-

Content Count

22 -

Joined

-

Last visited

Posts posted by Kons

-

-

-

5 hours ago, Atomspapa said:Kyle,

The work you have put in Amazing. Thank you!

I am having trouble with the setup. Wan't to make a quick hundred bucks via PayPal? If you'd be interested I would love to watch you set this up in my DAS while using TeamViewer.

It would be helpful to me as I could get the hotkeys right away and learn how to set them up and modify them by watching you ad them to my trade station.

try watching this one, might help

also videos from Kyle himself in more detail

-

1

1

-

1

1

-

-

Seems like data streaming mode is active with the latest update. Do I understand correctly that for IB users it’s only 15$ per month ? because I asked CMEG and their offer is 100$ per month which is too much.

-

Anyone knows if this is already available for CMEG users ?

-

I live in Japan now tho but I wonder if there are still many active members in singapore

-

On 1/26/2020 at 8:18 AM, Mario J said:Hi everyone,

is there a way zooming in and out a chart on the price axis? Like in TOS, or Ninja Trader I can point with my mouse cursor on the Y axis and by pressing and holding the left mouse key I can easily zoom in, or out. Especially right at the open I find it very difficult to watch the candles scaled in a lot to gain the right perspective.

Thanks in advance

Mario

You can use the hotkey developed by Kyle from this post, it has the Y axis zoom hotkey code in the spreadsheet. He also has a video on it somewhere.

-

On 1/2/2020 at 11:23 PM, KyleK29 said:For those planning on using this system, would you be interested in a historical BBT gap list lookup system?

I have gap lists for years 1999 - 2019 with a BBT (same as the TradeIdeas config) filter, I could make this accessible to BBT members if there's enough interest. It'd allow you to look up a gap list for a specific date (frozen as of 9:30am on that date). That way you can appropriately simulate the complete trading method.

Hi Kyle, I would be interested as well.

-

Hi Kyle,

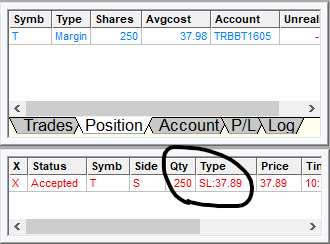

Yes that fix worked fine, now the updated stop shows as SM.

I have another issue though with the below hotkey. It is the one to scale in 10$ risk. When I try to scale in I get filled twice.. screenshots attached.

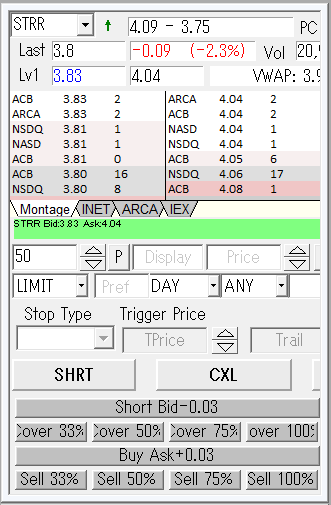

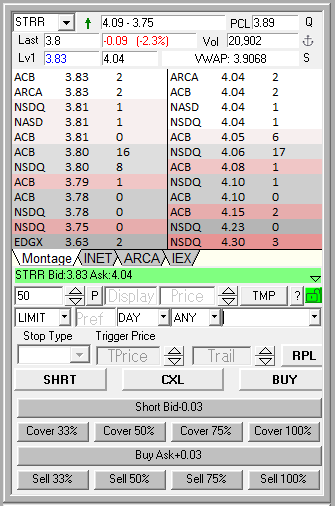

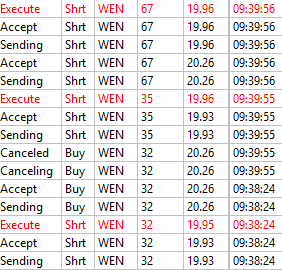

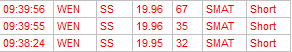

;CXL ALLSYMB;DefShare=BP*0.98;Price=StopPrice-Bid-0.02;SShare=10/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=LIMIT;Price=bid-0.03;TIF=DAY+; SELL=Send;DefShare=400;TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice-0.3 ACT:SELL STOPPRICE:StopPrice QTY:Pos TIF:DAY+; -

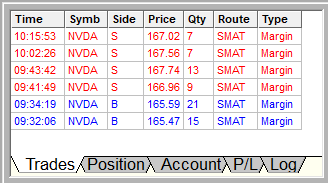

Hi, have a question regarding Stop Price update hotkey.

The below hotkey replaces the stop order from Market to Limit and I dont know whats the reason. For example I go long with automatic Market stop, but when I want to update the price with a hotkey the new order is Limit.

CXL ALLSYMB;Route=Stop;StopType=MARKET;Share=Pos;StopPrice=Price;TIF=DAY+;Price=StopPrice-0;SELL=Send; -

Is there any way to automatically update Stop order position size when Partial order gets filled ?

-

Thanks for the feedback!

I think I will go with tracking this as one trade from now on. I already have the $ risk set so as Kurt mentioned probably the best way would be to reverse calculate R/R from P/L.

-

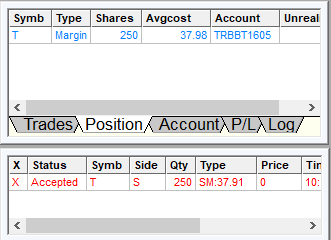

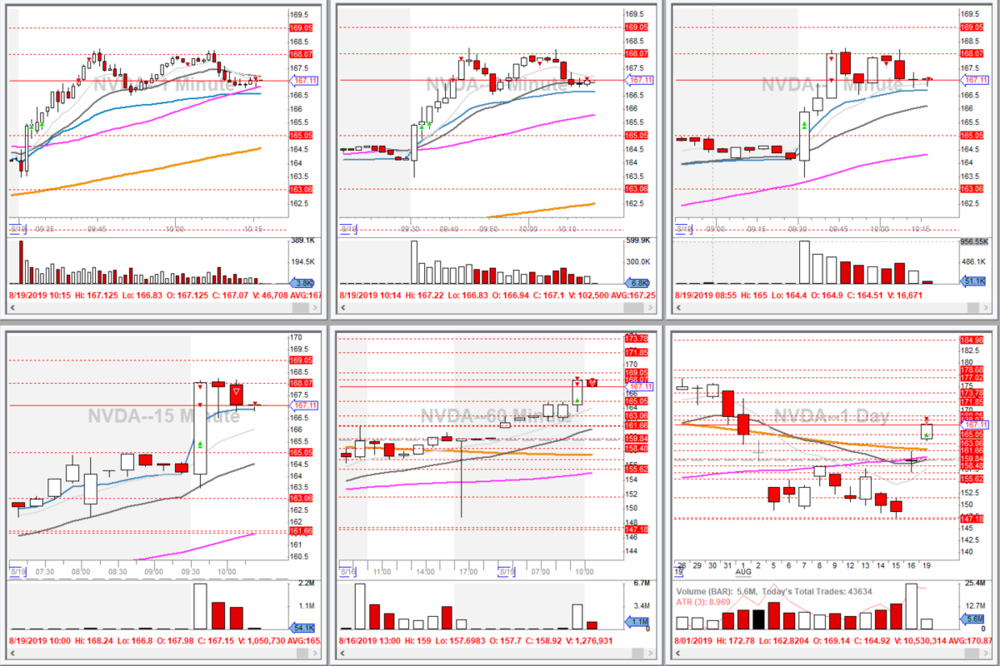

Hi traders,

I have a question, I guess mainly for those who log and track their R/R and payoff ratio. When you add to a position do you track it as a separate trade with separate metrics or do you count the average price with the latest stop to calculate new R/R ?

Hope this make sense, here is the example:

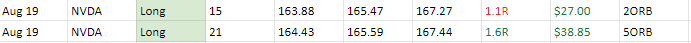

I traded NVDA yesterday 8/19th. Went Long at the open for 2ORB with wide stop first to be careful, added more on consolidation for 5ORB and moved stop higher. On the screenshots attached you can see that logging this as one trade will give 1.7R realized, however splitting this in two will give 1.1R and 1.6R which leads to a better total R number but a lower average. So when analyzing statistics for a month lets say, it will give different results.. which way do you think works better ?

-

Hi, I watched Japanese markets for a while and sometimes you can find the patterns we trade here in most active stocks.

The problem is that it is much harder to find the correct stocks without speaking Japanese. In addition the number of good setups per day seems to be lower, the min share size is 100 and trading after lunch break may be too volatile and spontaneous. Oh and margin requirements are too high in terms of account size and trade volume.

You can see a number of successful traders online sharing their results but it is hard to tell what strategies they are using. I would say it is possible to make money in Japanese market but it will take a lot of practice, reading and communicating with local traders which is difficult on itself not mentioning the language barrier.

-

seems there is no way to duplicate the tabs however, would be a useful feature

Any interest in this improvement to some fonts in DAS?

in DAS Trader Pro Tips and Tricks

Posted

@smp It works! thank you so much, now my montage is usable again 🙂