Lane_S

-

Content Count

19 -

Joined

-

Last visited

Posts posted by Lane_S

-

-

Thanks @Robert H! I finally made it further down in the Education Center playlist. Your contributions are still paying dividends. I know now that I am normal and it is fixable...

https://bearbulltraders.com/lessons/robert-h-2-17-19-time-frames-and-chart-patterns/

https://bearbulltraders.com/lessons/roberts-rants-patience-and-perspective-pilot/

-

2

2

-

1

1

-

-

I think the crux of the problem is you can have one or several down trends on the 1-minute candles and still be in an uptrend in the longer time frames. It conflicts the mind...

-

3 hours ago, Aiman Almansoori said:Trading the 1 min chart can get us in a mess, I honestly have been trading the 1 min chart for like 5 months. Imagine it, 5 months of only 1 min chart and I was convinced I was doing great until I decided to trade other timeframes.

I use the 1/2/5/15/30/daily, but the main ones for me are 1/5/15.

Thanks Aiman for the insight. I have been focusing on trading the open up until about 11am, so I have been using the 1/2/5/15 and the daily for support and resistance lines. I use the 1 min and 5 min for setups, and look to the 2 and 15 for confirmation of a setup still moving in my favor or falling apart. I just need to develop the patience to wait for setups to develop in the 5-min time frame. It's hard to wait for 5-minute candles to form! I'm not sure I could ever trade the 15 or later!

I am also still trying to figure out how the moving averages and VWAP relate between the different time frames, which ones to trust when, and also seeing congruence between the charts. I have seen that a setup can look great in one time frame, but can be a trap if it is not reflected in the other time frames. You seem to be right about moving to the larger time frames as the day moves along and the volatility decreases.

Great stuff - much yet to learn...

-

2 hours ago, Kasper said:1-2 min rule is just selling/covering if the price doesn't move in your favor in the first 1-2 mins.

I figured that was the case, but I wanted to be sure...thanks!

-

1

1

-

-

3 hours ago, Kasper said:My favorite strategy on the 1 min chart is waiting for the price to go back to the EMA-20. Most of the time it is possible to get in for a quick scalp and lock in some good gains. However, I also use a 1-2 min rule just in case the price decides to move further up or down depending on your position.

If you choose to only use the 1 min chart, expect to get out of the trade relatively fast. you can always keep a few shares for a bigger move if the price moves higher or lower.

Yes, I have really noticed on a couple of trades how powerful the 20ma is in the 1-min chart - especially those quick hits that jump there and right back.

I don't have the skill and speed to scalp the 1-min yet. I'll try your strategy in sim once I get farther along. What do you mean by a 1-2 minute rule?

-

3 hours ago, KurtLoeblich said:Its very much day by day. When we say trade very well, its typically from past experience. Some stocks just have a tendency to not make large or predictable moves so we tend to "blacklist" them unless they've shown that they are going to trade nicely. It just comes from personal past experience and it is impossible to know how a stock will trade before you get into it.

Great, thanks. I'll keep putting in time in simulator and keep studying...

-

Kurt,

Thanks for the input. I don't really want to try to scalp and trade the 1-min chart starting out. However, I do understand how important it is to watch it to get better entries and stops. It seems to just be a psychology issue right now. I have to get used to seeing price action happen in real time and not let the lower charts affect the patience I need on the higher charts. I just wondered if anybody else suffers from the same problem

Does a stock tend to respect the same MA in certain time frames over multiple days or weeks, or is each day a new ballgame? I'll notice on the pre-market that it is said of some stocks that they "don't trade very well". Is that in part because they do not seem to respect any levels or averages?

-

Glenn,

Yes, I am trying to get the hang of incorporating multiple time frames and finding setups where the charts harmonize somewhat. I don't want to focus so much on the 1-min, but it just draws my attention to it.

I plan on journaling and posting trades once I get a little further along. Right now I am just focusing on finding setups in the price action and figuring out which ones I am better at trading.

Good luck to you as well!

-

I am a couple of weeks into trading in simulator. I think the toughest thing so far is not getting caught up in the 1-minute candle action. I get so fixated on watching the price action there, that I fail to keep it in the context of the other time frames. Patience in the other time frames is not my virtue when candles are flying all over the place on the 1-minute chart. I guess all of that is part of the learning curve, though.

I did much better with this yesterday and had two really good trades, catching a dollar move twice. I also had two trades that were a wash - 10 cents up on a stock then giving 11 cents back, and one that flat went the opposite of the setup I expected and lost 26 cents. All but the last one, I could have traded better, had I not gotten trigger happy by overly concentrating on the 1-minute chart.

Does anybody have any pointers on using the different time frames correctly? It looks like Andrew is trading the 1-minute candles much more now than in his books. In what time frame is everybody else looking for setups and managing their trades? I know congruence is also key.

In which time frames are the moving averages more important? Is VWAP more important on the 5 min vs the 1 min or the 15 min. Or does each stock tend to trade one time frame 'better' than another? Do you just have to watch real-time price action to see in which time frame a stock will respect moving averages and VWAP, or are there some general rules that apply broadly?

Sorry for the barrage of questions. I am really enjoying learning this!

This community is great. Thanks @Andrew Aziz for your awesome books and the rest of the community for the wealth of information!

-Lane-

-

1

1

-

-

Hey Ross,

Thanks for posting this. I am new to BBT and am currently test-driving tradingsim after reading your post. It has been been great for practicing and studying price action in the evenings. Like you, I have a busy season at my day job, and I cannot devote time to trading live every day right now. Once I get better at recognizing price action, setups and am trading green in tradingsim, I will move on to the DAS simulator.

And wow, there really is no substitute for seeing real-time price action play out. My first trades were so bad it was laughable. I can't imagine jumping into day trading live with real money. I finally had my first "good" trade last night, which was a bottom reversal back to VWAP, squeezing the shorts after i recognized a bullish engulfing candle - woo!

Anyway, it is awesome to be able to get past some of the learning curve in the evenings on tradingsim.

The only thing that I find difficult is watching multiple stocks being while confined to one monitor and four charts.

Lane

-

1

1

-

-

Thanks SpoTT. I am slowly getting it figured out.

BTW - nice analysis of Andrew's MU trade. Those explanations of the thought process are invaluable to beginners like me.

Lane

-

Thanks Robert, that was it! I wanted to automatically include those price markers, but I didn't want to see the ones way out of trading range. So much yet to learn....

-Lane-

-

Thanks Abiel. I had looked at that post before, but still couldn't get it to do what I wanted. This time I tried entering a negative % and that worked. What I really need is more screen and a larger chart.

-Lane-

-

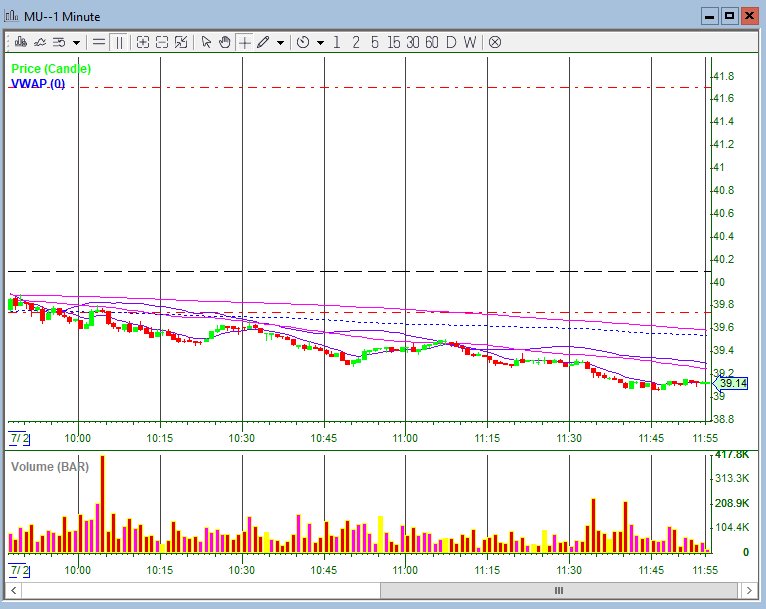

Is there a way to re-scale my Y-axis, so that a smaller range of prices are shown making my candles taller? For instance, in the chart below, how would I decrease the range from 38.8 to around 40.4?

Thanks,

-Lane-

-

Thanks guys. I'm new and green as Irish grass. Right now I am just trying to absorb market basics, patterns, strategies and the mechanics of DAS. But wow, what a great resource this is! I'll stay in the background reading posts, watching video, following price action and watching traders trade until I have more of a clue. I hope to start some sim trading in a month or so...

-Lane-

-

I apologize, this should have gone in the "basics"...

Lane

-

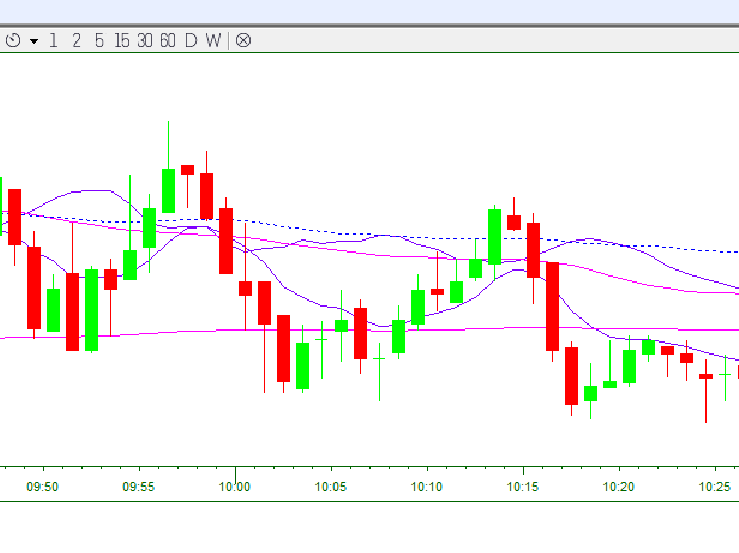

Bear with me, I am a newbie. Looking at FB today, would this price action be considered a reverse ABCD, or was that maybe some VWAP false breakouts? Or was it nothing at all?

Thanks,

Lane

TradingSim

in Day Trading Hardware, Software and Tools

Posted

Hey tardi,

Tradingsim is great for studying price action, but it does have limitations as far as duplicating what you would see in DAS. Getting nimble in the platform is important, especially if trading the open. But Tradingsim is fairly cheap if you want to study and practice for any length of time, and once you get the mechanics and mentality of trading in your head, it can be applied to any platform.

I've actually been playing around in the futures with the ES and NQ, so I have been on NinjaTrader. It has it's own replay function as well. I was just at the point of going live when the market went crazy, so I have stayed on the sidelines for the last few months just watching.

Sorry for the late reply. I guess I have been on the sidelines longer than I thought. This virus has made my regular day job very busy!