tntp45

-

Content Count

145 -

Joined

-

Last visited

-

Days Won

2

Posts posted by tntp45

-

-

2020-6-16

<SIM>

Red Day -5.5R

Took a lot of trades, not a lot of good strategies. New focus for tomorrow.

Trade of the day:

SPY +3.14R

Shorted SPY when it lost the 100 SMA on the 5 minute chart…

The other trades...

A lot of trading for trading...

Focus tomorrow on A setups and above, a small amount of trades is ok. A red day is ok.

Just looking for well thought out entries...and good entries !

Tomorrow Goal:

-

I am a trading genius on Replay !!

-

9 hours ago, Christopher Patterson said:Everyday is good bro!!! 10R or max loss, your job as a trader is to just learn everyday, if you're doing that then you should always feel good.

Some day I will get to that level !

-

2020-6-15

Going to call today a scratch...

Got to play around with Kyle's Hot Keys...

A term for the day, slippage...a real phenomenon on the higher priced stocks. $BA was my stock in the morning and a few of my 1R stops turned into 1.8R losses...

A few good trades, I feel like I am watching the price action better.

Goal for tomorrow: Look for longer wider movements, not just on the 1 minute chart.

Interesting market day !

Thanks All !

-tom n

-

Weekend Goals:

- Watch Aiman's Video. Awesome ! Thanks @Christopher Patterson !! - Complete

- Study Fallen Angel Video - Complete

- Study Double Bottom Video - Complete

- Install and test Kyle's Hot Key's - Complete

- Net Desktop layout - Complete

I was able to install Kyle's hot key's. Although, since I am only using the limited dollar amount I copied the script from this video.

Seems to be working fine...

Testing was a little odd in Replay, because it will not fire the stop orders...

However, my session I was up 12R in three trades, I am obviously a trading genius now ! JK

Interesting, when you have an excellent entry you are buying a lot of shares and using your margin account. Theoretically it should be the same amount of risk as 1R. It just makes me think about worse case scenario, day trading is risky enough. To make a mistake when you are leveraged 4:1 on margin you could really do some damage. Is this how most day traders make it work ? Is this how the successful ones are making the big dough ? There must be a certain amount of practice and time when you are feeling comfortable working with all that leveraged capital. Case in point; if you are trading a $30 stock and get in with a 3 cent stop.... $100 risk divided by 3 cent range allows for 3,333 shares. 3,333 shares * $30 = $99,990... All of your buying power in Sim. I understand the stop should provide for a $100 max...but wow...better be careful...

All in All. The HotKeys are incredible ! I am so impressed. Went to bed dreaming of all the money I am going to make

Thanks Kyle !!!

Just wanted to share my new layout with you...

One stock on my main screen with the montage.

Multiple time frames; 1min, 2min, 5min, 15min, Daily, SPY.

Looking forward to a good week !!

Also caught Hiltzy's video on YouTube. Great story on his journey. Appreciated his utilization of the High of Day strategy. I don't see him in the forum (?)

Looking forward to a Big Week !!

-tom n

-

Awesome Trade @Christopher Patterson !!

Impressive read on stock direction and the pre-market levels !

Question on the terminology; would this technically be a support & resistant trade as opposed to an ORB since the short was inside the 5 minute candle?

How was your overall day ?

The videos are Awesome !!

-tom n

-

-

Thanks Justin !

Will implement it into my montage this weekend and try it out !

-tom n

===========================

quote for tag...

33 minutes ago, Justin said:

33 minutes ago, Justin said: -

Chris;

First, thanks for taking the time to post this. A lot of great comments and constructive criticism! Much appreciated!

VWAP Trading - Agreed. I know I came into Friday ultra-conservative after have back to back big red day. I think you make a really good point. Very relevant.

Thanks for the video! Will go through it this weekend. I got a lot from Aiman's Thursday review. Just the way he analyzes each stock over multiple time frames was valuable.

1. Sub 2R Returns - I think you nailed my number one opportunity to bring in some Green !! My main focus is better entries. If I have a 10 cent stop I have double the reward with the same risk as a

20 cent stop. I like the Fixed R concept. Would you recommend setting a minimum or 3:1 or 4:1 or higher to enter a trade ?

2. Kyle's Hot Keys -

Funny that you said this. "Kyle's Hot Keys" is in all of my notes for the week. I have been hesitant because it seems like easy math I should be able to do on the fly. Also, I am assuming that his hot key is two steps; one to set the action (buy/sell) and one to set the risk. Either way, I will commit to find them and set them up into my Montage today so I can practice over the weekend.

3. Trade 2 $PLAY - Great analysis and Thanks !

"you want to have some type of confirmation on the 1 min chart" - Big lesson, thanks ! Will implement this.

"also $SPY was strong"

Is that screenshot typical of how you are setup when looking at a trade ? 1 min, 2 min, 5 min & SPY ? I currently keep just the 1 & 5....

The more I look at this it would be a D trade. But that is ok! Grow and Learn ! That is what is important.

"I'd be looking more for a fallen angel play" - Need to study this concept. Weekend commitment.

Just to add one more comment that kind of ties everything together...

Regarding my "good trade" Trade 3...(note, marked as "2" on graphic)

Hindsight 20/20, the correct analysis was to trade this as a reversal at the five minute mark. or even aggressively at the four minute mark.

The trick would be what wold be the profit target....

Also, another good excuse to focus on the one stock. I allowed my self by rule to go back to the scanners for a 5 minute ORB. Will adjust that rule!

Thanks Again Chris for taking the time and effort ! Looking forward to studying / practicing this weekend and trading next week !!

-tom n

==============================================================

Quote for tag...

1 hour ago, Christopher Patterson said:Hope this helps, gl!

-

Images are much cleaner ! -

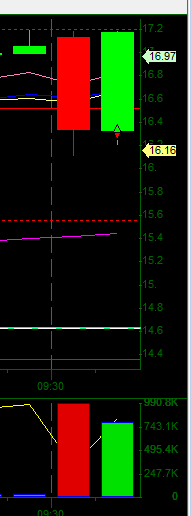

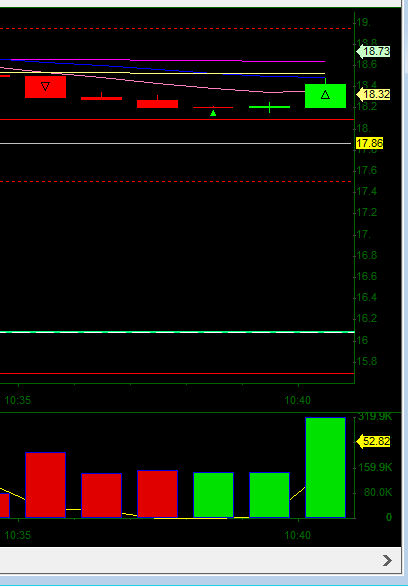

2020-6-12 <SIM>

Came in with a new game plan today...

Limited my watchlist to four stocks with a few rules..

Need to continue watching the same stock until it goes flat and choppy, no action.

However, ok to trade and change the one minute ORB and the five between stocks.

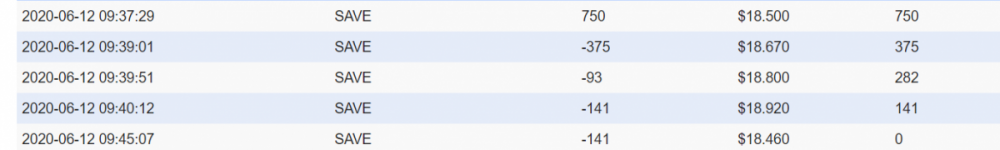

With that I ended up keeping an eye on one stock, $SAVE for the morning session.

Close to a break-even day at -$58.10 or -0.58R. Way better than the hemorrhaging over the last two days. But off my Monday winner of $600 plus. Some solid corrections.

1R = $100

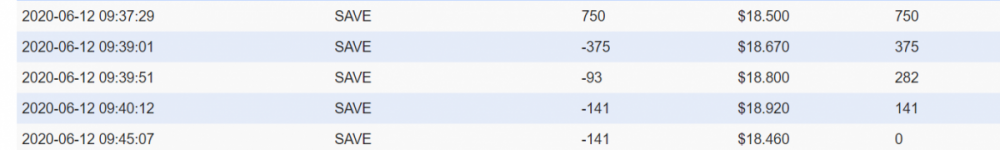

Trade 1

$SAVE +$62.10

One minute ORB. One of my goals from yesterday was to have an excellent entry on this trade. Had that and what were excellent exits. Not a lot of run here, but I caught it all ! Start the day Green !

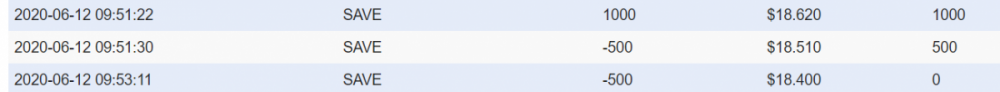

Trade 2

$PLAY - $80.08

5 Minute ORB

Good Entry, Good Exit.

Trade 3, 4, 5, 6 & 7

Trade 3

$SAVE +$145.23

Hindsight 20/20 and while I am looking at this a few thoughts crossing my mind.

First this is a positive trade. And I followed it all the way through.

I let the stock price cross VWAP, confirm and then I bought...

But...Had I kept the chart up from trade 1. (Remember, I am trying to stick to one stock instead of jumping around) Would have I caught the reversal in minutes four and five from the open. I don't think so. Would you have played this different ? Would you have played the reversal and if so...how long would you have hung on to it ? All the way ? This move broke the 9 the 20 and VWAP...I guess that's why we pick stocks in play...anyway a good move and a good start to the day !

The more I look at this trade the more I like it (clap, clap, clap)

Trade 4

$SAVE -$165

Stock went through VWAP, I went long. Too big of share size so I reduced my position by half, already lost 0.55 R with just that...stock drops below VWAP and I am stopped out.

Thoughts on this one ? Not an A trade ?

Trade 5

$SAVE +$41.40

Stock goes back above VWAP again. I waited for it to cross the 9 and the 20 to get in...

As I am writing this I am patting myself on the back because it looks so pretty, including all of the partials. However, I just didn't make a lot. Hindsight it is only a 1:1 r/r, you can't get a complete R if you are going to partial...good execution. Maybe a C trade...

This blown up chart shows this better, I should have been in three candles earlier...with double the share size...still, a lot of things done well here...

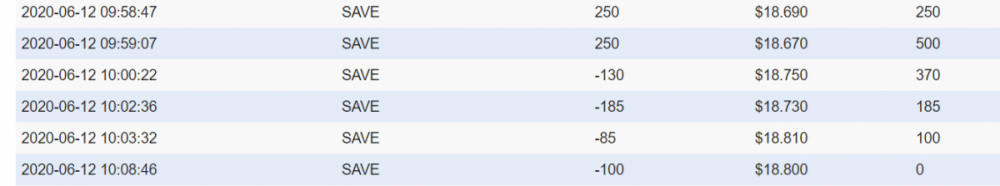

Trade 6

$SAVE -$76

Stock came down and bounced off VWAP, I went long...

Adjusted share size to 1 R Risk (good!) 2000 shares to 1200.

Stopped out.

Lesson; look for confirmation on five minute to confirm strategy...

Trade 7

$SAVE +$21.25

Really reversed myself from trade 6.

Partialed at the bottom but didn't finish it...was I completely focused (???)

Good trade, maybe a better entry would have added profit and share size...certainly could have improved the exit...green trade ! I like how I was watching the stock and took another better opportunity...goal for the day !

Trade 8

$SPY -$9.25

Tried to take a reversal of the $SPY before the market closed...

Unable to concentrate or complete the finish when my young daughter needs attention

A couple of candles early...but WOW look how that one finished...!!

Missed Opportunity !!

RECAP:

Wow I feel better !

First, just by having a major change to my setup and a new set of rules and sticking with them all day long. ( Of course I really only traded the first 75 minutes, but that's ok!)

Good discipline sticking to the rules and the plan !

Small watchlist.

Focused on one stock until it goes flat and choppy.

NO HOTKEY ERRORS !

Good use of stops.

Area for improvement: Focus on excellent entries. This allows not only for more room but for better leverage. IE $100 = R allows for 500 shares on a 20 cent stop, but 1000 shares on a 10 cent stop (and 2000 for 5 cents) This would allow for bigger winners which were absent today. Make sure completely focused on the trade and stock in action. It is ok to take a break !

Good day to go into the weekend.

One extra note to how much I enjoyed Aiman's trade recap on Thursday morning. I have to admit, I did not realize he was reviewing member trades. How valuable !! Will continue to attend these. One thing I got out of this is how he uses multiple time frames for confirmation and stock direction. I typically only use a one and five minute chart.

Sad my week didn't come together overall, but I felt that I have grown alot. Everyday in the chatroom you hear about how important it is to journal. I think I have gotten a ton out of this short exercise. Only one thing...the journaling process is taking hours...I can't imagine it should take that long. I imagine this will be more concise as I grow with trading.

Goals for the weekend:

Practice in Replay, complete with journaling.

Review strategies in education center.

Exercise !

Enjoy family time !

Have a great weekend All !

-tom n

-

1

1

-

-

2020-6-11 <SIM>

Another tough day, but feeling positive calm and collected.

Kept a full journal in google docs, but wanted to share my recap here:

Rules:

Break after three back to back losers 5 minutes

Three stocks at a time max

Out of a trade, keep watching the stock until it gets choppy. Should I re-fire or reverse the position ?

I am going to keep my R at $100.Lessons:

Get in that first trade early for an excellent entry. Excellent entry is the key to profit.

Watch the stock after you get out of the trade.

More Replay trading with recaps.Planning on working in Replay tonight and be back in action tomorrow to close off the week STRONG!!!

Started with a green Monday, might as well as have a green Friday !

-tom n

-

1

1

-

-

58 minutes ago, Christopher Patterson said:Lookin good dude! Make no mistake, learning how to trade is not easy. It's a skill, and like any other skill it takes time. Managing emotion / expectations is not easy, some days you'll feel you got it figured out, and others you'll be lost, but keep good documentation and stay positive!

Good luck!

-Chris

*ALSO* I think it's much better to think in terms of "R's" rather than dollar amounts, especially in the beginning. Just imo, i'm sure a lot of other people here would suggest the same thing.

Thanks Chris !

Will keep it going !!

-tom n

-

2020-6-10

Took the day off. Slept in.

Will work in DAS replay tonight. Back tomorrow !

-tn

-

2020-6-9

I wasn't going to post anything because of my frustration today. I made a full journal on google docs. I think I am just going to use the highlights that stick out.

BBT Trade Journal 2020-6-9

In SIM (Thank God)

Patience…

Starting to think I need to commit a day to trading one stock only…

Amazing what a mental game this is...

-tom n

-

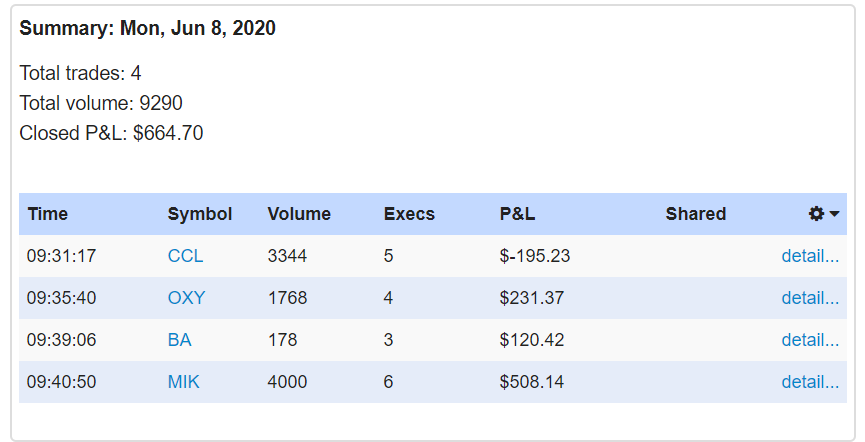

2020-6-8

GREEN DAY !!!

+$664.70 SIM

Trade 1 & 2

CCL -$209.75, +$14.52 = -195.23

One minute ORB went short. Trade went the wrong way, got out. (Late Entry?)

Re-fired short when it started dropping, picked up a couple of bucks, but a loser all the way around and bigger than my 1R= $100.

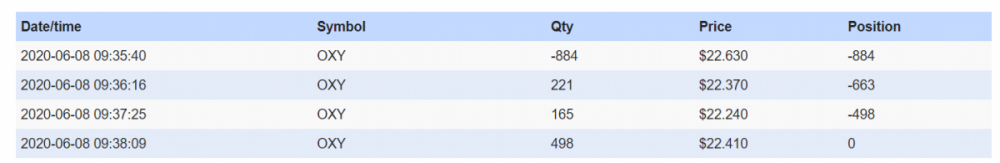

Trade 3

$OXY +$231.37

Five minute ORB took three partials over the next three bars for a profit of $231.17 !!

Trade 4

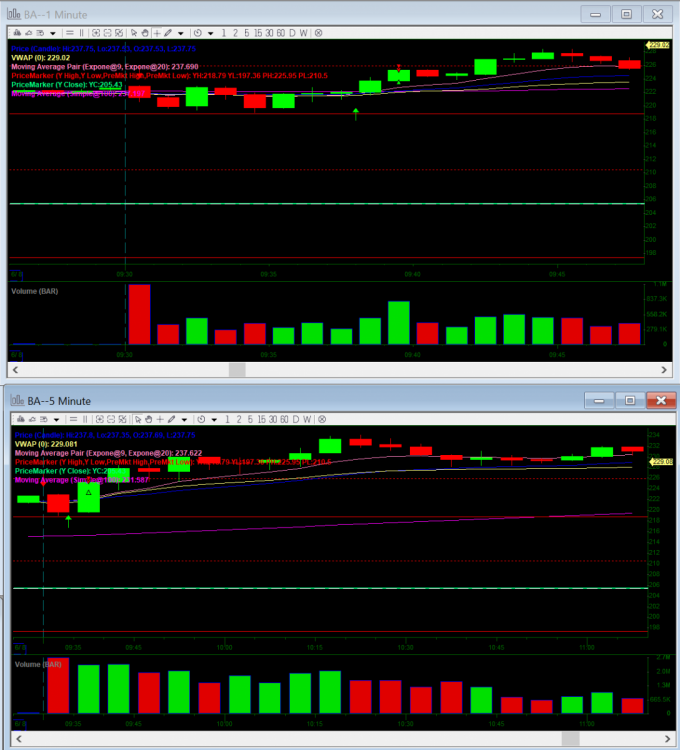

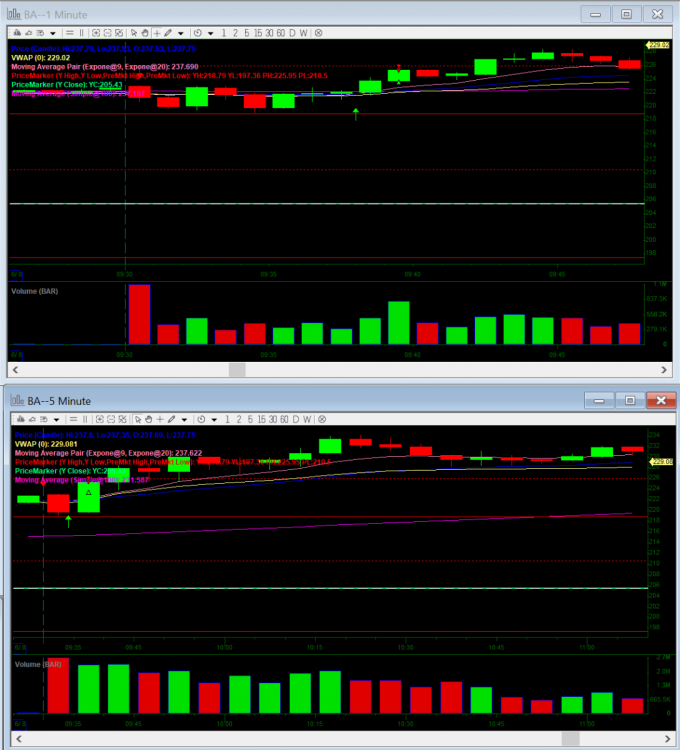

$BA +$120.42

Five Minute ORB went through VWAP and made a long trade.

Hindsight 20/20, should I have held the second half here for a big run (especially on this hot stock) went to run another $8 per share...

TRADE 5

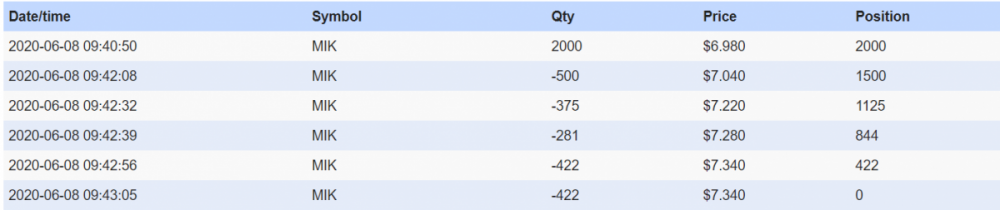

$MIK +$508.14 !!!!

Took a reversal on this one and went long.

The stock blew through my goal of VWAP and and hit an overnight high, I took partials the whole way...

This hit my daily goal of $500 !

Trading day complete in thirteen minutes after the open.

I was glad I had the discipline to stop and post a nice green day.

However, this stock went on to run...any input for those of you with more experience ? With my trading lately it seems smart to take the win. Maybe if was more advanced I would keep the day going looking for premium setups.

OVERVIEW

Green Day (+$664.70) + Hit Daily Goal ($500)

Needed this one. Looking forward to posting a solid week !

Any feedback is appreciated.

Looking back through these charts, the setups are good. With proper stops there good have been some big winners in there. Happy to have the green day right now, but need to work up to holding with proper stops. Not sure if I should change my strategy to much with one green day.

-tom n

-

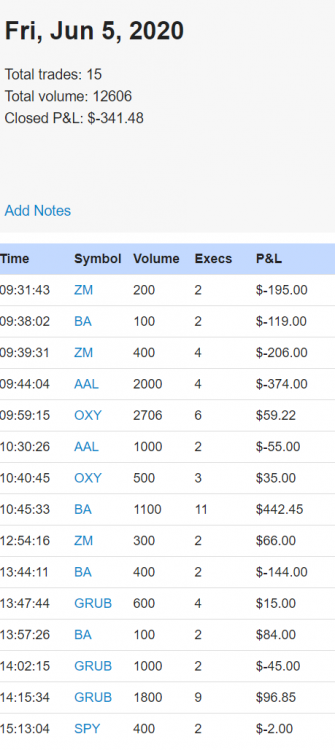

2020-6-5

Any golfers ?

When playing golf a lot of times you have one magic shot that brings you back for the next round. That was today. A beautiful 280 yard drive straight down the middle. With that I crashed on sixteen out of the other eighteen holes. A couple in the water, several three putts and a few slices that went OB. But that drive will bring me back.

That was trading today. I hit $BA as well as I could have. But several other trades that crashed the day. On the golf course the card would say 103 with a birdie on the front nine.

I traded all day from open to close for the first time in a long time. This reinforces the idea that I could do this all day. Sure would have to plan better with breaks and maybe a stand up desk.

The scorecard:

In SIM. Overall Red, -$341.48

Let's start with the 280 yard drive.

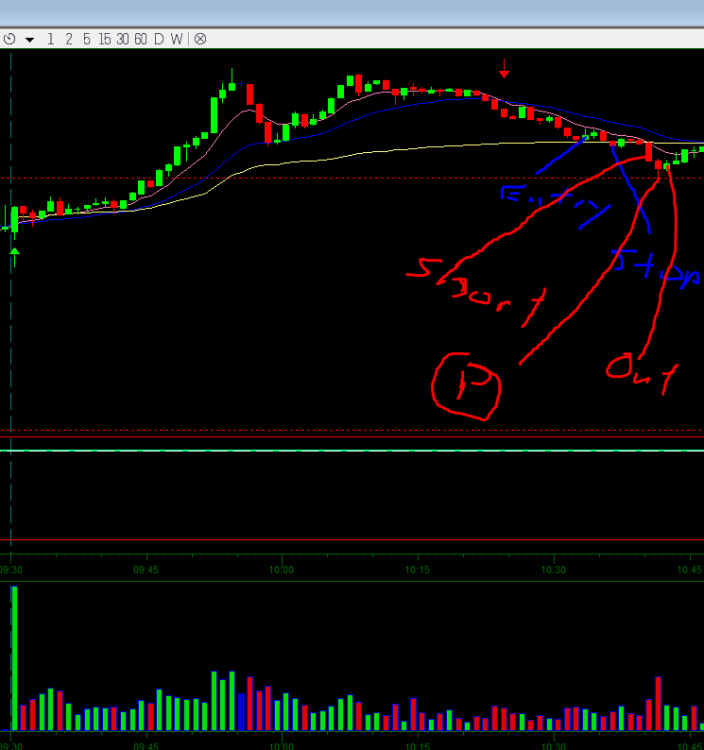

Trade 9

$BA +$784.95

Partialed most of the way up for the win of the week.

280 yard drive <Golf Clap>

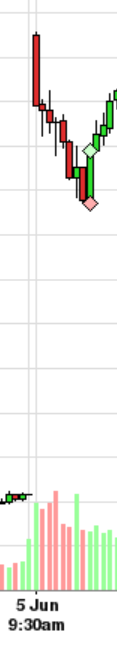

Trade 1:

One minute ORB. Hot-key error on exit, trade gone bad but lost to much. 5 minute time out for me.

$ZM -$195 with $100 = R

Trade 2:

Chasing the opening drop on $BA. -$119

Don't lift your head ! I mean don't chase !

Trade 3$ZM at 9:39am -$107

Poor all the way around

Trade 4

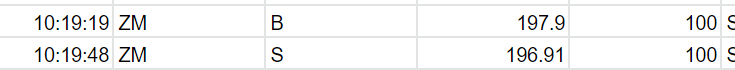

$AAL -$374

This one hurt.

Extended entry into an ABCD pattern. I decide I can only buy 100 shares because of the distance from VWAP. This is a cheap stock so I would like a lot more shares....

The stock goes up then down, back to my entry, I decide to re-buy but for 900 shares deciding to put the second stop below the 9SMA. New rule !

Of course it crashes through both and I am out for a huge loss.

Ouch ! Several lessons here. Snowman on a par four.

========================

Trade 5

$OXY +$175.05

Perfect ABCD pattern with partials. Look at those exits !

Par on Par Four !

Trade 6

$ZM at 10:19AM $-107

Trying to catch a reversal, trade went bad. Actually thought this was decent and within risk range

It went up two candles later...should I have kept watching the stock ?

Trade 7

Looking to short this against the 9SMA. Bailed out the next minute early for -$55.

Looking for feedback on this one...

Trade 8

OXY -$115.83

Seemed good for a losing trade. Entered long to hold and bounce off VWAP. Got a great risk to reward on 1053 shares. Stopped out below VWAP for a $115 loss. Seems like this is how a loss should be.

Trade 8B

Took the same trade short. Made a little +$35

Hindsight 20/20 looks only like a 1:1 risk to reward.

Trade 9

280 yard drive

See above.

See above.

$BA ABCD +$784.95

Trade 10, 11 & 12.

I felt like I money on the table with my $BA trade because it ran up another $4 when I got out. I had adjusted the stop close to the 9SMA.

I took three trades behind it trying to capture that money.

-$186

-$156

$0.50

Ouch ! That takes a chunk out of the nice one !

I think I was just trying to see levels in the 9 and 20 SMA....ouch !

Trade 13

Another stab at $BA -$144

Thought this one made sense, though it would hold VWAP. Stopped out with good Risk to Reward...thoughts?

Trade 15

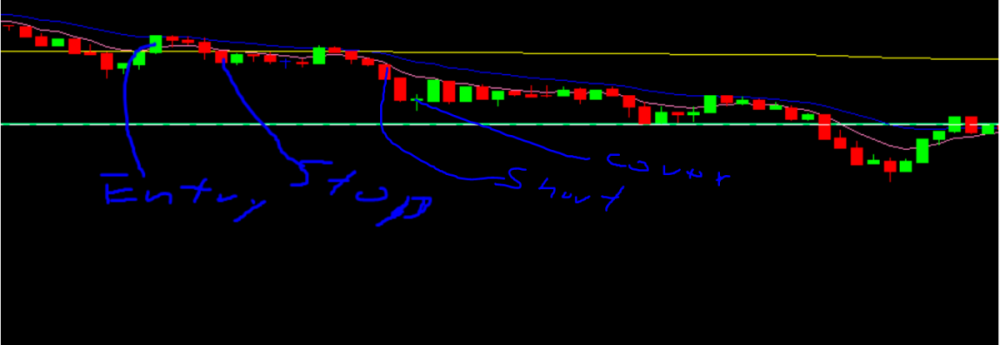

Skipping to 15 because...it is $BA again. Short against the 9SMA

Winner of +$84

Batting a single. Oops, golf analogies....Bogey golf is good golf (?)

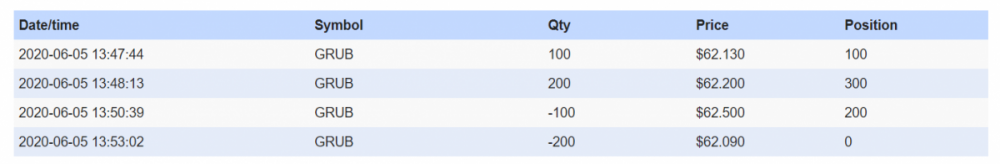

Trade 14

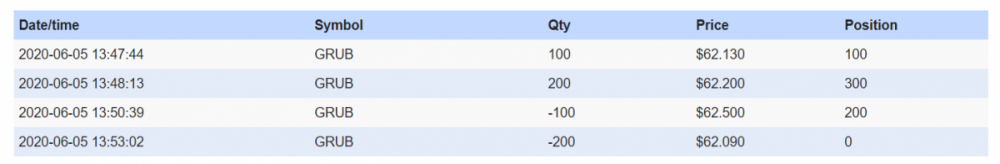

$GRUB came into play late in the day...I think I was just jumping in to try to get in on the action.

+$15, has to be a loser against commissions. Don't worry I come back to trade this one again before the close.

Thoughts ?

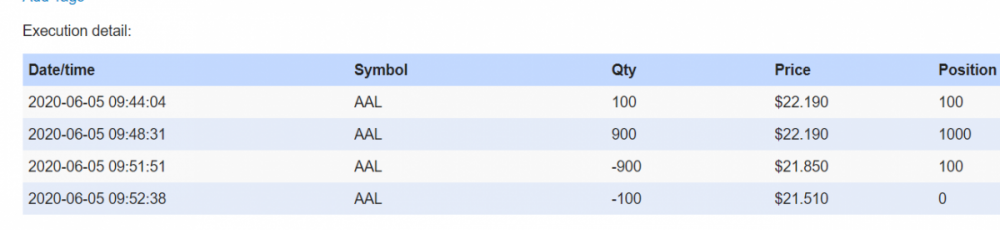

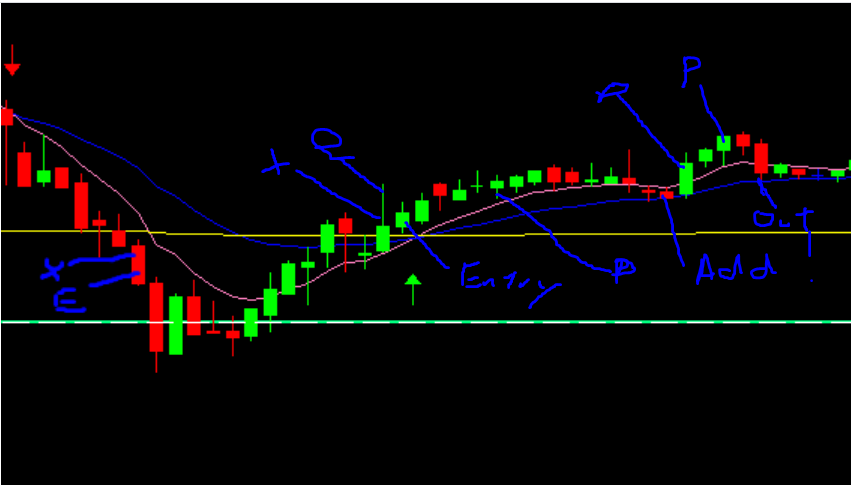

Trade 16, 17 & 18

Three more strikes at $GRUB

-$45

Go short as GRUB falls below VWAP, good risk : reward...and I chicken out selling in the same candlestick.

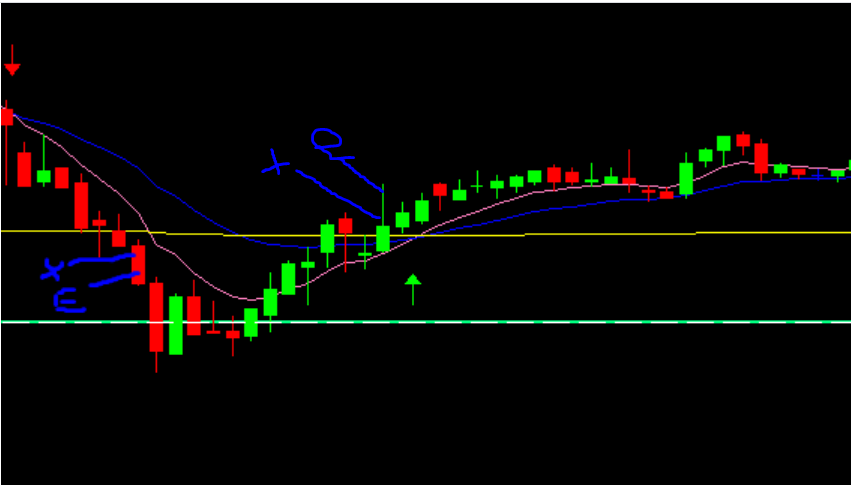

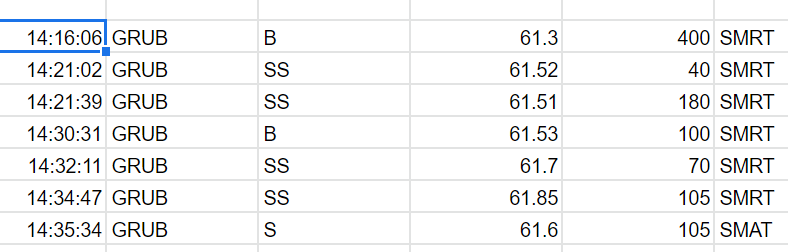

E = Entry X = Exit

17...

-$44

Going long after GRUB breaks through VWAP

Same thing, chickened out in same candlestick

18...

Going back long at the next candle stick for a better entry...

Ride it up, partial out, buy more on a pull back out for a profit.

P = Partial

The last one seems like a beautiful trade...seems like I should have made more $$ thoughts ?

Afterthoughts...

-341.48 for the day...

Five red days in a row for the week. (and a huge week for the market)

Concentrate on A, A+ setups.

Manage risk.

A little psychology would go along way. If you missed it you missed it. Don't try to make it up, find the next opportunity.

Better use of risk / reward. Don't chicken out to early, commit to the trade...

No Errors !

Need to break 80 ! Need to turn it Green !

Any feedback ?

-tom n

-

As I am writing my first journal, the first item is I need to do a better job of journaling!

I need to dedicate time every day to recap, reflect, make some notes and come out an improved trader !

I have only been in DAS for a couple of weeks but was previously paper trading in TD Ameritrade’s Think or Swim platform (TOS). I had real issues with executions and status updates that encouraged me to switch to DAS. Wow, DAS is like lightning compared to TOS.

Tough week across the board as I am posting my fourth red day in a row.

I am journaling with TraderVue which has been awesome.

Quick note on TraderVue; The owner contacted me via e-mail the first day I created an account and helped me import data from TOS. First Class !

Here is a testament to my inconsistent journaling (failing to import days)

The blue days are mostly in TOS. May 29 forward was DAS.

Then I made the switch to DAS, but did not consistently download the data until this week.

I am not blaming DAS on my switch from profitably, but I am definitely doing something different.

Just brainstorming while typing; what else is different. I hooked my laptop up to two more monitors so now I have a total of three. I would think this would make me a better trader.

Today’s trades: (SIM)

Well, this looks like a lot...

Ok Question #1; Can I get the buy and sell bullets on the DAS charts ?

It is nice on the TraderVue charts, but those don’t show the trend lines etc…

Trade 1: OXY

ORB on 1 Minute

What a late entry! Since that wasn’t my number one stock so not lined up in my montage screen. I think I wasted valuable time resetting my screen as opposed to executing my trade. Also missed the exit on the first resistance level. Minor loss. Poor execution. Good strategy.

(#1-B; Is there a better way to do this ?)

Trade 2:

Thought this was bouncing off VWAP for support and to form ABCD.

Had stop set below VWAP

Good plan and execution, just failed. Loss, but feel god about this one.

Same charts as Trade 1.

Trade 3:

Thought an ABCD pattern was setting up. Didn’t wait for candlestick to close.

Poor execution. Loss

Trade 4

Oh nasty bad word. I hit the wrong hot button.

Instead of selling 25% and 50% I hit cover and added to my position!

I have not done this at all on DAS and now I have done it several times this week. (Much worse on Tuesday) A couple of thoughts; 1. A miss-key should have a 5 minute time out from trading stocks. 2. I bought a keyboard that I programmed side “G-Keys” just for selling and shorting, maybe I should just use those.

Layout:

G1 - Sell 25%

G2 - Sell 50%

G3 - Sell 100%

G4 - Cover 25%

G5 - Cover 50%

G6 - Cover 100%

2b. “G-Keys” only work if the montage window is highlighted.

This should have been a beautiful trade.

Don’t make fun of my handwriting

ABCD Great strategy, poor-poor execution. Error on Hot-Keys.

Trade 5

Broke VWAP after four strong candles.

Number one stock on my list. Market is strong with heavy volume on the airline stocks today.

Of course now I am extra-burned with the huge take-off the stock did later.

I could not watch the market all day because I had errands to run

Only thing I feel good about is the entry and stop.

Looking for feedback on this one.

Trade 6

Revenge trade on previous trade.

UAL went under VWAP.

I went short.

It went up.

Seems funny now.

Ahhhhh!

Trade 7A and 7B

DAL breaks above VWAP and I go long with almost 1000 shares.

This is my all-in commit, so I am feeling good about the setup.

Hot-Key error (again?) cover 25% instead of sell, but I quickly sell 50% at one cent better so I adjusted fast.

And then…….my DAS froze !

I felt good because I put in a hard stop.

I called them in the afternoon and their advice was if that happened again to “Switch the Quote Server”

File => Data Stream Mode => Switch Quote Server

Ok, also set up my mobile DAS. Don’t know what to think about this one.

Got back in at 10:05 to continue the trade…

In at $30.22 down to $30.14...i’m out !

Poor entry and exit, but better to get out then hold while you're steaming…

Still a winner...sick….

Trade 8

EBAY

Looking for a reversal back to VWAP.

Buy at 49.20

Feeling really good about the trade, good risk to reward, good setup…

Double up and buy again at 49.26. ALL IN.

Hindsight 20/20 Risk Analysis

First entry at 49.20

If my stop should have been at 48.82. 38 cents to share, 1R = $100, max share size = 263 shares.

I was 304+304 = 608. I think I lost my nerves.

TRADE 9

OXY

Was thinking this was a reversal back to VWAP.

Good news got out as soon as it was going bad.

======================================================

Recap:

Another tough day.

A little frustrated for sure.

I have some leftover frustration because Wednesday was such a huge day in the market and I was red for the day.

On the positive notes.

I think I have a really good pre-market routine.

I am listening to the morning show, going through the scanners.

I am making my list independently and I felt confident about the stock selection.

I love the way my DAS is setup.

I think my trade station is laid out really well.

Some constructive take-aways:

When trading ORB for 1 minute, focus on the trade NOT the DAS layout…

I feel like I have a very good concept of the strategies in the book and the videos. (Can always be better!)

Good use of hard and soft stops.

Can’t have hot-key errors. I know this is practice in SIM, but jeez! Use programmed G-Keys ?

Slow down and think where you are in the trade.

I only take one trade at a time so no excuse.

Time-out for hot-key errors.

Looking for feedback on trade 5.

Thinking back at both trade 7 and trade 8

I got out early without proper stops.

Both setups had perfect strategies and would have been monster winners if I had stayed in.

Patience ??

Thoughts and questions:

Any overall thoughts/feedback ?

Too many trades for a beginner ?

I personally don’t think so, only because they all have a strategy attached.

After the open should I only be on 5-minute candles ?

I think what I really need is proper stops, proper risk and patience.

Should I be in the market longer ? The action dies down after the first 45 minutes, but it seems some patience would catch some huge potential moves.

Wow, this is a lot of work. I spent a lot of time on this, but I got a lot out of it.

Everybody can’t spend this much time (??)

Honestly frustrated. I have put a lot of time and effort in this.

I have studied and feel that I have a good concept of the strategies.

Will keep plugging along, this is something I really want to accomplish !

-tom n

-

1

1

-

-

Hello BBT Community !

My name is Tom and I am in San Diego, CA. My background is in the car business. I have been working at and operating dealerships since I graduated college.

I have been interested in the stock market ever since but have never actively traded. I purchased Andrew’s book in 2017 and have read it several times. I had the opportunity to meet with Andrew in San Diego at the Trade Ideas seminar in late 2019. He was able to speak with a panel in front of cameras and everyone. Everything just reinforced that BBT is about people who are serious about trading. Impressive.

About three months ago I started trading in SIM on TD Ameritrade’s Think or Swim platform. I started watching the BBT morning show and paper trading. After some success, I live traded for about a week for break-even and decided I needed to step-up to the DAS platform. This has been a little complicated since I am on Mac computers. I do not want to invest in a full blown gaming PC until I have had some consistent success trading real money. So my MacBook Pro is partitioned with BootCamp. It has worked pretty well. Today I am paper trading with DAS.

When I watched Carlos’ on boarding class he had the recommendation to start a team of same-level traders. I would be willing to start one. Please contact me if you are interested and at the same level trying to go from SIM to Live trading.

Looking forward to making this a profitable venture !

Thanks !

-tom n

Follow me at:

@tntp45 Twitter

@tntp45 Instagram

www.youtube.com/tntp45

www.flickr.com/tntp45

Tom N - Day Trading Journal - Looking for feedback...

in Day Trading Journals

Posted

Thanks Chris !