-

Content Count

266 -

Joined

-

Last visited

-

Days Won

29

Posts posted by Brendon

-

-

dang, i always have the worst luck with the meetups, missed the Seattle meetup by a week, and I won't be in NY until a week later on the 2/28, darn, oh well

boys drink well without me!

boys drink well without me!

-

It would be best if you call their customer support line for such questions. I only have experience with the IB in the USA, sorry.

-

6th Gen i5? Would this be a used PC? I would not get a used PC for trading, you don't know what you're getting.

Minimums to have:

CPU: at least an i5 or greater (latest gen recommended)

RAM: 16BG or greater

Monitors: 24 inch or greater, 1080 is fine

Video Card: 4x ports or greater, by far the best is nVIDIA P620 (I have the older P600, they are not for gaming), you're gonna need a screen for chat, platform, and the other 2 for stock watching.

-

Hey, sorry for the late response, I am still recovering from PRK eye surgery, it did stop me from trading but not from working on my gainz.

So if you were a beginner, keep your workout shorter, probably no more than an hour each session otherwise you may injure yourself, mostly in your joints by gaining the flexibility and stamina for longer more intense workouts. Over working out will slow your progress and fatigue your nervous system. Do about 4 exercises per session, 2 per body part, and 2 body parts a day. One compound movement and 1 isolation, example would be like a barbell bench press, then a dumbbell bench press or a barbell curl and the a concentration curl, and you're done for the day. Then for the full body lifts like deads or squats, just have that as your workout day, it should take you an hour to do say 5 sets of those with warm ups.

DO NOT bother with a personal trainer lol, they will take your money but you will learn best by your own trial and error on what your body tells you and your own research, like youtube, t-nation, etc.

Kind of like trading, trade with a community and learn from them, but trade on your own, no hand holding.

-

1

1

-

-

16 minutes ago, urby 251 said:interested in the Long $50 risk hotkey. does the montage have to be set at any parameters like share size or stop order type, etc., for this to execute?

try to watch the BBT youtube video in my link from earlier on how to set that up, it explains everything, literally, all your questions

-

Interactive Brokers

-

Wow 3rd post today on just HotKeys, dang popular request. Please see below link and scroll to the bottom for my keys and let me know if you have any questions. Also feel free to search the forums, there are dozens of hotkeys out there but mine are obviously the best

-

Hi Le,

Try my hotkeys and see if you're having the same problem. At the bottom of the page.

-

5 hours ago, sdube1 said:Hi Friends,

I have 2 IB accounts (Brokerage & IRA) and if I want to link both accounts to DAS, does the $150/month deluxe package will cover both accounts or do I need to have 2 separate DAS accounts. Do any one of you have any experience with it.

Thanks.

hmm i am not sure, but if you go to the DAS website support and contact tab they have a live chat where you can ask that question and get an immediate answer!

-

3 hours ago, Michael McCausland said:I am also trying to choose which DAS product level I want. I am assuming it is the deluxe so that I can get level 2 data. Is this true?

yup deluxe is what you want, see link below https://www.bearbulltraders.com/request-special-das-package-for-ib-traders/ $150 a month

-

1

1

-

-

50 minutes ago, Kairos said:Hey all, Dan here on the west coast. Been swing&value trading for 20+ years and never had the bandwidth for daytrading. Don't understand the current market valuations and macro conditions have been skittish to me the past several months. Makes me skeptical of holding long positions for extended periods. Have been dropping equities and needed another way to put cash to work so here I am learning the daytrading ropes. Am an engineer by training and I run a software and data analytics company (not in finance sector). Appreciate the wealth of information and resources on here and looking forward to crossing paths with the rest of you in the days ahead. Cheers!

Welcome! In Cali myself, moved timezones just for trading. Yes I agree, keep it simple, long term investing should be just in mutual funds like always, people will get burned hard if they stock pick. Then for additional cashflow I put my money to work in daytrading. Nothing revolutionary, just keep it simple, hard work and patience.

-

12 hours ago, peterB said:i saw it yesterday and i must say it has nothing to do with trading nor with the technology around the networks :). It's kinda sci-fi and i find it even boring.

What i liked was the Rogue Trader movie and the Black Monday TV series.

Dang son, Rogue Trader was a spittn image of me when I first started, fella didn't respect his stops and blow up (throw up).

-

4 hours ago, Stephen Harding said:Hey all,

My name is Stephen. I am 35 and I have a Masters in Aquatic Biology. I have just completed my third year pursuing a Ph. D. in Molecular Ecology and Evolution. I am very new and had just began my investing journey (mutual funds, stocks, etc.) when I happened to find Andrew's book.

I wasn't really interested in becoming a day trader; I was simply naive to the difference between traders and investors and wanted to learn the difference. It was very informative and compelling so I read it again. After the second read through, I decided to start building screens and practicing pattern recognition. After a couple of months of looking for VWAP setups, I decided to take a leap of faith and try out simulated trading for 3 - 6 months.

I am happy to have joined the community, excited to challenge myself, and to ready exercise the discipline to execute good trades.

Welcome to the club! Very cool areas of focus you have there! If you have any questions just message me, Ive been around the block a few times, then down that alley you dont want to go lol then back again

-

2

2

-

-

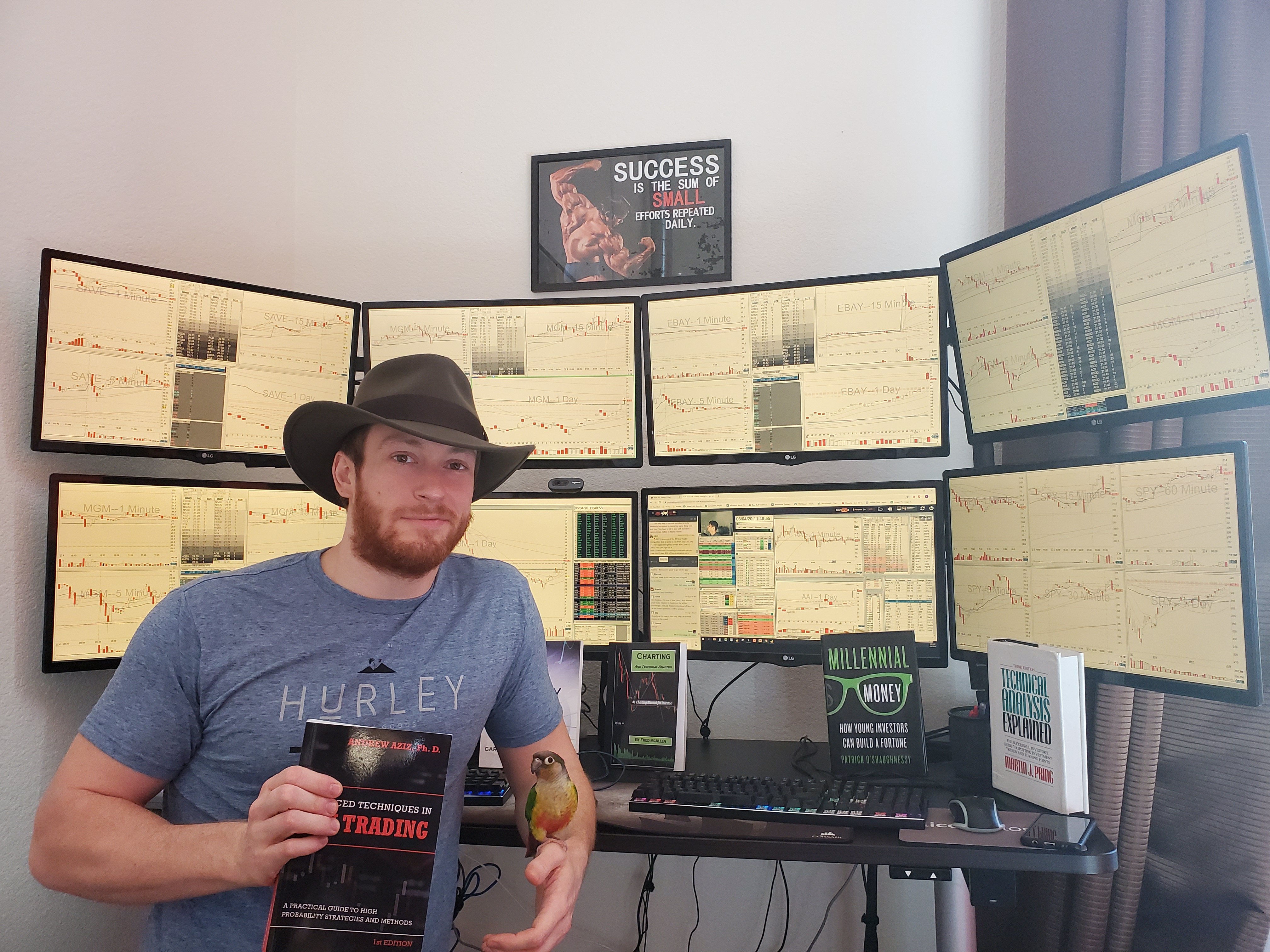

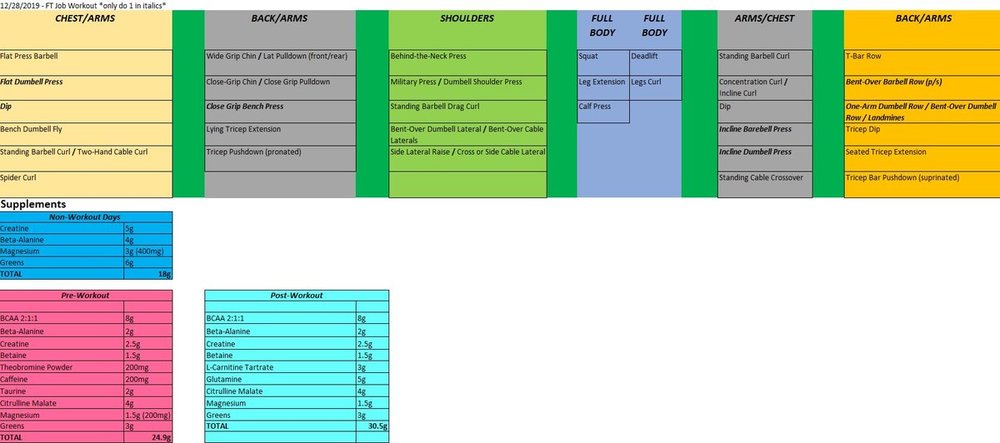

Hi BBT,

Some of you were curious about my workout routine during the SF meetup a month ago, so I thought I would share. How healthy your life outside trading will inventively affect life in the trading room. At the very least, discipline, structure, pain, and patience can transfer back and forth. I work out for 2 hours every other day, unless my day job grinds me to take an extra day off. I did not list abdominals, as I simply do a variety of hanging sit-ups, windshield wipers, and leg raises a few times a week.

Also listed are my supplements (I buy raw supplements off Amazon and mix, it's cheaper and healthier to make your own).

-

2

2

-

-

10 minutes ago, Jramosent said:OK so buying power comes into play here. Makes sense. In this scenario what can I do to better my 2-1 ratio? Lower my risk and strive for a 2 or more play?

If it is buying power related, just focus on less expensive stocks and less risk.

-

1

1

-

-

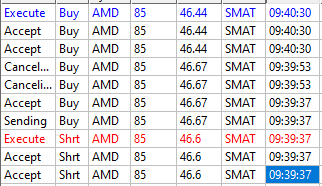

22 hours ago, Jramosent said:Hmm well if you shorted 85 shares, with a stop of 7 cents away, that's $5.95 risk, not $20. You may have the script set to $20 but as Peter pointed out you may be limited to your buying power...And to risk $20 with a 7 cent stop you would have needed to short ~285 shares of AMD (at that share price).

Hopefully this helps!

-

1

1

-

-

16 hours ago, Jramosent said:Kyle - I have a question regarding this hotkey. I have been using the script for a few months now and it works perfect. The concern I have is when I let the stock go to my stop loss (risk) $20, this is the exact amount I lose. The question is when I get my 2-1, I don't get a true $20 or even $40 reward. Why is this? I have let the stock run sometimes upwards of .40 cents where my risk is say only .12. I still don't get my actual risk to reward.

Hi Jra - post a screenshot of your order log because that sounds impossible. There could be some slippage between orders sent and filled, but be aware the script, by nature, is not 100% accurate with the risk calc.

-

On 12/4/2018 at 5:37 AM, jeremykelley80 said:Hey all,

Well since I'm going live today - I thought I'd formally introduce myself! I'm Jeremy - married without kids. Live in Seattle for the last 5 years but grew up in Redding, CA (made famous by the Carr Fire this summer). I've worked in retail management for 18 years, the last five being as a Starbucks store manager here in Seattle.

I've been in simulator since July - and now it's time to add emotion into the mix

I typically trade the 1st hour and then go make coffee for 8 more hours. Working with the public for so long, and interviewing/hiring so many people over the years, I've developed a strength in reading people... I'm finding that it has helped me read the market too.

I typically trade the 1st hour and then go make coffee for 8 more hours. Working with the public for so long, and interviewing/hiring so many people over the years, I've developed a strength in reading people... I'm finding that it has helped me read the market too.

I love all things outdoors, you could consider me a ski bum of sorts in the Winter.

Many thanks to Andrew and team for all that you do!

See you all in the chat,

J

Hey J,

Welcome! Try to make it to the Seattle BBT meetup in a couple of weeks. I'm down in San Jose, CA so it's a little bit far for me to make the trip. Hey as long as you're not drinking coffee all those 8 hours of I think going live will be great for you now. Start small and protect that account while you get better at reading the charts.

-

Unfortunately the only solution that worked for me was to move time-zones to have a 'sure thing' on my trading performance while I work my career. Last thing you want to do is practice in a replay simulator, save up all your money, then leave your job for day trading and find out you can't hack it yet. Too risky...but if you want to get a general feeling for day trading absolutely try a replay sim, that is the first step.

-

Hi Sheryl, in short, no you cannot adjust any of these features in the sim. You can adjust your commission calculator to match your broker when you go live however.

-

Hi Traders,

This time I actually have a question and not just running my mouth.

Does anyone know hot to set this up:

Say you are long 300 shares @ $10 and want to scale out 100 shares at $10.30, 100 shares at $10.60, and the last 100 shares at $11.00 but want your stop to be at say be at b/e $10.

And the stock hit your first two targets $10.30 and $10.60 but then failed and went back down to hit your STOP at $10.

My question is it possible to have the pending STOP order calc your current position size, which is now 100 shares, not the original 300 shares? Can this be done with a script or in the montage?

I know we can use a 'bracket order' to have one stop out price and in the money exit price, but is there one we can set up for multiple exits and then recalc your new position position to exit the correct size if stop is hit, without taking on a short (if the stop did not recalc). Also I am not looking for a trailing stop order.

Let me know if I worded this confusingly and I will edit. Thanks traders (looking at Kyle 'the script wonder dog')

-

20 minutes ago, AcKeBoNNiE said:Thank you guys for your answers

Ya percentagewise its not that much, but for my Stop it is

Ya percentagewise its not that much, but for my Stop it is

Ok, so I will always look at the VWAP in the montage!

But remember to not place your stop EXACTLY at VWAP, as it will never be the same on different platforms/market data providers. Leave a little wiggle room, like 50 cents on a 300 stock

but ya that wiggle room should be from the VWAP on the montage.

but ya that wiggle room should be from the VWAP on the montage.

-

I have not used TradingSim in years, and I personally did not like it. You don't want to cheap out on learning the ropes, if you are concerned with costs of your tools you are probably not psychology ready for the coming losses in learning to trade live. My opinion is to work with the real thing, the live market, and on the platform you will be using, like DAS. I would not buy a yearly package, that is probably way to long to spend on that platform for market replays. Then again I used this tool years ago and am not sure how good it is now. I heed to Carlos's advice!

-

Yup I asked this question myself, look at your montage and see what the VWAP figure is, that is the correct value. It is usually correct on the 1 minute but it shouldn't be THAT much different between 1 and 5. 50 cents on a <300 stock is not that much.

Scaling out of a position

in Risk, Account & Money Management

Posted

Yup, you have to partial out, i use 1/3 and usually take 3 partials before im fully out. As to when, it depends on how the stock is behaving and if levels were tested. But more importantly is to move your stop to b/e after your first partial, you never want a winner to turn into a loser.