-

Content Count

223 -

Joined

-

Last visited

-

Days Won

34

Posts posted by IamKarthi

-

-

16 & 17 Oct 19

I have been on and off in the chatroom last 2 days due to my other engagements. I think I should be back to normal trading starting next week.

-

On 10/14/2019 at 11:31 PM, Greg D said:Some great trades today Vikram! Like you, I won’t get near stocks like $SES as well as stocks that have greater than 30% short float. So many traders in the chat room choose to take super risky trades and I just don’t want to get burned by playing with fire. I ended up with a 1R day which is fine with such a low volume day.

Green is Green. 1R is very good. 👍. Yes, I don't trade lowfloats esp anything less than 10M flt. I do like trading the high Short float stocks, when they gap up and have some positive catalyst. Very long biased on this.

-

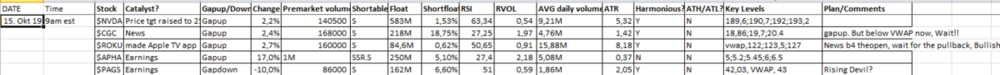

15Oct19

Red day. -3r. Today I missed the Rising devil on $PAGS at the open. It is difficult to comprehend how small distractions can mess up trades esp at the open.

Watchlist: $NVDA, $CGC, $APHA, $PAGS and $ROKU (added later on a news)

Trade 0: $PAGS, the one I didn't take. Few seconds after the open, $PAGS setup for Rising devil, I was going to enter and the alarm went off. That is enough for me to miss the entry and 4 points move. I didn't want to chase it, moved on to $ROKU.

Trade 1: $PAGS. Later, as i noted the stock pulling back to VWAP, took short. After one partial, it formed double bottom and stoped me out. Today was not going to be riding till close. $PAGS receovered later.

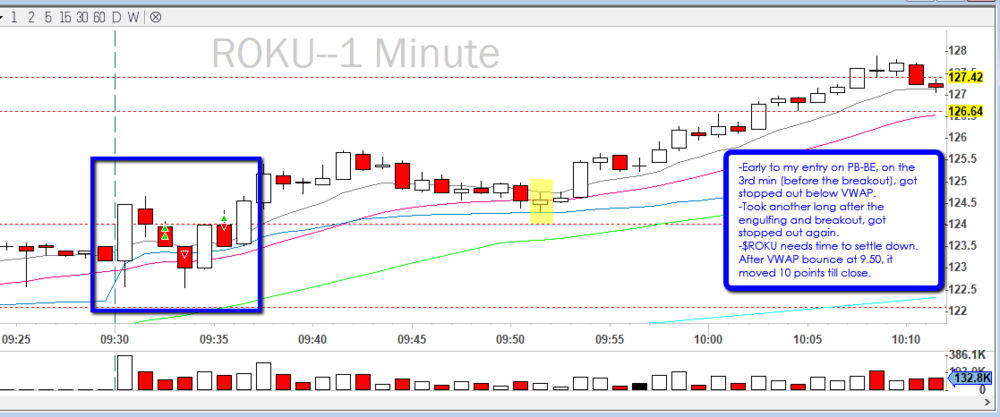

Trade 3: $ROKU. After FOMO on $PAGS, i moved to $ROKU. May be I was pushing for a setup, got in early on ORB. stopped out. Long again after the 1min engulfing and breakout, stopped out again. $ROKU takes time to settle down, after the VWAP bounce at 9.51AM it moved 10points till close.

Trade 4: $PAGS. $PAGS setup for the VWAP bounce TT (the one I missed on $ROKU), Took long and partiled at daily levels and at 200MA 1min. It was also and ABCD after bouncing off VWAP.

Good: i didn't chase entry on $PAGS. No revenge trading.

Improvement: I think $ROKU is a FOMO trade. I was pushing for entry, instead of waiting for the setup at the open.

-

1

1

-

-

14.Oct.19

Greenday. +2r.

Watchlist: $PE, $CRWD, $YNDX, $FAST

Trade 1: $PE. Took Rising devil setup on this. Stock had gapped down due to acquistion news. I took short just above VWAP, 2 portions. One got stopped out above 50MA, other one was above 200MA, that survived the stopout. Partialed at daily levels and got 2r/3r on this. Added after the stock pulled to VWAP, but it was forming Double bottom with big volume. So got out on the next candle. This is similar to my $YNDX trade from Friday. I held longer this time and got out only after the confirmation. my best trade of the day.

Trade 2: $PE. After the ORB trades, I waited for the price to breakout VWAP and took long. L2 had a Seller trying to push the price down, but still stock was strong to go back to 200MA on 1min. I got out last part, after the stock got weaker.

Trade 3: $OXY. This is from the reversal scanner, after noting double bottom, I took it long got out at VWAP. Then the stock broke out VWAP came back and bounced off VWAP, this is a new setup, so went long again, got out at daily levels.

Trade 4: $OXY. Noted 2 shooting stars on 30min. Took short, but got stopped out. Stock went back to 20MA before reversing to VWAP again.

Trade 5: $ROKU. Roku bounced off 200MA on 15min, such a strong support. Took it long for reversal, but got stopped out.

Good: I improved from my $YNDX trading from friday to $PE trade today, both Rising devil setups. This is a common setup for me, Rising devil followed by VWAP pullback short. If I get all out due to Double bottom, then there is an opportunity to go long till VWAP or HOD. atleast 3-4 setups available continously.

I made a conscious decision not to include $SES in my watchlist today (~1Mn shares flt). Although it created such a ruckus in the room today, I am glad I wasn't even tempted to look at it. These kind of lowfloats don't deserve my watchlist.

Improvement:

- Bounce off MA is not working out recently, may be due to the market conditions. Need to reevaluate if I am going to take this again, may be on certain conditions (for e.g 9/20 already crossed on 1min)

- Made an error on hotkey again. instead of covering I pressed short.

- I should have stopped after my 3rd losing trade of the day.

-

3

3

-

On 10/12/2019 at 2:25 AM, Greg D said:Vikram, what a great trading day! So this is what it’s like in a regular market with normal volume.? I was at seven R and took two more trades and ended my day at five R.

Great to know you are doing so well 🙂 ... Earnings seasons are usually good to trade except for the occasional Market dumps and squeezes which are happening more often these days!

-

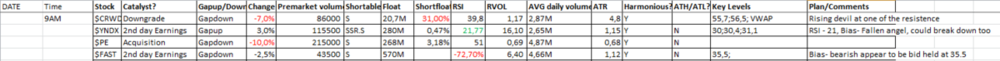

11Oct19

Greenday. +6r. Busy trading day, today I was able to spend the whole day looking at the market and trading. Green Friday once again.

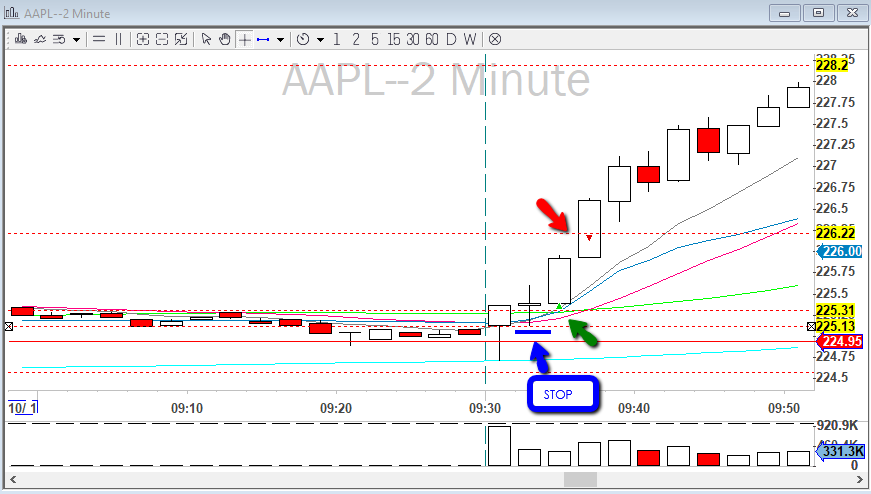

Watchlist: $ AAPL, $ROKU, $FAST and $YNDX. $YNDX had gapped down against the market and $FAST was harmonious setup(both earnings).

Trade 1: $YNDX. Rising devil setup. Short below VWAP, Stop 25c. Partialed at 2r, but the price turned against me and I got 2 more partials.

Trade 2: $YNDX. After the pullback to 20MA, added to my position, partiled towards low of the day. Added to my position again by mistake, got all out.

Trade 3: $YNDX. Later at Noon SPY dumped and pulled most of the stocks down with it. Slowly all the stocks were recovering to their original position, Robert called out $YNDX. And I took it long at the key level of 29.5 for 2:1 AON exit. Stock squeezed and I got my fill.

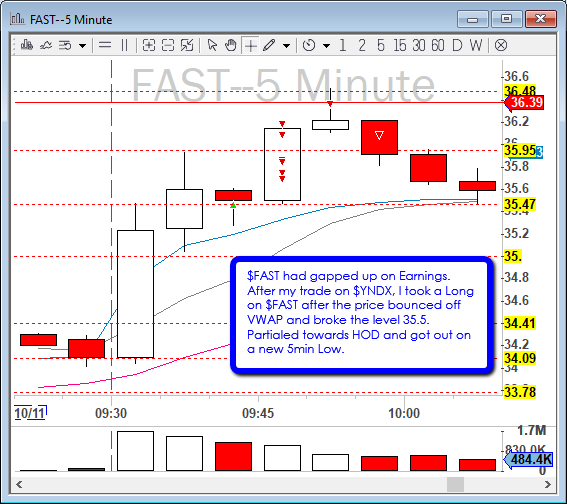

Trade4: $FAST. Gapped up on earnings. very strong at the open. I took long after the pullback to VWAP and bounc. Also at the break of daily level 35.5. partialed towards HOD and got all out on new 5min low.

Good: Very obvious premarket list today. Entries were good. Enjoyed watching the market whole day. Another +ve Friday.

-

3

3

-

-

09Oct.19

red day. -3r. I shouldn't have traded today, I was not relaxed and not in the right state of mind, may be due to lack of sleep. I still wanted to just sit thru premarket work, but ended up trading($ROKU). I had the right idea today on $ROKU, but messed up the trades, and $ROKU was choppy at the open too.

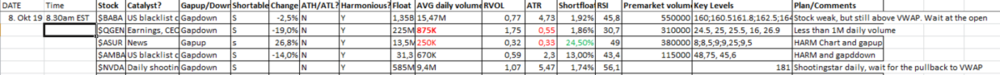

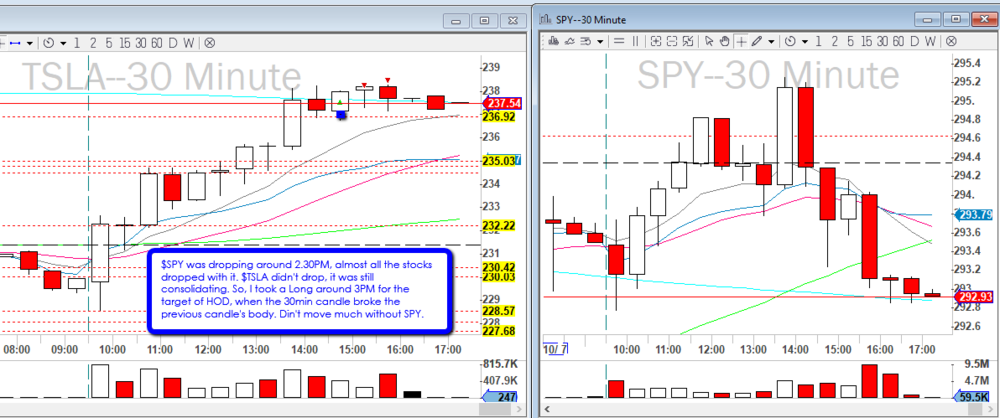

Watchlist: $ROKU, $QGEN, $LEVI, $DBVT

Trade1: $ROKU. Roku gapped up due to upgrade. I had the premarket level 111.4 which was strong premarket support. I was going to take long if the stock gets there. $ROKU was strong enough at the open, so i took long at break of 112.6, got 1r due to wide stop, din't partial, got stopped out.

Trade 2: $ROKU. Roku pulled back to my level 111.4 and I got long. Was great entry and I planned 3r range order, small stop. Stock moved 2.5r and stopped me. I should have known $ROKU was chopping at this stage.

Trade 3: $ROKU. Once the support 111.4 is broken, I took short, got stopped out again. Now I realized it was chopping.

Trade 4: $ROKU. long again after the break of 112.6 level (similar to first trade). Partialed quickly this time. Added some and got stopped out.

Trade 5: $LEVI. Earnings play. but flat at the open, so I was not sure which way it will go. At the open it sold off, I took a reversal in SIM, got stopped out. Took a live trade at the VWAP pullback short, 2 partials and 3rd at BE.

Trade 6: $X. $X was very bearish at the open, dropped 12%. after 11, it started reversing. I got stopped out on the first trade. After the double bottom, I took long again, small stop, but got out 2/3 my position by mistake. left 1/3 for 3r.

Good: After my morning trades, I switched to SIM, I made some very good trades. $QGEN I noted the RSI was 11% very much oversold. And it was very strong today, despite opening lower.

Improvement: I was hoping to have a clean trade on $ROKU similar to $NVDA yesterday. But it didn't happen and I didn't have a planB. My $ROKU trade had an impact on other trades in the afternoon and I stopped trading.

-

3

3

-

-

07Oct19.

Green Day. +3.5r. Today was a better trading day for me. Not because of the daily profit, but because of how I managed the trades. I also listened to a calming music 10min before the open till 30min after the open. I think it helped me a bit, I am planning to do this for few more days and see if and how it helps in the long run.

Watchlist: $NVDA, $BABA, $QGEN, $AMBA. $NVDA and $AMBA were in my main screens.

Trade1: $NVDA. I was interested in $NVDA yesterday, after it formed the Shooting star daily. Today SPY and $NVDA both gapped down. $NVDA sold into the open, I waited for the 2nd min candle pullback and went short. $NVDA had poor spread, so my entry wasn't ideal. I put 3:1 range order. I wanted to take a small partial at 2.5r, but by mistake added to my short. Got out of the addnl position immediately. Final partial at daily level of 177.29 (20MA daily). Entry was 179.85 with a stop of 75c. Actually I wanted to move my 3r partial even further to 4r, but before I did that, price dumped and filled me.

This is one of my Best trades, because I planned this from yesterday, took it at the open today when the setup appeared and managed the trade well.

Trade 2: $QGEN. QGEN gapped down due to bad earnings news and CEO leaving. It was down 20% on daily. At the open, stock was strong due to profit taking may be. I entered after the price broke thru the support levels and the new 5min candle broke the previous candle body (hive candle), Stop was above the wick. Got out at 2r and 3r. Final partial got out after it was clear double bottom on the 5min.

Good: Today my objective was to let my winning trade go, I did that. Usually my entries and Stops are good.

I was tempted to add to my $NVDA position at the 2nd VWAP pullback, but I resisted it. Same in $QGEN too, after the doji hammer on 1min at 9.40AM, wanted to add, but didn't. May be for another day.

Improvement: on $NVDA, I had the key level as 181. I was going to short it below this level, just before open stock dumped below this level, At the open I could have shorted it earlier, close to this level. That would have given me 1) best RR 2)more no of shares.

-

2

2

-

-

07Oct19.

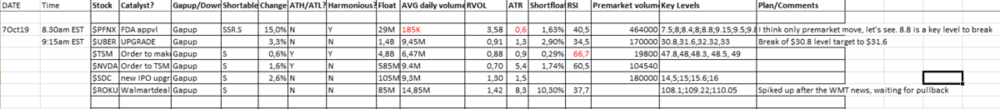

Flat day. I made a Hotkey mistake on $ROKU, so instead of +4r I closed the day just below flat.

Watchlist: $PFNX, $UBER, $NVDA, $TSM and $ROKU (just before the open).

Trade1: $ROKU. I added $ROKU just before the open. But choose to trade this, due to the strong catalyst (Walmart news) and also because I have traded $ROKU few times before. I didn't have time to include $ROKU in the premarket list above (I just added before journaling).

I was Long Biased on $ROKU, it was strong in the premarket, but selling off just before the open. I was waiting for the pullback. Stock was consolidating near the MA levels and I waited. Once it moved above VWAP with volume, I took long (wide stop, so very few shares). I realized the doji on the 2min could be giving me the PBBE/3C setup so added to my position and moved my stop. Was happy at this stage. Now I used the hotkey to set my range order to 3:1 RR and pressed Enter. But my Montage was not reset, so it closed the position immediately. I was frustrated. Setup was still there (as can be seen from the 5min chart), I reentered the trade, now I had less shares due to wider STOP. Partialed after stock moved 1.5$ and final part got stopped out.

Trade 2 :$BABA. Appears there was a news so, almost all the stocks moved up with SPY, around noon $BABA was losing. I took short below VWAP, supported by SPY. partial till 200MA on 15min. I have been trying to trade off longer timeframe in the afternoon, this is one of the trades (although helped by SPY immensely)

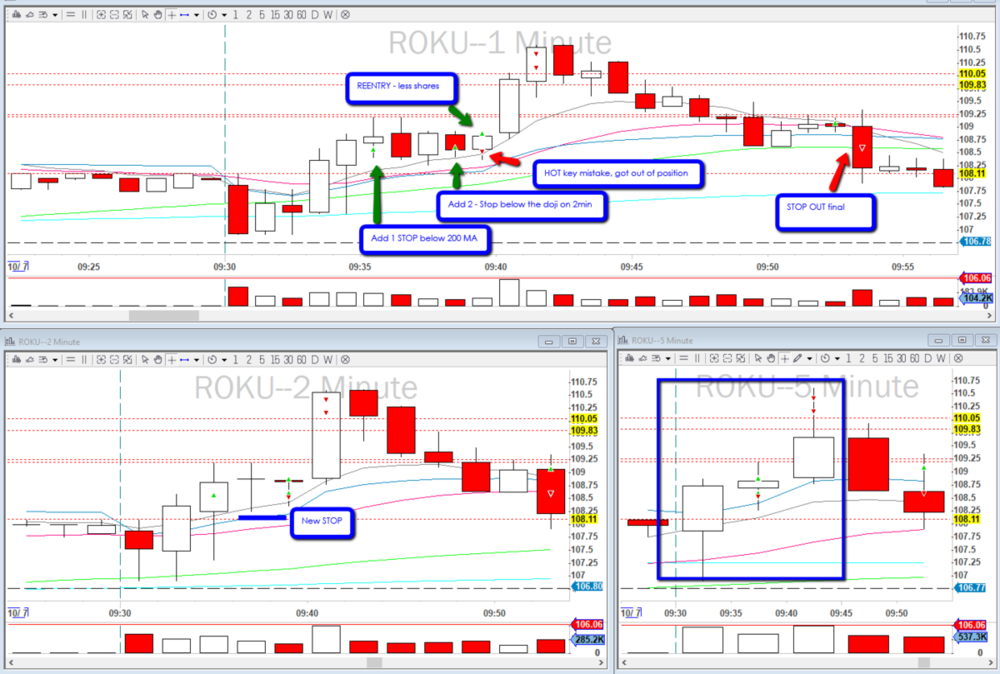

Trade3: $TSLA.

After 2PM SPY dumped, almost all the stocks dumped with it, except for $TSLA. It was still consolidating near HOD. Once the new 30min candle broke the previous candle body I took Long (60min was still bullish). Target was break of HOD. Move would have been much more, if SPY was strong.Other stocks from watchlist:

$TSM was stuck in range thru out the day (as justified by the ATR). $UBER was weak, but creating an ascending triangle, will be interesting to see tomorrow. Like I noted, $PFNX already made the move premarket and was dead for most of the day, until 14.30 when it moved. $NVDA was bullish at the open ended up creating a shooting star on the daily at the close. missed $SRPT and $SPWR.

Good: Didn't overtrade. Took the mid afternoon trade based on higher timeframe as planned during last week. Despite being frustrated on $ROKU hotkey mistake, still reentered only after confirming the setup and also kept my sharesize within my risk. This is an improvement.

Improvement: I really need to reset my Montage everytime, after setting a Range order. If someone knows how to reset Montage using Hotkey, please let me know.

-

2

2

-

-

04.Oct.19

Green Day. +9r. It was one and done day today. After my one trade at the open, I closed the platform, went out of the house. After coming back, just took couple of trades in SIM.

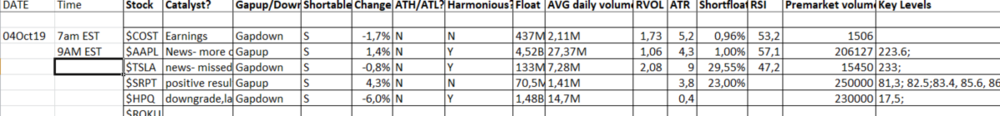

$WATCHLIST: $COST, $AAPL, $TSLA, $HPQ and $SRPT.

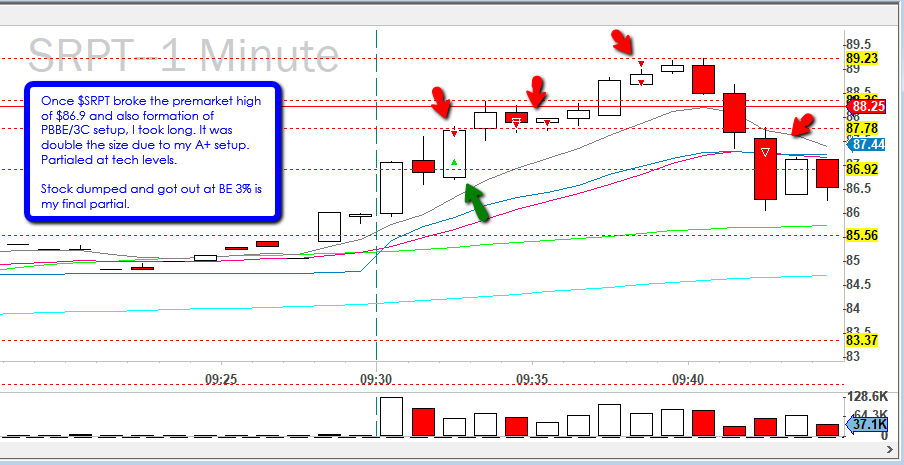

Trade1: $SRPT had a premarket high of $86.9. $SRPT opened strong. Once this premarket level is broken, I went long. This was also the PBBE/3C setup. I took partial at tech levels. My final partial of 3%, got stopped out once the stock dumped. When trading Momentum, I don't keep large portion of shares for BE (or further profit).

Good: I tend to overtrade on Fridays, today I made it specific not to trade anymore after reaching goal. I also increased my share size, during this A+ setup.

Improvement: I was looking to trade different setups of higher timeframes during midday. But postponed it till next week.

-

1

1

-

-

03Oct19

Red day. -3r.

Watchlist: $BBBY, $PEP, $TSLA, $GPRO. My watchlist except for $PEP had gapped down, but also had high short interest. So was not sure what they would do at the open. Had $PEP and $BABA at the open.

Trades 1,2,3: $BABA. I liked the small hammer and a strong 1min candle on $BABA, I took long at the breakout got stopped out below VWAP. Stock was strong enough it couldn't go back to touch 200MA and pulled back above VWAP with a hammer. I took long again, confident about the setup now, $SPY dumped on a news and I got stopped out. Later tried to scalp the SPY dump, but got out as it was too slow.

Trade 4: $SNAP. My one good trade. Took ORBD after the PBBE/3C setup. Slippage was bad and got a bad fill, which means, higher stop. Thought about adding to my position at VWAP, but stock was still consolidating below VWAP. It was about to breakdown and then SPY dumped and helped. I stayed in the trade for 40mins without any partial, first time for me at the Open.

Trade 4: $TSG. Another ORBD trade, After a red engulfing candle and below VWAP. Stock moved in my direction a bit then squeezed me out.

Trade 5:$PEP. $PEP was choppy in the morning, but after an hour took direction to HOD. I took a reversal, but stock was strong, so flipped my position Partial at HOD and another daily level above it. This was also my One good trade. More importantly, I noticed the 2 hammers on 30mins, and took a Long. to partial at HOD.

Trade 6: $SCHW. After the SPY dump in the morning all the stocks were pulling back to their positions. $SCHW was strong and created a double bottom reversal. I took Long above VWAP. I was thinking about false breakout, and still added to my position, Got stopped out. I should not have added.

Good: 2 very good Trades on $SNAP and $PEP.

Improvement: Looking to trade off higher timeframe 30/60 min in the afternoon. Took some trades in SIM that are coming out nicely recently that also fits my availability to trade.

-

3

3

-

-

I was short biased on $AAPL too, although couldn't trade it. Yesterday's daily was a nice Shooting star.

-

02Oct19.

Greenday. +4r.

Watchlist: $SFIX and $AMTD mainly. Secondary $TSG, $UNFI, $X

Trade1: $X. $X had gapped down daily and was selling into the open. Volume was ok. I took short on the pullback to VWAP, right stop. Took partials and then added on the 2nd pullback to VWAP. On my next partial, got all out by mistake.

Trade 2: $BABA. I took reversal $BABA on the bounce 200MA 5min. Left a range order as i had to take care of some things, but noticed the new 5min high and closed my position imm. Chickened out.

Trade 3: $X. $X had gapped down and I took the ORB short. My stop was above 20MA, stock pulled up above 20MA and I got out. Stock dumped after that.

Trade 4: $AAPL. T Took reversal in $AAPL at the 20MA on daily, got stopped out twice. 218 seemed to be a strong support in Bookmap, took SIM long. Got 17R.

Trade 5: $TSLA. $TSLA dropped on news, I took short on the pullback and got stopped out twice. Went long above VWAP and exited at the next daily level after 1$ move 4r.

Good: Emotions are generally ok, when in Trade. I am also getting good sleep last 2 days. I was able to cut down my losses small, so 2 BE trades.

Improvement: Could have traded $TSLA short better by waiting for the price to break 200MA 1min. Need to explore more on the Bookmap source. 2 $AAPL reversal trades were unncessary, as the reversal level was not established yet.

-

1

1

-

-

On 9/28/2019 at 6:37 AM, Mark D. said:Thank you Vikram! I am doing well but not making any money. Still trying though 🙂

Good to know Mark 🙂 , just wondering because haven't seen your updates in a while.

-

1

1

-

-

01Oct19

Green Day. +5r. I couldn't spend much time on Premarket today. But the day turnedout to be good. Also, because I have not been trading regularly in Aug/Sep I have reduced my risk now.

Watchlist: $X, $AAPL, $AMTD, $BABA

Trade 1: $AMTD, $AMTD was selling off at the open due to $SCHW offering zero fee stock trades (Infact all online brokerage stocks dumped). I wanted to take Rising angel setup, but at the open the

stock couldn't pull close to VWAP, as it was so weak. I took very small size, price didn't dump rightaway and I got out.Trade 2: $AMTD, Stock was extended and bottoming in the afternoon, I took long after the 15min candle break on the upside (level $34.86). Knew it was knife catching so MAs were exit targets.

Trade 3: $AAPL, After my first trade on $AMTD, I noticed the PB-BE/3C setup on $AAPL, I took it Long, put a range order for 3r to previous daily level. $AAPL was too strong and blew thru my target with no problems. Although $AAPL moved another 1.5-2$, I don't have any regrets, I stuck to my plan and it was my OneGoodTrade.

Trades 4,5: $X was very strong at the Open (due to acquisition), I took long on the pullback, got stopped out, flipped my position for short. Price struggled to drop and I got out for a small profit.

Trades 6&7: $AAPL, I was looking for reversal at noon, after price bounced off 50MA on 15min. Was not so confident about it as the bounce was not clearly from 50MA (didn't touch it). I would like the stock to go thru the MA and retrace. Nevertheless, took small sharesize on these 2 trades, first one BE and second one was small winner.

Good: I usually lose my first trade in the afternoon, after I come back taking care of my daughter. Today afternoon, I was patient looking for setups, went in with small size in $AAPL for reversal and got one winner. Overall I am happy about today. $AAPL orb was my best trade of the day, as I stuck to my plan.

Improvement: None today, I have some from Sep month that I need to address this month.

-

3

3

-

-

-

30.Sep.19

Break-even day.. I had one winner on $MU at the open. And then didn't take a trade for 6 hours. FOMO got to me and took a losing trade on $THO near the close.. Details below.

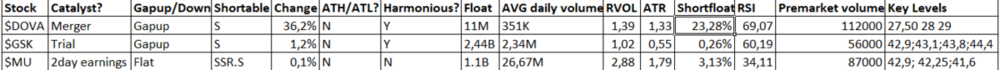

Watchlist: $MU, $DOVA, $GSK. The reason why I picked these stocks is below.

Trade1: $MU. $MU had earnings on Friday and dropped 5 points by end of the day. I was looking for a continuation move today, especially because the stock closed within the lower 20% range of the day. Also, Stock couldn't break $42.9 on Friday, which remained low of the day. $MU opened flat today, may be slighly gapped up. But my bias was that it will drop further atleast 2 points, if it could break the low of friday ($42.9) & premarket low ($42.73). $MU was on SSR.S thruout the day.

Today, we lacked volume in the market, may be due to the Jewish holiday. $MU was whippy at the open, couldn't find a direction (I found the same with $DOVA and $GSK too). Nevertheless, once it broke the $42.9 level, I went short. Due to SSR and lack of volume, my entry was $42.82 (9c lower). I wanted to add in the next pullback, but the fill was pretty similar. My first partial was $42.67 (15c lower), but I didn't like the price action, took another partial, Got out once price broke the resistence of $42.73 (premarket low) above.

I usually take VWAP pullback short, but this time, I didn't feel it. Good, I didn't enter, $MU squeezed big time and trapped all the shorts.

Trade 2: $THO. After my $MU trade, I switched to SIM, didn't get any setup in $GSK or $DOVA. I would have taken $GSK fallen Angel, except for the lack of volume. I was out for 2 hours. Came back and made some trades in SIM.

I was feeling FOMO about not trading anymore, having not reached the daily target or max loss. I was pushing for another trade. $THO was in the scanner thruout the day and I made some SIM trades too. 15min before the market close, price hit strong resistence (VWAP, 200MA 1min, 50MA 5min). I went Short. Realized it's not dropping fast and got out. Price eventually dropped, but I could have avoided this as it was not A+ setup. Switched to SIM and it did work. I didn't use Kyle's hot key, so my sharesize was twice bigger and took out my profit.

Good: $MU trade as per plan. the One Good trade (OGT) for me. $THO although I shouldn't have taken this trade, got out immediately, after realizing the mistake..

Improvement: Need to address FOMO, this results in trading not A+ setups.

-

2

2

-

-

I have read most of your journal. And one thing I find is that when you hit your BE after taking profit, you have lot of shares left. So your 2R profit may turn into effectively ~1R (i know you are also addressing taking early partial just like me). And with your 1R loss on losing trades and with 50% winrate you are probably coming out as Flat. I am just sharing something that is on top of my mind. I know you do extensive analysis on your trades and I may be TOTALLY wrong. but thought will share it for what it's worth.

-

Rob , I am not there yet. But i think after one year being flat is impressive. Lot of people blow up their accounts. You have been very disciplined on your trading and you will turn positive soon, I am confident about it.

-

hi Mark - hope you are doing good and making lots of trading money.

-

1

1

-

-

41 minutes ago, Glenn Budde said:Thought I seen a question from you in Williams Trade review but it went by and now I can not get it back....

Sorry..

No worries. I just mentioned, I like your trading overall and you are very good considering only 2months in SIM.

Regarding your $CCL trade, I know you wanted to Short it on the pullback , but we never know how far the price will pullback. So what I do is scale into my position with smaller sizes till VWAP, as VWAP is a good tech level for pullback Entry. My stop would be above VWAP. If price gets there, for me it is not pullback anymore but reversal. This way, we don't have to guess how far the pullback will be and get stopped out.

-

1

1

-

-

26.Sep.19

Green day. +2r. Traded $CCL at the open. Only one trade, switched to SIM after that.

Watchlist: $SQ, $RAD, $BIDU, $CCL

Trade1: $CCL. Gapped down due to poor guidance on earnings. Also was selling into the open. Looking for Rising Devil setup. Shorted on the 2nd candle after the daily level was broken. Partialed at the low of the candles. After the Doji appeared on 2min and the next candle opened higher, I got out completely. I was ready to play VWAP pullback short, if the setup occured. It did, but the price dumped too fast, and I didn't want to chase it. Would have been another nice 3r.

Good: One good trade. Didn't chase the entry on VWAP pullback short.

Improvement: I didn't use Kyle's hotkey and went with a very small share size. Would have been nicer to have gone with full size. But I am happy overall.

-

2

2

-

-

23 hours ago, Mike B said:$SNAP and me are not friends it never trades well for me.

I like $SNAP. I like the price range and when in action, it moves well. But recently it's failing me. So far, I am even with $SNAP (6 winners and 6 losers). I gotta make up with it 🙂

-

25.Sep.19

Red day. -2r.

Watchlist: $ROKU, $NKE, $BABA, $MO and $BA.

Trade 1&2: $BA. $BA had positive news in the morning, and stock moved up just before the open. Daily had gapped up breaking consolidation. At the open it formed 3c setup on 2min. I took it long, but got stopped out during the dump. Price bounced off 383.16 daily level. I took long again and AON exit at 2R. (first entry was in SIM by mistake). Good Trade.

Trade 3 &4 : $NKE. $NKE was top of my watchlist today, it traded beautifully at the premarket with volume. I was very long biased, chart was harmonious with ATH, my favorite setup. But at the open got chopped up badly. It remained choppy until noon, after which some news came in.

Trade 5: $NKE. Took reversal trade on my A setup, which worked out beautifully. It was V-reversal to VWAP at 200MA on 5min . I didn't think the move would be stronger, I got out at 2r, price moved to 3r. Best trade of the day.

Trade 6: $SNAP. Took VWAP pullback short setup , as the price dumped at the pen, pulled back to VWAP created a shooting star, as it couldn't close above VWAP. I took it short, but got stopped out. Today it failed. Even the pullback candle (white) to VWAP had low volume, but still din't work out.

Trade 7: $CGC. Another reversal trade, but failed. I had 15min shooting star and on 30min 50MA was swooping down, took short below 50MA, tight stop. Got stopped out. This is one of the setups I trade 50/200MA bounce with reversal candle.

Good: Traded only setups, except for $NKE where I tried to trade the choppy price action. Some of my highly accurate setups are failing, today in $NKE, yesterday in $SNAP. Hope it changes in October.

Improvement: Bit of overtrading, but only setups. Need to drop everything but A+ setups.

-

3

3

-

.thumb.png.9253287035c1f4fe4daf147275f9c58e.png)

Vikramaditya Trading Journal - Live 08Apr2019

in Day Trading Journals

Posted · Edited by IamKarthi

21.Oct.19

Green day. +4R. Today I had a better day. I am going to keep this journal short, as I am travelling. I may not be able to trade the next couple of days.

Watchlist: $AAPL, $AMD, $HAL, $YNDX. Last earning season, I did not trade well, partially due to having so many stocks on the watchlist and not watching one particular stock. This time, I made sure, I finalize only 3-4 on the watchlist and observe one at the open.

Trade1: $AAPL. $AAPL gapped up and at ATH. $SPY also gapped up, I had a key level at 238.2.

Trade 2: $MU. $MU also gapped up. Had a nice entry at 10.05, that I missed. Later took a long at 20MA (1min) final partial at HOD (also 200MA on 15min and 30min). My trade of the day (due to my poor add in AAPL).

Trade 3: $MU. I also took a reversal on $MU after trade 2 that worked well (under huge resistence in mutiple timeframes).

Trade 4: $INFY. Took a scalp on $INFY once it bounced off VWAP at 12 Noon.

Good: Whatever setups I took in Real and SIM worked out perfectly (including $AMTD Earnings Play). I was calm and patient today. I am still listening to relaxing music at the open.

Improvement: couple of them in $AAPL trade. Will try to improve on them.