Bryan W

-

Content Count

126 -

Joined

-

Last visited

-

Days Won

8

Posts posted by Bryan W

-

-

-

On 2/25/2021 at 6:59 AM, Hashim_MFin said:I do have the same issue, Stop order never filled. However, I have noted 2 different versions of the script not sure which one is the most updated one

DefShare=BP*0.75;Share=DefShare*0.25*Price*0.01;Price=Ask-Price+0.01;SShare=Share/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=LIMIT;Price= Ask+0.05;TIF=DAY+;BUY=Send;DefShare=400;

StopPrice=Price-0;DefShare=BP*0.925;Price=Ask-Price+0.00;SShare=150/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=SMRTL;Price= Ask+0.10;TIF=DAY+;BUY=Send;DefShare=200;TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice-0.10 ACT:SELL STOPPRICE:StopPrice QTY:Pos TIF:DAY+;

Thanks,

The first one doesn't contain the trigger order for a stop. The second one is correct for including a stop if you have IB. If you don't have IB, change SMRTL to LIMIT for it to control the montage properly. If there is something in the script that DAS doesn't recognize, it just ignores that part.

-

There is a "flaw" if I may, with the DAS SIM order server if you are not connected a brokerage for when you try to short something on SSR. So it is correct, you must change your shorting script while in standalone SIM to Bid+0.01 when something is on SSR. If you have a brokerage, DAS will make the necessary changes when you try to short something on SSR automatically ("cannot short on bid" or whatever the warning is). Changing it to Bid+ tricks it into working. I use my regular shorting hotkey Bid-0.05 regardless if something is on SSR or not. SMRTL and SMRTM are IB exclusive routes, so for everything else, SMRTL should be LIMIT and SMRTM should be MARKET in the script.

-

If you are in standalone SIM, for shorting something on SSR you have to change your shorting hotkey to Bid+0.01 It's a "fault" in the SIM order server that would normally be taken care of automatically if you had a brokerage.

-

I don't swing personally, but I believe I've heard Brian Pezim mention that he uses TD to swing, though I'm not sure if he uses TOS with it or not. I'm pretty sure that his analysis is all done on stockcharts.com and that's what you see when he does his analysis in the chatroom before the close.

-

1

1

-

-

4 hours ago, Hamish Arnold said:re-install done, and noticed one white window already - on to the next idea! make that 2 as i was typing this!

DAS support is pretty good at getting back to you, so hopefully they'll have an answer for you

-

It's funny what that can fix with a simple program like DAS. Just make sure that you copy all your files to a new place. File menu, tools, Back Up Settings, will make a zip file of all your settings on your desktop.

-

That is REALLY unusual, particularly because of that one random 0 on the asks list... I definitely have not seen this before, but I'm thinking it's because of your specific setup/computer. I'd highly recommend asking @KyleK29about this, and maybe try reinstalling DAS (as that seems to fix some of the weird issues). Your network delay is fine in my opinion, but it seems like the list wasn't rendering except for that one "0" size...

-

I can't see the pictures... However, I have not experienced that in almost three years of using DAS. A few months back, several people were having issues with bids/asks reversed spread, but they got that worked out.

-

-

On 7/13/2020 at 1:34 PM, [email protected] said:Sorry for redundant question. I still don't get it. Let's say I have a margin account. When I keep my long position (within my equity, not taking margin) overnight, do I still have to pay interest ?

If yes, that means swing trading is very expensive.

When I have open order, what happens if I switch my computer off.

I'm not sure about the interest if you aren't using margin, I wouldn't think there would be any, but your brokerage should be clear about the rate somewhere on their site.

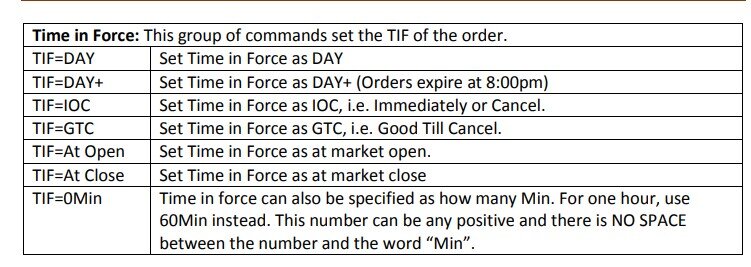

Unless you cancel your order, or it hits its expiry, it will remain open even with your computer or trading platform shut down. I'll attach an example of available times in force on DAS trader. For example, if you select DAY as the expiry, unless that order gets filled, it will cancel at 4pm Eastern. If you select GTC, the order will remain open until it's filled or you manually cancel it.

-

1 hour ago, [email protected] said:Thanks. This is really helpful.

I meant the far right! haha Oh well... I saw an "OTC" option there and they have free membership options.

-

When entry and exit on the nearest cent or second isn't critical, most of the "free" brokerages should be perfectly adequate. You'll have limitations of "settling periods" and PDT limitations if you're in the US though. Not critical, but you'll have to restrain yourself a little if you're using your full capital.

-

Have you tried Tradingview? On the far left is a filters button. https://www.tradingview.com/screener/

-

Swing Trading Setup

in Swing Trading

Posted

If you're just buying a computer to run a trading platform, especially DAS, you don't need to go over the top with a computer. DAS in particular is very lite on the system. You might want to check out the discord server if you haven't signed up already. There's a swing channel there. https://bearbulltraders.com/go/discord/