-

Content Count

44 -

Joined

-

Last visited

-

Days Won

1

Posts posted by Kasper

-

-

Yesterday I had an interesting discussion with a few trading buddies about planning the trades. I was baffled to learn that most of them didn't actually try to predict the move a potential stock in play could make.

I always find at least 2 stocks that I like and, try to predict the move. Basically if it could turn into a nice 1-min ORB if it rejected a level or a 5-min ORB if it held above a certain level etc.

Let me know how you guys plan out your trades and if it helps to release some of the stress that comes with trading.

Kasper

-

1

1

-

-

CMEG is a good choice if you are trading a small account. (less than 1000 shares)

Short list could be better. it is not as good as IB.

I haven't had any problems when transferring funds. However, International wires can sometimes be tricky.

Yes, it comes with a DEMO account.

Kasper-

1

1

-

-

1-2 min rule is just selling/covering if the price doesn't move in your favor in the first 1-2 mins.

-

My favorite strategy on the 1 min chart is waiting for the price to go back to the EMA-20. Most of the time it is possible to get in for a quick scalp and lock in some good gains. However, I also use a 1-2 min rule just in case the price decides to move further up or down depending on your position.

If you choose to only use the 1 min chart, expect to get out of the trade relatively fast. you can always keep a few shares for a bigger move if the price moves higher or lower.

-

I have the DasTrader app on my phone and Ipad both with separate data packages

However, I'm not sure if that would work doing a citywide blackout.

Kasper

-

Yeah these guys can be interesting at times.

Have you tried calling them on their TOLL free number ?

Kasper Jensen

-

No, you would have to set-up a cash account with your broker.

Kasper

-

How is your risk to reward in the last hour?

Are you risking too much for a small move?

Kasper Jensen

-

You don't have to master the open if you do better at the close. I have never been able to successfully trade the last hour as you do.

You can try different strategies and risk management if you are having trouble trading the open. However, Focus on what you are good at and trade the hack out of the last Hour

What strategy do you use when trading the last hour?

Kasper Jensen

-

I apologize for not responding back. For some reason, I don't get any notifications in the forum.

I'm happy your problem is resolved.

Question: how many trades do you usually do every week?

Kasper Jensen

-

Are you setting up an account below 25k?

If so, CMEG is the way to go. CMEG will allow you to have both a sim and real account which you can change in the montage.

Also, what is the exact problem you are having setting up an account?

Kasper Jensen

-

did your stop not trigger at the right price?

Kasper Jensen

-

-

People seem to blame the stock market for all their troubles. The (high-frequency trading) is my favorite because nobody is saying anything when the trade is going in their favor.

This type of tax has been proposed several times and it always ends up nowhere.

-

There must be a good risk to reward for me to enter a trade (R2.1), I'll pass on the trade if it's under R2.1.

Also, the stop loss has to be realistic. For example, I would never risk 20-30c on a stock like AMD because of its limited movement.

Checklist

- R2.1

- Stop loss (depends on the stock. You can use the ATR to figure out the movement)

- Decent target (High/Low or moving averages)

Good risk to reward, Realistic stop and a decent target.

Kasper

-

1

1

-

-

I don't think it's possible to save that information with DAS. However, You could set-up an account with TraderVue and import the information each day.

-

Yeah automatic trading does not mean you can just sit back and do nothing hehe. I go over every trade each day and calculate the stops and targets using the ATR. I had to make a few changes these last few months because of the increased volatility in the market.

I've put in some trailing stops to protect myself from the rapid reversals we are seeing during the day.

The strategy itself is taken out of a book, so it is nothing special.

-

Any thoughts on netflix.

I added below 300 and still waiting for a move to 410.

-

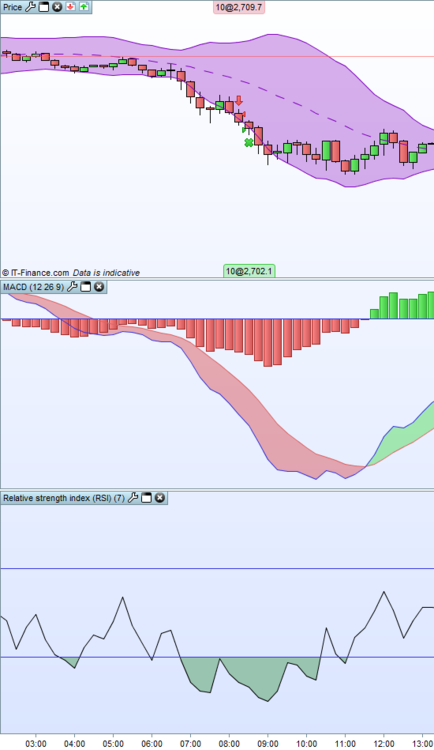

For the S&P 500, I use an automated system.

3 things that must happen for a trade.

1. Price must close below the Upper/Lower Band

2. MACD Line must be -1 or +1 depending on long or short,

3. RSI must be above 70 for a long and below 30 for a short.

Stop is 10% of the weekly ATR and the target is 15% of the weekly ATR.

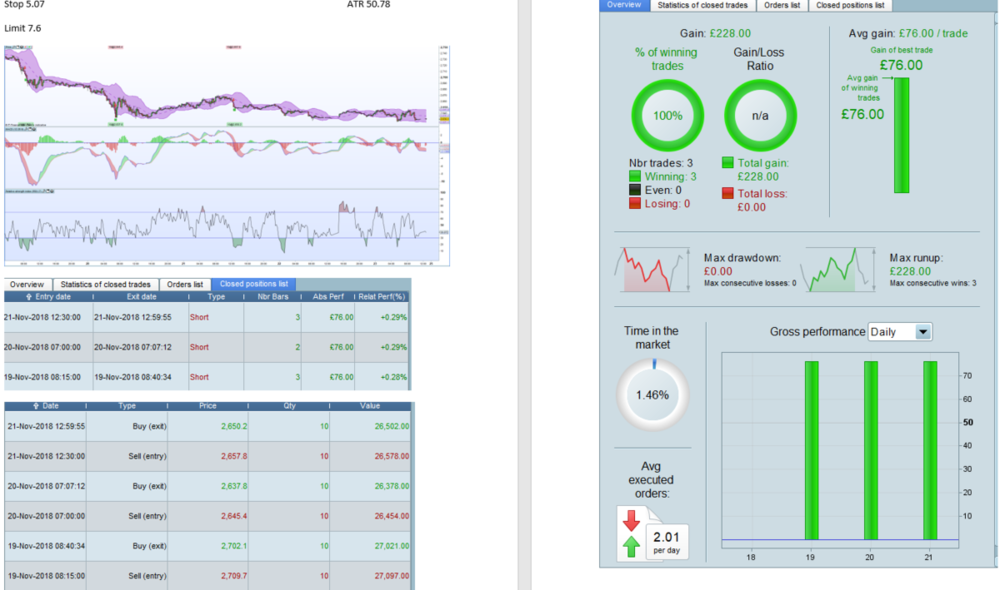

The system did well this week

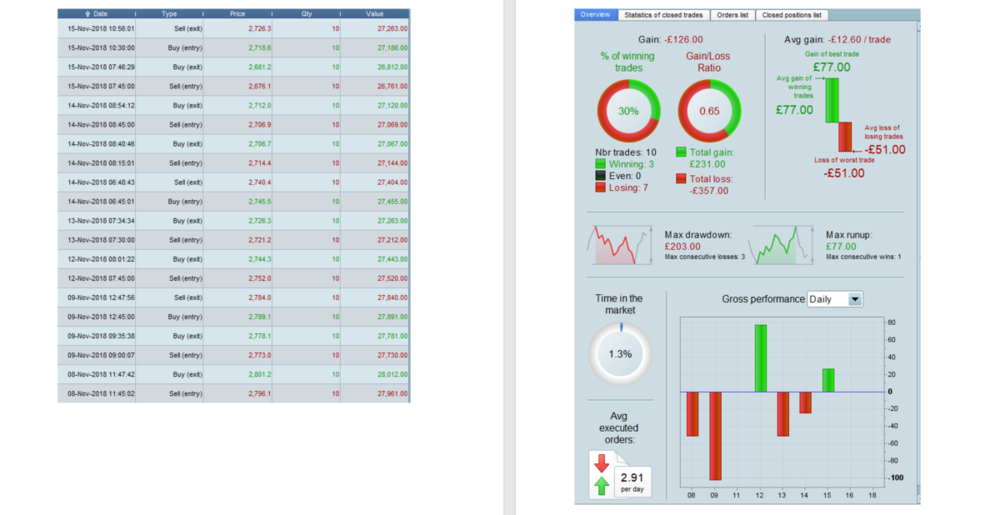

However, it does have its down days as well.

Good week with only 3 trades.

Didn't do that well in the middle of the month. A lot of chop.

This system can also be reversed for a sideways market!!!!!!

-

I swing trade the Dow Jones using the MA200 on the 1-hour chart. I enter the trade when the price closes above or below the MA200 with a stop above/Below the MA200 depending on the position.

I scale out using resistance lines and keep the last contract until the price crosses over or under the MA 200.

The biggest problem with this system is when the price is chopping up an down the MA 200.

This system does not yield a lot of trades. (Maybe 2-3 a month)

-

Looks like CL is making a run for the MA200

Do you think it can go back to the 70s ?

-

-

You can list yourself as a Retail Trader.

Regards

Kasper Jensen

-

The same thing happened to me on LUV.

I went long and did not notice the stock was on SSR. This is a scary thing because it can take several minutes for CMEG to get back to you.

I was supposed to sell half at the small pop but nothing happened. I kept getting the order rejection for 2-3 min before it finally sold my entire position.

ORB 5 min AMD. Got stopped out, what else to consider next time?

in Day Trading Examples and Review

Posted · Edited by Kasper

ORB looks fine.

What is that level it bounces off ?

Try to look at level 2 when price gets near a certain MA or S/R level

Kasper