-

Content Count

286 -

Joined

-

Last visited

-

Days Won

10

Posts posted by nassarsyed

-

-

-

Holding 1/4 position with B/E stop overnight. Don’t like the volume. Should have taken all out at EOD. will see tomorrow and take early profits due to Fed meeting.

-

I stopped on HRB for a 1R loss.

Today I initiated a Long position on NFG. This is a relief move, I think we should see 47.5...

Entry at $46.14 with a stop of $0.34 adjusted to 1R position size

I exited 1/2 on 2 R, and 1/4 on 3R profit - the balance of 1/4 is at B/E SL. Booked 1.75 R with 1/4 at BE Hard Stop

-

On 7/29/2019 at 1:20 AM, JenniferL said:Hi Nas -- Thanks so much for sharing your trades -- I am starting out with swing trading, and just did my first journal entries.

Can you share what parameters/tools you use for your stock screen. I am playing with Stock Charts and Finviz. Personally I like stock charts because there is so much educational material, Finviz is much simpler.

Thanks!

Hi @JenniferL you are welcome - I use Finviz for filters primarily and Tradingview for analysis. My 2 Go to filters are price moving over 20 MA and other one is the a hook, like the one I am posting on NFG next.

I also use volume, Trendlines and gaps...

-

Stopped out on BMY with Brian. - 1.1

still in HRB. came close to stop.

Tomorrow ahluld love higher due to BA and markets.

No charts as I am travelling.

-

1

1

-

-

-

Went long HRB again betting on this "Pull back" in strong uptrend.

Entered Long $28.34 with a $0.35 SL adjusted to 1R position size. Concerned that today it could not pop over 20 MA home-base, will watch carefully tomorrow, if it convincingly conquer 20MA, than I am out...

It sort of jumped off the 50 MA on the 15th of July...

First target should be $29.10 @Brian Pez

-

-

-

Watching HRB -decent pull back to 20 MA, stock trending well up... Entry on cross above 20....

price closed up strong on 60 min chart. brice near low of large green breakout candle

-

Entered EA along with Brian, I was watching this as well.

I agree with his technical read, EA bouncing of lower part of long channel and bouncing long serving pivot (end 2017) Targets tomorrow above 94 +

-

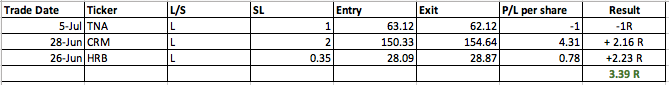

Results so far:

+ 3.39 R or 3.39% return on capital - based on 1% R Risk per trade.

Swing Trading Strategy

Here is the trading strategy I am using, I won't go into numbers but use a max stop loss per trade of 1% of working capital while I am learning. This is my 1R and you will see this as being referred to as such.

so technically, I should be able to take 100 losing trades in a row....

The way this works is, that e.g. your capital is $10,000, your 1R becomes $100. That number than determines the #of shares I would take in a trade.

E.g. if I enter a trade with an initial stop loss of $2.00, I would take 50 shares. If the initial stop loss is $0.35, that would mean I would take 285 max share size.

I use Hard stops.

I try to get a minimum of 2:1 winners to losers over time. I do scale out in 1/3 increments.

Make sense?

-

Stopped out with loss of - $105 - although the move I was expecting did happen, but later in the day. The market dropped on the job numbers - Even with a wider stop I would have stopped out based on cutting YLow. Oh well, this is trading at it will happen.

Green on swings for the week, will post results tomorrow.Good thing, had my loss stop for $100 and stuck to plan.

-

Bought 100 TNA $63.12, stop at 20 MA of 62.12 risking a dollar, initial target $65.12 for a 2:1 risk on this trade

Small Caps bounced of their 20 MA and closed strong towards day's high although on a shortened session. Sentiment is good, China is a friend and markets seem poised for a breakout barring negative news. Bullish hourly candles into close.

-

Exited CRM for 154.64 - for a $4.31 profit risking $2.00 - this can run over the next few days but don't want to hold in short week - Lack of volume and catalysts made the Gap up in the market the only good thing, volume and volatility dried up quickly - take profits and rest....

-

Took up a small position in CRM today - Bought 75 @ $150.33 Stop $148.33 - Seems to be in a downtrending channel short term, but bounced off 100 MA as well as medium term trending support line. It had 50/50 chance of breaking down further or as it can, it may run up. Will move Stop to 149.33 - Initial Target is 153.50 - will scale another piece around 155 - will keep last to run past 157.. Depends on market conditions. Institutions seem to be stepping back in to this strong performer.

-

Okay out of the position, 50% at 28.74, balance at $29.0 don't want to hold going into weekend and G20.

made $0.78 with $0.35 risk 2.2:1 Factor not bad. Only did a 100 shares though 😞

@Brian Pez, anything I could have done better here ?

-

UPDATE - took half off at 28.74 ).65 cents profit, moving stop to 28.28. small position size so cant scale too much

Haven't posted in a while, with summer months, going to be swing trading more as we lack volatility at the opens..

Took a small position on HRB at 28.09 stop 27.75

- Bounce off 50 MA and Green candle and Gap up. First target 28.75, hopefully market will co-operate - looking for a buck with 0.35 risk 1:3.

-

Haven't posted in a while, with summer months, going to be swing trading more as we lack volatility at the opens..

Took a small position on HRB at 28.09 stop 27.75

- Bounce off 50 MA and Green candle and Gap up. First target 28.75, hopefully market will co-operate - looking for a buck with 0.35 risk 1:3.

-

-

Been out of Swinging recently, as we had lots of good day trade opportunities, but here are 3 I like. Market has pulled back, so may be a good time to go long on some strong stocks. All 3 finished up strong.

TickerL Zuo

Strong close on Daily and hourly basis, crossed over 20 MA

Buy on Gap up in the morning, Stop Low of today. First Target 24.55

TickerL AYX

Strong close up, closed above home base..

Buy on gap up, Stop, low of today, targets, 1st scale 74, ultimate 79 - Near 52 week High.

Ticker:KL

Closed above 20 MA, filled Gap from Breakdown candle, moved lower, but close above 20 MA in green candle

Buy above 35.30 - first target 36.74 - Near 52 week high

fyi @Brian Pez

-

On 2/9/2019 at 9:30 AM, Stuart said:Nas'

Just saw this post. I checked the prices on the three stocks you mentioned Nov 13, and it would have been a nice win if even shares were applied to all three. BBBY+1.31, NTLA-4.82, BECN+6.63. (according to finviz this morning) 312 bucks on a 5963 investment given 100 shares on each stock. Better than 5% as of today! (I think my math is correct). I really liked your strategy on these. Do you think you would have held the swing that long? I've held a lot longer on trades and done a lot worse. lol!

Great post!

Regards,

Stuart

I think according to my rules, all 3 would have stopped out. If you held long, yes they would have worked out, but I would have re-entered if they triggered when the market started its next up-leg. The only things I hold long are INDEX funds like TQQQ, SQQQ or FFTY

-

-

Entered KDP Today at open as the higher Gap open triggered an entry and it broke above the downtrending line (yellow) on volume.

Entry was at 26.71 with an initial stop at 26.30.

It closed at 27.22 and moved the stop now to 26.55, looking for it to break the breakdown candle high from Nov 20th over the next few days. First target is 27.75 and than 28.50

EQT has not triggered an entry...

Nas' Swing Trades and Results

in Swing Trading

Posted

It’s 2 posts prior to the TSLA one. Here is the image