BBT Member 001

-

Content Count

111 -

Joined

-

Last visited

-

Days Won

1

Posts posted by BBT Member 001

-

-

Ok lets do 30th so we have time to coordinate. People fly out on Thursday because of Memorial so it ill be easy the following week.

I assume everyone is the northern Metro area so we can do something between Denver - Boulder like Broomfield or we can do downtown. -

Availability, any day. Location: I live in Downtown denver so am open to anywhere between Longmont and Castle Rock.

-

Before I do that, I need to have a green year lol

-

On 5/8/2019 at 8:33 PM, baxtroker81 said:I've been a member of Bearbulltraders since October 2018. I read Andrews first and second books in September along with a few other ones and I am really glad I did, his books are well written and well thought out and really gives you the tools and basics and most importantly rules and setups. I then wanted to join the community and see what real trading was like, I didn't even have a platform or setup yet, it took me about a week to realize this was not fake or a money making scheme. I then knew it was going to be something for the long haul and so it made sense to get the lifetime membership and so I did and I have not regretted it since. This is definitely not a get rich quick type of deal, it takes hard work day in and day out, but the people in this community are there to help and make it easier and they have! There is so many people I want to thank from Norm, William H, Robert H, Carlos, Brian, Abiel, I'm sure I'm forgetting people and of course Andrew who of course without him, none of this would be possible. Thank you guys so much!

-Seth Aldrich

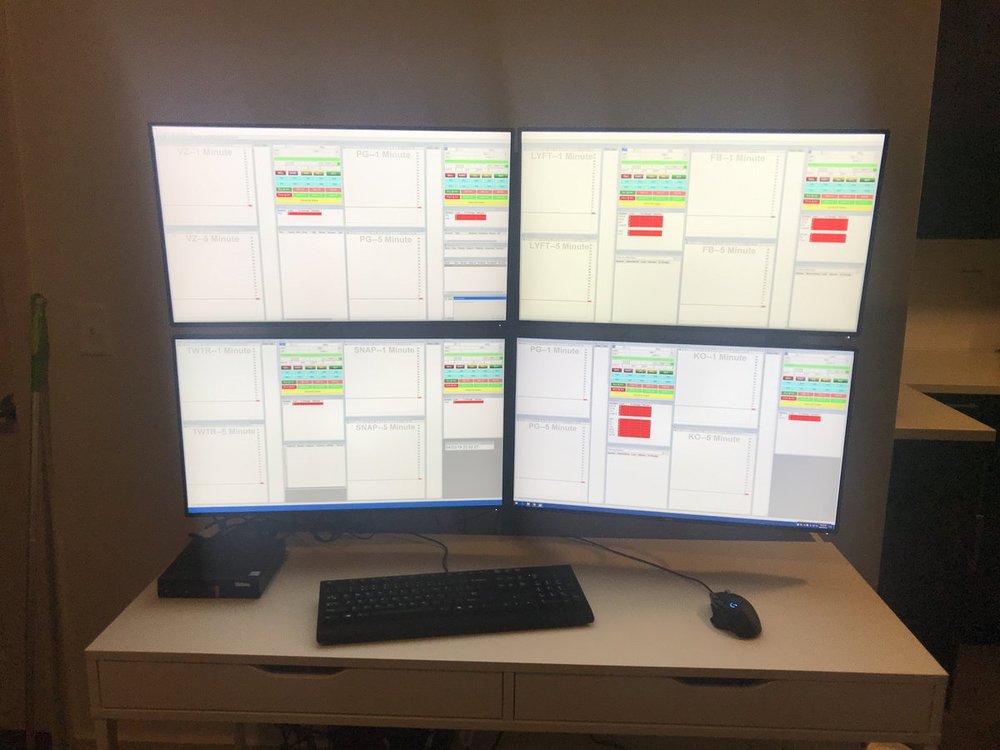

Wow, awesome setup!!! Do you have montage in all monitors?

-

I just purchased a Lenovo P330 tiny that supports up to 6 monitors on 4k. The cost is about $1k. Make sure you select quadro p1000 graphics.

https://www.lenovo.com/us/en/think-workstations/thinkstation-p-series-tiny-/ThinkStation-P330-Tiny/p/33TS3TP330X-

1

1

-

-

The answer is its depends and you shouldn't be biased in any way any time you trade our it might mess you up psychologically. Volume could be lower, same as days before holidays like the 24th of december, but I would not generalize, there are always opportunities and if there are none, then you can either not trade or lower exposure.

For example, yesterday for me was a great trading day, there were a lot of opportunities; and my expectations were much lower. -

After being part of the BBT community for a year and switching to live trading, I decided to go ahead an invest in my trading setup. During my 1st year, I was just using a laptop and a 27 inch monitor as I didn't want to invest much without being consistent first. I decided I was going to invest in a decent setup only if I could cover it with day trading profits and I did during the month of March.That was my gift to myself.

I bought a Lenovo Thinkpad Tiny P330 for $878 incl taxes with the following configuration:- Processor : 8th Generation Intel Core i7-8700T 6 core processor (2.40GHz, up to 4.00GHz with Turbo Boost, 12MB Cache)

- Operating System : Windows 10 Pro 64

- Memory : 16GB DDR4 2666MHz

- Video Adapter : NVIDIA Quadro P620 2GB 4 x Mini DP

- M.2 Storage Card : 256GB Solid State Drive, PCIe-NVME, M.2, Opal

- Networking : Integrated Ethernet

- WiFi Wireless LAN Adapters : Intel 9560 with vPro 802.11 (2 x 2) & Bluetooth 5.0

It supports up to 6 screens, 1 @ 4k 60hz using displayport, 1@ 4k 30hz using HDMI and 4 @ 4k 60hz using Mini displayport but I only have 4 screens connected as I this is enough for me right now.

The monitors are Dell U2718Q: 27" 4k resolution at 60hz. Retail price is about $450-$500 per monitor but I was able to get them factor refurbished and/or used for about $250 each on Ebay.

I also got a UPC battery at amazon for $90. So total cost about $2,000 for the whole setup.

-

I trade more of the Andrew style and I take 25% after the first move of .15-.20 cents (for an MU style stock) if it is not going down fast enough to reach a level. If it is very weak, I wait for it to reach its first support, resistance level and remove some. Many of the trades I take I end up getting stopped out quickly so taking some partial profit fast helps me get close to my daily profit target.

Some people are more patient and let the stock run more but it is a matter of style. You need to figure out what works for your best. -

Lets do it.

-

So I lived in Bali for three months in Uluwatu, Seminyak and Ubud and had the same issue.

The lowest you will be able to get will be about 250ms if you have an HFC or Fiber last mile connection with enough bandwidth to avoid a last mile bottleneck.

I went to co-working spaces and paid for the monthly package (night only rate). with this latency it is still possible to trade and do well, the only issue is to make sure the connection is stable as you might enter a position and get disconnected and it will be a pain if you use mental stops like I do.

You will never be able to get anything better than 250 because the submarine cable needs to go through pacific and then cross USA. I currently live in Denver and my latency is about 50ms.

When in Kuala Lumpur and Tokyo I was able to get 200 or below but because the submarine cables connect directly there and there are less hops.

Check out coworking spaces like Hubud, Outpost, etc..

Bali is my second home so I really envy you -

I missed this one. Let me know when we do another one. Also, If anyone is up for skiing/boarding let me know and we can meet up.

-

I have two accounts with DAS trader and would like to execute orders for both at the same time based on the size. I know there is an allocation feature in DAS but it only works after you have made the trade; so you can allocate after you opened the position.

Anyone know any script to do pre-allocations? -

I am available any day of the weekend or during the week. Let's try to do something.

Dan from Colorado when can you drive east?

-

Hi guys, I will be relocating to Colorado next week. Would like to see if there are any other day traders living in the Denver-Boulder county areas or nearby. It would be good if we could meetup, grab a coffee or something.

-

My wife is also trading but she is doing SIM still. It helps alot because after every day we go through all trades and a list of rules we have put together. The person that breaks the rules needs to do the house chores etc. haha

-

1

1

-

-

I used TWS for about six months before switching to DAS. It is completely worth it. TWS graphs get all ugly when you zoom and unzoom and market data lags compared to DAS. TWS can be a good alternative if DAS is down but definitely DAS is 10x better.

Also TWS software seems to require more processing power, memory and kbps/second and platform is not as stable (it disconnects quite often and has higher latency).

-

THe problem with Speed Trader is that if you fade out of positions, per trade structure might not be favorable.

-

This is very tempting. I am trading from my laptop and will probably buy that one once i move back home.

-

Technically, Trader Workstation is not free, you need to pay for market data which costs $30-$50 per month for basic Level 1 and Level II.

-

If you add liquidity (if you buy on the bid and sell at the ask).

-

Rob, how many shares do you trade in average per month?

-

-

1) No premarket trades

2) Maximum of 5 trades per day (5 plays, not tickets)

3) minimum risk reward of 2:1

4) Stop trading if loss reaches $500 in a day

5) No new trades after 11AM

6) No stocks with float below 50 million shares

7) No trades before 9:40

8) No trade without calling out loud the trade rationale and risk reward ratio

9) No trade if the daily levels have not been drawn out if it shows up in the scanner.

-

I use it, maximum daily loss of $500

BBT Colorado Meetup

in Topics

Posted

I'm in downtown so preferably Blue Moon but driving to Broomfield is fine with me as well.

Lets do 6pm thursday the 30th. I'm flexible. I will PM everyone in the group so we can decide on specifics

Can you guys share your phone # and we can do a whatsapp or txt message group. It will be easier as we can get instant replies. if not any other suggestions