just the way market works and how uncertain it can be. I'd be interested in hearing others' opinion on this matter.

-

Can you provide a clear example of the scenario you are trying to protect against?

-

Jimmy, I believe you're looking for a Stop Limit Order. Please see

.A Stop Limit order becomes a limit order once the trigger price is hit. The limit order is then filled at the specified limit price or better. This is useful for when prices are moving very fast with momentum. Using a Stop Market order may cause you to be filled at a price much lower than the Trigger Price. Conversely, a Stop Limit order is not guaranteed to be filled if the price drops quickly below your limit price. This may leave you stuck in the position.For example, I am long 100 shares of FB with an average cost of $160. The current price is $166. I want to protect my profit and exit if the price falls below $163. However, I am only willing to exit if I am filled at $162.75 or better. Once FB reaches $163, a sell limit order will be sent to exit the position at $162.75 or higher.This script can be used in a hotkey or Montage hot button:

Share=Pos;ROUTE=STOP;StopType=Limit;StopPrice=AvgCost-0.10;StopPrice=Round2; Price=StopPrice-0.01;TIF=DAY+;SELL=Send

The order will only fill if the price is 0.01 below your stop price. If the price moved so fast that you were unable to get filled at 0.11 below average cost, it won't get filled. Note that 0.10 is a rather tight stop for most stocks.

Day trading for Jimmy H.

in Day Trading Journals

Posted

Nice trades, Jimmy! Good job on noting areas of improvement.