-

Content Count

272 -

Joined

-

Last visited

-

Days Won

51

Posts posted by KyleK29

-

-

13 hours ago, Carlos M. said:Hi Cindy!

That is correct is not yet available on the IB version. I expect early next year DAS will most likely start releasing this feature to other platforms. Again just me guessing, I wont be surprise if they way for the level 2 feature to be done first. That was going to be upgraded on their phase 2 of programming.

BBT is getting a first look now with the hope of getting feedback from our community on the software. Unfortunately if you are not using the BBT Simulation version you are not yet able to use the DAS Replay feature. When this changes or as we hear more news on it I will make sure to update the forum post.

Thanks.

My guess is it'll be in soon, they probably just haven't figured out how they're going to package it for non-BBT users. It's in the IBCO / CMEG releases, users just don't have permissions to the data.

3 hours ago, Fayaaz R said:Hi Carlos,

Hope you are well. I have a question. I have tried using @KyleK29 Hotkey on the Quote Mode Replay but I am not able to send my stop-loss automatically to the market. When I do it on Quote Mode Normal during trading hours on SIM, it works alright. Do you have any idea what might be wrong?

Thanks in advace.

Fayaaz Roojee

Since it's a completely new feature, I don't know personally what would cause that and I doubt many users have figured it out yet. Once IBCO users can use it (me included), I'll be sure to update any documentation / configs for it.

-

1

1

-

-

**RESERVING for future space**

-

HELP / FAQ for this post:

Please post questions that have not been asked below, they'll be edited into the main topics as they're answered.

Frequently Asked Questions:

**RESERVING for future space**

-

On 10/19/2019 at 3:48 PM, Justin said:Here they are, but it's not fully relevant to the question. The point is, if someone is extremely fast at executing using their keyboard hotkeys, I'm just not so sure that the Stream Deck will be faster. My question is (like I stated above), that if you're supposed to be able to execute trades in fractions of seconds without taking your eyes off the trade window, what is the point in having a Stream Deck with images on the keys?

I know my Streamdeck layout by heart and can trade without looking at it, but it comes down to personal preference. Andrew uses hotkeys. I like being able to have a visual fallback and to have a ton of hotkey combinations for various things, without having to memorize it. It has cut down my hotkey "errors" that I used to get. I probably have around 100 different DAS hotkeys, trying to memorize that would be a nightmare.

I'd say StreamDeck has an advantage when it comes to traveling if you don't trade on the same keyboard, as it's smaller and easier to travel with, thus allowing you to keep the feedback exactly the same no-matter where you are (e.g. switching from desktop keyboard to laptop keyboard can be like relearning the hotkeys).

-

1

1

-

-

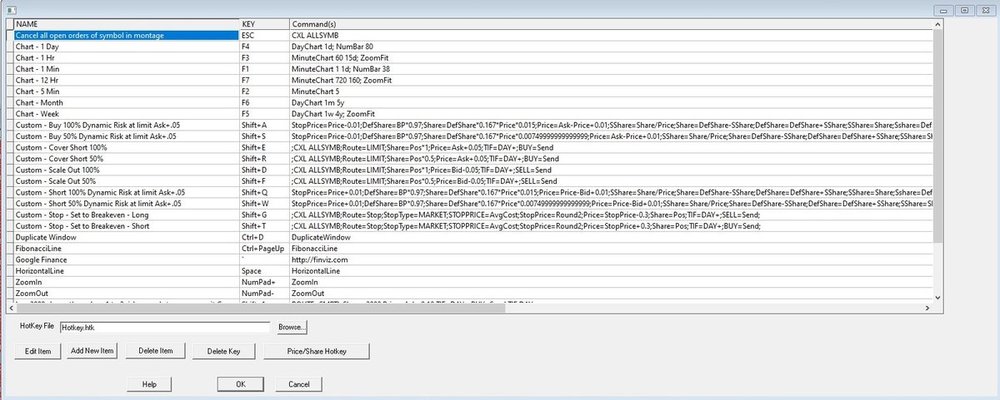

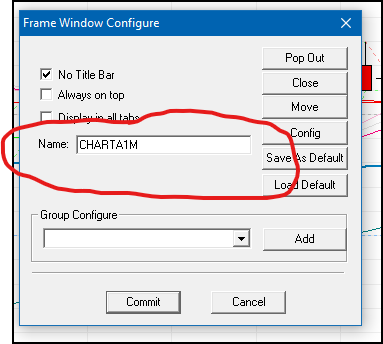

Yes, but you'd need to do some config before hand. You need to go to the titlebar of each chart window you want to change (see image) and give it a unique name. For my example, I changed my B-Montage 1minute chart name to "CHARTB1M" and my A-Montage to "CHARTA1M". You then need to do a hotkey with FOCUSWINDOW CHARTNAME; CHART-COMMAND for each chart you want to switch.

So for my example, changing two of my designated charts from 1minute to 5minute, my hotkey would be like this:

FOCUSWINDOW CHARTB1M; ZoomFit;MinuteChart 5 10d; NumBar 50; FOCUSWINDOW CHARTA1M; ZoomFit;MinuteChart 5 10d; NumBar 50;

-

1

1

-

-

On 9/30/2019 at 2:59 PM, dellen said:Hi everyone,

I'm looking for a platform with a good trading API. I'm currently using DAS TRADER but access to their API is too expensive. Can anyone recommend anything? It's for an automation project.

Thanks!I'd second Eric's suggestion on IB. You can use MetaTrader, but it uses it's own syntax that you'd have to get accustomed to. IB offers their API in a variety of languages. Plus, another added bonus is if you play nice with the API, you can download market historical data without paying the massive costs data-brokers want for it.

Other automated platforms would places like QuantConnect.com and TradingView.com.

-

1

1

-

-

Added some more icons, mainly to do with the upcoming Line Styles feature in DAS (hence all of the H-Line colors). Also added a newer option, if the file ends with "_trans.png" it is a transparent icon and you can change the color using the StreamDeck icon creator by adding a background color and then putting the icon-image over top of that background. Objects ending with "_trans90.png" have a 90% opacity (10% transparent) background. Only like two icons currently have this, but I'll try to rework it into more going forward for more flexibility.

DOWNLOAD: https://drive.google.com/open?id=1kushuhwPep1nfnNQdEWNdXZtyw8Z356g

-

1

1

-

-

Hey Lads and Lasses, apologize for the delay in replying .. I was on a vacation and then took some time to get back into the groove of things. I did find where they make those beautiful postcards (jk) ...

^^^ Beautiful location ... the swim back to the boat was a tad much though.

Anyways ...

On 9/10/2019 at 7:18 AM, Konstantin M said:Hi Kyle,

Yes that fix worked fine, now the updated stop shows as SM.

I have another issue though with the below hotkey. It is the one to scale in 10$ risk. When I try to scale in I get filled twice.. screenshots attached.

;CXL ALLSYMB;DefShare=BP*0.98;Price=StopPrice-Bid-0.02;SShare=10/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=LIMIT;Price=bid-0.03;TIF=DAY+; SELL=Send;DefShare=400;TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice-0.3 ACT:SELL STOPPRICE:StopPrice QTY:Pos TIF:DAY+;I missed this earlier. When you scale-in, are you using the scale-in version of the hotkeys or the original risk management version? You should use the scale-in versions if you aren't already.

On 9/21/2019 at 11:45 AM, Yann said:Hey Kyle, is there any way to incorporate "SwitchTWnd;" in the script so that it automatically highlights the montage window when pushing the hotkey? I just hate it when I miss an entry because my montage window wasnt selected. I tried adding it to the front of the script like so:

SwitchTWnd;StopPrice=Price-0;DefShare=BP*0.925;Price=Ask-Price+0.00;SShare=20/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=SMRTL;Price= Ask+0.05;TIF=DAY+;BUY=Send;DefShare=200;TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice-0.05 ACT:SELL STOPPRICE:StopPrice QTY:Pos TIF:DAY+;

But it gives an error when using the hotkey. Maybe the "SwitchTWnd;" command needs to be inserted at a specific place in the script for it to work but I wouldn't know where exactly. Any idea?

SwitchTWnd is for switching the Trade Window. You'd probably want FOCUSWINDOW. If you right click the titlebar of the Montage you want --> config and then give it a name .. you can then focus it. So the hotkey would be FOCUSWINDOW MYWINDOWTITLE; Just put that at the front of any hotkey you want. The double-click already does this though.

On 9/22/2019 at 8:29 PM, Shaun said:Hi Kyle,

Just wanted to let you know that in both v2.0 and v2.1 (only versions I've tried) selecting SSR in the drop down box under the DOLLAR RISK section on the Hot Keys tab doesn't update the formula. Selecting SSR for all the other sections in the tab works fine, just the DOLLAR RISK section is not working properly.

Ok, thanks. I'll take a look at it.

On 10/8/2019 at 8:44 AM, TommyK667 said:I am not sure what went wrong from the DEMO to Pro version of the app...and I don't understand how they have became negatives.

I have also tried using the spreadsheet script but shares also appear in negatives in the messages.

Any help would be much appreciated! Thank you.

I am using the training/simulator account on Pro with these.

Usually the negative values are caused by the BP function not getting the correct equity for the calculation. If I had to guess, your Montage was set to the IBCO account that isn't funded yet (your LIVE account, which has $0 buying power). It begins with "U". Swap the Montage to the account that begins with "TR" and give it another try ... let me know if that fixes it for you.

22 hours ago, David Furlano said:These hotkeys works great ! I am now looking to implement a 2:1 range order upon my entry instead of a stop. Have you dabbled into a script like this ?

Any help with this would be much appreciated ! Or maybe someone already has a script built.

You'd likely have to do it with two different hotkeys and the Spreadsheet has a few examples of Range Orders with a 2:1. The *ideal* way would be to modify the TriggerOrder, but I just tested it and DAS doesn't like the math at all. DAS has a very simplistic mathing engine, so you can't do the proper sequence like you could if it allowed HighPrice=(AvgCost-StopPrice)*3+AvgCost .

4 hours ago, Skye said:I am trying a script generated from the spreadsheet. It does enter the stop order but the stop price is 0. I tried David's script above and got the same result. Any idea what's going on?

Also, I have had a problem using stop orders in teh past that I can't exit my position using the "Sell All" button. Instead f selling all it enters a short (took me a while to figure that out!) Is there any way around that?

Finally, what I would like is a auto-size order hot key that would enter the stop order as above, but also a partial order at 1R. The problem with range orders is that you're all out at the top or bottom (unless I'm missing something). I find that my fast-moving ORB's sometimes hit my 1R cover point and return and it happens too fast form me to catch it manually, or enter a limit order in the montage.

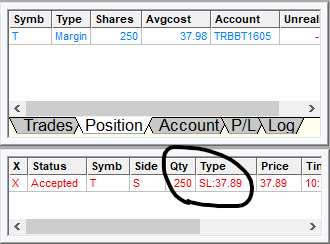

If you're using the "StopType=Market" (as recommended), the Price will be 0. This is because DAS forces it to that value when you submit the order, the actual triggering price is stored in the "Type" column (e.g. "SM: 10.10"). It's also the reason the stop-order arrow doesn't show on the chart (because it's sitting at 0).

For the 2:1 partial. You'd be better off doing a second hotkey that sets a partial limit order. Like:

1) Double-click, hit normal "long" hotkey (for this example). It'll set the stop order when it's filled.

2) Hit second hotkey that sets the partial take-profit .. like (assuming 25% partial):SHARE=POS*0.25;SHARE=ROUND;ROUTE=LIMIT;PRICE=AVGCOST+AVGCOST-STOPPRICE;TIF=DAY+;Send=Reverse;

-

You could try:

SHARE=POS*0.33;SHARE=ROUND;ROUTE=LIMIT;TIF=DAY+;Send=Reverse;

That should work in both directions (long or short). You must have an open position. To use it:

1) Double-click on the chart where you want to set the order (be sure to have Double-Click to trade turned on in the Chart Configuration; Right-Click Chart -> Double-Click to Trade [in Settings area]).

2) Hit hotkey.

3) Hopefully profit.-

1

1

-

-

1 hour ago, Konstantin M said:Hi Kyle,

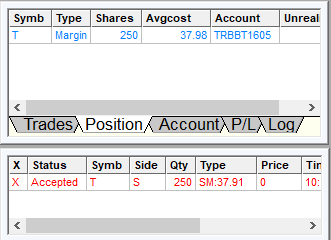

Yes that fix worked fine, now the updated stop shows as SM.

I have another issue though with the below hotkey. It is the one to scale in 10$ risk. When I try to scale in I get filled twice.. screenshots attached.

;CXL ALLSYMB;DefShare=BP*0.98;Price=StopPrice-Bid-0.02;SShare=10/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=LIMIT;Price=bid-0.03;TIF=DAY+; SELL=Send;DefShare=400;TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice-0.3 ACT:SELL STOPPRICE:StopPrice QTY:Pos TIF:DAY+;Seems to be a bug in the Excel sheet, it's not flipping the Trigger portion. Give me a few minutes.

*EDIT*

New version in OP. Please regenerate those hotkeys using this version and see if they work for you properly now.

-

On 8/27/2019 at 10:57 AM, Alastair Mowatt said:2) Ok I understand ur position......an opportunity exist here for all to benefit legally. I will bounce ideas off DAS and get back to you and Andrew on actual opportunity.

Did you know DAS has a new ORDER TYPE which allows true trading and dragging orders on the chart ? Its in BETA and be tested from this link

http://www.dastrader.com/download/fixes/DEMO.5.4.5.3.exe

Its under Chart Window hotkeys. This will allow exact profit target adjustments/dragging with RANGE orders etc. Take it for a spin, maybe u can update ur XL spread sheet when they release it officially.

AM

Been playing with this some, since you asked for feedback (I assume you have a developers ear on this), I'll post my suggestions here. I really like it, a few solid enhancements I think would be:

Functionality:

1) Double-clicking a flag should send that OrderID to the chart's connected Montage for easy replacement. This would make it very fluid with modifying the orders in a streamlined workflow. Right now double-clicking it just loads the clicked price to the montage (if double-click-to-trade is turned on).

2) Maybe Shift+Click could update the order's position size to your current position?Aesthetically:

1) Ability to adjust the font size on the flags, they can get quite big otherwise.

2) Color change --> Right now, short positions are blue and long positions are red. Be nice to have different colors for if it's a STOP order or a standard order. See attached screenshot for example. -

On 9/8/2019 at 3:08 PM, Yann said:I get the message: Error: No more Order server to connect.

What login am I supposed to use for the demo version? My TR account linked with my real one? Or do I have to request a new 14 days trial?

Thanks!

If you're in SIM with a BBT account, make sure you to drop the TR from your username when logging in. So if it's TRBBT####, your login would be BBT####.

-

2 hours ago, Konstantin M said:Hi, have a question regarding Stop Price update hotkey.

The below hotkey replaces the stop order from Market to Limit and I dont know whats the reason. For example I go long with automatic Market stop, but when I want to update the price with a hotkey the new order is Limit.

CXL ALLSYMB;Route=Stop;StopType=MARKET;Share=Pos;StopPrice=Price;TIF=DAY+;Price=StopPrice-0;SELL=Send;I confirmed this issue with the newer versions of DAS and I think it's the order of operations causing it to default to limit. In one of the DAS versions the stops started defaulting to Stop Limits in certain scenarios. Try these, if they work I'll put up a new update with the fix:

CXL ALLSYMB;Route=Stop;Share=Pos;StopPrice=Price;TIF=DAY+;Price=StopPrice-0;StopType=MARKET;SELL=Send;18 hours ago, Bo Trailblazor said:Kyle-

Thanks for hard work on this!!!...I messaged you, but just in case this reaches you better:

Trying to sim and test a few things out with your hot keys but keep getting MASSIVE share sizes that come out to over million dollar positions (maybe one day!, but for now...uh oh)

For example a $50 risk with following settings:

Account Leverage 4

Equity $30,000.00

Max Account %Risk 0.50%

Total Buying Power $120,000.00

Percent Equity to Total BP 25.00%

% of Total Buying Power 97.00%

New Total Buying Power $116,400.00

Send / Load Load

Route LIMIT

Order Bid/Ask Offset $0.05

Time in Force DAY+

Default Shares 100

Minimum Stop Buffer 0.01

Send a Stop Trigger Order? FALSE

Script per your excel is: DefShare=BP*0.97;Price=Ask-Price+0.01;SShare=50/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=LIMIT;Price= Ask+0.05;TIF=DAY+;BUY=Load;DefShare=100;

I have played around with this and cannot get it to work how I thought it would. I have tried placing the stop far away and close as well.

Any thoughts?

Best,

Bo

Hi Bo,

I tested your hotkeys in my version of DAS and they worked as expected. Even tried a few common mistakes to no avail. It seems like a calculation is failing somewhere. Can you post your DAS version and also go into Setup > Other Configuration and check "Debug Message". Try the hotkey out and then send me the latest file in the your DAS folder /LOG/ via PM? It'll help me see what it is doing.

-

16 hours ago, Little Shark said:Hello!

Can't get the hotkey to work. Keeps giving me this everytime I go for the trade:

Set default share to -258

Set default share to -285

Set default share to 400

Error:Invalid Sharesthx 😁

Update: fixed issue. Problem was my sim account was already using max BP when I tried to place trade.

Can you post the hotkey command(s) that you are using? And / or did you create them using the configuration Excel sheet yourself or did someone send them to you? I find that the ones users pass around tend to fail because a lot of messaging programs strip out (sanitize) the "*" in the command which causes calculation issues.

-

On 8/31/2019 at 11:51 AM, Alastair Mowatt said:How many variable fields do u think u or any other developer may require ? i will ask for them if u have not....requested some edits to Line Styles hotkey.

All of them. Just kidding. Depends if they can do dynamic typing and/or convert to the necessary datatype for a field. Probably at least 5 floats would be helpful (if they can still write to INT based variables).

1 hour ago, Konstantin M said:Is there any way to automatically update Stop order position size when Partial order gets filled ?

Unfortunately no. I wish there was a reoccurring Trigger Order that could do it. You have to just be vigilante with updating. I did make some requests that should make hotkeying it a tad easier in the future.

On 9/1/2019 at 3:14 PM, wayneb said:Tried to get it to work but would not accept my user and pass. How did you login?

Does your username start with TRBBT? You need to drop the TR part of it, so it's just BBT####. Otherwise it won't let you login.

Be careful with it though, I've managed to crash my PC 4 times yesterday (hard lock ups). The chart tools don't play nice at the moment.

-

12 hours ago, Nigel said:I still can't seem to figure out how to short a stock on SSR. I always get this error: "Short marketable limit order disabled due to SSR!"

This is in SIM, is there a known workaround?

My short hotkey:

StopPrice=Price+0;DefShare=BP*0.95;Price=Price-Bid+0.05;SShare=37/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=SMRTL;Price=Bid-0.05;TIF=DAY+;SELL=Send;DefShare=200;TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice+0.05 ACT:BUY STOPPRICE:StopPrice QTY:Pos TIF:DAY+;

The part that says "Price=Bid-0.05;" should be "Price=Bid+0.01;". Did you generate this with the configuration tool? There's an option to select "Short SSR" on the type drop-down on the latest version. It'll do this for you.

On 8/27/2019 at 10:57 AM, Alastair Mowatt said:Did you know DAS has a new ORDER TYPE which allows true trading and dragging orders on the chart ? Its in BETA and be tested from this link

http://www.dastrader.com/download/fixes/DEMO.5.4.5.3.exe

Its under Chart Window hotkeys. This will allow exact profit target adjustments/dragging with RANGE orders etc. Take it for a spin, maybe u can update ur XL spread sheet when they release it officially.

AM

Thanks for the heads up. I just played with 5.4.5.4 and it has some other improvements: BidAsk Spread in Level 1 data. Hotkeys to configure line styles. Replay functionality (if you have the data package).

The trade-from-chart functionality is interesting, but it lacks a lot of variable access, so we may not be able to use it for the initial order calculation. However, ALL orders can show up on the sidebar .. but right now, double-clicking those doesn't send them to montage. If they can get that functionality in it'll be really helpful for different scenarios (like updating position size quickly).

-

On 8/25/2019 at 12:28 PM, Alastair Mowatt said:1. Thks for testing and for the work around. In #3 u mean Order window not Montage ? Will try it. Maybe we can ask DAS to give us the variables/work areas you mention so we can do more manipulation. Not tht hard to add internal variables to the code. We should coordinate on edits/enhancements we want, and write a doc/specs for DAS, I am willing to do that. I recently gave them a list of 21 enhancements which they are working through.

2. API...u talked abt an API in your video. If this would empower you, let us review the idea with BBT/Andrew. BBT buys/gets the API gives to you.........members request edit/enhancements at a small charge which is split with BBT and you. If the enhancements is great BBT sells to DAS for larger split between u and BBT. Basically its an arrangement between BBT/Kyle/DAS/community members, all mutually benefiting. Would only work if u have time and interest. Something to think abt.

1) Yes, I meant the Order window (Open Orders).

2) It's not about monetizing with me. I follow a pay-it-forward approach to creation and knowledge sharing, so most of what I create will be published here for the community. Some of it will be limited (e.g. the AI I'm working on wouldn't be released, but the trade signals would be available to the community). I will release the majority of things I create to the community if I can do it A) legally, and B) with as minimal of difficulty as necessary (e.g. doesn't require a complex setup or a ton of knowledge).

The API I created fails both of those parameters. I can't release it, even for free, because I used techniques to alter the program's memory while it is loaded into RAM (changing memory data or OpCodes on the fly) - this is the same way you'd hack a multiplayer/video game. This is not a legal issue when it's on my PC, where it becomes an issue is if I distribute that code. It fails the second parameter because it's a complex setup to do it.

With that said, I would love for DAS to embrace a more open mentality to other programmers - providing the CMD API to non-professional traders at a reduced rate (or free), and / or allowing for more advanced scripting. Most trading platforms have a much higher level of scripting ability. Heck, giving us ability to do IF/ELSE, more complex math functions, and the ability to create our own data variables would be a huge step.

-

1

1

-

-

On 8/18/2019 at 8:16 AM, Alastair Mowatt said:hey Kyle,

Re-read the v2.0 and watched the videos a few days back. This weekend setting up SIM montage, computer issues last weekend. I have a few questions i need to bounce off u and some comments.

1. Move to BE fix...I saw this bug but was not sure if it was me not understanding.....thks man

2. Price target ... My targets are based on technical levels. I changed mine to add $1.00 for LONGS or subtract $1.00 for SHORTS as a target place holder, coz I was trying to have an addition Hot button to update/REPLACE that High or Low price based on a double click at technical target level. Have you played with REPLACE..ing a HIGHPRICE or a LOWPRICE ? I was unsuccessful and need ur input or thoughts. Do u think this is achievable ? Once price has moved in my direction I double click and use the following to move stop and set $1.00 price holder.

;CXL ALLSYMB;Route=Stop;StopType=Range;LowPrice=Price;HighPrice=AvgCost+1;Share=Pos;TIF=DAY+;SELL=Send;

then I would like to REPLACE the HighPrice with a double click at technical S/R level.

3. Scale out 100%......I noticed in v1.46 if I enter 1st trade with a R% then add another R% as a 2nd trade, when I scale out 100% it only scales the first trade, i.e. 1 X R% when I actually had 2 x R% in the position.

4. In ur video u talk abt easier way to config horizontal lines.......I have requested a command line script from DAS so it easy to switch color/style of horizontal lines and fib lines and trend lines but maybe u can use ur connections also. More ppl requesting they with increase the priority hopefully.

Thks

AM

2. I'd have to play with it. For REPLACE orders, you have to double click the open order in the Orders window. This is because the montage clears the Order ID (OID, it's a hidden variable attached to the montage), double-clicking it will pass in the value.

I'll experiment with some things to see if I can figure out a hotkey example for you on that.

**EDIT**

I played with some. I don't think it's possible to use the double-click function because of how they have it implemented. When you double click the Range Order (sends it to montage) and then double-click on the chart, it sets the STOP to LIMIT .. when any of the routes change, they clear out the Price function. You can't push the price to HighPrice until it's set as a StopOrder (they have a block in place). If your hotkey switches it back to a STOP RANGE, it will then clear that price variable before you can copy it in. The problem is, there's no intermediary Float variable to store the double-clicked price that survives the route change function. I really wish they'd give us some user storage read/write variables to use to clean up a lot of this stuff.

A more manual approach is like this:

1) Go long on a position.

2) Send a 1:1 Range order with hotkey.

3) Double click the range order in Montage.

4) Manually adjust the HighPrice to where you want it and hit "REPLACE" button on hotkey.3. Do you mean that when you hit a hotkey to sell 100% of your position, it only sells 50% of that position? Can you post the hotkeys? If I understand the sequence of events is [long for example] --> Go Long, Scale-In, Sell 100%. Or is this a Stop Order / Price Target hotkey?

4. Yes, I've requested it as well. Hopefully they add it, as it would be really useful.

-

On 8/19/2019 at 12:58 PM, Bethany Freel said:My orders in DAS Pro lately have been rejected with the following message: "Your order is not accepted. In order to obtain the desired position, the equity with loan value (number) must exceed the initial margin (bigger number)." The position size I'm trying to take is less than my equity let alone my buying power with margin. Anyone know what is gong on?

Out of curiosity, did you try it again right after to see what would happen? As others have said, it could be broker related.

But it is worth noting that since last week (Thurs, 8/15/19), I've been getting random rejections using the SIM. If I try immediately after, it goes through. This also occurs with some trigger orders (they reject when they send). The error I get is "Rep Order Val Limit[1279]," it's rare and random (like you, the Withheld Buying Power is below the account Equity) so they may have made some changes on the order servers that they're trying to work out. I've seen a few others mention this in chat as well the past few days.

-

User @Misjo asked in chat this morning how to do this. So here's a quick video, posting here to add to the shared knowledge base.

Question was: How to set an order so that if the price of a stock broke above an upper range limit that it'd go long and if it broke below a lower range limit it'd go short. Added that if one triggers, it cancels the other.

Set Upper Range as:

- Stop Order, Price is the "Up to" portion of the order (e.g. fill me up to this amount. Can also be a StopType: Market to not worry about this).

- Trigger Price: The price at which you want this order to fire.

- Hit "Long" button.Set Lower Range as:

- Stop Order, Price the "Down to" portion of the order (e.g. fill me down to this amount, can also use a Stop Type: Market)

- Trigger Price: The price at which you want this order to fire.

- Hit "Short" button.

Once range is set, open Open Orders window (Trades > Open Orders) and right-click one of the pending orders, select "Trigger Order" and then when the Triggers window pops up, hit the tab "Cancel Order." On the that tab, select the corresponding order you want to cancel (if we are doing the LONG portion, we'd have the option to select the SHORT portion). Do the same for the other Open Order.VIDEO:

As always, enjoy my lovely "has this guy hit puberty yet" sounding voice below.

Any questions, just post here.

-

2

2

-

1

1

-

-

14 hours ago, Abiel said:Damn I watched the "Cat tries to eat dog" video instead of the hotkeys video LOL!

Thx @KyleK29!!

Ahhh yes, I uploaded it and totally forgot about it many years back. Left it for prosperity.

Fun fact about that cat, I got him from a professional boxer and he was an F1 Bengal w/ a gene that made him white w/ blue eyes. Cat dad was an asian leopard (it's a boxer thing). That cat was as close to a dog as you could get and every night he'd bounce on my dog, wrap around his neck, bite (thrashing his head) .. obviously it was an attempt at murder, but also very cute. He'd escort you on your walks, bark if meowing didn't work, and weighed around 19lbs. He was legitimately catnapped. I'm not making that last part up, someone took him when they moved.

-

1

1

-

-

Videos are up, links in the original post up above. That took waaaay too much time.

On 8/9/2019 at 5:05 AM, SpoTT Trader said:Do you think one day you could do a youTube video tutorial and show how it actually works in real time? Demonstrate the usefulness of this program? That would be cool! 😉

Fantastic efforts and work here.

Yes, I had one trade where I happened to be recording during it. It's the part 3 video (trade example on SQ) - if you want a more walkthrough math breakdown, that's in Part 1. I'll probably do a few more here or there and add more videos to the series if I find certain scenarios that I think could be beneficial.

-

1

1

-

-

Some more icons created, included in the pack here: https://drive.google.com/open?id=1zoTI4RAYK0GRGmkVt-NQA3V9czg-UKHV

-

3

3

-

-

Latest version (2.0) is up. See changelog in original post. Video is rendering and will be up today or tomorrow. The video came in around 45minutes to 1 hour, so I'll include timecodes to jump around. I try not to ramble, but I cover *a lot* of scenarios to try and simplify this as much as possible for people. I also included a voice-over trade of me using it that I recorded a few days ago so you can see my workflow and how I use it in everyday trading.

-

3

3

-

.thumb.jpg.c0d6ec3a32f2bb9afe7baee6c5b529dc.jpg)

.thumb.jpg.eb389ea4264903b21f2828eb5be29164.jpg)

DAS Replay Feature (Qoute Mode)

in DAS Trader Pro Tips and Tricks

Posted · Edited by KyleK29

For those planning on using this system, would you be interested in a historical BBT gap list lookup system?

I have gap lists for years 1999 - 2019 with a BBT (same as the TradeIdeas config) filter, I could make this accessible to BBT members if there's enough interest. It'd allow you to look up a gap list for a specific date (frozen as of 9:30am on that date). That way you can appropriately simulate the complete trading method.

Thanks for answering that. That's interesting, triggers / stops are more complicated because they're stored on the server side once accepted (and it'd need to reference historical data there as well), but I'm surprised they don't just implement a local broker for it (at the application level), probably be way easier because they could just tie into their alert system.