mhileman

-

Content Count

57 -

Joined

-

Last visited

-

Days Won

2

Posts posted by mhileman

-

-

Check out the below link:

https://bearbulltraders.com/course/strategy/

Go down to the below section:

ABCD's and ORB's

-

1

1

-

-

ORB strategy is IMO, one of the harder strategies for a new trader to learn mainly due to the amount of volume and price that a stock can move in a fast amount of time. It takes more time to learn what to do for this strategy since you are pretty much playing the open and don't know the direction of the stock. There is a ORB video or 2 in the Education Center that you can watch to try to understand it as well as Andrew has put a couple of recap videos on Youtube. I've noticed that if you wait until after the first couple of minutes you will have a better understanding of where the stock might go but again it could be a false breakout but you need to keep an eye on the volume as that is the tell all of what is happening.

-

1

1

-

-

I as well have a full time day job that starts at 7am-4pm but I am able to work from home which allows me to be able to watch the market all day long as well as be in the chat with the entire BBT team. However, being able to watch it and pay enough attention to what is going on is a different thing. I usually take about an hour away from doing my day job to be able to at least try to make a decent trade from 9:30-10:30am. One day I'm hoping to be in a position to where I can trade like most of the moderators and be able to go out and enjoy life with the family more often.

-

Thanks for the post. I've downloaded the top chart as it may help me see the patterns a bit better when I trade.

-

Sorry the one I sent you is for a short sell.

The one below is for a long position to sell 25% and to put a stop at B/E.

CXL ALLSYMB; ROUTE=SMRTL;Price=Bid-0.02;Share=Pos*.25;TIF=DAY+;SELL=Send;TriggerOrder=RT:STOP STOPTYPE:MARKET StopPrice:AvgCost ACT:SELL QTY:POS TIF:DAY+

Now you have the one for a short sell cover 25% if you plan to do any Shorting.

-

1

1

-

-

Yeah that's how I use it as a button on the Montage.

-

When you hit the button to take your partial you can add this to the end of it to set a stop at break even.

This is a 25% partial with stop at break even:

CXL ALLSYMB;ROUTE=SMRTL;Price=Ask+0.02;Share=Pos*.25;TIF=DAY+;BUY=Send;TriggerOrder=RT:STOP STOPTYPE:MARKET StopPrice:AvgCost ACT:BUY QTY:POS TIF:DAY+

-

3

3

-

-

Looks like they used OneNote to take a screenshot of the trade they made and they added a textbox so that they could fill in all the information on the left.

-

6 hours ago, peterB said:just a hint: it would be best if you put them all into one post instead of spreading it into multiple posts as it can be messy over the time.

He has the second post on the main thread page updated with all of the printouts which was updated on July 13.

-

1

1

-

-

When I built my house I planned for the future by installing a 10Gb network switch which is coupled by easily replaceable Cat6 cable that runs to my office area as well as everywhere else in the house I planned on having a data point. When I built my pc I added a 1Gb Network card. I was just stating that if he was going to waste the money with a wireless network card he could just get a better overkill network card for the same price that wouldn't have latency issues. When I built my house I planned for the future by installing a 10Gb network switch which is coupled by easily replaceable Cat6 cable that runs to my office area as well as everywhere else in the house I planned on having a data point. When I built my pc I added a 1Gb Network card. I was just stating that if he was going to waste the money with a wireless network card he could just get a better overkill network card for the same price that wouldn't have latency issues.

-

1

1

-

-

I'd put the money in a 10 Gb network adapter instead of a wireless adapter. I had one of the wireless adapters and the connection was usually horrible. I would put money in the GTX graphics card as the newer RTXs are about the same price as what you are looking for. As far as the parts go I'd check www.newegg.com out. I buy almost all of my parts to build pc's there since they are really good with pricing. If you find it cheaper somewhere else they price match as long as it is a reputable competitor.

Link for good graphics cards based on what you had up above: https://www.newegg.com/p/pl?N=100007709 601321572 4019 50001312 50001314 50001402

Link for 10Gb Network Cards: https://www.newegg.com/p/pl?d=Gb+network+adapter&N=100158104 600013864&isdeptsrh=1

-

1

1

-

-

Nice description on what everyone is trying to figure out how Aiman hits those Parabolic Reversals so easily.

-

1

1

-

-

Thanks for the printouts as I've downloaded a few of the ones I wanted to try first and so far I think I've been able to understand them and use them to trade better since I've been able to take better entries and exit at the proper time.

-

1

1

-

-

Yeah I have my script to set a b/e +.10 so that I know it will stop me out with at least some profit after I take at least a 25% profit. That number can be removed or changed to whatever the user wants but I should have stated that when I put the first post.

-

1

1

-

-

Here is what I use:

Sell 25%

CXL ALLSYMB; ROUTE=SMRTL;Price=Bid-0.10;Share=Pos*.25;TIF=DAY;SELL=Send;TriggerOrder=RT:STOP STOPTYPE:MARKET StopPrice:AvgCost-.10 ACT:SELL QTY:POS TIF:DAYBuy or Cover 25%

CXL ALLSYMB;ROUTE=SMRTL;Price=Ask+0.10;Share=Pos*.25;TIF=DAY;BUY=Send;TriggerOrder=RT:STOP STOPTYPE:MARKET StopPrice:AvgCost+.10 ACT:BUY QTY:POS TIF:DAY -

I always use SMRTL when I buy shares of the stock that I'm watching. The only time I've been charged the flat $3.95 rate was a couple of weeks ago when they had issues with the Lamp Route and the other time was when I set the Route to use NSDQL. If you can I would set your route to use SMRTL and defer from trading if you don't want to spend $3.95 per trade or if you ever get a message when you load DAS that there are issues with the routes.

-

Pablo,

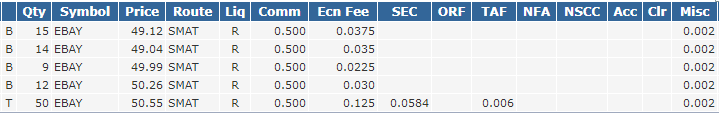

I am using CMEG with the BBT discount and here is an example of less than 1000 shares that I traded last Thursday on EBAY. If you look at the bottom trade that's where I shorted EBAY with 50 shares.

-

1

1

-

-

The only way to tell if a stock is shortable is within the platform you are using for that broker you decide to go with.

-

If the blue line is the VWAP and those two lines right below it are the 9 and 20 EMA I would have waited to see what would happen in the next few minutes to see where the trade is going. The VWAP could be a resistance level and could give you a good short but with looking at the 1 min chart you can see the 9 getting ready to cross the 20 which means the stock is going to move on up but that is only one of the indications. The stock was already trending up before that with average volume.

-

-

The issue is when you buy the 100 shares with a hard stop it has that amount of shares and can't get updated unless you close the current hard stop and create a new one based on the amount of shares you have left. Use what Justin gave you for a script and take the Share=Pos*.5 and just change it with Share=Pos to create a stop loss button.

Here is one I have for break even +.10. The StopPrice can be changed to what you want it to be. The AvgCost is what you paid for it.ROUTE=STOP; STOPTYPE=MARKET; StopPrice=AvgCost+.10; Share=Pos;TIF=DAY;SELL=Send

-

7 minutes ago, [email protected] said:Thanks Justin.

In the pre-market information e.g. GappersWatchlist, there is a column called "Vol today". What does it mean and where does the number come from ?

Thanks.

Vol today is Volume Today and it means how many shares have been traded from the beginning of the day which shows 0400 but can be different based on the stock.

-

First trade for a short should have been made around the 16.80-17 mark based on the second red candle starting below the moving averages and the volume being above the average volume. You could have set your stop loss at the moving averages right above it or the high of that candle.

The second trade shouldn't have happened either mainly due to the action being in between moving averages. It would have been best to wait on the stock to figure out which direction it wanted to go in which would have been indicated by a break above or below those moving averages as well higher than average volume.

-

That point C you have marked isn't an indicator that the C is finished with it's run for an ABCD pattern. The first candle past the red candle is a hammer and the next one is a doji or spinning top. If you look at the volume for those 2 candles the first one was resting and then the second one showed an increase which could mean a run up. The wick on the bottom of the second candle shows that their was indecision and the low was higher than the previous candles low which means to wait until the next candle to see what was going to happen. I'm assuming your blue line is the VWAP and the fist line that was touched was the 9 ema. The candle right after the spinning top or doji was the entry point for a long mainly based on that there isn't a low wick to show that their could have been some resistance.

-

1

1

-

Das Trader Market Viewer Hotkey for Scrolling Up and Down Through the List

in DAS Trader Pro Tips and Tricks

Posted

In case anyone hasn't fixed it yet DAS has hotkeys setup from default for the arrow keys. Up, Down, Left, and Right. You have to go to Setup/HotKey and look in the KEY column and find them individually and highlight them and hit Delete Item at the bottom.