-

Content Count

31 -

Joined

-

Last visited

-

Days Won

2

Posts posted by paul ang

-

-

-

@mlestina Wow sorry to hear about that...

I didn't know such things happen. I mean, why would brokerages say no to money.

-

I have a lot of high net worth friends on IB, none of them had any issues.

Anyway, usually we use the live chat or the message, it works faster.

-

I'm a happy customer with IB, they deal with a lot of huge institutional traders. Their support is very reasonable, although sometimes they have the high and mighty feel around it.... (like you mean you didn't know that kind of response hahaha).

I don't see why they should restrict your account. I remember there is a video/chat somewhere talking about using another brokerage for smaller accounts first, then later can move on to IB when your account size is bigger.

-

Hmm i'm assuming your IB account is a margin account (not a cash account).

I also have multiple open "virtual forex" positions. Where I have cash in AUD , SGD, HKD, USD, where some of these are for my long long positions.

When I day trade, all the commissions and fees are charged on the USD. (my base currency is SGD by the way) Doesnt seem to have a problem. I also haven't seen any currency conversion problems..

But maybe that is because all my accounts are in the positive.

Is it because you are on a cash account? And they had to charge a commission in USD so they converted the CAD for you? And they charge about ?6USD per conversion.

Have you tried to convert your CAD cash to USD?

Anyway, i'm a happy customer of IB, its a really complex piece of thing, but once you get the hang of it, it just works.

-

Right ! Thanks @mlestina for sharing with us!

Ok, anyway, i'm happy with my interactive brokers.

By the way how come you have 2 different brokers?

-

@mlestina Have you tried to contact DAS? They are pretty responsive, I think it should be possible. But i find it confusing at times.

-

Oh great. Thanks!

-

-

-

-

Hi I'm Paul, I'm from Singapore.

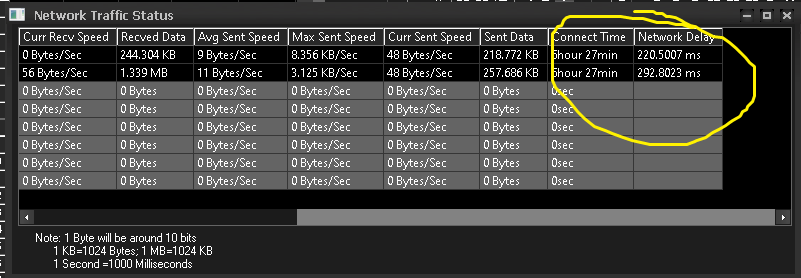

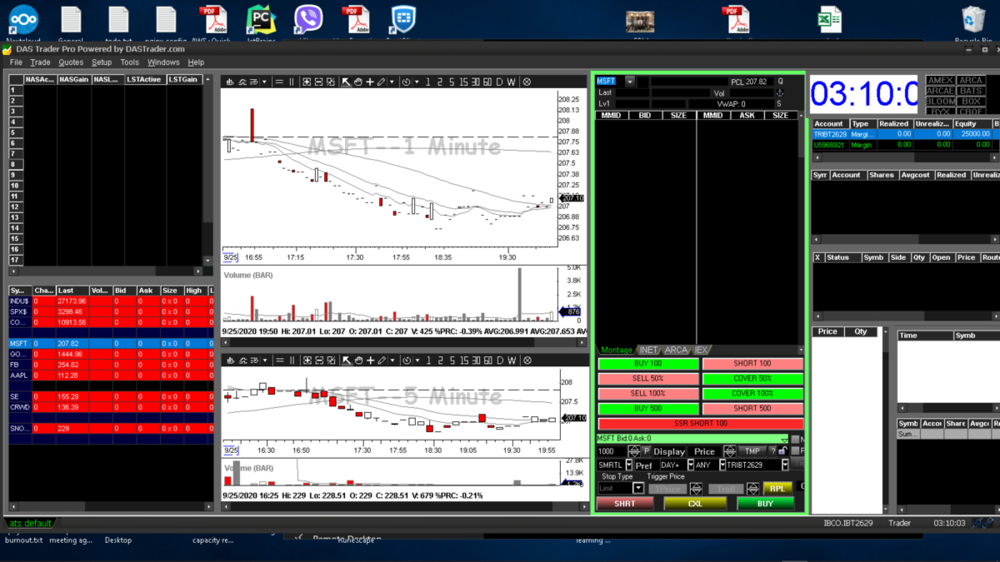

I've been doing quite a bit of day trading and has been profitable for the past 10 days with no training. Also there was once my live feed somehow got disconnected, and I almost freaked out.

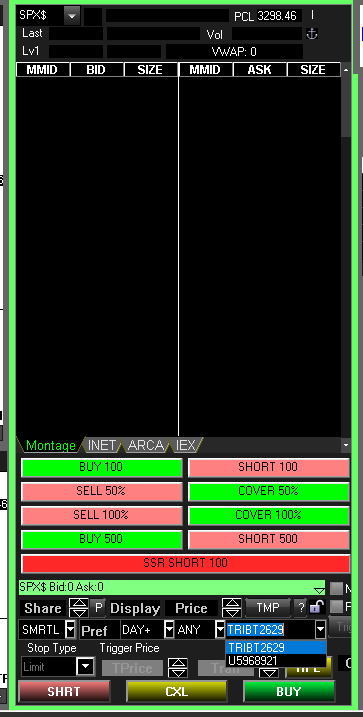

And that scares the sh*t out of me. It's time for me to actually buy/subscribe to all the professional software and take this seriously.

My main investment style is actually growth investing which is doing very well. I do some momentum trading to earn a few dollars to donate them away for any needy cause.

So please go easy on me. This place is quite overwhelming.

-

1

1

-

Introduce Yourself!

in Members Introductions & Meetups

Posted

hey wow!! Finally someone living in asia. I'm in singapore. I think BBT doesn't "focus" on anything, just happens that the founder and most of the traders trade this style.

Ultimately their trading style might not suit you. (I definitely can't trade like andrew)

And what is good is that there is lots of material here to get started, especially about understanding yourself.

See you around!