-

Content Count

272 -

Joined

-

Last visited

-

Days Won

48

Posts posted by KyleK29

-

-

On 6/3/2019 at 4:00 PM, Marek said:I tried this again in the DAS Trader Pro s/w today and was able to select a subportion of the screen to record. Did this a few times and played back the clips so the (draw window + record) function seems to work. What still does not work is the FULL SCREEN (DAS Trader Pro window) recording function. When I hit that button it returns an error "failed to record full screen".

I submitted a ticket to DAS Trader about this and will let you know when I hear back about a fix for this glitch.

I'm surprised you got that far. I played with the video tools multiple times and they never worked reliably (usually sent that error).

Not sure if they fixed it in newer versions, but in certain versions I tested the video/screen hotkeys didn't work outside of the video control window. So you had to focus that window, trigger the record, and then go back to what you were doing.

-

Are you getting the error message from DAS or is your order getting to the market and just not getting filled?

If it's the error message, you have to do SSR's with a bid+0.01. DAS automatically rejects anything else.

-

On 5/27/2019 at 11:03 PM, cwanxin said:Great stuff! Thanks so much for this. Am excited to use it with my new gaming keypad that just arrived! Will the new version and video be out this week? If not I'll run with the existing one first.

Should be this week, had what Norm had last week (no voice) and finished testing the last of the changes today, so I'm ready to record it now.

I added a new set to be able to add to (scale-In) an existing position by a set $Risk amount. So if you're long with $100 risk and want to add to it on a pullback, you can setup a Hotkey of +$20 (or whatever) and it'll calculate the shares to keep your current position + new position at the new combined $120risk.

On 5/28/2019 at 11:11 AM, aimeep said:Awesome! I had to give up on first version because I couldn't figure it out. I am psyched to try again with video instruction.

Yeah, it's been a very long time coming.

This next update will likely be the last for the Excel versions, as I'm moving development to a standalone (it'll be open-source) application. It'll bring added features such as allowing users to put the Hotkey config directly into DAS (so no copy/pasting), and updating/tweaking. So as traders grow and want to update their parameters, they don't have to fiddle around ... just open the app and enter the new value, hit save.

-

3

3

-

-

39 minutes ago, Ercilia182 said:HI guys,

I Need help!!! so I created a hotkey in montage, that automatically places a SL .10 away from my entry. The thing is that I don't think its working and I am not sure what I am doing wrong. I enter the # of shares I want to buy hit the hotkey, but it prompts me to enter the SL amount. I want to DAS to do it automatically and I don't know how. Here is what I am using:

Price=Ask+.05;TIF=DAY+;Buy=Send;ROUTE=STOP;StopType=Market;StopPrice=AvgCost-0.10;Share=Pos;TIF=DAY+;SELL=Send;

Price=Bid-.05;TIF=DAY+;Sell=Send;ROUTE=STOP;StopType=Market;StopPrice=AvgCost+0.10;Share=Pos;TIF=DAY+;BUY=Send;

thanks.

Without testing it myself, I believe the issue is that the AvgCost variable doesn't have any value to it until the initial order fills. In market time, your Hotkey is sending an entry order and the stop order at basically the same time. To test this, you could set the StopPrice = AvgCost-0.10 portion to StopPrice=Ask-0.10, since Ask/Bid variables are always populated by the data feed.

You're better off using a Trigger Order for the stop which only executes after the initial entry order fills (and thus, provides an AvgCost value). For an example on how to do that you can check out the other Hotkey thread that spun off this one as it has a few Trigger Orders to build from.

With that said, I would not recommend doing an auto stop at a set distance below your entry. Every stock is different and a .10 stop maybe fine for one, but incredibly tight for another (where you basically get instantly stopped). It also prevents you from accurately tracking your risk.

The other thread as the versions to do the stop calculation by double-clicking the chart.

-

1

1

-

-

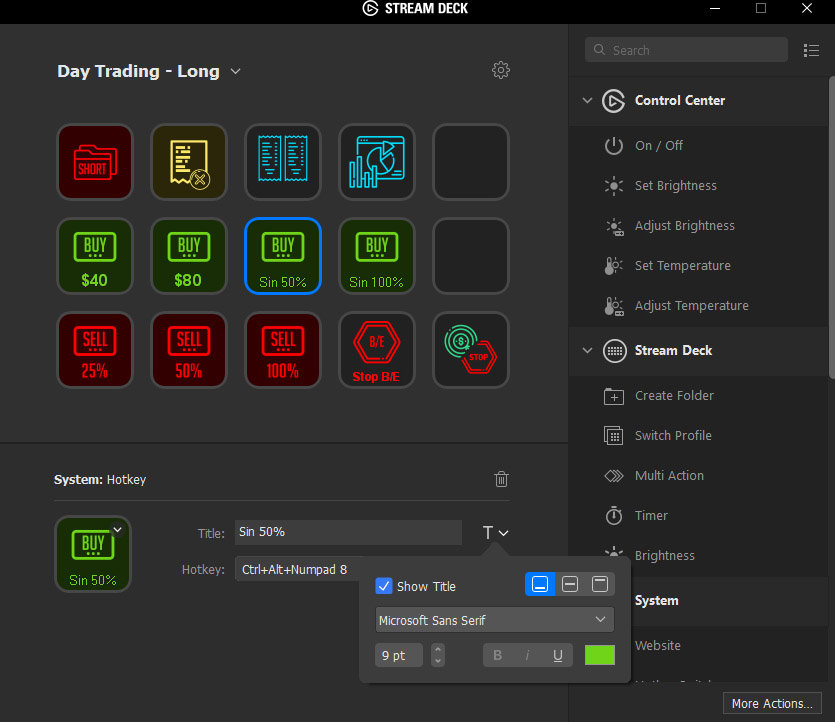

Got your message in my email but the post isn't here, you may have deleted it. But to answer your question for all, I found creating individual price icons a tad cumbersome and just use the StreamDeck's labeling with these settings, it looks pretty good (see screenshot) and is very flexible.

- Icon --> Version with the blank label space. (screenshot has:

- Font: Microsoft Sans Serif

- Size: 9pt

- Vertical Align: Bottom

- Color: #6fd519 [long, green], #3eb8ec [short, blue]

- Show Title (yes)

-

2

2

-

-

I'd be in, since I live here and can assist with any logistics (if you need discounts or a place to pre-ship things, let me know). Also, DAS has an office here in Vegas, so we could probably invite some of the people we interact with from there.

-

1

1

-

-

On 5/20/2019 at 9:33 PM, Jramosent said:Hello everyone, I am hoping I can find a way to do this.

With hotkey

Price=Ask-Price + 0.01;Share=50 / Price;ROUTE=SMRTL;Price=Ask+0.10;TIF=DAY+;BUY=SEND

How can I automatically add a profit target where it sells 25% of my position at 2-1, 3-1, 4-1, etc....?

If this is available can anyone point me in the right direction?

Thank you BBT's

You won't be able to do it with one hotkey. The problem is that DAS doesn't know your stop distance to calculate the profit target. To do the math properly, you have to have access to the AvgCost of the position. This is not available until after the order fills, so if it's all in one hotkey it'll kick back with a math issue (can't get avgcost) because of how fast it processes these commands (it's trying to get AvgCost).

I've added this to a newer version of the Excel config sheet (thread below). That'll give you the ability to get the proper stop-distance and set a price-target to whatever you want. It acts as an A / B hotkey. So once the first order (the one getting you in) fills and comes back, you should send the second hotkey (the one that puts the price target order in).

That version (1.5) should release this week, I'm just testing it and creating the videos to accompany it.

-

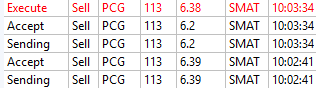

Did you have a stop order already set in the system? If you did and it's the error I think it is, it's because of the way DAS compiles the order. Example [just tested this]:

QCOM is SSR: QCOM Long, Qty: 50, $69.25 QCOM Stop Order in Place, Qty: 50, $69.00 Sell 25% Position --> Rejected w/ same error. Clear QCOM Stop Order Sell 25% Position [same command] --> Order FillsWhat's happening is that DAS see's the Stop Order as an unfilled (pending) order, any additional order (even one that sells your position) is considered on-top of the pending order. If you add the Stop-Order qty with the Position scale-out qty, you get a SHORT position. DAS rejects this because of the SSR.

A similar thing will happen when up against buying power limits (DAS uses the offset from the Stop-Order qty + Scale-Out qty to reserve more buying power than what is actually needed, rejecting if you don't have enough).

The Fix:

Clear any pending Stop Order and recreate afterwards.-

2

2

-

-

On 1/15/2019 at 10:25 AM, ragy said:Hi Kyle - I do not understand the idea of the BP in the equation if I specify my risk loss before entering the trade. Like if my risk loss is $50 fixed dollar with 100% BP, would the position size be different if I selected 50% BP? If I selected 50%BP would my risk still be at $50?

If you're using the DOLLAR RISK version, the initial BP calculation is calculating the Maximum Affordable Shares -- the shares your buying power can afford to buy. In this scenario, if you selected 50% BP, your risk would still be at $50, but the Maximum Affordable Shares calculation would now be cut in half. This only comes into play if you're doing position sizes that bump up against your actual leveraged buying power.

On 1/17/2019 at 12:49 PM, wpicotte said:Set up these hotkey scripts on my Stream Deck - love!

Have tried them in Sim and everything seems to work as expected.

One issue I encountered is with the 'Update Stop Order' hotkey. I have this configured and, following the instructions, double-click the stop market order in the orders window and then hit the hotkey. Nothing happens, however -- and I'm not exactly sure what should.

Can you advise?

Thanks -- and thanks for putting these scripts together. Awesomeness.I'll be including it when I release the video along with a bunch of other things.

On 2/19/2019 at 11:58 AM, nmarnson said:I'm assuming I can change the ROUTE from "market" to "SMRTM" with no issues? The spreadsheet has SMRTL but not SMRTM. I am with Interactive Brokers.

Yes, you can type whatever you want. The new version will have the SMRTM in it.

On 5/18/2019 at 3:56 PM, Jramosent said:Any videos on how to get this going? Seems like around January everything paused?

Yes, I'll be releasing them by the end of this month. Been a hectic year so far as I had many projects come due at the same time. I've got a lot of stuff brewing that I can't wait to share. V1.5 will be out this week with the following changes:

- Bug Fixes

- Price Target Hotkey

- Range Order Hotkey

- Zoom Y Axis HotkeysI just have to nuke my Excel as it keeps locking up with the latest version of Windows.

Along with the video and the new version (I want to launch both together)

-

4

4

-

1

1

-

-

On 1/14/2019 at 8:57 PM, True said:First off this is pretty awesome that you put in all this time and effort on this. Thank you very very much. Awesome. I have a quick question. If I want to use the dollar risk to go long at the Bid +.05 instead of the ask, do I change both "Ask" in the equation or just where it says Price=Ask+0.05?

Here's the original formula:

DefShare=BP*0.97;Price=Ask-Price+0.01;SShare=150/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=SMRTL;Price= Ask+0.05;TIF=DAY+;BUY=Send;DefShare=100;

To have it go long at the bid instead should it be like this instead?

DefShare=BP*0.97;Price=Bid-Price+0.01;SShare=150/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=SMRTL;Price= Bid+0.05;TIF=DAY+;BUY=Send;DefShare=100;

Or should I just change the ask to bid where it says Price=Ask+0.05 like this:

DefShare=BP*0.97;Price=Ask-Price+0.01;SShare=150/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=SMRTL;Price= Bid+0.05;TIF=DAY+;BUY=Send;DefShare=100;

Thank you for your help. Again, awesome stuff.

Would this be for stocks with SSR? If you still need it, I can add the option to do it. It's kinda cumbersome trying to figure by editing the hotkey itself.

This is my $80Risk SSR: StopPrice=Price+0.01;DefShare=BP*0.97; Price = Price-Bid+0.01;SShare = 80/Price;Share = DefShare - SShare; DefShare = DefShare + SShare; SShare = Share; SShare = DefShare - SShare; Share = 0.5 * SShare; TogSShare; ROUTE =LIMIT; Price = Bid + 0.01; TIF=DAY+; SELL=Send; DefShare = 400; TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice STOPPRICE:StopPrice QTY:Pos TIF:DAY+ ACT:BUY; And my normal $80Risk: StopPrice=Price+0.01;DefShare=BP*0.97;Price=Price-Bid+0.01;SShare=80/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=LIMIT;Price=Bid-0.05;TIF=DAY+;SELL=Send;DefShare=400;TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice ACT:BUY STOPPRICE:StopPrice QTY:Pos TIF:DAY+;

In this example, the part you'd edit is the one right after the "ROUTE=LIMIT".

On 1/15/2019 at 9:46 AM, True said:Been playing around with this today. This is great. Thank you again. I have a follow up question I guess just to make sure I'm not doing anything wrong. I was testing out the Stop - set to break even hotkeys and noticed some things that look weird, but don't seem to be an actual problem. First off, it seems like they worked so I guess that's all that matters haha. But I noticed two weird things. On the chart the hollow arrow that shows up for the stop order would be pretty far away from my actual break even point. Also, in the trade log the stop would get shown as sent at breakeven, but then what looks like a second order would also get sent when it gets executed that would be around 20-30 cents lower (if long), but the stop would actually execute at break even. Like I said, it seems to work right, but those things just looked odd to me so I thought I'd point them out to make sure I'm not missing anything. I'll attach pictures of some examples (FYI those are different trades). And just for reference I'm using DAS version 5.2.0.36 with IB and using the $ calculated risk. These trades were all in sim. I appreciate the help.

The price marker is wonky in DAS. For stops, it uses the "PRICE" value. If you do a STOP-MARKET order, the flag is placed at "0.00" (so it doesn't show). If you do a STOP-LIMIT order, the flag is placed at the PRICE value (so if your Limit is Price+0.30, it'd be placed at Price+0.30). If you're currently using any breakeven with a STOP-LIMIT, I'd recommend swapping them out with the new ones in 1.5 that will be releasing in the next few days.

-

Are you doing this for start of day? You can do this another way if you just want a market view full of empty rows.

1) Clear the market view window.

2) Add as many blank rows as you want by default (e.g. if you can fit 18, add 18).

3) Right Click MarketView -> Export -> Save .csv file as something memorable, I did mine as '_reset.csv' so it's always in the top of the folder that pops up.

4) When you start your day: Right Click MarketView -> Import -> Select your file.

4a) Just as an added tip, I usually do: Select MarketView, Ctrl+A (select all on Windows), delete key, and then do the import. DAS doesn't clear the memory registers when you import the list, so the old values will stick around until they're updated, makes it ugly. -

-

25 minutes ago, arbywilson said:@KyleK29 - the hotkeys I have programmed in DAS work on my keyboard, but when I program that same hotkey in streamdeck nothing happens. I am on version 5.3.0.10 of the DAS software and my Stream Deck is brand new. Any thoughts?

Is 5.3.0.10 the current beta version? I haven't tested that, so I can't say if it's related.

You could try downloading Carnac ( https://www.addictivetips.com/windows-tips/show-keystrokes-on-windows-10/ ), doesn't need to be installed (just run it). It'll put the keypresses on screen so you can see what commands the StreamDeck is sending to the OS.

Another thing you can do is set a StreamDeck command to be Ctrl+V. Copy some text to the clipboard and then select a text input box within DAS (like the symbol, or marketview) then hit that button and see if it pastes your text. If it does, you know that SD is passing the OS reserved hotkeys to DAS.

If you're in chat in the mornings, I'm usually there around 5:45am (PST) to 7:45am, so you can feel free to message me there and I can try to help out.

-

On 3/9/2019 at 9:55 AM, Marek said:I am looking into adding the Elgato streamdeck and was wondering about accidental activation of an order on the wrong montage...that seems like it could happen fairly easily if the wrong montage was selected earlier, no?

I have not used hot keys very much, instead focused on working better with the mouse and besides a few glitches and accidental orders it has worked ok for the most part..on the other hand getting I can see how hot keys or a stream deck can stream line the ordering process a bit with some practice and since I now also handle low floats a bit more I have a wider range of shares I buy and sell. So a stream deck with better easier access to more hot key combinations could come in handy.

The accidental order on another montage is going to be an issue with any hotkeys. I only execute trades from one particular montage, so I have FOCUS MONTAGENAME; set on my hotkeys, this way it will always select and execute on that one.

As with most things in trading, you have to practice and learn so that you work through these kinks. Once you get used to it, it'll become second nature. I've been using for a few months and I'm practically OCD on selecting the correct montage now.

16 minutes ago, arbywilson said:@KyleK29 I can't get my SD to work with my DAS profile. I've read thru the thread and I am somehow missing something critical. My hotkeys in DAS match my instructions in SD, however when I hit the button nothing happens. It seems that some people have figured this out, but so far I haven't. Any help would be appreciated.

And the hotkeys you set in StreamDeck are the same as you set in DAS? E.g. a hotkey on the SD set to send Ctrl+Alt+Z has a corresponding action set in DAS.

What operating system and version of DAS are you using? I remember having a brief issue where the StreamDeck and DAS wouldn't play nice.

-

1

1

-

-

1 hour ago, dellen said:Thank you. Is there any way to set a trailing order that gets deleted if a limit order is hit? So for example if the price moves 20 cents against me it stops me but if it hits my target it takes profit and deletes the trailing

I don't believe DAS has that level of scripting at the moment - maybe someone else can chime in if they know differently.

The groundwork is there, but it doesn't appear to be complete. You can see certain areas where a trigger order will (eventually?) have the ability to fire a script/hotkey.

-

On 12/14/2018 at 8:03 PM, Sean S said:@KyleK29, nice. This seems solved the "Not enough buying power" problem as well. Much Appreciated.

Going back to my original question. How do I set up a hotkey enter a stop loss order with the trigger price I double clicked on the chart?

It's a tad more involved (easier to mess up and leave yourself open to error) and best explained in a video. Essentially, you have to do it in one of a few ways - a replace order or you have to cancel all pending orders for that symbol, both have their tradeoffs. DAS does not currently have a hot key for grabbing the active stop of a symbol.

I've included the hotkeys for this in the 1.46 spreadsheet (under extras), but instructions will follow when I do a video on it all.

On 12/16/2018 at 12:15 PM, Jramosent said:Anyway you can do a how to video on how to set this all up, tips and tricks?

Yes, I'll be doing a video on the latest version once I make sure I've gotten everything corrected in this. I think there was one other user with issues, so if it's all good for him now, I'll do it before I leave on vacation.

On 12/17/2018 at 7:54 AM, Mark D. said:thank you @KyleK29 this has been a huge help to my trading! i was wondering if you know why sometimes the price double clicked in the chart shows up in the montage and sometimes it doesn't? the hotkeys work either way it just seems almost random if the price is displayed in the montage or not. thanks again!!

Technically, the price you double click in the chart should show up in the montage until you fire the hotkey. It's then overwritten by the order price (e.g. ask + .05 cents). There's a few other things that can cause DAS to blank the box or fill it with a L1 price.

If you want the price you initially clicked, you can store it by putting this at the beginning of the hotkey (if it's not already there).

StopPrice = Price;

That'll store it in the StopPrice variable which can be viewed on the montage if you use the "Stop Order" display style. Just note that this variable is MONTAGE specific, not SYMBOL specific. So it'll remain across all symbols, not a problem usually, but worth mentioning.

-

7 minutes ago, Sean S said:Re: version

The program only checks the production branch. You have to manually acquire and install the BETA versions. There is a 5.2.0.35 version, but it's a tad tempermental, 0.34 is decent.

I'd recommend backing up your existing DAS install by right-clicking the directory --> Send to Zip. Then install overtop of that directory.

https://www.dastrader.com/download/fixes/DASInstallDEMO.5.2.0.34.exe

^^ This is the SIM/Generic version. There are separate builds for IB/CMEG, if you happen to have them as a broker.

-

1 hour ago, ragy said:@KyleK29 Hi Kyle - Where is the updated excel file?

Should be in original post now, I copied the wrong share link so it was linking the last version.

-

Minor revision from the version (1.45) uploaded earlier today, 1.46 now includes more "bidirectional" modifiers (don't need Long / Short specific keys).

-

-

On 12/12/2018 at 7:56 AM, ragycpa said:@GaryD Hi Gary

I tried changing the Montage style to Stop but the hotkey only sends stop loss on the long side and doesn’t do the same for the short side. Did you experience the hotkey on short and still sent stop order?

19 hours ago, Sean S said:@KyleK29, I appreciate you taking your time to help me out here. I have inputted the new link and verified the montage is in "Stop Order" style, but the trigger order still doesn't work.

On the simulator account, the buy/sell orders were executed right away, but there was no stop orders in the "Orders" window.

Guys, I did find a bug in the prior version, for those willing to test (do so in SIM). Can you download the new version 1.45 of the spreadsheet? Then delete the hotkeys you've added in DAS from the prior version [or just create new ones], regenerate in this Excel file, and readd them to DAS. For testing, I'd add them exactly as copied from the sheet at first. Test to make sure they're working correctly, then add any modifications (such as the Focus Montage) you want.

If they still don't work, please do this:

- DAS --> Setup [top menu bar] --> Other Configuration --> Check the "Log debug message" (it's near the top).

- Restart DAS

- Do a few test orders to the long and short side.

- PM me with the following:

- - Your DAS version number --> Help --> About

- - The hotkey file in the DAS main directory, it should be called "Hotkey.htk" --> You may need to add a .txt extension to this to send it through the forum, that's fine. I can reverse it later.

- - The "log" file generated in DAS Main Directory \LOG\ *todays-date*.txt [default install for SIM/Demo: C:\DASTrader DEMO\LOG ]. -

24 minutes ago, Robert H said:Hi Kyle, this has always been an issue based on how VWAP is calculated. Here's an old post from @Dima regarding the subject:

Hope that answers your question.

Hi Robert, I'm aware of that, was just posting the workaround for other users that come across it. The issue circled is that the chart line (thick blue) falls behind the chart calculation (blue label on price scale). For example, in the image the chart is calculating the 1min VWAP as 35.746 (this is correct), yet the line is stuck at 35.70. Moving the VWAP study config up or down fixes this (it goes back to where it should be). Earlier for me, MU's line was stuck about .06 cents away from the chart label at one point on all timeframes until I did the reset.

I know a few other users have mentioned it. I think it's a bug in BETA 0.34/0.35 as they also added VWAP to the daily chart in these versions, so something else might have gotten messed up.*EDIT* Replaced image above with a more clearer example.

-

1

1

-

-

On 12/10/2018 at 1:19 PM, Robert H said:Thanks, Kyle.

I found that even using the dollar risk version, the diminishing available BP was still an issue. I'm assuming this is because it still contains the DefShare=BP*X variable.

I've since switched to a more simple version based on @fjmocke original hotkey:

Price=Ask-Price + 0.02;Share=100 / Price;ROUTE=SMRTL;Price=Ask+0.05;TIF=DAY+;BUY=Send

As we know, the downside is being rejected based on insufficient BP. I manage this by copy/pasting my Withhold BP from DAS to Excel.

For some reason I couldn't get the STOP orders to work at all. Maybe I'm doing something wrong.

On behalf of the BBT Team: thanks again for all the work!

I tested this more today and wasn't able to replicate with the $Risk version, it properly scales, only switching to the BP value when there wasn't enough buying power. If you're willing to help, can you post/answer the following?

- Were you trading LIVE or SIM?

- Can you post the hotkey command that you're using which is causing the issue?

- DAS Version, Excel Spreadsheet Version

- Can you PM the debug log from DAS Folder --> LOG --> *date-of-test*.txt file -----> You can edit out the top portion that has the server connection / account info if you wish.Best way for this is to close out DAS, delete the latest log file, reopen DAS, and then try to replicate (in a SIM) account.

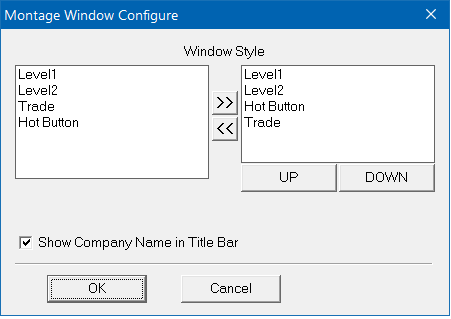

Also, I did confirm that the trigger orders only work with the following montage styles. They do not work on the default option.

Styles that work:

- Stop Order

- Detail

- TriggerStyles that don't work:

- DAS Default

- Basic

- OCO [enters, but scaling out doesn't do what you'd expect]

- Option

- Full -

On 12/10/2018 at 6:57 PM, Sean S said:but what if I want to double click the mouse on the chart, and then press the hotkey to set the stop price right there? Can we do that? In that case we can keep changing our stop losses as the price moves.

Forgot to answer this yesterday. Yes, it's possible, but it's a tad more involved. It'll be included in a video when I make sure all of the TriggerOrder issues are resolved.

Chart Y-axis

in DAS Trader Pro Tips and Tricks

Posted

Additionally, the only other way to scale Y-Axis is via the margins in the chart config. This can now be done in hotkeys with the newer versions (5.4.0.0+) of DAS. Just incase you momentarily want to widen the range to see upcoming levels. Those hotkey commands are:

IncreaseTopBottomMargin (+1% per command)

DecreaseTopBottomMargin (-1% per command)

ResetTopBottomMargin (<--- Resets to program default of 3%)