-

Content Count

286 -

Joined

-

Last visited

-

Days Won

10

Posts posted by nassarsyed

-

-

-

-

This is the one I have been tracking for some time.., interesting 23 days in uptrend, has see 9 Green consecutive. Forming a Bull Flag, Could go higher from here targeting recent highs.

Even though it keeps forming higher lows, of concern is the high volume on the pull back, so I am not biased only bullish, I would even look at the bearish break here.... will follow.

-

1 hour ago, Andrew Aziz said:Excellent Nas, excellent. Maybe you can join us and helping Brian in leading the swing section for us! See you in Toronto!

@Andrew Aziz Very timely - I 100% had ideas and was going to bring this up with you! Too bad @Brian Pez is not coming, but we can communicate through other channels. See you here! Friday is good weather, there is snow on Sat & Sun....

-

Update on latest swing considerations.

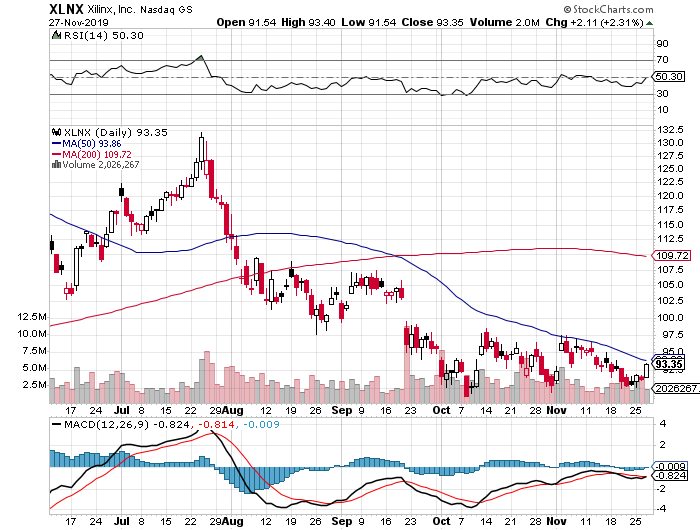

XLNX has started working have a small position in

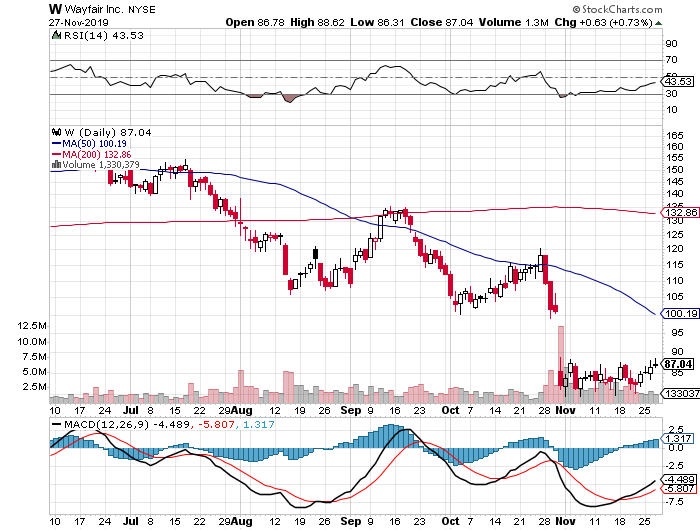

W at top of range ready to potentially breakout. Santa Clause rally may help

-

Swing Trade Idea 2

Strategy: Tight consolidation over several weeks, keep on watch

Watch for break out of consolidation

Symbol: W

-

Swing Trade Idea

Strategy: 3 Touch of Higher pivots, long on break up volume - Will also look at short, if it breaks below trend line and retests on Pull-back.

Long break above 91.90, Stop 90.25; Target 94.85

Symbol: XLNX

-

I will attend

-

On 9/19/2019 at 12:46 PM, misterchai said:Thanks for this idea, I actually took everything off before Powell speech yesterday, took it long for opening drive today. Glad you held and made bank!

Congrats!

-

1

1

-

-

-

-

-

Taking off 1/4 balance for all out 140.52 - don't like holding over weekend.

so

1/2 off at 138.52

1/4 off at140.25

1/4 at 140.52 (today)

-

Sold half of half over 140 and still holding balance.

-

1

1

-

-

-

57 minutes ago, JenniferL said:Nicely done on MSFT

Thanks!! partialed half end of day. Don’t trust this market. Rest is +$0.25 profit stop.

-

-

Nothing triggered today. I am a long biased trader and all my stocks were long plays. Not comfortable with short swings yet,

-

Scouting this early week for longs...

CRM - Strong stock corrected with market - looking at 143s to enter. Market should be in line for entry though.

ARES & BAH - in strong uptrend, paused with market correction - looking for continuation

SC - similair to ARES & BAH but more of a bear flag, sitting on a pivot - looking for continuation

BERY & PTC still scouting reversal - has to gap up on volume with market co-operating

ON WATCH - FND - strong earnings, 2 gaps to fill...

-

My PTC trade did not trigger, I look for gap up on strong volume.

-

1

1

-

-

-

4 hours ago, JenniferL said:Thank you so much for sharing your experience. I cannot tell you how much I appreciate your feedback. I am feeling quite dejected at the moment. I did not risk more than 1% on any trade, but now I can see how quickly one could be out of this altogether quite quickly. So happy that BBT emphasizes the importance of sim. Every loss teaches me so much.

One of the most important things I need to do is learn how to use DAS. The platform I am in right now does not have a good sim -no real time data, no retention of my trade data.

I really am having so much fun though -- there is so much to learn and test and adjust, and test again.

I do not have time to do any rigorous screening right now, so I will wait to take a trade until I can give it the attention it deserves. I imagined myself picking up some GE at $10.06 today (I watch it everyday) , and then just stalked it for 3 hours. If I had more experience, maybe I would have jumped on it. I am treating my sim account like real money. I need to have the emotions baked in when I go live.

Again, Nas, I really appreciate your taking the time to give me your input and your encouragement!

Having fun is the best approach. You will learn. When I look at the first few swing trades I posted at the beginning of my thread, I now see them and go what was I thinking?, you learn as you go. Best advice I ever received:

go to market everyday and just survive keeping small losses, everything else you will learn and it will work out over time. You need to bide that time...

so don’t be dejected.

-

2

2

-

1

1

-

-

I would not move stops and let things work. You really have to think I’m germs of risk reward and over several samples.

I look at max loss in a single trade as 1%. Will move to 2.5% when more confident gradually.

This is what I call 1R so currently that’s 1% of my working capital.

You have to give it long term I was up 3.38 R, than down to 1.28r than now closing July with 4.61R which is 4.61%

made mistakes and could have closed 6% or higher and if I use 2.5% as max loss, that would be a return of 15% for the month at which I could double my account compounded in 5 months....

there is juice in this stay with it

for relatives, that’s the beauty of swing trading do your analysis at night, trigger your trades in 1st or last hour or on buy sell stop, put in stop loss and walk away..... next day take profit, loss or adjust stops....

-

Closed final 1/4 pics of NFG at 4R

Total rerun of 2.75R although it reached 5R today

but green is green

but green is green

Nas' Swing Trades and Results

in Swing Trading

Posted

Thanks Rob. I was not able to take this as I saw lots of good intraday opportunities last week. Some people did take this. One person took it at the channel bottom as it bounced off support and is up good on it.