tntp45

-

Content Count

145 -

Joined

-

Last visited

-

Days Won

2

Posts posted by tntp45

-

-

-

2020-8-3

No trading today...

-

2020-7-31 <SIM>

Tough Day !!

Disappointing after a decent week...

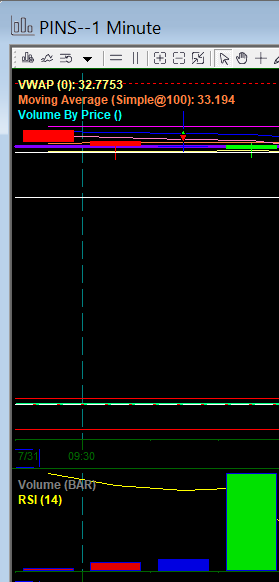

TRADE 1 $PINS

1 Min ORB -1.26R

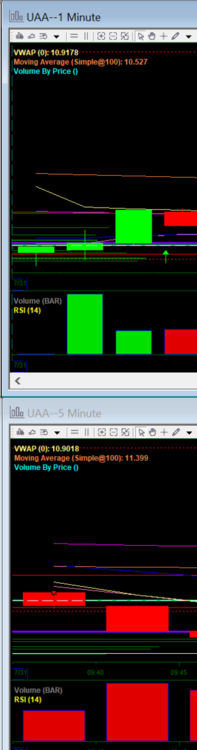

TRADE 2 $UAA

5 MIN ORB -2.0 R !!!!

Daaaang ! Out in three seconds for a 2R loss (???!!!)

Technically at max loss but decided I could have one more trade...

TRADE 3 $F

Reversal -0.33R

RSI got down to 14. Went long. Should have hung in there for a 2:1 winner. Gun shy with the price action did not want to lose another full R.

Break time per rule.

One more trade !

TRADE 4 $SPY

Support Level Break -.04R

SPY went from Green to Red and broke the VPA level.

Nothing else to say, but should have hung in there...would have been a nice 2:1

Conclusions:

0-4 for -3.63R Ouch !!

Maybe could have waited for a little more confirmations on my ORBs. I don't think so.

Need to be prepared to be in a trade longer as the day goes on. Even after the first fifteen minutes of open it takes longer for the trades to play out.

Weekend Goals.

Review basic strategies. Work in replay. Be fresh on Monday !

-

15 hours ago, hailchaser2 said:Yeah, no problem, I’ll copy it tomorrow and post it here.

Gracias !

7/31 - Found it ! Thanks !

-

1

1

-

-

1 hour ago, hailchaser2 said:I have my HotKeys all start with canceling orders (I’ll have to check the exact wording, but I think it’s CXLALL) that way when I take a partial, it removes my older stop order. Then I hit the Break Even hotkey.

Awesome ! Can you help me find the script for the Break Even HotKey ?

-

4 hours ago, hailchaser2 said:Thursday LIVE

23/28 +6.4R

Awesome Day ! Congrats !

-

1

1

-

-

Nice Day !

I like the $SBUX trade ! Nice catch ! Do you have the 50sma on your chart ? Would that also be Peter's mountain pass ?

What a crazy day for $KODK ! People must have made and lost some serious $$.

-

1

1

-

-

2020-7-30 One and Done ! <SIM>

$UPS +2.85R

One Minute ORB

Top stock on my watch list, went short on minute two.

Two 50% partials and then all out on minute three.

I have lowered my daily goal from 5R to 3R. I want to improve my probability of back to back green days.

Good news here, ok great news, utilized my clear orders to take my stop out. This is what hurt my Tuesday. Lesson learned !

Short of the 3R, but close enough. Another factor to hang it up for today, if Brian and Andrew are having a tough day...why would I need to push it!

ONE AND DONE !

-

1

1

-

-

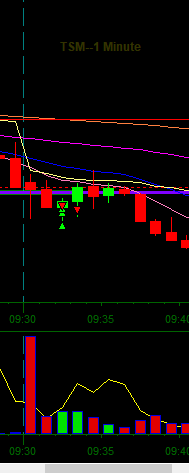

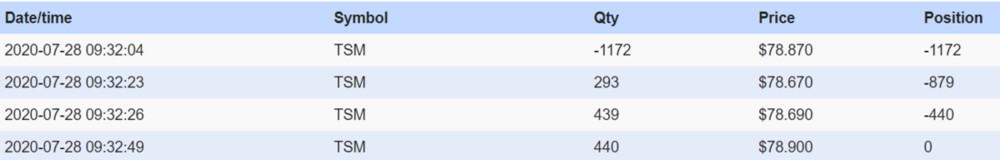

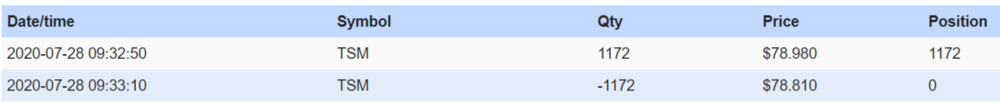

2020-7-28 <SIM>

TRADE 1A

$TSM +1.2R

2MIN ORB

Went short for a 2 Min ORB on TSM.

Super fast moving action. A lesson on how fast the action is first thing versus late in the day.

Past my break even and closed out all in the same one minute candle...

Then...

Trade 1B $TSM

Since I use Kyle's Hot Keys I had a stop order out for this stock...and it tripped.

Lost all of my profit and then some...

Lesson to be learned here...

-1.99R

Total Trade 1 = 0.75 R

Took quite a break. Caught my breath. Highlighted the cancel order hotkey on my keyboard...back in action.

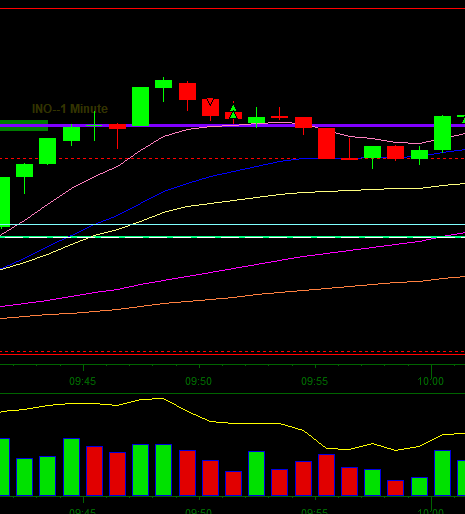

TRADE 2 $INO

+.08R

Went short for a reversal. Took a big partial for little profit. Then stopped out at break even.

Had I let my original stop would have made 2:1 at my target...

TRADE 3 $INO - Trade of the Day !

ABCD Pattern

Felt good because I waited for confirmation candles and confirmation in multiple time frames.

Small return for a good trade.

Trade 4 & 5 $INO

Triangle

Now here is a setup that I have never studied...

Although the pattern was so clear I had to take the trade...

Sorry, graph should say 4 & 5...

On trade 4 I thought I had waited for a confirmation candle but I was to early. Stopped out for -1R.

Went back in on trade for because I was confident. (5)

Enter at 21.32, 10% partial at 21.37.

For the second time today I got stopped out at break even when the stock would have continued to run. Now with that, it was very choppy to get anywhere as everything was today.

The strategy is proper though correct? Move your stop to break even after your first partial...

+.03R

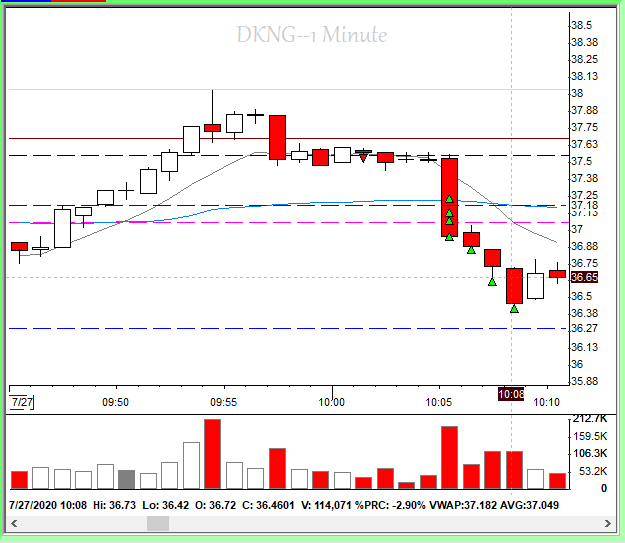

Trade 5 $KODK

Reversal -1R

Waited for confirmation in different time frames.

Stopped out to lose a full R. Tried fighting the trend on this one.

Conclusions:

The extra order on the stop loss is still killing me (Trade 1B) Not 100% sure how else to manage it except to make sure I cancel the order using the Hot Key when I am done. I want to continue to use hard stops for the immediate future.

Twice today I got stopped out at break-even when the stocks would have continued to run. I am feeling the same here, not to adjust this strategy as I think it is sound over the long run.

Very happy with Trade 3 ABCD. Low return, but waited for multiple confirmations.

Dabbled with a triangle pattern, that is what SIM is for !

-2R for the day.

My focus as of late has been to get confirmation on multiple time frames and and confirmation candles. I felt like I did this well all day. A few lessons to be learned today. Will keep moving forward !

-

Such an awesome post...wanted to share it here...

-

1

1

-

-

4 hours ago, Christopher Patterson said:Thanks Chris !

Appreciate the encouragement !

-

-

Got it ! Thanks John !

-

BBT Scanners

The more I look at these the more I think they are golden.

Posting this link for reference:

-

Just now, Andrew from Jersey said:Around 3R. Without partials, it would have been 4R, almost to the penny. My risk was 10 cents per share.

That's awesome ! Congrats ! One and done ?

-

Appreciate your recaps John.

Congrats again on becoming a BBT moderator !

Where do your set your stops at ?

-tom n

-

Nice trade Andrew ! What was your total return ?

-

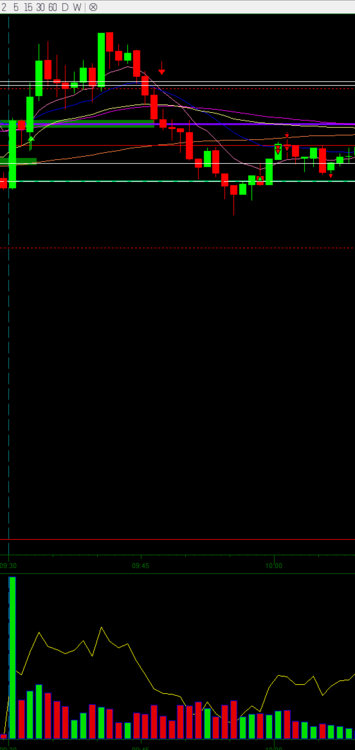

2020-7-27 <SIM>

So a few things first. One, I completed reading Anna Couling's book "Volume Price Analysis. With that I added the Volume by Price indicators (along with VPOC) on my charts. I learned a lot from her book, but one point that is resonating that I have heard from multiple sources is "to make sure you have confirmation on multiple time frames before you enter into a trade."

So with all of that, my first trade was not until 28 minutes into the open. No 1/2/5/15 minute ORBs. Also, only three trades for the day (although I had different commitments through the day) And a GREEN DAY ! Small green but we will take it !

Trade 1 +.053R

$AMD

Took $AMD long for a reversal. Late entry cost me share size and return but I am ok with that today to trade with confirmation.

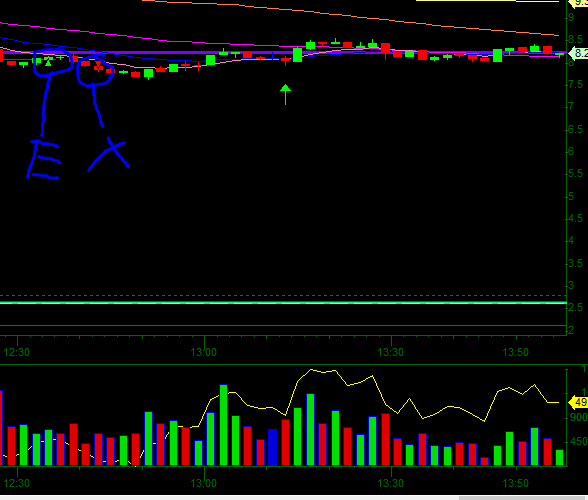

Trade 2 -0.27R

$INTC

My analysis was that $INTC was starting to consolidate for the day. One of the points I got from Anna's book was that stocks only move three directions; up, down or sideways. Most traders don't like sideways, why not ? It is setting up a support and resistance levels that we can trade off of for the next move. So I set alerts in DAS for the top and bottom of the consolidation range. With that I was not happy with the price action after I entered and bailed out on the trade.

Hindsight 20/20 this trade went with my original theory and traded almost all the way down to the next level.

Would you have stayed in this trade ?

I know part of the reason I pulled the trigger is I did not want to ruin my small profit for the day.

Interesting to me how much slower stocks move in the latter half of the day compared to the open. Need more patience for later in the day ?

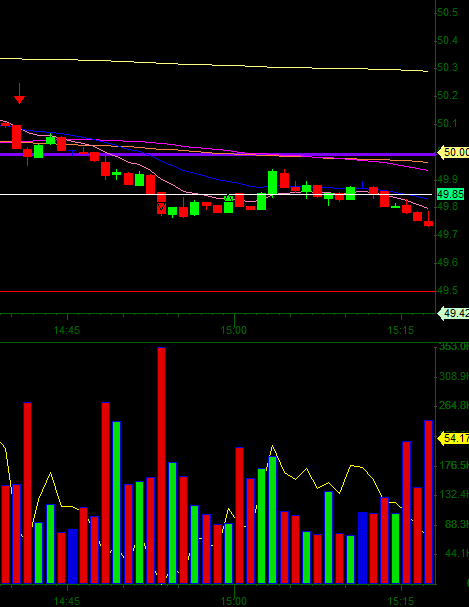

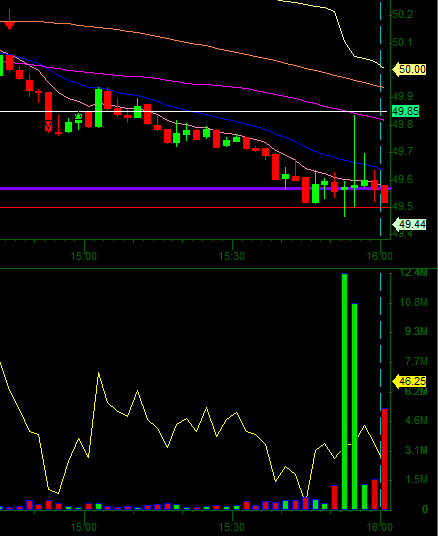

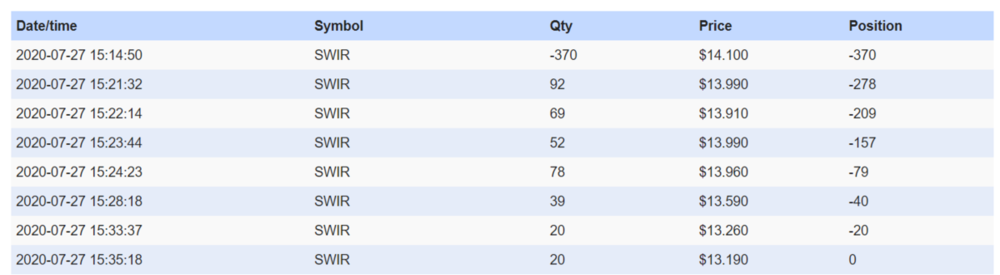

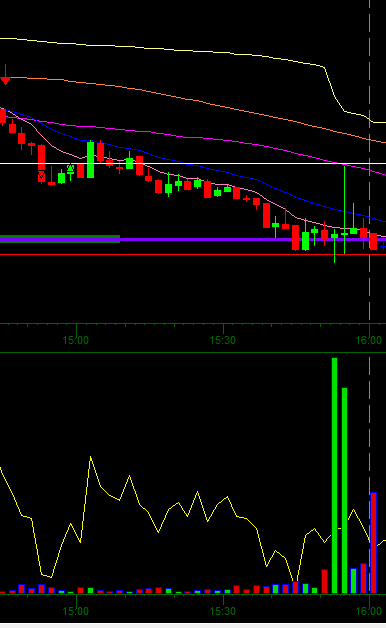

Trade 3 +.095R Trade of the Day !

$SWIR

The price action had gone away from my entire watch-list so I moved to the scanners. I have had a lot of success using the Turbo up/down scanners.

15 Minute chart for big picture:

One minute chart for detail

Well this chart looking backwards makes me look like a genius.

Truth is I quickly lost confidence in my trade over the next few candles when I jumped in.

I held in there, made a small profit over several partials and decided to leave a small amount in with a break even stop.

WOW look at that candle at 15:28 !! I could get used to that ! It moved so fast. I partialed on a bounce up. Had a few more shares run all the way to VWAP. The constructive criticism here will have to be partialing, but I feel good about this trade overall.

Partials:

Recap:

Overall a green day ! for +1.20 R

Really slowed everything down today and waited for confirmation.

-

On 7/24/2020 at 10:58 AM, Christopher Patterson said:Ah, my bad.

So, again this is just my opinion, there are way more experienced people around here. I've been at this everyday for about 9 months now. I think about 6 months in I was starting to reliably break even. Now, after nearly 9 months in, under the condition i trade well 3 to 4 days a week, I'm sitting at a reliable 5R-10R per week. That's with a daily goal in the range of 2.8R-3.3R and a max loss in the range of -2.8R - -3.3R.

Now, it's clear to me that on days I grab 3R-4R off a morning play, I need to give myself the go ahead to push for 5R-10R days. Max loss days really hurt, and you'll have them. For example if I didn't hit max loss yesterday, and instead had a conservative 2.5R day, i'd be around 11R-12R this week, which would be about 3.3% of my account, which is actually insane if you extrapolate that out for even just 6 months. Instead, i'm around 5.5R. That's a big difference, and all it took was one day getting just a little too loose with an opening play, getting stopped out, then being slightly tilted and chasing a couple not so great trades. I feel like the more I trade the more I see that hitting the A+ setups and managing your winning trades is the easy part, keeping your losses small and infrequent is the hard part, it's the latter that drops the 90% out of the break even / profit bracket.

If you can very consistently get in the range of 10R-30R weeks, then you can day trade for a living, period. A 5R daily goal sounds great, a 25R weeks sound great, and 100R months SOUND GREAT. But imo, you'd have to be a badass trader with a lot of experience to get those numbers. If you're pulling 100R months, i'd guess you're somewhere in the top .2% of traders. Hell, I think having very consistent 40R-50R months probably puts you in the top 3%. I have no data to support this, this is just what I feel to be the truth, or at least close to it.

I think a 3R daily goal in the beginning is a great place to start. Also, any trade that you take should have the potential to hit at LEAST 2R.

If you nail an awesome ORB at the opening for 3R, nice! you made it! If you're feeling good, keep going, but don't let yourself dip below 1R.

if you get stopped out once at -1R, 2 good 2R plays or a great 4R trade will get you to daily goal.

if you're down -2R and against the ropes, then 1 good 2R trade will take you back to break even.

gl! : )

-Chris

*edit*

I should also add that I only trade the first 30-90 minutes the market is open, if you're trading all day then maybe a 5R-10R daily goal is more realistic? But I'm not sure..

Thanks Chris ! Appreciate your thought processes & strategies !

Congrats on your consistent 5-10R per week !

Let's Keep it Rocking !!

-tom n

-

Awesome Recaps !

-

Awesome pre-market trade ! $AMD

-

1

1

-

-

15 minutes ago, Christopher Patterson said:Hey man! I'm not really sure about the fills, I haven't used Kyle's keys live. @Justin would know.

And just my opinion, a lot of people might disagree, but I think it's reasonable to just stay in SIM until you're getting consistent 5R-10R weeks, which is a lot harder than it sounds if you keep honest records.

Keep at it!

-Chris

Thanks Chris;

I am on my third month of DAS SIM and never had these issues, if it didn't happen multiple times today I wouldn't be worried about it. The next step is record my screen so I have all of the info and make sure I am not missing anything. If it continues to be an issue I will reach out. Thanks for the tip with Justin..

Just FY I am only in SIM. My point was that if I have a bad day and hit my max loss in SIM, was to stop, journal and reflect. Then if I jump back in later that day it would just be "practice", similar if you went from live to SIM during the day.

Since you brought it up, what do you think is a good weekly goal for a "good" live trader. I was thinking that 5R per day = 25R per week. Do you think this is unrealistic ?

My thought process was 5R per day goal. 10R max win to stop. 3R max loss to stop. With an overall goal of 5R per day.

Thanks for the feedback !

-tom n

-

2020-7-24

Back at home with my full workstation...

Question regarding Kyle's HotKeys... This happened to me multiple times to me today where my orders did not get filled immediately. Which of course means that the price ran up over the 5 cent mark. Question: Should I immediately cancel the order and start over ? I was a little shocked at this so I did not react. Each time the price fell back into to range of the order and was filled. I was still confident in the pattern, so I let it run...

<SIM> Max loss day...

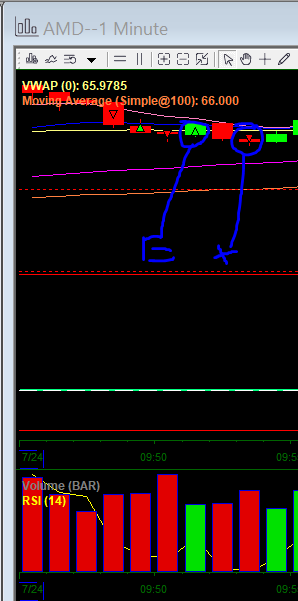

Trade 1 $AMD -1.52R

One Minute ORB

First, there was quite the delay for me to be filled. I assumed it was because the stock passed the 5 cent marketable limit order mark. The stock came back down and I was filled. Strange fill price as my order should have gone in at 65.42 as that was the top of the base of the one minute candle. With that it wicked down and I was stopped out for a -1.53 loss. Thoughts ?

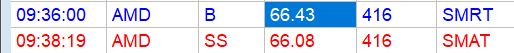

Trade 2 $AMD -1.45R

Five Minute ORB

Base of 5 minute candle at 66.05 fill one minute later at 66.43...

Stopped out for a -1.45 loss...

Trade 3 $AMD +0.09R

ABCD & VWAP Bounce

I felt good about this trade. Small share size because it got away from VWAP.

I partialed at HOD for only 10% because I was convinced that it was going to be super strong and should at least to go the next whole dollar amount of 67.00. This allowed me to move my stop to break even. Then it fell back and I was left with a lousy 0.09R.

Afterthoughts; should I have taken more at HOD? Probably, if for no other reason I seem to have overly-optimistic goals for some of these stocks. With that if your goal was HOD, you would not take the trade because that would only be a 1:1 Risk to reward. I am not sure, stock with a great catalyst and a good pattern. I know that I did not want to partial more because of the small share size and when I was green it was not by a lot...

Trade 4 $AMD -1.32R

VWAP Bounce

Nothing but a bad trade, did not let the candles complete to confirm.

Just trying to jump in. Certainly an anger trade from making no money the trade before.

Trade 5 $AMD -1.02R

VWAP Bounce

Repeat notes from trade 4, bad trade...need to wait for confirmation candles...

STOP FOR THE DAY WITH -5.23 R

Afterthoughts:

Well let's start with the positives

Woke up early, went through the entire morning show.

Good watch list, screens setup. Stayed on one stock until the action stopped (or I stopped)

No HotKey errors.

Stopped trading and got out, went to my journal.

I have often thought when I have a bad day, I need to stop and drop into SIM. Hahaha...I am in SIM. So I am going to move myself to complete my journal and then if I go back in I figure those will be just practice trades. Will let you know if I jump back in.

Full journal complete

Constructive thoughts:

I was having a decent month. Although I have had small green days they were green and no big losses. No big green days, but I figured this was a step in the right direction.

Frustrated with a couple of things. 1. The fills not completing and then filling later. I think if it does not go I need to cancel all orders and then re-evaluate. I believe it was three times the orders went late and then filled on a pull back, probably an excuse to not take the trade. 2. Also frustrated with losses being more than one R. I am using Kyle's HotKeys, probably would be worse without them.

Take Aways:

Need to start recording my screen. Any input ? The simple way to do it seems to be with Quicken, although DAS has this function as well.

WAIT FOR CONFIRMATION CANDLES.

Utilize cancel all orders HotKey.

Somewhere I read that when traders comeback positive ready to trade they end up overtrading and losing money, and when they come in cautious they make better decisions. Makes me think this applied to me today as I have not been on my desktop setup for a couple of weeks and traveling for the last couple of days. Carlos says to be cautious on Friday's so you enjoy the weekend. Wish I could say that, will have to enjoy it anyways !

Have a good weekend !

-

1

1

-

-

2020-7-20

Placeholder...will come back and finish...

Tom N - Day Trading Journal - Looking for feedback...

in Day Trading Journals

Posted

2020-8-4

Placeholder

Motivation & Thoughts

Placeholder