-

Content Count

373 -

Joined

-

Last visited

-

Days Won

49

Posts posted by Mark D.

-

-

Thursday May 23rd, 2019

Sleep: 7 hours. Mood: good ready to trade.

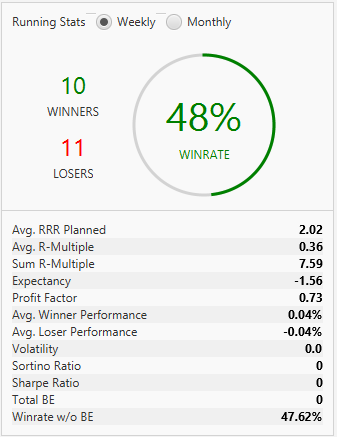

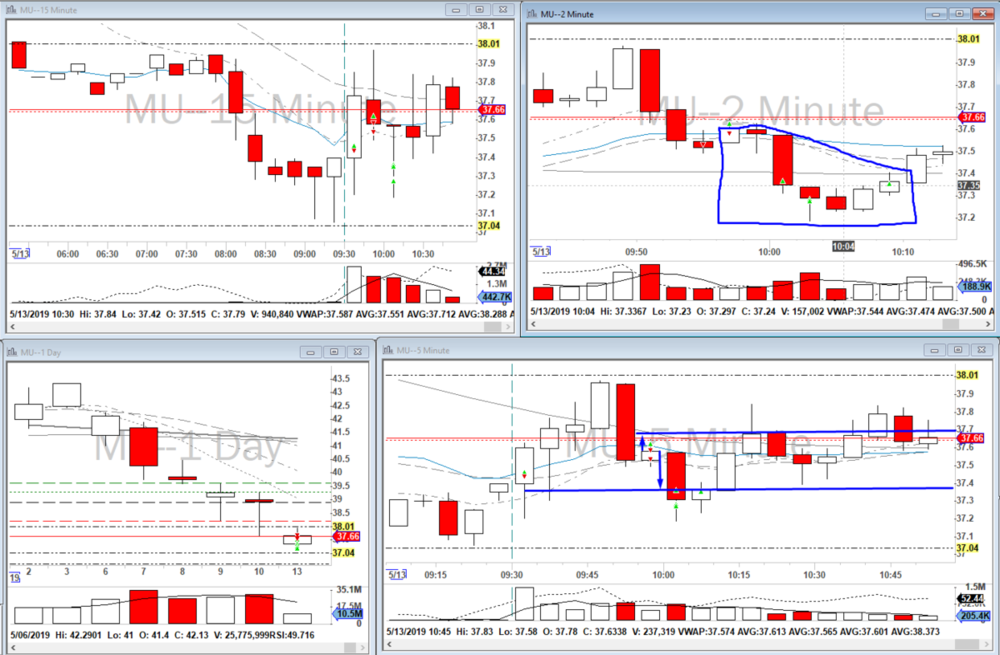

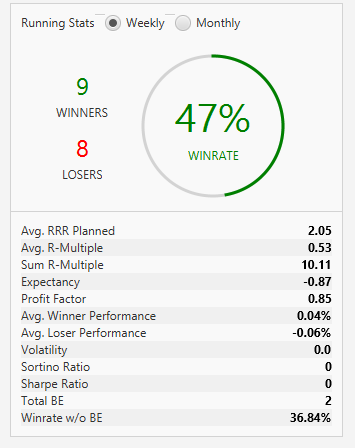

i've been thinking about my win percentage now that i've been scaling out and neither my excel sheet nor my Edgewonk journal is calculating what it truly is. for instance this week, i had one winner that i sold in two parts but both my journals show that as two wins. i had no trades Tuesday and three stop outs yesterday so i should have a win rate of 25% but my journals both say 40%. i'm going to start keeping a weekly "real" percent win on my weekly and work on getting that over 50%.

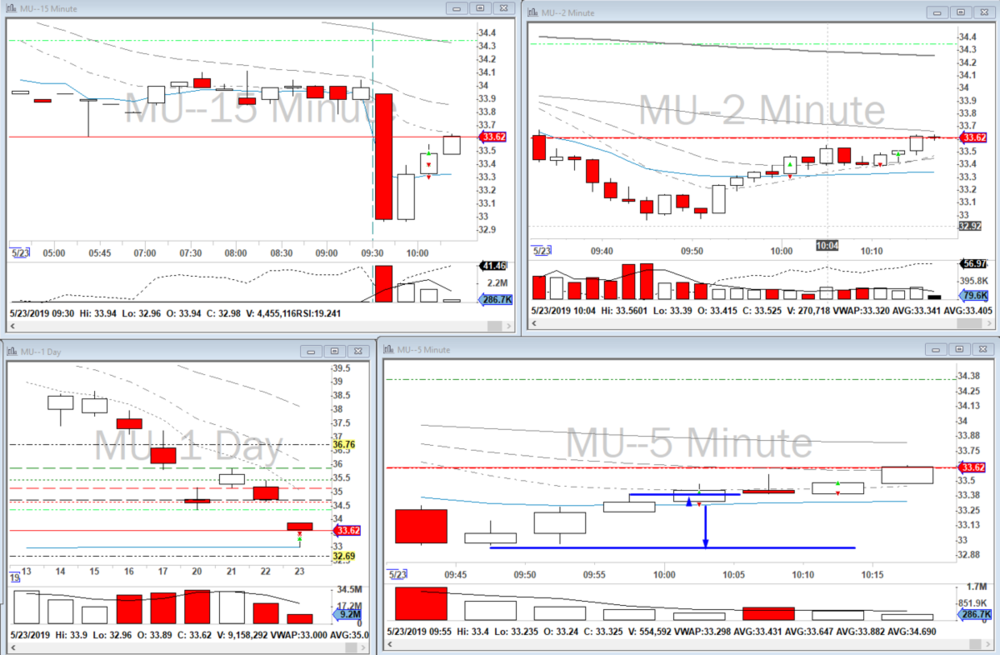

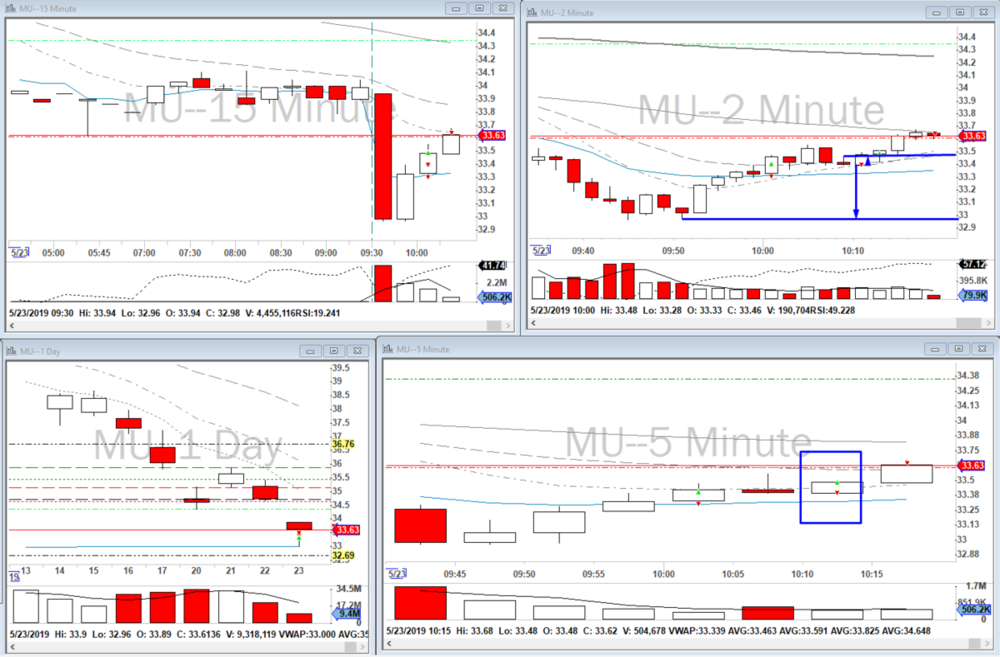

almost took MU on the ORBD but didn't then thought about taking it on a double bottom but thought it was too risky. I waited for it to come up to VWAP and then make a new 2min low and got in short, i was short bias because it was rising with lower volume so i thought that if it made a new 5min low it would try for the LOTD again. as soon as i got in i realized it was not close to making a new 5min low and it closed above VWAP. got stopped out on a new 5min high.

GOOD: got out of the trade

RFI: no 5min signal to get in

MOOD: frustrated

CONSISTENT: yes

Took the same trade again except this time i did wait for a new 5min low but i got short right in the face of the MAs and i went too heavy and got stopped out again. stubborn trading trying to revenge trade the same short again. at least i waited for a new 5min low this time.

GOOD: waited for a new 5min low

RFI: shouldn't have tried that trade again

MOOD: dissappointed in myself for trying another short above VWAP and the MAs, just being stubborn

CONSISTENT: yes but a little stubborn on my exit.

What i did good today: limited losses

What i did bad today: guessing on trades and not waiting for setups.

What can i do better tomorrow: trade setups.

Other comments for tomorrow: back to sim unfortunately. there's just no reason to trade live with a win percentage of 17%, i'm just wasting money. i don't like having to trade in sim because the emotions just aren't there but until i can reliably trade my edge there's no point in working on emotions. i'm off until Wednesday which is a bummer but i will regroup and come back next week!

-

3

3

-

-

I agree with Mike, that $SE trade was great, timing was just right and you scaled out with one piece at the low.

-

Wednesday May 22nd, 2019

Sleep: 7 hours. Mood: good, ready to trade.

first trade of the day was an ORBU in NEO. i did not like the time and sales before getting in but it looked like it was going to break with some movement and it did for a little but then the T&S slowed down and the spread got really bad and i got stopped out for a little more than i wanted to lose. I did not like that i got out at the low of that candle, could have held for a couple more seconds and got out at a better stop.

GOOD: good setup, good R/R

RFI: bad time and sales. shouldn't have taken this trade.

MOOD: mad about getting out at the low of that candle and not giving it a second

CONSISTENT: yes, got out at my stop

next trade was an ABCD in QCOM. this thing was really flat and not trending but i reasoned if it broke above the MAs on a new 5min high it may start trending up. it did and i got in risking the lowest point of the low move. it broke over to a new 15 min high but as soon as it did it came right back down and i saw that as stops being hit with no buying pressure behind it and i thought about getting out but didn't. then it sold off below the MAs for a new 15min low and i thought this is going to hit my stop i should get out but i didn't and then it hit my stop and i got out.

GOOD: respected my stop

RFI: so many signs saying get out of the trade and i was just too stubborn. also this was too flat to trade to begin with.

MOOD: mad at myself for being so stubborn about bailing

CONSISTENT: yes, i stuck to my plan.

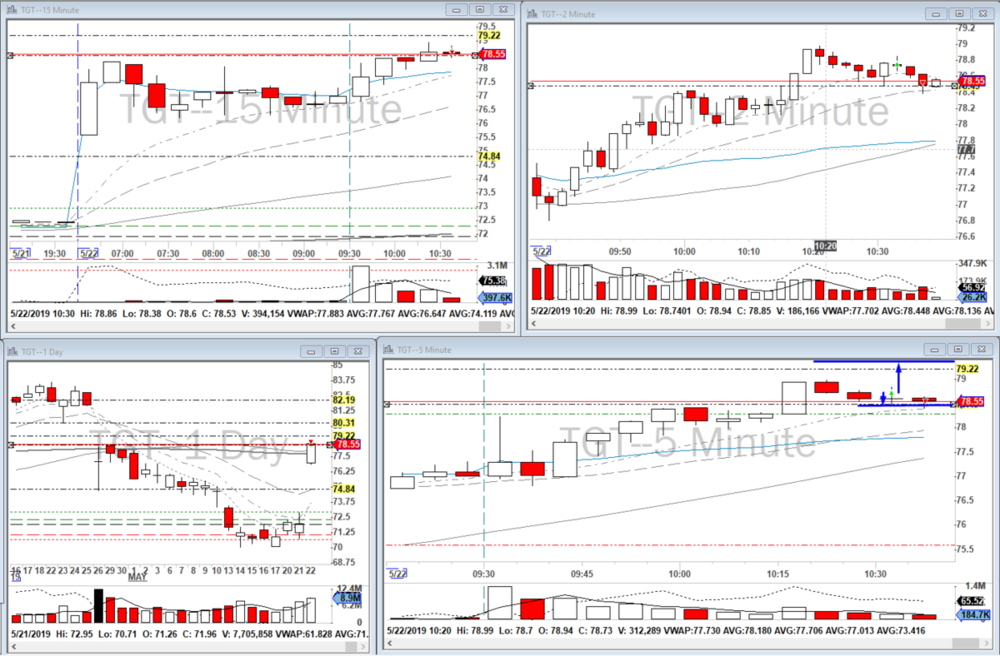

Last trade of the day was an ABCD in TGT. I just wanted to catch a winner but this was so late in the morning, it just fell flat. took an ABCD and got in on a new 5min high, risking a new 5min low at the daily level. Got stopped out pretty fast. Should not have taken this trade, it wasn't a bad setup exactly, it's just that i was more willing to take a risky trade after i stopped out twice that i'm sure i wouldn't have taken this trade had i been green for the day.

GOOD: respect my stop

RFI: dumb trade.

MOOD: frustrated.

CONSISTENT: yes

I was feeling really down about my trading today but now that i'm writing this out it wasn't a bad day. yeah i didn't take the best trades today but i respected my stops and took setups and followed my trading plan. I think the only thing i would change is that i should have stopped trading or took a break once I felt mad about getting stopped out in my first trade. I was upset solely because i lost money and that's the worst reason to be upset in trading. I will work more on noticing my emotions when i get stopped out and use that to judge if i should keep trading.

What i did good today: Took only setups and respected my stops.

What i did bad today: let my emotions about losing money throw me off my trading.

What can i do better tomorrow: Notice emotions after each trade and decide if i'm in the right frame of mind to keep trading.

-

2

2

-

-

11 hours ago, Patmartel27 said:Need a really great discipline doing that, I think you made the good choice!

thanks Pat

-

Tuesday May 21st, 2019

Sleep: 7 hours. Mood: good, ready to trade.

i had some personal stuff come up so i had to miss all my pre-market work and the first 15 minutes. when i finally got to trade, the only thing that looked like it was trending was ARRY and it was really extended so i didn't bother messing with it. Plus i just feel off without doing my routine so i thought it better not to take any trades today.

-

3

3

-

-

20 hours ago, Rob C said:I feel a little uneasy giving advice since I am struggling so much on my own. Plus, I am sure Mark can explain things better than me. But what I thought I would do is list the changes I made that helped me and maybe you can find something useful in the list.

My first 3 months of live trading I had 6 hulk days and 16 max/loss days. Since I made these changes 3.6 months ago I have had zero hulk days and zero max/loss days.

1) Switched brokers to CMEG so I could reduce my account size so blowing it up is not as much of an impact.

2) Added risk controls from CMEG/DAS. Realized max so it would prevent me from going hulk and unrealized in case I lose internet in the middle of a trade.

3) Made a simple goal for 3 months. Don’t go hulk. I could trade terribly but as long as I never went hulk I reached my goal.

4) Started with 1 trade per day max. I tried the 3/day rule during my first three unsuccessful months, but I kept breaking it. 1 trade a day is very much an on/off switch with very little gray area. It was REALLY painful and FOMO was high, but after a week it got easier. The satisfaction of having enough discipline to stop at 1 trade was enough to be proud of myself. After about one month I switched to two trades a day allowed if the first trade was a winner. If the first trade was a loser, I am done for the day. I use to trade terribly after a loser.

5) Remove the unrealized gain window. This was tough, but surprisingly after a week I got use to it.

So that worked for me. Hopefully that helped.

i'm in no position to give advice either! I agree with all this, hiding the unrealized window really helped me and as an additional note, DAS risk controls on both unrealized position and total realized for the day keep me from hulking out. i don't like having to use them but that's the reality of the situation.

-

3

3

-

-

7 hours ago, Rob C said:I got stopped out on AAPL and FB was a nice 1min ORBU.

i can really relate to that!

great trading!

-

1

1

-

1

1

-

-

5 hours ago, Rob C said:Great trade, good to see you live trading again. REALLY strong discipline holding through the pull back. Not sure if I could have done that. Also, really good discipline holding until 2R before the first partial. I know I couldn't have done that.

thanks Rob. i thought about bailing especially after that big dump at 11 but i figured if i get out now it's about the same as stopping out at breakeven so i might as well hold and see what happens. a lot of that price action i'm not seeing as well because i use range orders and step away from time to time so maybe i would have bailed had i been really watching. i thought for sure i was going to be stopped out right after i got in but glad it worked out.

-

2

2

-

-

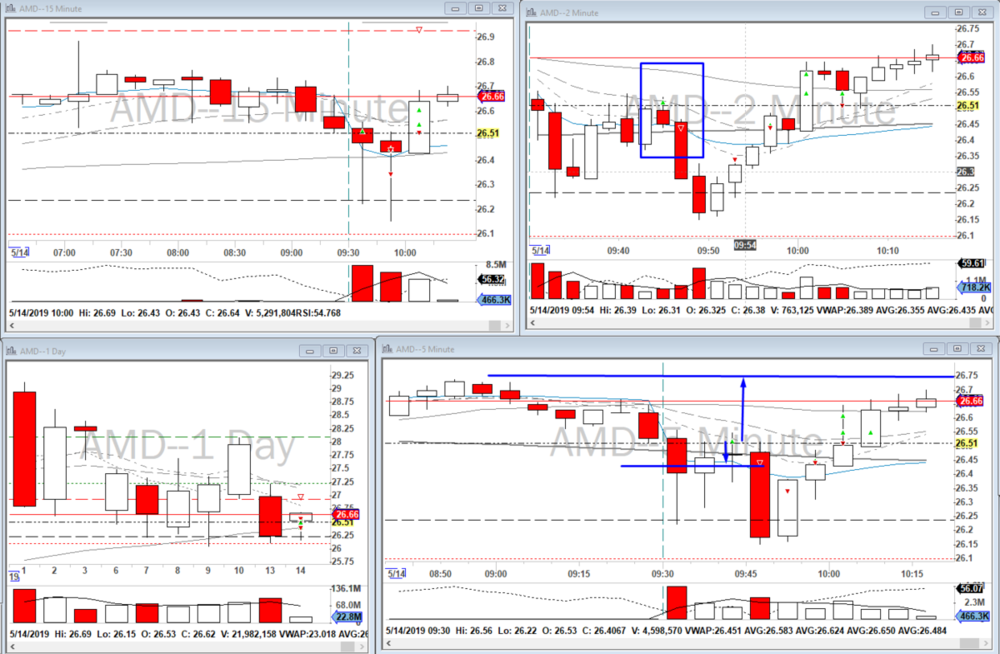

Monday May 20th, 2019

Sleep: 7 hours. Mood: good, ready to trade.

i think my nerves got to me today at the open because the 2min ORBU in T looked really good but i just couldn't bring myself to pull the trigger, chalk it up to trading live again after a couple weeks break . I waited for a 5min ABCD setup as well but that fell through too. I was starting to think i wouldn't get any trades today but then i saw AMD making a double bottom so i got interested in taking a position. i ended up getting in on a new 2min high. it wasn't the best entry but pretty good. i was not at all confident in the trade, nerves again. i took off about 75% at 2R and the rest i saved for $27.04 right under the 200 MA on the 2min chart but i had to keep moving it down as the MA moved down and ended up getting out at $26.93. i could have just left it at $27.04

GOOD: took a setup, pretty good R/R

RFI: could have got a better entry

MOOD: good

CONSISTENT: yes.

What i did good today: took only setups, didn't chase or FOMO

What i did bad today: could have got a better entry in the trade i took

What can i do better tomorrow: get better entries.

-

2

2

-

-

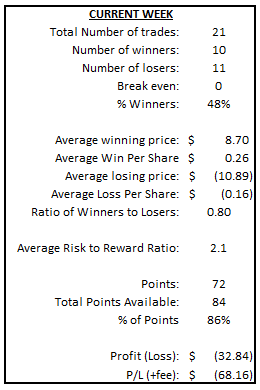

Week 20 Recap

Not a bad week of trading. Tuesday was the worst day with not taking setups and jumping in too early but the rest of the days were pretty good. Going back live next week because I feel like I’ve reset emotionally and I’m back in control of my trading and ready to start working on taking good live trades.

· Weekly stats

o 2.1 R/R (Goal: above 2.0) [Previous Week: 2.1]

o 72/84 86% (Goal: above 80%) [Previous Week: 83%]

o -$68.16 (Goal: $250) [Previous Week: -$52.51]

o 13/21 62% trades with the trend (Goal: 100%) [Previous Week: 74%]

o 6/21 29% Non-optimal Entries (Goal: 0%) [Previous Week: 32%]

o 1/21 5% Letting Losers Run (Goal: 0%) [Previous Week: 11%]

o 2/21 10% No Setup (Goal: 0%) [Previous Week: 32%]

· Highlights

o Most stats are better than last week which were better than the week before so improvement on entries, setups and stopping myself out.

o Good controlled trading with the exception of Tuesday.

o Nice ABCD setups taken this week.

· Ongoing things to work on

o Still too early on some entries (though much better than the last couple weeks) this was, again, the main reason I lost money this week.

o Need to work on getting out of trades that aren’t working sooner. Like the ABCD in UBER that couldn’t make a new 5min high.

o Focus on 5min chart and less on the 2min

o Limit orders on ORBs to limit chasing.

-

2

2

-

-

Hi Brandon, are you still trading? Hope everything is going well

-

6 hours ago, Patmartel27 said:Hey guys, I didn't post my journal for a while, I struggled a lot in the last week, several Hulk days, bad psychology

etc... So I feel pretty shy and guilty about that. I will take the weekend to work on my mind and having a good plan

for next week. Monday I will post it bad or good. If someone are willing to mentor me I will greatly appreciate

I think I'm needing someone with an external view.

Thanks have a good weekend

Don't be ashamed of bad trading or hulking out. We're all guilty of it and the whole point of posting is for reflection and where we can improve. One thing I do when I have a bunch of losses in a row is to go back to sim and just practice recognizing setups and getting good entries. If i get stopped out then I try to take notes on my feelings and frustrations to start to correct the behavior. The first step in changing patterns is recognizing them.

Something else that's really helping me right now is recording my trading and watching the replays at night. You notice so many things not apparent in the heat of the moment.

Above all, be kind to yourself and patient. The learning curve is very steep and while trading comes natural to some, most people take years and years before they're successful (if ever) so never forget its a marathon not a sprint.

-

5

5

-

-

On 5/16/2019 at 6:33 PM, Rob C said:What I did good today: Never thought to break my 2 trade rule, even though the thought of revenge trading was high.

Good job not revenge trading

-

1

1

-

-

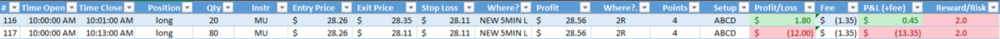

Friday June 17th, 2019

Sleep: 7 hours. Mood: good, ready to trade.

saw the AMD and MU ORBUs. i didn't want to chase either so i put in limit orders at about what i would have had as my stops and neither got filled. that's ok i'd rather be at 0 than in the red. first trade i took was an ABCD in AMD. took it right at the break to a new 5min high. i risked the recent 5min low not the total low for the leg down because that made my stop too wide. i made a hotkey error and got in for a full position instead of my calculated shares based on my stop so i got out 20% at the previous day high. it ended up reversing from this level and i got stopped out.

GOOD: planned trade and entry were good.

RFI: hotkey error.

MOOD: good

CONSISTENT: yes on the not panicking and reducing to appropriate share size.

took the same trade again about 20 minutes later after it bounced off the $28.00 level for a second time. I immediately realized this was a bad trade. i don't think it was a revenge trade, i was thinking rationally and i checked the other stocks on my watchlist for something else to trade but this was the only one i liked. My mistake was that this was no longer an ABCD but a double bottom so my entry should have been as close to the $28.00 level as possible. the way i traded it gave too wide a stop to get to 2R with the way AMD was trading today. i got out half at the PDH again and then moved my stop up to a new 15min low below VWAP which ended up getting hit. i should have got all out at the PDH but that's just hindsight.

GOOD: reduced risk when i saw the trade wasn't likely to work.

RFI: shouldn't have taken that entry so far from my risk level

MOOD: good

CONSISTENT: yes i adjusted according to the price action.

What i did good today: no chasing or FOMO

What i did bad today: second trade wasn't really an ABCD setup

What can i do better tomorrow: make sure to double check profit targets before taking trades to make sure they're probable

-

1

1

-

-

13 hours ago, Rob C said:Mark, great trades on UBER and CSCO the last two days. I even took a picture of UBER for my playbook. A perfect ABCD on the 2min and a perfect bullflag on the 5min. Great entry too. Funny how some the best trades don't actually make us money. I just had my best trade (based on my score card system) this week. How much did I make? Minus one R on a stop out.

thank you. the market never lets you forget it's all probabilities. i'm still salty about that UBER trade, not the stop out just the sudden huge jump in price.

-

17 hours ago, Mike B said:Great entry on that trade. By that time in the day I was emotionally drained dealing with FOMO and missing entries that I just moved to sim.

thanks Mike, i can relate to those kinds of days.

-

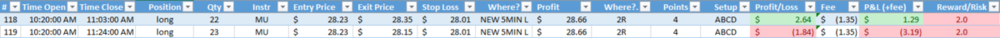

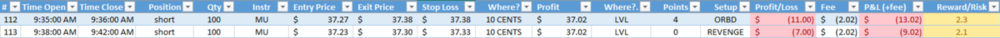

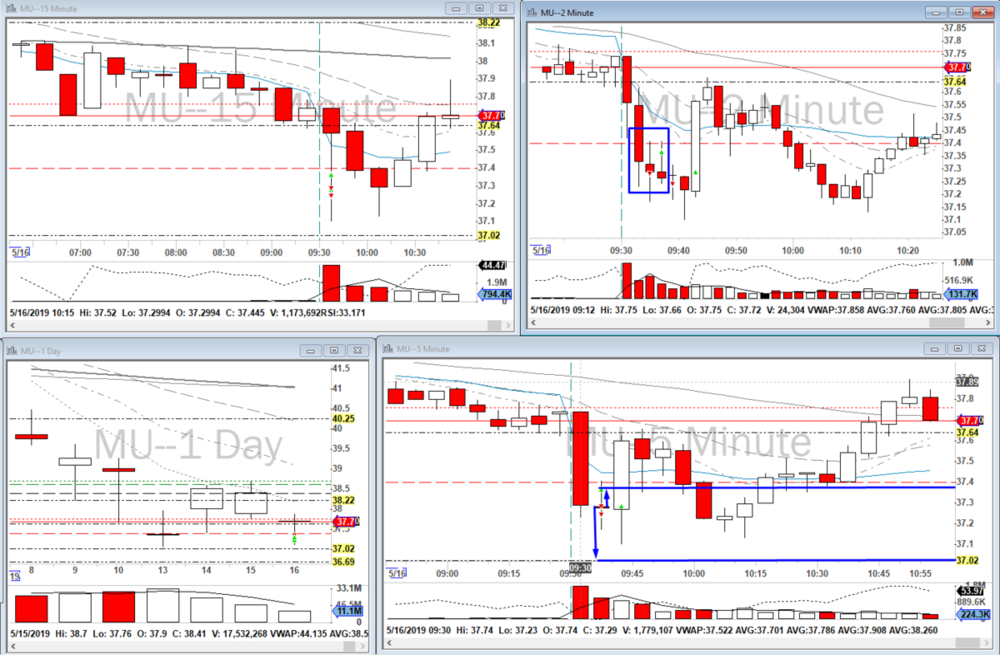

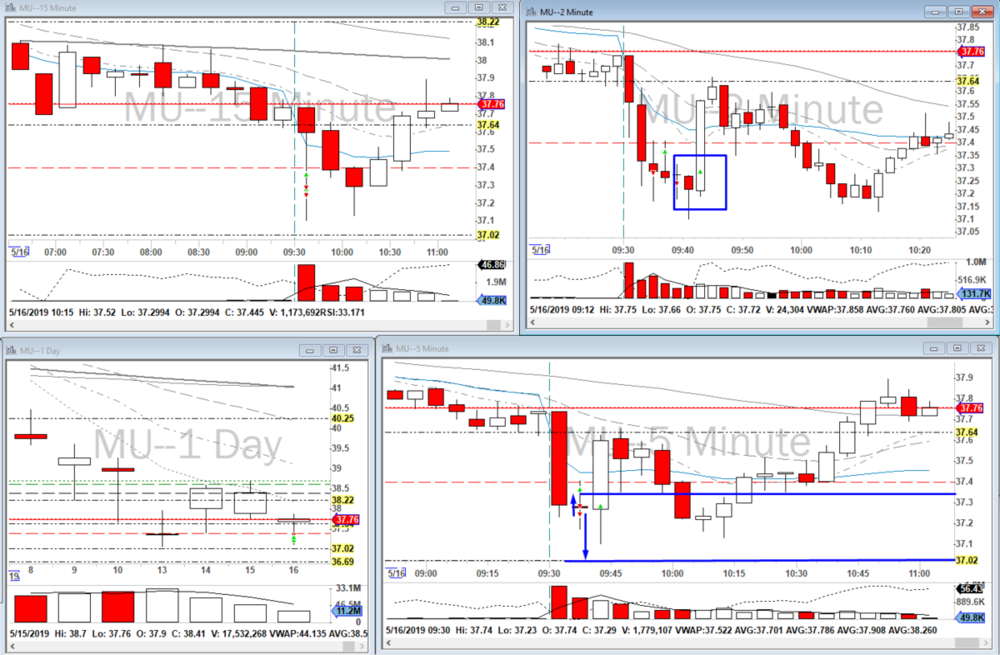

Thursday May 16th, 2019

Sleep: 7 hours. mood: good ready to trade.

first two trades were ORBDs in MU. wanted to use the previous previous day low as resistance and then i thought i should use it as my entry. but i FOMO'd and chased and when it came back up to my wanted entry i was already stopped out of my first trade. then i took it again on a new 2min low which worked but couldn't get low enough so i got out on a new 2min high. glad i did because it would have squeezed me for a worse loss. I should have put in a limit sell right under my wanted price and either got it or not. i'm tired of chasing trades and losing money also i need to stop getting right back in these ORBS after they don't work. no sense in losing twice on the same trade.

GOOD: ORBD setup with resistance level

RFI: chased the entry. tried the same trade again at a worse price

MOOD: ok

CONSISTENT: yes on the first. no on the revenge trade.

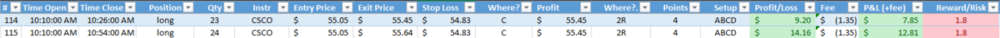

Last trade of the day was an ABCD in CSCO. got in on the new 5min high after a spinning top. sold half at 2R and the rest i saved for the $55.82 level that i got nervous about and sold on declining volume and flat price action. now after it has moved substantially higher i regret my decision lol. all in in though i am very happy with this trade. textbook ABCD.

GOOD: good setup, R/R

RFI: moved my profit up and didn't leave a tiny bit to run

MOOD: happy.

CONSISTENT: yes.

What i did good today: took only trades with setups.

What i did bad today: chased the ORBD in MU twice

What can i do better tomorrow: limit orders on ORBs to prevent chasing and don't revenge trade if it doesn't work out.

-

1

1

-

-

17 hours ago, Mike B said:Hey Mark,

I use to watch the Lvl 2 for my stop loss and about a 1 1/2 months ago, I heard Andrew say that he watches the last price marker on the chart more than anything. So, I started forcing myself to watch that instead of the lvl 2 and it became easier for me to exit at my stop. Also a by product that I was not expecting was I started noticing I had a better understanding of the price action by watching the price marker instead of the lvl 2 prices and time and sales.

Mike

hi Mike,

thanks, i typically do watch the price marker but i've been trying to not completely neglect T&S and the level 2 but now i'm focusing too much on them

-

Happy to see you posting again Mike

-

Wednesday April 15th, 2019

Sleep: 7 hours. Mood: good, ready to trade.

didn't see any ORBs i liked. i almost took UNIT 2min ORB but the orders were too slow. i saw UBER was making a bull flag, waited for a new 2min high. got in long on the break risking 25 cents. it couldn't make a new 5min high and when i was it was close to breaking to a new 5min low i was watching the time and sales to get out at my stop loss and it broke so fast i couldn't react. got stopped out for a almost 3R loss. thanks UBER, done for the day.

GOOD: nice setup, didn't try to guess the low

RFI: should have got out when it didn't confirm the pattern on the 5min.

MOOD: disappointed and fearful. doubt i'll be trading UBER any time soon.

CONSISTENT: this is a tough call. i had all intentions of getting out at my stop so i'm going to say yes.

after that i messed around and went long hoping for a rebound and got stopped out again. Not happy that i let myself do that.

What i did good today: took a good setup with a good entry

What i did bad today: held on to a trade that wasn't working on the 5min chart.

What can i do better tomorrow: get out of trades that aren't working on the 5min chart.

-

2

2

-

-

Tuesday June 14th, 2019

Sleep: 7.5 hours. Mood: good, ready to trade.

first trade of the day was a 5min ORBU in TME. i didn't want to chase it so i put in a limit buy at 14.79 which ended up getting filled. once i was in the trade i did not like the price action at all, too jumpy and when it went over $14.90 it sold off faster than i could even see it move so i got out with a small loss. I could have got out with a small win but i was afraid it was going to really sell off.

GOOD: used a limit order not to chase my entry.

RFI: could have got out at b/e or a small win.

MOOD: happy i didn't chase.

CONSISTENT: yes, good reading of the price action, this was a full stop had i stayed in the trade.

Next trade was a long in AMD. i chased the entry and when it didn't break the HOTD, it bounced back to the 200 MA and i got out for a full loss. glad i got out because it sank.

GOOD: got out at stop loss

RFI: bad trade, chased before it broke the HOTD.

MOOD: ok

CONSISTENT: yes, traded the plan.

once it sold off past the LOTD i waited for a pullback and got in short. i was confident in this trade but i was stubborn about getting out and got auto-stopped out. disappointed in my stubbornness to abandon the trade. also, i got in too early.

GOOD: good setup.

RFI: too stubborn to cut my losses

MOOD: disappointed

CONSISTENT: no, did not follow the plan.

That's three losers in a row and max loss for me so that's my journal for the day. i ended up trying that same short again in AMD, got stopped out. then i went long too soon and got stopped out and then long one last time that was a winner. still lost on the day.

What i did good today: good entry on TME. good idea on AMD it was just too strong. good job limiting losses in the first two trade.

What i did bad today: not taking strong enough setups. being stubborn on getting out of my AMD trade.

What can i do better tomorrow: take better setups.

Other comments for tomorrow: i've decided to re-instate my daily max loss on my SIM account. i removed it so i could practice trades and not worry about P&L but what i need right now is to practice as realistic as possible and part of that is having a daily max loss.

-

3

3

-

-

18 hours ago, Rob C said:Thanks for the video. Is his e-book worth a read?

you're welcome! i dunno, haven't read it

-

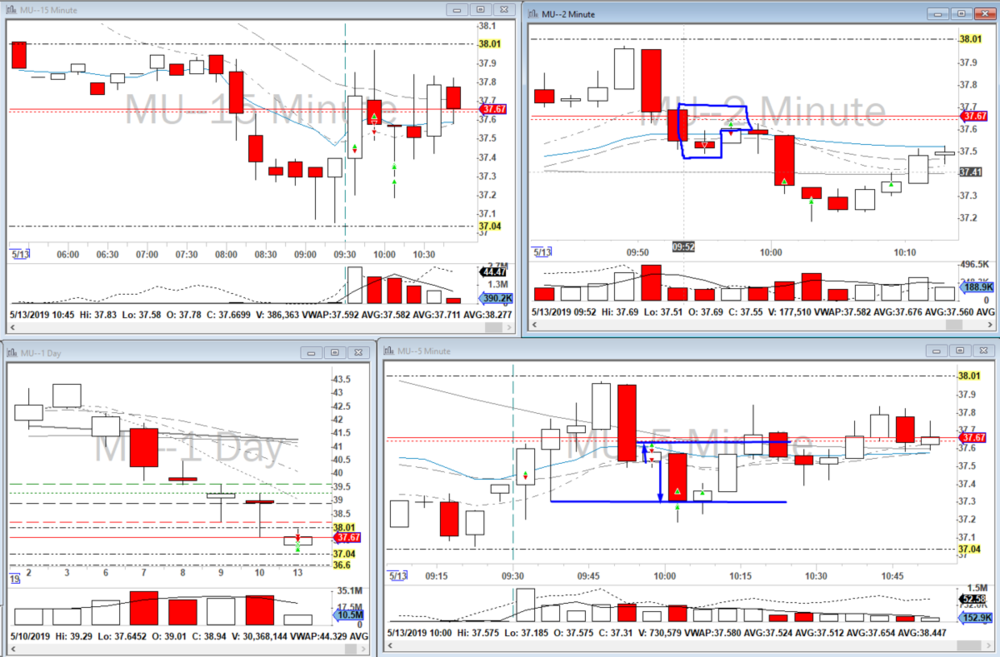

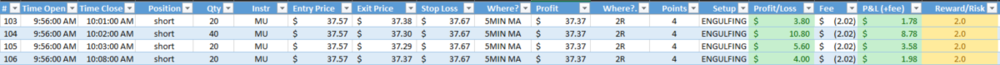

Monday May 13th, 2019

Sleep: 7 hours. Mood: good, ready to trade.

first trade of the day was a 2-minute ORBU in MU. it broke the HOTD but wasn't really pushing higher so i got out for a small loss. Should have taken a smaller size and gave it more room but i'm glad i limited my loss.

GOOD: setup was good, limiting loss is better

RFI: too big a share size for the range of MU at the open

MOOD: good.

CONSISTENT: yes.

Next trade was a 5min ORBD in TEVA. i got in on a pullback on the 5min chart, risking above VWAP. it hit my stop and came back down so i waited a little but it pushed higher and i got stopped out for slightly more than i wanted to lose.

GOOD: waited for a pullback and had a good resistance for my stop

RFI: should get out at my stop once it hits it and gives me an out.

MOOD: fine.

CONSISTENT: yes.

i was still short biased in TEVA so when i noticed it wasn't breaking the $13.00 level and made a shooting star on the 2min chart, i got in short. put in a range order for $13.01 to $12.65 and let it go. ended up hitting my profit target and went even lower.

GOOD: perfect entry and good R/R.

RFI: could have held a small amount for it to go lower.

MOOD: good

CONSISNENT: yes.

Next trade i saw MU make an engulfing crack on the 5min chart. i meant to get in for 50 shares and give it some room but i hit the wrong hotkey and took a full size and ended up having to take a loss at a closer stop loss.

GOOD: recognized a good setup.

RFI: hotkey error.

MOOD: ok

CONSISTENT: no, can't make hotkey errors.

I still liked the trade in MU so i got back in with a better entry and this one hit my profit target. i scaled out too much. one thing i did that i liked on this trade was that i set my range order on the last 20 shares to be at worse 2R from my entry and then at best right above the $37.04 level. i did this because i was tired of getting stopped out at my breakeven on my last piece. glad i used this strategy, i got 2R on the last part instead of break even.

GOOD: got right back in a good trade.

RFI: scaled too much

MOOD: good

CONSISTENT: yes.

last trade of the day was a quick scalp in INTC. i saw it was making a sort of ABCD pattern and making new 5min highs so i got in at the new 5min high, a little above what i wante, i was hesitating trying to see how many shares to get. took 50 a little bit higher than i wanted and got all out at the daily level.

GOOD: saw a trade setup and took it.

RFI: hesitating on share size

MOOD: good.

CONSISTENT: yes, exactly to plan.

What i did good today: didn't let my two stop outs effect the rest of my trading.

What i did bad today: TEVA ORBD was too early of an entry.

What can i do better tomorrow: always wait for a good entry, getting in early is too expensive.

Other comments for tomorrow: i watched this youtube video last night about how to help with impulse entries and what this gentleman was saying really resonated with me. i'm too hard on myself when i get stopped out because i take it personally. so today i took the mindset of not worrying about getting stopped out and just moving on to the next trade and it really helped me keep calm and focused on getting the trades that made money. here's the link for anyone watching. i love how this guy is just in the woods giving trading advice:

-

3

3

-

-

Week 19 Recap

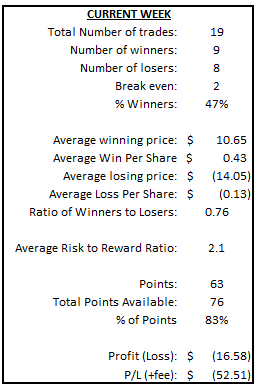

Not a bad week but not that great either. Not thrilled about being back in sim but my trading still isn’t good enough to get back in to real thing just yet. We’ll see how next week goes. I can’t believe I took 19 trades this week. That’s a good bit more than I usually do, I’ve been around 12 trades the last 3 or 4 weeks. Stats are better in every respect this week.

· Weekly stats

o 2.1 R/R (Goal: above 2.0) [Previous Week: 2.0]

o 63/76 83% (Goal: above 80%) [Previous Week: 33%]

o -$52.51 (Goal: $250) [Previous Week: -$97.43]

o 14/19 74% trades with the trend (Goal: 100%) [Previous Week: 44%]

o 6/19 32% Non-optimal Entries (Goal: 0%) [Previous Week: 78%]

o 2/19 11% Letting Losers Run (Goal: 0%) [Previous Week: 11%]

o 6/19 32% No Setup (Goal: 0%) [Previous Week: 56%]

· Highlights

o Almost all stats were an improvement from last week.

o Great trade in JD on Friday, SQ on Tuesday, MU on Monday.

o Better entries this week.

o Good one and done days Friday and Tuesday.

· Ongoing things to work on

o Hotkey error on AMD Monday.

o Still holding losers too long, that number needs to be zero.

o Too much scaling out on winners.

o Need to work on getting all out of trades way before breakeven.

Getting in to trades too early is the main reason im consistently losing money. I’m pretty much right on all my trades I just jump on too early with too big of a size for proper stop loss and then get knocked out of the trade before it goes in my direction.

-

2

2

-

Rob C's Trading Journal - starting Feb 1 2019

in Day Trading Journals

Posted

Nothing to be ashamed of Rob. It was probably the lack of sleep!