Abu Danny

-

Content Count

12 -

Joined

-

Last visited

Posts posted by Abu Danny

-

-

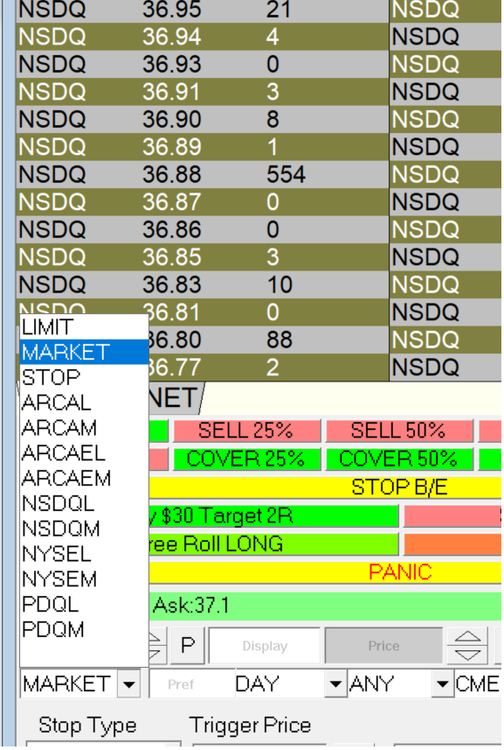

@MattJT just use Market and Limit and what i have with CMEG it automatically uses PDQ and based on my statement i'm getting the BBT discount

-

-

great piece! IMHO bounce in $TLT happens when $TYX breaks down the 1.2-1.3 yield support level , then TLT will shoot.

-

-

I am trying to get a hotkey which would sell (lets say a long position) 10 or 25% percent of the open position to lock in some gains but still adjust the Target Range order .

Here is what i currently do

1) Enter into a trade with say 2R (that is a hotkey). e.g using a $20 risk .

QuoteStopPrice=Price-0.01;DefShare=BP*0.97;Price=Ask-Price+0.01;SShare=20/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=SMRTL;Price= Ask+0.05;TIF=DAY+;BUY=Send;DefShare=400;Price=Ask-StopPrice*2+Ask;TriggerOrder=RT:STOP STOPTYPE:RANGE LowPrice:StopPrice HighPrice:Price ACT:SELL QTY:Pos TIF:DAY+;

2) I want to lock some gain say 10% so i execute the following (yes i know i am canceling existing Trigger order but i cannot find a way to grab/replace it programmatically inline)

QuoteCXL ALLSYMB;ROUTE=LIMIT;Share=Pos*.1;Price=Bid-.01;TIF=DAY+;SELL=Send;

I want my second hotkey to sell the 10% and re-set my targets based on the new remaining shares. However my problem is that Trigger range order is not executing and i cannot debug it . It is technically the command from step 2 and the triggerorder with stop just below the avgcost and X times that risk ( X here is set to 10). Can be adjusted on the chart later.

QuoteCXL ALLSYMB;ROUTE=LIMIT;Share=Pos*.1;Price=Bid-.01;TIF=DAY+;SELL=Send;Price=Ask-AvgCost*10+Ask;STOPPRICE=AvgCost;StopPrice=Round2;TriggerOrder=RT:STOP STOPTYPE:RANGE LowPrice:StopPrice HighPrice:Price ACT:SELL QTY:Pos*0.90 TIF:DAY+;

-

-

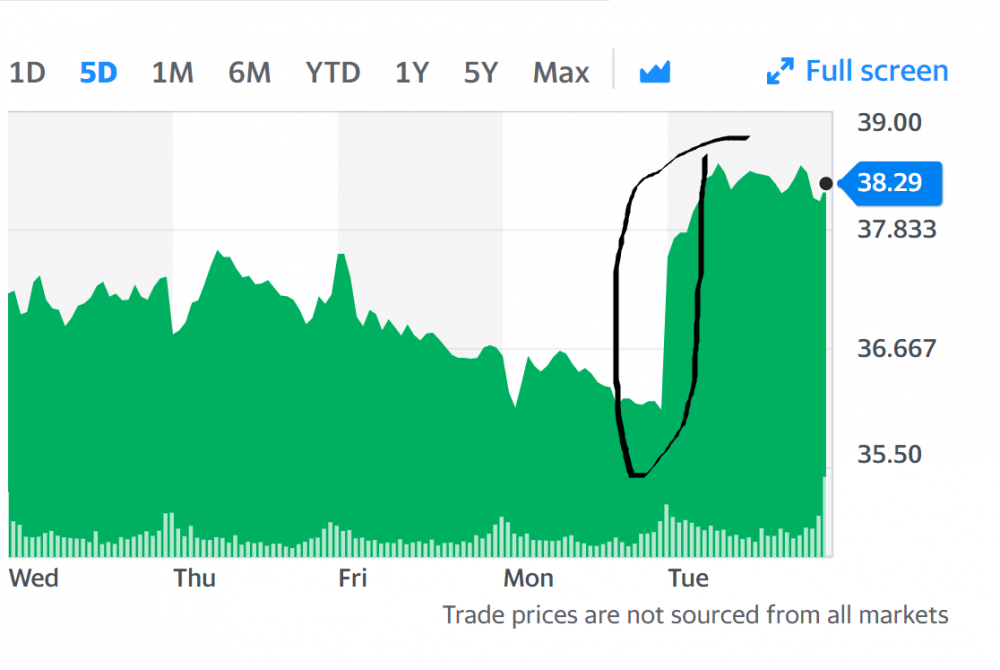

@JaradBBT so watching your webinar and seeing your excellent trend on OXY i'm more curious now.

XLE (energy sector) was booming yesterday and thus pulling OXY with it. So you were simply looking at August future oil market change in PreMarket?

saving trendlines after closing the das

in Day Trading Basics

Posted

I noticed that Carlos every morning has the trend lines (support/resistance) he plotted previously still show up.

For me they are gone after i close my das .

what is the setting for that?