-

Content Count

829 -

Joined

-

Last visited

-

Days Won

110

Posts posted by Rob C

-

-

Hi Kinga, if DAS doesn't work out for you for the MES I highly recommend Ninjatrader. I actually like it over DAS. It is too bad it is much slower than DAS for stocks. But it is lightening fast for Futures. For basic MES trading the platform is free.

-

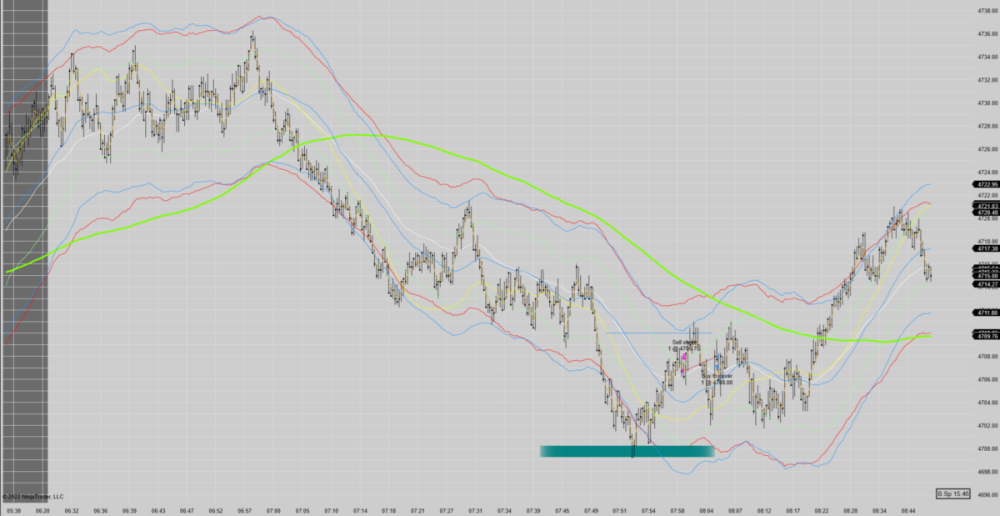

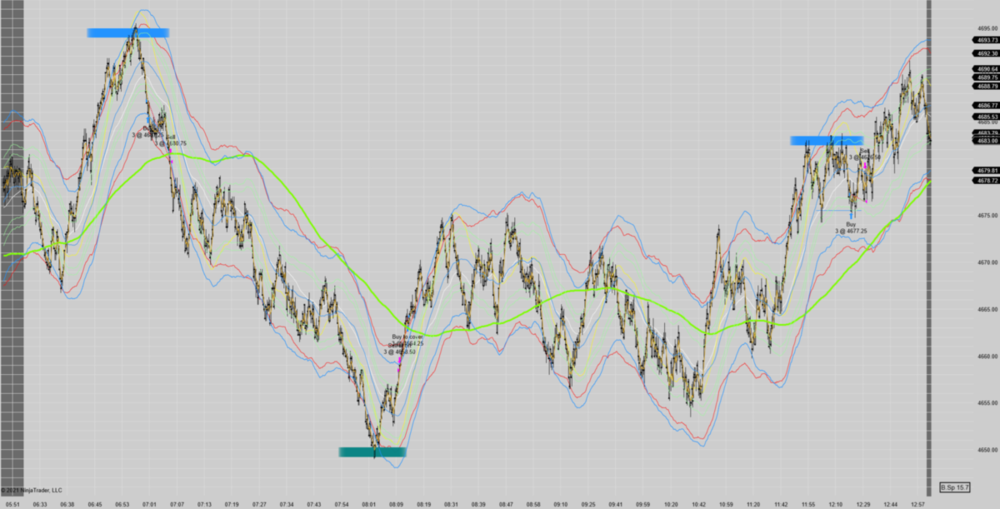

Futures (MES) algo trading journal Wednesday/Thursday/Friday 1/12-14/22

The algo did not trigger any trades Wednesday and Friday but did take two trades on Thursday. Lots of weakness on Thursday as the algo waited for strong downward price movement and a deeper pull back and lots of other filters. The first trade of the day was after some real local weakness and a deep pullback. The price kept moving higher after the short and almost hit my stop then dropped but didn't reach the target. The algo tried to cover at BE but got a bad fill for a loss. The second trade was late in the afternoon after continued weakness. The first pullback missed the entry by a tick the second pull back did trigger a trade but got a horrible fill. The price went right to the target also with a bad fill. Thus exactly half the profits went to the fills.

So for the week I had 1 win and 3 BEs.

Have a good long weekend.

Rob C

-

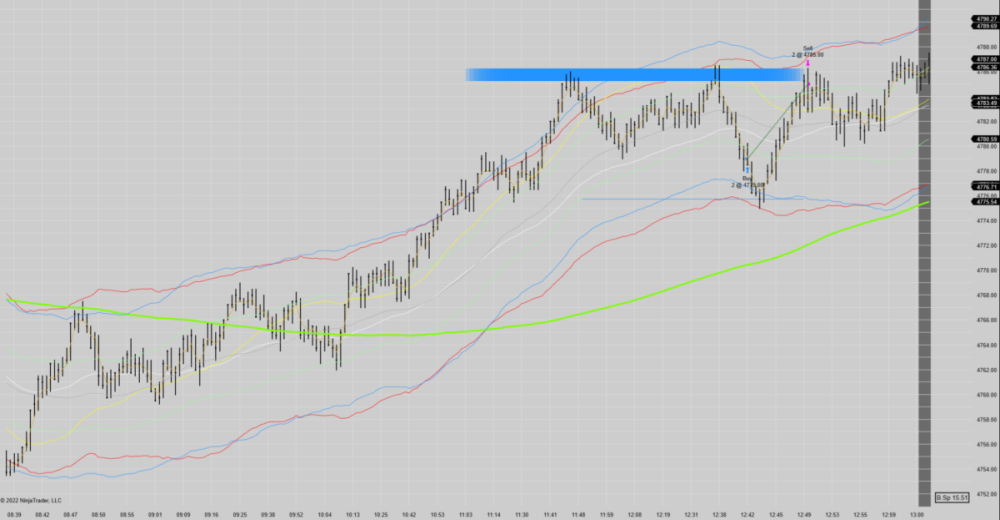

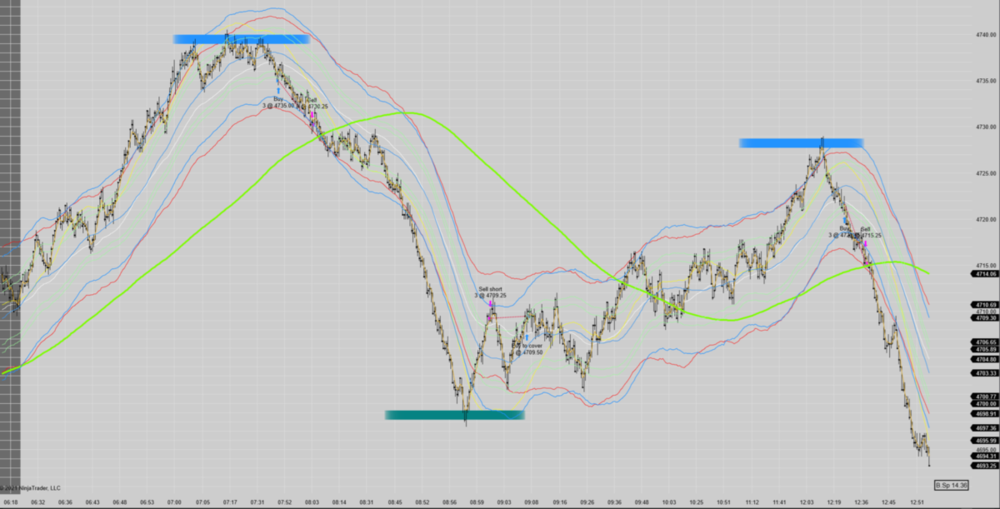

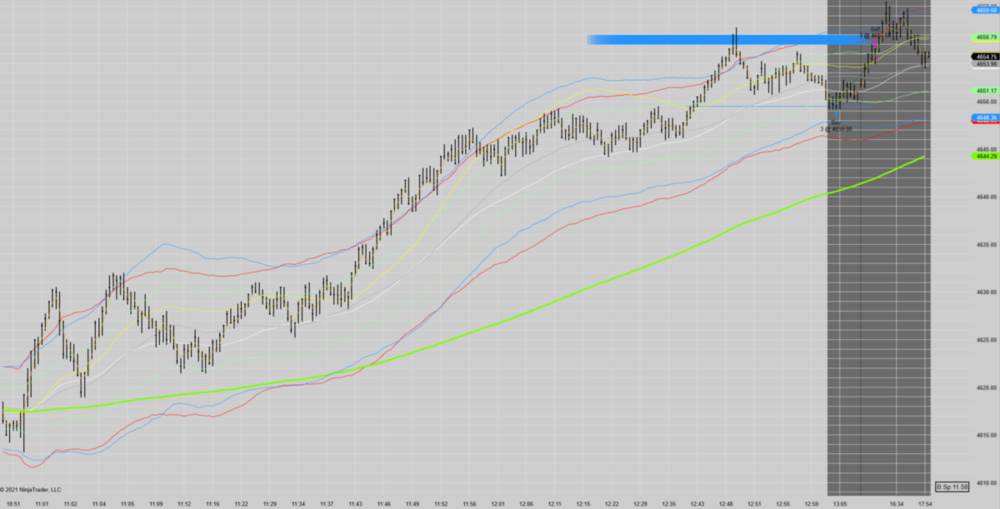

Futures (MES) algo trading journal Tuesday 1/11/22

No trades were taken by the algo yesterday due to a volatility upper limit spec that I had set. Actually, today it looked like the market was too volatile for the algo then the volatility dropped just before closing and a trade was triggered. There was obvious strength all afternoon and a nice pull back near the close. The algo went long and about 15 minutes later there was a big drop and I was almost stopped out. Then the price headed higher and reached just high enough for the algo to set the condition to sell at BE. Then the pull back occurred and the algo sold at BE. Shortly after the price rose to my target.

Have a good night.

Rob C

-

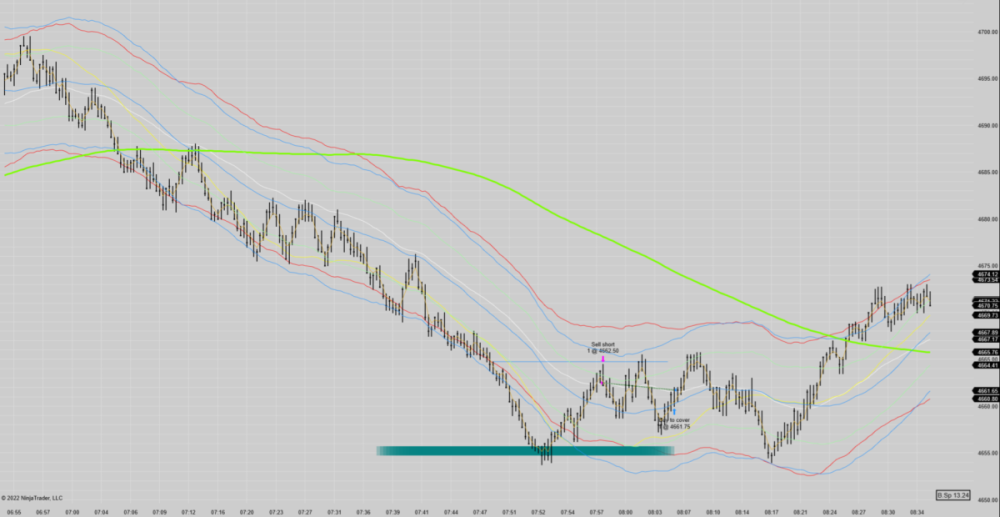

Futures (MES) algo trading journal Friday 1/7/22.

Market weakness triggered one short trade today. Nice setup with solid downward price momentum and a deep pullback. The price did drop and get close to my target but pulled back to cover at BE. Starting to wonder if I should pull my target in on the short trades. I have been leaving money on the table this week.

Have a good weekend.

Rob C

-

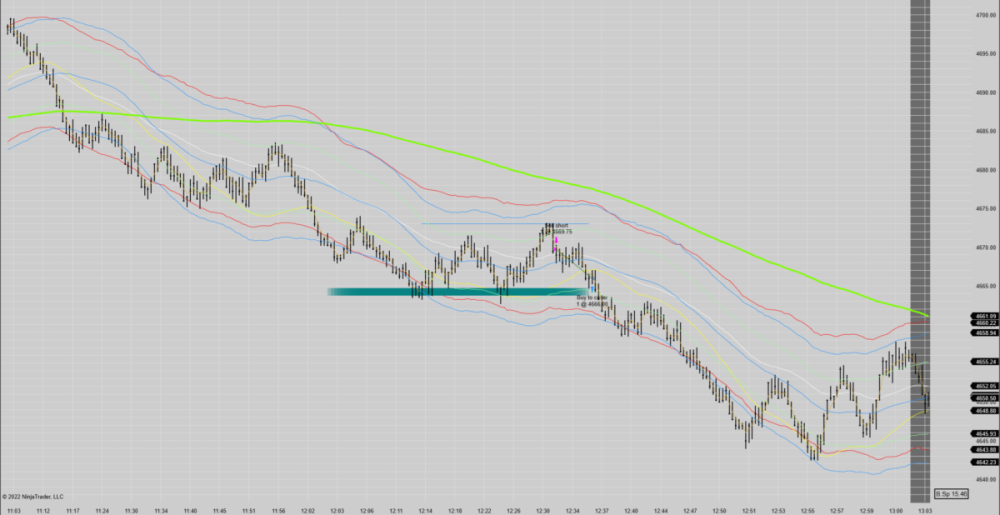

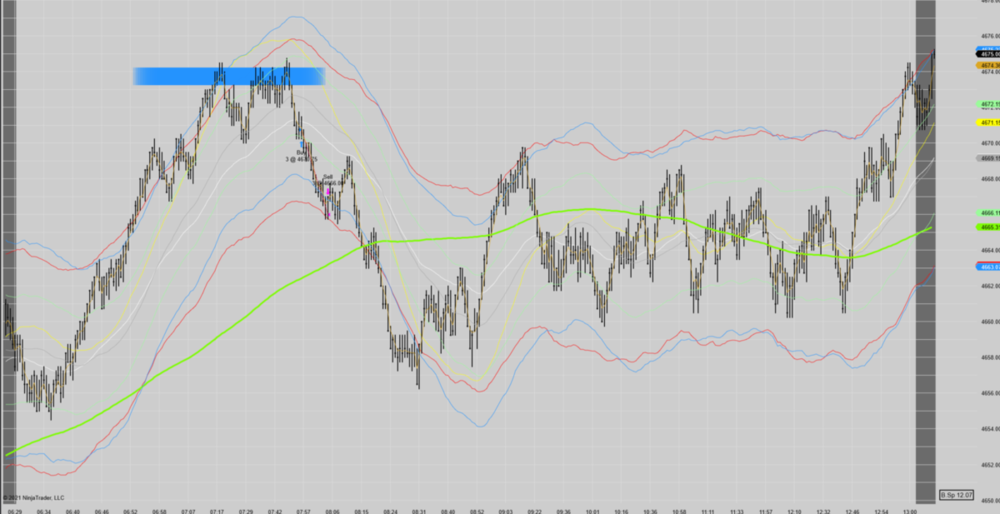

Futures (MES) algo trading journal Wednesday 1/5/22.

It has been awhile since the algo triggered 3 trades in a day. Though they all were essentially break even trades.

We had weakness which became well defined about 3 hours after the open. On the first deeper pull back the algo went short. The price did drop but didn't reach my target and the algo covered at BE. At about 11:30am (PST) we had another deeper pull back but 1 tick shy of the algo triggering the trade. Too bad that would have been a winner. Then the price really dropped and the algo went short on a deep pull back. Again we had the price move down but didn't reach the target. The algo meant to cover at BE but I programmed the short BE covers to wait until the close of the bar. And with luck the price dropped and I did make some money on this trade. Though technically it was a BE. Then with the final push down and another deeper pullback and again the price did not reach my target and out at BE.

Not sure if these attempt to test the low was just today or a new market personality. If it becomes common I will need to choose my target differently.

Have a good night.

Rob C

-

Futures (MES) algo trading journal Tuesday 1/4/22.

Though the algo triggered no trades today, we did have a trade right before close yesterday. This one barely got triggered. It just had enough momentum to qualify the minimum for the algo. I happen to get a good fill which helped me getting stopped out. Once it bounced from the local low it quickly retested the high. Four ticks below the high is my target.

Have a good night,

Rob C

-

Futures (MES) algo trading journal Tuesday 12/28/21.

The algo triggered one trade close to the open. Though the human eye it seems the price action was sideways this morning, the algo thought there was strong upward momentum. This is mostly due to the strong 200 SMA (in green). Then there was some short term strong momentum as well with a deep pullback. The algo went long and very quickly was stopped out.

See you tomorrow.

Rob C

-

Futures (MES) algo trading journal Monday 12/27/21.

I finally took my first live Futures trade in almost a month. The market changed and the algo stopped working and I left it in real-time sim. Then for 3 weeks the algo ran with a ~20% success rate as double top/bottoms either did not occur or the pullback was very deep. Finally, last week the market's personality changed back and the algo has been working well. I switched the algo from SIM to live today (though only 1 contract) and one trade was triggered near the end of the session. The trade was very close to text book with strong momentum and a deep pullback. The pullback continued after the algo went long so the price did get close to my stop.

It's nice to be back trading Futures again. I spent the month trading Equities exclusively.

I hope everyone fared well the past few weeks.

Rob C

-

Futures (MES) algo trading journal Wednesday 11/24/21.

5 trades triggered today by the algo. The MES had strong upward momentum then got stuck in a tight oscillator. Usually this type of price action is a money printer. But those times are gone, so I just finished the day a little green.

The first pullback triggered trade 1 and the price moved up and missed my target by 1 tick. The price dropped and I was out at BE. Shortly after a second trade was triggered. the price moved up again and missed my target by 4 ticks. Then back down and out at BE. The price dropped enough for the algo to enter the long with a really good price. Finally we hit the target. After that the price moved higher and created a new high and the pullback triggered a long trade. This slippage was the worse I have seen in 3 years of trading. There was 4 points (16 ticks) of slippage. Really bad slippage is usually 3 ticks. My target was 5.5 points. So even though the target was reached essentially no money was made. Then a final trade was triggered. The price moved a little in my favor then sunk and out with a full loss.

Have a good Thanksgiving. See you Friday.

Rob C

-

1

1

-

-

Futures (MES) algo trading journal Tuesday 11/23/21.

Another brutal day. Luckily I lowered my risk. Another day like today and I will lower the risk again.

Three textbook trades with good momentum and deep pullback that the price stalled. The first two trades I was stopped out quickly. The last trade did actually move in my direction and missed my target by 2 ticks. Then dropped down and stopped out at BE before moving back up to my target.

See you tomorrow.

Rob C

-

Futures (MES + GC) algo trading journal Monday 11/22/21.

Yesterday was another brutal day like last Thursday. Thus no winning trades in 5 days (0 out of 8 trades). This helps confirm that market conditions have likely changing. So I did cut down the number of contracts from 5 to 3. It seems the price no longer tests the top and bottoms any more. You get a sharp reversal or a weaker test. All 3 trades yesterday were text book setups with plenty of momentum and a pullback with some stalling. But none of them test the top/bottom again.

Will post my trades for today (Tuesday) after the close. It won't be good again...

I hope everyone is having better luck.

Rob C

-

Futures (MES + GC) algo trading journal Friday 11/19/21.

Two firsts. My first middle of the night trade. I did have the algo on all night for the whole week, but last night was the first trade that was triggered. The algo worked fine determining momentum and a deep pullback, but it happen to be a stop out.

I also had an adapted version of the algo that I wrote specifically for gold futures that was running all week. Today it finally triggered a trade (see second chart below). There was strong downward momentum and a deep pullback which triggered the trade. The price didn't do much then fell enough for the stop to be pulled back to BE. Then I was stopped out at BE.

Have a good weekend.

Rob C

MES

GC (Gold)

-

Futures (MES) algo trading journal Thursday 11/18/21.

Double stop out today. Algo worked just fine. Good momentum with deep pullbacks. Unsure if this is the new market conditions with reversals without double top/bottoms. It has been a much more difficult month than last month. I will need a week or two more to determine to keep using this algo or wait for different market conditions.

Have a good night. Hopefully the skies will clear up tonight to see the lunar eclipse.

Rob C

-

Futures (MES) algo trading journal Wednesday 11/17/21.

The algo did not trigger any trades yesterday. Today there was some early momentum down and a significant pullback which triggered the short trade by the algo. The price moved down enough to trigger the stop to be pulled to the BE. Shortly after the price rose to BE and the trade was closed. Then the price moved mostly sideways for the rest of the day so no more trades were triggered.

See you tomorrow (unless the algo doesn't trigger any trades).

Rob C

-

Futures (MES) algo trading journal Monday 11/15/21.

It's good to start off the week with two solid trades. There was a lot of upward momentum from the PM which peaked and dropped through the open. Within a minute of the open the pullback was deep enough to trigger the trade. The price moved a little higher but 2 ticks shy of pulling the stop to BE. Then the price dropped quickly off and I was stopped out. The price moved sideways for 2 hours then a large drop and a perfect pullback triggering the algo to go short. The price quickly dropped to my target. Then the price moved sideways for the rest of the day. So it was a good mildly green day.

See you tomorrow.

Rob C

-

Futures (MES) algo trading journal Friday 11/12/21.

I had a really good day today. After 6 straight trading days without a winner I was probably due. There was no real momentum yesterday so the algo did not trigger a trade. Today strong upward momentum kicked in about 1 hour after the open. Price stayed strong for an hour than leveled off and gave just enough of a pullback to trigger a long trade from the algo. The price quickly reached the small target. The price didn't do much until near the EOD. Then a strong price movement and strong pullback triggered another long trade. The price reached the target after the close.

So for the week: 2 wins, 1 loss and 3 BEs.

Have a good weekend.

Rob C

-

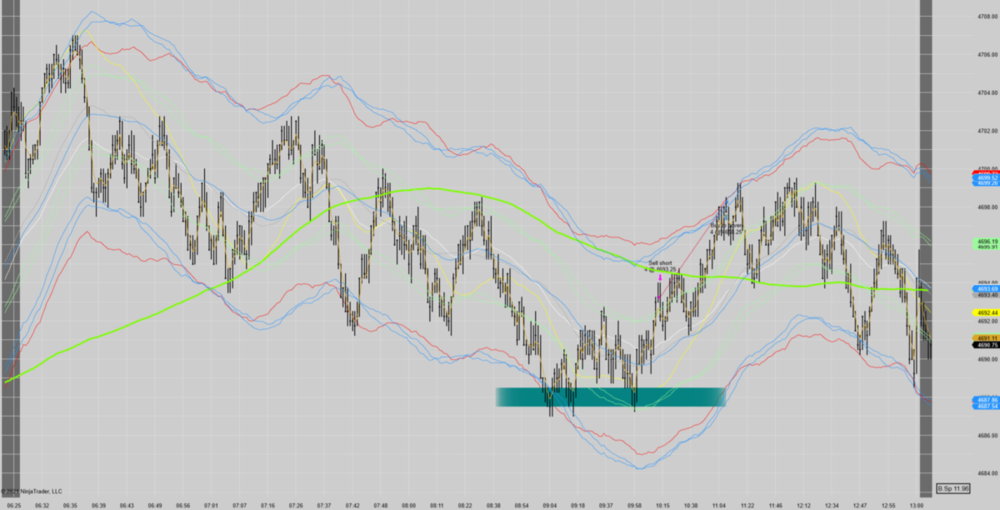

Futures (MES) algo trading journal Wednesday 11/10/21.

Wow 5 days without a winning trade. Strong downward momentum with a really nice pullback about 4 hours after the open which the algo did not take. Why it did not pull the trigger is not obvious so I need to investigate why since it would have been a nice winner. More downward momentum then about an hour before the close the algo triggered a short. There was some more downward price move but not enough to reach the target. After a pullback to BE the algo covered.

See you tomorrow.

Rob C

-

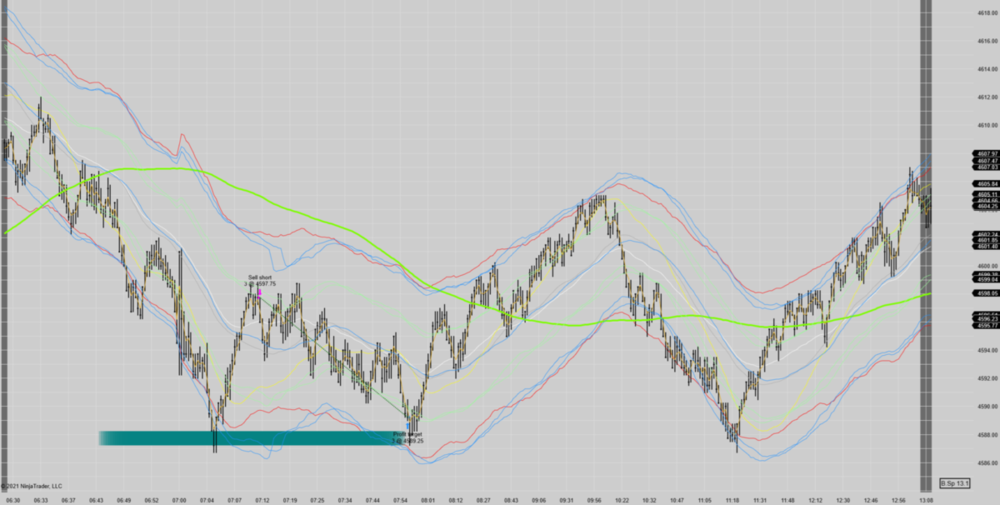

Futures (MES) algo trading journal Tuesday 11/09/21.

Another day I am so glad I don't watch my trades in real time. I don't know how you trend traders do it. I would have a head of grey hair.

First, we had downward momentum overnight and a strong pullback. I am glad the algo recognized it as a false break out and did not enter a trade since that would have been a loss. Then we had very strong downward momentum and a pullback, but not deep enough for the algo to trigger a trade. Then later in the day we had some more downward momentum and a pull back (see second chart) that triggered a short. The price dropped enough for the stop to be pulled up to BE and shortly after was stopped at BE. There was more of a pullback and the algo entered a short at a better entry. Again the price dropped enough to move the stop to BE. Then the price pulled back to EXACTLY the BE price (and no further) and stopped me out then. Then the price quickly dropped to my target. I am so glad I didn't see any of this until after the market was closed.

See you tomorrow.

Rob C

-

Futures (MES) algo trading journal Monday 11/08/21.

Three losing days in a row. A couple more and I may go back to SIM. When configuring the algo originally I noticed the optimal solution was trimodal. One solution, which was the most profitable was always trying for a homerun. Though the most profitable the % win was <30% and I would not be able to handle it with my personality. The second solution was approximately a 2 to 1 reward to risk with a win% ~45%. The third solution was a R/R~1 but a win% ratio ~60%. That fit my personality. With that solution back testing showed that the most losing trades in a row would be 6 using 1 year of back testing data. So if I reach that point it can be assumed that something has changed.

The one trade from today was a short after a few hours of downward grinding momentum. The momentum down was just enough to trigger the trade. The price reached the stop quickly.

Have a good night.

Rob C

-

Futures (MES) algo trading journal Friday 11/05/21.

It's a bummer going into the weekend with two losing days, but as long as everything averages out by the end of the month it's fine.

Huge downward hyperbolic price action at midday. A pullback did occur but not deep enough to trigger the algo. Then the price tested the bottom and pulled back again deep enough to trigger the short. The algo doesn't look for double bottoms yet. My stop got run over and then chop for the rest of the day.

So for the week: 5 trades, 2 winners, 2 losers and one BE for a 1R week.

Have a good weekend.

Rob C

-

Futures (MES) algo trading journal Thursday 11/04/21.

So I was able to get one trade today. There was very good strength at the open with a nice pullback. The price hung around the zone the algo looks for long enough to trigger the trade. But then I was stopped out quickly. Looks like a good trade, it just didn't work out. Then the price went mostly sideways for the rest of the day so no more opportunities.

See you tomorrow,

Rob C

-

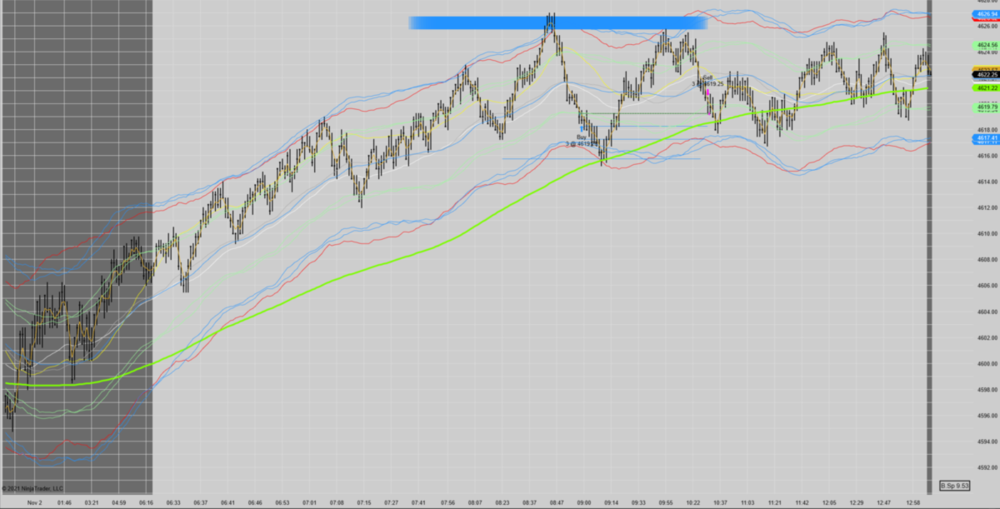

Futures (MES) algo trading journal Wednesday 11/03/21.

I didn't think I was going to trade live due to the FOMC minutes, but about 40 minutes after the announcement the price action acted quite normal so I turned the algo back to live. I was surprised a trade was actually triggered. But right at close we had a pullback after strength that triggered the trade. Though it took awhile in time to reach the target due to lower volume it wasn't that many bars.

Rob C

-

Futures (MES) algo trading journal Tuesday 11/02/21.

Again one of those days I am so glad I was not watching the trade live. Lots of strong momentum all morning and finally all the criteria was right that when a deeper pullback occurred the algo went long. The price kept dropping and my stop barely held. The the price shot up to miss my profit target by 1 tick. Then dropped back down for the algo to stop me out at BE.

I will have the algo running in SIM tomorrow due to the FOMC minutes. So I will probably not post tomorrow.

See you on Thursday.

Rob C

-

Futures (MES) algo trading journal Monday 11/01/21.

I like more what the algo did not do than what it did today.

Downward price momentum right from the open with a strong pullback about 30min after the open. The price stalled on the deeper pullback region and the algo went short. It took 30 minutes but the profit target was reached. Then strong upward momentum with a deep pullback which the algo ignored and would have been a stop out. Then strong downward price movement and a deeper pullback which the algo ignored again that also would have been a stop out.

See you tomorrow.

Rob C

Rob C's Trading Journal - starting Feb 1 2019

in Day Trading Journals

Posted

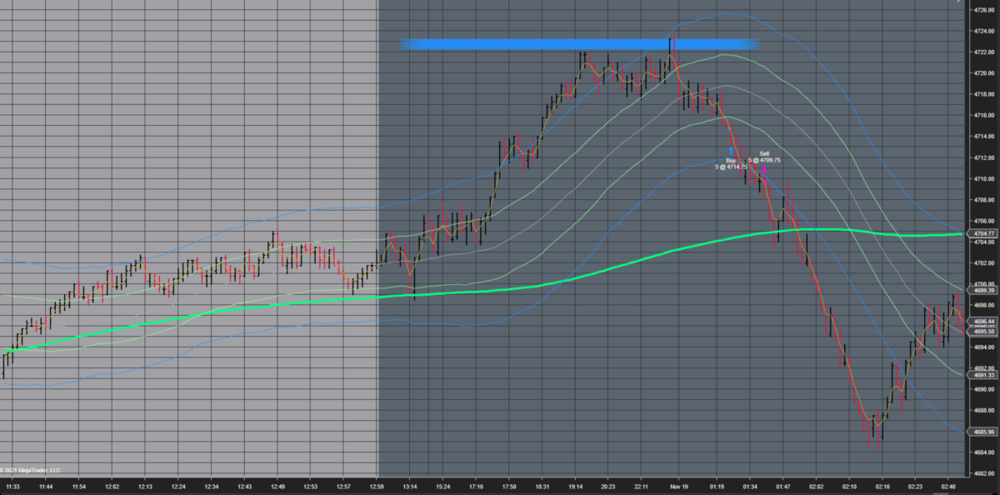

Futures (MES) algo trading journal Tuesday 1/18/22

There was weakness all morning then about 2 hours after the open there was a sharp drop and a deep pull back. The price stopped moving higher long enough that the algo thought it would drop again and went short. The price has been respected the pullback zone all morning (light green line). But not this time and I was stopped out. Essentially, a much deeper pullback than expected. The price did drop to the target about and hour later. Good trade just too deep of a pullback.

Have a good night.

Rob C