Peter

-

Content Count

80 -

Joined

-

Last visited

-

Days Won

2

Posts posted by Peter

-

-

-

-

I found interesting statistics:

If i had stopped trading that day: if first trade is loser then i had this statistics:

11 winners 10 losers +13.2R (+4.5R more than now)

53% win rate (11% more than now)

average trade +0.62R (its +0.38 more that i have right now +0.24)

up days and down days are the same but down days is much less losing money

This statistic shows there is clear problem after first losing trade....need to think what to do with it?

-

first 33 trade results +8.7R:

14 winners 19 losers win rate 42% its less that minimum what i need to see 50% but its increasing slightly

up days 7, down days 4 (63% up days, its less than minimum what i want to see 75% but its increasing slightly

average trade +0.26R (its ok, Slightly above minimum what i need to see 0.2R and its increasing slightly)

-

-

-

I m selling my winners caotically i created clear rules to hold winners longer:

stock selling rules:

1. I am raising stop to breakeven +1c after it reaches +2R ( to get "free trade")

2. I am raising stop after stock makes at least 3x1min. pullback, and after that new high/low to that pullback -1c

3. if I have +3R then i raise stop to closed 5min. candle -1c and creating range order with target: next clear level on daily chart

4. if I have +5R then i raise stop to closed 1min. candle -1c (i raise stop only if 1min. candle goes my way. if its opposite candle I do not raise stop) and I still have target next clear level on daily chart.

-

-

-

NB: i Noticed that i take too much trades, my winrate is too low, i make this change:

1. first i draw most significant move to chart

2. then i watch pullback to that move and only after that i can take trade ,but if i want to short strong stock then

i need to see double pattern: first double top and clear rejection and only after that strong move to vwap. (If strong stock make dbl bottom or higher ,low i cant short it if its below vwvap anyway.)

And if weak stock make opposite move i ćant go long.

traidingplan:

1. first i draw most significant move to the chart

2. then i wait pullback to that move, less than 50% of the first move

3. if vwap holds at least 3 candles then if stock make new 1min. high/low then i buy or sell it. stop loss goes other side of vwap.

If i want to short strong stock or long weak stock i need to see doubleltop or doublebottom and only after that move throw vwap.

If strong stock makes dblbottom or higher low i cant short it i need to see double conformation. and weak stock i need to see dbl bottom

and after that clear move throw vwap i can go long only after this double conformation.

-

-

first 22 trade results +4.9R:

9 winners 13 losers win rate 40% (its less that minimum what i need to see 50%)

up days 4, down days 3 (57% up days, its less than minimum what i want to see 75% but not much data yet)

average trade +0.22R (its ok, Slightly above minimum what i need to see 0.2R)

winning streak: 3, biggest win +4.1R

losing streak: 4, biggest loser -1.4R

I had 2 revenge trades, and 2 no setup gambling trades,if i can eliminate those then stats. is awesome ( 50% winrate, +0,55R average trade profit.)

1. I made change, and i cant trade same ticker after losing trade more. I need to take break also, after loser 10 minutes. I put it in my rules. Lets see next 2 weeks

is stats. getting better...

-

-

-

Problem found: if its weekend or 4 days not trading then after that i start gambling first two trades was not setup, third trade was bad setup i usually don t short strong stocks right away.

Need to be more careful Mondays. I put reminder myself to read trading plan before each Monday open.

Notice: if i had 1/1 all or nothing approach, then this first 15 trades would be +3R 9 winners 6 losers win rate 66% average trade +0.2R... need to see more data, i watch it again after 50 trades.

-

-

Thursday and Friday was travelling and was not able to trade.

first week results:

11 trades 5 winners 6 losers

win rate 45%

winners together +8,8R

losers together -6.4R

net profit +2,4R

average day +0.8R

average winner +1,76R

average loser -1.1R

average trade +0.22R

up days/down days 2/1... 66% up days

winning streak 2 trades

losing streak 6 trades

-

1

1

-

-

-

-

My general trading rules are:

DAS allows trade only after 9.35

3 losing trades is max loss per day.

+3R locks profit +2R and releases "free bonus trade" until loser.

I am risking 5 dollar per trade (1R) if I got +25R then I raise risk to next level, first 4 risk levels are: (5,12,25,50 dollar)

if I get -20R. from the top then its "game over".... level down and it can go till 0R no -R is allowed after i reach +20R.

Main goal is to to get +100R trading profits. If this is reached then I can make new goals but before that this is my main goal.

to watch stock I need to see before trading:

1. fresh news

2. daily breakout

3.rel.vol over 150%

to trade this stock I need to see:

1. signal candle direction of the gap

2. pullback to 9ema or vwap

3. 60min. chart supporting the move

4. 5min. chart supporting the move

5.after pullback new 1min. high/low is long/short

my playbook short setup:

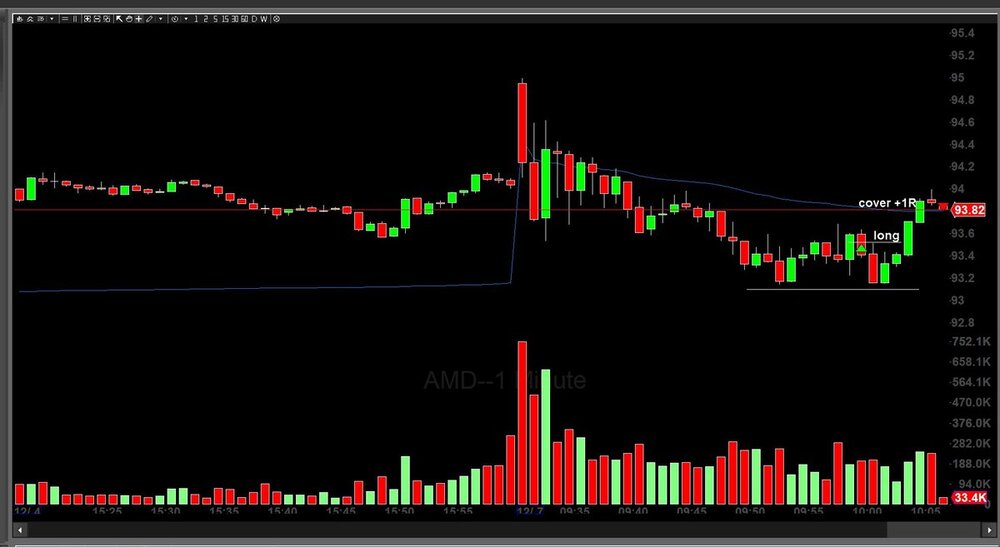

1. fresh news: AMD had earnings

2. AMD gapped down 4%

3. rel.vol was 400%

I put this candidate to monitor watchlist then i need to see:

1. Signal candle

2.pullback to 9ema

3. 60min. supporting the move

4. 5min. supporting the move

5. new 1min low after pullback is short

Raise risk i need to see:

1. average trade +0.2R or more... +0.5R would be superb ( after 100 trades i need to see +20R profit or more)

2. win % 50 or more

stock selling rules:

NB: I cant sell stock with breakeven, before first partial, if it is right side of 9ema

2/1 35%

3/1 35% or next price level

4/1 35% or next price level

last 12.5% I let run and raise only stop loss to last 5min. pivot after new high/low

My long setup: gap up+ fresh news+ daily breakout +rel. vol. over 150% + long pattern

my short setup: gap down + fresh news + daily breakout + rel. vol. over 150% + short pattern

Monday stat: 2 winners 2 losers +2R

1. trade +2,9R

2. trade -1R.

3. trade +1R.

-

Overall statistics after first 100 trades and 52 trading days:

52 trading days: +35.5R average day +0.68R

100 trades: 51 winners , 49 losers = win rate 51%

average trade profit: +0.35R

average winner 1.65R

winners together: +84.3R , losers together: -48.8R , profit factor: 1.72

risk level 2: 40% of the next risk level and 35% of the Main Goal +100R.

Trade 1-100 statistics :

Trade 1-25 stat: +4.8R , 10winners/15 losers 40% win rate, +20.2/-15,4, profit factor 1.31 , average trade profit: +0.19R

Trade 26-50 stat: +12.6R , 15 winners/10 losers 60% win rate, +23.6/-11 profit factor 2.1 , average trade profit: +0.5R

Trade 51-75 stat: +9.8R , 13 winners/12 losers 52% win rate, +22.1/-12.3 profit factor 1.8 , average trade profit: +0.39R

Trade 76-100 stat: +8.3R , 13 winners/12 losers 52% win rate, +18.4/-10.1 profit factor 1.8 , average trade profit: +0.33R

Trade 1-100 stat: +35.3R , 51 winners/49 losers 51% win rate, +84.3/-48.8 profit factor 1.72 , average trade profit: +0.35R

My main goal to learn my setup and show myself that i have edge in the market. I need to reach +100R trading profits, this +100R shows (if I reach there) that I have clear edge in the market. It takes more than 3 months (full earnings cycle), superb if I reach there within 4-5 months. Maximum is 8 months to show profitability ( +12.5R month average ). I start with 5 dollar risk and raise risk if I reach +25R (risk level 1 is 5 dollar 0-25R, risk level 2 is 12 dollar 25-50R, risk level 3 is 25 dollar 50-75R, risk level 4 is 50 dollar 75-100R)

Minimum acceptable profitability:

average trade: more than +0.2R profit, superb would be +0.5R or more...

and I want to see win rate 50% or more (this shows that I take quality setups)

profit factor more than 1.5

-

2

2

-

-

Is it possible to do hotkey with stoploss and target like range order. ( im clicking to stoploss on the chart and then hotkey and it buys stock and creates

range order for selling)

Im now using 2 different hotkeys one for buying with stoploss order and second to sell +2R target. And i need to watch if one order is filled i need to delete second. It would be amazing that

im only buying once and no need to watch stock...

If this one hotkey is not possible is it possible to do hotkey with range order -1R and +2R targets?

-

2

2

-

-

Hey guys is it possible to do two different range hotkeys :

1. it sells 20% -1R and +2R

2. it sells 80% -1R and +3R

forboth long and short

idea is that i buy with hotkey and then hit nr.1 and then hotkey and nr.2 and thats it no more decisions...is it possible?

-

thankyou, if you are so king it would be very helpful for me, if you could copy here two basic hotkeys:

i dbl click on the chart and then hotkey and it buys with 10 dollar risk and makes stoploss market order.

for both direction buy and sell.

Peter journal: First pullback+lightning bolt+ABCD

in Day Trading Journals

Posted · Edited by Peter

i make minor change on trading plan:

if i have 2 losers on the day i stop trading that day after first loser break min. 10 minutes, i tend to lose more after that, no reason to trade more...

I have 2 bullets each day if i have winner then i get my bullet back!

I updated my main goal too its +100R and i raise risk after each +25R