-

Content Count

62 -

Joined

-

Last visited

Posts posted by Andrew from Jersey

-

-

-

-

-

-

That's it for today. I'm taking it slow, as I need to get myself out of a sizable hole I dug late last week.

-

1

1

-

-

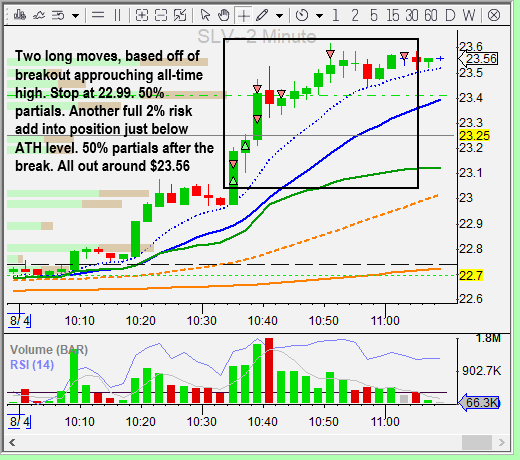

Around 3R. Without partials, it would have been 4R, almost to the penny. My risk was 10 cents per share.

-

-

July 24th 2020

Last two days, I totally hulked out and lost a good portion of my account. It was very disheartening. But, I am resolved to make day trading my career, so I brushed off the losses, and soldiered on.

the Morning's Trades

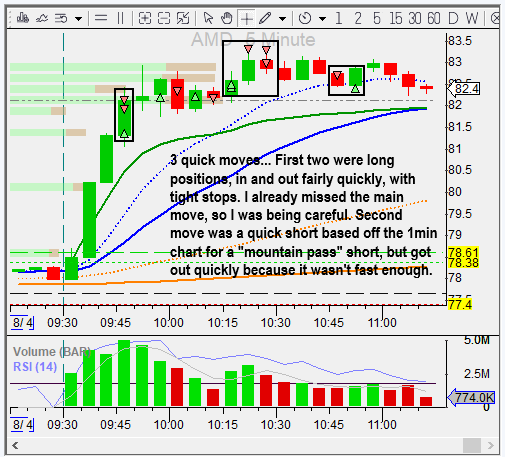

AMD was primed for a good day, so I entered pre-market for a real nice win.

-

2

2

-

-

-

-

-

July 17th 2020

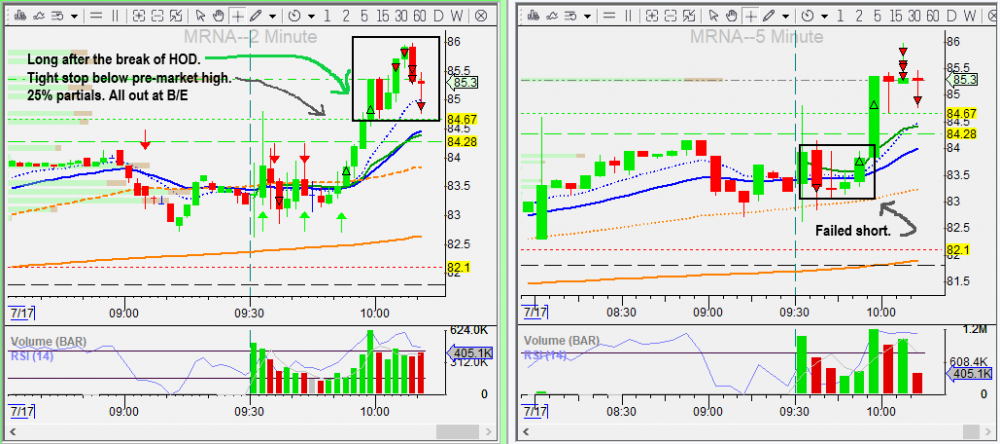

the Morning's Trades, with RCL and MRNA

Took the MRNA trade based off the break of HOD. Stock has been strong as of late. Set a tight stop just below the pre-market high (small-dashed green line).

Took the RCL trade based off of what I saw as a weak move back down on the macro level (15 min chart).

-

-

July 14th 2020

Trading WYNN and INMB

Took the INMB trade because I am interested in learning more about the opportunities with low-float stocks. This move wasn't quite the gainer I was looking for, but still not bad. I took a failed long position at the open that didn't pan out. But later in the session, I tried it again as the stock passed most of the moving averages in its way.

I did pretty good with WYNN yesterday as well, and I figured that big move up from yesterday wasn't going to sustain based off of the pretty much disappearing volume. Went short at the open, and missed the initial drop down, but I stayed patient, added some to the position, and finally made my moves when it took its second trip lower. Decided to go long as it approached the HOD, made a quick 25% partial, before adding some more to the position on a small pullback. Took my profits as the price came up to the SMAs.

I need to re-learn strategies involving the convergence or divergence of moving averages, because I seem to find myself in stocks that this occurs in often enough.

-

2 minutes ago, David Gottfried said:Thanks Andrew for all of your journals and progress. You're moving fast. I'm trying to do the same, still in sim. How do you create these beautiful trade snapshots with the text and boxes? I'm also using DAS, but haven't found the text and box tools yet.

@David Gottfried Thanks for the support my man. I'm actually just screenshotting my DAS screen, and then making all the edits on MS Paint. Good ol "Cntrl + Print Screen". Then paste in MS Paint. Then I crop the section of the screen I want, and away I go.

-

1

1

-

-

July 13th 2020

Took the short trade on WYNN at the open, because you know people love taking their profits at the open. Failed long trade, then another quick short scalp on the way to the bottom. Wasn't watching the ticker when the initial volume came in at the bottom, but I went long later in the session as volume increased, and it began to clear some of the moving averages. Got out of the position when it hit the pre-market high, although I should have been more patient, as it took another breakout for another 2-3 dollars higher!!

-

Can I get a quick explanation of the various "ROUTE"s that are used in the hotkeys, and the importance of making sure the right "ROUTE" is selected for certain functions? I have mine set to "LIMIT", but there must be a reason you included the other routes as well.

Thanks for your time.

-

1

1

-

-

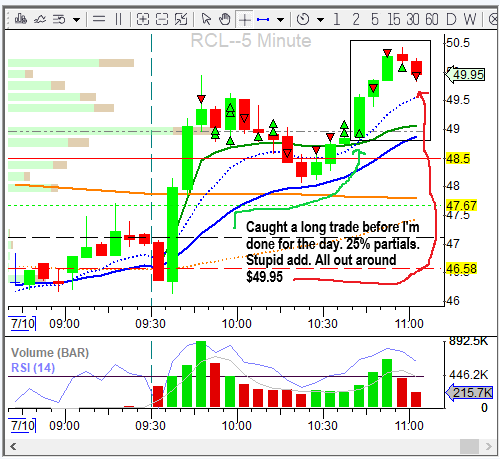

July 10th 2020

Trading with GILD and RCL

Woke up to see some news on GILD about a new Covid treatment, and watched the stock price gap up on it. But I'm think these Covid treatment or vaccine trial news breaks aren't having as much of an affect as they previously did, so I decided to go short. While I did make money off the ticker today, I was expecting a little bit more of a sell-off, and that coupled with the overall market kind of just chopping around, didn't yield that results I was looking for.

Took the RCL trades based off of where the stock is in the macro trend, and based off of shorter time frame volumes and price actions. The last long trade I took, I loaded up on shares, and it brought me to goal for the day.

-

-

@Justin Thank you! So I see the end of the script is what I was missing in mine, namely " TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice-0 ACT:SELL STOPPRICE:AvgCost QTY:Pos TIF:DAY+; ". Now, if I wanted to switch this to a short position function, would I just change that last part of the script from "SELL STOPPRICE:AVGCost" to "BUY STOPPRICE:AVGCost" ??

-

9 minutes ago, Justin said:Hey Andrew, If you open Kyle's spreadsheet you'll see he has options to scale in additional risk:

$20

CXL ALLSYMB;DefShare=BP*0.97;Price=Ask+0.02-StopPrice;SShare=20/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=SMRTL;Price= Ask+0.02;TIF=DAY+; BUY=Send;DefShare=400;TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice-0 ACT:SELL STOPPRICE:StopPrice QTY:Pos TIF:DAY+;Hard to test right now (because the market is closed), but I think if you simply change StopPrice to AvgCost, that will reset your stop to break even at the same time.

@Justin Is there a way to accomplish this with scaling in a percentage risk, instead of the set dollar amount risk? I use the 25% and 50% of position scale in function.

-

Good afternoon all,

Is there a way to scale into a trade, long or short, and have the stop set to break-even?

Thanks,

Andrew

-

July 9th 2020

SIM Trading

Unfortunately, CMEG doesn't always have shares to short, especially in stocks that I tend to follow. However, there were shares to short on RCL, so I took the short side based off of the pre-market action I saw, which seemed overextended ,and I figured there would be profit taking at the open. I also saw a few levels down south that the market liked to work out. Based off the general market sell off while I was trading RCL, I put in some adds as the stock hit these levels. Didn't disappoint. Green day.

-

July 8th 2020

SIM Trading with NIO and AYRO

AYRO is a low float, and I felt like trying out trading a lower float stock. I think I did ok. Based my decision based off of the morning scanners, previous day performance, and the opening volume/price action. Soon as it broke HOD, I went for it.

NIO had a great day yesterday, and I based my decision to go long on pre-market based on that. Took some initial profit on the opening breakout, added some good shares during that lower volume pullback, and took my profit as it went up a little more to start consolidation.

Andrew from Jersey - Day Trading Journey

in Day Trading Journals

Posted

August 7th 2020

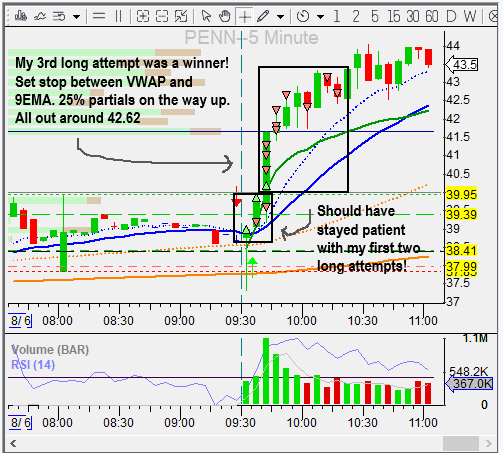

the Morning's Trades, with DKNG, PENN, and ROKU

Mostly HOD Breakout plays. The PENN trade was based off a continuation of yesterday.