Sapperstien

-

Content Count

123 -

Joined

-

Last visited

-

Days Won

10

Posts posted by Sapperstien

-

-

I don't think anyone's made a hotkey like this but Thor's (to my best knowledge has gotten close).

Thor's hotkey to my knowledge is a hotkey that moves stoploss to breakeven when you're in the green unrealized PnL on a trade.

What I'm after is a hotkey that (when in green PnL) will sell 'X' amt of shares (calculated upon the actual trade value and SL distance like Kyle's Hkeys) so as to essentially 'kill' the trade or get a 'gimme' trade without moving your SL from a technical level to your entry position but will make it so that if the stock moves back down to my SL I wont lose any money. So what I'm doing is getting rid of a certain percentage of shares when green so that I can stop out without a loss.

Ex. I enter a position at $10 a share with SL at $9 and TP at $12. At $11 I want to sell 'X' amt of shares for profit so that if it were come back down and stop me out at $9 then I would lose $0 on the trade due to profit taking.

Any help would be awesome. Dont even know if something like this is possible with DAS.

-

On 1/8/2018 at 11:04 AM, Andrew Aziz said:I have been working on my Fallen Angel Strategy for a while, and eventually I made enough examples to present it in the course.

Today we had it again, it was the perfect sitation

1. MYSZ: an Angel: low float stock with strong volume gapped up

2. sold off at the Open but held a level below VWAP at around $2.40.

3. On the way up, strong volume was the key for me to get in 4,000 shares to go above high of the day and high of pre-market.

Running through this now but werent we all kinda saying that FA/RD strategies happen within the first couple minutes and not 20 mins later or am i missing something?

-

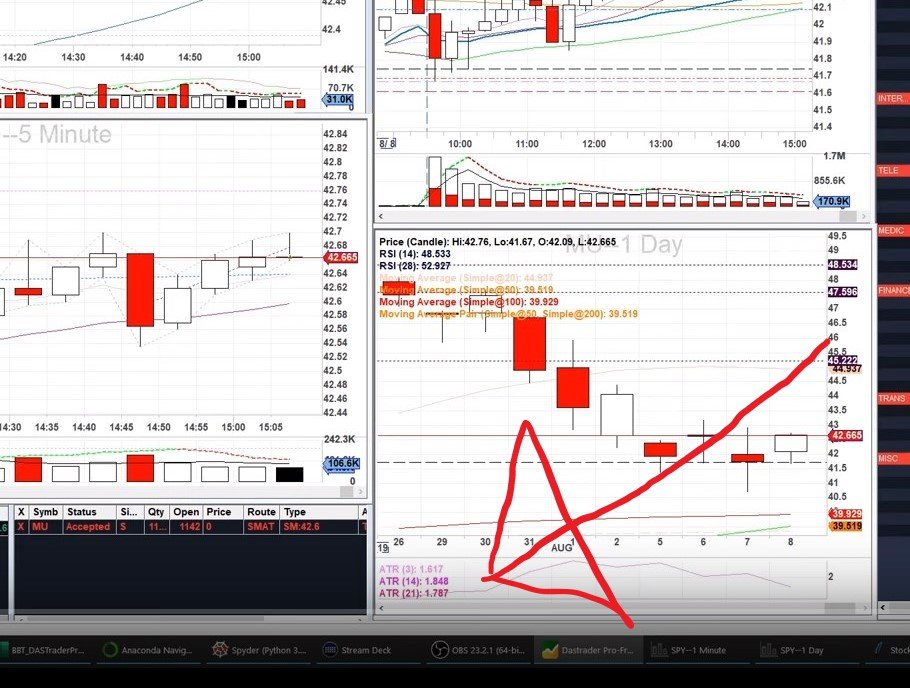

15 hours ago, Michael Thorne said:To add ATR , right click on volume chart (where your arrow is pointing) then right click and select "Study Config."

Click ATR from "Studies" column and move it (Select-->) so it's placed in the "Studies in Chart" column.

Click ATR in "Studies in Chart" column and Config (enter # of periods you require - default is 14). Then click "Commit".

Again, right click on volume chart (where your arrow is pointing) and select "Chart Area" and select " Config Area" (bottom of list).

Check " Show Study Info" and "Show Study Latest Value" then "Commit".

Your ATR values should now be displayed.

Awww wicked. it was that last little bit with the Show study lastest value I couldnt find. Thanks a lot.

-

Im using tradeinsights for free. Awesome so far. Easy import with DAS.

-

-

Okay so roll with me on this one here. If you've been around BBT for any length of time you know what a 1-min ORB is. And if you've tried it, I bet you've also noticed that it isn't as easy as 2nd minute makes a newer high than the previous minute close and vice versa and have gotten your pee-pee slapped. I've noticed lately that a lot of 1/5 ORBs dont work out. Especially the 1 min. They pump it up just enough for you to FOMO in the beginning for the second minute. Then damp it. (Link here for the uninitiated: https://www.youtube.com/watch?v=KV5QlSgq7lg So... My thought process is to get in to a stock at somewhere like 9:30:40, let it come up and allow for the start of the new minute to print higher to wreck people getting in and get out for a base hit. Whatever it may be in this case like 10-20cent scalp profit and get out at like 9:31:05 or so. Could even in to see if it runs. Thoughts? Ill be practicing this strategy in the future. Obviously if L2 is positive then let 'er run.

-

1

1

-

-

Anyone potentially having the same issue in the future, I've all but solved it by having all 4 screens on even though the fourth one has no DAS windows on it at all or have anything to do with DAS. I have to have that screen on and it solves the problem. Usually one window is still out of place. But I can live with one as opposed to like 20 windows being mis-located. (Charts,T&S,L2,Montage...)

-

1

1

-

-

10 hours ago, Brendon said:Dang, and you just got your dope new setup too! I run 8 monitors 1080 landscape, never had any issues at all. What gfx cards are you running? You can trouble shoot by maybe trying a different gfx card. I also have an HDMI switch that moves between my trading rig and my wife's work comp. Even with that I have no issues.

Make sure your res is the same for all monitors, like don't run 1080 on some and then a different res on another, I can see that messing with DAS big time maybe.

Lol I know right. Was so stuoked. For apparently nothing. Honestly, my computer is a bag. I only have on board integrated graphics card with 2 DP. Then I have one of those USB 3.0 to HDMI splitter for the two other screens. Already tried switching the cables in there. Thing is that it worked fine for like a week (pic is late).

Im definitely running different resolutions. Ill give that a go. Thanks for the tip.

-

Hey Carlos.

I have 4 screens but it’s the two verticals on the sides which are the same screens which are doing it. Both same resolution and hardware adapter updated.

yea even after saving it’s messed up.

-

Hey guys,

anyone have an issue with multiple monitors where DAS does not save the layout (default) on exit and windows are moved around on application restart? Magically my charts and L2 or montage are either on top of the main MDI window or the whole left screen is scrolled up or down 2 inches off screen. But the screen is within resolution and not off screen. Its random for what does it. I reached out to DAS and they just said that it could be a screen resolution error which I changed my resolution and it made it worse. Now the other screen is doing it too. Frustrating having to move everything back every morning. -

-

-

On 11/13/2018 at 10:15 PM, Robert H said:IB Canada gives 3.33:1 leverage (30% margin requirement) for eligible stocks. Most mid floats we trade fall into this category. Click the underlying stocks link here for further info.

Volatile stocks--such as $CGC--are not eligible for margin.

Hey, did they up it to 4:1 for Canada because on the IB.ca site under USA securities they list as 25%. https://www.interactivebrokers.ca/en/index.php?f=4745&p=stk

-

1

1

-

-

I was talking to DAS today they said that instead of having to click on the montage to enter orders on hotkeys you can make chart specific hotkeys so you can be clicked into the chart. This is done under normal hotkey setup>add new item>command categories dropdown and chartwindow. Helpful for me.

Also under Setup>other setup> Speed. Should be set to High speed although it usually isn't by default.

Also I see A LOT of you guys having your charts vertically challenged. What I mean by that is that the candles have almost NO height to them. To fix this issue right click on chart>study config>studies and then ConfigEx and uncheck-> Include in scale on ALL indicators other than Price candles.

Honestly that last one should be a PSA.

-

Hey Kyle, This might be difficult to do and kind of dangerous to rely upon but do you think it would be possible to implement having it only execute and round to the nearest and smallest board lot (100shares) so you don't execute in odd lots? Obviously and shares <100 (mixed) would have to be executed as 100.

I don't believe it would be possible given what I know of DAS' hotkeys but I thought it would be worth a shot. Would help save on fees. Thx.

-

Not trying to stir the pot here, I understand the custom coded hotkeys from Kyle and speed and reliability of DAS are big benefits. But I have seen other traders from other rooms (dont want to shill them here) use esignal successfully to trade large and mega caps. I find that platform so much more aesthetically pleasing and not looking like it was coded in the 90s. You can have sub 1min charts which ive seen deployed well on mega caps that trade relatively the same everyday and aren't necessarily 'in play'. They tend to show the trends really well. Also you can input se: the 200 daily moving average as a horizontal line onto a intraday 5min chart so that you dont have to constantly look over to a daily chart if that makes sense. Its the little things.

-

On 7/23/2018 at 3:45 PM, Lee W said:Robert is correct.

Jason, here's what you do. Log in to the IB Acct Management page. Go to Statements. To the right, you'll see Create Custom Statement. Click that. On the next page, give the statement a name (maybe Commissions and Fees). Under "period," choose Daily. Then, in the "sections" at the bottom, click Commission Details. A check will appear showing you've selected that one. It is the only one you need to select. Next, mark any of the "Section Configurations" you want. You don't have to choose any. Click "continue" at the bottom right. You'll then get to review you choices. Click "create" at the bottom right. Next page, click OK.

Next you'll be taken back to the Statements page. You'll see the custom statement off to the right. Click the little arrow to the right of the statement name. It will run the statement for whatever date is in the field (in the list of fields).

This report will show you the total commission as well as the breakdown of broker charges and third party charges.

Hope that helps!

The other thing is that as far as I know most people are lazy and keep it set to SMART routing instead of pick ARCA or the like and researching at what share point the route fees actually start to pay you to take positions as well as not routing out dark.

-

On 7/23/2018 at 1:01 AM, Ville said:Are we talking about ECN fees? They are separate from comission that brokers take. You can get them even in DAS simulator. Go to top bar "Trade" -> "Account Report". I'm in simulator and calculate costs 0,0035 per share + ECN fees shown in Account Report. The more you have tickets/scale, the more they add up.

Then there is different lot's. "Board Lot" is block of shares that are measured in hundreds(100, 200, 300, 1000 etc.). Block less then a hundred(60,70, etc) is "Odd Lot" and numbers between hundreds are "mixed Lot". All these have affect ECN fees. It's quite easy to understand. If you add liquidity like Board Lots you get rewarded by lower fees. If you make it harder to the market to fill orders you have to pay like in Mixed Lot.

My biggest weakness is overtrading and these fees has major impact if you overtrade. And Roberts post shows the range were i have seen them vary. But it's great that DAS calculates them so you don't need to guess or average them.

In few strategies i have tested by using LIMIT orders because it adds liquidity and it not only reduces ECN fees but you can get rebate for adding liquidity, hence reducing fees even more. Never seen these rebates in live or done research so not sure does it really work in practice. But at least ECN fees are smaller. Mostly i just try to scale fewer times than Andrew because it'll eat small account if you scale six times on small share sizes.

I still wouldn't start using LIMIT orders in fear of fees. Like Andrew says, at the beginning(or for a while after) it's not important at all. You need to learn everything else first and then you can make adjustments so you can be more cost efficient. But it is still good to know these things exists.

New to DAS. When you say you wouldn't start using LIMIT orders does that mean you use marketable limit orders right now? Ive never heard of them outside Andrews books and DAS lingo. Those are basically buying at the inside Ask and upto the limit you set (i.e ask+$0.05)?

Also whats your fee structure setup with at IBKR? The set fee rate of like $1 per trade or I'm assuming the $0.0035 fee structure. I never did the math. I wonder at how many shares its worth it to switch over.

-

Thanks Ill have a look

-

1 hour ago, Justin said:I would suggest buying a Logitech keyboard that is compatible with their G-Hub macro software. It's always being updated and has a ton of community support.

I'll definitely look into it. Thanks. Any keyboard in particular that you suggest? Im buying all new peripherals here on cyber monday

-

Anyone found software that records multiples at once? I tried OBS but found myself in multiple trades at once

-

On 1/30/2018 at 10:17 AM, Ryan W said:JP, HIDMacros can be a little quirky. As long as you saved the configuration and it's mapped to the correct keyboard, it will stick. But, if you unplug your keyboard or number pad, the ID will change, so you need to double check that. I've also found that HIDMacros "Gets stuck" sometimes. I've made it a habit of closing out HIDMacros as the end of the day and re-launching it so I know it's fresh.

Try this out and let me know if it works. HIDMacros is great, but it's not developed anymore, so it may have some bugs that won't get worked out unfortunately. This is the ONLY piece of software that I've found that actually works properly. There isn't much else out there surprisingly.

seems to have been updated earlier this year. Are you still using this? Thinking about using a seperate keyboard. Perhaps different software?

-

Hey Everyone. You can call me Terry.

I am an ex-industrial mechanic in Albertas oil and gas industry. My body could simply not keep doing the work even though I'm only 25. I got into crypto in 2016 and got caught up in it. I tried trading it for about 5 minutes before I realized it was too choppy and 'manipulated' to trade consistently. So I searched for the most liquid and easily accessible asset to trade, that being the ES mini future. I tried day trading that with a variety of indicators and strategies. Promptly blew out my account, as expected. Sadly this was right before they released the Micro E-minis. I rethought my strategy and needed I needed more a community than doing it all myself. I then went on to follow the low float pushers and started trading those way too quickly without spending enough time in sim and once again blew out my acct. BBT and higher priced stocks is my last hail mary. I haven't had income in over an year. I have dedicated myself to TA and read a ton of books/watched a lot of trading/investing videos from a variety of places. At this point I almost feel I have information overload. It seems I can't have a green day anymore. I watch every trade review, am in the chatroom every morning, and have gone through all the education material on the site. Oh well. Hopefully I can turn this ship around.

Terry

-

23 minutes ago, RTrader said:Yes it will show right away in TWS or the mobile app. But if you trade in TWS it will mess up everything in DAS in regard to your positions and PNL, until the next day. Just FYI on that 🙂

Jason

Thx

Can someone help me make this Hotkey?

in Day Trading Hardware, Software and Tools

Posted

@peterB Hey Peter, Neither of these two. My stop loss in this case for sake of ease is set to $9. But let us assume that its a very technical level that I dont want my stop to move from at all. I always want my stop to stay at $9. What I want to do is take a partial at $11 so that if the stock comes back down to $9 and stops me out of a position I dont take any loss because I already partialled out that same amt in $ value before when I was green.