-

Content Count

223 -

Joined

-

Last visited

-

Days Won

34

Posts posted by IamKarthi

-

-

08.Aug.19

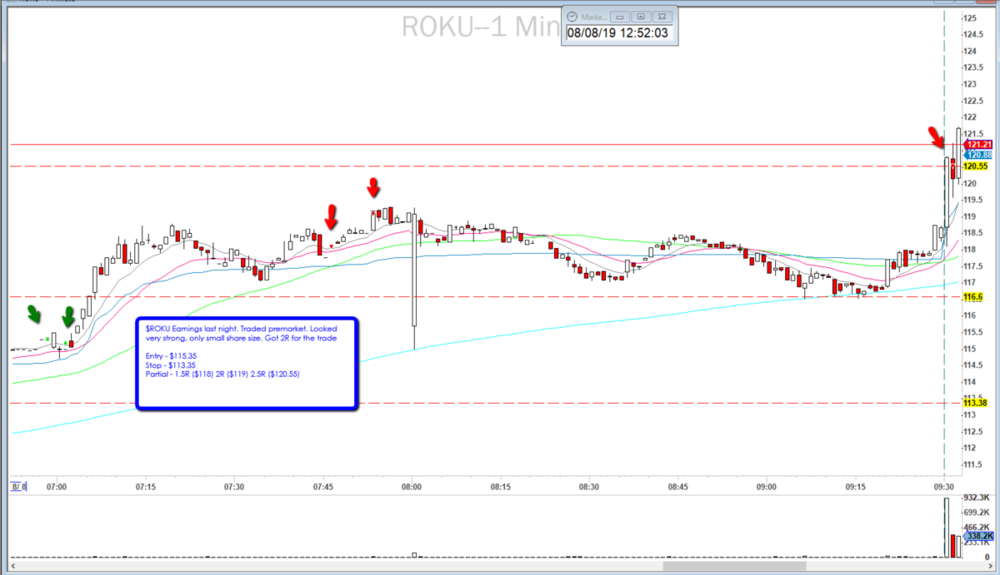

Green Day. 2R(4r) . I took a Pre-market trade in $ROKU after watching the earnings last night. I almost met my goal this morning even before the open. I could have stopped trading, except I didn't

Watchlist: $ROKU, $AMD, $CRON, $GDOT. $ROKU and $AMD watching at the open.

Trade1: $ROKU. Took this premarket at around 7AM EST, very small sharesize. On the 5min, it was a Clear ABCD pattern. Got 2R for the trade (I have 2 Risk sizes - regular 'r' that goes with A/B setups and Big ''R'' that goes with my A+ setups)

Trades 2&3: $AMD. Gapped up on good news. Took it long after the pullback to VWAP for long. Made a hotkey mistake and got out. Took another entry (Chasing) got out at 'r'. Total loss 2r.

Trade 4: $UBER. dropped at the open pulled back to 200MA-1min. thought it was breaking down and took it short. I was quick to stop after not getting the price drop. Good move. It was strong. 1r loss.

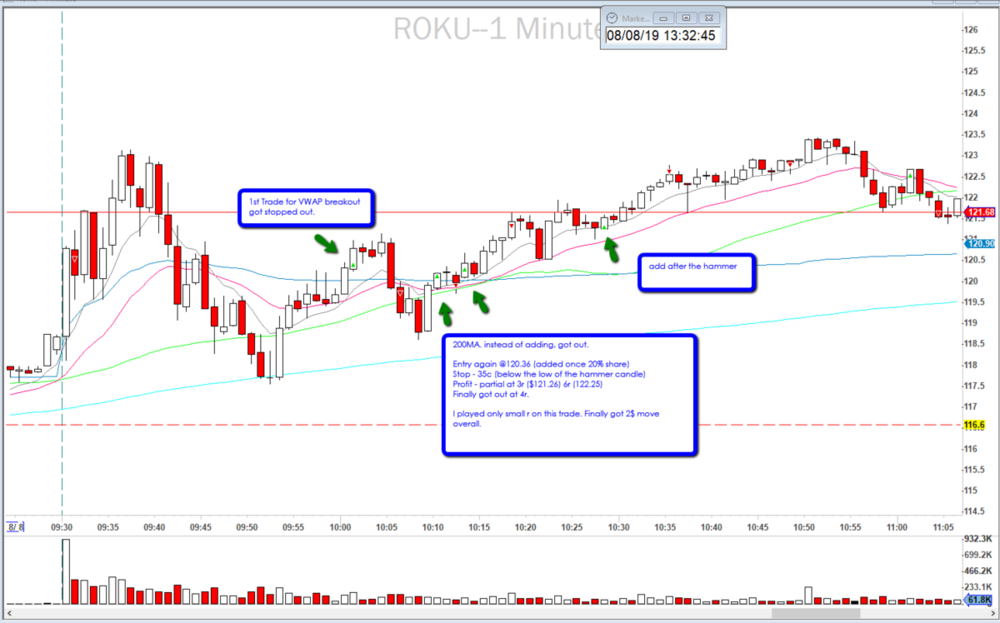

Trades 5&6: $ROKU. took VWAP breakout for Long (as the stock was very strong) got stopped out. Went long after the bounce off 200MA(1min) for Trend trade. Got 2$ move.

Good:

- Was very patient today with my partials, esp the last trade on $ROKU and got 3$ move. My last one trade covered the losses of 4 losing trades.

- I added to the position too and stopped out at the right time (before the dump).

- Traded premarket against strong fundamentals and was patient with partials, Held this for 2.5hours.

Improvement: So after my first premarket trade I was up 4r. I made 5 more trades and back exactly at the starting point ie) 4r. May be I should stop after one losing trade beyond achieving daily target. Pay less commission.

-

4

4

-

07.Aug.19

Green day. 2r. Overall good trading day. Losses were small. Cut down losses where possible. Some good winnners and some scalpers. Today was tag-team trading with JaredC at the open, as we exchanged updates in the chat.

Watchlist: $MTCH, $DIS, $TEUM and whole lot of other stocks which were moving with SPY. was watching $MTCH and $TEUM (i had a small position premarket) at the open. None traded very well in the first 5 mins.

Trade 1: $BAC. Jared took a short at the open. I liked it and waited for a pullback. Entered close to VWAP. It was a nice trade, but the Harmonious setup didn't give lot of move. It formed Double bottom and moved against me.

Trade 2: $TEUM. Took a long Premarket for a pop up to 4$, didn't give me the move, I got out Breakeven.

Trades 3&4: $NEWR. $NEWR was forming a wedge Took it short at 9MA stop 20MA, price moved 1R and stopped me out. Took Long at the MA cross got stopped out again.

Trade 5: $CVS. Scalped 3 times on a good trend. Would have been nice trend trade, had I held on to my 2nd entry.

Trade 6: $DIS. Moved with SPY, took it short below VWAP. Partialed at 1R, 2R, 3R as was worried about the false breakout. And so it happened.

Trade 7: $MTCH. Another scalp on a trend trade.

Good: Losses were small. Partialed and moved the stop to BE. Scalping worked in some cases to lock profits.

Improvement: Sclaping on a Trend $CVS and $MTCH, missed big profits. Overall happy today, after the 2X max loss yesterdady.

I am working on different Rs for Different setups. Will implement this soon.

-

2

2

-

-

06.Aug.19

Max loss day, more than maxloss actually, as got hit by Slippage of more than 1$ on $ROKU. I was so biased on Long today, It messed up all my trades and stopped me out.

I had less than 4 hours sleep for the last 2-3 days and it is really having an effect on my trading. That's why I journaled early today so I can take some rest.

Watchlist: $SNAP, $ROKU, $GSKY and $TWTR, $AMD, $MU. Watching $ROKU and $GSKY at the open.

$SPY is up. My main pick was $SNAP which was down (against the market). And $ROKU, which had a independent run yesterday and looked good today. Also watching $GSKY which was at ATL and harmonious.

Trade1: $GSKY. $GSKY had the perfect setup for me to take short. It had gaped down on Daily and pulled back at the open, I could have gone short. I hesitated because I don't know the stock. It dropped 1$ in the first 15 mins. got FOMO going now. So later when the stock appeared to have reversed I took a Long for fallen angel, but got out as the move didn't happen immediately.

Trade 2: $ROKU. Was long biased on the market and $ROKU today. I preempted the ORB move a bit. The FOMO on $GSKY may have played a part unconciously, although I didn't remember it while trading $ROKU.

Trade 3: $ROKU. Took a reversal after the price bounced off 200MA on 5min. Din't like the price action and got out.

on both Trade 2&3 I made a mistake in calculation of shares and went double the share size.

Trade 4: $ROKU. Took a reversal after the MA cross of 9/20 (1min), with a new 5/15min high. But it dumped on me following $SPY. Had a bad slippage and loss on this.

Trade 5: $PYPL. Price formed a hammer above VWAP and MAs. Took it long, but stock dumped me for a SO. Andrew also took the same Long and got stopped out.

Good: Din't overtrade or Revenge trade. Got stopped out alright, except for the slippage on $ROKU.

Improvement: I am ok to be biased about the market and stocks, but have to change the view as the market evolves during the day. Also, took twice the share size by mistake.

-

2

2

-

-

05.Aug.19

No Trades today. $SPY was down 4th consecutive day and at 285. Most of the stocks were down. I do not like to trade days like this when almost all the stocks just follow SPY. I'd rather trade SPY but it is not in my price range, so No trades.

I had $ALLK (gapup on earnings) on the watchlist, lowfloat, didn't trade well. So I played in SIM and made some good trades in $TWTR and $TSN, not journaling them here.

-

3

3

-

-

1 hour ago, Mark D. said:Try some range orders on your midday trades and go do other stuff instead of watching every tick

Thanks Mark. I use Range order all the time. Once I put my range order, I get out of my seat, get some coffee etc., come back in 30-40 mins and then I''m like, ''ok that's enough" and close my position. I think I have patience for upto 30-40 mins, but not more than an hour. May be I need to get couple of miles away from my house, so I don't come back within an hour.

Statistically I have only 9 trades that lasted over 40 mins out of 110 trades so far. Compartively, I have had 44 trades that lasted only 5 mins (500% more).

-

1

1

-

-

02.Aug.19

Red day. -1R. I was down -4R after the open, but ended at -R.

Watchlist - $PINS, $SQ, $MU, $NVDA and $CRON. Watching $PINS(gapup) and $SQ(gapdown) at the open.

Trade 1: $NTAP. Very good trade today. I took a reversal on this and made 2R on it. It's one of those Rubyred stairs setup, kind of rare setup.

Trade 2: $CRON. Very Good trade. Took Reversal on 5min shootingstar/15min 200MA bounce. I just didn't have the patience till my target is reached, I got out early.

Trade 3&4: $AAPL. $SQ did not give me the pullback that I look for at the Open. $PINS was very choppy. I moved to other stocks, Found $AAPL to give VWAP pullback short. Took 2 trades on it, didn't work out. Could have waited for more time

Trade 5: $CC. $CC also provided the VWAP pullback short, a hotkey mistake resulted in -1R .

Good: Traded 2 good setups on $CRON and $NTAP - Shootingstar/MA bounce reversal & RubyRed stairs setup. Both are A+ setups and had good RR.

Improvement:

- I could have waited for more time when my watchlist didn't give any setup at the open. Instead jumped into $AAPL on a Ok setup.

- Both my good trades in $CRON and $NTAP offered me more, I was not patient enough to take it.

- I like to trade at the Open and finish in few mins. I just don't seem to have the patience for mid day trading. Not sure how I am going to deal with it, anyone has any suggestions?

-

2

2

-

01.Aug.19

I would like to share another setup that may work at the open. This is based on the chatroom discussion with @Brian Pez .

Again, this setup works very well with WilliamH's Harmonious charts. I am attaching the screenshot of the trade I took.

$PS. The stock had gapped down today. During premarket, it kept selling. At the open it pulled back to VWAP/MAs (due to all the shorts covering at the open) and then $PS continues to drop. I took at entry below VWAP with stop of only 5c (above 50MA on 1min). And rest of the steps are included in the picture.

-

1

1

-

-

01.Aug.19

Green day. Today I wanted to try my other setup for the Open. I have seen this work on other stocks too (E.g $AMD yesterday). I was watching $WLL and $PS for this setup at the open.

Watchlist: $AMD, $MU, $FB, $QCOM and $WLL, $PS

Trade 1: $PS. The stock had gapped down today at the open. And during premarket, it kept selling. At the open it pulled back to MA (due to all the shorts covering at the open) and then $PS continues to go down. My main focus was getting the perfect entry today. My entry was just below VWAP. My stop was 5c above 50MA on 1min. And I had partialed at 2R, 4R and 6R.

- Entry - $20.9

- Stop - 5c ($21.04)

- Profit - $20.71(2R), $20.5(4R), $20.26(6R)

- Price dropped to $19.42 (ie more than 20R) but I had no shares left

Trade 2: $PS. I took 5min conventional ORB again, as the stock was very weak, but it failed me again and I got stopped out.

Good: My objective was met in this trade, ie) attempting this setup and getting a perfect entry.

Improvement: I could have held on to 10% of my shares, as the price dropped over 20R. I felt bad about leaving so much money on the table, but again my objective was met and I should be happy.

-

2

2

-

31.Jul.19

Green day. 4R. Today is a day of Patience for me. Took the first trade only at 12.25PM. Did the premarket analysis, watched the open, didn't take beautiful setups on $AMD (MA rejection- 2nd min) $AAPL (Flattop breakout - 4th min) and $GE (ORB - 20th min). Just wanted to make sure I don't take any ordinary setups.

Watchlist: $AMD, $MU, $FB, $AAPL also watching $ENPH, $TWOU

Trade1: $TWOU. $TWOU was bearish the whole morning, afternoon it reversed and I took long after the MA cross and the price bounced inside of 50MA. Partial at 2R, 3R and stopped out at 1R.

Trade2: $TWTR. Took a scalp below the 50MA on 1/5 min, Federal announcement on rate cut happened then. Took very smal size and scalped, as everything was following SPY.

Good: I was able to remain patient and calm, while everyone in the chatroom is taking their trades making money. I stuck to my rule and traded only setups. Didn't over trade, only 2 trades.

Improvement: None today.

-

4

4

-

-

30.Jul.19

small Red day. -1R. Overall I had some good trades and more ordinary trades today. My ordinary trades/commissions are eating up my profit from good trades. Also, I may be looking for more RR on some setups, where I am not taking upto 2R profits to get stopped out for -R. I have some preparations to do before starting Aug month Trading.

Watchlist: $FB, $MU, $PG, $PFE and $UAA. I was watching $FB at the open. $FB was below 20MA on daily, and Harmonious on all timeframes, i thought it would close the cap to 50MA. This may happen tomorrow.

Trade 1: $AAPL. Strong at the open, but the price bounced off VWAP and open higher and went to HOD. This is not my setup, and I traded the price action here. In terms of Poker card ranking, this would be just a PAIR, which doesn't win many games. And so, I got stopped out.

Trade 2: $AAPL. Immediately I saw the 200MA on 5min and 50MA on 15min acting strong resistence, I took Short. Now this is one of my setups MA bounce reversal with Double shooting star on 1min. I took one partial early (Trade1 messing up my mind) and then at the 200MA on1min.

Trades 3&4: $AAPL. I took 2 more trades on that at Breakeven under ordinary setups.

Trade 5: $FB. I was short biased on $FB from the daily. So when the price reached 200MA(5min)/PCL/Y low, I took it short, realized it was too strong and got out. Should have waited for confirmation. Another ordinary setup. A PAIR.

Trade 6: $MU. $MU formed triple top on 1min, missed entry, But when the price pulled up to VWAP and formed a shooting star (alike), I took it short. Missed 2R move and got out at BE with 50% sharesize. Setup was good. VWAP pullback Short.

Trade 7: $OSTK. Another ordinary setup, was looking for fallen angel setup on $OSTK, it kind of formed one, Took long, stopped out. Another long, realized this was ordinary setup and got out at BE. A PAIR.

Trade 8: $TWTR. ABCD pattern. Long after ABCD pattern, got stopped out to the penny. Took it long again, Price moved to 2R, but got stopped out at BE. Was hoping to get the move to $42.

Good: Traded 3 good setups.

Improvement:

- Few very ordinary setups, eating up profit from good setups.

- Good setup partials need to improve, I either don't take it or take it quickly.

- Missed 2R move on $MU and $TWTR. Had I taken it I would have closed the day at daily goal.

-

2

2

-

29.Jul.19

No Trading today. I couldn't do the Premarket analysis and BBT community chatroom was also down at the open. Enough reasons for me to skip Trading today.

-

10 hours ago, JenniferL said:Hi Vikram! I watched your interview last night -- thanks so much for sharing your experience! Looks like we are neighbors -- I live just outside of Zürich!

Tchüss!

Vielen Dank Jennifer! Actually, I was supposed to take up a project in Basel 4 years back, but ended up in Duesseldorf.

-

On 7/27/2019 at 8:22 PM, Rob C said:Great job with the interview. I just watched it. Congrats on being the top equities trader on the DAS challenge!!

Thank you so much!

-

26.Jul.19

No Trading today, as I breached my rule of trading beyond my maxloss yesterday.

-

1

1

-

-

25.Jul.19

Red day. I was very tired today and almost skiped the session. But I traded with too much distraction anyway. I was 2R up before hitting 4R loss.

Watchlist: $FB, $TWTR, $T, $SNAP, $PYPL, $MU & $AMD. Watched $SNAP and $MU at the open.

Trades 1&2: $SNAP. This was similar to my $FB trade yesterday, Took reversal at the open near the MA/PCL/Daily level (expecting a Double top on the daily). Price moved a little bit, but was too strong at the open. Small profits.

Trades 3-5: $FB. Once again, looking for MA bounce reversal. Trusted this as it was 200MA on 15min. Took it long, got stopped out. Took it long again, after the bounce, got stoppe dout again. It was knife catching. $FB was very bearish today, although my bias was Long and that affected my trades today. I did take 2 more Long trades and made some small profits.

Trades 6&7: $SNAP. Stock pulled back to 20MA and made a hammer. Took it long for HOD, BE stopout. Took another long after VWAP bounce. Partial and BE stop. $SNAP just couldn't break the $18 level today. Also creating a shooting star on Daily. tomorrow will be very interesting for $SNAP.

Trade 8. $PTC. $PTC was bearish at the open. Pulled back to VWAP, created a VWAP false breakout setup. I took it short, very confident as there were MAs as resistence too. But price chopped and stopped me out. Very volatile after the Open.

Trade 9: $MU. This was not a smart trade. Saw the doji hammer on 5min and went long, looking for ABCD pattern, realized I am caught in Double top setup on 1min. Got out for a loss. I should not have taken this setup.

Good: I think I traded setups, but today, I think the MAs/VWAPs were not respected (including 200MA/15min). I had good setups on $PTC and $SNAP, but they just didn't work out.

Improvement:

- Could have avoided trading today, being tired, or reduced the share size.

- Knife catching at the open on $FB, it was a 50;50 setup, could have avoided.

- $SNAP was exactly like $FB yesterday, din't give all the move. I could have waited for a confirmation,

- $SNAP also created the 3c setup on 5min, I just didn't notice it.

-

2

2

-

22 hours ago, Mark D. said:Hi Vikram,

Thank you for the advice. I think i'll try not worrying about P&L for the week starting August 1st. and see how it plays out. I don't look at my P&L during the trading day but i'm so used to thinking in "R"s and using a fixed dollar amount for risk, i know all the time pretty much spot on what my P&L is.

Please only take it as a suggestion my friend!. Very nice trade on $SNAP today.

-

1

1

-

-

24.Jul.19

Green Day. 2R Profit.

Watchlist: $AMD, $MU, $SNAP, $TXN, $CAT, $AMRN. Later I also included $ROKU, $IRBT, $TER. I traded a lot today, including $FB after earnings.

Trade 1&2: $FB. Took short at 200MA on 1min, stock was too strong and stopped me out. One of the failed MA bounce setups. This is fine. After 1min crossed 200MA and created a hammer, took it long just one partial near PCL.

Trade 3: $IRBT. Fallen Angel setup, but Poor entry. stock was very volatile and didn't get my move immediately, so got out for a small profit.

Trade 4: $SGEN. Long above 200MA (1min) and 50MA (5min). Had 1.5R didn't take it as the target was $72, missed by 3c. Got stopped out.

Trade 5: $TER. I was done for the day. not planning to take a Live trade. so just watching $TER, and noted MA cross reversal on 1min. Price bounced off the inside of 50MA (very good indication for good setup). Took it short on SIM, realized it was Live. But the setup was valid so traded this. This was a very good trade.

Trade 6: $CAT. Took VWAP bounce for Long, got stopped out. Then went Short twice before getting stopped out. 3 losing trades on not so great setups (C- setups).

Good: I was able to try out different trading setups, including post earning $FB. Still only trading with small share size, within my risk. $TER was my best trade of the day, although it happened by mistake (thought I was in SIM).

Improvement:

- Overtraded $CAT. It was not a great setup, still went back trading 3 times. Biased on $CAT, that had an impact.

- Partials need improvement, as I am missing 1.5R moves and getting stopped out.

- There were some great moves today, I just didn't catch one.

-

3

3

-

On 7/18/2019 at 5:47 PM, Mark D. said:Other comments for tomorrow: I've noticed that i have a cycle in my trading psychology which goes: 1.) bad trades -> 2.) red P&L -> 3.) focus on getting good entries and stopping out appropriately -> 4.) good trades -> 5.)green P&L -> 6.) focus on being green for the week instead of good trades -> 7.) chasing entries/ stubborn losses -> 1.) bad trades... repeat cycle. i'm currently at step 6 going on 7.

has anyone else noticed this? any advice for keeping in the 3 through 5 steps? i know on paper what i need to do is don't worry about P&L and just worry about my trades but i still fall in to this cycle. any advice would be appreciated. i think Robert H made a video about this in one of his rants. I need to go review those again.

I don't specifically have this problem, (but lot of other issues

) or the solution to this problem. But, do you have weekly targets, as you are trying to stay green for the week? If so, is it possible for you to have a monthly target, instead of weekly. That way, you don't have to stress out everyweek, but only once in a month. Since it will happen less often on a monthly basis, it may go away after a while. my 2 cents.

) or the solution to this problem. But, do you have weekly targets, as you are trying to stay green for the week? If so, is it possible for you to have a monthly target, instead of weekly. That way, you don't have to stress out everyweek, but only once in a month. Since it will happen less often on a monthly basis, it may go away after a while. my 2 cents.

I have heard people saying hide your P&L. Personally, I don't know how much that helps. I look at my P&L all the time. In fact, when I am in a bad trade and if I don't respect my stoploss, Looking at the P&L makes me stop out immediately as it is going from negative to Big negative. Also, Once I know I have achieved my P&L then I cut my share size. It's much more peaceful. I guess it's down to personality. You may try this option of hiding P&L too if it works out for you. Stay Green!

-

1

1

-

-

-

23.Jul.19

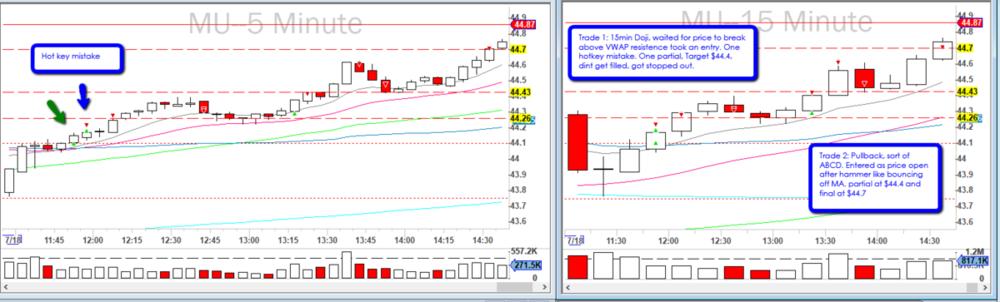

Green Day. Achieved daily target, traded $MU, 3 trades all Green.

Watchlist: $MU, $FB, $SNAP, $KO, $AMD and $INTC. Watching $MU and $AMD at the open.

Trade1:$MU. At the open price dumped and gave a pullback. I took it on the breakout of 1st and 2nd candle. This is the Pullback ORB and Breakout Entry setup. Took a partial at Y-Low, and got out at BE after the buying pressure creating wick.

Trade2: $MU. Took Short below the 200MA on 1min, this was also strong resistence with MAs on multiple timeframes. MA bounce reversal. Price din't drop fast, so i partialed. It formed a Double top, so I added and partialed at MAs and VWAP.

Trade3: $MU. Price continue to drop below VWAP and I took short under VWAP, very small stop. VWAP breakout. Price dint touch the target of $46.6, but bounced back up, so got all out.

Trade4: $MU. Doji on 5min. I took it long after the price broke the doji. SPY spiked and so did $MU. Hammer at support. Got all out at 200MA on 5min.

Trade5: $HAL. It's a small Test trade. Took it short below 50MA on 15min. had 2R on it, exited after the new 15min High.

I also took $AMD MA bounce reversal off 5 and 15min. Rode it till HOD, after crossing VWAP. It worked out very fine.

Good: Traded only setups today and not Price action. Pullback ORB, MA bounce reversal, Double top, VWAP breakout all worked out. Stopped trading after daily target. Resspected my Stop for $MU although it moved a lot.

Improvement: Partials, but I am happy with the overall trading today.

-

1

1

-

-

22.Jul.19

Breakeven day. But I am happy overall how it went today after my Hulk trading on Friday.

Watchlist: $MU, $FB, $AMRN, $TWTR, $PETS, $ACB, Watching $MU and $ACB at the Open.

Trades 1&2: $MU. Formed a White hammer on 1min, crossing the MAs. Took it short. Per my new layout, I don't have 2min chart, but the price bounced off 200MA on 2min (which I noted only while journaling). Took another short for LOD and got stopped out again. I need to find a way to implement the 'PullbackORB-Breakout strategy'at the open.

Trade 3: $ACB. This was a very good trade.. 5min ORB, one hotkey mistake, lost half the sharesize. But managed the remaining half very well, partialing at 3R, 4R, 5R before exiting on 15min High after 2 hours.

Trade 4: $FB. Another good trade on $FB. Setup: Bounce off 200MA on 15min. Partial at 50MA on 1min and at VWAP.Trade 5 & 6: $NVDA. Break even on a failed ABCD setup after 1R move.

Trade 7: $TWTR. Breakeven Trade. Reversal on 200MA 15min, but din't get the move.

Trade 8: $MDLA. Took Long after price moved above VWAP and MA's. Realized it was not a proper setup and exited. Small loss.

Good: Traded well, after the Hulk day on Friday. MA bounce reversaal (A+ setup) worked very well in Live ($FB) and SIM ($NVDA, $ACB & $AMD)

Improvement: I need to trade only the Setups. If not for my $MU and $MDLA trade, I would have been Positive. Both trades, I was trying to trade the current price action.

-

2

2

-

-

19.Jul.19

Red Day. It's a mixed day today. I have had some very good trades, but also Hulked out today.

Watchlist: $MU, $AMRN, $MSFT, $FCX, $CHWY.

Trade1: $MU Took conventional ORB and got stopped out. This has been failing me. I should stick to my Pullback ORB - Breakout entry setup.

Trade2: $AMRN. This is my Best trade today. Not only because of the setup, but because, I didn't manage this setup well yesterday, but today was almost perfect. Shooting star reversal at 50MA on 15min. Although I missed half of the move, I stick to my rule to exit completely on a 15min high and i did.

Trades3&4: $TSLA was setting up for a Trend trade with HH and HL with 50MA on 1min as Support. I took 2 trades, it missed my target of $257 by 2 pennies, before stopping me out. I think I should start partialing here.

Trades 5&6: $TSLA. Took another trade for breakout of flattop. didn't workout. Finally the price bounced after MAs cross and reached $260 before close.

Trade 7: $CGC. Took a ascending wedge breakout, that failed. It was a bad setup, with no MA supporting the wedge.

Trade 8: $ROKU. Took reversal off 200MA on 5min, price reversed a bit, but dumped with SPY. This was Doublebottom on 1min, but no Double Hammer, which makes it not A+ setup.

Trade 9: $ROKU. Later, $ROKU found a bottom and started reversing. Took it long at the MA's cross, and price popped immediately, this was a good trade, although it was Knifecatching reversal. Price dumped for the rest of the day.

Trades on $MDLA: Hulk Trading.

$MDLA had IPO on Friday along with $AFYA and couple of other stocks. I watched $MDLA thruout the day for an entry as it traded very well. I got one, after the doji at 200MA on 1min (although the MAs are less meaningful on IPO day). This was a good trade. Took another long at Double bottom, and this was good too. My partials were not so good, I kept getting stopped out with good amount of shares.

Then I noted the Double bottom Double hammer setup on the 5min. Took long 3 times and partialed. Although this is a good setup to hold long, i didn't want to do that on the IPO day. I felt so confident that 5 of my trades went so well, now I got greedy. My next trade i increased the share size a bit, stopped out, gave most of my profits back. I wanted to get my money back, I went Long again. I didn't respect atleast 2 of my rules on this final trade. I added to my position and didn't respect my stoploss. I Hulked. Finally stopped below 50MA on 1min.

Result: I was 7times my max loss, due to my last 2 trades. I was so upset with myself and my emotions yesterday, i didn't journal. Today, retrospectively, I think I am fine. This had to happen at some point of time, I am kinda happy it happened now and it wasn't a costly lesson. Because my R is very small.

Attaching the 15min chart of $MDLA also, to indicate where it failed to form the $ABCD pattern.

Good: $AMRN trade was very good. Even $MDLA, i traded well most part. After my final loss on $MDLA, I closed the DAS platform went out for dinner with my family. Just wanted to take my focus away from Trading.

Improvement:

- My partials need improvement. Either I don't take partial ($TSLA at $257) or I leave too much to go to Stoploss ($MDLA). I need to find a balance.

- Conventional ORBs not working again. Need to focus on the Pullback ORB breakout entry setup.

- Hulk day on Friday. Hoping for a normal session coming Monday.

Psychologically, it is very difficult to accept a Loss (and lose most/all the profit) after few Wins, than accepting a Loss on your first trade. By analogy, If I get knocked down in the first round it is OK, but if I have my opponent on the mat, but he comes back to beat me, then I am furious and want revenge. That's what I saw myself doing on Friday. That's the lesson I take from it.

-

2

2

-

18.Jul.19

Green Day. I had changed my strategy a bit. I have reduced my R factor by 50%, My Max loss is 4R, Daily goal is 4R. Because I am starting out without PDT rule, I would like to take as many trades as possible to confirm my style of trading. It may result in overtrading a bit and lot of commissions. But I think it is important not to restrict myself when i feel the setup is there. My Risk controls are my Maxloss per day and small R. I can do this in SIM, but sometimes I get very complacent in SIM. I will journal most of the trades that are relavant, if not all.

Watchlist: $AMRN, $AMD, $MU, $FB, $ROKU (although I liked $NFLX, price is not in my range)

Trades 1, 2, 3 & 4: $AMRN, I liked $AMRN because it was gapped down. Price is within my range and it is not very volatile. I took ORB down after a shooting star (alike), got stopped out after 1R. I waited for the price to pop above VWAP, took it long after the long wicked candle, got stopped out. Did it again, and got stopped out. Then the price starts to move up on ABCD pattern, I took it long now and exited at HOD. Missed the move, but I was short biased on $AMRN and was worried about the Double top. But $AMRN traded much better than I imagined.

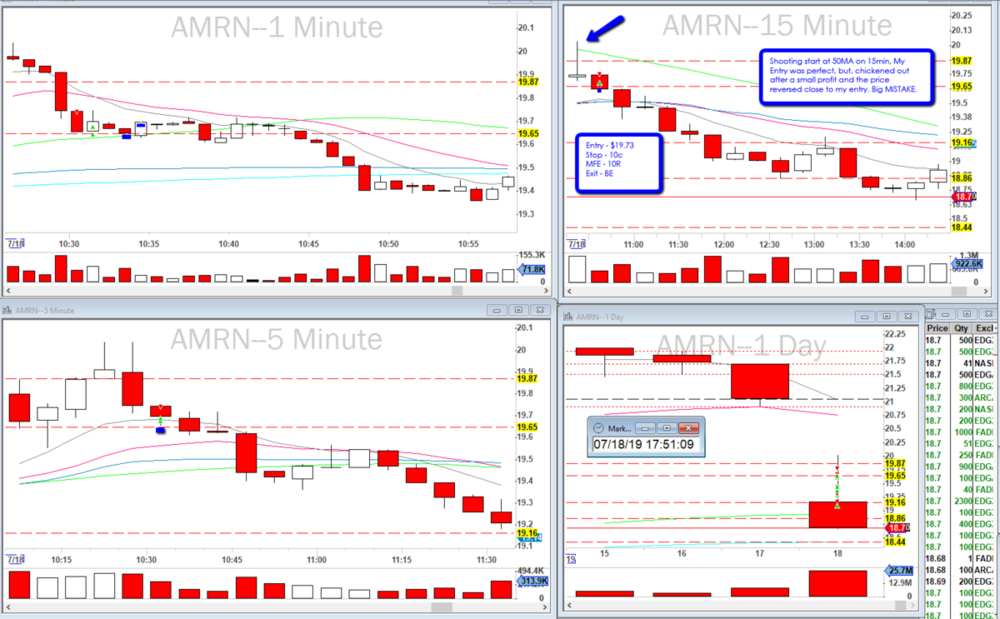

Trade 5: $AMRN. I am a bit emberassed about this one, because of the way I managed it. This is probably one of my worst Trades if not The absolute worst. Mid day, I noticed that $AMRN started to reverse. i saw the Shooting star on 15min at the 50MA. This was perfect setup. My entry couldn't have been better. But I chickened out after the price retraced back to my entry. I missed a 10R move. I was already Short biased on $AMRN and I should have stayed in this. As expected price came down to 50MA on daily and even close to 200MA daily. May be I just wanted to stay green today, however small that is. I expect $AMRN to be in play again tomorrow.

Trades 6 & 7: $MU. $MU was strong on the daily. It created a false VWAP breakout on the downside, then came above resistence including VWAP. I took it long and partialed at HOD. Went long again on the pullback to the HOD. Nice Trend trade. I managed it quite well.

Trades 8: $AMD. Noticed $AMD wedge forming at $32.77 (daily level) Took it short at the break of wedge to LOD. Partialed once before exiting at new 15min high. Neat trade.

Trade 9: $ROKU. This was a really nice Reversal trade. 15min had strong support 50 and 200 MA below. Price bounced off of 50MA also forming double bottom on 5min. This is A+ setup. Sold all the way to VWAP.

Good: I like my new strategy to cut down the R and be open to take more trades. I can learn a lot from it. Also means, I am operating with small share sizes, which I will slowly increase every month. I changed my DAS layout also, and like the new format.

Improvement: Need to accept the loss on a Trade, I am still hesitant and assume that my trade setup is going to work every time. Or I am cutting short my trades so the A+ setup now becomes an Invalid setup ($AMRN short). $AMRN could have been my one and done. My focus is to try and avoid this going forward.

-

3

3

-

-

17.Jul.19

Red day. Watchlist: $MU, $SQ, $TSLA, $QCOM $CSX.

Trade 1: $MU. Took conventional ORB at the open. Took short on the pullback to VWAP, got stopped out. 1.5R loss.

Trade 2: $CSX. Another ORBD at the pullback. One partial and then got stopped out above VWAP. I don't think the stop was too tight. May be I could have re-entered, but after a loss, I move to other stocks. Probably to avoid Revenge trading.

Trade 3: $ AMD. $AMD and $MU were choppy today. I noted the price popping up above the resistence and also setting a trend. I took it long after the bounce (red hammer candle 1min) Price moved slightly and then dumped to stop me.Trades 4&5: $TSLA. I took long after price broke VWAP mid-day with a strong candle and offered pullback. Got stopped out. Went long again as the setup was there. my target was $257(2R), I moved it higher, once the stock was strong. But got stopped out BE. No partials. .

Good: Not much, except no Revenge trading.

Improvement:

- I need to reduce my sharesize. And analyze my stops. For the 3rd day, I am getting stoped out on good setups.

- I had 2R on $TSLA, but moved my target after seeing the price action, stopped BE. May be i should partial once before moving my Target to higher levels.

-

3

3

.thumb.png.9253287035c1f4fe4daf147275f9c58e.png)

Vikramaditya Trading Journal - Live 08Apr2019

in Day Trading Journals

Posted · Edited by IamKarthi

9.Aug.19

Small Green day. 2r. Happy with my trading today, although my profit is small. After the target, switched to SIM after long time and made some nice trades.

Watchlist: $ROKU, $UBER, $DXC, $FTCH and $RKDA

Trade 1& 2: $ROKU. Gapped up at the open, waited for the pullback, but late on the Entry. So took 1min ORB and got out at 2R. While putting a range order made a mistake and exited completely, like an idiot. Waited for the next setup. 5min formed the PB-BE setup on the 3rd candle. Took it long, got a partial at 2R, added on the pullback. But the price seemed to be rolling over so got all out immediately.

Trade 3: $FTCH. Gapped down at the open. took it short after the price couldn't break up all the MAs. Din't get the move quickly, so got out BE. I usually move on to other stocks to avoid Revenge trading. This one had a nice shooting star on 5min. Could have taken short. But there is always another trade.

Trade 4: $RKDA. Took a small size on $RKDA premarket, took a partial, and then stoped out. There is no leverage of Range order, so I must get out immediately after the price broke my SL. Did just that.

Switched to SIM and traded $DIX for a reversal at 11.35AM, as the price was bottoming. had 70c move against 20c stop. Traded $MSFT reversal on Double bottom at 12.30, had 50c move against 25c stop. Took a Long position in $AMD for the break of $35.

Good: overall good trading day, as losses were very small and wins big. Also had some good trades in SIM.

Improvement: must avoid these hotkey mistakes. $ROKU was a nice ride up. Also on the 2nd entry in $ROKU, i could have gone with big R instead of r.