-

Content Count

373 -

Joined

-

Last visited

-

Days Won

49

Posts posted by Mark D.

-

-

Monday February 4th, 2019

No trades today

-

January Recap

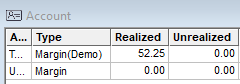

Hello Bear Bull Traders! Thursday completed my first month of live day trading. i've been using Edgewonk since Jan 1 and i thought i would share some of my interesting stats.

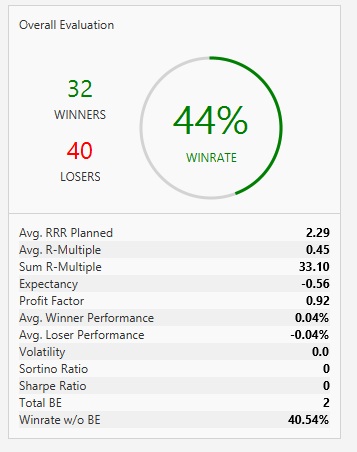

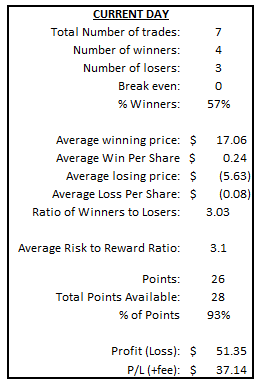

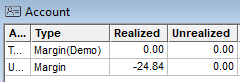

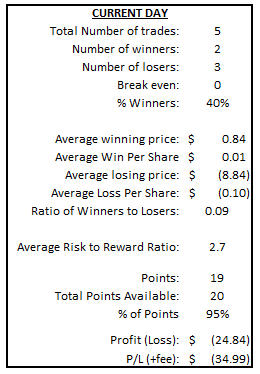

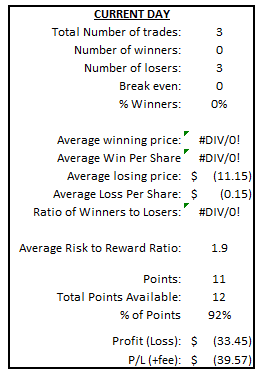

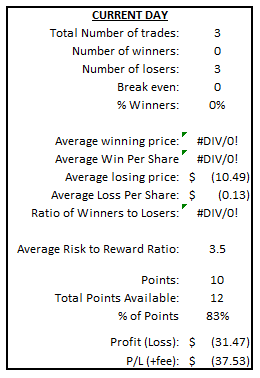

I feel like i'm doing worse than the numbers show. i'm in the red and that's to be expected but without commissions i'm only down about $30. unsurprisingly, paying 20% ($2) on top of a full R loss ($10) is adding up and i've paid about 5x my losses in commissions. I'm ok with this, i'd rather lose small and eat the high commissions now instead of not being able to emotionally control my trades. One thing that is bothering me is my win rate is only 44%. so i will be working on taking better setups in February to improve this to at least 50%. My R/R planned is good at 2.29 but my executed R multiple is only 0.45. i need to do better on the trades that are going my way.

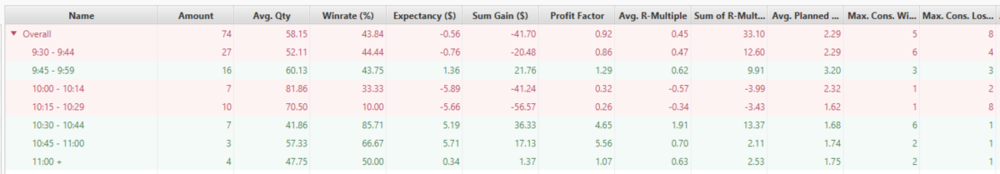

I wanted to dive deeper in to my winrate and I before i saw the numbers i would have guessed that my ORBS and trades in the first 15 minutes were what's killing me. to my surprise, it's my trades from 10 - 10:30 that i'm doing the worst in.

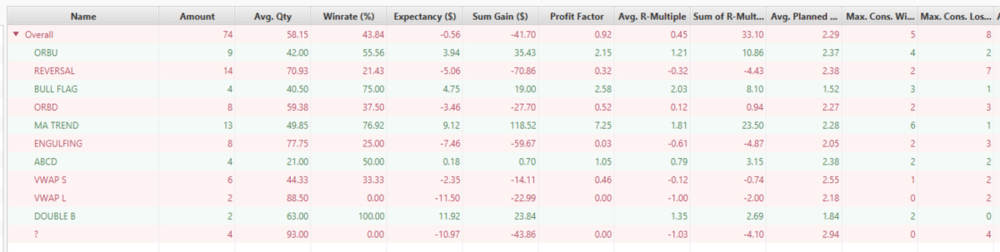

also by setups, the long and shorts i'm taking at the VWAP are not working:

So pretty much i need to avoid taking trades off the VWAP (short and long) and reversals without clear signals. I'm trying to get in on the first change of direction and a V reversal rarely happens and i'm just getting chopped up. These trades are clearly not working and if i eliminate these trades, i should see some improvement in my P&L. Goal for February is to only take the setups that work (ABCD, ORB, MA TREND, DOUBLE B, BULL FLAG) and focus on nailing those setups. My best setup is taking a long (or short) that's above (or below) all the moving averages that i can get in on a pull back to the MAs between 9:30 and 10:00. if i just did that trade i would be much more successful than i have been. i'm going to make more effort to hunt for that setup.

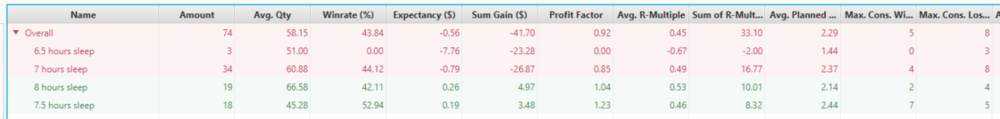

here's some other stats that i keep. Like Andrew said in his recap maybe a week or so ago, sleep is crucial and i can already see that in my stats:

Also if i rush in to the trading day, i'm probably going to lose money:

thank you all for reading, have a great February. Trade safe and smart!!

-

1

1

-

-

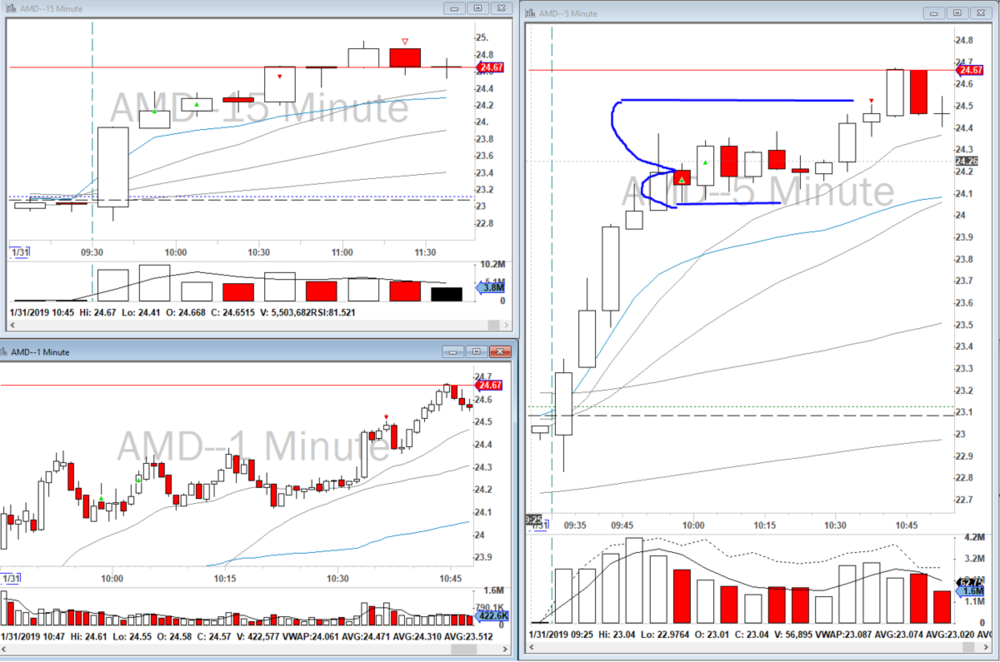

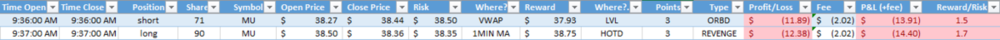

Friday February 1st, 2019

Sleep: 8 hours. Mood: rushed. didn't get to my computer until ten minutes after the market opened.

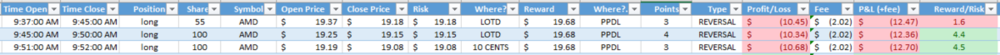

First trade of the day was a long trade in AMD. it engulfed in the first ten minutes so i went long. I'm not mad about the setup. i'm mad that i didn't get out at the VWAP like i planned to. stubbornly held on for twice my risk allowance. dumb.

GOOD: ok setup

RFI: stubbornly held a loser for a bigger loss

MOOD: anger

CONSISTENT: big no.

So when i saw that it was breaking the PDC, i took AMD short risking the VWAP again. instead of marking levels when i was late i jumped in to trading so instead of a profit target of the low of the premarket, i tried to get to the even $ level at $24. i saw it bouncing off the premarket low and i thought it would come back up to the moving average and march lower but it just bought all the way past my entry. got out on a new 5min high for a small win/breakeven.

GOOD: got in for a good R/R on the short side.

RFI: should have took some or all profit at the LOPM. dumb, i wanted a bigger winner because of my previous loss and i got nothing

MOOD: got out on a clear signal so that's good.

CONSISTENT: yes

Next trade was another long in AMD. this stock is not trending at all and i keep trying to get in on a trend. it bought up over the VWAP and i got in long on a pullback with a new 1min high. it did end up making a new 5min high but it's so choppy today, after the next five minutes it made a new 5min low and i should have got out but didn't and ended up taking a small loss.

GOOD: ok plan.

RFI: stock is not trending and i'm trying to get a trend

MOOD: angry at my trading today in general.

CONSISTENT: yes, got out at risked level

took a reversal trade in MU. it bought up for over an hour and i was hoping for a pullback to get in on for a ride back to the HOTD. got in on a new 5min high with volume but it didn't have the follow through and i got stopped out. about 15 minutes later it did an ABCD pattern that i tried to get in on but my max loss risk controls stopped me for the day. it didn't work anyway.

GOOD: took the trade with a good setup, waited for a signal

RFI: i could have actively managed this one, when it made the second 5min low i could have got out but then again that wasn't the plan.

MOOD: happy with this trade even though it was a loser

CONSISTENT: yep

What i did good today: the last trade in MU i'm proud of

What i did bad today: jumped in to trading without preparing for the day. that was a big mistake. also stubbornly holding on to my loss in the first trade and then not taking profit on the second one. dumb dumb dumb

Worst trade of the day and why?: first trade in AMD because i held past my stop loss

What can i do better next week: get out at your planned stops. don't start trading until you've had time to mark levels and don't feel rushed.

Other comments for next week: even though today was especially bad and I went from a green week to red and hit another max loss day (two this week) I am slowly getting better. just need to keep focusing on good setups and following my rules. next week is a new week!

-

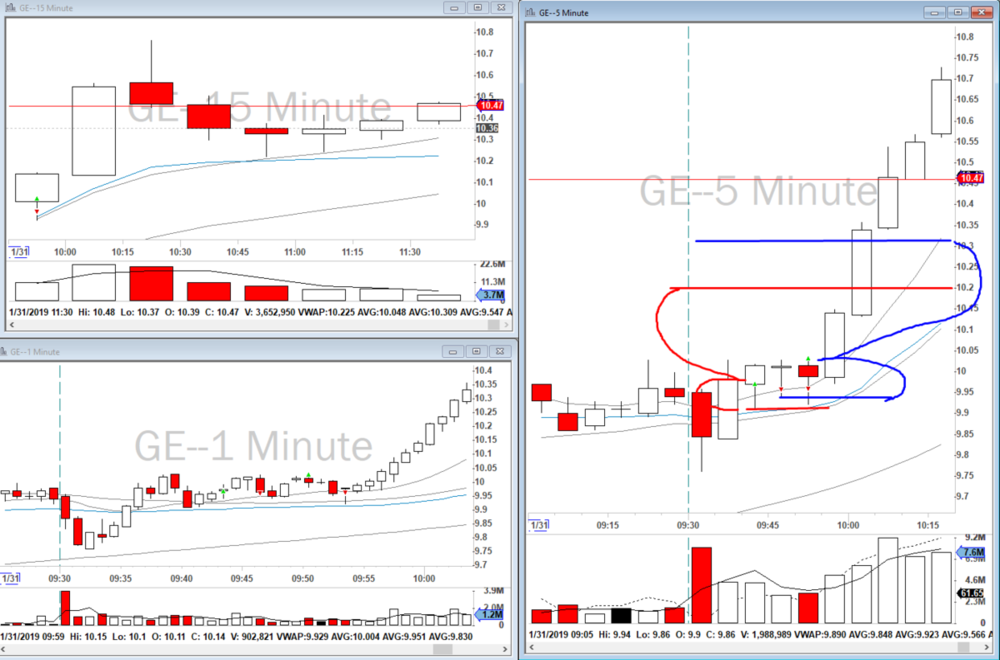

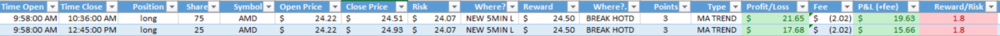

Thursday January 31st, 2019

Sleep: 8 hours. Mood: good, got in early and was prepared for the trading day.

first two trades were in GE. both to the long side. i got in for the break of HOTD on the first one but i got cold feet and got out after a new 1min low for a small loss because i've been getting killed in the first fifteen minutes the last couple of days. then i waited for a new 5min high and HOTD but i think it was just the spread that broke it and it came down past my stop and i got out right after that. it ended up a couple minutes later doing what i expected on the first trade. Had i stuck to my original plan, i would have had one nice trade. i'm not upset about it. i'm proud that i'm managing risk and it needs work like all aspects of trading.

GOOD: good R/R.

RFI: should have stuck to my original plan

MOOD: good

CONSISTENT: No on the first, yes on the second trade.

last trade of the day was a trend trade in AMD. it bought up in the first 25 minutes and i got in on a new 1min high for a small size and then added more at a new 5min high. i almost bailed on the trade because i was getting bored and the volume was dying off but i've been in this situation in the past when i get out just because it's not going anywhere and it ends up taking off. i'm glad i stayed in, i sold 75% at $24.51 and the last 25 I put in a range stop at $25 that did not get filled so i lowered it to $24.93 which eventually did get hit.

GOOD: stayed with the trade even though i thought about bailing.

RFI: put the range stop a little below the whole dollar. also could have got a better R/R

MOOD: glad to get a nice winner

CONSISTENT: yes.

What i did good today: no emotional trades. kept my head in the game

What i did bad today: didn't follow through on the first trade in GE

What can i do better tomorrow: be careful getting out of trades just from a new 1min high or low against your position

Other comments for tomorrow: Keep up the careful trading.

-

1

1

-

-

14 hours ago, Carlos M. said:Hey Mark, great job staying consistent with your journal! You are putting in the work off the trading station and it will surely pay off in the long run.

There were not many good ORB's today on the watchlist, below was my trade for today and actually turned out to be a good ORB Down but got stopped out too early. Funny you mentioned taking a break from ORB as I just finished responding to a member who also was telling me they were thinking of stopping the ORB strategy. What we have to realize is that not every day the market will give is great clean ORB's. We might go on a streak were it might seem as they do not work any more then they will be back in play. My suggestion to this is continue to look for this strategy at the open but if you do not see a clear signal for one just bypass it for that day and focus on your secondary strategy.Once again, great job with this daily journal!

thank you Carlos!

i'm not going to quit on the ORBs but i am going to be much more selective and wait for a clear signal. i tend to wait for a pullback so i can get a good R/R from the VWAP but a good bit of the time it just ends up pulling back too much and chopping me up.

-

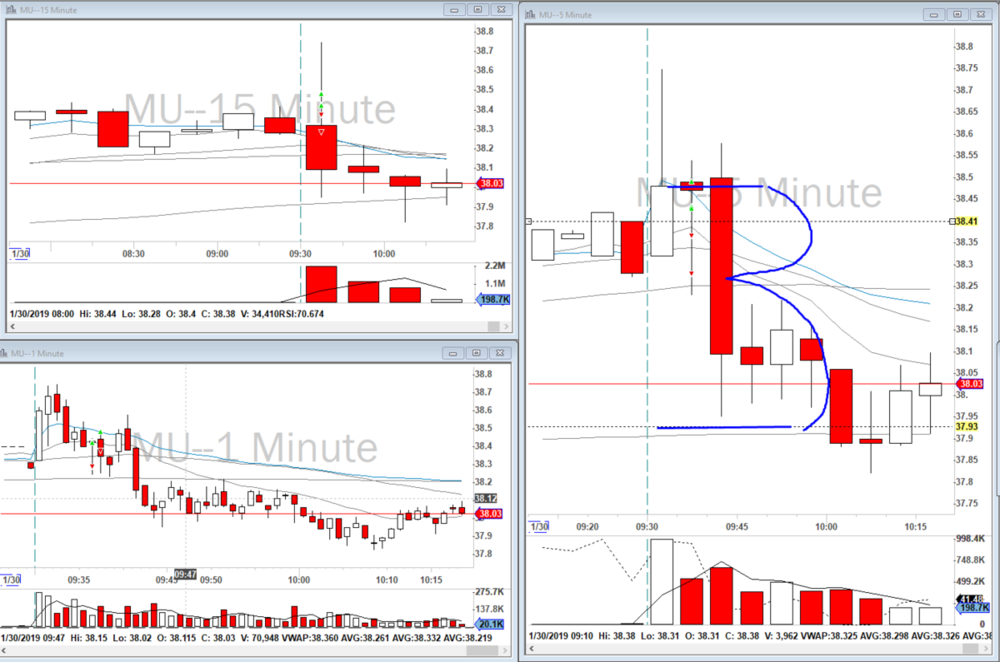

Wednesday January 30th, 2018

Sleep: 7 hours. Mood: got in late so i'm rushed this morning.

oh boy that was a bad day. MU bought up in the first five then came down and i tried to get in on an ORBD but i put my stop too tight and got stopped out. then i went long with too many shares and got stopped out immediately. so i'm two full R losses in the first ten minutes. i should have just walked away and cooled off but i didn't. also my risk controls are not helping me, they're too strict and they're just killing me with commissions and losses that i would have held because they're too tight. i do a good job of stopping my trading when i'm not doing well for the day so what i'm going to do is change my auto risk control to a per trade loss of $36 and then use my discipline to hang it up for the day. if i'm ever in a position where i'm giving up a whole day's worth of loss on one trade then i shouldn't be trading anyway. we'll see how that goes. i hate to just change my risk controls on a whim almost but i've been thinking about this all month and i think the tight per trade stop is doing more harm than good.

GOOD: took R losses on both trades

RFI: chased the entry on the first one, revenge on the second. garbage trading

MOOD: mad at myself for trading like crap at the open again like yesterday

CONSISTENT: yes

I was too emotional to trade anymore and i tried a terrible reversal in AMD that didn't work at all. just garbage emotional trading. then my auto risk controls added to my position then stopped me out??? no idea i'm done with trading today.

GOOD: max loss stopped my bad trading.

RFI: dumb dumb trade. no new 5min high, didn't get out on a new 5min low. embarrassing.

MOOD: frustrated

CONSISTENT: NO

What i did good today: stopped trading

What i did bad today: emotional trades with bad or no setups.

Worst trade of the day: the last one in AMD because i knew better and let my emotions get the better of me

What can i do better tomorrow: take a break from ORBs or take a tiny share size with a lot of room.

Other comments for tomorrow: rough day today. need to brush it off and focus on taking good trades tomorrow.

-

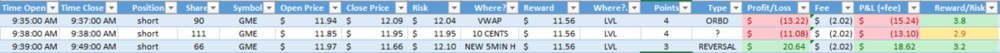

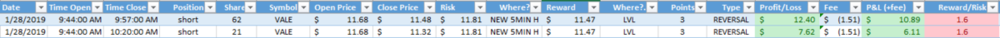

Tuesday January 29th, 2019

Sleep: 8 hours. Mood: feel groggy and a little bit out of it.

wild start this morning in GME. it looked good for an ORBD because it sold off below the VWAP and then came back up to it and i got in too early, the next minute i got stopped out. i really like the auto risk controls but sometimes, especially in the first 30 minutes, they can really burn you, i would have held through that 1min pop. The next trade i chased it and got stopped out. the last time I realized i need to take a smaller share size. my profit target was the daily level below the LOTD but i just got out at the LOTD. i was not prepared for how volatile this stock was going to be.

GOOD: position size on the last trade

RFI: chasing the second trade and not waiting for a new 1min low on the first trade.

MOOD: those trades made me nervous.

CONSISTENT: yes and no. definitely not on the second trade. the other two weren't great but not terrible either.

next trade was a double bottom in VZ. I got interested in the long side after the bottom at 10:10-10:15. I was waiting for a good entry on a new 1min high. but it sold off again, didn't make a new low and i got in at the MA supports on the 1min chart. i risked a new 5min low at $53.17. I thought about my profit target being the $53.57 level but it wasn't a 2:1 so i just roughed it out as a 30 cent profit target. it got there and i sold but i could have done better had i held on two minutes longer. GME has me nervous today, i'm really jumpy with wanting to get out of trades. this is may last trade for the day.

GOOD: setup was good

RFI: profit target should be a significant level not arbitrary

MOOD: nervous

CONSISTENT: yes.

What i did good today: didn't hit max loss right at the open (came close) and

What i did bad today: chased GME on the second trade. also kept trying to force the same trade over and over.

Worst trade of the day and why: second trade in GME because i chased my entry and didn't size properly

What can i do better tomorrow: wait for a new 1min low or high in the direction of your trade before getting in to a trade.

Other comments for tomorrow: nice job ending the day green but still need work on entries and emotional trading on stop losses.

-

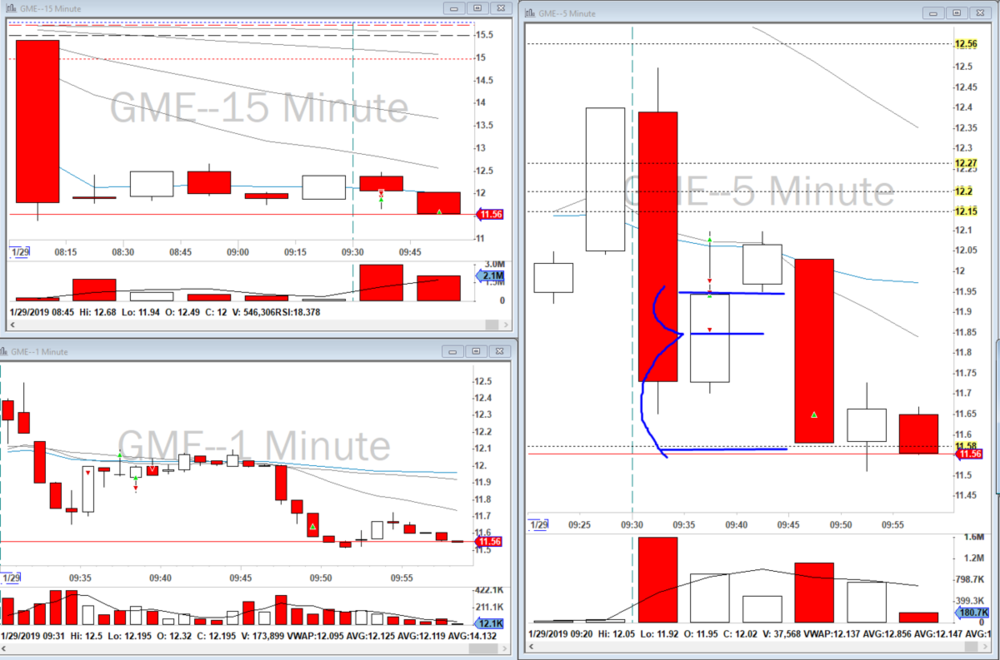

Monday January 28th, 2019

Sleep: 7 hours. Mood: a little bit tired but otherwise ready to trade.

First trade of the day was a reversal in VALE. it sold off for a good portion of the premarket. so i read the buy up at 9:40 as profit taking and thought i would go short,i got in at a new 1min low below the MA on the 1min chart. placing my stop loss at the break of a new 5min high. it touched my stop loss but didn't go through. first price target was a daily level that i sold 75% and the last piece i was planning on holding for a couple hours but decided it was better to get all out at the previous LOTD.

GOOD: good trade, really happy with this one.

RFI: R/R could have been better.

MOOD: good, happy to not get in the trade too early and actually get out at my profit targets.

CONSISTENT: yes

What i did good today: didn't force any trades, focused on my problem areas

What i did bad today: missed a good trade in PCG.

Issues with problem areas today?: no.

Comments for tomorrow: keep focusing on good trades.

-

Friday January 25th, 2019

Sleep: 7.5 hours. Mood: good, at home it's quiet, ready to focus on taking good trades.

first trade was an ORBU of sorts on CGC. i waited for a pullback and got in on a new 1min high. it double topped on a daily level and i thought about getting out but didn't and got stopped out for a full loss.

GOOD: waited for a good entry with volume

RFI: need to be quicker with my exits. also, not really an ORB on the 5min chart.

MOOD: not happy that i'm being to slow in reacting to what i'm seeing in the price action

CONSISTENT: i guess so, the auto stop got me out at my original risk.

Next trade was a VWAP S in PCG. the stock made a spinning top and then made a new 5min low below the WVAP. i took it short and got a horrible fill but it dropped to $12 and i took half out and then it came up to my b/e and i got out.

GOOD: got in at the right moment, good R/R. didn't let it run against me.

RFI: maybe could have given it a second on the stop loss, i pretty much got out at the high of that candle

MOOD: ok

CONSISTENT: yes

Last trade was a short in CRON. i got in half size because i've seen other oppurtunities of getting short at the VWAP that work but it wasn't making a new 5min low so i wasn't super confident in the trade. regardless i stubbornly held on like i always do and took a full loss instead of just getting out with a small loss. Getting very frustrated with making the same mistakes over and over and over.

GOOD: small size for the idea of the trade

RFI: should of got out

MOOD: frustrated i keep repeating the same mistakes every day.

CONSISTENT: got out myself finally which is good.

What i did good today: didn't let my emotions get me in to any bad trades.

What i did bad today: same mistakes as every other day. refusing to take a loss on a trade i know isn't working

What can i do better tomorrow: practice getting out of losing trades.

Other comments for tomorrow: regroup for next week.

-

Thursday January 24th, 2019

No trades today, meetings

-

Wednesday January 23rd, 2019

Sleep: 7.5 hours. Mood: good, got in the chatroom early and am prepared for the day. noticed when i opened DAS this morning my P&L didn't change and realized i had my dang montage in SIM. i think i was messing around with stuff last time i traded at work and forgot to switch it back. bummed about that.

first trade was an ABCD in PG that failed a new 5min low so i got out at my stop loss.

GOOD: got out at my new low and got out of the way

RFI: it was a risky trade. and it double topped and i held on. could have got out at b/e.

MOOD: fine, happy to get out at my stop.

CONSISTENT: yes.

took the same trade again in PG but with a better entry, it made a new 5min high then another but then just couldn't get over $96 and i got out for a small loss.

GOOD: got out better this time

RFI: could have got out earlier.

MOOD: ok, it was a small loss.

CONSISTENT: yes

So i had a meeting at 10 so i set a stop range on my last trade in PG. what i can figure is that i had too many shares in the order because by the time i pulled it back up in my laptop i was stopped out of the previous order and then stopped out of a new order for 82 shares! lost more than my max loss. i should have confirmed the order before undocking my computer.

GOOD: risk controls stopped this from getting out of control. thankful to have them in place even though they cost me a full risk that i had not planned but it is what it is.

RFI: i really struggle with my stop orders. i need to confirm and then reconfirm that the order is correct before walking away

MOOD: eh, not that bad.

CONSISTENT?: N/A

so the next trade was a beautiful short in PG that was going my way great and i was on track to make back all my losses in one trade. noticed I WAS IN SIM AGAIN. i never changed my DAS settings on my laptop setup from last year. this trade really tilted me.

GOOD: great call on the trade, PG triple topped so i figured it had nowhere to go but down.

RFI: you have to make sure your in the trade. this sim/no sim has been an issue. need to work on that.

MOOD: extremely angry, beat down.

CONSISTENT: no, need to make sure you're in the trades.

I wanted to wait for a pullback in PG to $95 but instead saw a trade in TEVA. it was trending higher but as soon as i got in the volume died and i held on way too long and took a full loss.

GOOD: got out at my stop

RFI: bad trade management, bad R/R, should have checked volume. that PG sim trade tilted me big time and this trade was not well thought out at all.

MOOD: just frustrated and done. max loss day.

CONSISTENT: no, should have got out earlier. if it's my last trade for the day and i'm in the red i hold on to my trade too long.

What i did good today: PG trades were well thought out and planned nicely

What i did bad today: Technical issues in DAS and using my laptop killed me today. hit max loss.

Worst trade of the day and why?: TEVA wasn't even a good setup. i was tilted from not making money in my PG short and i let my emotions ride on this one.

What can i do better tomorrow?: make sure you're montage is live every morning before trading. double check your stop orders both before and after they are placed.

Other comments for tomorrow: really frustrating to have a good trading day turn bad from not paying attention to my orders and stop settings. BUT i traded well (except for TEVA)

-

Tuesday January 22nd, 2019 **NOTICED THE NEXT DAY MY TRADE WAS IN SIM*******

Sleep: 7.5 hours. Mood: good, excited to trade. ready to work on making consistent trades.

took an ORBD in EBAY. risked the MA on the 5min chart for the daily level at $34.63. sold my first half too early then held on to my second half and got out a little bit lower but not great. should have held on and sold 75% at my target and held the rest until b/e. My journal is telling me my first sell is typically too early and that was the case again on this trade.

GOOD: entry was good, waited to see if it was going to break the LOTD before hoping on. it didn't give me any trouble coming close to my stop loss

RFI: position size again is an issue and getting out too early is still something to work on.

MOOD: ok, disappointed in my sizing and selling but making money is always better than losing.

CONSISTENT: no because i sold at weird spots.

have meetings at 10:30 so that was my only trade. Mad that i didn't get in short in HAL at the VWAP, that would have been a really nice trade.

What i did good today: took only trades i was confident in.

What i did bad today: position size and selling

What can i do better tomorrow?: selling at my profit targets and get better risk levels to get more shares.

Other comments for tomorrow: Keep your head in the game tomorrow and don't FOMO trades because you missed them today.

-

Friday January 18th, 2019

Sleep: 7.5 hours. Mood: good, ready to focus on taking good trades.

Took a long trade in SLB risking the MA on the 1min chart for a level to a found daily level. got chickened out a little bit and sold half early. Held the rest for the profit target

GOOD: good entry, I waited for a pullback to get a good R/R

RFI: i should have held my first sell for my profit target. wish i had more shares, i set my risk level too far from my entry

MOOD: happy to have a winning trade

CONSISTENT: not on the first sell, yes on the second.

Next trade was a bull flag in CRON. it sold off below the VWAP but then came back up and started making new 5min highs. i got in on a pullback risking the a new 5min low from the flag to the HOTD. sold half at the HOTD and then scaled out the rest to $15.00

GOOD: good trade management

RFI: initial R/R not good

MOOD: good, really happy with this one

CONSISTENT: yes.

What i did good today: practiced patience and a cool head in making trades.

What i did bad today: selling my winners too early

What can i do better tomorrow: make your first sell at you profit target.

Other comments for tomorrow: keep focusing on trading and don't rush.

-

Thursday January 17th, 2019 **sim trading**

Sleep: 7.5 hours. Mood: good, ready to get back to basics and start making consistent winning trades.

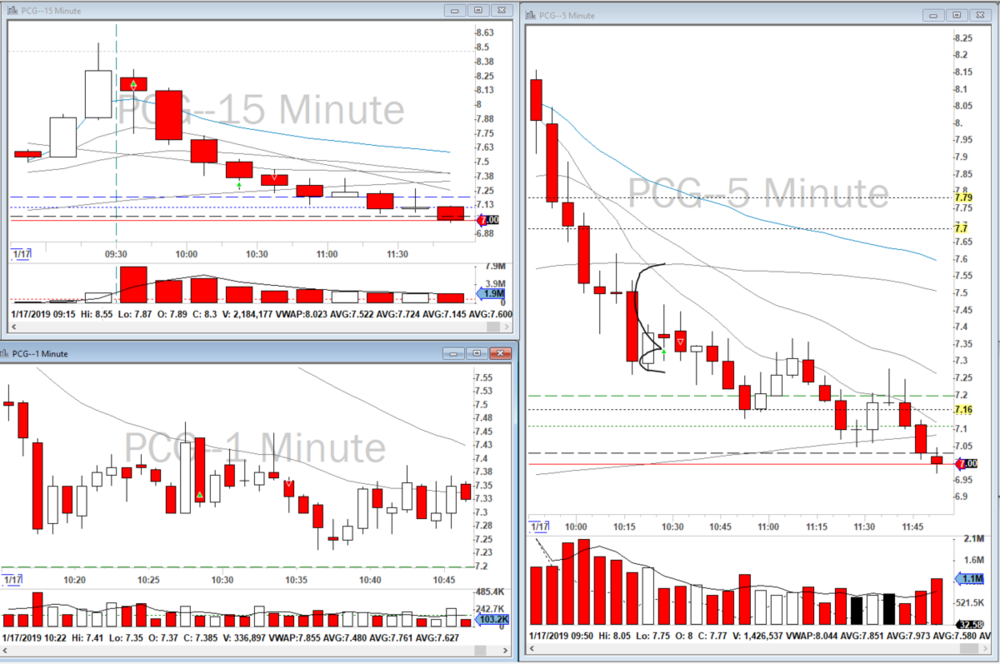

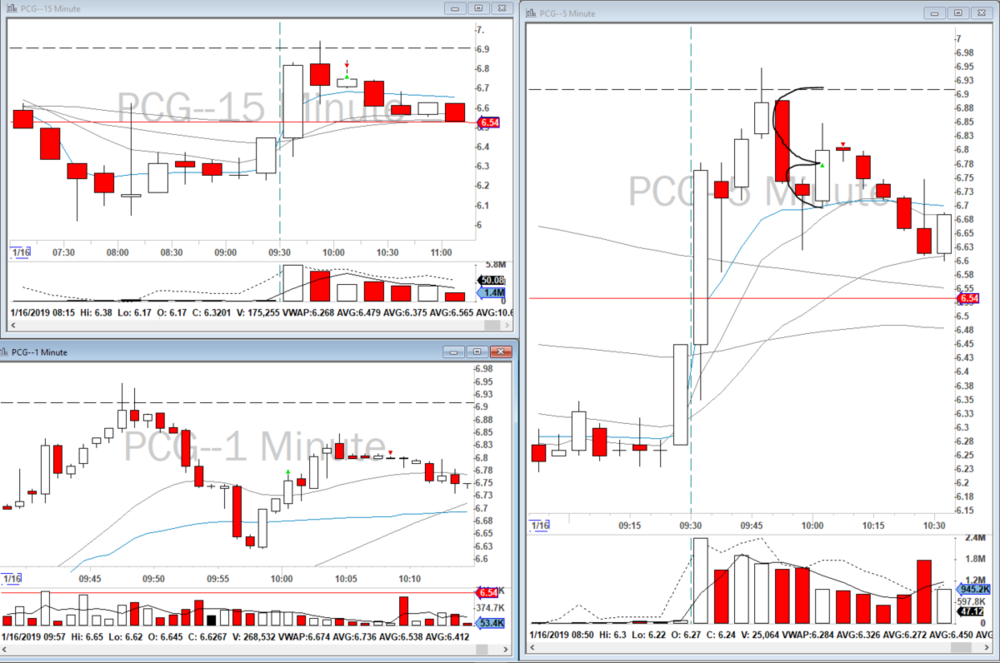

First trade of the day was on ORBU in PCG. the 5min trend was down but it had a good buy up over VWAP in the first five minutes so i got in long, it made a new 5min high but lost momentum and started making new 1min lows so i got out of the way.

GOOD: got out of the way.

RFI: overall trend was down so i should have been looking for short opportunities.

MOOD: fine

CONSISTENT: yes.

Next trade was a short in MS. it looked like it was going to engulf below the VWAP so i got in short, but i was too early. it pulled back to the MA on the 1min chart and was holding there so i added more. sold some at the PPDL and the rest at another level below that.

GOOD: nice add on the rush in

RFI: got in too impulsive, got out too soon.

MOOD: happy for a winner

CONSISTENT: yes.

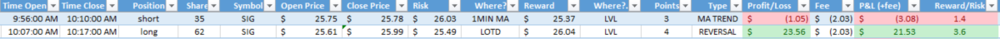

Next two trades were in SIG. the first was a reversal MA trend to another low. sometimes these stocks will sell off at the the open then pull back to a MA on the 1min then go on to make new lows. i waited for the pullback and then got in on a new 1min low. it did drop but it was not going through the LOTD so i bailed for a b/e small loss. then i noticed it bounced off the LOTD about 6 or 7 times so i risked that for a bounce back to the VWAP. called it correctly but sold half about a minute too soon. got out the rest at a good price.

GOOD: good ideas, pretty good execution

RFI: sold my winner too early.

MOOD: good, happy to be making the right calls.

CONSISTENT: yes.

Next trade was the same type of LOTD reversal but in PCG. after i got in, the 5min chart made an indecision doji and i thought that if we didn't make a new 5min high there was a good chance this would go lower. it came up but not close enough for a new 5min high so i bailed at b/e

GOOD: got out when the trade wasn't working.

RFI: ?

MOOD: ok

CONSISTENT: yes

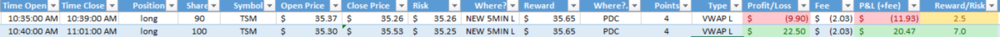

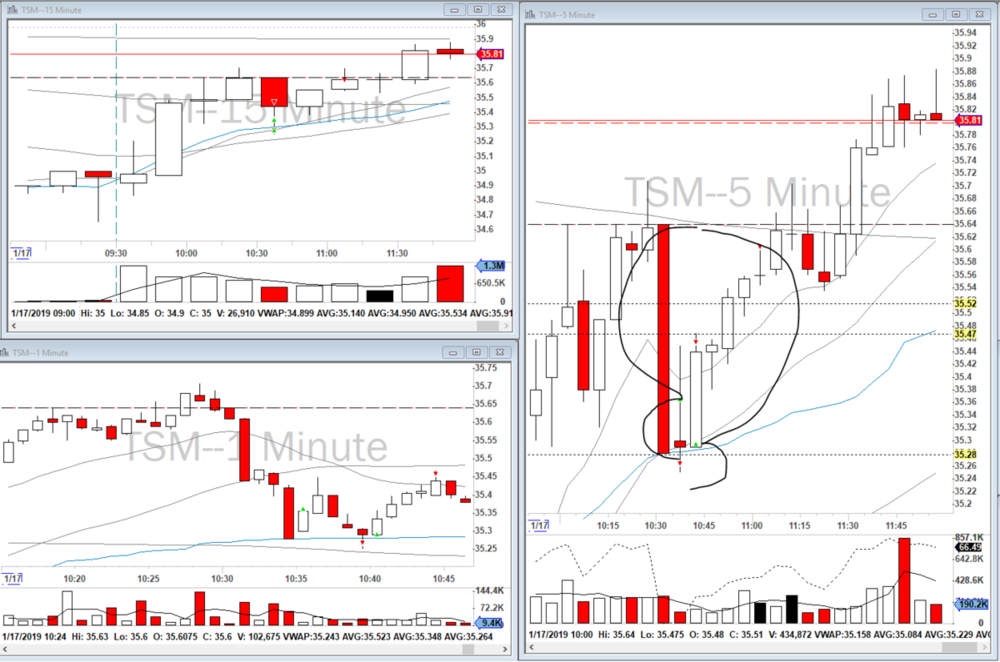

Last two trades of the day were long trades in TSM. i wanted to take this short at the PDC if the 5min closed below it at 10:30. unfortunately i was not watching and i made that move without me. But i saw that it dead stopped at the VWAP so i thought it would make a good long. i got in risking the VWAP and new 5min low for it to come back to the PDC. the first stab at it didn't work and i got out at my stop loss. i could have bailed on this one earlier. once it came back above the VWAP and made a new 1min high i got in again for a nice move back to PDC.

GOOD: got back in when i saw the trade was still viable.

RFI: got in too soon on the first one and didn't get out soon enough

MOOD: happy

CONSISTENT: yes

What I did good today: kept my head in the game and had a great day executing. I’m noticing the substantial emotional difference between live and sim trading.

What I did bad today: I’m getting crushed on my ORBs this week.

Worst trade of the day and why?: ORBU in PCG was dumb move

What can I do better tomorrow: So me hitting my profit target with no stress has me really concerned that it’s solely my fear of losing real money that’s holding me back. I have no idea how to fix it. I think the only way to fix it is to just keep focusing on making good trades and just slowly get used to the feeling of losing money.

Other comments for tomorrow: Back to live trading tomorrow. Just practice making good trades and work on emotional control when you’re getting stopped out.

-

15 hours ago, Greg said:Quick Update: I didn't forget about this thread. I've been out these past two days. Our little baby girl arrived 2 and a half weeks early!

(Pic coming soon) So I've been quite busy. Not sure of my schedule for this week, but will post if I trade.

(Pic coming soon) So I've been quite busy. Not sure of my schedule for this week, but will post if I trade.

congrats!

-

Wednesday January 16th, 2019

Sleep: about 7 hours. Mood: rushed this morning getting to work late and not having my typical 20 minutes to get ready for the trading day.

first trade was an ORBU in FDC. i did not see that it was below the VWAP until after i got in the trade. I should have got out sooner than i did but got out before my auto stop.

GOOD: got out before the autostop

RFI: bad trade, this was not thought through at all.

MOOD: dissapointed in myself for not paying better attention before hoping in.

CONSISTENT: yes, i bailed on the trade when i saw it was going bad.

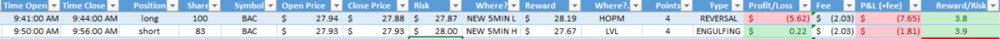

next two trades were in BAC. the first one i went long when i saw that the stock broke VWAP on the 5min and then got bought back up. i got in long risking a new LOTD to the HOPM. i got cold feet and got out before it hit my stop. it turned out to be the right move eventually but it was really choppy for too long. I have no idea why i got in short risking a new 5min high to some level way below the LOTD. got out of this one at b/e when i noticed it wasn't going to break the low.

GOOD: got out when the trade wasn't working

RFI: too choppy to be trading.

MOOD: disappointed and frustrated.

CONSISTENT: yes.

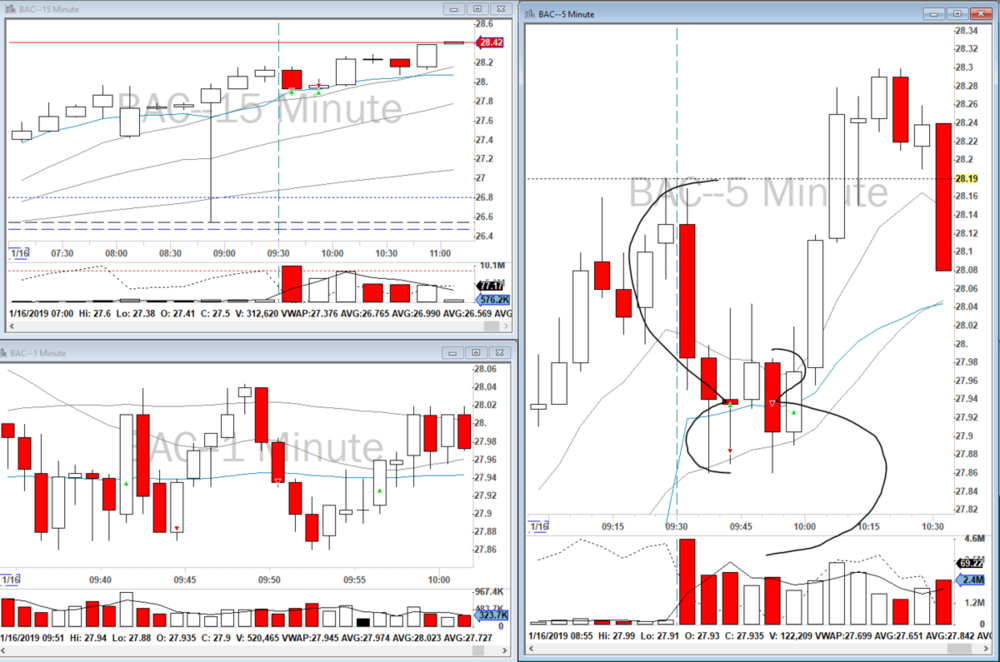

Next trade was an engulfing long in PCG. i felt like this trade was the right move, it bought up above the VWAP, then made a new 5min high so i felt good about the trade. then the volume just died and i bailed.

GOOD: got out when the volume died.

RFI: R/R not good.

MOOD: disappointed and frustrated i can't catch a winner but happy with my trade management

CONSISTENT: yes.

Last trade of the day was a long off the VWAP. Like the last trade in PCG, I felt like I did the right thing. the stock was trending higher on increasing volume consistently making new 5min highs. i waited for a pullback to VWAP and got in long, good R/R. then it made a new high but pulled back violently from the PPDL. I should have bailed right then but i held on for a full stop loss. this turned out to be a VWAP false break out. i'm not trading well since i started trading live. i would have taken the other side of that trade in SIM. i'm not giving the VWAP trades enough time before getting in.

GOOD: good plan, good R/R.

RFI: bad execution. should have got out long before my stop loss.

MOOD: beat down.

CONSISTENT: yes.

What I did good today: for the most part, managed my losses.

What I did bad today: just being on the wrong side of every trade.

Worst trade of the day and why?: ORBU in FDC. Absolutely the wrong thing to do, it was a very dumb trade. I did spend enough time thinking that through before getting in to the trade.

What can I do better tomorrow: need to work on my strategies, I’m trading terribly.

Other comments for tomorrow: back to sim to work on my strategies. No point in keep losing money everyday being on the wrong side of every trade. I’m always trading SIM on Thursdays since last week’s disaster but also I need to readjust and refocus on getting my win percentage above 45% and my winners need to be much better than they are now.

-

On 1/12/2019 at 2:33 PM, Marek said:I picture/visualize it for myself this way: we harbor two creatures in us...one mostly controls decisions that get made "on the fly" the other is responsible for "deliberative thinking" but that creature is also lazy and easily overrun by the impulsive creature in us. We need to retool/train the lazy creature not to be overrun by the impulsive creature.

I recommend this book by Daniel Kahneman....Kahneman won a Nobel prize in behavioural economics for research on the two major forces in the brain that dictate decision making....intuitive vs deliberative thinking. It's very useful to understand the brains impact on impulse and biased trading.Daniel Kahneman: Thinking fast and thinking slowAnother good read is a book written by Anni Duke ... Anni Duke is a professional poker player who talks about how to think in terms of bets and statistics of making good and bad calls. Those who play poker might agree there's a few "decision making" similarities between poker and trading. Like traders poker players have to quickly make decisions (fold, call, bet or raise) when confronted with complex decisions. They too have to learn to tame the impulsive creature they harbor...

Anni Duke: Thinking in betsthanks Marek, i'll check those out

-

Tuesday January 15th, 2019

no trades today.

-

Monday January 14th, 2019

Sleep: 7 hours. Mood good, ready to trade.

First trade was an ORBD in MU. Stopped out at the VWAP.

GOOD: good entry, good risk target.

RFI: could of got out when it failed to make a new 1min low

MOOD: ok

CONSISTENT: yes.

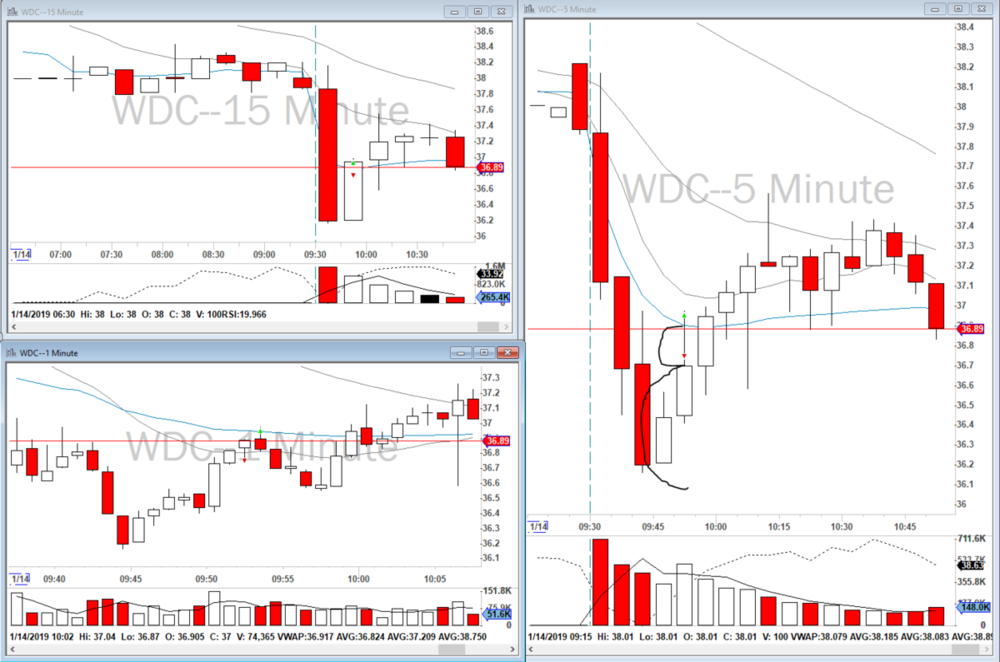

Next trade was a VWAP reversal in WDC. WDC sold off in the first 15 minutes then came back up to VWAP. I got in short, a little bit too early and got stopped out.

GOOD: good idea

RFI: it was trending higher so I should not have got in counter trend. chased my entry.

MOOD: alright, not happy about two full losses.

CONSISTENT: yes.

Last trade of the day was in AMD. It was running up for the first half hour. I waited for a sell off and got in on a new 5min high. That same candle turned in to a doji and I should have got out at b/e, there were several chances to get out but I held on for a full loss.

GOOD: good initial plan, got in with the trend.

RFI: could have got out at break even.

MOOD: sad that I hit max loss again for the second day in a row.

CONSISTENT: yes but I could have saved myself some money here.

What I did good today: logged my losses after they happened to take a step back and not make emotional trades.

What I did bad today: not managing trades once I’m in them to limit losses.

Worst trade of the day and why: last trade in AMD because it was really choppy and not trending and I had multiple chances to get out at b/e but I stubbornly held for a full loss.

What can I do better tomorrow: actively manage your trades and get out when they don’t do what you plan them to do.

Other comments for tomorrow: it’s been a rough last couple of days. 2/10 in my last ten trades. Well below my winning percentage. Keep your head up and focus for Wednesday.

-

Friday January 11th, 2019.

No trades today, i was not watching the markets.

-

22 hours ago, Greg said:Some of the problems that I currently deal with:

Walking Away - I have a hard time walking away when I am losing. Often times, I finally quit when Das Stops me Out. This will be one of the things that I report on daily.

Stopping Out/Doubling Down - This used to be one of my bigger problems. Again, I hated to lose, so I will let me losers run or double down on my position to try and get out at break even. It works until it doesn't. I've been better at not doubling down with the Pos Max Loss with Auto Stop.

Overtrading - My problem since the very beginning. When I first started trading, I didn't have a stopping out problem, I just had an overtrading problem. If anything I had the problem of stopping out too quickly. I tried to implement a trade limit for myself, but then I started letting my losers run a little because it was one of my limited trades for the day. I still let trades run (not as bad as before) , and I still overtrade on a daily basis. I probably average about 12-15 trades a day.

Taking Bad Setups - Another issue that I've been working on is my patience and taking better setups. The emotions get to me at times, and I will trade to just be in a trade. Sometimes as soon as I exit a trade, I will find a reason to enter a new one.

Short Bias - I have an extreme short Bias. Since Oct 2018, 80% of my trades have been short.

Relying too heavily on the 1 min chart - This one, I've been getting better at and its really helped. I used to trade solely off the 1 min chart and at times I still do. Less often than before.

The walking away and not over trading is particularly difficult for me as well. i know in my head what i need to do but i just get steamrolled by my emotions and do the bonehead thing instead of the prudent thing. i think that's the main reason why trading is so difficult. i've been thinking a lot about what Mark Douglas says in trading in the zone that I have to slowly diffuse the habits that are holding me back from being consistent and slowly infuse good habits. the only way to do that is work everyday on the things I can control but also realize that these habits have been with us our entire life so they're not going away easy and to not be too hard on myself when i make a mistake.

Maybe pick one specific issue to work on and dedicate six weeks to that task? Go easy on your goal as well for example, 75% of the time i will get out of a losing trade instead of doubling down and then track that specific goal to see if you're making an improvement.

Right now for myself i am working on stepping away when i'm losing so after my first loss i'm working on logging that trade and seeing what i did wrong instead of jumping right back in the market and then if i lose again taking a 5min break to calm down. you can see in my trade journal that i did not do that Thursday and i hit max loss and that's ok, there's always going to be set backs on the road to improvement.

-

1

1

-

-

Hi everyone,

I'm Mark from Pittsburgh, PA. 33 years old been working as an engineer in oil and gas for almost 9 years. I've always been interested in finding a way to make money on my own and have been investing in the stock market since college. After finding Andrew's book i knew i had to try being a day trader. Love the journey so far, look forward to many more years of hard work and good trading!

Mark

-

1

1

-

-

Thursday January 10th, 2018

Sleep: 7 hours. Mood: tired and busy with meetings.

Tried to take three reversals in AMD, none of them worked and hit max loss for the day.

GOOD: auto-risk stopped me from trading.

RFI: trying to force a long trade when the stock is a short. Also don’t trade when you’re distracted.

MOOD: not pleased with myself.

CONSISTENT: no because I kept forcing a bad trade.

What I did good today: Quit trading at max loss.

What I did bad today: Traded during meetings and not paying attention 100%. Tried to force a long trade in a short and didn’t log my first loss after it happened and didn’t take a 5min cool down after my second loss.

Worst trade of the day and why: All of them for the above reasons.

What can I do better tomorrow?: Take a step back after a losing trade a reevaluate. Use your rules.

Other comments for tomorrow: I knew not to trade today but I did it anyway and took bonehead trades and got what I deserved. Need to accept that it’s better not to trade while distracted than to lose money and be frustrated.

-

Wednesday January 9th, 2018

Sleep: 7.5 hours. Mood: good, nervous about keeping my win streak going this week.

First trade of the day was an ORBU in AMD. I was watching MU for an ORB but I missed my entry so I went with this one instead. I chased this entry a little bit as well. Stop was below VWAP at the 5MIN MA and the goal was to get to the $21.40 level on the daily chart. I got cold feet and sold 75% before my target and held the remaining piece before B/E

GOOD: good R/R

RFI: entry was not great, sold the majority too early.

MOOD: good, wish I had more shares for this trade.

CONSISTENT: yes.

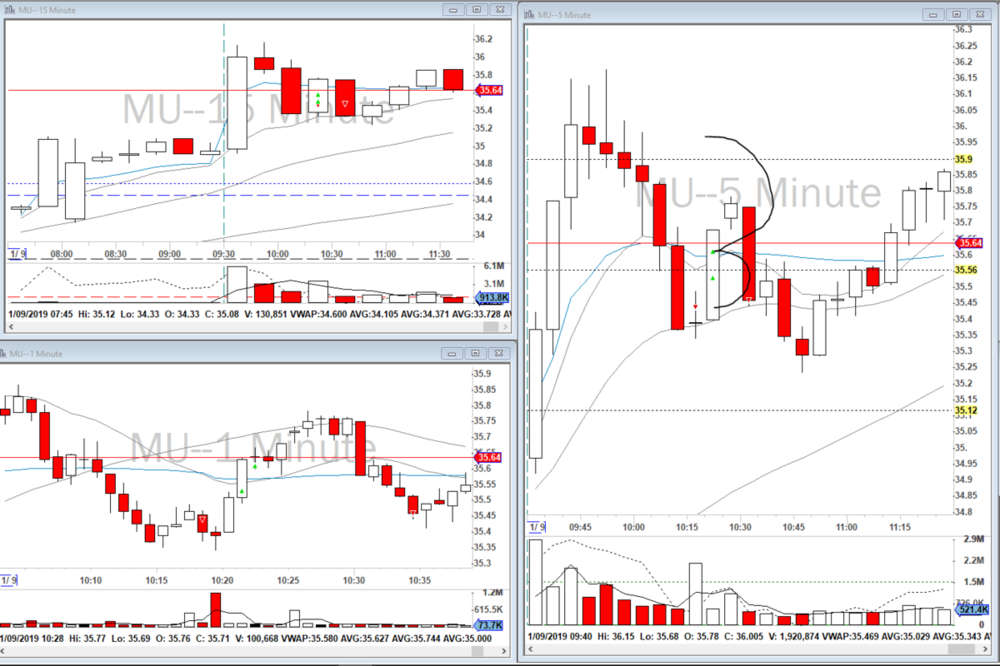

Next trade was a short in MU. MU sold off down past the VWAP. i waited for an entry at $35.56 risking the VWAP but it never came up that high and i got in on a new 5min low. same risk at VWAP so my share size was small. this trade threw me for a loop. huge volume on a spinning top and I ended up selling on a new 5min high.

GOOD: got out on a new 5min high and saved me from a full stop loss.

RFI: could have got out at b/e

MOOD: ok

CONSISTENT: yes

turned right around and went long in MU with a bad risk level. i came up a little bit but then right back down on a SPY selloff and stopped me out. glad i got auto stopped because i was being very stubborn about not letting this one go.

GOOD: auto-risk got me out of this trade.

RFI: needed to see that it was selling off big and should have got out at break of VWAP at least.

MOOD: frustrated.

CONSISTENT: yes because of the auto-stop

next trade was a short in AMD. like MU it sold off and so i waited for a pullback to the MA on the 1min chart. it didn't quite get there and i got in on a new 1min low. again i didn't change my risk level so i didn't have that many shares and it kept me from selling at the PPDH which was the smart move. got out on a bounce from PPDH and then a new 5min high.

GOOD: didn't impulse jump in and waited for a good entry.

RFI: needed to change my risk level before getting in

MOOD: mentally exhausted.

CONSISTENT: yes.

i was done trading but then i saw the double bottom in AMD with the PPDH and the PDC and thought it was too good to pass up. i got in long but i rushed it a little bit. it started having trouble getting through the MA on the 5min chart and i had to use the bathroom so i thought i put in a stop at my entry but i accidently got out of the trade. a little frustrated that it then went to my profit target. oh well.

GOOD: saw a really good setup and took it.

RFI: learn how to make correct stops

MOOD: tired

CONSISTENT: yes? i meant to be.

What i did good today: kept my head in the game and didn't make too many bonehead mistakes.

What i did bad today: didn't change my risk levels and got too small amount of shares for most of my trades.

Worst trade of the day and why?: the long trade in MU because it was poorly planned with no real stop level to risk

What can i do better tomorrow: need to remember to take a step back and log the losing trades so i don't just jump in to a crappy trade.

Other comments for tomorrow: i was nervous at the open because i traded well Monday and Tuesday and i started focusing on making money and not on good, consistent execution of trades. need to remember to always focus on taking good trades and don't worry about the money.

Mark D. Day Trading Journal - Live 2019

in Day Trading Journals

Posted

Tuesday February 5th, 2019

Sleep: 8 hours. Mood: good, ready to trade.

first trade of the day was an ORBU in SQ. had my stop at VWAP and i got stopped out. i should have held on longer than i did maybe, but it did touch my stop. i think next time I need to give it to below support not right at it. i didn't get stopped out for much though. the market shook the crap out of my weak hand. My nerves rocked me on that one.

GOOD: got out at planned stop

RFI: got out too soon. even though it was my stop

MOOD: frustrated that every day my first trade is a loss

CONSISTENT: yes.

Next two trades were in CRON. i got in long above the PPDH support on a new 5min high. i went to sell and at around $22.60 but my montage wasn't highlighted and my hotkey didn't work so i waited for it to come back up but it kept falling and then made a new 5min low so i bailed for a small profit/breakeven.

GOOD: waited for confirmation to get in. decent R/R

RFI: didn't take profits when given the chance.

MOOD: frustrated that i got out with a small winner but i've learned from other trades that if it's making a new 5min low, it's better just to get out of the way.

CONSISTENT: yes.

Then it came back up and made a new 5min high, i saw a good R/R with the MA on the 5min charts so i hopped back in. sold half at the break of the HOTD and then the last half at the even $23. happy with this trade.

GOOD: didn't let my emotions from the previous trade stop me from hoping back in on this one.

RFI: could of held the first piece for better selling.

MOOD: good. happy to be green to start the week

CONSISTENT: yes.

What i did good today: didn't let my previous trade in CRON effect me and got in for a good winner.

What i did bad today: put my stop too tight on SQ and got stopped out of a winner.

What can i do better tomorrow: put my stops below the support, not right on it. give it a second when it hits the stop, i might get a bounce.

Other comments for tomorrow: keep up the good trading tomorrow.