-

Content Count

373 -

Joined

-

Last visited

-

Days Won

49

Posts posted by Mark D.

-

-

Monday September 9th, 2019

Sleep: 6:45. Mood, tired but ready to trade. feeling calm this morning

Overall market is up again, SPY is over last weeks highs, up about half a percent.

Gappers list: $MU, $ROKU, $PAYS, $ACAD, $T, $NTNX

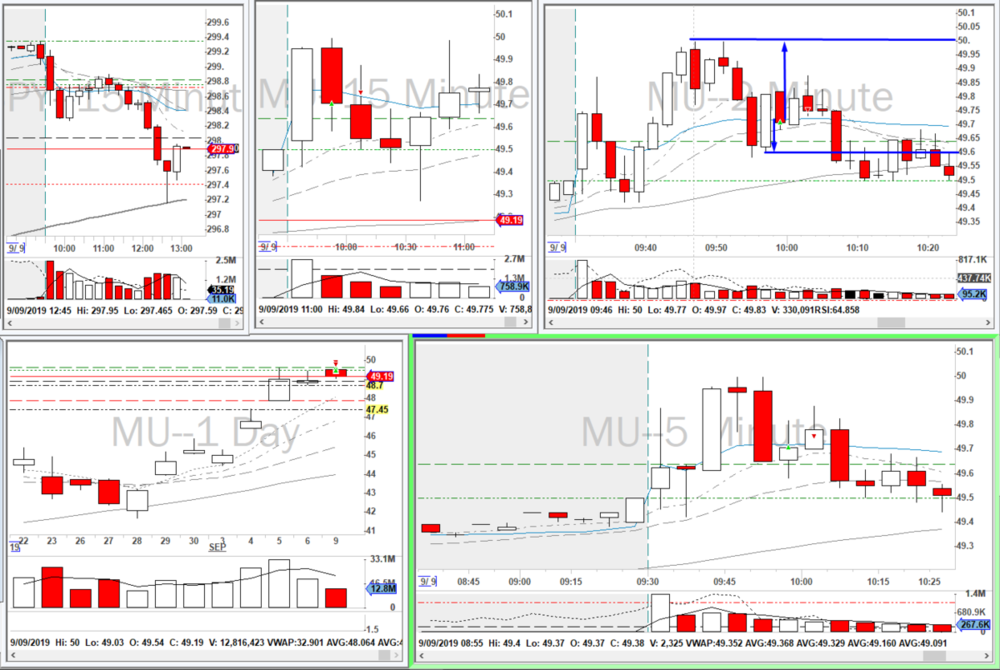

first trade was an ABCD in $MU (4/4). liked the trade but i keep trying to go long right before 10 o'clock and these trades just turn around on me consistently. i feel like i'm going crazy taking the same long trade over VWAP just for it to come back and stop me out.

GOOD: everything about the trade technically was good, entry was good, reward was HOTD, got in on a pullback after a bullish 2mins.

RFI: trying to go long right at 10 o'clock when it's time for them to head lower.

MOOD: tired of getting stopped out.

CONSISTENT: yep, saw the trade wasn't working and bailed early

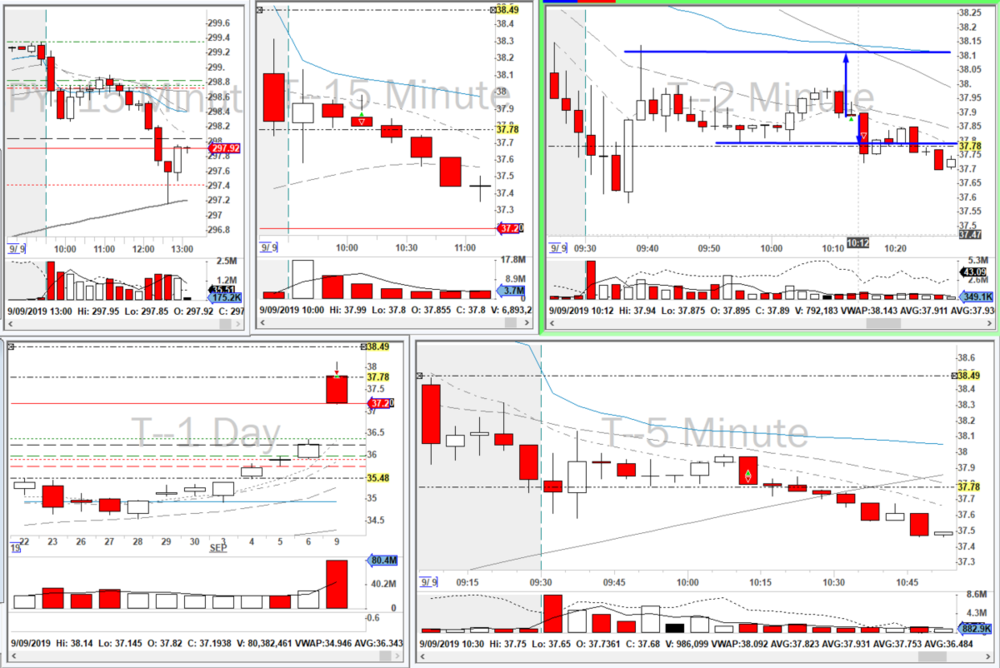

next trade was in $T (0/4). so what i wanted to to was get in right where i would have got in if i was paying attention. i did that but then i realized it lost the MAs and i held for almost a full R loss. also realized it's not a setup so no points (0/4)

GOOD: waited for the entry i wanted

RFI: not a setup. could have bailed earlier

MOOD: ok

CONSISTENT: yes.

tried the same long trade in $MU after a big run up to the HOTD. i wanted to go short near the high because i thought it was an overreaction but i chickened out. got in on a pullback after a new 2min high on volume that also didn't work. i set a range order because i had to get up from my desk and I got stopped out immediately.

GOOD: waited for the pullback

RFI: another dumb long trade that didn't work

MOOD: frustrated

CONSISTENT: yes

last trade was a frustration short trade in $MU. as soon as i put it on i realized i was just doing it out of revenge and i sized too big so i got out half and then when it wouldn't make a new 5min low i bailed the rest for a breakeven

GOOD: realized i made a mistake and got out

RFI: shouldn't take revenge trades.

MOOD: angry at myself for taking emotional trades

CONSISTENT: yes got out as planned

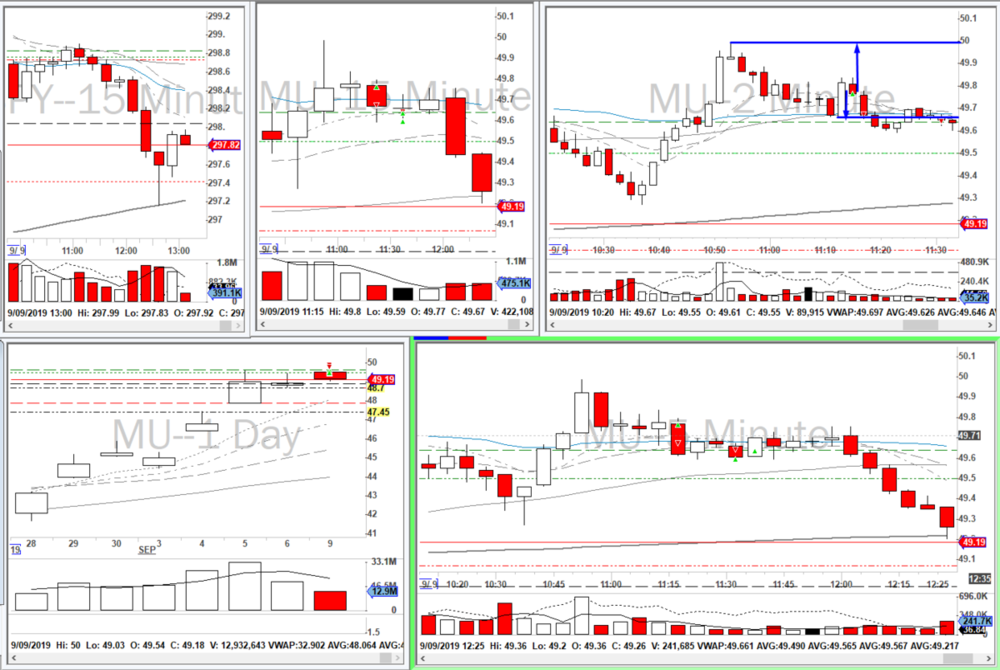

What i did good today: managed trades to 1R or less.

What i did bad today: took no setup trades, or bad setup trades 0/4 trades went as planned

What can i do better tomorrow: need better more reliable setups.

So i really don't want to go back to SIM but i feel like i have to. i'm just taking the same ABCDs that don't work and then just throwing my other trades away out of frustration and it's pretty much the same story every day for the last two weeks or so. I'm doing a great job managing trades, much better than i've ever done but the problem i'm having now is that basically none of my trades make it to the profit target before my stop so my plan is to go to SIM and work on my setups and i need to have two weeks in a row where i have 3R trades that work more than 34% of the time. Until then, it makes no sense trading real money if i don't have an edge to exploit.

-

3

3

-

-

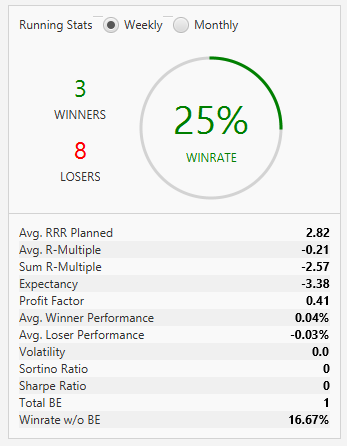

Week 36 Recap

Took some poor trades Tuesday and Wednesday that killed my week. Only had one trade that went to my intended profit target for the whole week. Thursday and Friday entries were much better, proud of those entries. The main issue, in my opinion is just not waiting for the best setups even on trades with good entries and at worst just FOMO jumping on trades that have already risen a ton on the day (ROKU Tuesday, MU Wednesday). Couple those bad trades with an order mistake costing a whole R and that leads to a -2.5R week. I was focused on profits and not setups or getting in on pullbacks Tue and Wed and my results reflect this.

Last week my focus was on smaller stop losses. While that is still important, I think my focus also needs to be on better setups that actually hit my intended profit targets. I can’t be profitable with only 8% of my trades hitting my 3R profit targets.

Every week I review my trades and every week I can point to one or two trades where I was not at my best and think if only, I didn’t do such and such I would have had a better week. This is an ever-present reminder that it’s never the markets that are wrong or choppy or whatever reason I give for losing money and it is always 100% my efforts that either make or lose my money. Reminds me of a quote from Trading in the Zone (I think) that says your daily P&L is how you viewed yourself as a trader that day.

· Weekly stats

o 22/48 46% grade on trades out of 4 (Goal: above 80%) [Previous Week: 83%]

o 1/12 8% trades hitting PT without hitting stop first (Goal: 33%) [Previous Week: N/A%]

o 6/12 50% Non-optimal Entries (Goal: 0%) [Previous Week: 50%]

o 0/12% Letting Losers Run (Goal: 0%) [Previous Week: 0%]

o 4/12 33% No Setup (Goal: 0%) [Previous Week: 17%]

o 3/12 25% true win percentage (Goal 45%) [Previous Week: 17%]

· Highlights

o Great entries on Thursday and Friday.

o Great job limiting losses on most trades towards the end of the week

o Didn’t think I would like knowing about why the stocks are gapping (because of bias) but I’m seeing that it is valuable because it gives more context to the price action so I’m going to keep doing that.

· Ongoing things to work on

o Have to find more reliable setups that actually hit my intended profit target.

o Working on incorporating research into the gappers time in my morning routine

o Don’t enter on the 2min breaks, enter on the pullback to the MAs on the next candle

o Great entry + small stop loss = easier price targets = more 3R trades.

-

1

1

-

-

19 hours ago, Magnus Alexander said:I considered taking the same trade on DOCU at around $56.36 when Andrew called it out in the chat, but something about it made me not wanting to take the trade. Now that I think about it, there were so many MAs in the way on the 1 minutes chart. Especially when there were a 200 SMA in the 1 and 50 SMA in the 5 which can be very strong resistance. Andrew probably realized that this was a quick scalp because I saw him scaling out most of his positions quickly at that $56.80 area. If I remember correctly, the thought of holding towards high of the day wasn't even there for him. Perhaps he had a feeling that the stock is weak? I don't know, just wanted to share my observation on how Andrew took the trade lol.

Andrew is crazy good at reading price action so i'm sure that's a lot of it also he's more of a scalper so $0.35 cents for him is a nice move. i thought about getting out some at the 5min MA but it was too close with my R/R so i just let it ride. Just happy i got out before it really dumped.

-

1

1

-

-

Friday September 7th, 2019

Sleep: 7.5 hours. Mood: good ready to trade. have family in town so i really didn't have a lot of time to concentrate on my trades today. i wasn't planning on taking any but i saw some opportunities and i though, why not.

First trade of the day was an ABCD on $DOCU (3/4). Docu was gapping up on earnings. missed the ORBU but then i saw it was making an ABCD on the 5min. got in on a pullback to the MAs. didn't like the rejection of the MA on the 5min and i got out before a new 5min low at break even.

GOOD: setup, R/R, trade management

RFI: maybe skip the trade because of the MA resistance.

MOOD: glad i was quick enough to get out

CONSISTENT: yes.

Last two trades were in $TNAV. $TNAV gapped up after yesterday's collapse from news GM was partnering with Google. the first trade was a bull flag on a 2min chart. waited for the new 2min high on volume and the pullback to the MAs. cold not break though the daily level of $6.03 so i got out at breakeven or small win. (3/4)

GOOD: good setup, entry.

RFI: wasn't in love with this trade.

MOOD: good

CONSISTENT: yes

should have got back on after the new low but i didn't and i pretty much took the same trade again with the same result. liked it better the second time and i'm happy with the entry just wasn't the right time again.

GOOD: good setup, entry.

RFI: had i got in lower, it would have been a decent trade.

MOOD: good

CONSISTENT: yes

-

2

2

-

-

Hi Glenn, be careful with those ORBs after that inverted hammer. I used to take those ORBDs like the one on DOCU right after that 2min inverted hammer until Vikram pointed out its actually a reversal signal. Thor took the opposite side of that trade today because of the hammer.

-

Taking two trades at the same time successfully is really tough, excellent work!

-

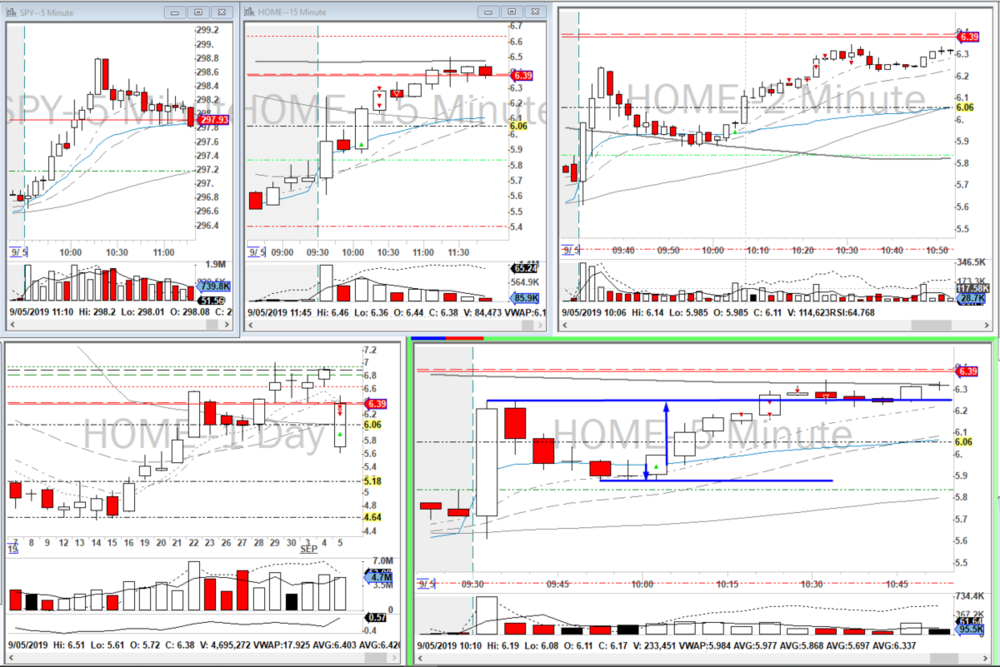

7 hours ago, Rob C said:Perfect entry on HOME. It's one of those entries that you point to after you see the chart at the end of the day and say, "that is where I wished I entered."

Thank you Rob!

-

Thursday September 5th, 2019

Sleep: 7.5 hours. Mood: better than yesterday. i was feeling crappy about my six losses in a row this week and my struggle with waiting for pullbacks. I had a chance to watch the Bellafiore interview and it was a good reminder that i am still really new to trading and that i have a long way to go. it did a really good job of putting my progress in perspective. Also i need to do a better job understanding the overall market and the catalysts in the stocks i'm trading.

SPY is up breaking the 284 - 294 range it's been in for the month of August. watch list today was $CIEN, $SIG, $LYFT, $WORK, and $HOME.

$SIG had an earnings beat and raised guidance with the stock up over 20% pre-market and has a short interest of 26%. my plan was to take it long if the setup was there.

So the first trade i did in $SIG did an ORBU (3/4). i took it long on a pullback to VWAP after a 2min engulfing and closing above VWAP. it did break the pre-market high but just couldn't go higher and i got out before my stop on the break of VWAP. i'm overall really pleased with this trade, i waited for a pullback to support to get in. had a stop loss that was a level though probably too far and i got out when i saw it wasn't working.

GOOD: i like everything about this trade.

RFI: could have decreased my risk

MOOD: good

CONSISTENT: yes.

i tried to take $SIG long again on a wedge trade (2/4) on the 5min chart. got in before the break that never happened. had several chances to get out early that i didn't take and when i got out at my stop, it blew through so hard i lost 10 cents on slippage. yikes. grading myself a +1 for a setup that i trade even though it wasn't the best wedge and +1 for my stop loss level was at a new 5min low. +0 for trade management and the HOPM not being 2R from my entry.

GOOD: got out of the trade

RFI: could have bailed earlier, not a great setup, too early on the entry, have to wait for the breaks then get in

MOOD: not too pleased with this trade

CONSISTENT: yes, i can't help the slippage, i got out at my stop.

$HOME gapped down on mixed earnings and guidance but i felt that it wasn't that terrible of news so i was also long biased. saw that is was making a pretty nice ABCD (3/4) so i got in on a pullback to the moving averages after it starting making new 2min highs on volume. really happy with this trade. i did botch the selling a little bit. i don't mind the first sell because that was over 2R and it wasn't really moving, i don't like the second sell because it was out of fear and not price action, had i just waited a minute longer i could have sold at my price target. this should probably be a (4/4) but i'm going to leave it.

GOOD: setup, entry, R;R

RFI: selling could have been better

MOOD: happy

CONSISTENT: yes.

What i did good today: finally got a winner! much better entries today, excluding the second $SIG trade

What i did bad today: second $SIG trade could have been skipped all together

What can i do better tomorrow: keep trading setups and waiting for good entries.

-

1

1

-

-

Wednesday September 4th, 2019

Sleep: 7.5 hours. Mood: good, ready to trade but feeling more nervous than usual this morning.

first trade was a 2min wedge in $MU (3/4). told myself i was chasing and i was right below the daily level of resistance so i had no business being in the trade but i'm currently struggling with FOMO on my trades and i got in anyway. ended up going to $47.50 but rejected that level aggressively and i got out at -0.5R. +3 for setup, stop loss and risk management. no point because i went long on right against that

GOOD: limited loss

RFI: FOMO entry

MOOD: disappointed in myself because i keep taking extended FOMO trades

CONSISTENT: yes

Next trade was no setup in $MU (0/4) decided to go long on a new 2min high because i thought it would hold the 20 MA on the 2min and i thought it would try for the HOTD but it came right back down for a full R loss. 0 points because it's not a setup

GOOD: got out as planned

RFI: no setup and no confirmation

MOOD: anger

CONSISTENT: yes, got out as planned even though it wasn't a good one.

Then i revenge traded $MU to the short side (0/4) since it lost the MAs on the 2min. got out on a new 5min high had a hotkey mistake and added more on accident. ended up touching my original stop and going lower. not sure it's going to hit my intended profit target, it's having a really hard time breaking $47. no points because it's not a setup.

GOOD: got out with a small loss

RFI: don't revenge trade

MOOD: frustrated

CONSISTENT: yes got out on new 5min against

What i did good today: limited losses

What i did bad today: Poor or no setups

What can i do better tomorrow: trade setups. don't FOMO enter trades.

-

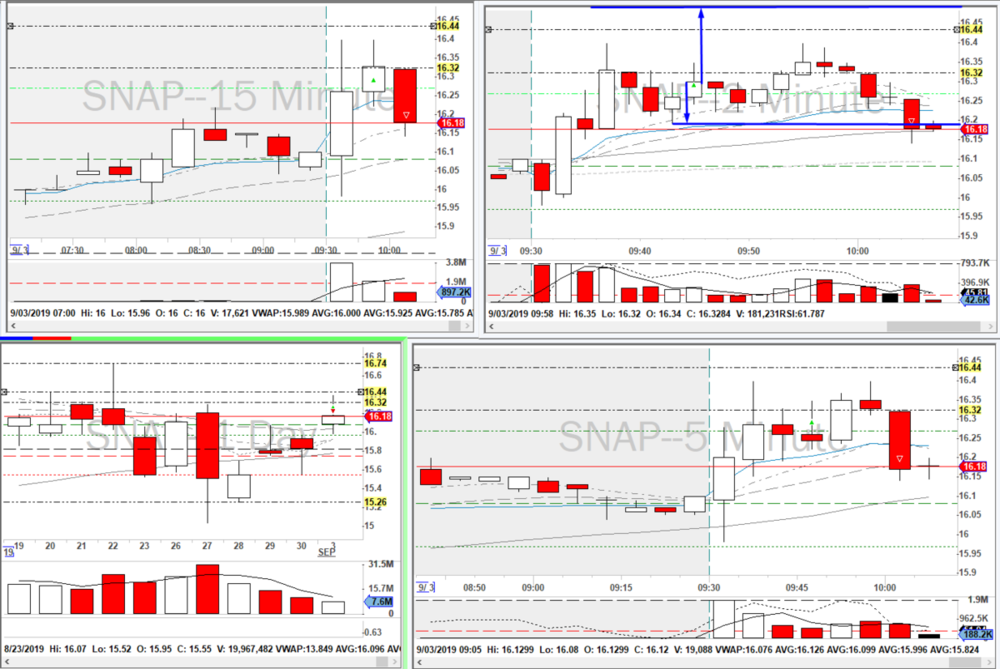

4 hours ago, Mike B said:Nice trade on $SNAP. I took the same trade, it looks like you got in right before me. I think my stop was at the same level or pretty close. I got out when it was having trouble pushing past the 16.35 price level with a lot of bids. I think it tested it 3 times before finally popping up and just barely touching the high of the day before reversing on us.

thanks Mike! i was just watching the replay of this trade and i'm really happy with it, not so much the exit but -1R is acceptable. there was so many asks stacked at $16.40 and there was a ton of buying on the T&S. just one of those trades that didn't happen to work out.

-

Welcome Magnus! nice trades! that entry on MDCO was perfect

-

1

1

-

-

1 hour ago, Glenn Budde said:I also like the SNAP trade, you had a 15min ORB with confirmation of ABCD on 2min...... I had a couple today that did the same thing, I will continue to trade them for a bit as I think it may just be bad luck. As long as we are getting the correct R/R it should work itself out.

thanks Glenn, i'm going to keep trading them too mostly because it's the setup i'm most comfortable with, but i think i'll wait for the R:R from my stop to the day high is close to 2:1 otherwise i'll skip it because they seem to always test the high but more often then not don't go higher. I will keep testing.

-

1

1

-

-

11 minutes ago, Rob C said:I really like you SNAP trade and your entrance right on the new 1min high after creating a line of support. What was your level for your final target? I can't make it out on chart. Was it the $16.50 level?

Hi Rob,

thanks! $16.63 was my target i didn't have the $16.44 level on my chart when i took the trade, i added it after as it was a day high from about a week back. So i picked $16.63 when i entered because it was under the next daily level but was 3R.

-

1

1

-

-

Tuesday September 3rd, 2019

Sleep: 7.5 hours. Mood: good, ready to trade after the long weekend.

First trade of the month was $SNAP long ABCD (2/4) risked a new 2min low to a HOTD breakout. hit the high of the day and bounced right off, made a 5min shooting star and i wanted to give it more time but really i was just hoping it would try the high of the day again and i got stopped out for a full R. +1 point for the setup, +1 point for the stop level, +0 because HOTD was not 2R from my stop and +0 for trade management because i could have got out of the trade earlier than a full stop

GOOD: setup was good, risk level much better than last week.

RFI: i'm thinking these ABCDs at 9:45 are not worth the risk. all they do is turn around at 10:00 - 10:05. i should only be getting in if it's 2R to the high of the day so i can at least get some profit.

MOOD: disappointed but i liked the setup and risk level.

CONSISTENT: yes followed my original plan even though i could have got out earlier.

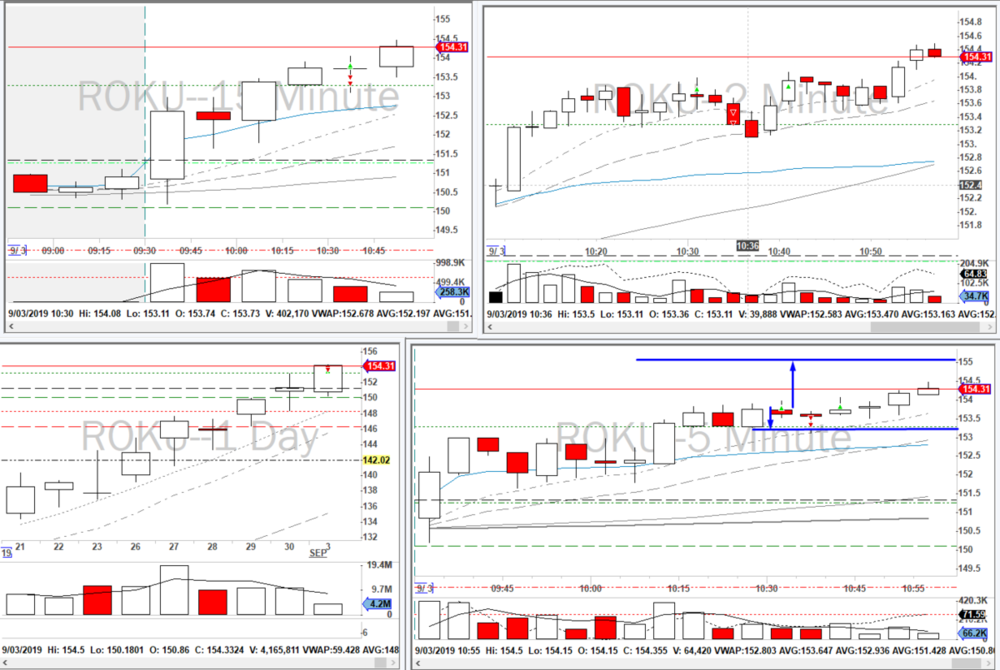

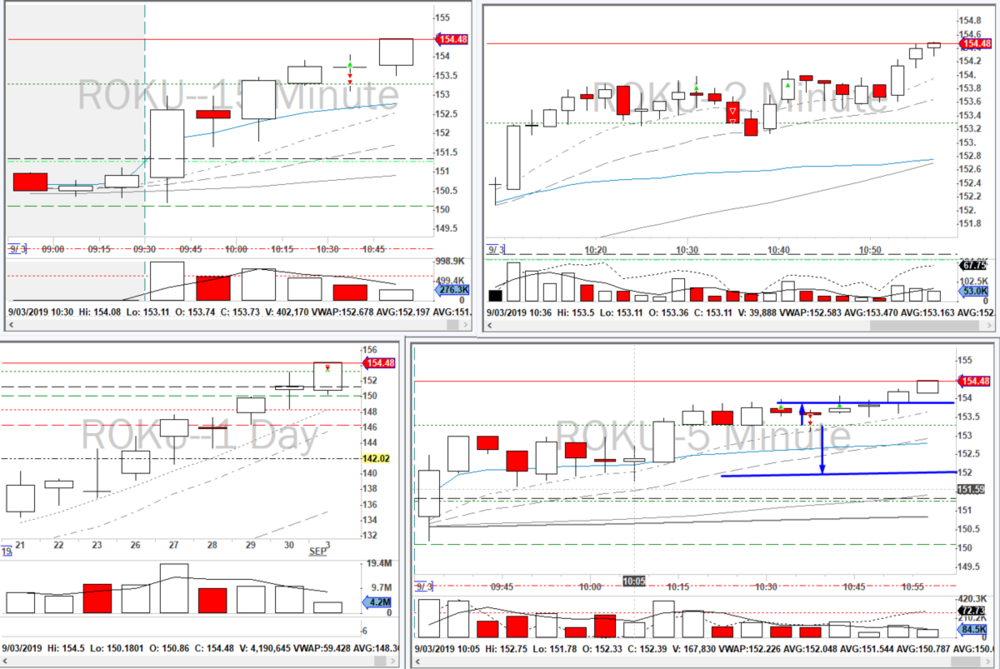

Tried to take a long in $ROKU that wasn't a setup (0/4). The idea was that since it engulfed and then engulfed long again it was probably going higher and there was the PDC high as support so i took this trade. it made a shooting star and i got out on a 5min low. happy with the trade management but still get an automatic 0 for the trade because it's not a setup.

GOOD: got put before my stop.

RFI: don't take trades that aren't setups.

MOOD: disappointed in myself for taking this trade

CONSISTENT: yes

Last trade of the day was an accident in $ROKU (0/4). as soon as i stopped out of the last trade i got up to use the bathroom. i realized after that i forgot to cancel my range order from my stop on the last trade. came back to a short position that i didn't want in $ROKU. i thought about just getting out with a small loss which was the right answer but then i thought i would give it to my entry because that's 1R even though it wasn't a level. $ROKU then moved right to my stop and i got out. first time i've ever had that happen, i'm embarrassed to journal this but it's important to remember to get out of the range orders. grading myself an automatic 0 because not a setup and complete accident

GOOD: limited loss to 1R

RFI: cancel range orders once you're out of the trade

MOOD: feeling really crappy

CONSISTENT: eh, limited my loss but should have just got out all together

well not the way i wanted to start the month. three losses in a row, 2 of which I had no business being in the trades. my thinking last week was that i'm not hitting profit targets because my risk was too big. now i think my ABCD 2min setup is garbage and i shouldn't trade it. not sure what to do. maybe i should go back to sim and try to find new setups that actually hit my profit targets 35% of the time. on top of that just unhappy with my self control today, i should not have taken that trade in ROKU. i take so many dumb trades in ROKU becuase it's always hitting new all time highs and i keep seeing $ signs and taking awful trades in it.

What i did good today: stopped out of all my trades with -1R or less

What i did bad today: not taking setups, hotkey mistakes

What can i do better tomorrow: find out what are my reliable setups. better yet, what is my ONE reliable setup that i can practice trading consistently and be profitable. i'm probably not going to go back to sim but i do need to spend some time reviewing my last two or 3 months of winning trades and try to find some reliable pattern i can use to trade effectively.

-

1

1

-

-

21 hours ago, Glenn Budde said:Glad to here that things are starting to turn around for you.

Self reflection is worth a ton. I summarize more here on the forum but my written notes I am much harder on myself with colorful metaphors and such.....

Have a great weekend....

thanks Glenn, you too. i used to be harder on myself too but i learned from the daily trading coach that it's more detrimental to your performance to be negative in your writings. I try to keep my journal tones the same as i would giving advice to a friend, though easier said than done.

-

2

2

-

-

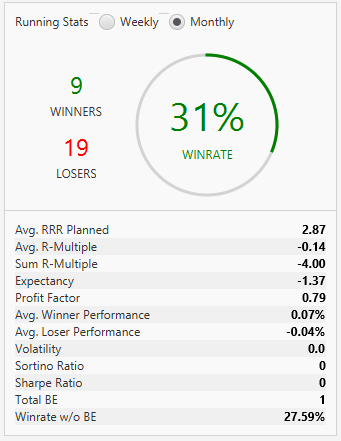

August Recap

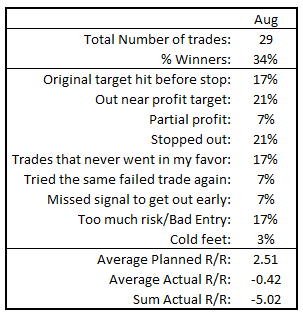

Hope everyone has a great holiday weekend. i've used this long weekend to do some extended research on my trades for the month and see where i can improve. I started a new spreadsheet that shows trade outcomes in my own words to try and better grasp areas where i can improve my trading. this is still a work in progress but here's how it looks for August:

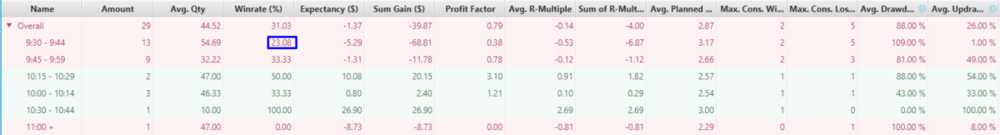

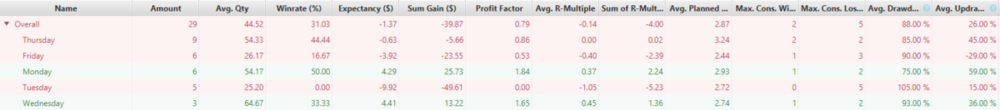

As i've been discussing this week, i'm picking stops that are too far to make my profit targets. So one of my major focuses for next month is to take smaller risk but still have the risk level be a resistance point. My "original target hit before stop" needs to be double what it was in August in order to be profitable. i'm comfortable with my low win rate to get 3R winners but i'm not comfortable with having unrealistic profit targets.

Another issue i've noticed is my lower than average win rate between 9:30 and 9:45. the average up-draw is only 1% which means these trades are never going in my favor. i would be better to do the exact opposite of what i'm currently doing during that time frame. i'm a little torn on what to do about this because i know that's a crucial time for big moves but it's obvious i'm not good at trading this fast market action. My options are to not trade then at all or trade sim during that time. i think i'm going to avoid trading then next month all together because i don't know how to quickly switch my hot keys between sim and real and i don't want to accidentally get in to a sim trade when i want to be in a real one later in the day. i will also look in to seeing how to quickly switch hotkeys from sim to real so i can sim trade 9:30-9:45 then real trade 9:45+

There's another area i can improve that i have been doing better at and that's trade management. it's tough to know when to get out of a trade and when to stick with it so i'm using two objective markers to get out of my trades. the first is a 5min shooting star/hammer after a new high or low of the day and the 2min engulfing after breaking the high or low of the day which usually results in a 5min shooting star. if i'm in a trade and i see either of those two, my plan is to get out at the best price but before my stop. otherwise i hold the trade.

psychologically, i'm feeling the best i've ever felt about my trading. i've graduated from bleeding money to pretty much break even. i used to have days or weeks with just fear that i was going to lose all my money and now i don't feel that way at all. i'm gaining confidence in my setups and more importantly, my trade management. i can see signals once i'm in the trade that tell me it's not working so i can limit my losses instead of seeing them and just ignoring them and hoping i don't get stopped out. Acting on these signals to exit a trade makes me feel in control and less stressed because i have a plan and i know what to do. so if i'm confident in my setups and i'm confident in myself to exit the trade on specific signals, there's nothing to fear while trading.

-

3

3

-

-

Week 35 Recap

Went in to the week barely in the red thinking this month could be the first month I’m green in live trading. Got too focused on P&L trying to make the month green and ended up hitting max loss 3 out of 5 days.

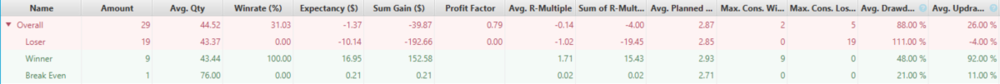

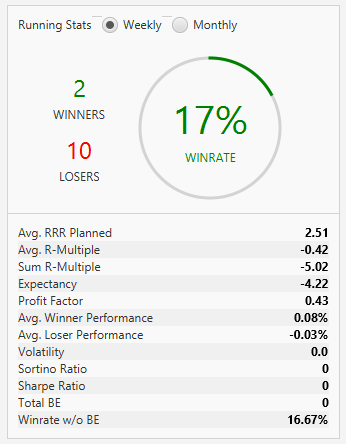

· Weekly stats

o 2.53 ave planned R/R (Goal: above 3.0) [Previous Week: 2.9]

o -5.02 sum actual R/R (Goal: above 15.0) [Previous Week: N/A]

o -0.422 ave actual R/R (Goal: above 1.0) [Previous Week: N/A]

o 40/48 83% (Goal: above 80%) [Previous Week: 95%]

o 4/12 33% trades with the trend (Goal: 100%) [Previous Week: 60%]

o 6/12 50% Non-optimal Entries (Goal: 0%) [Previous Week: 40%]

o 0/12 0% Letting Losers Run (Goal: 0%) [Previous Week: 0%]

o 2/12 16.67% No Setup (Goal: 0%) [Previous Week: 0%]

o 2/12 16.67% true win percentage (Goal 45%) [Previous Week: 60%]

· Highlights

o Trade management this week was maybe the best it’s ever been.

o Besides my ROKU trades on Tuesday and BBY on Thursday, I took good setups that made sense.

· Ongoing things to work on

o Stop loss was way too far. Going to work next week on getting good entries that are also reasonable reward levels that are closer.

o Revamped my spreadsheets no longer tally P&L and I deleted all charts showing P&L. focusing on setups and R values next month

o Waiting for new 2min in my direction before getting in to a trade.

o Too much FOMO chasing this week and two trades no setups killed my win percentage

-

1

1

-

-

2 hours ago, Rob C said:Same thing with me Mark. It's the worse week for me (live trading profit) in 7 months, but it was my best week for my score card (the rating that I give to each trade) since I have been scoring my trades. Can you imagine how bad it would have been if we traded poorly this week in these market conditions?

don't want to think about it. could have been much worse!!

-

1

1

-

-

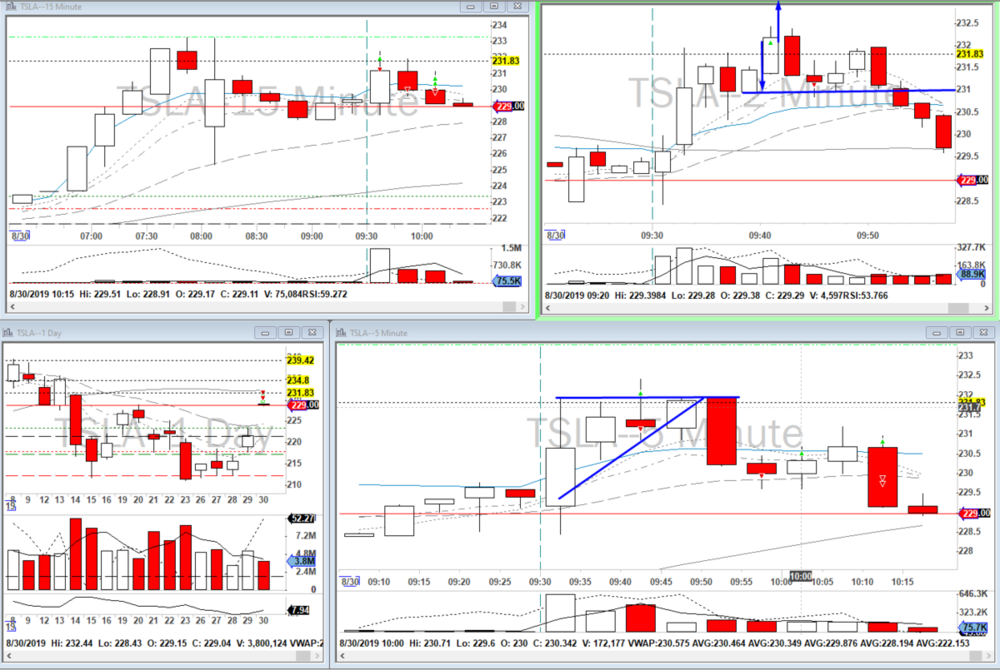

Friday August 30th, 2019

Sleep: 7.5 hours. Mood: good, ready to trade.

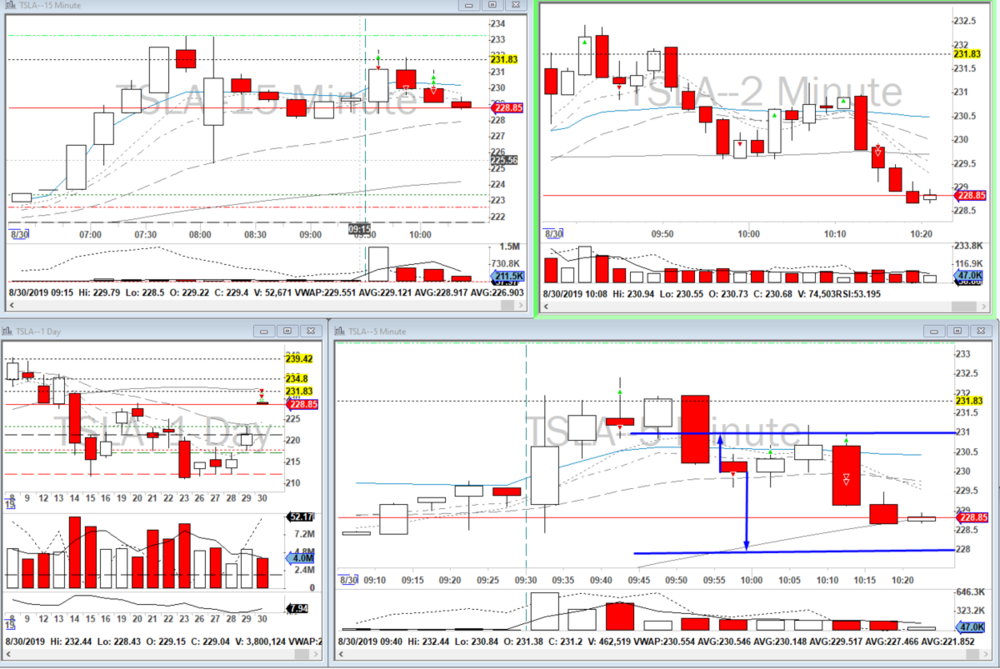

first trade was a HOTD wedge in $TSLA. got in risking a new 2min low for $1. hoping to break the premarket high and give a nice run. it did that dang 2min engulfing pincer that Robert H. was talking about in one of his latest videos so i new i was getting out of the trade. i wanted to get a more favorable exit but the small pop on the next candle was too quick to react so i got out at a -0.9R. grading this trade 3/4. setup was good, stop loss made sense and trade managed well, losing 1 point because the high of PM was not 2R from my entry

GOOD: most of the trade

RFI: i need to take these on new 2min highs, much better entry and R/R.

MOOD: fine, i'm really used to getting in on a HOTD 2min candle only for the very next one to engulf lower. i see it pretty much everyday. i need a new strategy for these long trades 5-15 mins. in to the day

CONSISTENT: yep, knew exactly what to do.

Next trade was a 5min engulfing crack in $TSLA. dang it if this wasn't a really good idea just executed poorly. i knew i needed to wait for a pullback but I FOMO'd the entry and ended up too extended and it made a new 5min high and i bailed. i would have got stopped out anyway so i'm glad i got out. giving myself a 2/4 on this trade, i liked the setup, the stop was on a resistance level but the entry was awful and the LOTD was only 1R from my entry.

I took two more trades in TSLA, both in SIM. the first trade long was revenge garbage, glad it was SIM and the last short worked out great also in sim.

GOOD: setup was good

RFI: FOMO'd the entry and i knew it and did it anyway which is the worst kind of entry

MOOD: disappointed because i was confident in the trade i knew i got in too early.

CONSISTENT: yes, saw the new 5min high and VWAP and knew to get out

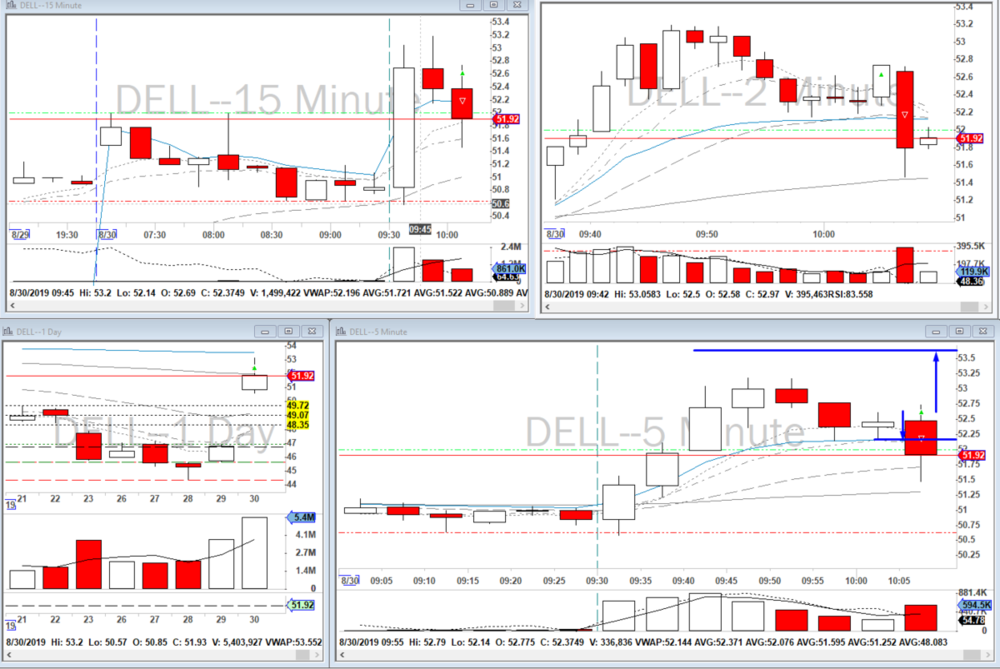

last trade of the day was 5min ABCD in $DELL. i usually stop with two losses but i did a good job limiting the losers i had room for one more. i was waiting for DELL to have a pullback to do a 5min ABCD. got in right at the break and this thing just crashed. got out a -1R thankfully. holy crap that was rough. that cemented the end of my live trading for the day. grading myself a 3/4, good setup, stop was at a level, managed the dump really well. -1 point because high of the day was not 2R from my risk. Ended up getting a really nice SIM short in this one too.

ended up green on the day counting my sim trades but just got tore up live trading. it's been a challenging, choppy week in the markets. hopefully next week is better. i've been really happy with my trade management this week but i was either wrong on the trade direction or taking too wide of stops to get the moves i needed so I got killed on win percentage. thinking about doing what Rob C. does and only taking one trade a day and if it's a loser, practice in sim but if it's a winner then keep trading. i'm down almost 5R for the week which is a bad week for me money wise but i feel really good about my trading, i'm holding to my stops with less emotions and i'm managing the trades i'm in much better than i have in the past.

What i did good today: trade management was excellent, traded all setups.

What i did bad today: FOMO'd the entry on a really nice TSLA short

What can i do better tomorrow: really need to take advantage of good setups, with better entries and stops that make sense but aren't too big. this will be my focus next month.

-

AMD has me so salty at the open. definitely not a good buddy.

also, caught up on your youtube trade reviews. they're great, keep it up!

-

1

1

-

-

On 8/28/2019 at 3:38 PM, Daniel Meakin said:Also configured Kyles risk per trade hotkey last night which i think will help me massively managing my share size

that was a huge help for me!

-

1

1

-

-

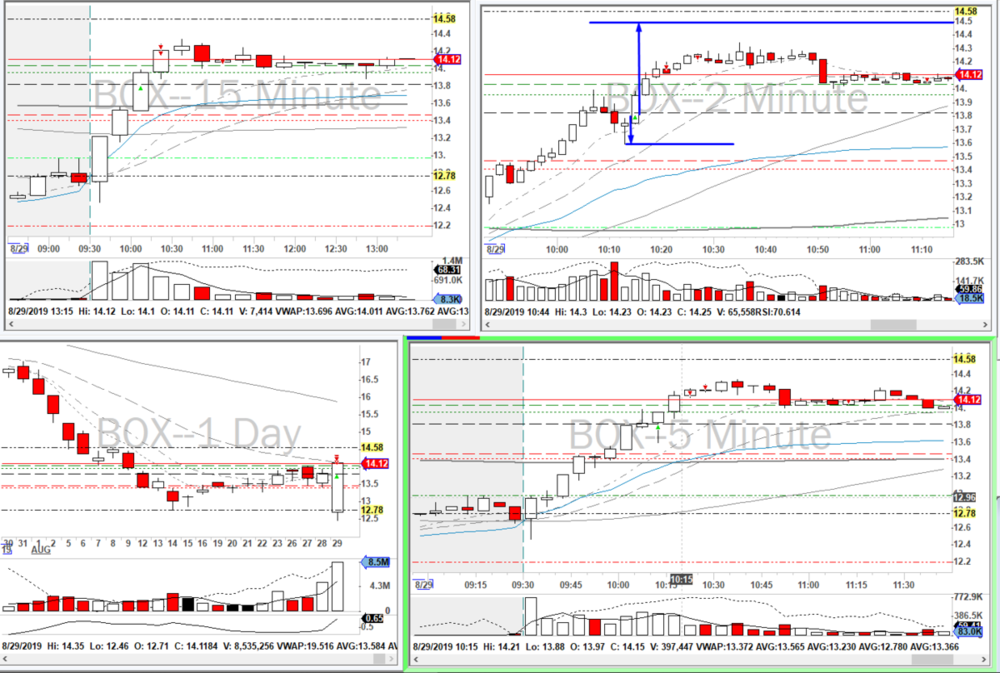

10 minutes ago, Glenn Budde said:I took a very similar BOX trade.... worked out nicely.....

I like your stops, maybe adjust share size a little smaller when the stop is further away...... I have worked on this the last two weeks and are getting close to just knowing right away how much to take...

Have a great night and have a fun green day tomorrow...

thanks Glenn you too! BOX was great this morning. i used to try and keep my stops to 10 cents on $50 and lower i'm going to work on doing that more next week.

-

Thursday August 29th, 2019

Sleep: 7 hours. Mood: good, ready to trade

planning on staying away from the first 15 mins this morning. also, i've implemented a new point system for grading trades that will help with keeping me trading setups and is more relevant than my old system:

· Is this a setup I trade? Yes +1, No automatic 0 for the trade

· Is my stop loss a level of resistance? Yes +1, No +0

· Is my first reward level greater than 2:1? Yes +1, No +0

· Trade management judgement call BUT not respecting stop is auto 0 on the trade.

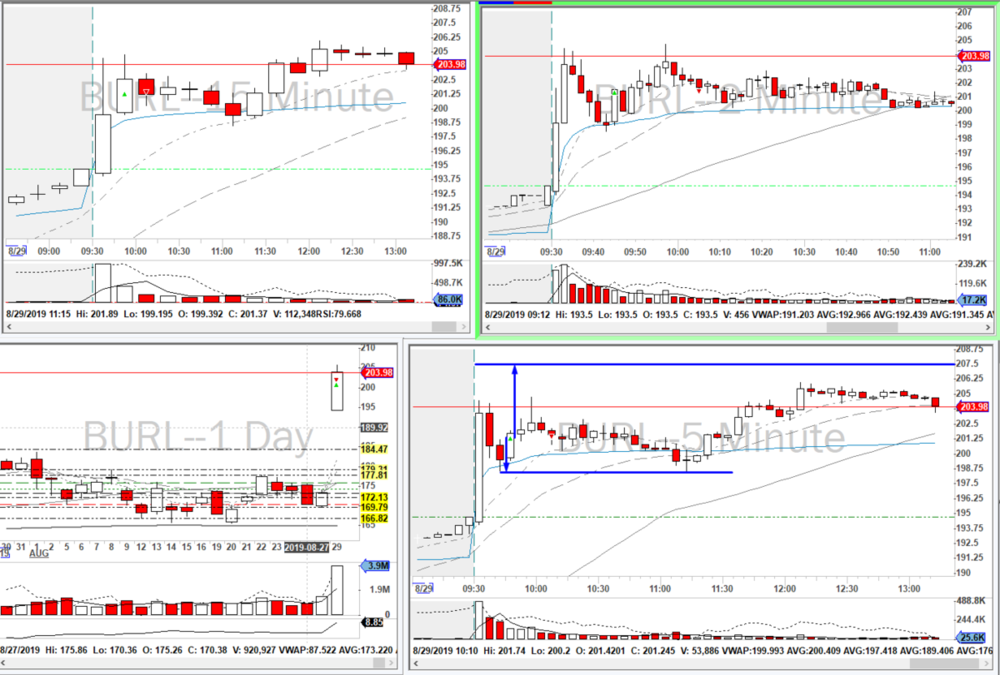

First trade of the day was 5min ABCD in $BURL (3/4). as soon as i got in the trade i saw my stop was way too big because i only got 3 shares so a 3R move would have to be $10 so i said that's unreasonable but 2R is possible so that's what i decided to shoot for. it broke HOTD for a second and made a shooting star on the 5min. got out on the next 5min lower at breakeven minus a little for slippage.

GOOD: traded setup, good trade management

RFI: stop way too wide, should be 2R to HOTD

MOOD: good, glad i got out, it would have wicked me out at a full R loss and went back higher

CONSISTENT: yes.

Next trade was a MA trend trade on $BOX (3/4). once i saw it was trending up nicely, i waited for a pullback and when it made the doji on the 2min and held the 9MA i got in long. again my stop was too far but better than BURL. partialled 75% at ~2:1 and the last piece once i missed that last attempt to run higher. happy with this trade

GOOD: traded setup, got in at resistance, partialled out when it stalled

RFI: still too far on the stop.

MOOD: good, wish it would have went higher but it was already extended

CONSISTENT: yes, managed the trade well.

last trade was a 5min bull flag in $BBY (2/4). Saw the 2min engulfing holding the MAs plus it looked like it was going to make a new 5min and 15min high so i got in. it's a weird time for me to trade but i was feeling like trading more and I wasn't particularly busy with anything else. as soon as i got in the volume died and it made a 2min shooting star. moved my stop up to break of the 2min chart 20 MA and new 5min low and got out as planned with new stop. glad i got out early but i was hoping we'd get some volume to the upside and it just died probably because it's lunch time.

GOOD: changed plan and got out of the trade early

RFI: probably should have just skipped this trade or i could have at least got a better entry

MOOD: fine

CONSISTENT: yes.

What i did good today: trade management

What i did bad today: stops too far, probably should have not taken the BBY trade

What can i do better tomorrow: gotta work on tighter stops.

-

2

2

-

-

13 hours ago, IamKarthi said:he spinning top (or an inverted hammer, but it doesn't matter) is actually a sign for reversal, so other traders might have traded it for long with the stop at LOTD.

thanks Vikram! that's interesting, i was reading those as confirmation it was going to break lower. that would be an awesome place to get in long if it ends up trending higher like yesterday.

Jens' Trading Journal

in Day Trading Journals

Posted

Welcome Jens! nice trading!