Patmartel27

-

Content Count

21 -

Joined

-

Last visited

Posts posted by Patmartel27

-

-

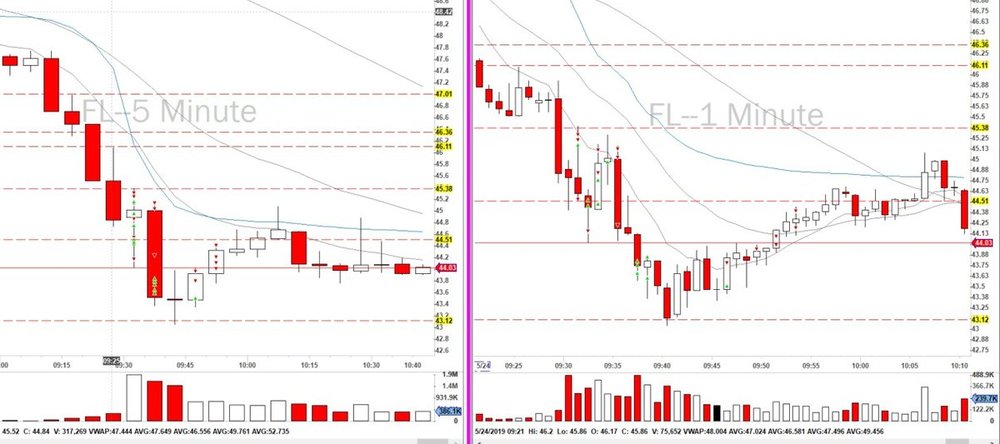

35 minutes ago, Tommy said:may 24, im not sure how many trades i made..

i came back home just in time for the open today, had a dinner and quite a lot to drink after work. i was thinking of not trading but since i got home in time and im doing sim anyway i figgured why not.i

i just put on watchlist what andrew waas mentioning., in order to not be influenced by andrew i put the sound of chat off.So FL looked very much in play.

at the open it was a bit choppy i found but i still got inin the first 5 min i went long twice to get out both times with a small profit, and short twice once i got out at breakeven and once i took a big loss.

after this the stock finally seemed to have decided on a direction and it got in though with a bad entry. i got out with profit but again not a great trade.then i believed it had found a bottom, i wnet long with a stopless in mind when it broke the support below. it turned out to be good but moved so slowly i got out to quick.

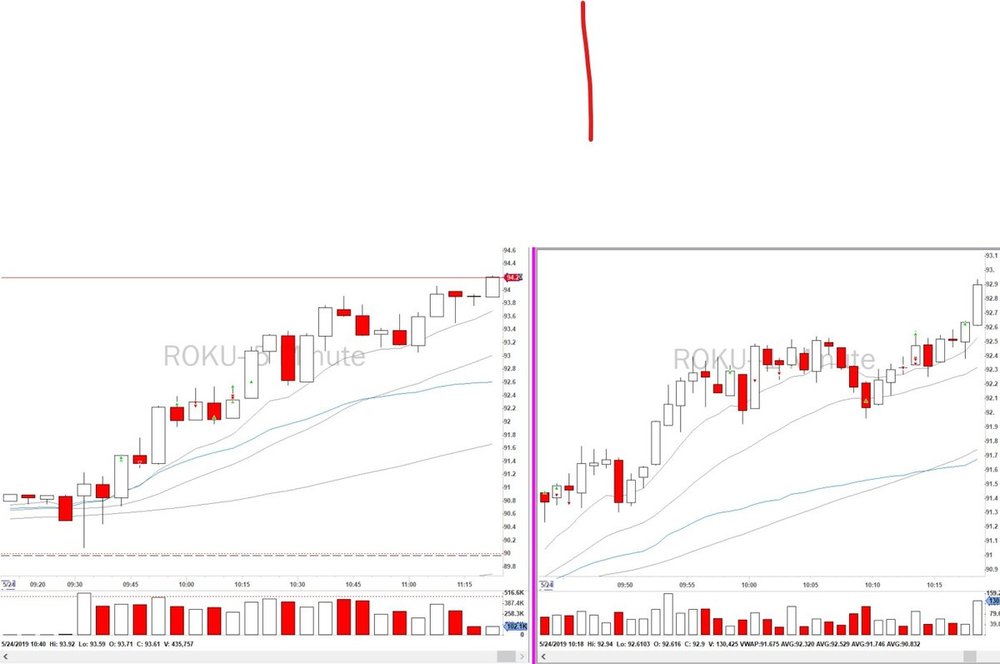

roku, first 2trades was in between FL, i looked like an abcd but i didnt wait for the c and got in at the b to stop out at the c (if that makes sense) once i got out with a small loss and the other time was a short i gout out at breakeven after partial.

these 2 trades im not sure why i took, well, i really thought it would be a long first but i had my eye on FL too much (this was before my long on FL)i went long again on roku after a pullback but it turned against me, then i got out because it kindal looked like a bdouble top was forming.

then i did a stupid thing, i tried to short the stock twice even though it was strong, the first time was kinda ok, i thought there was a possibility for a double top and i got out at breakeven since i realized i was wrong.

the second time however there was no reason at all to go short and even worse i shorted it a third time. even when im holding the position i was thinking oh, this actually relly looks like it still wants to go higher but i didnt get out when i got a chance.

this was a pain to write, i want to go sleep.. but i feel this is important i do this for the record. i had to look at my tradelog to remember what i exactly did

so it confirms what i thought, dont trade when drunk... kinda obvious right...

its also kinda because of sim i think. i likely would not have taken so big risk letting it run. i have learned my lesson with that. still i want to make sim as real as possible so i should not have done what i did.bad bad trading, although FL was not too bad except for overtrading at the open.

ill update some more tomorrow i think. today is finished, goodnight

Roku was a really nice ABCD pattern in 5min chart, but I found it was hard to estimate the R/R beacuse it's at all time high.

-

2

2

-

-

Routine:

-Reading

-Music

-5 minutes meditation (wich was pretty hard my mind was always thinking)¸Psychological and physical state before session:

-Shaky from yesterday

-Not my best night I get to bed late and only had a 5.5h sleep

-Some ambivalence about partialing to save profits or wait, hold trade vs momemtumGoals for the day:

-2 trades max

-Be very aware at how I feelPsychological and physical state after session:

-Happy

-Proud to get back from this bad day

-Confident at my skills as a market learner and hard worker beginner trader

-I know my biggest issue is to control my Hulk days and emotions when things goes badWhat I did good

-Come back from a lose in the beginning and stay focus

-Had a good idea and take setup in my playbook

-Wait most part for my profits targetWhat I could did better

-Follow my plan and what chart and tape told me

-Improve my tape reading skillStrategy description

Premarket breakdown

-Stock gap down in premarket at least 2%

-Trading mostly below VWAP in premarket

-Most MA are above in all timeframes

-Next technical level give good risk/rewardBig picture

-SPY gapped down yesterday

-Little recovery in the premarket (about 0.4%) but not that much active

-Next technical level give somme roomIntraday fundamental

-TSLA was in an hard down trend from the las days

-A lot of news in the last days and negatives comments from analysts

-Kind of bad sentiment about TSLA

-Had a bounce yesterday

-Gap up a little bit in premarketLong term technical analysis

-Trending down

-Next technical level give good R/R, PDC, YY lowShort term technical analysis

-Traded mostly below VWAP and MA exept 200SMA in premarket

-Consolidate just above Y high in premarketReading the tape

-I'm really not an expert in this but I try to improve

-There was occasionnaly big bid in the level 2 mostly when it break support level or whole number

-There some pullback at the ask but often have a really clean stop at 9EMA on 2min chart

When it break YY low it was a huge wave of at the bid for quite a whileTrade management

-This is the perfect exemple of good idea and bad execution and trade management

-I get a very good entry and add more on a little pullback-I was nervous from by bad lost of yesterday so I partial, but made a hotkey mistake, wich really shake me so I exit most of my position quickly and cover the rest in a little pullback not near close to my b/e.

-After I just teold myself ''It's a short it's a trade of my playbook, but I dont wait a good entry so I entered several bad places get stopped out or got cold feets.

-I finaly get I decent entry when it break the low of day which seems a potential resistance level.

-I partialed a little part of my position @ daily level 192.48, the bigger part @ Y low 191.90 and finally I exited the last part when it makes a new 5min high @ 191.05. I was really in the driver seat I think I should wait when it fails to make a new 15min low.Trade review

-Good idea from my playbook

-Good setup

-My first entry was really good

-My emotions made me took some bad decisions and not follow my plan

-Happy to prove myself I can trade after this terrible day

-If I was more confident there's a lot of place I could had to my position-

4

4

-

-

Hey guys I didnt post my journal in the las 2 days, I will explain why and hope it can help someone.

Wednesday I started pretty good follow my plan and quickly my money was made and I traded pretty well, I told me another one...

I lost some of my profits, I wanted it back, so I started trading without real plan or setup and lost more and more and more and so on....

Close the day with a lose not a huge one but not a small one.

Yesterday I was just totaly out of control from the open until I just force myself to leave.

My worst Hulk day since I traded, I just cant recognize myself it was if it was someone else who traded, I just want my money back and I was willing

to do anything, take huge position, double up, no plan, TSLA long, stopped, TSLA short, stopped, TSLA long, and so on.

Result: very big lost and pain at this time I just wat quit trading.

Last night I read and think a lot, my thoughts was I think what's hurt me most is that I traded so well monday and thuesday and was so in the zone,

doing good preparation, taking good setup, follow muy rules and daily goals, I really though Hulk days was being me and just like Robert explain

in this psychology series I relapse....

This morning I'm shaky, but I understand I learned a lot from this 2 days, most about myself and the psychology of trading, I look forward and build on this.

-

10 hours ago, Mark D. said:Tuesday May 21st, 2019

Sleep: 7 hours. Mood: good, ready to trade.

i had some personal stuff come up so i had to miss all my pre-market work and the first 15 minutes. when i finally got to trade, the only thing that looked like it was trending was ARRY and it was really extended so i didn't bother messing with it. Plus i just feel off without doing my routine so i thought it better not to take any trades today.

Need a really great discipline doing that, I think you made the good choice!

-

1

1

-

-

Routine:

-My night was so so, my yougest daughter was sick so I get up several times

-Reading

-Music

Psychological and physical state before session:

-Calm

-A little enthusiasm from yesterday result

-Honnestly a little overconfident, I will have to focus and turn off this thoughs

Goals for the day:

-1 trade max

-Patient, wait for a real setup and opportunity (save your ammo)

Psychological and physical state after session:

-Obviously I wish I took profit @ 54.15 but I didn't because it wasn't my plan and dont have any technical levels. But I'm ok with this is part of the game, I managed it good and I learned from it.

What I did good

-Preapartion and analysis

-Have a good idea and follow my plan

-Doesnt get disapointed when the price suddently goes against my and I reacted to this

What I could did better

-Being more aware of potential support/resistance and maybe taking part of profit, something like 1/4 of my positionBig picture

-Spy gap up 0.6% in premarket

-Still some incertitude about China/US trade war

-Also some incertitude about the relations with Iran

-A lot of resistance near in the uspside of SPY in a daily chart (3MA just above actual price and daily levels)

-Y low and YY low could be a potential support @ 285,50 and 285Intraday fundamental

-Gap down 10% in premarket

-Bad earnings newsTechnical analysis long term

-Trade below all MA

-Next daily level give a great Risk/Reward

-Trade below previous day rangeTechnical analysis short term

-Show some respect for VWAP and all MA in premarket

-Bounce several times from premarket low @ 55.88Reading the tape

-At the beginning the tape was very clean but suddently it change

-The second time it was much slower and shows some support level

-Sometimes huge ask pass very fastTrade management

-The first time prich shows respect to VWAP and level @ 55.83 so I went short

-Put my order at 53.9 but price bounce at 54.15 so I didn't get fill

-It was a huge squeeze and the tape really change so I said myself ok people cover so I get out with small profit

-I was patient and telling myself if I had another opportunity I got it if not I'm ok with this.

-Price goes to 55.83 (support level from premarket) ang go back down so I went short again this time my profit target was low of the day

-I took some out @ 54.85 because it seems to be a potential support level

-The stock struggle to went lower and big ask pass time to time

-When I saw 54.70 could be a potential support level I put an order to cover half my position but I didn't get fill and the stock start to squeeze so I got out @ 55.09Trade review

-Overal I think it was a good trade, I like the idea and I manage it good, I could were more aware of the potential support to adapt my plan to exit

-I think one major difference to my yesterday tradey is the SPY doesn't move in the same way as my trade-

3

3

-

-

8 hours ago, Mark D. said:Monday May 20th, 2019

Sleep: 7 hours. Mood: good, ready to trade.

i think my nerves got to me today at the open because the 2min ORBU in T looked really good but i just couldn't bring myself to pull the trigger, chalk it up to trading live again after a couple weeks break . I waited for a 5min ABCD setup as well but that fell through too. I was starting to think i wouldn't get any trades today but then i saw AMD making a double bottom so i got interested in taking a position. i ended up getting in on a new 2min high. it wasn't the best entry but pretty good. i was not at all confident in the trade, nerves again. i took off about 75% at 2R and the rest i saved for $27.04 right under the 200 MA on the 2min chart but i had to keep moving it down as the MA moved down and ended up getting out at $26.93. i could have just left it at $27.04

GOOD: took a setup, pretty good R/R

RFI: could have got a better entry

MOOD: good

CONSISTENT: yes.

What i did good today: took only setups, didn't chase or FOMO

What i did bad today: could have got a better entry in the trade i took

What can i do better tomorrow: get better entries.

You was good to follow your plan and initial stop loss, that give you to survive the spike in the next 5 minutes and turn in a very good trade.

-

3

3

-

-

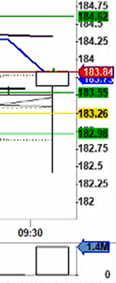

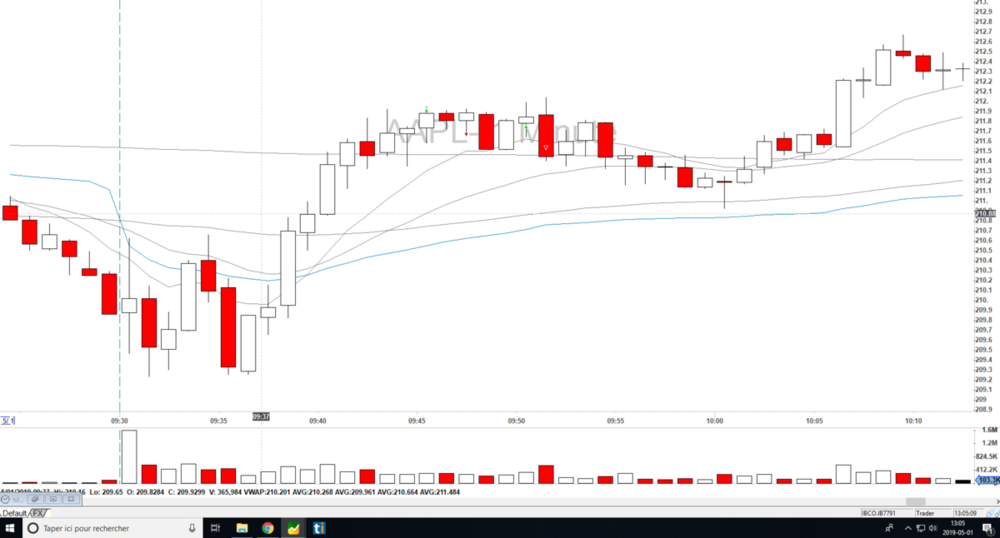

9 hours ago, Rob C said:Monday 5/20/2019

I had a well-being score of 6.5/10 this morning. My nerves would have been good, but when I saw I may trade AAPL today my mood went sour.

Before I start complaining too much, let me say I had a good trading session. I took 2 live trades with AAPL.

The plan, based on back-testing, was not to trade AAPL and have FB as my primary focus. But at 1M shares and almost -3% in premarket I couldn’t ignore AAPL. And yes you see the punchline coming. I got stopped out on AAPL and FB was a nice 1min ORBU.

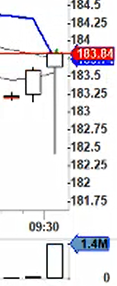

AAPL created a really nice hammer with very high volume. I was concerned since the R/R~1.5 with 200MA-1min as the target, but it had two strong daily levels above it with R/R>2 so I went long when it broke VWAP. It did move a few pennies before reversing and stopping me out at my planned stop 183.50 (daily level and 50MA)

What it looked like when I took the trade:

1min 5min

My stop out:

I started looking for other trades and saw FB’s nice 1min ORBU, but I would be chasing it so I didn’t take it. Oddly AAPL was setting up again, though I really didn’t want to get burned again on AAPL. But it was making a nice mini ABCD on good volume and had a really good R/R (182.98 as a S/O and 180.78 as the target). I shorted when it broke the LOTD. My partialling (my spell check says that’s not a word) was horrible. I do notice I partial worse after a S/O, but this was really bad. My aim for my first partial was 181.50, that was my third partial!! My first was at 182 and I got a bad fill essentially covering at B/E. When I only had enough shares left for one last cover I told myself I must wait for my actual planned target or original B/E. Luckily I didn’t have to wait too long and took my last cover on my 180.78 target. Anyway I got my $1+ move from AAPL, so it still all good.

My score card for today:

Same score on both trades but for difference reasons. My first trade the setup was just OK, but was executed well. The second trade had a great setup but not executed well.

Same score on both trades but for difference reasons. My first trade the setup was just OK, but was executed well. The second trade had a great setup but not executed well.

What I did good today: I had a win% of 50% but still profitable for the day!

How did I challenge myself today? I took a short after 2min from the open, which is unusual for me.

What I did bad today: Between the substandard R/R and the plan not to trade AAPL I shouldn’t have taken that first trade.

What can I do better tomorrow: AAPL is too much in my comfort zone, I need to break out more, at least for the 2min ORB.

In this moment I read The playbook from Mike Bellafiore and something I found really interesting is the focus he puts on let the winner run until you have a reason to exit (profit target reached, trend have change, something in the tape, etc.)

I partial a lot too and when I see my results often my losers are bigger than my winners because only a part of my position reach my profit target when I'm in a winner but when I lose it's all my position.

You seems pretty good to cutting your losers, maybe letting you winner run could help you.

I feel pretty weird trying to give some advices, but I really appreciate what you do for me so I try to give you back.

-

2

2

-

-

15 minutes ago, Rob C said:Yes, I am always able to see your charts previously. I am not sure why I can't now. I just get an error "Traderview forbidden".

I changed someting I think now is gonna work

-

1 hour ago, Rob C said:Great prep work and thorough journal entry. But I wasn't able to access the links you had. So I couldn't see your trade on a chart.

Thanks, I follow your 1 trade max advice.

I dont understand why the link doesn't work. I put in as usual and when I open it it's work...

-

Routine:

- Reading

-MusicPsychological and physical state before session:

- Really calm and focus

- Want to be well prepareGoals for the day:

- Only 1 trade

- Having a clear trade plan before market openPsychological and physical state before session:

- Really happy

- Proud to my preparation and follow my plan and goalsWhat I did good

- Preparation

- Having a plan before market open

- Stick to 1 trade maxWhat I could did better

- Was a little scary by my big position I dropped half too soon with no reasons to coverBig picture

- Spy down more than 0.70% in pre-market

- A lot of incertitude about China, Iran and some comments from the president Trump about EUIntraday fundamental

- Down 2.8% in pre market

- China/US commercial incertitude

- Drop hard in the last 2 days

- Analysts downgrade price targetTechnical analysis long term

- In a down trend for the last 3 days

- All Ma above actual price

-200 SMA on daily as a resistance level

-The next daily level give a really good risk/rewardTechnical analysis short term

- Trade below previous day range

-Trade below VWAP in all the pre market

-Daily leval at 165.03 as a resistance in pre market

-All MA above actual price action

-Break the low of pre market in the first moment of openingReading the tape

-There wasn't big bid but constanly went low and I ave a lot of volume

-The time and sale was very clean almost all at the bid and really fastTrade management

- I expected to wait for the first 5-15 min and watched if 165.03 was a real resistance level, but the price just fall so I jump in with half of my share size

-When the price continu to fall without any pullback I add more fo reach my full position

-Being full position in this range of price and in the first minutes make my a little nervous so I dropped half my position at 162.91

-I put an order at 160.55 a little above the next daily level to be sure to get fillTrade review

- I felt confident in the setup

-Really focus on price action and the tape

- Good Preapartion and analysis

- I waited for my profit target

- I could controlled better my emotions in the beginning and be fully confident in the set up and dont Exit half my position too soon

-All signals and analysis show a short trade

-I jumped early but no FOMO just be reactive to chart and analysis

-Really proud of this idea, trade management and how I manage my thoughts and feelings-

3

3

-

-

11 hours ago, Rob C said:I feel a little uneasy giving advice since I am struggling so much on my own. Plus, I am sure Mark can explain things better than me. But what I thought I would do is list the changes I made that helped me and maybe you can find something useful in the list.

My first 3 months of live trading I had 6 hulk days and 16 max/loss days. Since I made these changes 3.6 months ago I have had zero hulk days and zero max/loss days.

1) Switched brokers to CMEG so I could reduce my account size so blowing it up is not as much of an impact.

2) Added risk controls from CMEG/DAS. Realized max so it would prevent me from going hulk and unrealized in case I lose internet in the middle of a trade.

3) Made a simple goal for 3 months. Don’t go hulk. I could trade terribly but as long as I never went hulk I reached my goal.

4) Started with 1 trade per day max. I tried the 3/day rule during my first three unsuccessful months, but I kept breaking it. 1 trade a day is very much an on/off switch with very little gray area. It was REALLY painful and FOMO was high, but after a week it got easier. The satisfaction of having enough discipline to stop at 1 trade was enough to be proud of myself. After about one month I switched to two trades a day allowed if the first trade was a winner. If the first trade was a loser, I am done for the day. I use to trade terribly after a loser.

5) Remove the unrealized gain window. This was tough, but surprisingly after a week I got use to it.

So that worked for me. Hopefully that helped.

Thanks Rob great advices!

I 'm gonna certainly take your 1 trade by day max, I think is a very good idea for me now.

-

2

2

-

-

On 5/17/2019 at 7:19 PM, Mark D. said:Don't be ashamed of bad trading or hulking out. We're all guilty of it and the whole point of posting is for reflection and where we can improve. One thing I do when I have a bunch of losses in a row is to go back to sim and just practice recognizing setups and getting good entries. If i get stopped out then I try to take notes on my feelings and frustrations to start to correct the behavior. The first step in changing patterns is recognizing them.

Something else that's really helping me right now is recording my trading and watching the replays at night. You notice so many things not apparent in the heat of the moment.

Above all, be kind to yourself and patient. The learning curve is very steep and while trading comes natural to some, most people take years and years before they're successful (if ever) so never forget its a marathon not a sprint.

Thanks Mark for your comments I appreciate, I think going back in sim could be an good option, maybe I'm a little bit hard on me and I have to accept more that the learning curve is tough.

I will maje a setup to record my trades this week.

Thanks for your advices.

-

2

2

-

-

Hey guys someone are in Quebec province and speak french?

I'm looking to ctach up with trader and english is not my first language.

Let me know if you are interested.

-

Hey guys, I didn't post my journal for a while, I struggled a lot in the last week, several Hulk days, bad psychology

etc... So I feel pretty shy and guilty about that. I will take the weekend to work on my mind and having a good plan

for next week. Monday I will post it bad or good. If someone are willing to mentor me I will greatly appreciate

I think I'm needing someone with an external view.

Thanks have a good weekend

-

1

1

-

-

I didn't post my journal for yesterday and I don't for today, just because I took so many trades.

My reflections about my trading now is about 3 issues:

-Overtading

-Trading with my feelings and not with the startegies Andrew's teach

-Not be patient I always want to be in a trade

Next week I can only trade friday, I will take this time to focus on my playbook and consolidate my psychology and the necessity to follow my rules.

-

Today was very tough day for me. Not my worst day, but I didn't follow my 3 trades max rules, not wait for good entries ans didn't be patient to wait the setup to be really good.

Today I disapointed myself because I worked really hard and I mentally prepared before each trading session and eveen break my rules and not trading good.

Sorry if that sounds depressed, I'm not, but I really struggle and be disapointed, in the last 6 days I dont have any positive days and struggle to get some positive trades, so it's hard times.

Tomorrow I go back in sim. For today I will only put the screenshot of my trades, I will go running before I quit for work.

If you have any comments or advices I will appreciate.

-

3

3

-

-

Todays was not a great day for me, no trades went on my way, but I learned a lot and most important I follow all my rules and goals for today.

I traded MOMO 3 times, 2x for the 5min ORB and 1x for the VWAP as resistence level

Physical state:

-feel a little bit asleep, I worked last night

Psychological state before trading session:

-calm

-focus on rules and being patient

-still have some doubts about my abilities

Goals for the day:

-3 trades max

-no trade in first 5 minutes

-only 5min ORB and VWAP false breakout

Psychological state after trading session:

-not happy, but not to disapointed

-happy I had follow my rules

What I did good:

-follow my rules

-be calm

-managed the risk

-dont think about p/l

What I learned:

-VWAP is strong but the resistence level can be at another level

-be cautious to identify new trend like higher high and higher low and dont trade against its wishful thinkingHow I felt at the moment I took the trade:

-calm and confident

What I told me during the trade:

I was just aware

Strategy:

5min ORB

Signals:

Break the 5min range and VWAP as potential resistence level on the 1min chart

Entry:

near below the VWAP at 33.66

Stop loss:

above VWAP at 33.85

Profit target:

low of pre-market at 33.23

Risk/Reward: 2.25:1

Exit:

stop loss at 33.83

What I did good:

-respect my stop loss

-good entry

-be in control of my emotions

What I learned:

-The resitence level could be at another level than the VWAP

-maybe on the 5min ORB I should take profit quicker (more scalping)How I felt at the moment I took the trade:

-Calm and confident

What I told me during the trade:

-if the VWAP couldn't support I got out

Strategy:

-VWAP as resistence level

Signals:

-on the 1min and 5min chart VWAP seems to be a potentiel resistence level

Entry:

near below VWAP at 33.63

Stop loss:

above VWAP at 33.80

Profit target:

low of pre-market at 33.23

Risk/Reward:

2.25:1

Exit:

stop loss at 33.78

What I did good:

-manage the risk

-respect my stop loss

-have a clear plan

What I learned:

-the resistence level wasnt VWAP it was at 33.88ish-The trend has change I short against 5min higher highs and higher lows

-

4

4

-

-

Hi IamKarthi, thanks a for your advices I apprecciate a lot!!!

It's nice to catch up with others traders who have a similar situations than mine, thats make me feel if I 'm not alone in this.

-

I think I should give a little introduction to this. I start sharing my journal with you on the advice of Robert,

and by this day I read the daily trading coach, so it's seem obvious if I want succeed in trading reaching other traders will greatly help.

I'm a full time firefighter since 2009, father of 2 little girls, I started investing in markets 5 years ago, last year I read Andrew's 2 books

and after became a lifetime member of the community, I did 3 months in simulator (almost honnestly) and I'm live since March 22.

I really struggle, I had several Hulk days, breaking my rules, trade without real setup, chasing entry and FOMO is now my second name.

I can't recognize me in this actions, I'm habitually so disciplined and calm, sometimes I ask me if I have what it takes.

Today I had an Hulk day (15 trades) I traded in the first 5 minutes (against my rules), trade TSLA (the price is against my rules).

I won't share all this trade, I will post my worst and my better for today, I will appreciate any type of comments and advices.

P.S. I'm a french canadian, feel free to correct my english mistakes, I will improve my english at the same time as my trading.

Routine:

-Read 2 lessons from the daily trading coach

-Be at my desk by 8:30

-Doing my watchlist with Carlos's premarket show

-5 minutes meditation at 9:05

Physical state:

-Feel good, I've a good night (8h)

Psychological state before trading session:

-I read a lot yesterday night so I felt focus

-Confident

-Excited

Goals for the day:

-Placing my stop loss cleary in my head before taking the trade

-If I feel frustration concentrated to my breathing

-Wait for the setup

Psychological state after trading session:

-Bad, really bad, my first tought was I just cant, I quit.

-I disgusted myself to had another Hulk day and breaking so many rules

-I was mind fuck till the afternoon were I get back to my feet and searching for growing and solution from this.

What I did good:

-Catch VWAP false breakout, I was pretty good at this in the last days

What I learned:

-I have to find my edge and stick to it

-I have to internalized more my rules from my good trade and days, I must attach to them more emotions and feelings.How I felt at the moment I took the trade:

-Agitated

-Anxious

What I told me during the trade:

I cant wait to my profit taget, I lost money in the trades before I cant have the trade reverse against me and dont have any profits on it.

Strategy:

VWAP false breakout (short)

Signals:

Break the VWAP and after candlestick close below VWAP on 5min chart

Entry:

Just below VWAP at 130.10, but I enter in the trade 2 times before, I saw thw setup but lack of patience to wait is ready.

Stop loss:

A break above VWAP (R: 0.10)

Profit target:

Daily level 129.42 (low of pre-market I think)

Risk/Reward:

Almost 7:1

Exit:

Way to much partials because I was nervous from my last losses and finaly hit my profit target and even more

What I did good:

-I'm happy recognize this pattern very well

What I learned:

-I should wait to let the setup get ready

-I should wait for my profit targetHow I felt at the moment I took the trade:

-Very not comfortbale beacuse the high price and I donr realy trade any strategies

What I told me during the trade:

-What the fuck I'm doing

-Please work

Strategy:

-I just see the down trend and it break VWAP, so not really any strategies, all about feeling

Signals:

-Lower highs and lower lower

-The break of VWAP

Share size:

-50 shares

Entry:

-Just below VWAP 254.55

Stop loss:

-A break above VWAP +-254.90 (R: 0.35)

Profit target:

-Low of the day 250.55

Risk/Reward:

11:1 but I think my profit target wasnt realist

Exit:

Stop at 255.47 way higher than my stop loss

What I did good:

-Trying to learn fron this and hoppefully I took a small position it's the only positive I can see

What I learned:

-Higher price stock is not for me

-I must respect my stop loss

-Wait for a real setup with a real strategyThats it for my first trading day sharing, I hope for your comments and advices, this day is not representative of the majority of my day, it was really a Hulk, bad and sad day.

I dont trade tomorrow because I work at the firehouse.

Thank and have a nice weekend guys!

-

4

4

-

-

You can count me in.

-

1

1

-

.thumb.png.45e58df9b2ddba111800ef610c6ee00b.png)

.thumb.png.92fa512139f5300ca19c3311fdb06458.png)

.thumb.png.4d93f4c8dc412e37ae351db1490abe53.png)

.thumb.png.8d66abf1e81d512c0616000afa7c896e.png)

.thumb.png.2066f096891f2afd7b0d0f7958230eac.png)

.thumb.png.d60178bd6216f78b256860cdbe47bef1.png)

.thumb.png.9ea76a61a2f85056bd5765d4c6a15171.png)

.thumb.png.c21650e1a5d826855006cc48edf0f97f.png)

.thumb.png.ce07688344b8baeac5c36a0f283b6df4.png)

.thumb.png.70820b89bb30b4196b67af555bd1362d.png)

.thumb.png.ef2cdc40d977b92eba073aab026b13fa.png)

.thumb.png.e855ed367e4ea2d0638d865d5ec50359.png)

.thumb.png.598d190a2553ac90ca4501456531acb7.png)

_LI.thumb.jpg.c89072346b4800add6cfd40e6d4f3f72.jpg)

.thumb.png.c52b74c16cf9a79ef50b8c94fc94d164.png)

Patrick M journal

in Day Trading Journals

Posted

Hey guys, just few words to let you know I'm fine, my trading works good. I actually not posting my journal

because I'm redefine my process and some of my trading strategies, I take a little step back to come back stronger.

I thank all of you for support and advices, specially @Mike B, @Rob C, @Mark D.,

I'm not quitting trading at all I just need a step back to focus on the process and searching for the best way and style to me.

I hope you guys doing good and I will still be in the chatroom and read your posts.