-

Content Count

83 -

Joined

-

Last visited

-

Days Won

9

Posts posted by zulkafil

-

-

Hi Drew,

When you place stop loss order, set your TIF=GTC. GTC means Good Till Cancel.

Best of luck.

-

1

1

-

-

I used TOS in the past and level 2 wasn't useful to me.

-

On 2/14/2022 at 2:53 PM, RunGoodRob said:Hi Everyone,

My name is Rob (RunGoodRob in the chat) and I'm from the Niagara area in Ontario. During the pandemic I was permanently laid off from a winery where I worked for 17 years in IT. I've always been interested in day trading and am looking to get some good education and do it correctly. I'm mostly interested in options (SPY) but since they trade in tandem with the underlying security I'm looking to learn everything I can.

I'm also quite into poker and am not sure if that will be a positive or a negative to my trading career. On the plus side it helps thinking in probabilities and knowing that you can do everything right and still not get the desired outcome. But on the downside I don't want to venture too far into "gambling" in the market.

From everything I've learned about BBT it sounds like an awesome community and I'm looking forward to (virtually) meet everyone.

Cheers,

RobHi Rob, welcome to BBT!

-

8 hours ago, stofur said:Hello everyone,

My name is Chris Self (ChrisNWA in the chats). I'm from Bentonville, Arkansas (Home of Walmart). I've been in various corporate finance roles for 27 years, either with Walmart or various CPG companies. As I'm approaching 50, I've been considering retiring from Corporate Finance and moving into my 2nd career. After all these years, I'm pretty burned out from working really hard and crazy hours, all while missing out on family stuff...and for minimal returns. I first started researching day trading in May 2021 as a possible 'control my own destiny' option. I started off with a $500 cash account and quickly found out it day trading was much harder than I thought. I read Andrew's book and had so many "Ah-Ha" moments. It made me want to learn even more. I was hesitant to spend money on formal training, but in December, I finally accepted the importance of it and that it was a relatively low risk to spend the cash there. In the last month since joining the community, I've only had one red day (all in Sim). The stuff I'm learning is FOR SURE worth what I spent as I try to get this new career started. I've been attending as many of the webinars as I can, and watching the recordings of the ones I miss. I can't believe how much I'm learning. And I can't speak highly enough of being a part of a community. I'm excited to get to know some of you and will be planning to join one of the meet-ups in 2022.

As for now, I'm targeting a retirement date of July 4th....Independence Day. I'm very anxious about making the transition...it's very hard to let go of the 'guaranteed' paycheck. I'll be shifting to trading live over the next few weeks. I want to give myself time to learn how I react when there's real money on the line. The psychology is so stinking important...probably the biggest thing I've learned so far. Money makes me emotional. If I lose it, I get angry, sad, depressed, etc. If I get a big gain, I can become consumed with making even more. I'm learning to keep those emotions in check, while allowing myself to celebrate the wins and learn from the losses. Today, I hit my profit target early, and shut down the computer....had to fight the urge for over an hour to power it back on. But, progress made still...

Sorry for the long-winded intro....

Keep it Green!

Chris

Hi Chris, welcome to BBT!

-

12 hours ago, Bob Pike said:Hi, Everyone, my name is Bob Pike and I'm in Barrie, ON. After 28 years with the military and 5 years with Shared Services Canada I've decided on trading as a third career. I plan to retire from SSC in two years as my pension will be at max after 35 years. This sounds great, unless you have an ex that walked away with half your pension and every penny you had, sigh.

I started with some Motley Fool subscriptions and became fascinated with Coupang. I opened an account with Questrade and started swing trading Coupang, riding the bumps for 10 cents or more per share, eventually trading 1,000 shares at a time. Recently the January correction trapped me with 1390 shares at $22.63 and it's trading around $19 right now so I'm stuck for a few weeks. Once stuck, I bought Andrew's book "How to Day Trade for a Living" and realized that I have no idea what I'm doing, LOL.

I want to start over and do everything you folks are doing, use the same brokers, software, methodology. I like to help people so hopefully I can learn enough to be of service to others. I have a lot of family and ties to BC so it's nice to belong to a group headquartered there.

I have a new monitor coming on Monday so I'm really excited: 4K HDR display with Ambiglow 558M1RY/27 | Philips . I want to see if one giant monitor will be as good for trading as a bunch of little ones. I've read that you can go either way. I'm doing data center networking from home now due to the pandemic so spend all day in front of screens, I just accidentally broke my ASUS 49" curved monitor that I loved.

Thanks for having me, I hope to learn quickly and help others if I can.

-Bob Pike

Hi Bob, welcome to BBT!

-

34 minutes ago, johnjnc said:Anyone else noticing DAS lagging today? I was using the simulator, but another guy at our group was trading live through COBRA. Super laggy today... I hadn't ever noticed it before.

thanks,

John

Same here!

-

-

7 hours ago, ahmerqureshi76 said:Ahmer,

This button always shows "SHRT", you can use the same button for closing your open long position or when you are not in a trade you can use this button to open a short position (selling borrowed stocks). This button basically execute a sell order, sell your own stocks or borrowed stocks.

Best of luck.

-

1

1

-

-

45 minutes ago, Boardercol said:Hi All

I'm Colin , 54 years old and from over the pond in the UK.

I've always been interested in figures and numbers, but never really did much with it. Qualified in electronics, but bounced around doing various things, now semi retired with a bit more time on my hands.

For years I have been saying i need to do some type of course, so I started an accounting course last year, but after passing the first year, I decided it was not for me. Then trading slowly started to work its way into my brain, it was a slow steady calling in my head. After much research, I decided on Bear Bull ( one of the UK companies said its dead easy !!!! Pffff, they went straight in the recycle bin) .

I look forward to learning and hope my brain doesn't get too frazzled.

Cheers

Colin L

Welcome to BBT!

-

2

2

-

-

You can save more with Trader Tax Status. You can show all of your losses but getting the trader tax status is not easy.

-

Hello,

Placing all these orders are possible but the trader needs to manage the trade actively. Profit target prices need to be dynamic. The share price can only reach 1st profit (or 1st and 2nd,) target before returning to the stop loss. In that case the stop order needs to be updated with proper position size, stop price can be adjusted to b/e price. Other scenarios also possible. OCO can be implemented.

Best of luck.

-

1

1

-

-

11 minutes ago, Citadel78 said:Thanks zulkafil. If I train on the simulator both off and on market hours will I be able to see level 1 and level 2 depending on the time of day I am in the simulator?

Hi,

You will see level 2 data always during market hours and after hours (post-market/pre-market). DAS only support level 1 replay features so you will only see level 1 data while trading with replay mode. Hope you got your answers.

Best of luck..

-

1

1

-

-

21 minutes ago, Citadel78 said:I am about to begin Simulator Training and do expect to move on to Day Trading. What Hardware is required for Simulator Training? Is it the same level of hardware needed for Day Trading? I do not mind taking risk (meaning if I fail to move on to Day Trading I will not be sorry I bought a new computer, need a new one anyway).

I am also assuming a Windows and not an Apple computer is the best choice. I currently run both in my home.

Thanks in advance.

Hello,

DAS Trader Pro real account or simulator uses same resources from a trading station. There are many posts in the forum for computer spec.

Best of luck.

-

46 minutes ago, Citadel78 said:I need to do most of my simulator training after hours and weekends. I can do some of it during normal hours. I do understand that the simulator is capable of accommodating that, but is the training experience and quality the same for after hours and weekends? Thanks in advance.

Hello,

- You can only see level 1 data while trading with replay mode, so if your strategies depend on level 2 data, then a problem

- You need to follow your trading plan strictly to get the most out of it.

Best of luck.

-

1

1

-

On 1/14/2022 at 5:57 AM, babado said:ROUTE=MARKET;Price=Ask+0.05;Share=1000;TIF=DAY+;BUY=Send;TriggerOrder=RT:STOP STOPTYPE:Market STOPPRICE:AvgCost2-.20 PX:AvgCost2-.20 ACT:SELL QTY:POS TIF:DAY+

Hello,

DAS uses some variables to calculate different values. Average value of shares save in the variable AvgCost. Assignment statement need semicolon at the end so DAS can execute. I will suggest read and understand how script works before writing your own scripts. You can also use BBT provided scripts, update as you needed. Always try your scripts in the SIM first for safety.

Best of luck.

-

26 minutes ago, stofur said:Sorry for the new guy question...I've been paper trading in TOS for a little while. As a new member, I have short term access to DAS Trader Pro. I have a couple of questions.

- Does DAS Trader Pro have a simulator/paper trade function?

- If so, is it worth it to move to DAS Trader Pro and connect it to my TD Ameritrade accounts for future trading?

- If you have used both platforms, why would you choose DAS Trader Pro over TOS? (I've been using TOS for a little while and I'm pretty comfortable in the application, so nervous about changing).

- Any other pointers or questions I didn't think about that you can think of, please feel free to share....I'm open to anything as I work towards my goal of becoming a full time trader.

Thanks in advance!!

ChrisNWA

Hello Chris,

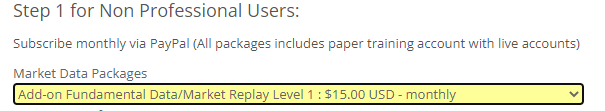

- Yes, DAS Trader Pro subscription (IB, TD, CMEG or other brokers) comes with a training account. If you want to practice out of market hours, you can add the replay package for additional $15.00 (Level 1 only)

- It is worth to move to DAS Trader Pro if you day trade, customized hotkeys/scripts is not available in TOS (some hot keys available in TOS) like DAS

- The functionality and speed of DAS is needed for day trade, it is true that many day traders use TOS.

Best of luck.

-

Hello Ahmer,

Your win rate looks great.

-

1

1

-

-

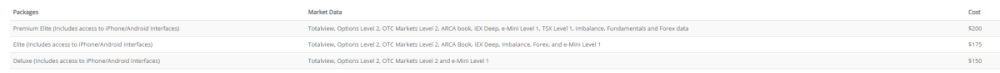

7 hours ago, SamuelRice said:Hello I was wondering the differences between the packages offered by DAS, I am currently trading with the promo offered by bbt on IB under the deluxe package and was wondering which one was most similar to that with TD. Below is a photo of the different options as wel as a link to the packages. Also I was wondering If i would qualify for a professional or non professional account and if that mattered. I have no relation to the SEC btw.

Hello Samuel,

You should be fine with the Deluxe package that comes with the level 2 data. All subscription comes with a training account. As you mentioned, you need a non professional account.

For practicing out of trading hours If you want the replay feature, you can add the following package for additional $15. Note that replay feature only for level 1 data.

Best of luck.

-

1

1

-

-

On 12/31/2021 at 4:16 PM, ItsLippy said:I put in this hotkey script in Das Trader to sell all 100% of shares & its not working. What do I have wrong? ThanksROUTE=LIMIT;Price=BID+0.05;Price=Round2;Share=Pos*100;TIF=DAY+;SELL=SendHi Lippy,

Look at the bold item

- Price=Bid-0.05; (You are willing to sell at current bid price or even 5cent lower. Not + sign)

- You don't need to round your price here since you are just placing a simple limit order to sell

- Share=Pos; shall be fine for selling your entire position. Pos*100 means you are multiplying your position by 100

So the following script should work (I guess you are in SIM. Always try any new script in SIM first for safety.)

ROUTE=LIMIT;Price=Bid-0.05;Share=Pos;TIF=DAY+;SELL=Send

Best of luck.

-

-

4 minutes ago, Jaimemeraz said:Hi Everyone! I have set up some hotkeys successfully but I can not get the dynamic $risk to work and I believe its due to my DOUBLE CLICK TO TRADE feature is not working. The checkbox in the dialogue box in the CONFIG section checked but still no luck. Any insight on how to fix this?

I a trading on DAS SIM

Hi,

Did you set montage style to "Stop Order"?

Best of luck.

-

Hello,

- Without a stop order how are you risking only $20? You are risking the total amount of an open position.

-

The initial script you provided "StopPrice=Price-0;DefShare=BP*0.925;Price=Ask-Price+0.00;SShare=1000/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=MSPOL;Price=Ask+0.05;TIF=DAY+;BUY=Send;DefShare=200"

- See the bold items in your script, 1000 means risking $1000 if you place an stop order when you open a long position

- ROUTE=MSPOL , I didn't get it. It should be ROUTE=LIMIT (SMRTL for IB) if you are placing a limit order.

Finally I will say that, someone should have basic knowledge of script when he/she uses any script.

Always try your new scripts in sim first for safety.

Best of luck..

-

2 hours ago, bluethetien said:StopPrice=Price-0;DefShare=BP*0.925;Price=Ask-Price+0.00;SShare=1000/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=MSPOL;Price=Ask+0.05;TIF=DAY+;BUY=Send;DefShare=200

Hello Bluethetien,

As you said the script for long w/out stop, it doesn't make sense. The script will open a long position but logically it is not accurate for opening only a long position or with a stop lose order. I will suggest you to read this post from the very beginning, so you will understand how any script works.

Best of luck.

-

5 hours ago, ahmerqureshi76 said:Hi Guys, I am new here, exploring DAS PRO Scanner and Trade Signals today, cant find any training vdo on it. Do we have any feedback on these tools from BBT or any senior member? Can we use it instead of paying for Trade Ideas?

Thanks,Ahmer

Hello Ahmer,

You can watch the following..

Best of luck.

-

2

2

-

Excited to Join

in Welcome: Bear Bull Traders Forums

Posted

Hello Nate,

Welcome to BBT.

Best of luck!