WestCoastTrader

-

Content Count

8 -

Joined

-

Last visited

Posts posted by WestCoastTrader

-

-

On 5/20/2022 at 8:13 AM, peterB said:just my opinion so adopt as you like...

partialling is counterproductive most of the time especially for new traders.

proof of that are your patials on your screenshot.

if you set stop to break even instead of first partial then you would have more shares to partial on the 2nd partialthe 3rd partial is basically the same as the 2nd partial so there is no reason to do it at all. if you did not exit on the 2nd partial price then there is no reason to exit on the second as well as nothing changed, onlyt he price is a bit lower which is so small that it does not matter.

some ideas how to solve it: try to use 2R/3R all or nothing hotkeys/range orders. once you open a trade you have no control over the outcome anyway and i bet if you look at your own stats if you did not do the 1st partial on your winners you would have more profits. its just the nature of it. why do you need the profit from the 1st R? i guess to make you calm and be able to hold longer.

implement ATR into your trading. if you see that daily ATR for AMD is $6 and you see the stock opened at $99 you can statistically expect that if you caught the whole day move you can expect the price to go to $93 on this day. so you can target for example 70% of the move so $4.20 from 99 which would be $94.80 so this is your target for the stock on the move down. another advantage of using ATR is that once you start looking at it this way you will look for sooner/better entries and catch the even bigger moves in your case you would have confidence to short iat at 97 as you expect it to move down below 95 so 4R move in this case.

you need to go through your trades to see if it would make sense or retest it in replay mode to practice your patience as usually overpartialling is a bad habit which takes time to get rid of.

i always remember what @Aiman told me when talking about partialing: "Who needs to book 0.5R? What do you need it for?"

Thank you Peter, There is some good advise in there, and it does make sense that I am taking partials too soon

Thanks Again

Michael -

Hi,

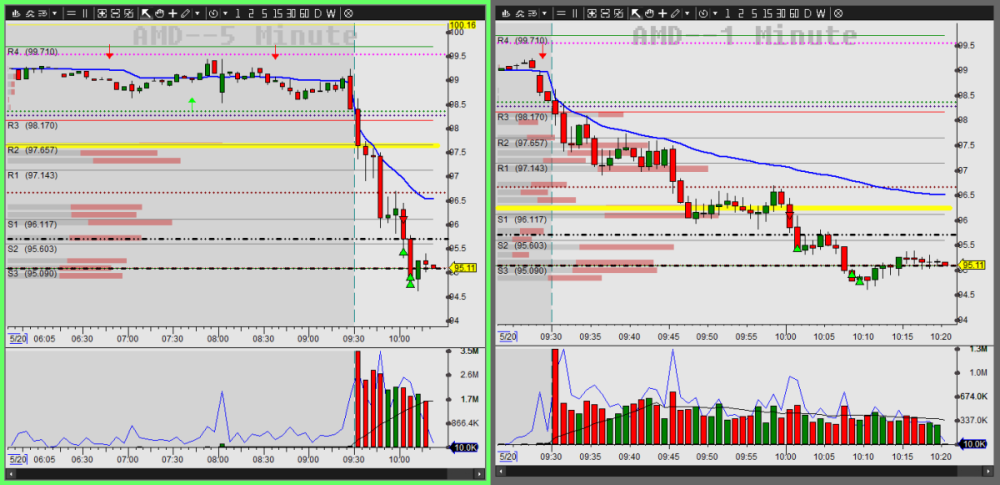

I looking to get some ideas and how to maximize my trades. My trade from today I am going to use as an example

Entry short at 96.03

Stop set at 96.50 (Top of the previous candle)

My risk is $0.50My exit on this were

Half my position at the next support level (The half dollar at 95.50)

Another half at the whole dollar (95

Then I had a oopise on DAS, I wanted to get out at the next half dollar (94.50) it was super small size and hind sight AMD didn't get there so I guess it was a good oopsAll in all I got 1.8R on this trade, not bad, but I would like to be above 2 and hopefully closer to 3R on the trades.

Looking at this trade I only see 2 ways to increase my R

1. Tighter stop loss leading to more shares, which on this one I don't see a better place for the stop?

2. Don't partial as aggressive and hold a bigger position for the further drops.Just wanted to see what your guys strategies are and what you guys would do?

Thanks

Michael -

I am looking into the API for a project I might take on, and yeah i though the price of the DAS API was crazy.

If i go ahead and create the project i am planning on using IB's API... it is free and seems like it is better supported... They call it the TWS API

-

Hello,

I am just finishing up Anna Coulling book on VPA, and i am working on getting Volume by price setup and there are setting that I am not sure about.

The settings I can change are

Volume Look Back Depth: (Currently set at 70 can be 10-1000)

Number of Bars (Currently set at 100 can be 10-500)

Bar Length Multiplier (Currently set at 50 can be 10-100)

Bar Horizontal Offset (Currently set at 30 can be 0-100 )

Bar Width (Currently set at 2 can be 1-20)Just curious what settings you guys would use?

Thanks

Michael -

So I have a 1 hour commute to work and I am looking for some recommendation for books to "read" that I can listen to the audio book on the way to work. I have already read Andrews Day trading book, i am currently working on his phycology book, but what other books do you guys recommend?

Thanks

Michael -

Hi Everyone,

I am trying to setup a buy hot key that automatically set a stop order that has a fixed max loss dollar amount and have it calculate what the stop loss price would be at

For example. I want to buy 100 shares of a $30 stock and have a max $50 loss. So the raw math would be $30 - $50/100 or AvgPrice - 50/Pos

Here is the hot key i have but it does not set the stop for some reason

CXL ALLSYMB; ROUTE=LIMIT;Price=Ask+0.05 ;Share=100 ;TIF=DAY+;Buy=Send;TriggerOrder=RT:STOP STOPTYPE:MARKET ACT:SELL STOPPRICE:AvgCost-50/Pos QTY:Pos TIF:DAY+;

Thanks Everyone!!

-

Hi,

I was looking though DAS Traders website and i noticed that they are in beta for integrating with TD Ameritrade. Is anyone part of the beta, what do you guys think about TD with DAS.

I started with TOS and left because the level 2 is crap, and TOS at times has issues, but if TOS is replaced with DAS and zero commission trades....

https://dastrader.com/subscribe/

Thanks

Mike

Looking for serious trading buddies!

in Day Trading Education, Books, Peer-to-Peer Support

Posted

I am also looking for a small trading group to bounce ideas off of and get ideas

Mau, the discord invite does not seem to work

I am in the Los Angeles area, but same time zone as Vancouver.

Thanks

Mike