-

Content Count

1,096 -

Joined

-

Last visited

-

Days Won

124

Posts posted by Abiel

-

-

For only stocks use the $150 package.

You can add Arca Book more more order book depth (more Level 2)

-

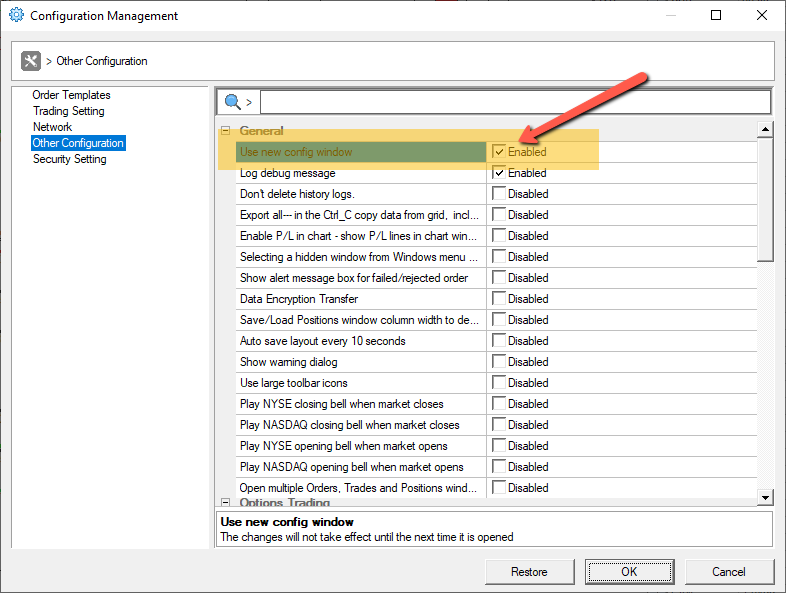

Newer versions of DAS have two options to visualize menus and settings. Go to Setup > Other configuration and you have USE NEW CONFIG WINDOW selected. That´s the new menus and settings. Uncheck it and you will get the old menus, just like the videos.

-

1

1

-

-

-

On 3/9/2024 at 2:19 PM, flyingalaska said:Good morning. Where is the Trading Workshop being held? Looking to know where the best place to stay might be? Thanks

All the information is posted here:

-

-

Details of this hike are posted.

-

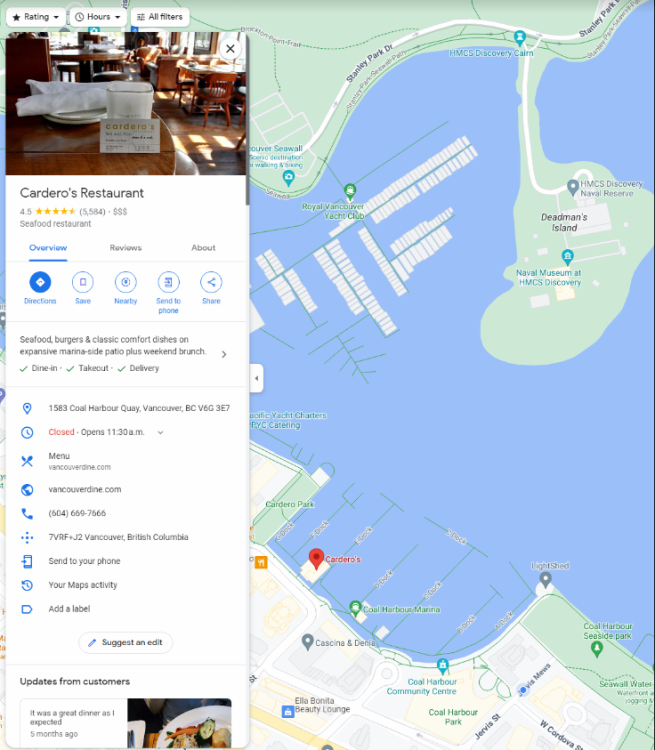

For those visiting Vancouver for the first time, here are some useful links:

-

-

1 minute ago, RandyB said:Good morning @Abiel,

I know you stated more details to come, however, do you happen to know the time frame Andrew is aiming for? I fly in 4/6 @ 2:09pm local time there. Would love to participate if it is an afternoon event?Andrew mentioned a morning hike, but we´ll finalize details soon and will post them here.

-

1

1

-

-

Fatima & Abiel joining!

-

12 hours ago, Yogi_theWanderingTrader said:Hello BBT

My family and I will be travelling to Vancouver in our RV. We are outdoor people who prefer to stay in a rural campground and not in the city. We also hike several times a week. A typical hike for us is around 5-6 miles maximum as we have two kids with us.

I am posting this to see if anyone is planning to do any hiking or outdoor activities that would be good for meeting up and talking trading.

Hiking group here

-

Andrew is hosting a hiking on Saturday, April 06 for Live Trading Workshop Vancouver attendees.

Grouse Grind Trail

2.5 hrs; 2.5 Kms

Rating: challenging

7:00 AM at Grouse Grind Trailhead

More information here. It says it is closed now, but it will be open by April, unless rain or snow.

Also, watch this video:

Please confirm in this forum post.

-

1

1

-

-

This thread is for Members attending the Live Trading Workshop in Vancouver, BC - April 7th & 8th, so you can plan fun activities outside the event! Connect with fellow attendees for hikes, city tours, and more.

-

Hey Everyone, as you know Ardi and Andrew are presenting at the MoneyShow, if anyone is interested in meeting up for some drinks and talk trading please RSVP HERE.

Date: Thursday, February 22

Time: 7:30 PM

Location: Beer Park at the Paris Hotel

Address: Paris Las Vegas, 3655 Las Vegas Blvd S, Las Vegas, NV 89109=========================================================================================

📢 Make sure to register for Ardi and Andrew presentations at The MoneyShow Las Vegas:

Ardi´s presentation 👉 https://bit.ly/47xvcfD

Andrew´s presentation 👉 https://bit.ly/3HbxG8Q

-

-

On 9/25/2023 at 10:11 AM, Angel Albertos said:Qué tal, me llamo Angel, soy de Monterrey. Empecé en BBT desde finales de 2023. Es mi segundo trimestre en el simulador. Saludos a todos.

Bienvenido Angel nos vemos en el chatroom!

-

1

1

-

-

-

On 8/16/2023 at 8:53 AM, Scott0033 said:Hi will be there

Hi Scott, please email Andrew for this meetup, [email protected]

-

Join Andrew and Ardi in Toronto on September 9th at 5:30 pm after Ardi´s presentation!

Get ready for an evening of insights and discussions on trading.

Venue details coming soon.

Don't miss out – RSVP now below in the comments and mark your calendars!

PD1 Make sure to sign up for Ardi MoneyShow presentations.

PD2 Make sure to sign up for Andrew MoneyShow presentations.

-

Join Andrew for a meetup in Reno, Nevada on August 25th!

Don't miss this opportunity to connect with fellow enthusiasts and gain valuable insights.

More details to come!

RSVP now!

See you there!

-

There you can set defaults for each Exchange (shares, route, etc.)

-

The only route I use is LIMIT and MARKET for stop loss orders.

RE: #3, where the default is Q?

-

Test in simulator and adjust as needed:

Buy

ROUTE=SMRTL; Share=100; Price=Ask+0.10;TIF=DAY+;BUY=Send;Sell Partial 25%

CXL ALLSYMB; Share=Pos*0.25;ROUTE=SMRTM;TIF=DAY+;SELL=Send;TriggerOrder=RT:STOP STOPTYPE:MARKET STOPPRICE:AvgCost PX:AVGCOST ACT:SELL QTY:POS TIF:DAY+Sell (or short)

ROUTE=SMRTL; Share=100; Price=Bid-0.10;TIF=DAY+;SELL=Send;Cover 25% (or buy)}

CXL ALLSYMB; Share=Pos*0.25;ROUTE=SMRTM;TIF=DAY+;BUY=Send;TriggerOrder=RT:STOP STOPTYPE:MARKET STOPPRICE:AvgCost PX:AVGCOST ACT:BUY QTY:POS TIF:DAY+Exit at Break Even

CXL ALLSYMB;ROUTE=STOP;Price=AvgCost;StopType=MARKET;STOPPRICE=AvgCost;StopPrice=Round2;Share=Pos;TIF=DAY+;Send=Reverse;ROUTE=MARKET;-

1

1

-

-

On 8/1/2023 at 10:29 AM, Roland Wiebe said:does anyone know how DAS calculates the Slope of the moving average? Thanks!

Ask DAS support, thay have shared indicator calculations before.

.thumb.jpg.adc04f9c08fd75afd86d88691b67351f.jpg)

Here are some of the biggest premarket US stock movers today - Dec. 19 2024

in Day Trading Basics

Posted

Here are some of the biggest premarket US stock movers today - Dec. 19 2024

The Federal Reserve cut its key interest rate by 0.25% and signaled a cautious approach to further cuts. It now expects only two more rate reductions in 2025, down from four projected in September.

The Supreme Court will hear arguments on Jan. 10 regarding a law that could ban ByteDance’s TikTok. The ruling could have implications for $META and other social media companies.

OpenAI launched 1-800-CHATGPT, allowing users to interact with its chatbot by phone or WhatsApp. Consumers will get 15 minutes free per month, expanding the AI tool’s accessibility.

$AAPL is reportedly in talks with Tencent and ByteDance to integrate their AI models into iPhones sold in China, a key market for the tech giant, according to Reuters.

$MU is down 11.6% after issuing weak second-quarter guidance despite beating earnings expectations.

$TSLA is up 3.5% premarket, rebounding after an 8% decline on Wednesday. The stock remains up 77% for the year.

$NVDA is up 2.6% in premarket trading, recovering from recent declines tied to broader market trends.

$LEN is down 8.2% after reporting lower fourth-quarter earnings and revenue due to higher mortgage rates affecting the housing market.

$PLTR is up 2.7% after extending a U.S. Army contract worth up to $619 million, highlighting continued reliance on its data analytics services.

$LW has fallen 20% after disappointing earnings and announcing CEO Thomas Werner’s resignation, raising concerns about the company’s future.

$ACN and $KMX are up 5.9% and 6.4%, respectively, after both companies posted better-than-expected earnings results.

$TRIP is up 10.7% after announcing plans to acquire Liberty TripAdvisor Holdings in a $435 million deal.

$DRI rose 8.2% after reporting better-than-expected fiscal second-quarter results, with a 6% sales increase and optimistic guidance.

$KMX up 7.2% after posting third-quarter earnings and revenue that surpassed analyst forecasts, driven by higher unit sales and strong profit margins.

$ACN is up 5.7% after exceeding first-quarter revenue estimates, supported by growing demand for its AI-powered services.

$AMZN rose 1.4%, recovering from a nearly 5% decline in the prior session, despite strikes at seven U.S. facilities aimed at pushing the retailer into union contract talks.

$DLTR named interim CEO Michael Creedon as its permanent chief executive.

Disclaimer:

The information provided is for informational purposes only and should not be considered financial advice. Market movements are subject to change as trading activity continues before and after the market opens. Traders and investors are encouraged to conduct their own research, verify news from reliable sources, and consider their financial situation before making trading and investment decisions. Trading involves risk, and past performance is not indicative of future results.