Silviu

-

Content Count

24 -

Joined

-

Last visited

Posts posted by Silviu

-

-

Hello! I would like to try doing day trading on a real platform (I have been practicing for more than 6 months), using break of the high of the day strategy. I usually buy once per stock and sell several times as it goes up (assuming everything goes well). I rarely do more than 2 different stocks per day (usually AAPL being one of them). I can use about 10k for now, so I won't be able to do day trading in the USA. As far as I understand there are other options, outside US but still trading US stocks, but with higher fees. What would be the best option for me (as a beginner and given my strategy)? Thank you!

-

Thanks a lot! I was just using the opening range as a comparison with the ATR, not the gap, too. So basically, ideally, we would want a stock that gapped (such that we expect some momentum in a given direction), but the gap + the opening range of the first candle should be smaller than the ATR, such that there is still room for the stock to move.

One more questions: What if the gap is bigger than the ATR, but the stock moves in a direction that reduces the gap. For example, what if in the example you showed above the stock would set up for an opening range break up, instead of bread down? Would you take that trade? Or do you take the trade (at least for ORB) only in the direction of the gap (so downwards in the example above)?

-

Hello! I saw it mentioned many times that one of the most important requirements for ORB (here I am talking about 5 mins ORB) is that the ORB is smaller than the ATR and I have a few questions (I am aware that everyone has different trading styles, so any advice from your personal experience is greatly appreciated). How do you calculate the ATR? Do you use the daily average over the past few days (and if so how many?)? How strict are you about ATR being bigger than the ORB? Is it a strict rule, or you would take a trade if other indicators are good. For example if the ORB is bigger than the ATR by $0.5 on a $100 stock, but there is large volume in the right direction and an ABCD pattern on the 1 min chart, would you take it (assuming it is one of the stocks you were looking at)? Does it usually work, or should I just completely ignore any stocks with the ORB bigger than ATR? Thank you!

-

@NikkiB actually trying to watch several stocks at the same time especially for ORB is one of the main things that affects me, too. I didn't think that using just one stock would give me profit. May I ask how much do you make per day on average (in terms of R)? Also, when you say one stock per day, do you mean it is always AAPL (or at least APPL for a long time), or it can be a different one every day?

-

Thanks for this! May I ask what strategy do you use to trade AAPL?

-

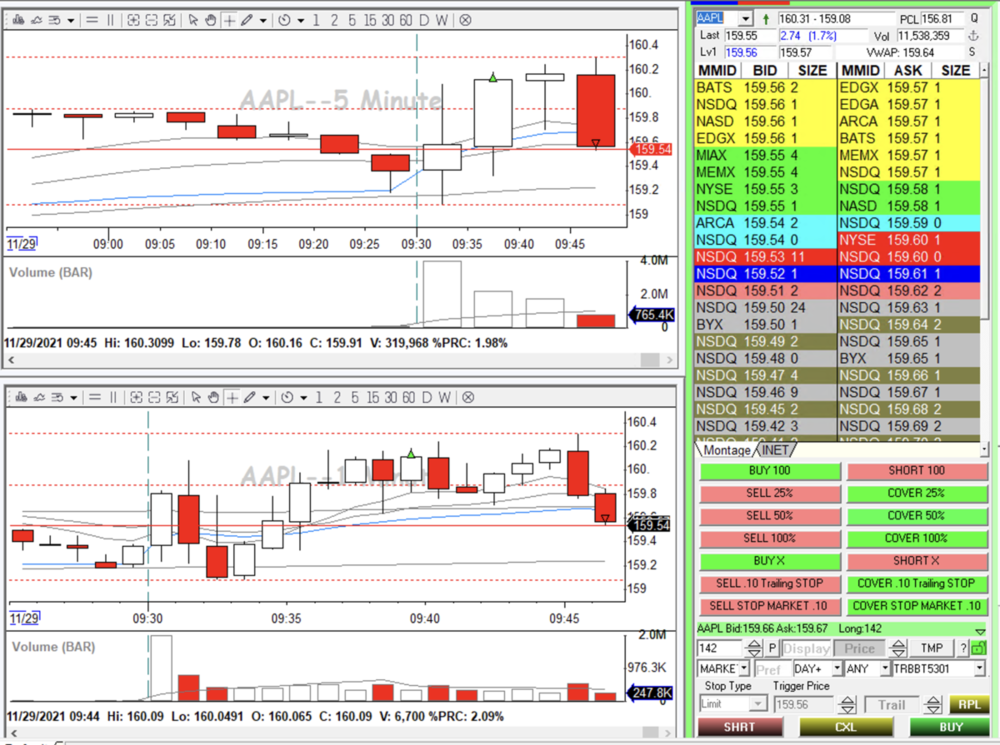

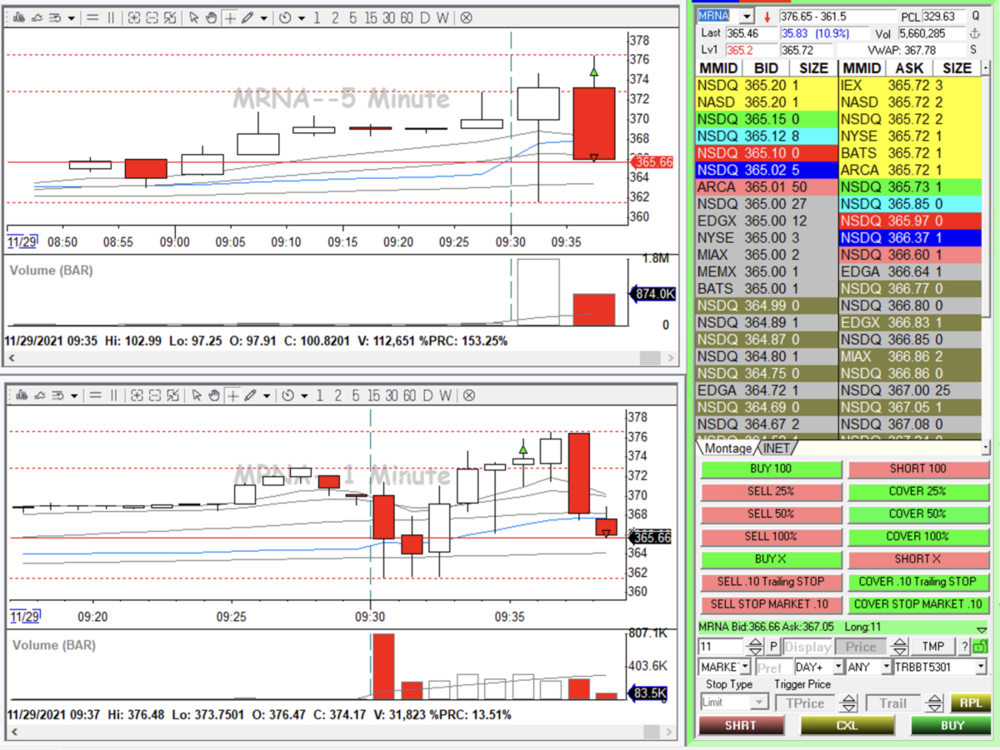

Thanks a lot for this! I attached below 2 trades I took today (the only 2 I took after the ones I posted, I am not choosing only the failing ones). For the AAPL one I saw an ABCD pattern on the 1 min chart and also there was that hammer red candle before that tried to go down but it was pushed up strongly so I really thought it will work (on top of all the rules I mentioned in the original post). For MRNA it wasn't a clear ABCD pattern, but again a strong hammer before. I guess the problem I am trying to figure out is what is the best way to improve. I am taking screenshots of all my trades and try to write down the thinking process, but for these last 5 trades (and many before), except that AMD issue maybe, I am not sure what I would change. I mean (at least from my beginner perspective) I don't see something wrong with my entry and if I would be in a similar situation I would probably do the same. I guess the issue is that these trades that seem good but fail don't give me any feedback to work with (i.e. I don't know what in my thinking process was wrong), so I am not sure how to figure out what I am doing wrong. At this point working on managing the risk/taking profit doesn't even matter as I get stopped out before I can even take 1R (and setting the stop loss even lower wouldn't help in most of these trades). It is true that I am not good at picking stocks yet, but usually I just choose the ones mentioned in the chatroom, usually Andrew's ones. Of course he has so much experience, but he heavily uses ORB, so I assumed that at least I can trust that the stocks are suitable for this strategy. Do you have any advice on more entry rules (or anything really). Thank you!

-

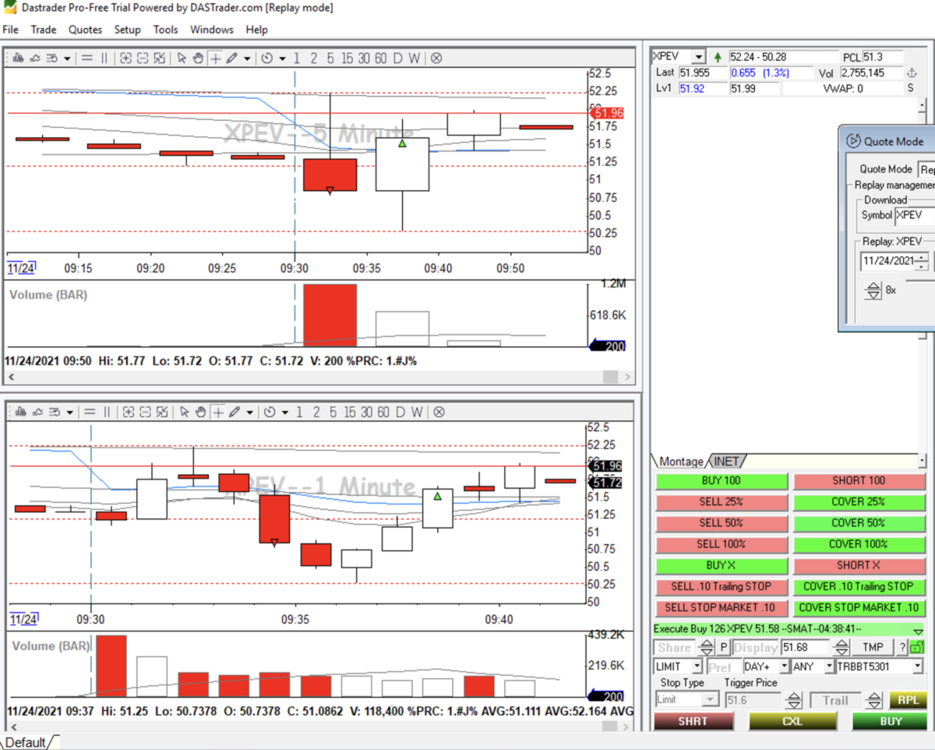

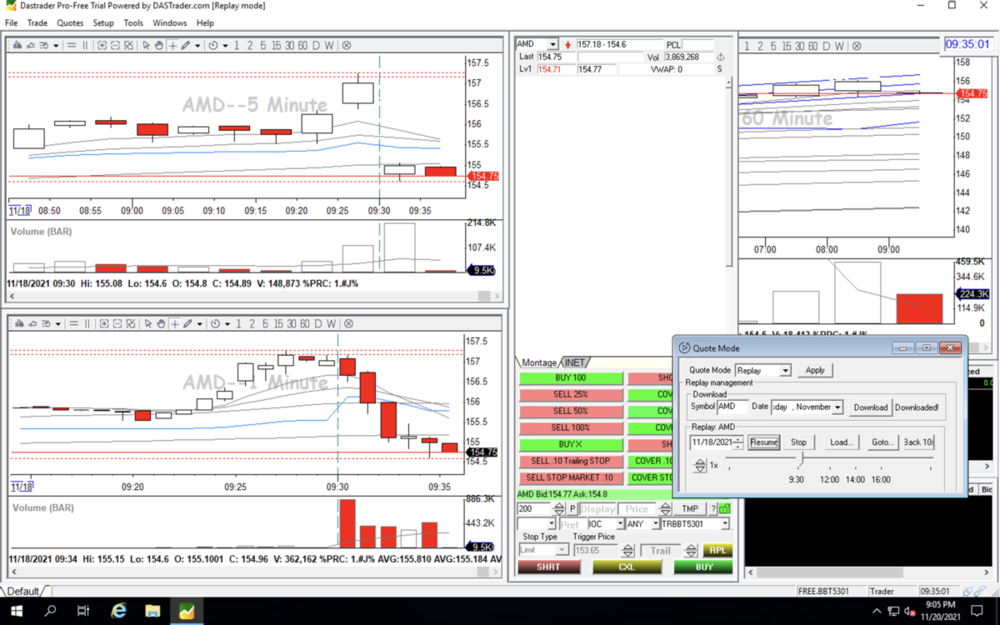

Hello! I have been practicing the ORB strategy for about 3 weeks. I know it is not a lot of time, but I feel like even if the way I approach it improved since I began using it, I still fail at it. I attached below my last 3 trades trying to use this strategy. Currently I usually entry when the opening range is actually broken on the 5 mins chart (I use the wicks not the body), I entry when I see increased volume on 1 min and 5 min chart in that candle I enter on, I make sure I am not too extended from VWAP and also make sure there are no resistance levels along the way (I tried to do all of these in the trades below). Also, I am using stocks that are recommended in the chat room. I set the stop loss right below (or above) VWAP and my targets is usually 1R (or integer or 0.5 values). However, I failed all the 3 trades below (I got stopped based on my stop loss). And these are just the last 3, but most of my trades are like this. I am aware that this strategy is not 100% successful, but I definitely lose more than 60-70% of the time, even when I use all the rules above, so I guess I am still missing something about this strategy. Can someone advice me? I am really not sure what other indicators to use. Should I use larger timeframes, too? Should I set my stop loss further away from VWAP and take profit faster (maybe 0.5R)? I really feel stuck and I would appreciate any suggestion on how to improve with this strategy. Thank you!

-

-

Thanks a lot!

-

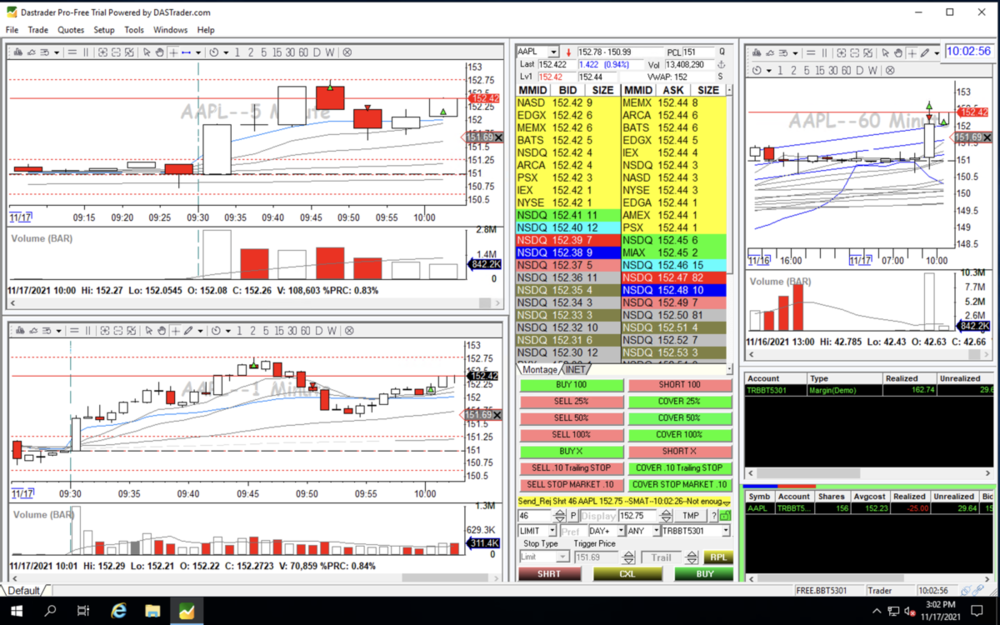

Hello! I attached below a SS of the trade I am talking about. I bought 156 shares of AAPL at 152.23 and I am trying to place a limit order of 46 shares at 152.75. However I can't seem to be able to do so. I am getting a message saying "Not enough buying power!". Can someone explain to me what I am doing wrong? Why do I need buying power to sell shares I already have? Thank you!

-

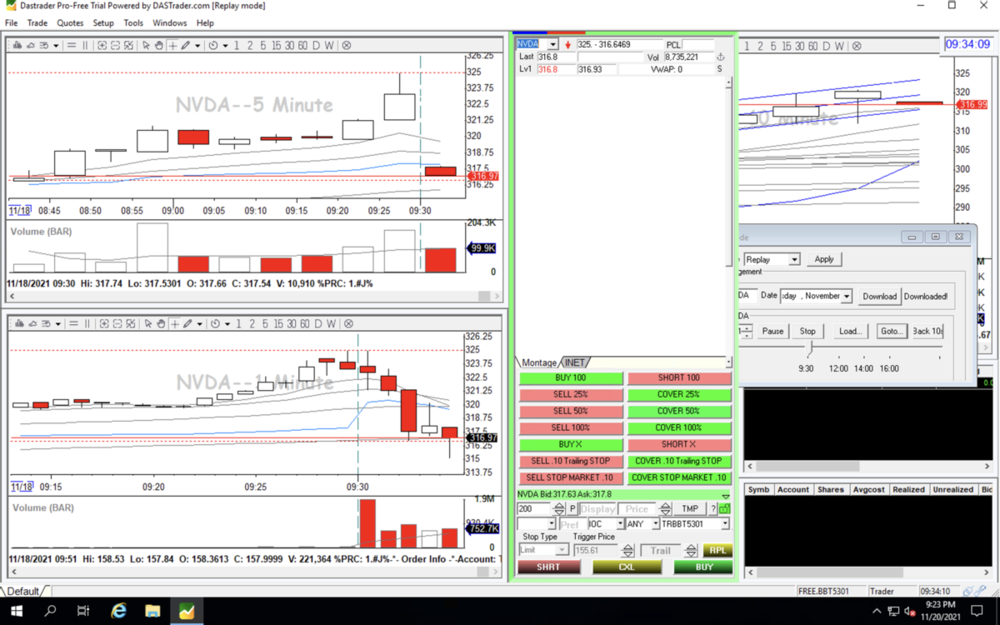

Hello! I am just getting started with using the DAS simulator and I want to practice ORB., but I am having some issues when trying to apply what I learnt from the videos. Any advice on how to improve would be greatly appreciated.

I attached below a screenshot of one of my attempt to ORB (just the first 15 mins). I think most of the indicators were there: it had a decent premarket activity, the volume in the first 1-min and 5-min candle was pretty big and it was not too extended from VWAP (I entered a bit earlier, but it looked good to me). The way I enter for now is by using the hot key in which you click on a level and DAS automatically calculates the number of shares needed for a risk of 50$ (this is what I decided to use for now). I clicked just below VWAP, so my risk was about 0.5$ per share, so I had about 100 shares. However, I realized I was so lost in deciding where to exit my position. I sold 25% at the first red triangle, which happened to be the top of that second candle, but that made me about 0.5$ per share, so in total 25 x 0.5 = 12.5$. Then my stop lost was moved at break even, and I made nothing there. So overall I made 12.5$.

I guess it's not horrible, but given that the risk was 50$, I would need to do 4 trades like this, just to cover a bad one. If I waited for longer before taking profit, I wouldn't have reached the stop loss, and I could have gone to 152.50, but I had no idea when to take profit. And I've noticed this in several other ORB trades I took (today was my 3rd day only, so not a lot of statistics). I make very little money, as I exit too soon (given that I don't have any technical indicators nearby). By little money I mean much less than the risk. Can someone advice me on how to improve (tell me what I am doing wrong)? Should I just wait until I get to at least 1R before taking any profit (assuming there are no technical indicators along the way)?

(Sorry for the long post!)

Thank you!

-

Thank you!

-

Hello! I just bought the demo version of DAS, but I can't seem to see the premarket data (in live mode, no replay mode). If I type a stock name before 9:30, I see as the last time 4:00 pm of the previous day. How can I see the data from the premarket in real time? Thank you!

-

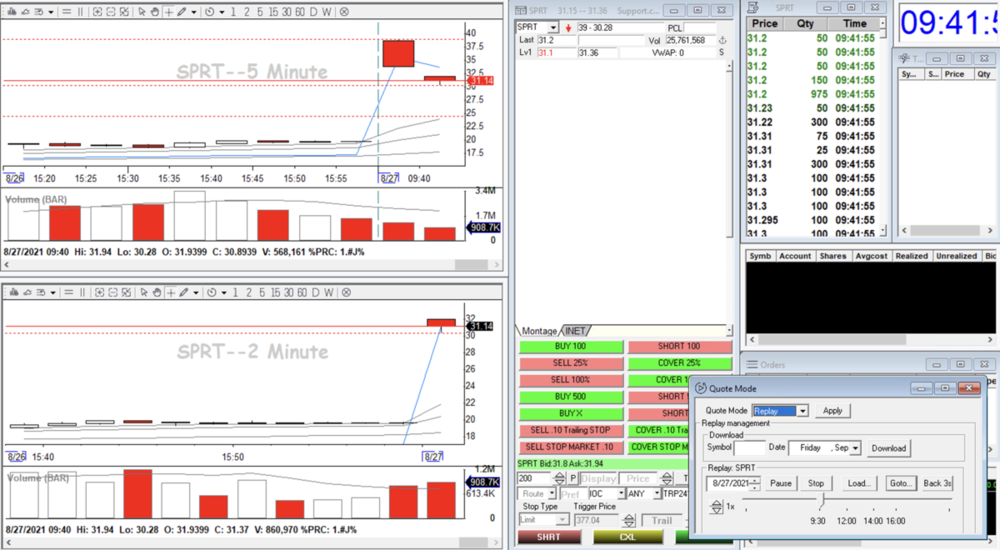

Hello! I am trying to look at some stocks in the replay mode using the free 2 weeks trial of DAS and I am getting some weird results. I attached below a SS of this. For example, I tried to use the Go to button and move from 4:00 am to 9:35 am, but for some reason it moved to 9:40 am (I tried several times and with several stocks and I got the same result). Also, despite the time being 9:41:50 in the SS below, the 5 minutes chart is at its second candle, when it should be at its 3rd and the 2 minute chart is at its 1st candle, when it should be at its 6. Everything looks messed up. Am I supposed to do some configurations before using the replay mode? Can someone help me fix this? Thank you!

-

Thanks a lot! Why is that the case? Also, if I am to use Equalized Risk Per Trade button, will that at least select the right number of shares (even if it doesn't place the stop order), given the place where I double click (I noticed that sometimes the number of shares bought when I use that hotkey is the same regardless of where I double click, in replay mode).

-

Hello! I am using the 14 weeks free trial version of DAS simulator and I added the hot keys Equalized Risk Per Trade. If I use them with live data, it seems to be working fine (the stop loss symbol gets placed where I double click, and I buy the right number of shares). However when I use it in reply mode (I used it for AAPL on 23rd August 2021), it doesn't seem to work properly. When using the hot key I see no stop loss mark on my chart. Also when the price went below the place where I initially double clicked, it didn't stop me out automatically. What should I do to fix this issue? Thank you!

-

Thanks for this. I haven't, I will look into it. Honestly, over the past months watching videos in which they show in practice how to do stuff was more useful for me than reading about it (and eventually seeing some figures), so I would prefer videos. But I will give it a try.

-

Hello! I would like to do some swing trading to bring my account to 25k. I watched some online lectures on pair trading and it is going fine (still paper trading). I was wondering if you can point me towards some other strategies for swing trading. Thank you!

-

Uh, it is the M1 chip mac... Have you ever tried (or know someone who did) using a remote desktop option (using teamview for example)? I could have access to a Windows machine that way, but I am not sure if the delay would be too big.

-

Thanks again! One more thing, do you know how much slower is DAS on a virtual machine? I am using a MAC and as far as I understand DAS requires Windows. Or do you have any suggestions on how should I use DAS under this circumstances (beside buying a windows machine :P)?

-

Thanks a lot for this! One more question (sorry I just want to make sure I get it all right from the beginning). You said: "if you plan to learn only in sim then you could use tws to see what trading is about. but then you will have new challenges when you will go live and there is a quite big chance you will struggle with the platform and your own capabilities.". I am a bit confused. Shouldn't I learn how to trade only in sim (with live data, of course, but not real money)? Isn't the 100$ DAS version only sim, too? Also, if I decide to continue actual trading (using real money) also in TWS (after doing paper trading in TWS), why would I struggle when starting to use real money? Shouldn't TWS paper trading and live trading be exactly the same in terms of functionalities? Or did you mean that if I paper trade in TWS and then move to DAS I would struggle?

-

Thank you for you reply! As far as I understand, the main difference is in the fact that DAS has some extra functionalities, that are probably really useful in practice. But it still seems like DAS is about $90 more per month than IBKR Lite (plus the fact that DAS requires IBKR Pro, which adds extra costs for trades, maintenance fee etc.). I guess my question is if this pretty big difference (for someone just getting started) is worth it (I am willing to pay for it, if I am sure that is it actually a good idea). IBKR Lite does offer a trading simulator and live market data. One other thing that confuses me a bit is the difference between Lite and Pro (unrelated to DAS now). It seems like the difference is in the fact that Pro has an API and lower margin rates. But given that I plan on doing day trading and hold the stocks for few minutes, the margin rates should not be a problem. So beside that API, I see no advantage of using Pro. Thank you again for your help!

-

Hello! I just started learning about trading, so I apologize if my question might be silly (also I hope this is the right place for this question). A few weeks before joining BBT community I made an IB Lite account and I played a bit with their paper trading Trading Workstation app. I read a bit online and as far as I understand (please correct me if I am wrong), even with a Lite account I can subscribe to live market data and Level 2, and overall that would cost about $60-70 per month (for the main ECN's for stocks). After joining BBT, and watching some of the education videos and live trading, I really started to like the DAS layout and functionalities, but I am not totally sure I understand the big price difference relative to IB. For simulator it would be $100 per month while for the actual trading, thorough IB, it would be $150 per month (right?). I assume that the price includes live data and level 2, but IB+TWS seems to offer this for only $60. Also for Lite, there are no commissions for trading or inactivity/maintenance fee. Is the data from IB Lite not real time, even if you subscribe to Level 2? Can someone help me understand the benefits of DAS? Thank you!

Trading with less than 25k

in Day Trading Hardware, Software and Tools

Posted

Hello! I would like to try doing day trading on a real platform (I have been practicing for more than 6 months), using break of the high of the day strategy. I usually buy once per stock and sell several times as it goes up (assuming everything goes well). I rarely do more than 2 different stocks per day (usually AAPL being one of them). I can use about 10k for now, so I won't be able to do day trading in the USA. As far as I understand there are other options, outside US but still trading US stocks, but with higher fees. What would be the best option for me (as a beginner and given my strategy)? Thank you!