Sapperstien

-

Content Count

123 -

Joined

-

Last visited

-

Days Won

10

Posts posted by Sapperstien

-

-

So the typical trader only has the first hour of the day to make money and markets moving.

I've searched with no luck as to a service that will allow me to replay stocks I would have wanted to trade but didn't have the screen real estate or were outside my price range like Apple. Something tick by tick, with preferably L2 and T and Sales although not needed. Something tradingview replay mode doesn't show the candles forming in realtime. Just prints one candle and the next. Pretty fake.

Something to practice in the evenings. Thanks.

-

On 11/5/2019 at 5:56 PM, Brendon said:Well I used a grid and the streamdeck to help me calc share size depending on risk and share cost. Now I use Kyle's hotkeys which auto calcs share size and risk.

Check out this video:

Wow. This is super helpful. Im definitely gonna be using this. Already imported into DAS.

-

16 hours ago, Aiman Almansoori said:Hi! So first of all, with 5000$ if we go by the books you’re allowed to risk 1% of your account per trade which equals 50$ right? Now, by the books again, you can’t lose more than 2% of your account per day, and again, if you lose 6% of your account per month you must go to simulator for the rest of the month right? As day traders, we need to take more than one trade as it’s tough to get your winner from the very first trade, sometimes you need to make 3/4 trades. Imagine losing 2 in a row, now you’re down100$ which is 2% of your account, if you take 3 and lose two days in a row then you’re down 6%. So in my opinion, this isn’t the best rule for day trading, maybe good enough for swing trading or investing, but not day trading. don’t forget about the part where you can risk less than 1% per trade, it doesn’t need to be 1 every time, especially for beginners, I personally was risking 0.1% of my 25k account when started

Eventually, despite the account size, I prefer going by this rule:

Risk as much as you want as long as you won’t feel emotional after giving it to the market

Some people have 25k account but they spent years and years saving it, 1% might be their weekly salary, and giving it per trade will make them really nervous, and vise versa

now regarding the leverage. If you’ve 5000$ account and you’re willing to risk 1%, then it’s always 1% of your cash account not the leverage. So your risk is 50$. Let’s say you’re trading 2$ stock with 10 cents risk, you can take up to 500 shares which equals buying power of 1000$. You don’t need leverage in this case. Let’s say you want to trade tsla with 1$ risk per trade, you need around 50 shares *250=12500$. Here you’d need to use some leverage, but your risk is still the same. So basically, leverage shouldn’t be used to increase your risk or shares only because you have it. It should be used widely to help you respect the trade management rules you’ve

Thanks big guy. Its the simple stuff like this that went right over my head in trading 101. I guess it comes from my trading perspective from another trading group that is always on max risk. Would say the name and you'd know who it is but dont know if that group's a swear word around here...

I will greatly reduce risk/trade so that like you say I can feel comfortable with it if I lose it.

Okay, that's kinda what I'm after. Like The info-graphic with the risk per trade based on stop loss distance doesn't take the price of the stock into account. So a $0.10 SL on a $250 stock is severely different than a $0.10 SL on a $2 stock. If I have to decided in real time on how far I want my SL to be from my entry then I have to check the infographic.

That means that I still have to know how many share I can take for that stocks price per share and Im wondering how you guys do that in real time. I did the math for a $0.10 SL and a $1 SL on both a $2 stock and a $250 stock. The numbers work out to needing a $1000,$100,$125000,$12500 account respectively. Since the $125000 is clearly impossible I would have to decide my max amount of share for that stock price before I decide the risk per trade. Does that make sense?

Im basically trying to figure out which comes first. The risk per trade calc or the account size calc. And how to do it quickly.

Im thinking for now I just do the risk per trade calc and not trade stock more than like $50.IDK still confused out hurr.

-

2 hours ago, RTrader said:You should look at the leverage as only a way to trade more expensive stocks, and to short. It also allows you to open more than one position of 5,000 (your cash balance) at one time. Your risk should always be based on your cash balance, or even better... what you personally can handle losing on a trade, or in a day as long as it's < 1%!

Jason

Thanks for the reply. So it isn't typically advised to use leverage to increase acct size? Why would I need it to short?

-

Hey there,

Say I have a $5000 starting account balance. At 1% risk per trade that $50 risk on each trade. I download the infographic which is taped to my desk. I'm with IBKR in Canada which gives me 3.33x leverage. Okay cool, that means on a $0.25 stop loss I can take 200 shares. How do I work my leverage into that now. Since my Risk per share is capped at $50 do I multiply that by 3.33x to get a risk per share of ~$165 (at $5000 X 3.33= $14000) and thusly ~600 shares?

Or do I only get to take more shares (~600) but not increase my risk per trade ($50) at $0.25?

Kinda having a hard time wrapping my head around this one?

-

1 hour ago, Brendon said:This may be silly but did you try holding down CRL while you select the 2 files?

That worked. Thanks boss.

-

1

1

-

-

-

1 hour ago, Abiel said:Hi, try clearing cache and cookies on your browser and try again,let us know if this works for you.

I did. And also just used a different browser. Still no go. Ugh.

-

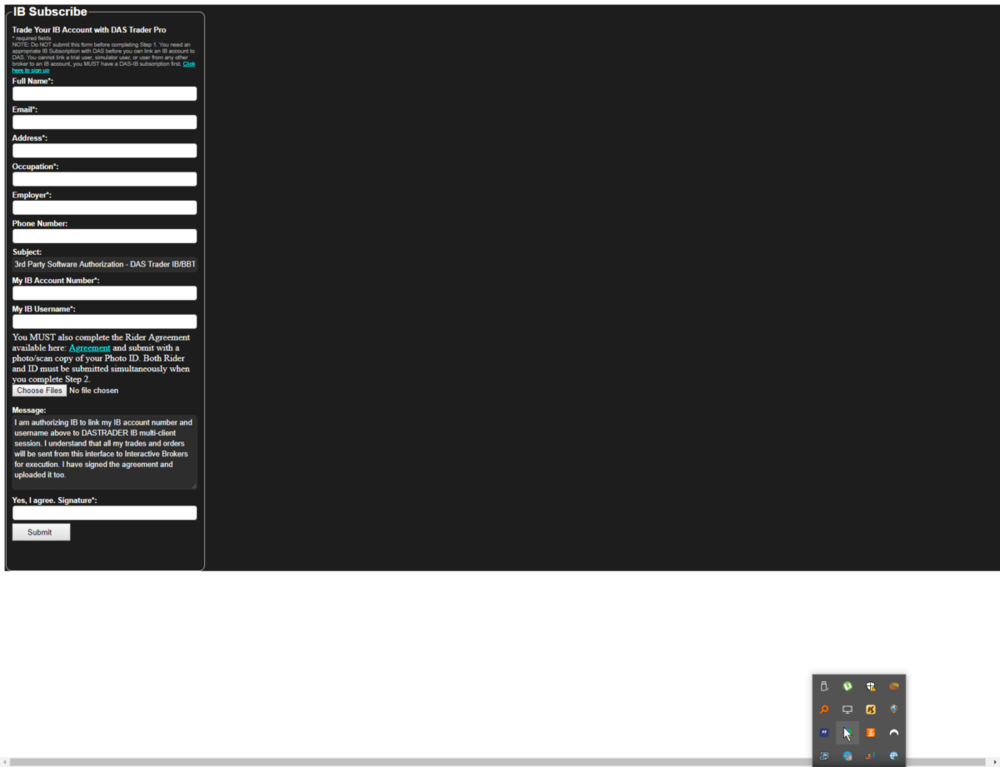

When you get to step 2 after you pay it asks you to sign the attestation as well as upload a gov't photo ID simultaneously. I have tried multiple times to choose to upload two items at once. It wouldn't allow it. Then I pasted the image into the the attestation PDF file so I was only sending one file and still I got an error telling me to upload both pieces at once. Has anyone else had the same issue and can help me out? Thx

-

On 10/29/2019 at 1:18 PM, Brendon said:You bet, the rules of trading are a 'click' type learning curve, you either get it 100% or are completely lost, but we all get there.

Haha. Apparently. Thanks again.

-

6 minutes ago, Brendon said:Margin allows you to have a larger position size, say for expensive stocks like +$200 with setups that the stop is only a couple cents away from your entry, you will have to take a large position and you will need the leverage, but your risk (stop) will still be 1% regardless. Your only risk is your stop, not the cash you use to enter the trade.

ahhhhhh. The lightbulb went on. I totally get it now. Thanks.

-

2

2

-

-

9 minutes ago, Brendon said:That 1% is how far away your stop is from your entry in a trade (stop is where the trade no longer makes technical sense). So if that's 10 cents away from your entry, you better make sure your share size times 10 cents equals 1% of your acct. Hopefully that helps, I know it can be confusing with these terms at first.

Right, but thats also the actual $ amt that youre putting at risk in every trade. And you cant do more because you dont know if it'll be a successful trade. So im still confused as to when anyone would use the leverage. People would have to take on positions 3x their actual account size? I dont think you'd find anyone like that.

-

4 minutes ago, Lee W said:You can’t choose to use the borrowing power as priority over your equity. The trade will always use your equity first. If the trade exceeds your equity, it will use margin.

Equity: $30,000

Total Buying Power with margin: $90,000

If your trade is for 1,000 shares of XYZ at $25/share, it will use $25,000 of your equity and total buying power.

Lol then whats the point of margin. Who would take on a trade 3x the size of their account? Thats just... I mean were to work with 1% per trade so I dont see the need.

-

6 hours ago, Brendon said:Yo, not entirely sure what you mean by your question, but you can just call IB and ask, they have great fast customer service. Leverage is just increases you potential BP (and risk).

What I'm asking is that if I only want to use 1% of my acct size per trade, then how do I get the 3.3x leverage without it just using 3.33% of my trading account?

-

Canadian here so ew only get 3.33x leverage with IB. Which is fine. But every time I trade it always uses from my own margin acct and not using their leverage. Id like to use their leverage before using the entirety out of my acct. How do I actually use the margin when I want to only take 1% acct risk per trade? Thx.

-

Just thought I'd share that it'd be awesome to have all the lessons in the education center uploaded to YT on a private playlist so that we can play them at different speeds. I usually watch videos at 1.25 or 1.5x speeds... Just an idea. Thx.

-

-

4 hours ago, csxilin said:Here is the link to the original post:

Thanks for the replies. That's awesome. I also just found the printable chart for q quick calc. Do you have any idea on the max loss per day question?

-

Ive been going through all the materials and studying the lessons and i see the three steps to deciding how to choose how many shares per trade to take. It just seems like in the moment when were fighting for tenths of a second with special order types with routes etc. that punching that all out in a calculator takes too long.

Also how do you guys choose the number for max loss per day?

-

Anyone live in Edmonton area wanting to meetup/talk about trading?

Interested to talk to other traders since I haven't found one in the city. Thx.

IB Trader Workstation Day Trading Setup

in Day Trading Hardware, Software and Tools

Posted

If I trade a position in DAS does it show in TWS? I know it doesnt the otherway around until the next day with DAS.