-

Content Count

348 -

Joined

-

Last visited

-

Days Won

23

Posts posted by hailchaser2

-

-

-

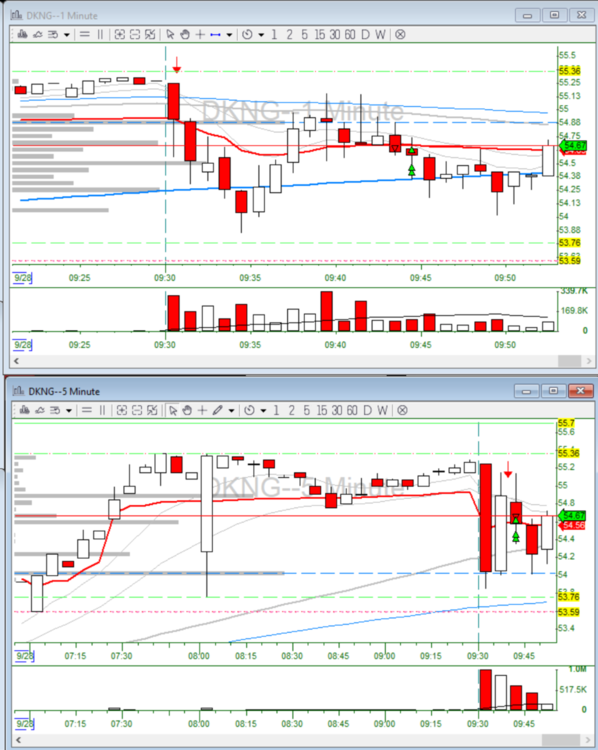

+1.0 R today 3/4.

MSFT 1st try bailed early, 2nd trade was good, third trade was good, but SPY started dropping and killed momentum.

DKNG ok trade, nothing special, had the 200SMA that kept it from dropping like I wanted.

Tomorrow is the last day of “practice” for PCT BootCamp.

My plan is to only risk either $50 or $100 this week, not sure which one yet. I don’t want to dig a big hole because of emotional trading. I won’t know how this “competition” effects my psychology until it starts Wednesday.

-

Sorry all, I'm finding it difficult to find the time to post here since starting PCT BootCamp. Had to test hotkeys and make charts in DaS Demo for PCT. Now I am Journaling in Chartlog, Tradervue, My Playbook in OneNote, and compiling my "Official" PCT TradeBook. Maybe once I get the hang of ChartLog I can get back to consistently posting here.

-

1

1

-

-

On 9/14/2020 at 7:08 AM, Wayne Ferguson said:@hailchaser2 I may have missed it earlier in the thread, but have you posted a link to your onenote trade journal? I stumbled across your thread and really like how you have yours organized and if you are willing to share it I would appreciate being able to use it.

Thanks!

I am a novice at OneNote, so I don't know how to share my template from there. I would be happy to share it if you tell me how, lol.

Attached are a couple of screen shots of my 1MinOrbDown TradeBook setup.

It's basically two different "table" inserts, both 1 row, 2 columns

Top table is for pictures of my trades that I screen shot every day.

Second table is my criteria, trade entries and exits, then Psychology and what I could have done better

Screen Shot of Template

Screen Shot of full page, IDK why its so blurry on this. It won't look like that in your OneNote.

-

1

1

-

-

12 hours ago, Rob C said:Hi Hailchaser2, what is the Peak Capital Bootcamp?

https://www.peakcapitaltrading.com

Andrew has started a prop firm, there is a 3 month "bootcamp" of learning and trading to earn an interview to be hired on.

-

So, trying to decide if I should continue this journal thread, or start a new one for the Peak Capital BootCamp. What do you all think?

-

Are you talking about HotKey issues exiting, or you can’t even exit when you try to do so in the montage?

Maybe take a screen shot of your montage tomorrow. There are different styles of montages in DaS.

-

-

-

-

-

-

+0.02R, 6/13

I was still able to trade even though my account was below $500 in CMEG, but it is with ZERO margin. So my "R"s are all messed up, I am not able to risk 10$ per trade because my shares get limited to max buying power. I'm trying to get back above $500 without adding more capital. Last time I dipped down here, it took a few days before they locked my live account. So I'll address it then.

I plan on doing the Peak Capital boot camp, so I would rather use 1k for that instead of re-loading my CMEG account.

I did not do the R study pic for these, because like I said, my Rs are not accurate with limited buying power.

-

1

1

-

-

For the month +10R, 62% Win Rate

12 Green Days

9 Red days

That is two positive trading months in a row, but with fees and commissions, it's still a net negative month again. I'm ok with that, because I'm working on my trading right now, not my profits. The negative is that my account has dipped below $500 again, so I will more than likely have to add more money to it again. Next month I'm going to have a NET positive month, not just a GROSS positive month.

-

1

1

-

-

-

Here are a few pics of my TradeBook. I used OneNote and made a Template. I have 4 templates total right now both 1MinOrbs and both 5MinOrbs.

Template

I will be able to click whichever strategy, then just hit add page and it will automatically load the template. I can then add my screen pics with drag and drop. Go through my checklists, input my entries exits, put a checkbox in my Psychology. then put any notes on what I could have done better in the trade to help see where my areas of improvement are.

I print each trade out and put it in my BBT TradeBook 3 Ring Binder.

Today I went back and entered all of my 1MinOrbUps for the past two months and printed them out.

I'm considering printing out the page without filling out the checkboxes and remarks. I think doing it by hand might have a better "imprint" on my mind.

-

1

1

-

-

I took the time today to start my Tradebook, I went back through all of my trades the past couple months and put my different orbs in their own folders, 1min orb up, 1 min orb down, 5 min orb up, 5 min orb down. I realized I was trading pretty well before I started my "all day trading" at work last week.

I used OneNote to make templates for each trade strategy. I'll share them here tomorrow when I get back on my trading laptop

https://twitter.com/hailchaser2/status/1299875988235485190?s=20

-

-

-

-

-

-

Friday -2.9 Max Loss 3/9

2:1? 3/3

4:1? 2/3

PDD Pre Market 3 trades. I think I need to stop trading pre-market. It takes away from my pre-market prep, I concentrate on the trade instead of watching all of my stocks in play and planning an open strategy.

PDD.1 -0.9R

PDD.2 -0.56R

PDD.3 +0.71R

2:1? YES

4:1? YES

AAPL 1MinOrbUp +1.1R

2:1? YES

4:1? YES

SQ.1 5MinOrbUp -1.03R

SQ.2 5MinOrbDown -0.74R

SQ.3 BODown@Level 0.24R

2:1? YES

4:1? NO

BA 5MinOrbDown -0.6R

AMD BODown@Level -1.24R

-

Thursday 9/10 +2.4R

2:1? 5/9

4:1? 2/9

BA.1 Pre Market +0.05R Look at that bad fill on my exit! LOL

2:1? YES

4:1? YES

INTC 1MinOrbUp +0.39R

2:1? NO

4:1? NO

BA.2 1MinOrbDown +0.06R

2:1? NO

4:1? NO

BA.3 5MinOrbDown +0.9R

2:1? YES

4:1? NO

BA.4 LighningBoltUp +0.5R

2:1? YES

4:1? NO

AMD.1 5MinOrbDown -0.8R

should not have went short with the first 5 Min candle having a big bottom wick.

AMD.2 5MinOrbUp +0.1R

This ended up running to 8R, but I only made 0.1R on it because I was afraid of the daily levels above my entry, but looking at it now. thefirst 2 5 Min candles both had big wicks down, I should have had more confidence in this trade.

2:1? YES

4:1? YES

TGT.1 5MinOrbDown +0.16R

2:1? NO

4:1? NO

TGT.2 5MinOrbDown 0.12R

2:1? NO

4:1? NO

INTC.2 Double Bottom +0.94R

2:1? YES

4:1? NO

-

1

1

-

New Trader Journal

in Day Trading Journals

Posted

2/2 +1.0R

First day of PCT, I am happy with my start. This weeks goal is to trade small and get used to the pressure of the competition.